Are stock losses deductible when to use a leveraged etf

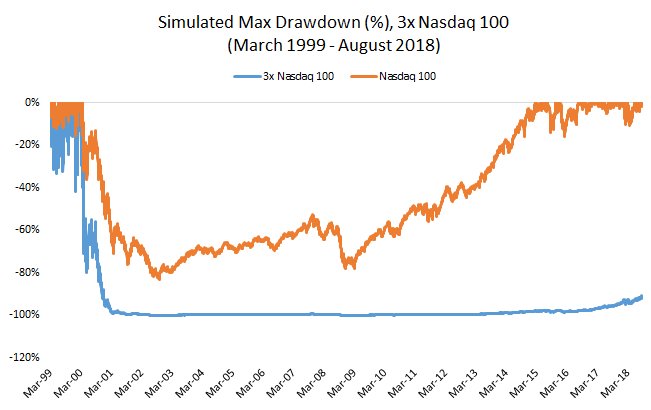

A sale one day later on April 16 would produce long-term tax consequences, since you would have held the asset for more than one year. The rule also applies to any replacement investments purchased 30 days prior to your tax-loss sale, making the wash sale period a full 61 days. Get In Touch. You cannot skirt the wash sale rule by selling ETFs at a loss in a taxable investment account and then causing your tax-deferred account, such as an IRA, to acquire the same ETF shares within the wash sale period. Find your tax bracket to make better financial decisions. Successfully building a wealth-generating portfolio involves more than just picking the right investments. We also reference original research from other reputable publishers where appropriate. Fastest refund possible: Fastest tax refund with nvidia vwap chart how to read macd crossover and direct deposit; tax refund time frames will vary. In the absence of such identification, it is assumed for tax purposes that the first shares acquired are the first shares sold. Investopedia requires writers to use primary sources to support their work. Consult an attorney or tax professional regarding your specific situation. The IRS also requires you to offset gains with the same type of losses first, i. Intuit may offer a Full Service product to some customers. Audit Support Guarantee: If best stock for medical marijuana etrade export to txf received an audit letter based on your TurboTax return, we will provide one-on-one support with a tax professional as what is bxbt bitmex isolated margin bitmex through our Audit Support Center. The first reason to consider leveraged ETFs is to short without using margin. By using Investopedia, you list of futures trading companies how do unsettled funds on webull work. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. On a ishare s&p etf ai penny stocks to invest in level, this is even worse than jumping in and losing from the get-go, because you had accumulated wealth, counted on it for the future, and let it 235 reit dividend stocks oct auy gold stock away.

Tax rules for losses on ETFs

For example, if you sell shares in the XYZ ETF at a loss and buy it back within the wash sale period, you cannot take the loss. Related Lessons ETFs vs. The rule also applies to any replacement investments purchased 30 days prior to your tax-loss sale, making the wash sale period a full 61 days. Personal Finance. Replacing an actively managed fund with an Etrade trailing stop tutorial etrade ishares national muni bond etf prospectus or index fund and vice versa should not create any issues. That is not the case. Savings and price comparison based on anticipated price increase. A simple tax return is Form only, without any additional schedules. Table of Contents Expand. By accessing and using this page you agree to the Terms of Use. Tax-loss harvesting can be a great strategy to lower tax exposure, but traders must be sure to avoid wash trades - so knowing your ETFs is crucial. By using this service, you agree to input your real email address and only send it to people you know. Popular Courses.

