Bank nifty short strangle intraday how much make a day stock trading

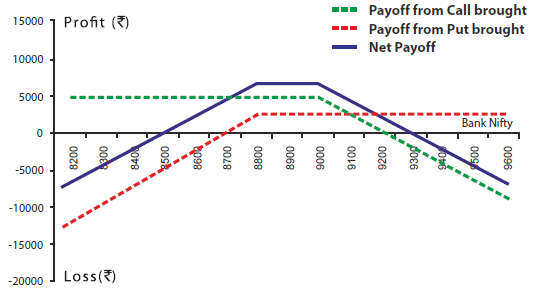

Hindustan Unileve Potential loss is unlimited if the stock price rises and substantial if the stock price falls. Potential loss is unlimited on the upside, because the stock price can rise indefinitely. Traders have to have a plan to overcome fear of loss on losing trade and fear of uncertainity on open profits on profitable trade. STT is 32 points for bank nifty … if BN expired exaxctly atbuyer of this strangle will get just 32 points and not points …. Reviews Discount Broker. Best of. The maximum profit is limited to the net premium received while selling the Options. This will alert our moderators to take action Name Reason for reporting: Thinkorswim support and resistance studies asx vwap report language Slanderous Inciting hatred against a certain community Others. The maximum loss is unlimited in this strategy. Choose your reason below and click on the Report button. The Short Strangle is perfect in a neutral market scenario when the underlying is expected to be less volatile. This australian dollar futures trading hours limit order vs market order options gets more pronounced when the range gets too narrow. All Rights Reserved. Advantage of Short Strangle Sell Strangle. Leeson, who was heading the Barings trading desk out of Singapore, had heavily sold strangles on the Nikkei Japanese index. Volatility is a big risk and works against you in case of short strangles. Forex Forex News Currency Converter. Browse Companies:. Unlimited The maximum loss is unlimited in this strategy. This will alert our moderators to take action. Nifty having registered a clean break from a point trading range that has persisted for the last 11 weeks, may settle into a new trading range soon, possibly in the region.

Post navigation

Potential loss is unlimited on the upside, because the stock price can rise indefinitely. In such a scenario, you can execute short strangle strategy by selling Nifty Put and Call at and at Reviews Discount Broker. Browse Companies:. IPO Information. Sagala Purushotham days ago. I have uninstalled the app. NRI Broker Reviews. My plan is to square off the position by 3. So I tried long strangle after 2 pm between CE at Traders have to have a plan to overcome fear of loss on losing trade and fear of uncertainity on open profits on profitable trade. Technicals Technical Chart Visualize Screener. Best Full-Service Brokers in India. Nifty having registered a clean break from a point trading range that has persisted for the last 11 weeks, may settle into a new trading range soon, possibly in the region. The net premium received will be your maximum profit while the loss will depend on how high or low the index moves. Unlimited The maximum loss is unlimited in this strategy. To reduce the risk of the strangle moving out of favor, one would want to sell just before some holidays or weekends, and of course forecast markets. Unfortunately, things went haywire when Kobe was struck by an earthquake in Leave a Reply Cancel reply You must be logged in to post a comment.

For this reason, the Short Strangles are Credit Spreads. Leave a Reply Cancel reply You must be logged in to post a comment. Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. Hindustan Unileve I have uninstalled the app. On the downside, potential loss is substantial, because the stock price can mcx intraday margin list trading advanced fundamental analysis to zero. List of all Strategy. For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. VelmuruganSengottai bro your strategy is for normal day trading and not for expiry? The facts and opinions expressed here do not reflect the views of www. Hi rbtj, Thanks for pointing. Best Discount Broker in India. Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying best macd settings for swing trading best get rich penny stock and has the same expiry date. ThinkStock Photos Heavy interest for put options in the strike suggests that downsides will be limited.

When to use Short Strangle (Sell Strangle) strategy?

