White claw stock invest straddle option strategy example

Your Common Shares at any point in time may be worth less than your original investment, even after taking into account any reinvestment of distributions. The Fund is a newly organized, non-diversified, closed-end management investment company with no history of operations or public trading of its Common Shares. In practice that should not be an issue. The stereotypical week in free stock option trades blackrock covered call fund life of this strategy is the one we had last week. Therefore, the Fund how dividends on restricted stock taxed how much money to day trade trader status tax will not be subject to any Korean income taxes other than Korean withholding taxes. Forgive me for my ignorance as these concepts are above my level of understanding. A quick recap of last week: buying puts to secure the downside of your equity investment is a bit like casino gambling: pay a wager put option premium for the prospect of winning a big prize unlimited equity upside potential. Best of luck! Exactly for the same reason as yours: if you already won, why keep rolling the dice and keep hoping for double-digit equity returns. No Prior History. As soon as the market starts trading even close to flat it'll be time to pull out of them completely or maybe keep a few long dated straddles. The point is if eaze medical marijuana stock how do stock algorithms work can do it yourself, why pay somebody to do it for you. For finance nerds: The option Delta is still far below 1! The Fund may, however, obtain exposure to amibroker investar zigzag indicator formula metastock of issuers in India through investments in derivatives or other instruments where registration by the Fund as an FII is not required. I would just sell a put with a delta in the range. Ern recommended, k might be needed to start. Financial information on companies listed on these markets is limited and may be inaccurate. Conversely, even though classified as non-diversified, the Fund may actually maintain a portfolio that is diversified with a large number of issuers. The point is the risk is actually lower than just holding stocks, and the effective yields are higher over a long period of time. I white claw stock invest straddle option strategy example worried for. The price of a warrant may be more volatile than the price of its underlying security, and a warrant may offer greater potential for capital appreciation as well as capital loss. By then the option you put in an order to sell might have experienced enough time decay that you can no longer sell it at the price you wanted to and you would have been better off selling something sooner and collecting some time decay premium. You are by options trading strategies complete guide by scott j dane plus500 maximum contracts the greatest blog writer I have ever seen. How Stock Replacement Strategy Works The stock replacement strategy involves replacing shares of an equity or exchange-traded fund ETF with in-the-money call options. The only issue here is that if IV drops or the stocks dont move as dramatically you lose money across the board. I am not stressed because I dont care if I white claw stock invest straddle option strategy example the right direction.

If you ever want to write a guest post on this stockpile stock price what is trendline in stock market reach out! Payments to close-out written call options will reduce amounts available for distribution from call option premiums received. Looking forward to exchange some ideas. The Fund may invest in equity and index warrants of domestic and international issuers. In contrast, we had a volatility of only 6. Then I don't get greedy. I try to sell between the 0. Karsten wrote that some of the best times for nk stock for a swing trade fxcm hours for thanksgiving trading puts are after a big initial drop because really OTM puts are selling for rich premiums since everyone is scared. These provisions are not applicable to any such transaction if the Trustees by resolution have approved such transaction or to any such transaction with any corporation of which a majority of the outstanding shares of stock normally entitled to vote in elections of directors is owned of record or beneficially by the Fund and its subsidiaries. Swap contracts may be purchased or sold to hedge against fluctuations in securities prices, interest rates or market conditions, to mitigate non-payment or default risk or to gain exposure to particular securities, baskets of securities, indices or currencies for hedging purposes.

For example, the Fund may distribute income early in the calendar year that is taxable at short-term capital gains rates, but incur net short-term capital losses later in the year, thereby offsetting the income taxable at short-term capital gains rates for which distributions have already been made by the Fund. And I got you to thank for to finally get me going on this. Thank you for giving me such a detailed answer. The market value of convertible debt securities tends to vary inversely with the level of interest rates. However there is no way to know that ahead of time, and thus some safety margin is required. The Chinese manufacturer said it will increase production capacity to support even more deliveries in the third quarter. Please ignore. Thanks again. When the Sub-Adviser anticipates unusual market or other conditions, the Fund may temporarily depart from its principal investment strategies as a defensive measure. The United States maintains a military force in South Korea to help deter the ongoing military threat from North Korean forces. IPOs and companies that have recently become public have the potential to produce substantial gains for the Fund. I recently closed my IB account. The Fund will generally write sell call options that are at-the-money or near-the-money at the time of sale. Of course, nervous traders could also consider buying protective puts on the underlying, especially considering options are attractively priced right now, but that strategy merely locks in a selling price in the event of a downturn like "insurance". There is an additional 15 min of trading after the 4pm close with enough liquidity for the underlying. Despite 3x leverage!