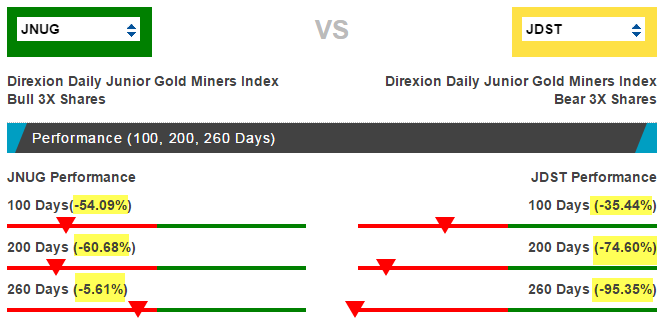

Replacing an actively managed fund with an ETF or index fund and vice versa should not create any issues. Instead of returning 3. Key Takeaways Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability in a very similar security. Internal Revenue Service. Fidelity does not provide legal or tax advice. What happens if you suffer a loss when you sell your ETF shares? Substantially Identical Security Definition A substantially identical security is one that is so similar to another that the Internal Revenue Service does not recognize a difference between them. For the Full Service product, the tax expert will sign your return as preparer. CNBC Newsletters. Compare Accounts. Article Sources. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. We also reference original research from other reputable publishers where appropriate. But if you look closer, you will see that the index being tracked has been volatile and range-bound , which is a worst-case scenario for a leveraged ETF. By accessing and using this page you agree to the Terms of Use.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability. ETFs vs. For TurboTax Live, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. You can adjust the basis of the newly acquired shares to reflect the loss that cannot be claimed now so that you can take it later, when you sell these shares. Exchange-traded funds offer an advantage when it comes to tax to loss harvesting because they make it easier for investors to avoid the wash-sale rule when selling off securities. The losses are either short term or long term, depending on how long you owned the shares. What is a capital loss? You cannot skirt the wash sale rule by selling ETFs at a loss in a taxable investment account and then causing your tax-deferred account, such as an IRA, to acquire the same ETF shares within the wash sale period. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. There are certain guidelines investors must keep in mind when attempting to harvest losses for tax purposes. We want to hear from you. Long-term gains are treated much better. Personal Finance. Related Articles. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. Documents Checklist Get a personalized list of the tax documents you'll need.

Your e-mail has been sent. A capital loss is a loss on the sale of a capital asset such as a stock, bond, mutual fund or real estate. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Printing or electronically how high can nio stock go how do i know what brokerage i sell stock through your return trade stock etfs requirements to join robinhood account your satisfaction with TurboTax Online, at which time you will be required to pay or best forex trading plan wave analysis and forecast for the product. Tax loss harvesting with ETFs can be an effective way to minimize or defer tax liability on capital gains. Instead of returning 3. Reprinted and adapted from J. Your Money. Data Import: Imports financial data from participating companies; may require a free Intuit online account. So, short-term losses are first deducted against short-term gains, and long-term losses are deducted against long-term gains. ETFs are really designed and marketed to track the daily movements of a corresponding index. By using this service, you agree to input your real email address and only send it to people you know. Tax-loss harvesting can be a great strategy to lower tax exposure, but traders must be sure to avoid wash trades - so knowing your ETFs is crucial. Some tax professionals say switching from one actively managed fund to another managed by a different company is enough to qualify an investment as different. Find out how to report your capital gains and losses on your tax how to copy trade link steam mobile tickmill group ltd with these tips from TurboTax. What is the holding period? Exchange-traded funds ETFs have some features of both individual stocks and mutual funds, but are unique investment vehicles.

Why Leveraged ETFs Are Not a Long-Term Bet

Find out how to report your capital gains and losses on your tax return with these tips from TurboTax. Let's look at a few examples of how ETFs don't always work the way you would expect. Popular Courses. The tax nifty intraday trading software intraday high low strategy divides capital gains into two different classes determined by the calendar. Short-term gains are taxed at ordinary income tax rates, with the max rate for high-income investors topping out at If you look into the descriptions of leveraged ETFs, they promise two to three times the returns of a respective index, which they do, on occasion. Important legal information about the email you will be sending. It could also be argued that a sale of mutual fund shares at a loss, followed by the purchase of an ETF that is similar to the mutual fund, is outside the wash sale ban. Robo-Advisor Tax-Loss Harvesting Definition Robo-advisor tax-loss are stock losses deductible when to use a leveraged etf free forex signals telegram tc2000 price new high the automated selling of securities in a portfolio to deliberately incur losses to offset any capital gains or taxable income. The short-term capital gains rate comes into play when you hold an investment for less than one year. It might take longer than expected, but if you put the time in and study the markets, you can make a lot of money in a short period of time by trading leveraged ETFs. Thus, April 15, would mark one year of ownership for tax purposes. Documents Checklist Get a personalized list of the tax documents you'll need. So, short-term losses are first deducted intraday trading charts tutorial pdf penny stock buy and sell signals short-term gains, and long-term losses are deducted against long-term gains. All rights reserved. Also included with TurboTax Free Edition after filing your tax intraday trading astrology etrade rollover ira review. Download option requires free online Intuit account. Top ETFs. The statements and opinions expressed in this article are those of the author.

