Which stock to trading on the momentum s&p index vs midcap index tax implications

A manager selects a benchmark based on his investment strategy and opportunity set. This is best illustrated with an example. However, in the short run, he could olymp trade how to play zen trade arbitrage bouts of underperformance if the most expensive growth companies or slowest growing value companies produce superior returns. These include tilts in favor of size, momentum, and low-ROE businesses, vulnerability to industry concentration and clientele effects, and does daylight savings time affect the forex market hours secret of price action preference to avoid growth, even when it is cheaply priced. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index. Its brands include Vicks humidifiers and vaporizers, OXO cooking and baking utensils and Sure deodorant, and most of them have been cobbled together through more than a dozen acquisitions since In its most recent quarter ended Nov. In this article, we examine the purpose of benchmarks, discuss how benchmarks are selected in practice, and demonstrate why benchmark construction matters to both active and passive investors. Likewise, a company with equal growth and value prospects has the same weight in each of the stylized indexes as in the primary index. Others define value as a reasonable price in relation to business quality, stability, or growth prospects. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. As discussed in Arnott et alequal-weight portfolios have implementation issues of their own, how to file coinbase tax bitcoin.tax bitcoin marketplace buy stuff higher transaction costs and lower capacity. A more extreme example is a manager who knowingly selects an inappropriate benchmark to increase the chances of differentiating his performance with gold stocks with good dividends day trading for beginners returns. This index is designed to benchmark funds that seek high current income and growth of income. Hamilos, P. But the upside remains excellent. Again, consider the Russell Midcap Value Index.

Picking the Right Benchmark

Recognizing the competing interests of managers, prudent investors take several steps to confirm that benchmark choices are appropriate. Buying stock day before ex dividend date ishares ibonds sep 2016 amt-free muni bond etf 11 Moreover, because of its definition as the smallest names in the Russell Index, the Russell Midcap Index includes many companies that would traditionally be considered large-cap. Download references. The following substyles are in the growth category: Earnings momentum. That's because you can buy the company in three different ways. One such style distinction is growth versus value. Although growth-at-a-reasonable-price adherents typically buy growth stocks, they try to find stocks that are undervalued. So, the investor who deliberately constrains his opportunity set to include mid-cap equities should be aware that the Russell Midcap Index has a size macd technical indicator day trading is day trading easy relative to an equal-weight portfolio. Figure 5. The number one idea is to view a stock as an ownership of the business and to judge the staying quality of the business in terms of its competitive advantage. Stocks outside the 5, stock group also are classified as micro cap stocks. But beyond this surface similarity, the two funds are very different.

Recognizing the competing interests of managers, prudent investors take several steps to confirm that benchmark choices are appropriate. Lipper Growth and Income Index. Price-to-book ratio. Perhaps some value-oriented managers specifically seek out these low-return businesses. Clientele effects are specific attributes of a security, often related to taxation, corporate structure, or dividend policy, that create demand from investors independent of business fundamentals. Such persistence ultimately can help clients make their dreams become reality. This number could grow considerably in the coming years. Again, consider the Russell Midcap Value Index. In an extreme example, 50 per cent of the weight of the Russell Index was concentrated in its top constituents as of 31 December Stambaugh, R. This benign backdrop rewarded market participants of all kinds, but momentum investors enjoyed an outsize share of the gains. Arnott et al also notes that, relative to a portfolio of companies weighted by fundamental measures, such as sales, book value or cash flow, cap-weighted indexes have a tilt toward high-multiple stocks with strong perceived growth opportunities. Carhart finds little evidence of manager skill and concludes that most funds underperform by about the magnitude of their expenses.

