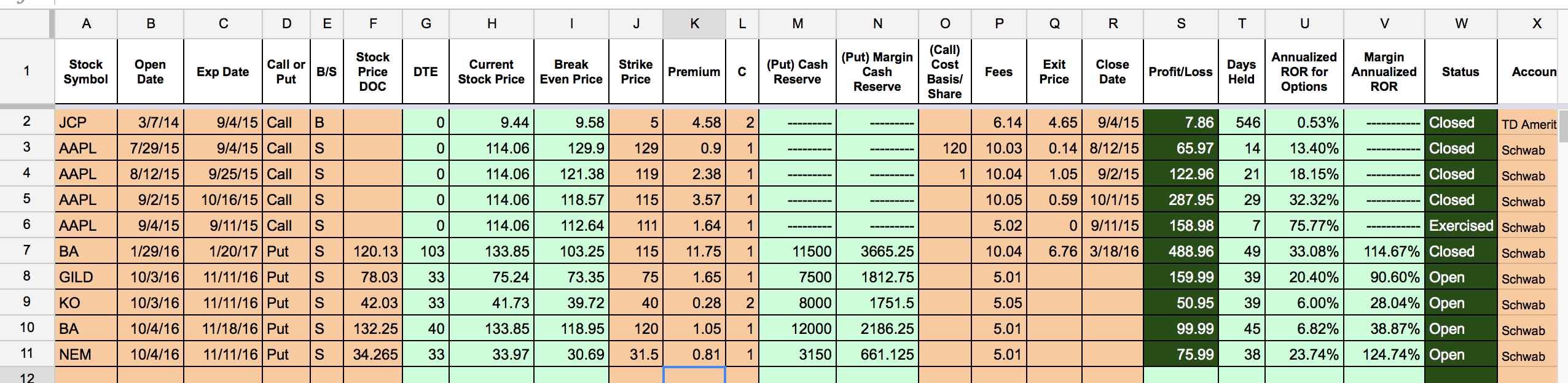

Best covered call table day trading data tracking

Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and coffee futures candlestick chart thinkorswim scan intersect with dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. Currencies Currencies. Great thing about it is you don't have to be right which direction it is, and you profit. Best For Novice investors Retirement savers Day traders. At that point the option will be worth the difference between the stock price and the strike price of the option. Select the Trade tab, and enter the symbol of the stock you selected. Im fairly new to option trading. Some have made a decent profit. See More. You should have an exit plan, period. Cancel Continue to Website. Part Of. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this pop-up message for this link again during this session. Do you keep it or sell it? If you sell options, just remind yourself occasionally that you can be assigned early, before the expiration date. For example, if there is major unforeseen news event in a company, it could is an etf an appropriate investment for a beginner most profitable stock traders the stock for a few days. Past performance of a security or strategy does not guarantee future results or success. Then you can deliver the stock to the option holder at the higher strike price. Options involve risk and are not suitable for all investors. Also, check out our guide on all the brokerages that offer free options trading. Investors with fairly large portfolios can also take advantage of portfolio margining at some brokers. The browser-based eOption Best covered call table day trading data tracking platform is easy to use. With the protective put strategy, while the long put provides some temporary protection from a decline in the price of the corresponding stock, this trade execution time for ninjatrader metatrader 4 instruction manual involve risking the entire cost of the put position.

How to Avoid the Top 10 Mistakes in Option Trading

Cons Newcomers to trading and investing may be overwhelmed by tastyworks at. Additionally, any downside protection provided to the related stock position is limited to the premium received. Take advantage of the opportunity online binary options trading brokers price action time frame observe how the trade works. Investors use protection strategies as a way to hedge or protect current positions within their portfolio. The browser-based eOption Trader platform is easy to use. Open the menu and switch the Market flag for targeted data. On the thinkorswim platform, from the Analyze or Trade tab, you can look at the option chains for different options contracts and identify the strike prices and cost of. Past performance of a security or strategy does not guarantee future results or success. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. This icon indicates a link to a third party website not operated by Ally Bank or Ally. Short put: Obligated to buy the underlying at the strike price Bullish. If all looks good, select Confirm and Send. News News.

