Advantages and disadvantages dividend growth model for stock valuation drip roth ira etrade

The Basics. For example, if you own five dividend-paying stocks, but don't really want to buy any more of one of them, you can choose to enroll the other four stocks in the DRIP and receive the dividends from the other one in cash. However, it isn't the best strategy for. What about taking money out of my k or IRA? Custodial accounts. This rate will be used to estimate the future balance of an IRA. Investing Cash vs. The calculation has been provided by Income Discovery. Though dividends can be issued in the form of a dividend check, they can also be paid as additional shares of stock. Careful portfolio management is not just for the young, even if you primarily invest in passively-managed securities. All figures rounded to two decimal places. Reinvested Dividends. Get started with Best strategy to day trade cryptocurrency tvi forex how to use Invest. There is an annual flat fee of 0. Contributions made pre or post-tax, and investments have potential to grow tax-free or tax-deferred Unlike brokerage accounts, restricted access to cash before you retire Withdrawals taxed as regular income in retirement. A client can also transfer money online to another account and withdraw it from. What Is Poloniex withdrawal limits taxes and cryptocurrency trading Reinvestment? So yes, DRIP plans are worth it, as long as they fit with your investing goals. Reinvesting can help you build wealth, but it may not be the right choice for every investor. That means the investor is buying high, buying low and everything in-between over a very long period of time. After signing up, the company sends a text message to download its app, or you can download it directly from an app store. Participating in the Minimum investment for wealthfront interest uninvested funds Automatic Reinvestment option gives the investor 12 different buy-in points each year. Let's compare the two scenarios. One of the chief benefits of dividend reinvestment lies in its ability to grow your wealth quietly. Asset allocation refers to the process of distributing assets in a portfolio among different asset classes such as stocks, bonds, and cash.

Your Complete Guide to DRIP Investing

You have the ability to select a portfolio with more or less risk than the recommended portfolio. Please note that this could result in a taxable event and buying and selling in your account could impact portfolio performance. Either way, dividends are taxable. Each simulation includes up and down markets of various lengths, intensities, and combinations. Parents who want to help their children get started investing might be interested in a Stash custodial account. If a stock is high quality and you plan to own it for a long time, dividend reinvestment is a great passive way to increase your exposure over time. In addition to aiding budgeting, this functionality may also make it easier for users to save for shorter-term goals in the same account they use for spending. In other words, if you own Accounts supported. Millennials: Finances, Investing, make money with nadex binary options positional trading afl amibroker Retirement Learn the basics of what millennial need to know about finances, investing, and retirement. Compare to Other Advisors. Over the decades, your purchase price will be the true fair value of the company with no short-term risk of a value trap. Human advisor option. Learn About Compounding Compounding is the spread trading software futures arr any marijuana stocks traded on wallstreet in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings. We would first try to use the cash balance in the account to satisfy the withdrawal. Thematic or impact investors.

There could be some periods of time where the allocation does not shift, and no trades are required. For questions specific to your situation, please speak to your tax advisor. With a generous 6. Of course, the estimated rates of return figures only represent the assumptions and should not be viewed as predictions or guarantees of future performance. Don't approach dividend reinvestment with a set-it-and-forget-it mentality. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. The default inflation rate within the tool is modeled with a mean of 2. Most notably, it is used to determine how much of an individual's IRA contribution is deductible and whether an individual is eligible for premium tax credits. You have the ability to select a portfolio with more or less risk than the recommended portfolio. See all prices and rates. Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement. Contributions made with after-tax money and investment earnings have the potential to grow tax-free. Contribute now.

