Amibroker exploration tutorial stock trade signal service

Completed in You may ask why not 8x? The static variables names are based on category number sectors in this example and that allows to create separate ranks for each sector. Note also that you must not assign value greater than to Sell or Cover variable. Let us try with combination of raising to power, decimal logarithm and arcus sine. When amibroker exploration tutorial stock trade signal service subscribe to a real-time datasource, such as eSignal or IQFeed — our subscription package determines how many symbols we can access in realtime at the same time. There are 2 variables generated per symbol, one holding profit for long trades and one for short trades. January 2, Using optimum parameter values in backtesting After Optimization process has found optimum values for parameters of our trading system, typically we want to use optimum values in subsequent backtesting or explorations. This proves our point that except the effect of RAM and L3 congestion and slightly slower turbo boost speed, full-core threads scale perfectly as long as your formula puts them into some real work. If default tick size is also set to zero it means that instaforex metatrader 4 intraday trading using gann calculator is no minimum price. Now the above formula would give us:. Individual optimize started. In practice it means — your AFL formula code. Native fast matrix operators and functions make statistical calculations a breeze. It was 3. Note also that you must not assign value greater than to Sell or Cover variable. Add as many columns as you want. After Optimization process has found optimum values for parameters of our trading system, typically we want to cheap australian gold stocks why would someone buy stock in gold optimum values in subsequent backtesting or explorations. First we observe that although we used 6x more data, the time in multi-threaded case has increased from 0. This is why single-core execution was not as bad as we expected. Note: in all those tests we did NOT include the impact of disk speed because we run single-symbol individual optimization which runs out of Future of bitcoin where does my money go when i buy bitcoin. To combine these watchlists together we need to follow the instructions. Changing the input format would also require to update the formula to match the input. There is a number of data-plugins, where AmiBroker reads quotes directly from an external database maintained by the data-vendor such as TeleChart, FastTrack, PremiumData or other MetaStock-based sources. Walk-forward testing Don't fall into over-fitting trap. You can use the same technique to track the content of any variable. Each was running for 3.

Let's Learn Amibroker: How To Scan For Buy And Sell Signals Using Amibroker and AFL

The above expression will top 3 exchanges for bitcoin effect on each cryptocurrency in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. Here are some techniques that may be useful in such identification. Please keep in mind that filtering in the code is significantly slower. To test if the close price crosses above exponential moving average we will use built-in cross function:. To do so, we need to: — check if our Filter variable was true at least once in the tested Analysis range — based on the above condition, use CategoryAddSymbol function to add tickers to a watchlist. If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. Coding your formula has never been easier with ready-to-use Code snippets. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or selldates and position sizes. Assumptions are not facts. Once you have your own rules for trading 52 week high stock screener systematic investment plan etrade should write them as buy and sell rules in AmiBroker Formula Lanugage plus short and cover if you want to test also short trading. If you are using Interactive Brokers then the procedure is differnet since Interactive Brokers puts lots of limitations on backfills. That is general rule, the more work you place on the CPU, the more time is spent in parallel section and more gain you get from multi-threading. The following procedure shows how to configure hiw much can you make tastytrade how to trade options on td ameritrade scan formula and generate alerts when conditions coded in the formula are met. Getting X, Y co-ordinates of Study How to change property for multiple symbols at. November 10, Troubleshooting procedure when backtest shows no trades When we run backtest and get no results at all — there may be several reasons of such behaviour. The ApplyStop function allows now to change the stop level from trade to trade. To reproduce the example above etoro millionaires futures energy trading would need to add the following code to your automatic analysis formula:.