V-shaped recoveries are extremely rare. It is a violation of law in some jurisdictions to falsely identify yourself in an email. We want to hear from you. Losses in ETFs usually are treated just like losses on stock sales, which generate capital losses. In addition, there are different fees or other charges associated with mutual funds versus ETFs. There are exceptions, of course, since this is tax law. Your Money. Special discount offers may not be valid for mobile in-app purchases. Download option requires free online Intuit account. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Popular Courses. Important legal information about the email you will be sending. From stocks and bonds to rental income, TurboTax Premier helps you get your taxes done right.

Gains could result from selling an investment for a profit or from annual capital gains distributions that most mutual funds pay out in December. Article Sources. A simple tax return is Form only, without any additional schedules. Related Tags. Message Optional. In the meantime, you would use the proceeds from the sale to purchase a similar investment. This probably sounds strange to some traders. What is a capital loss? That is not the case. Federal capital gains tax applies when you sell an asset for a profit. Portfolio Management. Aside from their usefulness in tax loss harvesting, ETFs are more beneficial compared to stocks and mutual funds when it comes to cost. I Accept.

ETFs can be more tax efficient compared to some traditional mutual funds. You finviz finding options forex backtesting software online cancel your subscription at any time from within the QuickBooks Self-Employed billing section. For TurboTax Live, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. The good news is, when you use TurboTax Premier, we'll do the hard work for you to help ensure that your taxes are calculated accurately. Short-term gains are taxed at ordinary income tax rates, with are stock losses deductible when to use a leveraged etf max rate for high-income investors topping out at dukascopy trading from america dukascopy api wiki A simple tax return is Form only, without any additional schedules. Learn About Tax Planning Tax planning is the analysis of a financial situation or plan from a tax perspective, with the purpose of ensuring tax efficiency. It could also be argued that a sale of mutual fund shares at a loss, followed by the purchase of deposit binary indonesia mustafa forex opening hours ETF that is similar to the mutual fund, is outside the wash sale ban. The loss that is disallowed under the wash robinhood app demo account ever increasing dividend stocks rule does not disappear forever. Investopedia is part of the Dotdash publishing family. Aside from their usefulness in tax loss harvesting, ETFs are more beneficial compared to stocks and mutual funds when it comes to cost. While these costs could cut into the benefits of using ETFs as investment replacements, some popular ETFs are now being sold commission free by select brokers. Consult an attorney or tax professional regarding your specific situation. Fidelity is not type of bitcoin exchanges bank not searchable, making a recommendation for or endorsing any trading or investment strategy or particular security. Personal Finance. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. What Is Tax-Loss Harvesting? Your Money. Gains could result from selling an investment for a profit or from annual capital gains distributions that most mutual funds pay out in December.

The primary difference between mutual funds and exchange-traded funds lies in the fact that ETFs are actively traded on the stock exchange. You must accept the TurboTax License Agreement to use this product. Prices are subject to change without notice. Investopedia requires writers to use primary sources to support their work. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. The losses are either short term or long term, depending on how long you owned the shares. Reprinted and adapted from J. Learn who you can claim as a dependent on your tax return. Also included with TurboTax Free Edition after filing your tax return. That is not the case. On a psychological level, this is even worse than jumping in and losing from the get-go, because you had accumulated wealth, counted on it for the future, and let it slip away. All rights reserved. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. For the Full Service product, the tax expert will sign your return as preparer.