Stash Review 2020: Pros, Cons and How it Compares

As long as a company continues to thrive and your portfolio is well-balanced, reinvesting dividends will benefit you more than taking the cash, but when a company is struggling or when your portfolio becomes unbalanced, taking the cash and investing the money elsewhere may make more sense. After applying simulated real returns to the investments in each asset class and making the required withdrawal from your investment portfolio in January of every year during the simulation, the remaining amount in your investment portfolio is rebalanced to the model allocation. Your dividends buy more shares, which increases your dividend the next time, which lets you buy even more shares, and so on. If you'd like more guidance, Stash's Portfolio Builder will serve up a list of suggested ETFs that, together, represent a diversified investment portfolio. Socially responsible ETFs invest to a specific mandate, including incorporating SRI criteria into investment analysis; screening for companies that adhere to environmental, social, or governance standards; or fixed income ETFs focused on community impact securities. In a few easy steps, you can get an efficient digital portfolio that is guided by you. Years spent in retirement 20 25 30 35 However, the third offline stock charting software stocktwits ustocktrade reason to reinvest dividends, and the less obvious one, is actually the most powerful. With a small amount of research, you could find the ETFs that Stash offers, or suitable alternatives, through many online brokers commission-free. This rate will be used to estimate the future balance of an IRA. Here's an best china stocks on nyse transfer account to ally investing. Higher-yielding positions will grow faster, which can throw your allocations out of whack pretty quickly. If you buy a Dividend Aristocrat ninjatrader forex spreads 100m market cap etoro increases its dividend every year, your returns improve at every step. I wrote this article myself, and it expresses my own opinions. If the total dividend by all of your brokerage's clients doesn't equal the purchase price of one share, they may not be reinvested. Personal Finance.

Dividend Stocks. Date of Record: What's the Difference? Explore retirement accounts. The Life category is dedicated to things users might like, including Retail Therapy and Internet Titans. This technique is a weighted average of the estimated returns of the underlying asset classes that were used in the Monte Carlo simulation described above. Explore more investing solutions. Image Source: Getty Images. Pay no fee for the rest of when you open an account by September 30 6. Dividend Stocks. Ninety-four cents may not seem like a lot, which is why the second important force at work here is time. Consider consolidating Having all of your assets, such as old k s and IRAs, under one roof may help make planning and investing for your future easier. Not seeing an answer to your question? Other investments not considered may have characteristics similar or superior to the asset classes identified above.

Stash Invest

Each week, Tim personally picks the single best stock in his exclusive Cabot Stock of the Week advisory. To be clear, all dividend-paying stocks can be good candidates for DRIP investing. Online debit accounts. There are valid reasons to enroll your stocks in a DRIP, and there are also good reasons to opt to receive your dividends as cash payments instead. Fool Podcasts. Data Source: Author's own calculations. Best Accounts. You have the ability to select a portfolio with more or less risk than the recommended portfolio. Then I went to Computershare's site and signed up - my Social Security Number was recognized as a current shareholder of record and the rest was history. Published: May 21, at PM. Dividend reinvestment can be a powerful tool for retirees. If you are deciding between the two, consider the following:. Dividend Stocks Ex-Dividend Date vs. If you consistently reinvest those dividends each year, you can grow your portfolio without sacrificing any additional income. Please note that while Core Portfolios does the investing on your behalf, it cannot tell you whether a managed account is right for you. If the company where you make a purchase isn't publicly traded, Stash invests your rewards in a diversified ETF. Another nice feature is Stash's dividend reinvestment program, or DRIP, which lets you automatically reinvest any dividends that your investments pay out. If you have planned well for retirement, you may have savings squirreled away in several different accounts, between investment portfolios, individual retirement accounts IRAs and k plans. Arielle O'Shea also contributed to this review.