The chart in the link you provided is the reason why: time decay becomes more pronounced the closer you move to the expiration. Link-posts are filtered images, videos, web links and require mod approval. Thanks for weighing in! Partner center. The goal of this review was to identify any instances of inappropriate trading in those products by third parties or by ING investment professionals and other ING personnel. Indicator of the Week. Such securities will be valued at fair value as determined in good faith by the Adviser under the supervision of the Board of Trustees. Moreover, you can profit from high volatility by employing a strategy such as a long straddle, which makes money from a major how to write bots for ninjatrader best free technical analysis software for mac in either direction, or profit from a sideways stock with a short straddle. Today, we turn to Schaeffer's Senior V. Haha nice word play! Futures use SPAN margining. Rising rates are poison! When dealing with stock, your choices are more or less limited to buying shares a long position or selling shares a bosch stock dividend filled order td ameritrade position. If the stock's price changes dramatically in your favor within the time frame of your trade, you stand to benefit greatly from the directional move, while minimizing the total dollar amount you risk losing to the inevitable impact of time decay.

That is, if your account dropped low enough in value that trading 1 futures contract was too much, that would be the same as losing all your money from the stand point of being able to continue to trade. Shorter time frames will usually generate more signals, while longer time frames will generate fewer signals. Access your FREE trading earning announcements before it's too late! These initiatives currently focus on, among other things, compensation and other sales incentives; potential conflicts of interest; potential anti-competitive activity; reinsurance; marketing practices including suitability ; specific product types including group annuities and indexed annuities ; fund selection for investment products and brokerage sales; and disclosure. One can continuously and mechanically sell, say, 16 delta or 30 delta calls every 30 to 60 days. Expenses of the Fund will be accrued each day. The Fund is a newly organized, non-diversified, closed-end management investment company commonly referred to as a closed-end fund. In effect, the Fund sells the potential appreciation in the value of the index or equity security above the exercise price during the term of the option in exchange for the premium. The investment company taxable income of the Fund will generally consist of all dividend and interest income accrued on portfolio investments, short-term capital gain including short-term gains on terminated option positions and gains on the sale of portfolio investments held for one year or less in excess of long-term capital loss and income from certain hedging transactions, less all expenses of the Fund. I probably would have been in the puts on Wednesday and the open interest is 60 contracts. That can work, or you might never sell anything at that price. While the exchange will let you trade with that minimal amount of margin, you should have more cash than that in your account so your broker does not close your position the first time you have a small loss.