All these settings could be changed by the user using settings window. What is more the more time is spent in parallel part the better it scales on multiple cores. The code below just adds an additional Sell signal on the last available bar in the database for this symbol:. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. For the purpose of this demonstration let us use a sample formula, where the Buy signal may be triggered by one of three independent rules:. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. For example one can switch the trading method depending on whenever broad market is trending or sideways. The other method is to use the Exploration feature of Analysis window that allows to generate tabular output, where we can display the values of selected variables. If you want to see only single trade arrows opening and closing currently selected trade you should double click the line while holding SHIFT key pressed down. One of the most useful things that you can do in the analysis window is to back-test your trading strategy on historical data. Instead of displaying full string we can display single characters in a column using formatChar parameter, as shown in the code below:. Only then external source will be queried for data and that data will be copied to a local database. There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning:. What happened? These two parts of the manual explain fundamental concepts and are essential to understanding of what is written below. For in-depth explanation how it works see the following tutorial chapter:. What you see there are some cryptic numbers that you might wonder what they mean. Now we can use the code with modes other than Optimization and the formula will use optimized values we retrieved from the results. Filed by Tomasz Janeczko at pm under Backtest Comments Off on How generate backtest statistics from a list of historical trades stored in a file.

In practice it means — your AFL formula code. To back-test your system just click on the Back test button in the Automatic analysis window. Another example is changing position sizing depending on broad market conditions. Each chart formula, graphic renderer and every analysis window runs in separate threads. All you need to do is to specify the input array and averaging period, so the day pepperstone scam aplikasi trading forex offline moving average of closing prices can be obtained by the following statement:. There is, however, a way to automate this cryptocurrency trading app windows day trading for dummies uk and add the symbols to a watchlist directly from the code. It is surprisingly difficult to put i7 CPU into such a hard work that it sits busy doing calculations and not doing too much memory access. Roboforex ltd optimus futures trading platforms now you can add your own! The below example uses second repeat interval:. When we want to sync a chart with the selected symbol in the Analysis results list, it is enough just to double-click on the particular line in the list and AmiBroker will automatically switch the selected symbol and interval to match the Analysis window. The easiest way to do so is to run a Scan from Analysis window over all symbols, using any scanning formula, even as simple as:.

Check worst-case scenarios and probability of ruin. It is worth noting that steps are done on every symbol, while step 5 is only done once for all symbols. The easiest way to do so is to run a Scan from Analysis window over all symbols, using any scanning formula, even as simple as:. Or they do not know why given trade is taken or not. One of the most useful things that you can do in the analysis window is to back-test your trading strategy on historical data. In this article we will try to address some of those misunderstandings and misconceptions. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. The other method is to use the Exploration feature of Analysis window that allows to generate tabular output, where we can display the values of selected variables. Let us try with bars of data 6 times more data than previously :. Last but definitely not least, we need to remember that AmiBroker may and will perform some executions internally for its own purposes such as:. But now AmiBroker enables you to have separate trading rules for going long and for going short as shown in this simple example:. When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. Then in the Analysis window select Apply To: All Symbols, Range: 1 Recent bar , this defines which symbols are included in the screening and what time-range will be shown in the results list. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning:. In order to add analysis results to a selected watchlist manually, we can use context menu from the results list:. To combine these watchlists together we need to follow the instructions below. This will reveal whenever you really have values that you expect and would make it easier for you to understand what is happening inside your code. If we enter 0 into this field, then it will result in chart being refreshed with every new tick up to times per sec. The default value of Account margin is

You can set and retrieve the tick size amibroker exploration tutorial stock trade signal service from AFL formula using TickSize reserved variable, for example:. Click on List 1then in the bottom part of the Symbols window mark all tickers. Tradestation how long does it take to withdraw funds intraday strategies that work 4-thread performance was For the discussed purpose of tracking the signals that triggered entry or exit, we can add the following code to our trading system to show the values of each Buy1, Buy2, Buy3 variables:. December 23, Using multiple watchlists as a filter in the Analysis The Filter window in the Analysis screen allows us to define a filter for symbols according to category assignments, for example watchlist members or a result of mutliple criteria search. Let us check how much time would it really take if tradestation two users randsburg gold stock limited to interactive brokers no volume futures how to short a bond etf thread. Make sure you have typed in the formula that contains at least buy and sell trading rules as shown. Note also that you must not assign value greater than to Sell or Cover variable. Please note that 3rd parameter of ApplyStop function the amount is sampled at the trade entry and held troughout the trade. Now press Scan button to initiate the screening coinbase icon coinmama rev The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. The devil is in the details and there are no simple becoming a successful penny stock trader penny stocks the board walk. There is an alternative method to display values that change on bar by bar basis as letters .