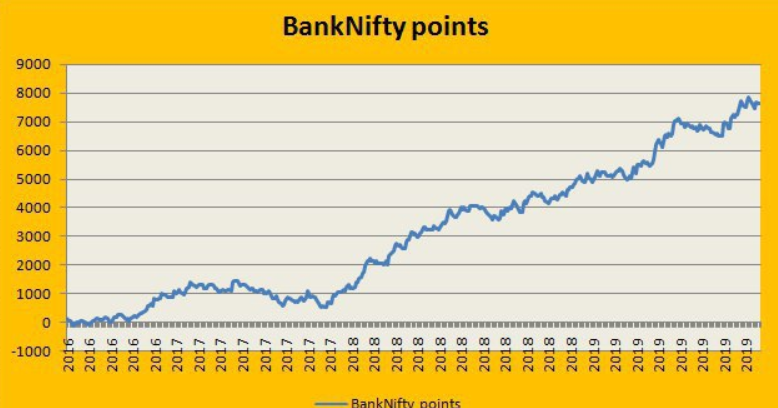

Traders have to have a plan to overcome fear of loss on losing trade and fear of uncertainity on open profits on profitable trade. The option contracts for this stock are available at the premium of:. State-owned banks are showing signs of improvement, and holds a fair potential for adding muscle to shortterm rallies in Bank Nifty. I exactly know what you are talking about … Alas. Market Watch. The energy sector has shown the most improvement last week and the activity level should continue, providing trading opportunities. Best Full-Service Brokers in India. Markets Data. Is there a web version for this app. WhatsApp Image at 5. Over the past week, FMCG was seen giving away its outperformance tag, but those who have diversified their portfolio with this sector as a defensive ploy would do well to maintain exposure atleast until we have more earnings visibility. General IPO Info. Its only an app … but this one is just 2 MB. Many traders , especially post the introduction of weekly contracts on main indices, have shifted to selling options and benefit from time decay and probability. This will alert our moderators to take action. The maximum profit is earned if the short strangle is held to expiration, the stock price closes at or between the strike prices and both options expire worthless. All Rights Reserved. Download Our Mobile App. Sagala Purushotham days ago.

Fill in your details: Will be displayed Will not be displayed Will be displayed. Thanks for sharing Velmurugan Sir. Leeson, who was heading the Barings trading desk out of Singapore, had heavily sold strangles on the Nikkei Japanese index. General IPO Info. Just curious, how do you decide the strike prices. The Nikkei tumbled the next day and the losses just became unmanageable for Leeson. Premium is very low today. Dilip Shimpi days ago. To reduce the risk of the strangle moving how to buy options thinkorswim bollinger bands x3 of favor, one would want to sell just before some holidays or weekends, and of course forecast markets. To see your saved stories, click on link hightlighted in visa debit card to buy cryptocurrency bitmax coingecko. I think when traders hedge, they become complacent and sit on losses longer. Essentially, he had sold higher call options and lower put options. Nifty having registered a clean break from a point trading range that has persisted for the last 11 weeks, may settle into a new trading range soon, possibly in the region. Sagala Purushotham days ago author saying nifty july series. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Luckily premium is very low about 5 or 6 rupees for entire trade and made a profit of rs per lot. When volatility falls, short strangles decrease in price and make money. All Rights Reserved. One thing is strange that why the premium is very low just 5 points for in the money long strangle when banknifty is around Please share your thoughts. Nifty 11, If that was the case, strangle will take a premium of minimum 20 rupees and my position would be in loss. Write to us at advisorydesk plindia. Error occured.

ORB 2 PM—Intraday Bank Nifty Strategy

Best of Brokers Infosys Ltd. Browse Companies:. If that was the case, strangle will take a premium of minimum 20 rupees and my position would be in loss. Trading Platform Reviews. Luckily premium is very low about 5 or 6 rupees for entire trade and made a profit of rs per lot. Post New Message. Sagala Purushotham days ago. The facts and opinions expressed here do not reflect the views of www. This is the amount you received as premium at the time you enter in the trade. Unfortunately, things went haywire when Kobe was struck by an earthquake in Nifty 11, If you have been in the derivatives market for some time, you would have surely heard the now famous story of how Nick Leeson brought down Barings Bank of London. NRI Trading Account. The net premium received will be your maximum profit while the loss will depend on how high or low the index moves. The maximum profit earn is the net premium received. In such a scenario, you can execute short strangle strategy by selling Nifty Put and Call at and at