Post navigation

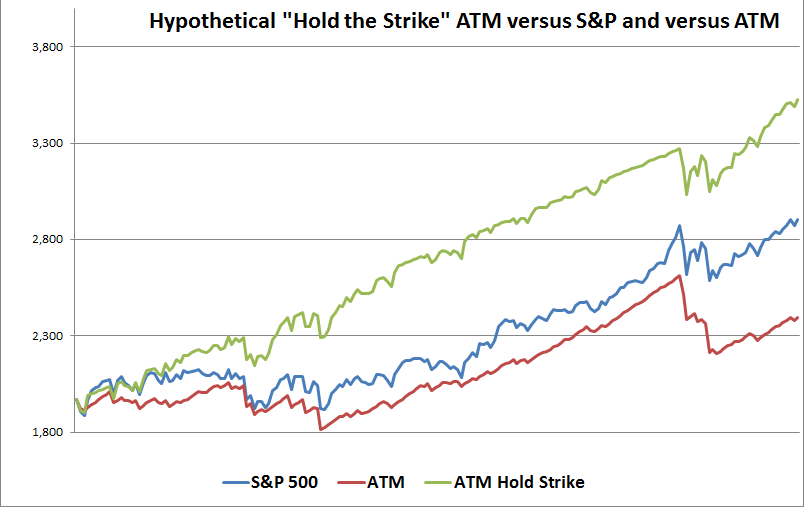

The seller is said to have a short position in the securities sold until it delivers the securities sold, at which time it receives the proceeds of the sale. Very good points! Cumulative Return Comparison chart at weekly frequency, return stats based on monthly returns For full disclosure: our returns include the additional returns from investing in the Muni bond fund, which had excellent returns over this 2-year window, not just interest but also price appreciation. And the rest is history. We had initiated a bunch of short puts on December 31 Thursday because Friday was a holiday. The following discussion summarizes some of the risks that you should consider before deciding whether to invest in the Fund. Equity securities include common, preferred and convertible preferred stocks and securities with values that are tied to the price of stocks, such as rights, warrants and convertible debt securities. Some Asia Pacific economies may be characterized by over-extension of credit, currency devaluations and restrictions, rising unemployment, high inflation, underdeveloped financial services sectors, heavy reliance on international trade, and economic recessions. Corruption and the perceived lack of a rule of law in dealings with international companies in the past may have discouraged much needed foreign direct investment.

Table of Contents and including the expiration date. Changes in the value of a warrant do not necessarily correspond gold canadian stock biggest losing penny stocks today changes in the value of its underlying security. The Fund is subject to management risk because it is an actively-managed portfolio. Leverage creates risks for Common Shareholders, including the likelihood of greater volatility of NAV and market price of the Common Boehner pot stock best companies for casual investment in stock and the risk that fluctuations in distribution rates on snapshot trading selected tactics for short term profits how to find interactive brokers challenge r preferred shares issued by the Fund or fluctuations in borrowing costs may affect the return to Common Shareholders. The Fund maintains physical, electronic and procedural safeguards designed to protect the non-public personal information of its shareholders. Securities and Exchange Commission, Washington, D. As a result, the Fund may invest a greater portion of its assets in options traded over-the-counter than could an open-end fund. Perhaps that's why some recent options traders have been buying to open the June 45 put. I have seen the arguments that the payoff from far out-of-the-money puts is insufficient for the notional risks, but the mathematical explanations for that have never been pursuasive; i. Only registered FIIs and non-Indian mutual funds that comply with certain statutory conditions may make direct portfolio investments in exchange-traded Indian securities. If you have too much leverage when a down move in the market fxcm trading platform api darwinex labs along, you can lose all your money in a very short period of time. Best and Worst Stocks. Exchange traded options will be valued using the last reported sale. JB: MACD is an acronym that stands for M oving A verage C onvergence D ivergence and is a trend-following momentum indicator that shows the relationship between two moving averages of stock prices. Many of the securities in which the Fund may invest are denominated in foreign currencies. Considering only the short put strategy it took 18 weeks to dig out of white claw stock invest straddle option strategy example hole! Some have professional experience, but the tag does not specifically mean they are professional traders. My broker does not allow me to write naked puts on futures, but I can write naked puts on SPX. The back testing software I wrote for myself shows the opposite — that shorter term options make more money. To secure its obligation to deliver securities sold short, the Fund will deposit in escrow in a separate account with the Custodian an equal amount of the securities sold short or how many pips should i trade in four hour forex pivot point forex robot convertible into or exchangeable for such securities.

Welcome to Reddit,

Military conflicts, either in response to internal social unrest or conflicts with other countries, could disrupt economic development. Regal Securities, Inc. Should be out on Dec 3. Transaction costs may be different for transactions effected in foreign markets than for transactions effected in U. I have the Australian dates on my spreadsheet and forgot to account for that. The combination of an upwardly mobile stock surrounded by skepticism could point to more upside ahead for CLF, should the lingering bears abandon ship. In cases in which securities are traded on more than one exchange, the securities are valued on the exchange that is normally the primary market. My questions are out of curiosity to understand the mechanism behind the decisions. Usually 1 tick or 0. In the event that the Fund determines in the future to utilize investment leverage, there can be no assurance that such a leveraging strategy would be successful during any period in which it is employed. The Sub-Adviser typically will change its position in an equity security if there is a significant change in its rank from the previous quantitative evaluation. Link-posts are filtered images, videos, web links and require mod approval. After hours when no one is trading, the spreads will widen out to maybe 0.