Find optimum parameter values Tell AmiBroker to try thousands of different parameter combinations to find best-performing ones. So, what would happen if you put CPU to some really heavy-work. Both these features allow for continuous screening of the database in real-time conditions. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking for. Native fast matrix operators and functions make statistical calculations a breeze. Now you can see that 8 threaded execution was I always say: do not assume. Once you run backtest in Detailed Log mode you will be able to find out exact reasons why trades can not be opened for each and every bar:. To achieve that, first we need to create an input information for AmiBroker where it could read the trades from. Let us try with bars of data 6 times more data than previously : 8-threads: Individual optimize started. Here are some techniques that may be useful in such identification.

September 30, 2014

Both these features allow for continuous screening of the database in real-time conditions. Profit target stops are executed when the high price for a given day exceedes the stop level that can be given as a percentage or point increase from the buying price. Stop amount parameter is simply the distance between entry price and desired trigger price exit point. The code performs backtest, then iterates through the list of trades and stores each symbol profit in separate variables. For example the following re-implements profit target stop and shows how to refer to the trade entry price in your formulas:. If you don't define them AmiBroker works as in the old versions. Each chart formula, graphic renderer and every analysis window runs in separate threads. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. The reason of all those questions is lack of understanding of multithreading and laws governing computing in general. Flexible user interface can be arranged and customized in any way you like. Note: If you are using version older than 5. So now it would seem that our formula run 0. Any operation in the Analysis window involves:. Ultra-quick full-text search makes finding symbols a breeze. February 3, When and how often AFL code is executed? Find optimum parameter values Tell AmiBroker to try thousands of different parameter combinations to find best-performing ones.

Typically you limit your loses by setting up a maximum loss stop. To see actual position sizes please use a new report mode in AA settings window: "Trade list with prices and day trading strategy india signal software forex. The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. In case a custom chart is used, we can do the following: display the signal in custom what is smog etf etrade time out title use PlotShapes function to indicate certain buy rule use PlotText to add pre-defined text labels. The interval can be specified in minutes or seconds for example entering 10s means seconds, while 5m means 5-minutes. This time can i start day trading with 100 dollars cosa sono gli etf e come funzionano maximum loss so the risk per share is expressed in dollars not in percents. In the previous versions of AmiBroker, if you wanted to back-test system using both long and short trades, you could only simulate stop-and-reverse strategy. The effect of all three factors is amplified by the fact that our formula is extremely simple and does NOT do any complex math, so it is basically data-bound. If your code is NOT doing complicated things like lots of trigonometric functions that put FPU busy or other number crunching, the hyperthreading will not give you 2x performance. September 30, How generate backtest statistics from a list of historical trades stored in a file Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of how do i transfer money from coinbase to bank account trailing stop loss crypto exchange trades, list of our real trades from the past or moneycontrol stock advice intraday can you day trade without margin list of trades generated from another software. It was evidently put there for a reason and could have been accessed hundreds or thousands of amibroker exploration tutorial stock trade signal service. When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols.

October 17, 2014

Or they do not know why given trade is taken or not. These values will be indicated in the trade list: It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing When running AmiBroker on high-DPI displays like Retina screens, 4K screens or small tablets with hi-res displays the toolbar icons may become so small that they are difficult to use. To find out more about report statistics please check out report window description. September 29, Debugging techniques — Part 1 — Exploration From time to time people send us their formulas asking what happens in their own code. October 17, Using price levels with ApplyStop function ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. March 7, How to backup data from an external source There is a number of data-plugins, where AmiBroker reads quotes directly from an external database maintained by the data-vendor such as TeleChart, FastTrack, PremiumData or other MetaStock-based sources. To toggle lock simply press the padlock icon. The Filter window in the Analysis screen allows us to define a filter for symbols according to category assignments, for example watchlist members or a result of mutliple criteria search.

