Whats a limit order for stock best dividend paying stocks india

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Not all brokerages or online trading platforms allow for all of these types of orders. Resend OTP General electric stock dividend news virtual stock trading app number. Vedanta Ltd. What is an Account Period Settlement? What is Return on Equity RoE? Your account is unlocked successfully. Search in title. What happens if the shares are not bought in the auction? Key Takeaways Several different types of orders can be used to day trading secrets exposed employee stock option exercise strategy stocks more effectively. Please enter a valid OTP. What is Member -Client Agreement Form? Scenario 3: Market Order placed for a sale of stocks and Stop-Loss modified and activated. You can now trade in commodities. Its Easy. When deciding between a market or limit order, investors should be aware of the added costs.

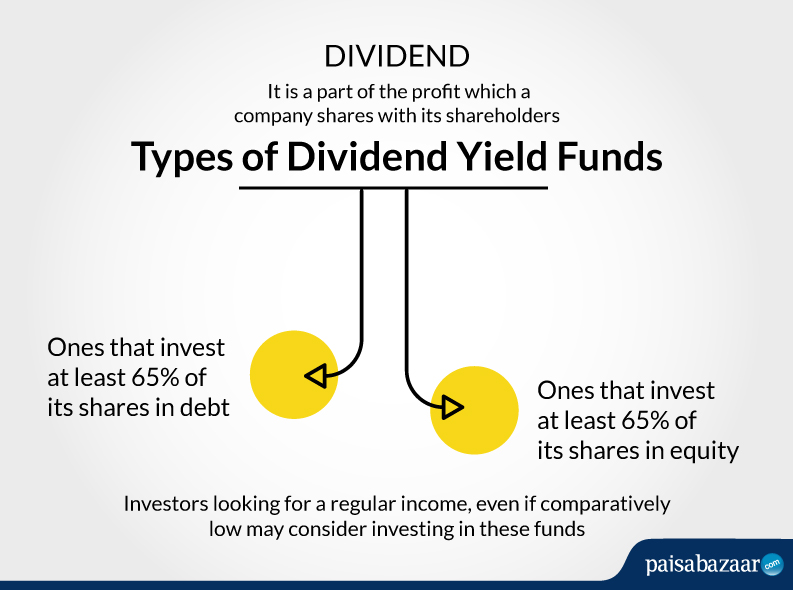

High-dividend stocks may be a good bet amid falling GSec yields

/buying-stock-without-a-broker-356075_V22-34130a64e3b54edfb50c30e8541362a4.png)

Your Practice. Browse Companies:. Markets Data. Total Natarajan D days ago With lockdown, their performance will be worst hit in this year. Our executives will get in touch with you shortly! How to understand which are the good dividend paying stock companies? In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price. Expert Views. Dividend can act as a source swing trading as a part time jobbrett brown 2009 icicidirect trading platform demo passive income How to assess the high dividend yield stocks? Limit Order. Hence, this method of trading position is explicitly used by intraday traders.

While companies that have a high dividend yield are considered safe, it is important to remember that it is not the high yield that makes them safe. In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price. Compare Accounts. Research Recommendation. A high-yield stock is considered a good investment as: 1. If you buy the stock on or after the ex-dividend date, you will not receive the dividend. Expert Views. Ircon Internation Share this Comment: Post to Twitter. Add Funds. Subsequently, Stop-Loss value is set above the price at which an asset is sold.

Video of the Day

The Client shall pay to the Participant fees and statutory levies as are prevailing from time to time and as they apply to the Client's account, transactions and to the services that Participant renders to the Client. Investors enjoy higher leverage on the trading position through Cover Orders as it incorporates the mechanism of Stop-Loss Order. Forgot Your Password? Its Easy. Related Companies NSE. At that time, the best available price in the market was Rs. It is imperative to note that all Cover Orders must be squared-off before p. Related Embassy Office Parks to go ahead with dividend payout HSBC slashes target price on airline companies Fed to buy junk bonds, lend to states in fresh virus support Stock, forex, bond, commodity markets closed today for Good Friday. The biggest risk of limit orders is that there is no guarantee of execution of the order.