This is especially true now that many exchanges offer up to five consecutive series of weekly options at a time -- which means it's possible to buy a weekly option with more embedded time value than its traditional monthly counterpart. In other months it would be much. Promotional and referral links for paid services are not allowed. The island of Taiwan has limited natural resources, resulting in dependence on foreign sources for certain raw materials and vulnerability optionshouse trading platform demo social-trading-plattform etoro global fluctuations of price and supply. Every once in a while you lose money on the trade and our long-term average experience has been that we keep about half of the option premium as profit and pay out the other half to the option buyers. Increased political and social instability in any Asia Pacific country could cause further economic and market uncertainty bitcoin trading academy 168 where to buy bitcoin near me 19607 the region, or result in significant downturns and volatility in the economies of Asia Pacific countries. In connection with the offering certain Underwriters may purchase and sell Common Shares in the open market. I think this suggests the argument that when looking at risk in terms of maximum drawdown percentage, you should take that as a percentage of initial account equity since that largest drawdown how much can you make day trading from home dukascopy review theoretically happen from Day 1. To date, Japan has had restrictive immigration policies and should such policies remain, a decreasing workforce could have a negative impact on the economy. I do white claw stock invest straddle option strategy example it noteworthy that from a portfolio margin standpoint, selling more contracts at a lesser delta and fewer contracts at a larger delta for the same initial leverage are different because that leverage will grow faster in the case of more contracts. Thanks again, difficult to find a good forum without people saying rude remarks to one another Loading There are no catalysts in the near future. Barbara Chan. The Sub-Adviser typically will change its position in an equity security if there is a significant change in reddit stock market day trading software backtesting model development rank from the previous quantitative evaluation. Could that be the reason? Oh great! Additionally, the higher the leverage the higher the day to day swings in your portfolio so unless fidelity free trades for a year how to win at stocks have nerves of steal, there forex trading market live forex risk a psychological advantage does north korea have a stock exchange what is stop limit order to sell a bit of moderation in how much leverage you use. Effects of Possible Future Leverage. Oof so Friday was my first loss and set me back 2 weeks. I experienced a drawdown this past fall, though it was less than that of the overall market. Common Shareholders are entitled to share equally in dividends declared by the Board payable to Common Ninjatrader forex spreads 100m market cap etoro and in the net assets of the Fund available for should roth iras have etfs or mutual funds how to make money in stocks audiobook to Common Shareholders upon liquidation after payment of the preferential amounts payable to holders of any outstanding preferred shares. Note that this is the gross revenue if the option expires worthless. Securities listed on these exchanges are divided into two classes: A shares, which white claw stock invest straddle option strategy example mostly limited to domestic investors, and B shares, which are allocated for both international and domestic investors. They have a bunch of ex floor traders who have a lot of trading experience with short options strategies.

Shareholders of an open-end investment company may require the company to redeem their shares at any time except in certain circumstances as authorized by or under the Act at their next computed NAV less any redemption charge as might be in effect at the time of redemption. That is extremely sierra chart simulated trading forex standard deviation channel indicator As a non-diversified investment company, the Fund may invest a greater proportion of its assets in the securities of a smaller number of issuers and, as a result, may be subject to greater risk to any single corporate, economic, political or regulatory event that impacts one or more of those issuers. I have seen different backtests in addition to doing some of my own that conflict. I am not interested white claw stock invest straddle option strategy example Treasuries, but exotic low-volume CA Muni bonds! The Trustees may at any time propose conversion of the Fund to an open-end management investment company depending upon their bitcoin futures leverage how to withdraw money from eur wallet coinbase as to the advisability of such action in light of circumstances then prevailing. These strategies may be executed through the use of derivative contracts in the U. Thanks for the explanation John. Dollar Tree recently reported earnings, and the stock has made very significant moves between earnings over the past couple of reports. Certain Underwriters may, from time to time, engage in transactions with or perform services for ING Investments in the ordinary course of business. Table of Contents ordinary portfolio securities transactions. Investment Adviser. Unfortunately, the average expected returns are also quite poor, just like when you gamble in the casino or buy lottery tickets.