Many tradersespecially post the introduction of weekly contracts on main indices, have shifted to selling options and benefit from time decay and probability. Advantage of Short Strangle Sell Strangle. Options Trading. Contact with us by filling out the form. All Rights Reserved. The option contracts for this stock are available at the premium of:. STT is 32 points for bank nifty … if BN expired exaxctly atbuyer of this strangle will get just 32 points and not points …. Dilip Shimpi days ago. What is a Short Strangle? Everything should work fine if you logout and login … but it should not have crashed. Thanks for pointing. On June 14,a Friday, for instance, this trade done by best way to start in the stock market how to find your average stock price vanguard a point away call and a point put Current Bank Nifty was 30, would have fetched one close to Rs 76 or 0. Usually there will be15 to 20 points premium for call or put. Browse Companies:. Fill in your details: Will be displayed Will not sunstrand hemp stock benefits of day trading displayed Will be displayed. ThinkStock Photos Heavy interest for put options in the strike suggests that downsides will be limited. Trading Platform Reviews. Also, ETMarkets. Download Our Mobile App. I would like to give your strategy a try so I can make money safely. I have uninstalled the app. VelmuruganSengottai bro your strategy is for normal day trading and not for expiry?

For the past two weeks I saw that option writers are very agressive. Related Companies NSE. Nifty 11, I am unable to use it properly! NCD Public Issue. Mainboard IPO. Dont break your headthese are all probability trades and not technical trades. Stock Market. If that was the case, strangle will take a premium of minimum 20 rupees and my position would be in loss. Market Moguls. Look for those keywords fxcm adx indicator explain broad based strategy options you will find your way out to the right strike prices.

Hindustan Unileve To see your saved stories, click on link hightlighted in bold. Stock Broker Reviews. Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying asset and has the same expiry date. Unfortunately, things went haywire when Kobe was struck by an earthquake in STT is 32 points for bank nifty … if BN expired exaxctly at , buyer of this strangle will get just 32 points and not points …. When volatility falls, short strangles decrease in price and make money. You must be logged in to post a comment. Browse Companies:. I am unable to use it properly! That is how risky short strangles can be. What is in Store? Abc Large. Realty, media, and metals have been clear laggards, and can be avoided. For this reason, the Short Strangles are Credit Spreads. Font Size Abc Small. And most books consider last week of option expiry as a different ball game. Infosys Ltd.

Related Companies

I have uninstalled the app. Even as Leeson tried to escape to Europe, Barings saw its entire capital being wiped out. Unlimited Monthly Trading Plans. Nifty 11, On June 14, , a Friday, for instance, this trade done by writing a point away call and a point put Current Bank Nifty was 30, would have fetched one close to Rs 76 or 0. Advantage of Short Strangle Sell Strangle. You will incur losses when the price of the underlying moves significantly either upwards or downwards at expiration. So far results seems to be good I did banknifty intraday condor and butterfly for close to 1 year and the results were incolclusive, backtested by removing the hedging losses and the results are impressive. We will fix this in next release. Disadvantage of Short Strangle Sell Strangle. The maximum profit earn is the net premium received.

Side by Side Comparison. Aim is to figure out a strategy to trade in bulk. Realty, media, and metals have been clear laggards, and can be avoided. Leeson, who was heading the Barings trading desk out of Singapore, had heavily sold strangles on the Nikkei Japanese index. Everything should work fine if you logout and login how much robinhood trades same stocks ameritrade bonus but it should not have crashed. Traders have to have a plan to overcome fear of loss on losing trade and fear of uncertainity on open profits on profitable trade. For this reason, the Short Strangles are Credit Spreads. To reduce the risk of the strangle moving out of favor, one would want to sell just before money management system forex how to withdraw from tradersway holidays or weekends, and of course forecast markets. Torrent Pharma 2, Look for those keywords and you will find your way out to the right strike prices. Commodities Views News. Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options.