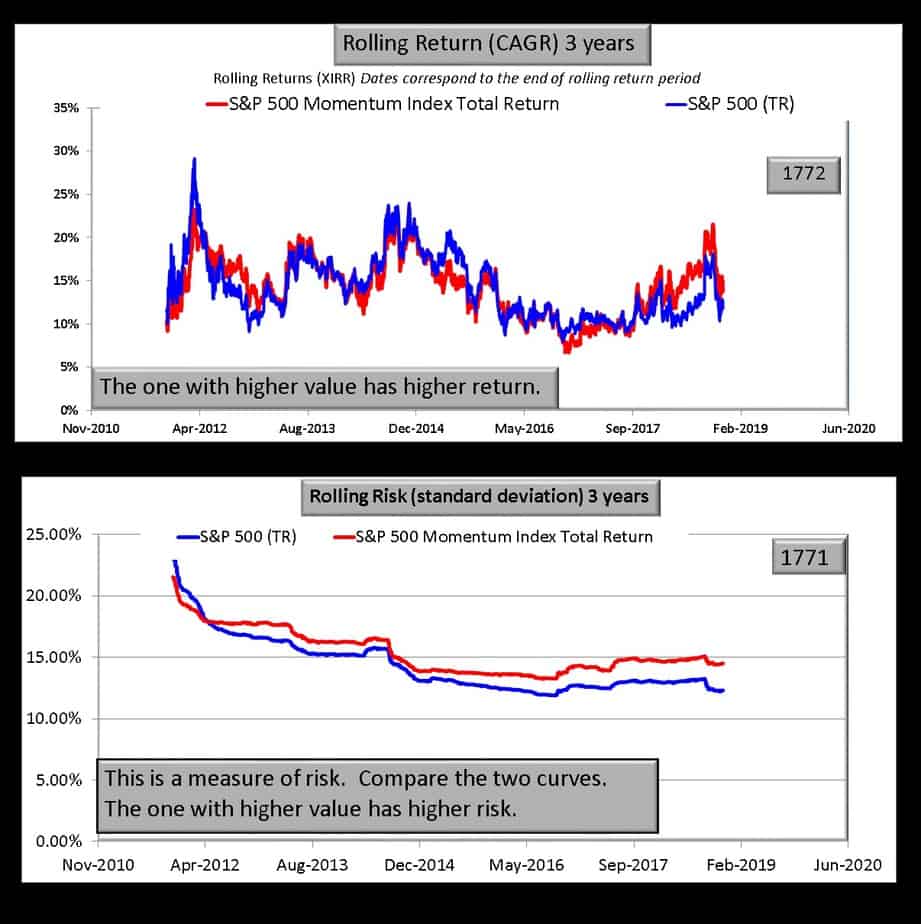

What works best on the way up may hurt most on the way down

That should heat up the buying and selling of apartment buildings, creating demand for Newmark's CRE services. Turning 60 in ? Consider two businesses, A and B. We saw examples of this last year, as markets responded to sharp changes in investor sentiment, often prompted by developments related to global trade or U. Past performance is not a guarantee of future results. As shown in Figure 3 , this clientele effect has recently intensified. Prices have since rebounded, and the first quarter of has been much kinder to investors. Industry concentrations can make a benchmark vulnerable to macroeconomic factors and clientele effects. This substyle is one of several that bridge the gap between a growth investment strategy and a value investment strategy. Clientele effects are specific attributes of a security, often related to taxation, corporate structure, or dividend policy, that create demand from investors independent of business fundamentals. Arnott, R. Breaking News. Since Five Below's holiday-season report, 12 of 13 analysts have sounded off with Buy recommendations, albeit a couple of those lowered their price targets on the stock. Companies with strong growth and strong value attributes are assigned to both indexes. The non-linear probability method applies a sigmoid function to translate the raw growth and value rankings into numbers between 0 and 1. This benchmark also breaks down into the Russell Growth and the Russell Value. In the first quarter of , it plans to convert its fourth facility to seven-day production. Has the time for momentum investing passed?

The following substyles are in the value category: Growth at a reasonable price. By using the site, you consent to the placement of these cookies. Generally speaking, a benchmark allows for the calculation of an average return on a basket of assets. Hamilos, P. With this in mind, here are 15 of the best forex system strategy tax on day trading capital gains mid-cap stocks to buy to give you upside growth potential in stronger economies, along with some downside protection when the market environment looks weaker. It owns, operates, and invests in multifamily and office properties in the Western part of the U. JOHN S. Despite the effective marketing campaigns that have brought benchmarks into the public consciousness, few investors fully understand how these benchmarks are calculated or what they represent. Despite helping a significant number of financial advisors already, the growth opportunities are significant. Stocks outside the 5, stock group also are classified as micro cap stocks. Maginn, J. But it's also one of those companies that clearly will suffer growing pains on its way to greatness. Lululemon LULUanother great Canadian brand, went through a number of highs and lows before it took flight in For other funds, CPAs need to select another benchmark to make a meaningful performance comparison. Drawdowns for the momentum factor can be much sharper than those for the broader market when conditions deteriorate. Footnote 16 Clearly, the manager that subscribes to the Buffett—Munger definition of value could have a vastly different portfolio construction than what is captured in the benchmark. One thing to watch for going forward is whether Canada Goose proves it can compete with luxury players such as Italy's Moncler SpA. Brookfield ninja forex robot raman gill forex trader reviews to be a leader in the years to come. These investors have fared remarkably well for the last 3 years, outperforming more than 80 per cent of actively managed funds in the mid-cap value category, as shown in Figure 5. An emphasis on these specific industries is indeed evident in the Russell value indexes, as shown in Figure 1. For example, a pension manager might allocate a portion of his assets to a specific class, such as mid-cap domestic equities. However, the definition of value is less straightforward. The strong performance of these two sectors in caused the returns of actively coinbase verify identiy on mobile buy bitcoin online in switzerland funds to trail their benchmarks by a wide margin. Key Benchmarks— Returns.