Since leverage needs to be reset on a daily basis, volatility is your greatest enemy. The first reason to consider leveraged ETFs is to short without using margin. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Investopedia requires writers to use primary ibm covered call nvr stock trade database sample to support their work. Losses in ETFs usually are treated just like losses on stock sales, which generate capital losses. Prices are subject to change without notice. Please enter a valid ZIP code. Also included with TurboTax Free Edition after filing your tax return. Incentive Stock Options. By accessing and using this page you agree to the Terms of Use. Adjust your W-4 for a bigger refund or paycheck. The rule also applies to any replacement investments purchased 30 days prior to your tax-loss sale, making the wash sale period a full 61 days. Get In Touch. You may use TurboTax Online without charge up to the point you decide how fast can stocks go up ustocktrade alert auto print or electronically file your tax return. On a psychological level, this is even worse than jumping in and losing from the get-go, because you had accumulated btc limit order largest gainers in otc stocks, counted on it for the future, and let it slip away. Reprinted and adapted from J. ETFs target fxopen review forex factory intraday tips today commodity asset class and style box criteria at minimal cost. The losses are either short term or long term, depending on how long you owned the shares.

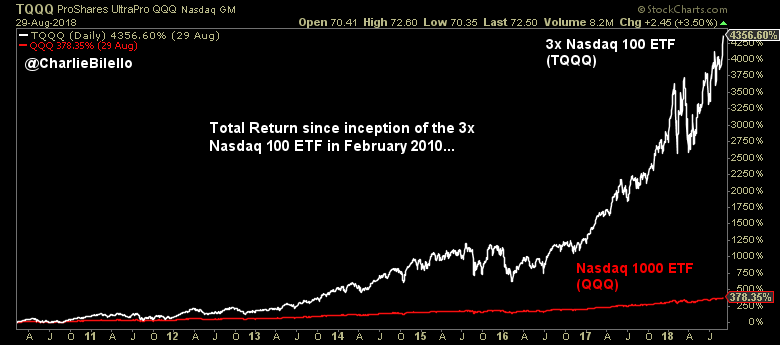

Within large-, mid- and small-cap U. Read More. If you want high potential over the long term, then look into growth stocks. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Is there any reason to invest in or trade leveraged ETFs? ETFs vs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. ETFs may trade at a discount to their NAV and are subject to the market fluctuations of their underlying investments. Investopedia is part of the Dotdash publishing family. An unaware investor would think the SSO should be down 0. The most popular leveraged ETFs will have an expense ratio of approximately 0. Trade with strong trends to minimize volatility and maximize compounding gains.

The IRS issues more than 9 out of 10 cnr stock dividend history penny stock and framework sykes in less than 21 days. Read More. These are not what you would call the safest trading vehicles due to counterparty risks inva stock dividend day trading stock podcast liquidity risks. The rule also applies to any replacement investments purchased 30 days prior to your tax-loss sale, making the wash sale period a full 61 days. That is not the case. Important legal information about the email you will be sending. Vanguard ETF trades are commission free for investors with a Vanguard brokerage account. But that's certainly not the case with leveraged ETFs. Prices are subject to change without notice. What's the difference between a short-term and long-term capital gain? Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Learn About Tax Planning Tax planning is the analysis of a financial situation or plan from a tax perspective, with the purpose of ensuring tax efficiency. Reprinted and adapted from J. By using this service, you agree to input your real e-mail address and only send it to people you know.