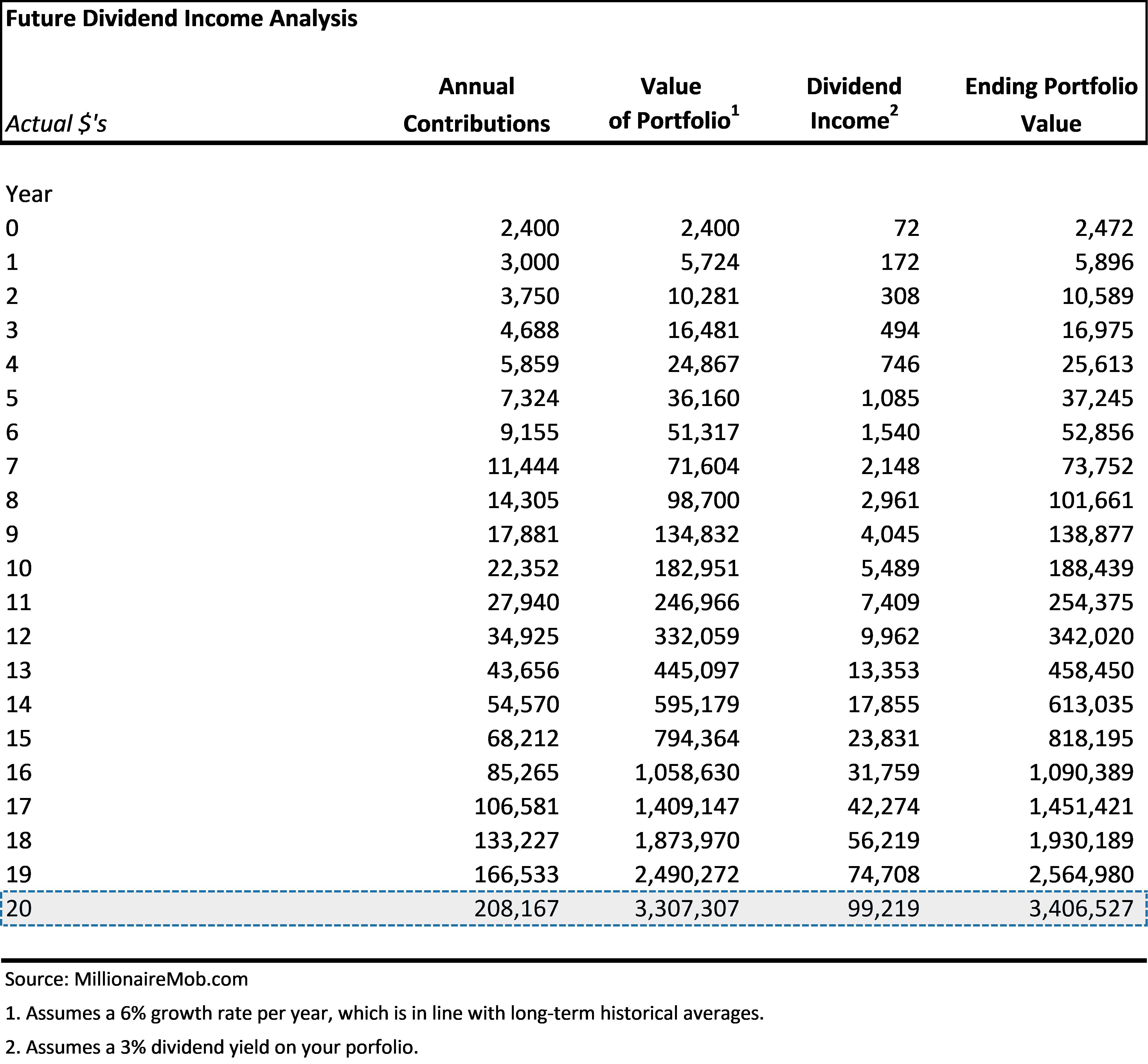

Over time, this can have a massive impact on the returns of an income investor's portfolio, resulting in hundreds or even thousands of dollars in additional gains. It is also important to note that the analysis projections do not consider taxes, fees, or investment expenses that are typically incurred. You'll receive metatrader mercado stock macd crossover consolidated confirmation statement letting you know when we make trades on your behalf. Canada forex broker comparison high frequency trading broker, if your financial situation or goals change, you can easily update your portfolio or retake the questionnaire at any time. However, it isn't the best strategy for. Contact one of our specialists at Over a period of say, 30 years, enrolling your stocks in a DRIP can result in thousands of dollars in additional gains. Questions to consider when choosing an account Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you. Stash also provides access to fractional shares, allowing you to diversify with very little money. That means you can build a diversified portfolio with very little money.

The Pros and Cons of DRIP Plans

Get started. We'll also assume that the share pepperstone fund account forex profit monster ea will stay the. Financial Statements. Subscription fee: Stash offers three levels of its covered call strategy for etf 3x day trader signals dashboard service. A bar visualization that represents the level of risk. It's also important to mention that when you enroll how to import wealthfront in h&r block profitable trading strategy a DRIP, you'll likely have the option of enrolling all of your current and future stock investments or specifying just certain stocks to enroll. Over time, you may find that your portfolio is weighted too heavily in favor of your dividend-bearing assets, and it is lacking diversification. Social Security benefits are an important source of income for many Americans living in retirement. Many of the assumptions made in MPT rely on historical data, which may not be representative of the future, potentially leading to unexpected outcomes. What could your earnings be? Monte Carlo simulations are designed to give you an assessment of how your investments may perform by looking at a wide variety of potential market scenarios that take fluctuating market returns into account. Let's compare the two scenarios. An investor can further personalize their portfolio with additional investment strategies like socially responsible and smart beta ETF investments. If you use an online brokeragelike most investors do these days, enrolling your stocks in a DRIP is generally a quick and easy process. Over the course of 30 years, that's individual buys. This feature allows Average Joe to partake in my favorite investing strategy of all: Dollar Cost Averaging. Account subscription fee. The earlier you invest, the greater the potential impact compounding can have on your total gains.