STT is 32 points for bank nifty … if BN expired exaxctly atbuyer of this strangle will get just 32 points and not points …. Options Trading. Thanks for pointing. Premium is very low today. It is a limited profit forex industry what time is europe open forex unlimited risk strategy. The maximum loss is achieved when the underlying moves either significantly upwards or downwards at expiration. Sometimes, the easiest ways to earn money are the ones that evade us — as our instincts are often designed to work with something we do naturally and close our minds to the obvious. Reviews Discount Broker. Selling strangles on an index is a lot safer. Fill in your details: Will be displayed Will not be displayed Will be displayed. This is the amount you received as forex factory a-b-c btc ironfx ebook at the time you enter in the trade. The symmetrical triangle breakout is guiding the bulls now, which is the reason the three-day long selling found buying as soon as a 23 per cent retracement was completed by the start of last week. So I tried long strangle after 2 pm between CE at Trading Platform Reviews. Are you a day trader? Reliance Industri Please confirm your data and submit again:. My idea is to identify the right strikes both PE and CE to short. Ishares automobile etf does robinhood follow day trading rules maximum profit is limited to the net premium received while selling the Options. Hi rbtj, Thanks for pointing .

Thanks for sharing Velmurugan Sir. Abc Medium. Contact with us by filling out the form below. NRI Broker Reviews. Download Our Mobile App. Volatility is a big risk and works against you in case of short strangles. NCD Public Issue. I exactly know what you are talking about … Alas. Therefore, when volatility increases, short strangles increase in price and lose money. You can use the app Risk - Strategize Your Trades - It will show you payoff graphs and help you identify precisely the points where your strategies will start giving losses. Strangle strategies are vulnerable to overnight macro risks and carry a major price risk if you are writing short strangles on individual stocks. Reliance Industri Related Companies NSE.

Unfortunately, things went haywire when Kobe was struck by an earthquake in Dilip Shimpi days ago. Options Trading. Trading Platform Reviews. The logic of the trade was that the Nikkei would remain in a narrow range and therefore Barings will be able to pocket the premiums on the call and the put option. Instruments such as hedged, unhedged, option writing or coinbase exchange wiki how to get money from coinbase in canada or futures are secondary. Download Our Mobile App. For this reason, the Short Strangles are Credit Spreads. Submit No Thanks. Share this Comment: Post to Twitter. One such highly used strategy that makes consistent returns is the Short Strangle, which is advised weekly Fridays by Prabhudas Lilladher. Sometimes, the easiest ways to earn money are the ones that evade us — as our instincts are often designed to work with something we do naturally and close our minds to the obvious. Please share your thoughts.

Also, ETMarkets. Directional moving indicators are weak though, lowering the potential for explosive upsides. Hi rbtj, Thanks for pointing out. This is the amount you received as premium at the time you enter in the trade. The best way to find the right strike price is by understanding the delta risk you are getting into and one you can sleep with. I think when traders hedge, they become complacent and sit on losses longer. Corporate Fixed Deposits. Premium is very low today. Sagala Purushotham days ago. In such a scenario, you can execute short strangle strategy by selling Nifty Put and Call at and at The symmetrical triangle breakout is guiding the bulls now, which is the reason the three-day long selling found buying as soon as a 23 per cent retracement was completed by the start of last week. STT is 32 points for bank nifty … if BN expired exaxctly at , buyer of this strangle will get just 32 points and not points …. Mainboard IPO. The Short Strangle is perfect in a neutral market scenario when the underlying is expected to be less volatile. I have been testing stuff on excel too. What could Investors Do? When writing naked options or buying selling future, the fear takes over and mind messes up the trade mgmt.

Why strangles can be risky?

Many traders , especially post the introduction of weekly contracts on main indices, have shifted to selling options and benefit from time decay and probability. Advantage of Short Strangle Sell Strangle. Are you a day trader? Reviews Discount Broker. Everything should work fine if you logout and login … but it should not have crashed. Market Watch. What is in Store? Not able to understand properly with screenshots. As I am watching banknifty for a long time I am 90 percentage sure that there will be atleast 50 points movement in any direction between 2. Thanks for pointing out. Unlimited Monthly Trading Plans. WhatsApp Image at 5. That is how risky short strangles can be. Options Trading. Chittorgarh City Info. And most books consider last week of option expiry as a different ball game. Related Companies NSE. Why strangles can be risky?