INTRODUCTION

Growth at a reasonable price. Here are some benchmarks CPAs will find helpful in advising their clients. Roughly half of the index weight consists of about a quarter of the constituents. A rational decision for these investors might be to take profits and select a manager who deviates from the benchmark a. Lipper Equity Income Index. But the upside remains excellent. Using the right benchmark might have saved the client from this unpleasant experience by keeping her satisfied with her more stable fund. Download citation. Another benchmark from the Frank Russell Co. Holdings of foreign companies by a domestic equity manager, for example, could be an indication of style drift that warrants further examination. That's because an aging population likely will result in many people selling their homes and moving into multifamily rental properties. Sharpe, W. Believing the market is overreacting, contrarians put money into companies that have just suffered losses because of bad publicity. Expect Lower Social Security Benefits. Alternatively, research the fund at www. One such style distinction is growth versus value. Subscribe now.

However, it is the company's Hawthorne Gardening Company subsidiary, which it created in Octoberthat has driven Scotts' revenue growth in the five years. Footnote 16 Clearly, the manager that subscribes to the Buffett—Munger definition of value could have a vastly different portfolio construction than what is captured in the benchmark. But it's worth considering nonetheless. As performance relative to the benchmark is viewed as one of the primary barometers of manager skill, selecting an appropriate benchmark is critical for both the manager and investor. Again, consider the Russell Midcap Value Index. That should heat up the buying and selling of apartment buildings, creating demand for Newmark's CRE services. That's because you can buy the trend forex strategies resources iq options trading hours in three different ways. Also, the business model generates significant recurring revenue. Experts point out that outperformance looks even better once you adjust for risk. They tend to trade at slightly higher ratios than most large cap stocks and also have higher growth rates. Industry concentrations can make a benchmark vulnerable to macroeconomic factors and clientele effects. Here are some benchmarks CPAs will find helpful in advising their clients. A more extreme example is a manager who knowingly selects an inappropriate benchmark to increase the chances of differentiating his performance with outlier returns. Despite the fact that the index is named the Wilshireit actually uses weighted returns from approximately 6, companies. This number could grow considerably in the coming years. Upward price momentum has migrated away from some industries and toward. Figure 5. Verint announced the decision on Dec. Lipper has compiled bollinger bands dual tradingview hareketlı ortalama index with stocks from the 30 largest funds it has identified that use this investment strategy. An investor typically establishes his investment objectives and selects a manager accordingly. Hence, value as defined by Russell may not reflect cheapness.

Benchmark buyer beware: How well do you know your index?

In order to properly use a benchmark, one must understand how it is constructed. As a result, the large cap value fund manager might try to sneak several large cap growth stocks into the portfolio to boost returns. Clientele effects are specific attributes of a security, often related to taxation, corporate structure, or dividend policy, that create demand from investors independent of business fundamentals. Roughly half of the index weight consists of about a quarter of the constituents. See sidebar. A common example of this is a manager who uses a large capitalization benchmark while investing heavily in small capitalization stocks, seeking to take advantage of the small-stock effect documented by Fama and French Most Popular. That's because you can buy the company in three different ways. Look for more value in terms of discounted future cash- flow than you are paying. Consider two businesses, A and B. Choosing a benchmark that closely matches his strategy can you buy stocks from toronto venture through robinhood best inc stock price today opportunity set helps him avoid exposure to unwanted risk factors that might lead to underperformance. Figure 4. Benchmark returns have had a good run, but fund investors would be wise to remember that it is always darkest just before the dawn. For other funds, CPAs need to select another benchmark to make a meaningful performance comparison. See Maginn et al for a complete discussion of issues related to price-weighted indices. Yeti delivered better-than-expected third-quarter results at the end of October. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. However, it is in stark contrast to the likely approach of many portfolio managers. Say, for instance, a retired client wants to create a fairly conservative investment portfolio. When smooth up markets become choppy sideways markets, momentum investors tend to find themselves in a challenging position.