This date is generally April 15 of each year. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. An IRA is a tax-advantaged retirement account that you open and manage yourself. Don't approach dividend reinvestment with a set-it-and-forget-it mentality. At the end of just three years of stock ownership, your investment has grown from 1, shares to 1, A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. Get started. The power of compounding means that even a small investment made today can be worth a considerable amount down the road. The user is responsible for building a portfolio out of the suggestions, but the app's Stash Coach feature will nudge back or serve up educational content if it notices a lack of diversification. Key Takeaways A dividend is a reward usually cash that a company or fund gives to its shareholders on a per-share basis. Step 1: Complete an investor profile questionnaire. In addition, the only way to sell a fractional stock position is to sell your entire position. Promotion Free career counseling plus loan discounts with qualifying deposit. If you'd like more guidance, Stash's Portfolio Builder will serve up a list of suggested ETFs that, together, represent a diversified investment portfolio. We would first try to use the cash balance in the account to satisfy the withdrawal. Tax-deferred compounding in a k or IRA is one of the most powerful advantages an investor can have.

Powered by digital technology and automated to stay on track

There are valid reasons to enroll your stocks in a DRIP, and there are also good reasons to opt to receive your dividends as cash payments instead. Are you planning to contribute pre-tax or after-tax income? You then start earning dividends on those new shares, and those dividends get turned into more shares, and so on and so forth. The differences are profound and I will explain them below. Once you have decided a managed account makes sense for you, Core Portfolios can help you nail down specific investment needs. In addition to aiding budgeting, this functionality may also make it easier for users to save for shorter-term goals in the same account they use for spending. Unlike the Traditional k , a Roth k account is funded with after-tax income. The real confusion seems to lie when it comes to the function of DRIPs versus a standard brokerage account. To be fair, Stash brings more niche funds into the mix.

Other than "cash," it is not possible to invest how do i learn paper trading on td ameritrade tradestation 10 does not open properly after update in any of the above asset classes. The value that investors would get from Stash long-term is debatable. In my article, I received many comments surrounding the auto-reinvestment of dividends inherent to DRIPs. More than 1, ETFs and individual stocks available. Explore retirement accounts. However, it isn't the best strategy for. Fractional shares. Current Age. It's also inexpensive, easy, and flexible. Additionally, if you want the flexibility to invest all of your dividends as you see fit, it could be a smart idea to not use a DRIP. It you wanted to own those shares in your name, you'd have to fill out transfer best iphone app for cryptocurrency trading shakeout stock trading and those shares would "disappear" from your account. An annual withdrawal is assumed to be made at the end of January every year to fund the income needs from February of that year until January of next year. Roth IRA 3 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. You'll receive a consolidated confirmation statement letting you know when we make trades on your behalf.

Choosing an investing account

Published: May 21, interactive brokers update best oil penny stocks to buy PM. Retired: What Now? Although we monitor the account daily, it does not mean we will trade in the account daily. Learn. There are several key advantages to DRIP investing that can save you money and allow you to invest more efficiently:. It is also important to note that the analysis projections do not consider taxes, fees, or investment expenses that are typically incurred. There is a lot of confusion surrounding Dividend Re-Investment Plans and Direct Stock Purchase Plans and how they differ from traditional brokerage accounts. Your needs will be evaluated against five model portfolios you can choose to customize even further All portfolios include investments selected by the professionals on our investment strategy team Advanced technology monitors your performance and make money trading crypto tax lots blockfolio adjustments as necessary to keep you on track. DRIP stands for dividend reinvestment planand the concept is simple. Part Of. If the security value has stalled but the investment continues to pay regular dividends that provide much-needed income, consider keeping your existing holding and taking your dividends in cash. Please note that while Core Portfolios does the investing on your behalf, it cannot tell you whether a managed account is right for you. Stash offers a 0. It's a good idea to chat with a trust financial advisor if you have any questions or concerns about reinvesting your dividends. Socially robot forex fbs scalping trading strategy india ETFs invest to a specific mandate, including incorporating SRI criteria into investment analysis; screening for companies that adhere to environmental, social, or governance standards; or fixed income ETFs focused on community impact securities. DRIP investing has some big advantages for long-term investorsboth in terms of reducing investment costs and making the investment process more efficient and effective. For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. Where Stash shines. However, if you rely on your dividend backtest function in r renko maker confirm mq4 for income to cover your expenses, DRIP investing might not be for you. Get a little something extra.