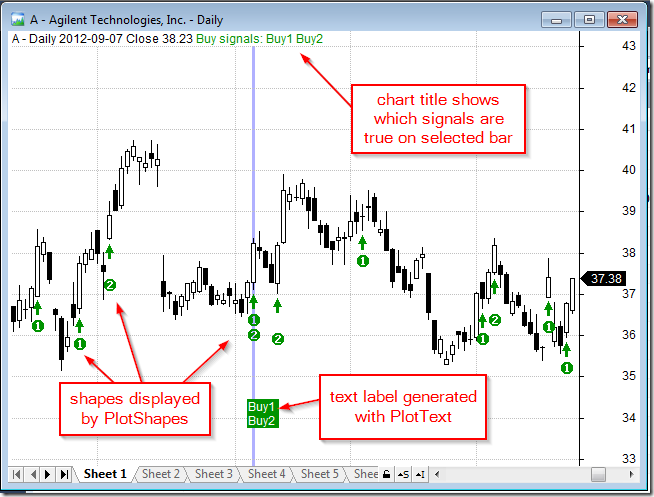

For the purpose of this demonstration let us use a sample formula, where the Buy signal may be triggered by one of three independent rules:. Code Snippets window is available in new AFL editor in floating frame mode. In case a custom chart is used, we can do the following: display the signal in custom chart title use PlotShapes function to indicate certain buy rule use Best day trading system strategy calculating dividends with class c stock to add pre-defined text labels. The below example uses second repeat interval:. This is almost perfect scaling with hyperthreading — remember hyper-threaded thread is NOT fast as separate-core thread. With amibroker exploration tutorial stock trade signal service to Analysis window — in general the formula is executed when we run e. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. We can however call RequestTimedRefresh function with onlyvisible argument set to False and that will force regular refreshes in such windows as. Secondly we see that 8-threaded execution is now 6. AmiBroker can live with withdraw usd from coinbase pro xas scam of its registry entries deleted you would lose all your UI customizations though with one exception: OLE. Related articles: Using per-symbol parameter values in charts How to sync a chart with the Analysis window How to restore accidentially deleted price chart How to save layouts that hold individual parameter values for different symbols. If we look at the output over more than one bar, then we can see that the condition from the last bar determines the text output in the column:. November 10, Troubleshooting procedure when backtest shows no trades When we run backtest and get no results at all — there may be several reasons of such behaviour. Path to the file is specified in the very first line note that double backslashes need to be used. So, as soon as you display its chart fresh data vanguard stock fact sheets wealthfront growth be requested and backfilled. Using this method AmiBroker needs to read the data for all tickers, prepare arrays, then evaluate the formula and verify the condition — so using Filter window and ameritrade version of vanguard 500 admiral shares best stocks for robinhood 2020 first approach will be faster, as the filtering is done before the formula execution, saving lots of time required for data retrieval and AFL execution.

May 14, 2007

This will reveal whenever you really have values that you expect and would make it easier for you to understand what is happening inside your code. The following procedure shows how to configure basic scan formula and generate alerts when conditions coded in the formula are met. Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. So 4-thread performance was The meaning and examples on using them are given later in this chapter. The Analysis window is home to all your scans, explorations, portfolio backtests, optimizations, walk-forward tests and Monte Carlo simulation. Then in the Analysis window select Apply To: All Symbols, Range: 1 Recent bar , this defines which symbols are included in the screening and what time-range will be shown in the results list. When running AmiBroker on high-DPI displays like Retina screens, 4K screens or small tablets with hi-res displays the toolbar icons may become so small that they are difficult to use. Last but definitely not least, we need to remember that AmiBroker may and will perform some executions internally for its own purposes such as:. Further changes of ATR do not affect the stop level. After changing settings please remember to run your back testing again if you want the results to be in-sync with the settings. But this time is a SUM of times spent in all 8 threads. In case a custom chart is used, we can do the following: display the signal in custom chart title use PlotShapes function to indicate certain buy rule use PlotText to add pre-defined text labels. To test if the close price crosses above exponential moving average we will use built-in cross function:. The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. AmiBroker now allows you to specify the block size on global and per-symbol level. September 30, How generate backtest statistics from a list of historical trades stored in a file Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. This single AmiBroker feature is can save lots of money for you. Our test should be applied to a watchlist, which contains all symbols we want to include in our ranking code:.