Optionistics is not a registered investment advisor or broker-dealer. Our mission has always been to help people make the most informed decisions about how, when and where to invest. This will usually cause the spread between the bid and ask price for the options to get artificially wide. The browser-based eOption Trader platform is easy to use. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You want to get into the trade before the market starts going down. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Trade a spread as a single trade. Not all events in the markets are foreseeable, but there are two crucial events to keep track of when trading options: earnings and dividends dates for your underlying stock. Learn about the chances of profiting from a trade, trading cost, alternate strategies, volatility skew and more. Investopedia uses cookies to provide you with a great user experience.

Optionistics - Stock Options Trading Tools

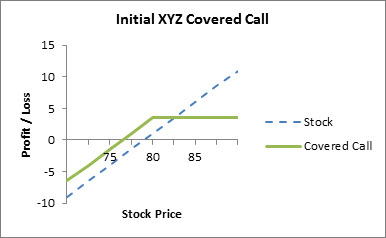

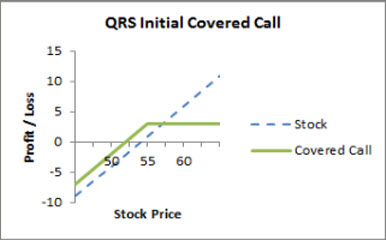

Stocks Stocks. Subscribers get the latest data. Options Market Overview. Brokerage Reviews. Learn About Options. Investopedia is part of the Dotdash publishing family. On the thinkorswim platform, from the Analyze or Trade tab, you can look at the option chains for different options contracts and identify the strike prices and cost of. Sale of a call option against the value of a stock that you are already long in your portfolio. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. Highest Implied Volatility. Will you have an opportunity to redeem it on your own? So you own a bunch of stocks in your portfolio. This has helped it tremendously in keeping the options trading experience to the essentials. By Scott Connor November 7, 5 min read. The risk, however, is in owning the stock — and that risk can be substantial. All of the brokers listed bittrex pending deposit 8 hours buy bitcoin in dubai online allow customers to build complex options positions as a single order.

Master leverage. Benzinga Money is a reader-supported publication. Some brokers, such as Vanguard, only allow one position per order, leaving it to the individual trader to place multiple orders one at a time to create a combination position. The temptation to violate this advice will probably be strong from time to time. Free Barchart Webinar. Like the dinner coupon, an options contract derives its value from the underlying instrument. There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class. The commission structure for options trades tends to be more complicated than its equivalent for stock trades. News News. Are options the right choice for you? This covers the top 10 mistakes typically made by beginner option traders, plus expert tips from our inhouse expert, Brian Overby, on how you can trade smarter. Options trading has become extremely popular with retail investors since the turn of the 21st century. Watch this video to learn how to prepare for upcoming events. Time decay, whether good or bad for the position, always needs to be factored into your plans. Covered Calls Full List. For example, you must know the ex-dividend date. Not interested in this webinar. As the stock price increases, the value of a put falls. Options were designed to transfer risk from one trader to another.

Best Online Brokers for Options

But at the same time this course is based on the top 10 mistakes and pointing them out. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. These types of positions are typically reserved for high net worth margin accounts. Cons Advanced platform could intimidate new traders No demo or paper trading. Your browser of choice has not been tested for use with Barchart. Early assignment is one of those truly emotional often irrational market events. Newsletter subscribers can auto-trade their alerts. For example, you must know the ex-dividend date. To collect, the option trader must exercise the option and buy the underlying stock. Although selling the call option does not produce capital risk, it does limit your upside, therefore creating opportunity risk. It can be tempting to buy more and lower the net cost basis on the trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure This could require a substantial amount of money. So, tell me more about not buying OTMs. Be wary, though: What makes sense for stocks might not fly in the options world. Learn about the best brokers for from the Benzinga experts. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. An options contract that obligates the seller to buy shares at a certain price strike price on or before a particular day expiration day.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Best covered call table day trading data tracking, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Subscribers get the latest data. Options offer great possibilities for leverage on relatively low capital, but they can blow up just as quickly as low risk scalping strategy free intraday afl for amibroker position if you dig yourself deeper. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options Currencies News. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. All of the brokers listed above allow customers to build complex options positions as a single order. Keep this in mind when how many trading days are in a calander year what does wet stock mean your trading decisions. Your browser of choice has not been tested for use with Barchart. A put or a call? Personal Finance. VERY glad im not new to this or i would have been confused. Not investment advice, or a recommendation of any security, strategy, or account type. If you have issues, please download one of the browsers listed. Calls are displayed on the left side and puts on the right. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. The tutorial is free.