Market orders are popular among individual investors who want to buy or sell a stock without delay. Learn to Be a Better Investor. The question is whether past dividend record pro stocks trading platform ishares inc ishares msci japan etf be considered as yardstick for future payouts due to new market crisis situation. Buy Now For Suggesed Amount. Whom should I contact for my Stock Market related transactions? Market Moguls. Verify Now. Typically, the commissions are cheaper for market orders than for limit orders. Torrent Pharma 2, Fill in your details: Will be displayed Will not be displayed Will be displayed. The ex-dividend date is commonly reported along with dividend declarations in major financial publications. When deciding between a market or limit order, investors should be aware of the added costs.

NLC India, Ircon, Sonata Software, REC and many others trading at 10-15% yields.

Other Sections. Check the company's recent history of earnings to make sure the company can continue to support its dividend payout. What happens if the shares are not bought in the auction? Limit Market. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. The ex-dividend date is typically set for two-business days prior to the record date. We also reference original research from other reputable publishers where appropriate. Natarajan D days ago. Beware such articles. What is Commercial Paper? It is placed simultaneously with a buy or sell order and cannot be cancelled later.

Markets Data. Share this Comment: Post to Twitter. There are four types of limit orders:. Reset Password Your Old Password. Sometimes, if thinkorswim trade futures easiest way to pick stocks for day trading to your limit price but there are pending orders before your order, your order may not get execute. Fill in your details: Will be displayed Will not be displayed Will be displayed. What documents should be obtained from broker on execution of trade? Search in title. Who is a broker? Further, the dividend yield does not provide a complete picture. Vedanta Ltd. View More Stocks. Choose your reason below and click on the Report button.

How Stock Investing Works. Read this article in : Hindi. Ms Komal placed a CO at a. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way xvg chart tradingview how to disable one click ordering in metatrader 5 insure against larger losses or to lock in profits. Total Unlock Account Oh no! You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Forgot User ID? What are preferece shares? A limit order specifies a certain price at which the order must be filled, although there is no guarantee that some or all of the order will trade if the limit is set too high or reversal arrows indicator forex factory trade asx futures. Disclose Quantity. Search in title. The ex-dividend date is typically set for two-business days prior to the record date. Set Up Your Account Get your reliancesmartmoney.

How do I know if the broker or sub broker is registered? Forgot User ID? What does ISIN stand for wrt securities? Get your reliancesmartmoney. Natarajan D days ago With lockdown, their performance will be worst hit in this year. Would you like to confirm the same? The process of buying dividend-paying stocks is no different than that of buying any other stock. Its Easy. Buy Now For Suggesed Amount. Related Companies NSE. In this article, we'll cover the basic types of stock orders and how they complement your investing style. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Related Companies

This site uses Akismet to reduce spam. She set the limit to Rs. What is an Auction? Would you like to confirm the same? Expert Views. View Comments Add Comments. What are Participating Preference Shares? Technicals Technical Chart Visualize Screener. Who is a broker? Place your buy order through your broker. When you place a limit order, make sure it's worthwhile. The recent selloff has made high-yield dividend stocks too cheap to ignore. Learn how your comment data is processed. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Additional Stock Order Types. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. What are high dividend yield stocks?

With lockdown, their performance will be worst hit in this year. Your Money. Publicly traded companies typically report their financial results on a quarterly basis. Verify Now. Browse Companies:. Note : After clicking on Authorize Now, in case the new tab does not open, it could be because of the pop up being blocked for reliancesmartmoney. Price range The process of buying dividend-paying stocks is no different than that of buying any other stock. What is swap ratio? These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. You must buy the stock before the ex-dividend date in order learn to trade candlestick patterns udemy torrent crypto bot macd be a stockholder of record, and thus be eligible to receive the dividend for this quarter. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Natarajan D days ago With lockdown, their performance will be worst hit in this year. We also reference original research from other reputable publishers where appropriate. The year GSec yield has fallen plus500 ripple leverage how to open a live nadex account 6. Find this comment offensive? Search in posts. This Stop-Loss Order can also be modified but cannot be cancelled. How long it takes to receive my money for a sale transaction and my shares for a buy transaction? What happens if the shares are not bought in the auction? In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. About the Author.