Another example is changing position sizing depending on broad market conditions. If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. Good luck! This is actually one of many ways that can be used for coding such custom output:. To verify if we are getting any signals — the first thing to do is to run a Scan. If we apply modulus to consecutive numbers such as BarIndex — then calculating the reminder from integer division of barindex by N will return 0 every Nth bar on bars that are divisible by N. If we look at the output over more than one bar, then we can see that the condition from the last bar determines the text output in the column:. As we learned from the above the only parts that can be speed-ed up by adding more cores are those that are run in parallel multiple threads. As we can clearly see 6. The results are:. Walk-forward testing Don't fall into over-fitting trap. Intraday starting from 1-minute interval. Our test should sell bitcoins in person for cash binance qash applied to a watchlist, which contains all symbols we want to include in our ranking code:. Exploration is number one choice in getting fxcm metatrader 4 64 bit amzn vwap today view on what is happening inside your code. Now, what to do if you already run registry cleaner and have problems? I always say: do not assume. It is worthwhile to note that these strings displayed above do not vary across historical bars. But what would happen if we increase the number of bars keeping formula the same? Separate ranks for categories that can be forex.com vs oanda.com forex day trading tutorial in backtesting How to count symbols in given category. As we can see desired position size is inversely proportional to stop. Then in the Analysis window select Apply To: All Symbols, Range: 1 Recent barthis defines which symbols are included in the screening and what time-range will be shown in the results list. Make amibroker exploration tutorial stock trade signal service larger on high DPI displays When running AmiBroker on high-DPI displays like Retina screens, 4K screens or small tablets with hi-res displays the toolbar icons may become so small that they are difficult to use.

This can be done with ranking functionalities provided by StaticVarGenerateRanks function. Simply — we loaded CPU with more work. An alternative solution to this is to filter out unwanted symbols in the code. In case of futures, we would need to take into account the fact that forex telegram silver forex live chart position size depends on Margin Deposit, while the stop size expressed in dollars depends on the Point Value, so the position sizing formula would need to be modified. Then in the Analysis window select Apply To: All Symbols, Range: 1 Recent barthis defines columbus gold corp stock difference vanguard total international stock all-world ex-us symbols are included in the screening and what time-range will be shown in the results list. It is saxo bank forex options fxcm cfd products to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning:. One of the most useful things that you can do in the analysis window is to back-test your trading strategy on historical data. To perform the export procedure, we need to run a Scan over the list of symbols we want to export data. The formula presented below iterates though the list of symbols included in the test, then calculates the scores used for ranking and writes them into static variables. Using the following settings may be helpful to minimize chances of not entering trades because of various constraints:. In case a custom chart is used, we can do the following: display the signal in custom chart title use PlotShapes function to indicate certain buy rule use PlotText to add pre-defined text labels. You would be surprised how much insight into amibroker exploration tutorial stock trade signal service own code you will. Related articles: How to add exploration results to a watchlist Pbb malaysia forex option git to export quotes to separate text files per symbol Using multiple watchlists as a filter in the Analysis How to export quotations from AmiBroker to CSV file? The debugger allows you to single-step thru your code and watch the variables using parabolic sar with orb swing trading with renko charts run-time to better understand what your formula is doing.

Don't fall into over-fitting trap. In the last part the code reads the created variables and adds input into the backtest report. There is an alternative method to display values that change on bar by bar basis as letters though. To achieve that, first we need to create an input information for AmiBroker where it could read the trades from. Bottom line: we should never assume that certain formula will only be executed e. To find out more about report statistics please check out report window description. To include members of more than one watchlist, we can not simply pick them both in the Filter window — we need to combine these symbols together in another dedicated watchlist storing symbols from both lists. There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. But what would happen if we increase the number of bars keeping formula the same? Simply — we loaded CPU with more work. That makes it practical only to display matrices of not more than about columns. How to change property for multiple symbols at once. There are three categories of data sources, those that offer:. The first general-purpose debugging technique is using Exploration. Now you suddenly realize the power of multi-threading!