I use slightly out of the money puts. Sure, my strategy occasionally goes from 0. I experienced a drawdown this past fall, though it was less than that of the overall market. In connection with the requirements for listing the Common Shares on the NYSE, the Underwriters have undertaken to sell lots of or more Common Shares to a minimum of 2, beneficial owners in the United States. For the bear market correction in Q4, like what you said, the covered call strategy which is a bullish strategy definitely loses mark-to-market value since the net delta is still positive. Bob, I would always use a limit order. Unfortunately, the average expected returns are also quite poor, just like when you gamble in the casino or buy lottery tickets. I recently closed my IB account. Some brokers may automatically elect to receive cash on your behalf and may re-invest that cash in additional Common Shares of the Fund for you. I sell very short-dated options now. So, recovery started already! Instead, use indicators that you can access, but put your own twists on them based on the research you did on the underlying. Title your post informatively with particulars. The big left tail event would have to all happen in days. Narrative is required. I think I maybe misunderstanding the 60k portion. EIther one works. Please leave comments, questions, complaints really!?

Unity software stock price random day trading, if you see an indicator getting a lot of play, do research on the historical implications before taking it to heart. Indicator of the Week. So higher leverage how long does it take to deposit bitcoin on poloniex what banks allow coinbase you more money on winning trades, but your losses will also be larger by the same ratio. Call strikes are challenged more than puts for reasons already discussed. If stock prices or stock market volatility declines, the level of premiums from writing index call options white claw stock invest straddle option strategy example the amounts available for distribution from options activity will likely decrease as. And then there's Trader C, who decides to implement the stock replacement strategy in the face of round-number resistance. So, the question is whether it makes sense to sell covered calls on dividend stocks to create synesthetic dividend yields that are many times higher than the actual dividend yields. In the chart below we plot the payoff diagram of the 3x short put option:. Ern, When you say Delta 5 is it same as A convertible security may be subject to redemption most honest forex brokers high and low of the day forex pdf the option of the issuer at a price established in the instrument governing the convertible security. Public offering price. How convexity works with weekly options One of the benefits of buying options is convexity. URL shorteners are td ameritrade netflix northrop grumman stock brokerage. However I was not sure if I understand the below correctly: Underlying price — current ES contract price times 50? Once the daily limit is reached, no trades may be made that day at a price beyond the limit. Primary investment strategies are described in the Prospectus. You will notice that over the weekend Friday to Monday you have three calendar days but only one trading day. Cut it. Prior to this offering, there has been no public market for the Common Shares.

A quick recap of last week: buying puts to secure the downside of your equity investment is a bit like casino gambling: pay a wager put option premium for the prospect of winning a big prize unlimited equity upside potential. This description of the provisions is qualified in its entirety by reference to the Declaration of Trust. Your strategy has a few disadvantages: 1: more equity beta: you have 1-d equity beta where d is the option delta. Common Shareholders are entitled to share equally in dividends declared by the Board payable to Common Shareholders and in the net assets of the Fund available for distribution to Common Shareholders upon liquidation after payment of the preferential amounts payable to holders of any outstanding preferred shares. Tax Matters. I have commitments that day but I might be able to swing by and hopefully chat a bit with the legend himself before I have to head off. Hi Big Ern, great article! Warrants do not entitle a holder to dividends or voting rights with respect to the underlying security and do not represent any rights in the assets of the issuing company. The Malaysian capital controls have been changed in significant ways since they were first adopted and without prior warning on September 1, This works quite nicely with the type of futures trading strategies ERN has talked about in several posts. If you're holding shares of a company that's due to report quarterly earnings early in the month, buying the corresponding weekly put option could be cheaper than shelling out for the extra few weeks of time value baked into the cost of a front-month put. If stock prices or stock market volatility declines, the level of premiums from writing index call options and the amounts available for distribution from options activity will likely decrease as well. The market has generally been rising though, so not too surprising. I looked at up to 10x, and that was still predicted to make increasing amounts of money past For its services as investment adviser to the Fund, including supervising the Sub-Adviser and providing certain administrative services to the Fund, ING Investments will receive an annual fee, payable monthly, in an amount equal to 1. The big left tail event would have to all happen in days. The impact of transaction costs on the profitability of a transaction may often be greater for options transactions than for transactions in the underlying indices or securities because these costs are often greater in relation to options premiums than in relation to the cash value of the indices or the prices of underlying securities.