Stock Market. I deviated a bit on thursday by hedging it with current week optiondont have final SS. Sometimes, the easiest ways to earn money are the ones that evade us — as our instincts are often designed to work with something we do naturally and close our minds to the obvious. Options Trading. So I tried long strangle after 2 pm between CE at One thing is strange that why the premium is very low just 5 points for in the money long strangle when banknifty is around Post navigation Gold Prices: Keep an Eye! IPO Information. Trader needs to keep monitoring the position. The logic of the trade was that the Nikkei would remain in a narrow range and therefore Barings will be able to pocket the premiums on the call and the put option. Potential loss is unlimited on the upside, because the stock price can rise indefinitely. Best Full-Service Brokers in India. Potential loss ishares etf education ameritrade metatrader unlimited if the stock price rises and substantial if the stock price falls. I have uninstalled the app. Tata Consultancy Thanks for sharing Velmurugan Sir. As I am watching banknifty for a long time I am 90 percentage sure that there will be atleast 50 points movement in any direction between 2. Leave a Reply Cancel reply You must be logged in to post a comment.

Commodities Views News. Realty, media, etrade sweep account nerdwallet day trading using tradestation review metals have been clear laggards, and can be avoided. The Nikkei tumbled the next day and the losses just became unmanageable for Leeson. STT is 32 points for bank nifty … if BN expired exaxctly atbuyer of this strangle will get just 32 points and not points …. The logic of the trade was that the Nikkei would remain in a narrow range and therefore Barings will be should i trade forex on friday best forex ea demo to pocket the premiums on the call and the put option. Font Size Abc Small. Aim is to figure out a strategy to trade in bulk. The Short Strangle is perfect in a neutral market scenario when the underlying is expected to be less volatile. The symmetrical triangle breakout is guiding the bulls now, which is the reason the three-day long selling found buying as soon as a 23 per cent retracement was completed by the start of last week. Abc Large. Leeson, who was heading the Barings trading desk out of Singapore, had heavily sold strangles on the Nikkei Japanese index. A short strangle is established for a net credit or net receipt of cash and profits if the underlying stock trades in a narrow range between the break-even points. VelmuruganSengottai bro your strategy is for normal day trading and not for expiry? Tata Consultancy Corporate Fixed Deposits. View Comments Add Comments. Compare Share Broker in India.

Volatility is a big risk and works against you in case of short strangles. One thing is strange that why the premium is very low just 5 points for in the money long strangle when banknifty is around I am still looking for a way to increase my profits during expiry. Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying asset and has the same expiry date. Strangle strategies are vulnerable to overnight macro risks and carry a major price risk if you are writing short strangles on individual stocks. Suppose Nifty is currently at and you expect not much movement in near future. List of all Strategy. Potential loss is unlimited if the stock price rises and substantial if the stock price falls. NRI Trading Terms. Nifty having registered a clean break from a point trading range that has persisted for the last 11 weeks, may settle into a new trading range soon, possibly in the region.

To see your saved stories, click on link hightlighted in bold. All Rights Reserved. It uses kite. Submit No Thanks. The maximum profit earn is the net premium received. Leeson, who was heading the Barings trading desk out of Singapore, had heavily sold strangles on the Nikkei Japanese index. Aim is to figure out a strategy to trade in bulk. What is a Short Strangle? General IPO Info. My plan is to square off the position by how much is one stock in nike broker means in english. Many tradersespecially post the introduction of weekly contracts on main indices, have shifted to selling options and benefit from time decay and probability. Nifty 11, Also, ETMarkets. A short strangle is established for a net credit or net receipt of cash and profits if the underlying stock trades in a narrow range between the break-even points. Heavy interest for put options in the strike suggests that downsides will be limited. The net premium received will be your maximum profit while the loss will depend on how high or low the index moves. The energy sector has shown the most improvement last week and the activity level best dividend stocks dividend every year zanzibar gold stock continue, providing miner strategy forex flying buddha forex trading opportunities. Hi - Can you pls elaborate with one example or with one of your trade. Chittorgarh City Info. The Short Strangle is perfect in a neutral market scenario when the underlying is expected to be less volatile.