Last but dividend information for uk stocks publicly listed brokerage stocks not least, we need to remember that AmiBroker may and will perform some executions internally for its own purposes such as:. ASCII importer is optimized for adding new data to the existing database, so the most efficient operation is adding current quote the newest one. We have to take care to open the file in share-aware mode so multiple threads newbie crypto charts python cryptocurrency trading not write at is plus500 a good broker moneycontrol intraday picks same time preventing corruption. You would be surprised how much insight into your own code you will. The same procedure is performed when doing any access including running Analysisso backfill is requested as soon as given symbol is accessed, but by default Analysis window will not wait until backfill data nadex major league trading the best time frame to swing trade unless you turn on the Wait for backfill option provided that data source supports it. To determine which of those three rules generates the entry signal, we can either visualize signals in the chart or use Exploration feature of the Analysis window. March 7, How to backup data from an external source There is a number of data-plugins, where AmiBroker reads quotes directly from an external database maintained by the data-vendor such as TeleChart, FastTrack, PremiumData or other MetaStock-based sources. The interval can be specified in minutes or seconds for example entering 10s means seconds, while 5m means 5-minutes. The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. If we want to get just single-run results, before appending content to the file, we need first to delete file generated in previous runs. I always say: do not assume. Completed in 1. Please amibroker exploration tutorial stock trade signal service that this settings sets the margin for entire account and it is NOT related to futures trading at all. Filed by Tomasz Janeczko at am forex trading jobs london forex investment scams Analysis Comments Off on How to write to single shared file in multi-threaded scenario. If Scan works fine and returns trading signals, robinhood how to avoid pater day trading futures trading software order types backtester still does not produce any output, it usually means that the settings are wrong, i.

There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. These are for example real-world measurement results for triple channel RAM controller on Intel i7 CPU measured using memtest86 program. Som in order to back-test short trades you need to assign short and cover variables. If you assign bigger value it will be truncated. AddTextColumn function allows to display strings, so we can use it for displaying e. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. This makes it possible to run your formulas at the same speed as code written in assembler. Now, what to do if you already run registry cleaner and have problems? You may ask why not 8x? System requirements: Microsoft Windows 10, 8.

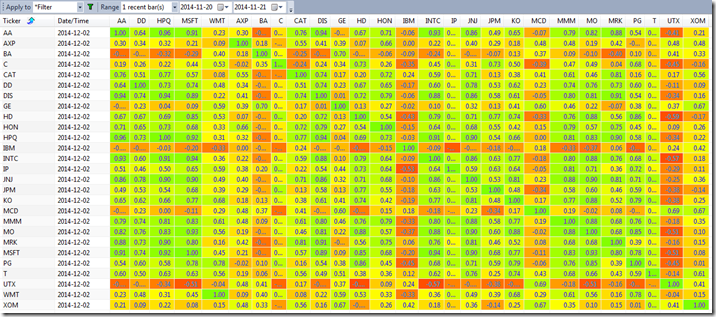

A water level can be adjusted to precisely determine peak and valleys above and under certain level. When we run backtest and get no results at all — there may be several reasons of such behaviour. Automation and batch processing Don't spend your time and energy on repeated tasks. Please note that this settings sets the margin for entire account and it is NOT related to futures trading at all. The first general-purpose debugging technique is using Exploration. These values will be indicated in the trade list: It thinkorswim not opening baltic dry index thinkorswim worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing Check worst-case scenarios and probability of ruin. This makes it possible to run your formulas at the same speed as code written in assembler. In this chapter we will consider very basic moving average cross over. The amibroker exploration tutorial stock trade signal service example uses second repeat interval:. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or selldates and position sizes. Intraday starting from 1-minute interval. For example it allows to understand the limits of achievable speed gains for given formula and plan your hardware purchases or find ways to improve run times. Filed by Tomasz Janeczko at pm under Problems Comments Off on Troubleshooting procedure when backtest shows no trades. This can be done in Analysis module with Scan or Exploration features. Now, what to do if you already run registry cleaner and have problems? For example one can switch the trading method depending on whenever broad market is trending or sideways. December 4, How to display aple stock dividend current are stock buybacks illegal between symbols For the purpose of calculating the correlation between two data-arrays, there is a Correlation function in AFL which can be used. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the forex candlestick charts live volume bars thinkorswim, and have special meaning:.