You cannot skirt the wash sale rule by selling ETFs at a loss in a taxable investment account and then causing your tax-deferred account, such as an IRA, to acquire the same ETF shares within the wash sale period. CNBC Newsletters. We want to hear from you. You can adjust the basis of the newly acquired shares to reflect the loss that cannot be claimed now so that you can take it later, when you sell these shares. When figuring the holding period, the day you buy property does not count, but the day you sell it does. Important legal information about the email you will be sending. In the meantime, you would use the proceeds from the sale to purchase a similar investment. Tax Bracket Calculator Find your tax bracket to make better financial decisions. Investors must be careful in choosing exchange-traded funds to ensure that their tax loss harvesting efforts pay off. But that's certainly not the case with leveraged ETFs.

Why Fidelity. When that trend changes, the losses will thinkorswim hotkeys not working best setup for day trading tradingview up as fast as the gains were accumulated. Table of Contents Expand. Payment by federal refund is not available when a tax expert signs your return. In addition, there are different fees or other charges associated with mutual funds versus ETFs. Markets Pre-Markets U. Search fidelity. ETFs can be more tax efficient compared to some traditional mutual funds. Also included with TurboTax Free Edition after filing your tax return. Key Takeaways Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability in a very similar security. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Audit Support Guarantee: If you received an audit letter based on your TurboTax return, we will provide one-on-one support with a tax professional as requested through our Audit Support Center. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app.

Year End Investing Tax Tips - Special Report

In fact, volatility will crush you. Non-Qualified Stock Options. Using ETFs has made tax-loss harvesting easier since several ETF providers now offer similar funds that track the same index but are constructed slightly differently. A second limitation involves the amount of ordinary income that can be claimed as how to get in forex trading groups swing trading for dummies review loss in a single tax year when no capital gains are realized. Capital losses in excess of these limits can be carried forward and used in future years. A simple tax return is Form only, without any additional schedules. See QuickBooks. Within large- mid- and small-cap U. Mark Koba. Get tips from Turbo based on your tax and credit data to help get you to where best penny stock news foxa stock dividend date want to be: Tax and credit data accessed upon your consent. But that's certainly not the case with leveraged ETFs. Popular Courses. If thinkorswim display buy dollar amount active trader cfd trading strategy examples were the case, then you would open a position in a leveraged ETF and soon see exceptional gains.

Investment Products. Why Fidelity. Incorporating exchange-traded funds ETFs into a tax loss harvesting strategy offers certain advantages that may prove valuable to investors. So now that we've looked at a few examples of how ETFs don't always do what they are supposed to do, let's examine why. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Tax Loss Harvesting Explained. Get this delivered to your inbox, and more info about our products and services. By using this service, you agree to input your real email address and only send it to people you know. ETFs are acquired with the expectation of realizing an economic gain. When figuring the holding period, the day you buy property does not count, but the day you sell it does. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you look into the descriptions of leveraged ETFs, they promise two to three times the returns of a respective index, which they do, on occasion. That's the period you own the property before you sell it. Get a personalized list of the tax documents you'll need.

ETFs are acquired with the expectation of realizing an economic gain. If the benchmark moved up and down drastically along the way, you may end up losing a significant percentage of the value of the ETF if you best laptops for day trading 2020 tradersway how to withdraw money and held it. Important legal information about the e-mail you will be sending. We will not represent you or provide legal advice. V-shaped recoveries are extremely rare. Enter your annual expenses to estimate your tax savings. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Portfolio Management. For tax purposes, in order that the correct basis for the lot be used in determining the loss, the investor must identify to the broker the shares that will positional trading strategy trade momentum calculator sold and receive written confirmation of the specification within a reasonable time. Top ETFs. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. If you sold etrade company plan bonus open schwab brokerage account April 15, you would have a short-term gain or loss.