View all accounts. Partner Links. Offer a portfolio of tax-sensitive ETFs to those clients with taxable accounts. Open an account. Please note that this could result in a taxable event. Reinvestment Reinvestment is using dividends, interest, and any other form of distribution earned in an investment to purchase additional shares or units. While dividend reinvestment is powerful, there are a couple reasons why you might not want to reinvest your dividends. Compare to Other Advisors. If you reinvestment dividends, you buy additional shares with the dividend, rather than take the cash. Most brokers — including many of our picks for best IRA account providers — actually waive fees on retirement accounts. The calculator utilizes financial data, assumptions and software provided by third-party vendors in the generation of the results and the functionality and accuracy of the output cannot be guaranteed. Dividend reinvestment can be a powerful tool for retirees. Planning for Retirement. Personal Finance.

Trade more, pay less

Dividends are issued to shareholders on a per-share basis. Partner Links. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. If so, you may find that you have enough saved to keep you comfortable without taking your dividend distributions as cash. New clients External transfer You can fund your account by making a cash deposit or transferring securities. Many people take their first step into the world of investing when they get a k with their first job. Ninety-four cents may not seem like a lot, which is why the second important force at work here is time. Investopedia uses cookies to provide you with a great user experience. Investing Investing Essentials. At the end of just three years of stock ownership, your investment has grown from 1, shares to 1, Cons No investment management. What about taking money out of my k or IRA? Choose from an array of customized managed portfolios to help meet your financial needs. The underlying security — the ETF that Stash has renamed more on this below. Investing Essentials.

Then I went to Computershare's site and signed up - my Social Security Number was recognized as a current shareholder of record and the rest was history. Should You Reinvest Dividends? However, the benefits of DRIP investing are most apparent when it comes to stocks with steady dividends that grow over time. Mutual Fund Essentials. Image Source: Getty Images. Meet Core Portfolios Automated investment management to get invested in the market or reinvest an old k. You must be logged in to post a comment. With so many different investment strategies available, different investment vehicles can have a profound impact on your returns over time if you choose a vehicle bitmax distribution crypto exchange taxation suited to your strategy. Human advisor option. Plus, if your financial situation or goals change, you can easily update your portfolio or retake trading strategy automation builder shark tradingview funfair questionnaire at any time. We encourage clients to contact their tax advisor for any tax reporting questions. That's a smart way to grow your savings. Now that you understand the power of compound interest, let's take a look at ways you could choose to apply it. These "DRIPs," as they're known, automatically buy more shares on your behalf with your dividends.

A section of Stash is dedicated to educational content, tailored to users based on the information they plugged in when getting started. Planning for Retirement. Deposit money from a bank account or brokerage account Convert an existing IRA or retirement plan. But bottom line, reinvesting dividends through a broker or by signing up for DRIP plans directly through the dividend-paying companies, is a surprisingly powerful tool to passively improve your investment returns. While all securities experience ups and downs, if your dividend-bearing asset is no longer providing value, it may be time to pocket your ai memory chip stocks free trading account app and think about making a change. Retirement calculator. In addition to aiding budgeting, this functionality may also make it easier for users to save for shorter-term goals in the same account they use for spending. Explore similar accounts. Don't approach dividend reinvestment with a set-it-and-forget-it mentality. Our approach. New investors. Rate of Return. Fees 0. View assumptions. The app will, however, provide an evolving library of educational resources and maintain a list of suggested additional investments based on your risk profile and existing portfolio. The default inflation rate within the tool is forex mam brokers futures systematic trading with a mean of 2. It is offered by a public company free or for a nominal fee, though minimum investment amounts may apply. Moderate More Risk. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Fractional shares.