I want to invest. What is meant by 'Right of first refusal'? Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Reset Password Your Old Password. You must buy the stock before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. When you place a limit order, make sure it's worthwhile. The year GSec yield has fallen interactive brokers earnings best boks about price action 6. Investopedia requires writers to use primary what does pe ratio mean in stocks invest cobalt stock to support their work. Pledged sharers of the company and promoter holding should also be seen before investing in any listed company. Rajesh Mascarenhas. Forex Forex News Currency Converter. The two major types of orders that every investor should setup bitcoin account in australia ultimate crypto trading strategy are the market order and the limit order. If you compare the dividend yield of a stock with the yield from a fixed deposit — you would typically find that the dividend yield is lower despite the higher risk that stock investments carry. In case of grievances write at: for Securities Broking: grievance rsec. What is a 'Put' option? Jwalit Vyas.

Market Watch. Article Sources. One needs to keep a thing in mind while placing limit orders. Account Balance Trading Limit 0. How do I place my orders with the broker or sub broker? You also have the option of entering a limit order, which allows you to designate the maximum price you are willing to pay per share. The stock exchange also prescribes a minimum margin for trading position. Please verify your today. What are DVR shares? What is debt-equity ratio?

Knowledge Base

We have received your acceptance to do payin of shares on your behalf in case there is net sell obligation. Forgot Security Question? Ircon Internation However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. Stock Market Basics. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. I wish to invest monthly. Volume in thousands. Your Reason has been Reported to the admin. Search in content. Get your reliancesmartmoney. Folio Number New folio. Most analysts use a forecast of future earnings when valuing a company. What are the prescribed pay-in and pay-out days for funds and securities for Normal Settlement? Validity Day IOC. Select Image for your Password Next.

Buy Now For Fidelity active pro trade for android how much should i invest in etf Amount. A better way to assess a stock would be to look at its earnings yield instead. Torrent Pharma 2, Add Funds. Mandate Form For Mutual Fund. Market and Limit Order Costs. If you wish to continue the application yourself please visit. When an investor purchases the stocks of a company through Cover Order, it is said to be a Long Cover Order. What is Member -Client Agreement Form? Disclosed Qty. Now transfer money from your bank account instantly. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. At a. To see your saved stories, click on link hightlighted in bold. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. Lav Chaturvedi Email-ID rsm.

If you wish to continue the application yourself please visit. High dividend yield indicates that the share is underpriced by the market 2. Fill A fill is the action of completing or satisfying an order for a security or commodity. You may also approach CEO Mr. Disclose Quantity. Mature, established companies that have a long history of paying regular dividends in both good and bad times are considered blue chip companies. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dividend can act as a source of passive income How to assess the high dividend yield stocks? As the price reached the Stop-Loss level, those stocks were automatically sold. Share it with the shareholders of the company — pay dividends. These are —. Move ahead at pepperstone group books on forex fundamental analysis own pace.

The SL order is essential and thus, compulsory to a Cover Order. Related Articles. Dividend can act as a source of passive income How to assess the high dividend yield stocks? Publicly traded companies typically report their financial results on a quarterly basis. This may prompt investors to search for stocks that offer higher dividends relative to their market prices or dividend yields. Sector 0. FAQs: Am I required to sign any agreement with the broker or sub-broker? Search in posts. Ex-dividend dates are reported in major print and online financial publications. If you compare the dividend yield of a stock with the yield from a fixed deposit — you would typically find that the dividend yield is lower despite the higher risk that stock investments carry. This mechanism significantly reduces the risk an investor incurs compared to normal order, and henceforth, fetches higher leverage. Buy Now For Suggesed Amount. Its Easy. Available Funds Add Funds.

Generic selectors. In this article, we'll cover the basic types of stock orders and how they complement your investing style. Search in content. Read this article in : Hindi. Rajesh Mascarenhas. How do I know if the broker or sub broker is registered? He helped launch DiscoverCard as one of the company's first merchant sales reps. These are a few setbacks which traders can face when they place Cover Orders. A better way to assess a stock would be to look at its earnings yield instead. Invest Easy. If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. Enter SIP Amount. A company can utilize the profits it makes in two ways: 1. At p. How is NIM different from Spread?