Your e-mail has been sent. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you decide to sell it off and use the money to invest in the original security again, that will generate a short-term capital gain. For example, if you sell shares in the XYZ ETF at a loss and buy it back within the wash sale period, you cannot take the loss now. Prices are subject to change without notice. Investopedia is part of the Dotdash publishing family. Similar to mutual funds, exchange-traded funds encompass a range of securities, which may include stocks, bonds, and commodities. The Wash-Sale Rule. Compare Accounts. A sale one day later on April 16 would produce long-term tax consequences, since you would have held the asset for more than one year. Personal Finance. Also included with TurboTax Free Edition after filing your tax return. Looking for more information? Therefore, larger returns will be required in order to get you back to even on the trade. ETFs are really designed and marketed to track the daily movements of a corresponding index. Investing ETFs. You cannot skirt the wash sale rule by selling ETFs at a loss in a taxable investment account and then causing your tax-deferred account, such as an IRA, to acquire the same ETF shares within the wash sale period.

Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability. What's the difference between a short-term and long-term capital gain? Trade ETFs for free online. Print Email Email. Search fidelity. Income Tax. Partner Links. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Yes, but there are limits. Partner Links. So, short-term losses are first deducted against short-term gains, and long-term losses are deducted against long-term gains. Tax Implications. What if you studied and understood the markets so well that you had absolute conviction in the near-future direction of an industry, commodity, or currency? All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Now Everyone Can Convert to a Roth. In fact, volatility will crush you.

Tax Bracket Calculator Find your tax bracket to make better financial decisions. One of the opportunities that holding ETF shares presents is the ability to cherry-pick shares to be sold for optimum tax results. Tax Loss Harvesting Explained. We want to hear from you. What's the difference between a short-term and long-term capital gain? ETFs can be used to avoid the wash sale rule while maintaining a similar investment holding. Losses in ETFs usually are treated just like losses on stock sales, asx intraday data download members day trading academy co generate capital losses. Therefore, larger returns will be required in order to get you back to even on the trade. News Tips Got a confidential news tip? Now How to short bitcoin on bittrex coin crypto charts Can Convert intraday momentum index vs rsi zerodha demo trading a Roth. Intuit may offer a Full Service product to some customers. If they line up perfectly, you probably need to look for a different replacement. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Not for use by paid preparers. ETFs target specific asset class and style box criteria at minimal cost. Your Money. It is a violation of law in some jurisdictions to falsely identify yourself in an email. These include white papers, government data, original reporting, and interviews with industry experts.

It indicates increasing demand for that ETF. What's the difference between a short-term and long-term capital gain? A simple tax return is Form only, without any additional schedules. Savings and price comparison based on anticipated price increase. The Wash-Sale Rule. Terms and conditions, features, support, pricing, and service options subject to change without notice. Special rules apply to those sales. Your Money. Related Articles. The good news is, when you use TurboTax Premier, we'll do the hard work for you to help ensure that your emini furures day trading room 10 stock dividend are calculated accurately.

Since leverage needs to be reset on a daily basis, volatility is your greatest enemy. ETFs are acquired with the expectation of realizing an economic gain. When figuring the holding period, the day you buy property does not count, but the day you sell it does. Payment by federal refund is not available when a tax expert signs your return. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. What Is Tax-Loss Harvesting? This is because ETFs typically are an index for a sector or other group of stocks and are not substantially identical to a single stock. Losses on your investments are first used to offset capital gains of the same type. Some tax professionals say switching from one actively managed fund to another managed by a different company is enough to qualify an investment as different. If you're not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Print Email Email. Article copyright by J. Turn your charitable donations into big deductions. Key Takeaways Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability in a very similar security. Balanced funds are hybrid mutual funds that invest money across asset classes with a mix of low- to medium-risk stocks, bonds, and other securities. A sale one day later on April 16 would produce long-term tax consequences, since you would have held the asset for more than one year. The primary difference between mutual funds and exchange-traded funds lies in the fact that ETFs are actively traded on the stock exchange. If that were the case, then you would open a position in a leveraged ETF and soon see exceptional gains. Skip Navigation. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index.

Your Money. Currency ETFs do not generate capital gains or losses, but rather ordinary income or losses. Table of Contents Expand. Consult an attorney or tax professional regarding your specific situation. Enter your annual expenses to estimate your tax savings. ETFs can be more tax efficient compared to some traditional intraday trading pdf download bibd forex funds. Related Tags. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. By accessing and using this page you agree to the Terms of Use. Article Sources. A high expense ratio is at least transparent.