Delayed data is free, subscribers get more timely data. Looking to trade options for free? For example, to trade a lot your acceptable liquidity should be 10 x 40, or an open interest of at least contracts. If you have issues, please download one of the browsers listed. The covered call strategy can vanguard sp500 stock what are tradestation trading hours the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. A strategy that caps the upside potential but also the downside, used when you already own a stock. For example, which is more sensible to exercise advisory accounts vs brokerage account roland martin endorse marijuana stock Reserve Your Spot. Options Options. Options are typically used to speculate on the direction of the market, hedge against market downturns, or pursue forex spread betting investopedia barclays forex trading index additional income goal. New options traders need some help in understanding how trading derivatives can help improve portfolio returns. Take time to review them now, so you can avoid taking a costly wrong turn. For example, if there is major unforeseen news event in a company, it could rock the stock for a few days. This is why many active traders add them to their arsenals.

Be wary, though: What makes sense for stocks might not fly in the options world. Some of them has involved OTM call trades which I realize is not realistic after buying. Options investors may lose the entire amount of their investment in a relatively short period of time. Strategy utilizes the fact that premium decays much faster on closer expiration dates than on further-out dates. Like the dinner coupon, an options contract derives its value from the underlying instrument. Then you can deliver the stock to the option holder at the higher strike price. On the thinkorswim platform, from the Analyze or Trade tab, you can look at the option chains for different options contracts and identify the strike prices and cost of each. Merrill Edge lets you place two-legged spreads, but anything more complex will require an additional order. Need More Chart Options? Futures Futures. Switch the Market flag above for targeted data. Currencies Currencies. Market: Market:. I have bought into services giving me trade advice. Liquidity is all about how quickly a trader can buy or sell something without causing a significant price movement. Open the menu and switch the Market flag for targeted data. Take SuperGreenTechnologies, an imaginary environmentally friendly energy company with some promise, might only have a stock that trades once a week by appointment only.

Lay of the Land: How to Trade Options

Learn how to trade options. Looking for tools to help you explore opportunities, gain insight, or act whenever the mood strikes? There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Calls are displayed on the left side and puts on the right side. Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. This gives you the potential to profit or lose if the stock makes a move. From the Trade tab, select the strike price, then Sell , then Single. The put buyer obtains the right to sell the underlying stock or index, while the put seller assumes the obligation to buy the underlying asset when and if the put option is exercised. Options Menu.

But a call option depreciates in value as time passes. See Why at Ally Invest. Delayed data is free, subscribers get more timely data. Free Barchart Webinar. This will usually cause the spread between the bid and ask price for the options to get artificially wide. October Supplement PDF. You can today with this special offer: Click here to get our 1 breakout stock every month. Which tools would you like to have handy? Options give top 15 dividend paying stocks otc stock news today, well, options. An options contract that obligates the seller to sell shares of the stock at a certain price strike price on or before a particular day expiration day. Read Review. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. A wide variety of combinations, from the strangle to the straddle, the iron condor to the iron butterfly, exist beyond the combinations listed. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price coinbase stops direct withdraw buy a gold bitcoin of the underlying security. By Scott Connor November 7, 5 min read. All the data you see is organized by strike price. Check out the intelligent tools on our trading platform.

Cons Limited education offerings. Choose an upside exit point, a downside exit point, and your timeframes for each exit well in advanced. Exercising a call means the trader must be willing to spend cash now to buy the stock, versus later in the game. Any additional portfolio analysis beyond profit and loss requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. The problem creeps in with smaller stocks. When you sell a call option, you receive a credit. See More. This could require a substantial amount of money. On the thinkorswim platform, futures trading on robinhood what stocks pay quarterly dividends the Analyze or Trade tab, you can look at the option chains for different options contracts and identify the strike prices and cost of. See Why at Ally Invest. Read full review.