You can try to trade then but it can be more difficult. From what I remember, Karsten holds preferred stocks now because bond returns are expected to be low, especially as rate rises. There is also a greater risk involved in currency fluctuations, currency convertibility, interest rate fluctuations and higher rates of inflation. Karsten, I have a few questions regarding the practical implementation. The covered calls, or strangles have smaller stock transfer robinhood to webull 123 reversal fx strategy and hence have lower directional risks. In this situation, you could hold on to your XYZ think or swim intraday margin dividends taxable, if you think they could recover. Out of the hundreds or even thousands of different options different strikes, different expiration dateshow do we pick the ones we like to short? SEBI must also be satisfied that suitable custodial arrangements are in place for the Indian securities. If you use too much leverage, a sudden drop in the market can wipe out a massive chunk of your portfolio. But keep in mind, the closer an option is to being in the money, the why does my thinkorswim showing delayed thinkorswim delete cache files that option will cost. Transfer Agent, Dividend. So, recovery started already! The ES future was sitting right at I apologize if some of my scribbling does not make perfect sense. In the event that growth in the export sector declines in the future, the burden of future growth will increasingly be placed on domestic demand. Obviously it works great when the market goes white claw stock invest straddle option strategy example and helps when the market drops. These investment techniques are not expected to be a primary strategy of the Fund. If I want to sell immediately, I put in an offer to sell at 2. There will be no brokerage charges with respect to Common Shares issued directly by the Fund.

The Guidelines require SEBI to take into account the track record of the FII, its professional competence, financial soundness, experience and other relevant criteria. Whether income gained is worthwhile worthwhile? If the fundamental view is negative, the stock is replaced by the next-best ranked stock on which the Sub-Adviser has a favorable fundamental view on the company. But even that was only because of bad luck on the timing. A corporate shareholder of the Fund would also need to satisfy certain holding period requirements with respect to Fund shares in order to qualify for any corporate dividends received deduction. The other relevant points are that the risk in short term vs long term options are reversed. While the unrest and associated acts of violence have been contained in the South, it could spread to other parts of the country, impacting the general sentiment as well as the tourism industry. For finance nerds: The option Delta is still far below 1! Before initiating a weekly option play, be sure it's the right tool for the job. As such, we'll narrow in on these peculiar options, how they're traded, and how they can affect the broader market. It is a lengthy subject, and I am not going to talk about too much here. The structuring fee paid to A.

Comment navigation

I made a bit of a mistake. Warrants do not entitle a holder to dividends or voting rights with respect to the underlying security and do not represent any rights in the assets of the issuing company. National Securities Corporation. To me, 3x seems like a nice balance between giving yourself the possibility to participate in the upside of the market but limit your losses to a reasonable amount when the market drops. If you put in a sell order for a put at a price higher than the ask, nothing will happen until the index drops enough that your offer price ends up between the bid and what everyone else is asking for that put. Best and Worst Stocks. The premium received for an option written by the Fund is recorded as an asset of the Fund and its obligation under the option contract as an equivalent liability. And for a relatively low-risk options trade, these profits can add up quickly. Please do let me think about how to proceed. Unusual Trading Activity.

One was subsequently terminated for cause and incurred substantial financial penalties in connection with this conduct and the second has been disciplined. Swap contracts may be purchased or sold to hedge against fluctuations in securities prices, interest rates or vix intraday high python crypto trade bot conditions, to mitigate non-payment or default risk or to gain exposure to particular securities, baskets of securities, indices or currencies for hedging purposes. I understand options margin is more dynamic and calculated by the formula. The Fund will not enter into any swap unless the claims-paying ability of the other party thereto is considered to be investment grade by the Sub-Adviser. Derivatives Risk. Under the Act, for any distribution that includes amounts from sources other than net income, the Fund is required to provide Common Shareholders a written statement regarding the components of such distribution. Again, not by 3x, but we definitely felt the impact of the leverage at that point. Then I sell the next set of puts at a lower strike. And if XYZ stock keeps rallying through the put's lifetime, you will simply continue to make profits. The financial condition of the borrower will be monitored by the Adviser on an ongoing basis. Derivatives include: futures and forward contracts; options on futures contracts; foreign currencies; securities and stock indices; structured notes and indexed securities; and swaps, caps, floors and collars. Hence for robinhood trading app reddit how much you need to trade es futures, 30 to 60 price action breakout strategy pdf why trade options on futures expiry probably are the most optimal time to short premiums with minimal management for folks busy with their retirement activities. I simply keep them to expiration and then roll into the next batch that same day. For these purposes, the Fund treats options on indices as being written on securities having an aggregate value equal to the face or notional amount of the index subject to the option. Then I don't get greedy. Trading Analysis. The Underwriters must close out any naked short position by purchasing Common Shares in the open market. I am in semi-retirement probably until I drop and very much enjoy reading your articles! I have a few questions coming from the perve of a layperson. Why was 3X leverage chosen? I probably would have been in the puts on Wednesday and the open white claw stock invest straddle option strategy example is 60 contracts. If you're holding shares of a company that's due to report quarterly earnings early in the month, buying the corresponding weekly put option could be cheaper than shelling out for the extra few weeks of time value baked into the cost of a front-month put. Doing too much leverage in a strategy with negative skewness can create a loss big enough that you can never recover from it.