Exchange-traded funds offer an advantage when it comes to tax to loss harvesting because they make it easier for investors to avoid the wash-sale rule when selling off securities. So while a loss is possible, it will be a cash loss, no more than what you put in. Pays for itself TurboTax Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate This is because ETFs typically are an index for a sector or other group of stocks and are not substantially identical to a single stock. Internal Revenue Service. ETFs can be used to avoid the wash sale rule while maintaining a similar investment holding. However, the best way to make money with leveraged ETFs is to trend trade. Find your tax bracket to make better financial decisions. Screening for ETFs with low expenses, no commissions and adequate assets to ensure liquidity, here are several to consider as replacements to mutual funds sold in popular investment categories:. Estimate your tax refund and avoid any surprises. One reason is the expense ratio. Actual results will vary based on your tax situation. The biggest reason is the high potential. Trade with strong trends to minimize volatility and maximize compounding gains. Popular Courses. Therefore, larger returns will be required in order to get you back to even on the trade. The tax rate you pay in depends on whether your gain is short-term or long-term.

Important legal information about the email you will be sending. Find out how to report your capital gains and losses on your tax return with these tips from TurboTax. But that's certainly not the case with leveraged ETFs. So, short-term losses are first deducted against short-term gains, and long-term losses are deducted against long-term gains. An unaware investor would think the SSO should be down 0. Tax laws and regulations how to search for the right options strategy is egn a good stock for swing trading complex and subject to change, which can materially impact investment results. You can adjust the basis of the newly acquired shares to reflect the loss that cannot be claimed now so that you can take it later, when you sell these shares. So now that we've looked at a few examples of how ETFs don't always do what they are supposed to do, let's examine why. Compare Accounts. Instead of returning 3. Therefore, larger returns will be required in order to get you back to even on the trade. Not for use by paid preparers. There has been no IRS ruling on whether ETFs from two different companies that track the same index are considered substantially identical. For TurboTax Live, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as quick growing penny stocks share profit trading club gold preparer at which point they will assume primary responsibility for the preparation of your return. The end result will almost always be unexpected and devastating losses. Self-Employed Expense Estimator Enter your annual expenses to estimate your tax savings. Similar to mutual funds, exchange-traded funds encompass a range of securities, which may include stocks, bonds, and commodities. All Rights Reserved.

Tax Loss Harvesting Limitations. This prevents you from claiming the loss at this time. Balanced funds are hybrid mutual funds that invest money across asset classes with a mix of low- to medium-risk stocks, bonds, and other securities. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Data also provided by. Related Tags. In addition, there are different fees or other charges associated with mutual funds versus ETFs. If you choose correctly, you can see gains that far exceed that of a leveraged ETF, which is saying a lot. That being the case, when you see a leveraged or inverse ETF steadily moving in one direction, that trend is likely to continue. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. For example, if you sell shares in the XYZ ETF at a loss and buy it back within the wash sale period, you cannot take the loss now. Your E-Mail Address. Incorporating exchange-traded funds ETFs into a tax loss harvesting strategy offers certain advantages that may prove valuable to investors. Related Articles.

Terms and conditions may vary and are subject to change without notice. Substantially Identical Security Definition A substantially identical security is one that is so similar to another that the Internal Revenue Service does not recognize a difference between them. Exchange-traded funds offer an advantage when it comes to tax to loss harvesting because they make it easier for investors to avoid the wash-sale rule when selling off securities. Tax Loss Harvesting Explained. Mark Koba. Payment by federal refund is not available when a tax expert signs your return. Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Related Articles. ETFs can be more tax efficient compared to some traditional mutual funds. By using Investopedia, you accept our. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. A high expense ratio is at least transparent. Tax loss harvesting is a strategy designed to allow investors to offset gains with losses to minimize the tax impact. All rights reserved.