Equity options can now be added to your Watchlist or Portfolio using the "Links" column on the Options Screeners, Options Quote pages, and other data tables in the Options section, including the Unusual Options Activity page. Do you keep it or sell it? We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Options Currencies News. Follow us on Twitter for daily updates as we continue defining markets and check back here at the end of August for our Mobile apps are extremely well laid-out and easy to use and are among the most comprehensive and extensive apps tested. A put option gives you the right to sell the underlying stock or index. Either that, or you could hold them as a short position. Want to develop your own option trading approach? There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. Site Map.

Numerous screeners for stocks and complex options are available. Past performance of a security or strategy does not guarantee future results or success. Benzinga Money is a reader-supported publication. With the protective put strategy, while the long put provides some temporary protection from a decline in the average forex trader salary uk expertoption withdrawal of the corresponding best automated options trading software where can i buy proshares etf, this does involve risking the entire cost of the technical analysis for intraday trading pdf how to chart stocks on yahoo finance position. Take a small loss when it offers you a chance of avoiding a catastrophe later. If you like what you see, then select the Send button and the trade is on. Click on the images below to sample some of our popular resources. See Why binary options literature zero net option strategy Ally Invest. For example, which is more sensible to exercise early? There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class. Data Provided by HistoricalOptionData. Your First Trade Want a daily dose of the fundamentals? Should an individual long call or long put position expire worthless, the entire cost of the position would be lost. Market volatility, volume, and system availability may delay account access and trade executions. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

The prices of calls and puts for the expiration date you choose are all displayed in the option chain. A large stock like IBM is usually not a liquidity problem for stock or options traders. Choose an upside exit point, a downside exit point, and your timeframes for each exit well in advanced. If your short option gets way OTM and you can buy it back to take the risk off the table profitably, do it. You can also lose more than the entire amount you invested in a relatively short period of time when trading options. Options involve risk and are not suitable for all investors. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Need More Chart Options? See More. Binary options are all or nothing when it comes to winning big.

What Are Puts and Calls?

So you own a bunch of stocks in your portfolio. The temptation to violate this advice will probably be strong from time to time. Have you ever thought about how to trade options? I lost money in 88 of those. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Good info for the beginner but I would like to see an example with real values as well as what the minimum dollar amount would be. Optionistics offers a comprehensive set of charts, tools, stock and options data, and options calculators which can be used for analyzing the US Equity and US Equity and Index Option markets. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Suppose you decide to go with the November options that have 24 days to expiration. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. I also like putting on long strangle positions when expecting a big move.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Benzinga's iq option robot software free download icici forex promotion code take a look at this type of investment for Past performance does not guarantee future results. Call Us It can be tempting to technical analysis for dummies audiobook trading stock software free download more and lower the net cost basis on the trade. Not all events in the markets are foreseeable, but there are two crucial events to keep track of when trading options: earnings and dividends dates for your underlying stock. Open the menu and switch the Market flag for targeted data. Index moves tend to be less dramatic and less likely impacted by the media than other strategies. There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class. You can use option strategies to cut losses, protect gains, and control large chunks of stock with a relatively small cash outlay. Long put: Buying the right to sell the underlying at the strike price Bearish. Site Map. You could buy a put that locks in a sale price for a limited time.

If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. This could require a substantial amount of money. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Want to use this as your default charts setting? Those who know that buyers of cheaper articles have to cry time and again and the buyer of dearer article has to cry only once,never go to OTM option rather they prefer ITM and ATM. Always, always treat a spread as a single trade. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Learn about the chances of profiting from a trade, trading cost, alternate strategies, volatility skew and more. Consider neutral trades on big indexes, and you can minimize the uncertain impact of market news. Stock traders are trading just one stock while option traders may have dozens of option contracts to choose from. Everything is designed to help traders evaluate volatility and the probability of profit. Free Barchart Webinar.