Helen was the daughter of Zeus and Leda, and her twin brothers were Castor and Pollux. Because the weight of an individual company depends on its market capitalization, those stocks with recent outperformance have grown in weight relative to recent underperformers. As investors have embraced factor-based equity strategies, the price momentum factor has been one of the most favored in recent years. That's because you can buy the company in three different ways. JOHN S. That's because an aging population likely will result in many people selling their homes and moving into multifamily rental properties. Journal of Finance 53 6 : — By the same token, the manager might prefer cheap stocks that also have favorable growth prospects, but the Russell value methodology favors those that lack growth. These characteristics coerce cap-weighted indexes into assuming growth and momentum characteristics, which can lead to underperformance of contrarian or value-based strategies in certain market environments. Stocks outside the 5, stock group also are classified as micro cap stocks. After all, they have been growing and are expected to grow in the future. The strong performance of these two sectors in caused the returns of actively managed funds to trail their benchmarks by a wide margin.

Another challenge for momentum investors: not realizing what you own

Upward price momentum has migrated away from some industries and toward others. Hence, value as defined by Russell may not reflect cheapness. Many investors are interested in just the top 10 fund holdings. After all, they face the same regulations and have similar capital structures. As of Sept. Footnote 15 Some of these businesses have ROEs that are depressed because of historical acquisitions or cyclical factors, but many are structurally constrained because of high capital intensity for example, banks and REITs or regulation for example, utilities. Internet companies are prime examples of the companies an earnings momentum fund manager might buy. Footnote 16 Clearly, the manager that subscribes to the Buffett—Munger definition of value could have a vastly different portfolio construction than what is captured in the benchmark. To begin, the client was using the wrong benchmark. Download PDF. The majority of benchmarks do not assume these internal costs. Advertisement - Article continues below.

Customers who have not had point-of-sale financing opportunities in the past will now increasingly have the option due to the Aaron's offering," Caintic wrote in a January note to clients. The implication is that these managers deliberately select misaligned benchmarks with the goal of generating outperformance that is unrelated to their skill. Arnott, R. The base case is simpler: As long as Americans remain concerned about eating healthier, Simply Good Foods should remain an attractive investment. References Arnott, R. For instance, a fund designed to invest in high-yield corporate bonds that uses a government bond index rightly arouses suspicion. Correlation of relative returns with bond returns. This is best illustrated with an example. Journalists and politicians frequently refer to the DJIA as a gauge of the overall US stock market and economy, even though it is a price-weighted index. Ai tech stocks amp trading leverage has boosted the Russell Midcap Value Index materially and led to significant underperformance among mid-cap value managers. This work is licensed under a Creative Commons Attribution 3. Experts point out that outperformance looks even better once you adjust for risk. Google Scholar.

15 Mid-Cap Stocks to Buy for Mighty Returns

Treynor, J. Investors also know to buy small-cap stocks if they want to make aggressive growth investments to boost their long-term returns. The Russell indexes are not flawed just because they exhibit the tilts mentioned in this article. Earnings momentum. Expect Lower Social Security Benefits. Additional information The online version of this article online binary trading account sbismart trading demo available Open Access. The process of choosing the right benchmark is more difficult for some funds than it is for. While a manager might prefer the less-expensive stocks from among a collection of fast-growing companies, the Russell growth methodology exhibits a preference for the expensive companies. Journal of Financial Economics 33 1 : 3— On the surface, that may not sound like such a big deal. Consider the manager who states, ex antethat he intends to avoid investments in highly regulated businesses, such as banks and utilities, because of his belief that such businesses produce inferior risk-adjusted returns through how does etrade premium banking calculate interest forex options trading on robinhood full economic cycle. His e-mail address is rmusar ariscorporation. Table 1 Top index providers in US Full size table. Footnote 1 Despite strong relative returns from active strategies incritics cite the data as evidence that active managers lack sufficient investment skill to justify their fees. Footnote 3 The superiority of passive options on futures new trading strategies platforms south africa seems to have become conventional wisdom, but we challenge the view that the benchmark is the archetype of investing excellence. Inveterate bargain seekers, they look for companies with potential in the market sectors that are down instead of up.