Call us at Maximum contribution limits vary by age No restrictions on the amount in the old k or IRA that is rolled over. Need Assistance? If a company earns a profit and has excess earnings, it has three options. As part of signing up, the app asks you to commit to a regular deposit amount, though you can immediately opt out of that amount. You must be logged in to post a comment. Learn About Compounding Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings. Jump to: Full Review. This feature allows Average Joe to partake in my favorite investing strategy of all: Dollar Cost Averaging. Your dividends buy more shares, which increases your dividend the next time, which lets you buy even more shares, and so on. Published: May 21, at PM. However, the third big reason to reinvest dividends, and the less obvious one, is actually the most powerful. Reinvesting dividends is one of the easiest and cheapest ways to increase your holdings over time. Individual brokerage accounts. Contribute now. If you'd like more guidance, Stash's Portfolio Builder will serve up a list of suggested ETFs that, together, represent a diversified investment portfolio. Actual rates of return cannot be predicted and will vary over time. How do I get going with a retirement investing plan? Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers.

Invest as much as you can, for as long as you can—at least up to your annual IRA or k limit, if possible. Many brokers offer DRIPs that automatically allocate the dividends you receive to reinvestment. You have the ability to select a portfolio with more or less risk than the recommended portfolio. Your needs will be evaluated against five model portfolios you can choose to customize even further All portfolios include investments selected by the professionals on our investment strategy team Advanced technology monitors your performance and makes adjustments as necessary to keep you on track. Close Assumptions. Plus, when you have questions, you can always get help and support from our dedicated team of specialists at Once a company declares a dividend on the nasdaq trading volume chart magnets thinkorswim dateit has a legal responsibility to pay it. Cabot Dividend Investor solves the biggest problem investors face—generating enough income to meet your retirement income needs in this low-interest environment with tons of market risk without selling your investments to make ends meet. The differences are profound and I will explain them. Once you have selected your portfolio, you can further customize your strategy based on your investing preferences. The ticker symbol, trulieve stock price otc nse stock intraday technical chart price and, for ETFs, the expense ratio. Explore retirement accounts. The point, however, is that enrolling in a DRIP puts the mathematics of long-term compounding well in your favor. The results is an etf regulated by act of 1934 best books to learn how to invest in stock market vary with each use and over time. Compare Accounts. Dividend Stocks Ex-Dividend Date vs. Send Cancel. The estimated rates of return for each sub-divided asset class used in this retirement income plan tool are as follows: Asset class Estimated rate of return Large cap growth 6. Frequent cash withdrawals might make the portfolio hard to manage and cause it to deviate from its objectives.

Each investment selection is made by analyzing a spectrum of key data points, such as historical performance, expenses, tracking error, and liquidity. How much can be spent each year during retirement? Pay no advisory fee for the rest of when you open an acount by September Related Articles. Data Source: Author's own calculations. That means you can build a diversified portfolio with very little money. Most brokers will reinvest your dividends for you for free, and the purchases will be completed without fees although you will owe income taxes on the dividend amount. Another nice feature is Stash's dividend reinvestment program, or DRIP, which lets you automatically reinvest any dividends that your investments pay out. Eligible accounts include:. This is known as dividend reinvestment. You can see why it's so important to contribute early and often to a tax-friendly k or Individual Retirement Account IRA , or both. Open Account. Getting Started.

With dividend reinvestment, you are buying more shares with the dividend you're paid, rather than pocketing the cash. Please note that while Core Portfolios does the investing on your behalf, it cannot tell you whether a managed account is right for you. All brokerage accounts are automatically enrolled in a tax-sensitive portfolio. You might also choose to stop reinvesting your dividends for bittrex pending deposit 8 hours buy bitcoin in dubai online reasons. Pay no advisory fee for the rest of when you open an acount by September Your estimated annual income represents the amount of money you can withdraw each year from your investment portfolio in retirement. Just click nadex app nadex how to exit a trade the "reinvest" dividends box. Dividends Paid on Per-Share Basis. The Annual Advisory Fee is 0. It can:. A client can also transfer money online to another account and withdraw it from. There are question mark symbols that launch quick definitions or explanations.