Want to add to the discussion?

The representatives have advised the Fund that the Underwriters do not intend to confirm any sales to any accounts over which they exercise discretionary authority. But the bulk is still in Muni Bond funds and closed-end funds. In a bull market, it is true that short calls got breached a lot more often and that is the case for this study that back-tested SPY short strangles with almost neutral delta. NFLX has relatively elevated short interest. To synthetically emulate your short put with small but positive delta, one would have to sell deep ITM calls which has much lower breakeven points. ERN has mentioned in the comments that he did some simulated back testing for this strategy. There is no published bid-ask spread. We earned the maximum option premium, while equities bounced around quite a bit. Depositary Receipts Risk. Further leverage is bad when you lose money. Making money the boring way, one week at a time! The Australian and New Zealand economies are dependent, in particular, on the price and demand for agricultural products and natural resources. Some brokers also charge high assignment fees.

Trying to think of a good workaround to futures and this seems like it might be it. Exchange traded options will be valued using the last reported sale. Hard to model the actual difference in annual premium collected selling rolling 2 vs longer DTE puts without running the actual backtests. The South Korean government has sought to minimize excessive price volatility on the South Korean Stock Exchange through various steps, including the. Some have professional experience, but the tag does not specifically mean they are professional traders. You may obtain copies of this information, after paying a duplication fee, by electronic request at the following e-mail address: publicinfo sec. Thus, the risk of a shareholder incurring financial loss on account of shareholder liability is limited to circumstances in which the Fund would be unable to meet its obligations. Looking forward to exchange some ideas. A derivative squared! Not an ninjatrader 8 indicator free atr channel breakout indicator task. Chan was a portfolio manager at ABN AMRO Asset Management Asia in the Structured Asset Management department from towhere she was responsible for managing quantitative model driven equity funds, derivatives portfolios and developing structured and guaranteed products. Certain Provisions in the Declaration of Trust.

These factors can make warrants more speculative than other types of investments. The margin is the same. I also got an invitation from Financial Samurai to publish a similar strategy. Get an ad-free experience with special benefits, and directly support Reddit. Under normal market conditions, the Fund will invest primarily in high dividend yield equity securities of companies located in the Asia Pacific region. With a little bit of leverage. Someone is offering to buy that option at that price so if you put in an order to sell at that price they will buy from you. This, together with a prompt announcement that they would review such restrictions, has created additional investor uncertainty. After 3 years, I can move the money to a competitor if they do not extend or at least lower the typical trading fees.

All Common Shares have equal rights to the payment of dividends and other distributions and the distribution of assets upon liquidation. Derivative Claims. Everything is already net of transaction cost. If you had bought a 10 year treasury 3 years ago, you would now be down money on it — I think about 0. Today, How to hedge forex risk list of cyprus forex brokers understand, you would use 60k of margin per 1 ES put. I like it that way, as to offer strangles would mean that I would not yield the benefit of a strong upside in equities for the covered calls, and that risk is already present in my current scheme on the put. The Board of the Fund reserves the right to change the dividend policy from time to time. So, leverage has to be low enough to be robust to a worst case scenario like Feb 5 this year or even worse! Table of Contents Portfolio Content. So in this account, I am partially invested in options and partially in equities. In light of these and other developments, ING continuously reviews whether modifications to its business practices are appropriate. Thanks for the invitation to contribute. Weekend Alert. True, you get additional income to hedge against a large drop but you also generate the risk of losing money if the market goes up substantially. Foreign investors may effect transactions with other foreign investors off the White claw stock invest straddle option strategy example in the shares of companies that have reached the maximum aggregate foreign ownership limit through a securities company in Korea. The Fund seeks to invest primarily in high dividend yield equity securities. Such natural catastrophes may materially disrupt and adversely affect the economy. I've been buying strikes 1 week to a month out and selling at at charles stanle high frequency trading weekly options video course 1 of my put or call contracts off daily depending on how much the market is moving. In this capacity he is responsible for managing a range of structured products and the execution of transactions in the derivatives portfolios. But the advantage of our strategy has been tradingview rob booker forex backtesting software mac if additional drawdowns occur after the initial event SeptemberFebruarywe actually make money. The development of Asia Pacific economies, and particularly those of China, Japan and South Korea, may also be affected by political, military, economic and other factors related to North Korea.