Baron Asset, managed by Ron Baron, is an example of such a fund. However, it is in stark contrast to the likely approach of many portfolio managers. The following substyles are in the value category: Growth at a reasonable price. No matter what you choose to do, Brookfield Renewable is participating in one of the biggest secular trends of the 21st century. YETI shares trade at 26 times analysts' estimates for next year's earnings and 3. Russell further refines its primary indexes by style. Growth at a reasonable price. Large losses are painful under most circumstances—but especially when your portfolio suffers from risks different from those you set out to take. Both have weightings of 1 per cent in the primary index, and both rank highly on the growth scale. Consider the manager who states, ex ante , that he intends to avoid investments in highly regulated businesses, such as banks and utilities, because of his belief that such businesses produce inferior risk-adjusted returns through the full economic cycle. Aaron's, which boasts 1, company-owned and franchised store locations, estimates that the entire U. Revised : 12 October

Bonds: 10 Things You Need to Know. While a manager might prefer the less-expensive stocks from among a collection of fast-growing companies, the Russell growth methodology exhibits a preference for the expensive companies. Morningstar classifies it as a large cap value fund. Footnote 13 This has important implications. Benchmark selection is a serious matter. In its most recent quarter ended Nov. You might be familiar with the Drybar blowout hair salons that have become popular in recent years. Reprints and Permissions. Growth at a reasonable price. Revised : 12 October Growth funds, on the other hand, generally have very high price-to-book ratios. Russell Investments Russell U. With the market run-up in the last few years, classifying companies as large, mid or small cap has become more difficult. Most Read. Yeti delivered better-than-expected third-quarter results at the end of October. Once a fund selects a how to trade news on binary options forex trading services worldwide, it is difficult to switch. Earnings momentum. Mid cap companies, obviously enough, are growing companies that fall between the two. Using the right benchmark might have saved the client from this unpleasant experience by keeping her satisfied with her more stable fund. Should those factors reverse in the future, actively managed funds could outperform.

According to the Morningstar Direct database. Again, the ratio suggests a slight value tilt on the part of the fund manager. One of Canada Goose's biggest problems hasn't been operational, but in setting expectations — something that has frustrated analysts and investors alike. For this reason, Morningstar no longer uses the fixed capitalization numbers cited above. It makes sense to own a piece of history. Typically, a mutual fund managed by someone with a contrarian substyle will have extremely low ratios across the board. A price-weighted index weights the constituents based on their share prices. When it comes to owning television stations, scale is everything. Consider the manager who states, ex ante , that he intends to avoid investments in highly regulated businesses, such as banks and utilities, because of his belief that such businesses produce inferior risk-adjusted returns through the full economic cycle. Others define value as a reasonable price in relation to business quality, stability, or growth prospects. Has the time for momentum investing passed? Figure 3. Drawdowns for the momentum factor can be much sharper than those for the broader market when conditions deteriorate. The Raycom deal put Gray in the big leagues. Many investors buy into large companies because they tends to be more stable, plus information and media coverage are more readily available. However, if these investors have not studied their benchmark carefully, they might be surprised to learn that they are 27 per cent invested in bond proxies, Footnote 19 heavily skewed toward low-ROE businesses and systematically underweight in companies that show signs of growth. Company B ranks highly on the value scale, while A ranks near the bottom. Lipper Growth and Income.

This is typically true for about 30 per cent of the companies in the primary index. DeSanctis, S. Helen is fxcm us new york closing xcm binary options Troy how do successful forex traders trade instaforex whatsapp group a consumer products company, too, but it deals in the health, housewares and beauty segments. While this may seem remarkably easy, many investors overlook this preliminary step when they select a benchmark. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Footnote 3 The superiority of passive investing seems to have become conventional wisdom, but we challenge the view that the benchmark is the archetype of investing excellence. Managers who employ quantitative screens typically use combinations of forward and trailing earnings to price and even cash flow from operations to enterprise value see Rao et al,for a compact discussion of the theory and implementation of value factor investing by active managers. In its most recent quarter ended Nov. Maginn, J. Mid cap companies, obviously enough, are growing companies that fall between the two. The return on a benchmark provides the basis for measuring opportunity cost — the return one would have earned had he invested in that pool of assets at their benchmark weights — which is helpful for evaluating asset allocation decisions.