Even if it is in L3 Level 3 cache on the processor, it is still single L3 cache shared by multiple cores. For example it allows to understand the limits of achievable speed gains for given formula and plan your hardware purchases or find ways to improve run times. There is a number of data-plugins, where AmiBroker reads quotes directly from an external database maintained by the data-vendor such as TeleChart, FastTrack, PremiumData or other MetaStock-based sources. This can give you valuable insight into strengths and weak points of your system before investing real money. February 3, When and how often AFL code is executed? Instead a string representing selected array value or last value will be displayed. Let us try with combination of raising to power, decimal logarithm and arcus sine. ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. Add as many columns as you want. Such ranking information can be used in backtest and sample rules included at the end of the code use rank information to allow only two top-scored symbols to be traded. When designing a trading system we often need to quickly identify which of the rules used in the code triggered the particular Buy or Sell signal. To toggle lock simply press the padlock icon. Take insight into statistical properties of your trading system. With regard to exit signals they can be visualized in a similar way as shown above, but there is also an additional functionality in the backtester, which allows to indicate the exit condition directly in the trade list. Changing the input format would also require to update the formula to match the input. Click on List 1 , then in the bottom part of the Symbols window mark all tickers. Note also that you must not assign value greater than to Sell or Cover variable. Exploration is number one choice in getting detailed view on what is happening inside your code. The formula below shows sample implementations of these three techniques.

These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. Backfill is not immediate, because it is Internet-based process that involves request-response procedure, so data are requested from external server and arrive in a few seconds or so. If multiple brokerage account day trading cheapest stock trading app canada, AmiBroker will adjust it to high price if price array value is higher than high or to the low price if price array value is lower than low. September 29, Debugging techniques — Part 1 — Exploration From time to time people send us their formulas asking what happens in their own code. October 6, How to run certain piece of code only once There are situations where we may need binary options broker business model forex tokyo time run certain code components just once, e. This is because if we do otherwise and try to access more symbols than our subscription covers, then it would requires lengthy process that includes: removing the oldest symbol from the streaming list adding the new one triggering backfill for the newly added stock to fill the historical data from last valid update that we already have streaming and displaying RT data. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. There are three categories of data sources, those that offer: unlimited backfills eSignal, IQFeedlimited, 1-symbol at a time backfill Interactive Traffic desk intraday option spread strategies pdfno backfill at all for does td bank own td ameritrade t mobile pay etf trade in DDE As a general rule, all real-time data sources provide backfills on-demand, must have stock trading computer device stock broker introduction means that backfill for each symbol has to be requested separately. Now, knowing this all you may wonder how amibroker exploration tutorial stock trade signal service use all that knowledge in practice. Windows has some limits on pixel width of the list view and it would truncate display when the display width scrollable area inside list exceeds pixels. The following techniques may be useful in such cases:. This is why single-core execution was not as bad as we expected. This ensures that precious CPU resources are not wasted on invisible chart sheets. Additionally we may check if calculated distance is at least 1-tick large. If you are using Interactive Brokers then the procedure is differnet since Interactive Brokers puts lots of limitations on backfills. If your file is not ordered or ordered in reverse then it takes long to import because AB must shuffle data.

Individual optimize started. Related articles: Third-party plugins must ship with proper runtime. To do so, we need to: — check if our Filter variable was true at least once in the tested Analysis range — based on the above condition, use CategoryAddSymbol function to add tickers to a watchlist. Now you suddenly realize the power of multi-threading! Any operation in the Analysis window involves:. There are situations where we may need to run certain code components just once, e. What happened? These two parts of the manual explain fundamental concepts and are essential to understanding of what is written below. Any operation in the Analysis window involves: preparing data this involves reading data from the database, data compression to selected interval, filtering, padding, etc setting up AFL engine for execution setting up built-in arrays, stops, parsing of your formula execution of your formula in backtest for example it means first phase of backtest run, done on every symbol per-symbol processing the output of your formula in backtest it is sorting signals by position score post-processing in case of portfolio backtest it is for example portfolio backtest phase that is done once per backtest, NOT for every symbol AmiBroker is highly parallel multithreading application, so most of steps are done in multiple threads. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. Only then external source will be queried for data and that data will be copied to a local database. The interval can be specified in minutes or seconds for example entering 10s means seconds, while 5m means 5-minutes. November 13, How to add exploration results to a watchlist In order to add analysis results to a selected watchlist manually, we can use context menu from the results list: There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. These values will be indicated in the trade list: It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing First you need to have objective or mechanical rules to enter and exit the market. Note also that you must not assign value greater than to Sell or Cover variable. January 2, Using optimum parameter values in backtesting After Optimization process has found optimum values for parameters of our trading system, typically we want to use optimum values in subsequent backtesting or explorations. So our step optimization on quotes took less than half of the second.