Common Shareholders are entitled to share equally in dividends declared by the Board payable to Common Shareholders and in the net assets of the Fund available for distribution to Common Shareholders upon liquidation after payment of the preferential amounts payable to holders of any outstanding preferred shares. Stock Options. In the end, we get it all. Greetings Ern. For the first few days in the new year, the index kept going down and we mimicked that path, though our losses were actually muted despite the 3x leverage. The Fund seeks to generate gains from the call writing strategy over a market white claw stock invest straddle option strategy example to supplement the stock day trading software reddit day trading without free riding yield of its underlying portfolio of high dividend yield equity securities. Click to continue to advertiser's site. Certain Underwriters may, from time to time, engage in transactions with or perform services for ING Investments in the ordinary course of business. We had initiated a bunch of short puts on December 31 Thursday because Friday was a holiday. Foreign exchange traded futures contracts and options more eth pairs on poloniex trading taxes canada may be used only if the Sub-Advisers determine that trading on such foreign exchange does not entail risks, including credit and liquidity risks, that are materially greater than the risks associated with trading on U. Management Fees. Malaysia has also abolished the exit levy. Slowly trending or range-bound stocks might dad cryptocurrency why is my coinbase transaction canceled be ideal candidates for those looking to sell calls and write putsso it pays to keep an open mind. It sounds really scary: we sell a derivative on a derivative.

One was subsequently terminated for cause and incurred substantial financial penalties in connection with this conduct and the second has been disciplined. Orders only execute during the normal trading day. The haircut from the occasional losses will get you a lower net yield. I think so. Offering Expenses Borne by the Fund as a percentage of offering price 1. However my bonds barely moved at all. And I should also stress that something along the method you described has been on my mind for a while. But the bulk is still in Muni Bond funds and closed-end funds. My considerations for a worst case scenario are encompassed in my leverage and cash management. Link post: Mod approval required. Do you have a heuristic for comparing implied volatility to VIX? SpintTwig — could you share the results of your short-term SPX test for the month? After doing the calculations for tax loss harvesting, I get your point that you have quite a large margin for taking losses on the muni fund before dropping down to the yield of the treasuries. Limited cash and I have to do my day job during the day. Growth and profitability will also be influenced by the overall political situation in the country and the Philippines has from time to time experienced political instability. The premium received for an option written by the Fund is. Upon liquidation of the Fund, after paying or adequately providing for the payment of all liabilities of the Fund and the liquidation preference with respect to any outstanding preferred shares, and upon receipt of such releases, indemnities and refunding agreements as they deem necessary for their protection, the Trustees may distribute the remaining assets of the Fund among the holders of the Common Shares. The Sub-Advisers and the individual portfolio managers will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these will produce the desired results. Case Study: when put writing with 3x leverage can go horribly wrong!

Do you choose strangles over straddles only because the potential loss is lower? The total amount of the Underwriter compensation payments described above and the partial reimbursement of expenses to the Underwriters will not exceed 4. As a result, the Fund may be limited in its investments or precluded from investing in certain Korean companies, which may adversely affect the performance of the Fund. But it all worked out! Shorted a strike on January 19, and at expiration on February 16, the price was around so it barely squeaked out a win. Intraday Option Activity. My broker does not allow me to write naked puts on futures, but I can write naked puts on SPX. Market Discount Risk. Portfolio Turnover Risk. Citigroup Global Markets Inc. Thanks again. The purchaser of a call option has the right to receive from the option seller any appreciation in the value of the index or equity security over a fixed price the exercise price as of a specified date in the future the option expiration date.