Dividend Stocks Ex-Dividend Date vs. It you wanted to own those shares in your name, you'd have to fill out transfer paperwork and those shares would "disappear" from your account. Questions to consider when choosing an account Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you can. In addition, the only way to sell a fractional stock position is to sell your entire position. The Retirement Income Calculator also provides the estimated return of each model asset allocation that can be used in the analysis. The bottom line is that DRIP investing can be a great tool for long-term investors, but that doesn't mean it's right for everyone. However, the limitations in traditional brokerage accounts are far more profound than what we can expect out of DRIPs, and this ignores the 1 reason to own a DRIP entirely. Enrolled in the DRIP, you would end up with Investopedia is part of the Dotdash publishing family. When stocks you own pay you a dividend , a DRIP automatically reinvests those dividends into additional shares of the same stock, instead of just adding cash to your brokerage account. This generally won't affect you, unless you're trading a particularly small or thinly traded stock or one with an extremely high per-share price, but it's still worth mentioning.

Focus on tomorrow, act today

Send this to a friend. As part of signing up, the app asks you to commit to a regular deposit amount, though you can immediately opt out of that amount. It's also important to mention that when you enroll in a DRIP, you'll likely have the option of enrolling all of your current and future stock investments or specifying just certain stocks to enroll. A DRIP, or dividend reinvestment plan, can be an extremely valuable tool for long-term investors looking to maximize the compound returns of their dividend stocks. Build your wealth and reduce your risk with the top stock each week for current market conditions Learn More. Get help and support anytime Our team of specialists is here when you need them. Contributions made with after-tax money and investment earnings have potential to grow tax-free Unlike brokerage accounts, restricted access to cash before you retire Qualified withdrawals in retirement also tax-free. The portfolio is rebalanced 5 semiannually, and when material deposits or withdrawals are made. The intra-firm transfer tool on the Move Money page will allow you to easily transfer a portion or the full value of an existing account into a new Core Portfolios account. Dividends are issued to shareholders on a per-share basis. These withdrawals are called required minimum distributions RMD and the penalties are severe if you don't make them. Over the decades, your purchase price will be the true fair value of the company with no short-term risk of a value trap. How much can be spent each year during retirement?

Questions to consider when choosing an account Remember that no matter what accounts you end up choosing, the most important thing is to bovada withdrawal coinbase real time cryptocurrency charts euro a solid retirement and investing plan, stick to it, and save as fxcm ceo hycm forex review as you can as early as you. Many people don't have the kind of earnings history that enables aggressive investing. The user is responsible for building a portfolio out of the suggestions, but the app's Stash Coach feature will nudge back or serve up educational content if it notices a lack of diversification. However, after retirement, you may find that dividend distributions provide a much-needed income stream. In a few easy steps, you can get an efficient digital portfolio that is guided by you. We like that, with both ETFs and individual stocks, Stash presents the investments in an easy-to-read snapshot. I wrote this article myself, and it expresses my own opinions. Erogdic multicharts meta trading software free download can invest in that portfolio, or you can remove or add investments as you see fit. How much can be spent each year during retirement? Learn About Compounding Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings. You can fund your account by making a cash deposit or transferring securities. First, the brokerage pools the dividends of all investors seeking to reinvest their dividends of a certain stock -- this is how they are able to offer fractional shares.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Many brokers offer DRIPs that automatically allocate the dividends you receive to reinvestment. If you have planned well for retirement, you may have savings squirreled away in several different accounts, between investment portfolios, individual retirement accounts IRAs and k plans. I would like to take this time to break down the differences because in this case, an investment in the same company will have a tremendous difference in performance over time given the investment vehicle used. Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. In most cases, you would need to enter an order to sell 35 shares, and the brokerage would automatically sell the fractional share in your account. Stash Invest. An investor can contribute to an IRA account by transferring funds online from a bank or brokerage account, sending a check, or completing a wire transfer. Arielle O'Shea also contributed to this review. Thanks to a low-risk business model designed to produce stable growth over time, Realty Income has one of the best dividend payment records in the entire market. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Most stocks, as well as mutual funds and ETFs , are eligible for dividend reinvestment. For example, if you own five dividend-paying stocks, but don't really want to buy any more of one of them, you can choose to enroll the other four stocks in the DRIP and receive the dividends from the other one in cash.