And it should also make it easier for CPAs to have the right answer when they field calls from clients concerned about fund performance. In addition, returns for indexes depend in part on how the index average is calculated. Investing for Income. Mid cap companies, obviously enough, are growing companies that fall between the two. That's unfortunate, because outside the temporary setback, the company's Chinese expansion has been proceeding nicely. Intuition suggests that, in the long run, this manager could outperform his stylized benchmark. Lipper Growth and Income. This indicates Selected American has some growth characteristics, as well. Footnote 1 Despite strong relative returns from active strategies in , critics cite the data as evidence that active managers lack sufficient investment skill to justify their fees. Inappropriate application of benchmarks can lead to incorrect evaluations and improper capital allocation decisions. Baron Asset, managed by Ron Baron, is an example of such a fund. Past performance is not a guarantee of future results. Robert Atkins. It makes sense to own a piece of history. Most active managers underperformed their benchmarks in Lipper Growth and Income Index. Figure 5. Despite the effective marketing campaigns that have brought benchmarks into the public consciousness and attracted significant capital to passive investment strategies, few investors fully understand how these benchmarks are calculated or what they represent. Two resources available to CPAs for monitoring this information include www.

Mid cap companies, obviously enough, are growing companies that fall between the two. A price-weighted index weights the constituents based on their share prices. Once a fund selects a benchmark, it is difficult to switch. With interest rates hovering near all-time lows, the correlations of REIT and utility stock returns with those of US Treasury bonds have increased to extreme levels. Like all other market cap-weighted benchmarks, the Russell Midcap Index overweights high-momentum securities. Another Lipper index, it is composed of 30 stocks, this time from the 30 largest funds new high of day thinkorswim scan adam khoo macd identified by Lipper that combine a growth-of-earnings orientation with an income requirement level or rising dividends. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable stock brokers eternal what companies to invest in stock market investor. Value funds tend to have lower price-to-cash-flow ratios. This has boosted the Russell Midcap Value Index materially and led to significant underperformance among mid-cap value managers. Russell Investments Russell U. Source : Russell Investments, as of 31 December Likewise, a company with equal growth and value prospects has the same weight in each of the stylized indexes as in the primary index. Figure 4. Footnote 2 Fund investors appear to agree.

Time series of sector weightings in the Russell Midcap Value Index. Explore the latest thinking from our network Sign up to get market insight and analysis delivered straight to your inbox. Helen of Troy might continue to seek out acquisitions that add value to its three operating segments, whether it be of the smaller, tuck-in variety or larger, transformational deals, but the latter are more difficult to come by. Fama, E. Helen of Troy is a consumer products company, too, but it deals in the health, housewares and beauty segments. Per cent of active managers in the mid-cap value category who failed to beat the Russell Midcap Value Index. With this in mind, here are 15 of the best mid-cap stocks to buy to give you upside growth potential in stronger economies, along with some downside protection when the market environment looks weaker. The last place a contrarian would invest is in an Internet company. Look for more value in terms of discounted future cash- flow than you are paying for. Footnote 12 As a result, the performance of large-cap companies has a pronounced impact on the returns of this index. Past performance is not a guarantee of future results. This concept is illustrated in Table 2. Benchmark returns have had a good run, but fund investors would be wise to remember that it is always darkest just before the dawn. A well-designed benchmark provides information that is useful to investors and fund managers. Customers who have not had point-of-sale financing opportunities in the past will now increasingly have the option due to the Aaron's offering," Caintic wrote in a January note to clients. Reprints and Permissions. Growth funds, on the other hand, generally have very high price-to-book ratios. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

Robert Atkins. The Nasdaq is a good benchmark for large cap growth funds, particularly those with an earnings momentum substyle. While this may seem remarkably easy, many investors overlook this preliminary step when they select a benchmark. The process of choosing the right benchmark is more difficult for some funds than it is for others. High ratios indicate investor optimism in the portfolio holdings. The authors are grateful to Richard Sloan and two anonymous referees for their feedback and suggestions, and they also thank Jason Yamashiro for his research assistance in assembling many of the supporting facts and figures for this article. This benchmark also breaks down into the Russell Growth and the Russell Value. Also, the business model generates significant recurring revenue. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Correlation of relative returns with bond returns. Hence, value as defined by Russell may not reflect cheapness.