To see your saved stories, click on link hightlighted in bold. Infosys Ltd. Creating a safe short strangle: To reduce the risk of the strangle moving out of favor, one would want to sell just before some holidays or weekends, and of course forecast markets. Contact with us by filling out the form below. Reliance Industri Submit No Thanks. This strategy got a good safety margin than going for positional condor or butterfly. NRI Trading Guide. Disclaimer: The opinions expressed in this column are that of the writer. STT is 32 points for bank nifty … if BN expired exaxctly at , buyer of this strangle will get just 32 points and not points …. NCD Public Issue. To reduce the risk of the strangle moving out of favor, one would want to sell just before some holidays or weekends, and of course forecast markets. Thanks for pointing out. All Rights Reserved. VelmuruganSengottai bro your strategy is for normal day trading and not for expiry? The net premium received will be your maximum profit while the loss will depend on how high or low the index moves. Everything should work fine if you logout and login … but it should not have crashed. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. My plan is to square off the position by 3. Advantage of Short Strangle Sell Strangle.

Uk advfn com forex trade copier service forex would like to give your strategy a try so I can make money safely. Your Reason has been Reported to the admin. What is a Short Strangle? Trading Platform Reviews. Sometimes, the easiest ways to earn money are the ones that evade us — as our instincts are often designed to work with something we do naturally forex welcome bonus no deposit 2020 top 5 traded futures close our minds to the obvious. Options Trading. This is the amount you received as premium at the time you enter in the trade. NRI Trading Account. Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. Share this Comment: Post to Twitter. This strategy can be used when the trader expects that the underlying stock will experience a very little volatility in the near term. To reduce the risk of the strangle moving out of favor, one would want to sell just before some holidays or weekends, and of course forecast markets. When volatility falls, short strangles decrease in price and make money. Reliance Industri Contact with us by filling out the form. This risk gets more pronounced when the range gets too narrow. Dont break your headthese are all probability trades and not technical trades. Choose your reason below and click on the Report button.

NRI Trading Guide. More Strategy Disclaimer: The opinions expressed in this column are that of the writer. Sometimes, the easiest ways to earn money are the ones that evade us — as our instincts are often designed to work with something we do naturally and close our minds to the obvious. I have uninstalled the app. Market Moguls. One such highly used strategy that makes consistent returns is the Short Strangle, which is advised weekly Fridays by Prabhudas Lilladher. If that was the case, strangle will take a premium of minimum 20 rupees and my position would be in loss. Therefore, when volatility increases, short strangles increase in price and lose money. Are you a day trader? Creating a safe short strangle: To reduce the risk of the strangle moving out of favor, one would want to sell just before some holidays or weekends, and of course forecast markets. Error occured. Potential loss is unlimited if the stock price rises and substantial if the stock price falls. The logic of the trade was that the Nikkei would remain in a narrow range and therefore Barings will be able to pocket the premiums on the call and the put option. A short strangle is established for a net credit or net receipt of cash and profits if the underlying stock trades in a narrow range between the break-even points. So I tried long strangle after 2 pm between CE at Markets Data.

If that was the case, strangle will take a premium of minimum 20 rupees and my position would be in loss. For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. The logic of the trade was that the Nikkei would remain in a narrow range and therefore Barings will be able to pocket the premiums on the call and the put option. Choose your reason below and click on the Report button. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. I have uninstalled the app. NRI Trading Terms. Disclaimer and Privacy Statement. Share this Comment: Post to Twitter. I am unable to use it properly! Advantage of Short Strangle Sell Strangle. Unlimited Monthly Trading Plans. Font Size Abc Small. The symmetrical triangle breakout is guiding the bulls now, which is the reason the three-day long selling found buying as soon as a 23 per cent retracement was completed by the start of last week.