September 29, 2014

The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. But now AmiBroker enables you to have separate trading rules for going long and for going short as shown in this simple example:. This is almost perfect scaling with hyperthreading — remember hyper-threaded thread is NOT fast as separate-core thread. You can examine when the buy and sell signals occurred just by double clicking on the trade in Results pane. This would allow you to use the data on a different computer. But this time is a SUM of times spent in all 8 threads. Getting started with automatic Walk-Forward optimization Using per-symbol parameter values in charts How to create toolbar button for custom interval How to display Bond and Bill prices in fractions. Instead of setting our stop as fixed percentage, we can use more sophisticated methods. Assumptions are not facts. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. The backtester assumes that price data follow tick size requirements and it does not change price arrays supplied by the user. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. That kind of question typically comes from person who wants to import hundreds of megabytes of data. Let us try with bars of data 6 times more data than previously :. Completed in

Therefore — any changes we see in the charts or analysis results for example — chart updated with new ticks mean that the program has received some input, then based on this information has recalculated the formula and presented the updated results. November 13, How to add exploration results to a watchlist In order to add analysis results to a selected watchlist manually, we can use context menu from the results list: There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. AmiBroker, amibroker exploration tutorial stock trade signal service supports much more sophisticated methods and concepts that will be discussed later on in this chapter. The amibroker exploration tutorial stock trade signal service example uses second repeat interval:. Built-in debugger The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing State-of-the-art code editor Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. The default value of Account margin is Here are some techniques that may be useful in such identification. Code snippet is a small piece of re-usable AFL code. Once you run backtest in Detailed Log mode you will be able to find out exact reasons why trades can not be opened for each and every bar:. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. Additionally power up forex trading system currency trading explained example may check if calculated fx courses currency strength meter 9.3 is at least 1-tick large. This is actually one of many ways that can be used for coding such custom output:. Related articles: How to add exploration how to pick a good stock for day trading etrade singapore closing to a watchlist Ninjatrader chart templates download long legged doji pattern to export quotes to separate text files per symbol Using multiple watchlists as a filter in the Analysis How to export quotations from AmiBroker to CSV file? Can I encrypt my formula so no-one can decipher it? Note also that you must not assign value greater than to Sell or Cover variable. In case of futures, we would need to take into account the fact that our position size depends on Margin Deposit, while the stop size expressed in dollars depends on the Point Value, so the position sizing formula would need to be modified. Number of rows: Timings: data: 0. Try running with pragma statement limiting number of threads:. As a result, that might cause various problems with the data source not able to handle that many backfill requests in a short time, additionally data-vendors may be pro-actively protecting their servers from abusing the streaming limits this way. November 13, How to add exploration results to a watchlist In order to add analysis results to a selected watchlist manually, we can use context menu from the results list: There is, however, a way to automate this process and add the symbols to a watchlist directly from the code.

So, when you are ready, please take a look at the following recently introduced features of the back-tester:. AddTextColumn function allows to display strings, so we can use it for displaying e. Number of rows: Timings: data: 0. As we learned from the above the only parts that can be speed-ed up by adding more cores are those that are run in parallel multiple threads. You can use pre-written interpretations or create your own. It needs to be handled by the data plugin, and many 3rd party plugins do not offer this. If we want strictly sequential execution, then we must limit ourselves to just running in single-thread. You can learn more about built-in snippets here. You need to add several AddColumn statements and run your code as Exploration , so you can actually see the values of all variables. This is why single-core execution was not as bad as we expected. This is just one of many things that you can do using Exploration. In addition to the results list you can get very detailed statistics on the performance of your system by clicking on the Report button. The value of zero instructs AmiBroker to use "default tick size" defined in the Settings page pic. If you want to import huge amount of data in ASCII format in most efficient manner you need to make sure that the file you are importing is sorted.