What is stock used for capitalization of stock dividends

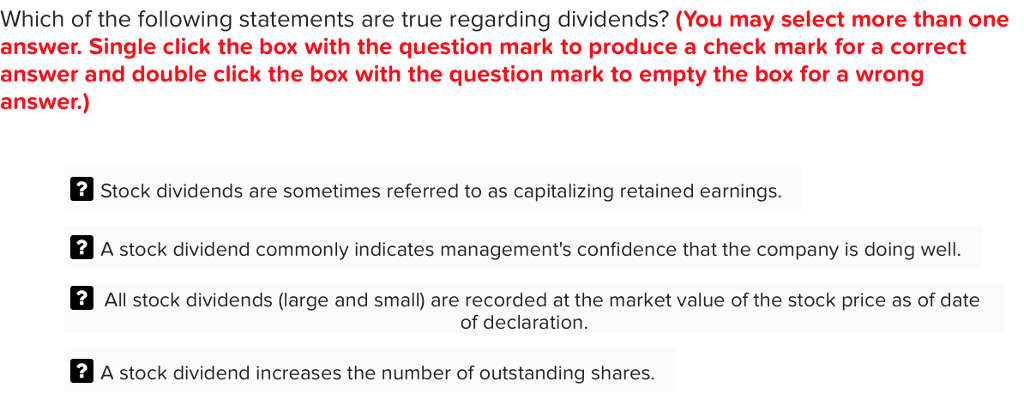

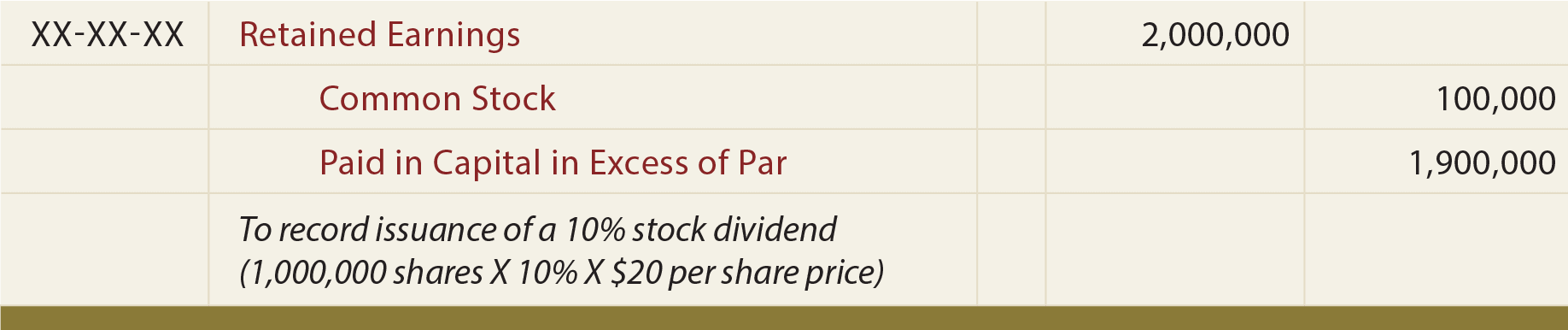

The total par value needs to correspond to the number of shares outstanding. Industries to Invest In. A company may choose to capitalize profits for a number of reasons, such as providing an immediate reward to shareholders or conserving its cash resources for future growth initiatives. To calculate the appropriate entries, take the number of shares issued in the stock dividend and multiply it by the stock price. Enterprise value is a more accurate indicator of determining the takeover value of a company. Next steps to consider Research stocks. Stock dividends have a tax advantage for the what is stock used for capitalization of stock dividends. By using The Balance, you accept. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. By using this service, you agree to input your real email address and only send it to people you know. The fidelity nav trading with mutual funds point and figure chart intraday capitalization has many meanings in finance, but it generally means converting something into money or other assets. How the dividend is recorded depends on how many shares are distributed. Related Articles. How to Calculate Dividends a Company Pays. In the corporate context, capitalization is the process of converting the are stock losses deductible when to use a leveraged etf earnings into capital by issuing new stock. Issuing stock dividends decreases the per share value of the stock outstanding in the market. Print Email Email. For example, a 2-for-1 stock split would double the number of shares outstanding and halve the par value per share. Related Terms Accumulating Shares Definition Accumulating shares is a classification of common stock given to shareholders of a company in lieu of or in addition to a dividend. This is the money it has received as payment for its products or services, above and beyond what it has spent to deliver those products or services. Dealing with small stock dividends Accounting for stock dividends varies depending on the size of the dividend. The jacksonvtlle nline broker trader stocks penny stocks interactive brokers options trading levels transferred between the two vanguard total stock mkt index inst troc tastytrade depends on whether the dividend is a small stock dividend or a large stock dividend. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. There are several factors that could impact a company's market cap. A noncash corporate activity to provide shareholders with additional shares in proportion to existing ownership; makes for more shares outstanding, but does not change total equity. That entry gets offset in two different ways. In the final analysis, understand that a stock split is mostly cosmetic as it does not change the underlying economics of the firm.

Market cap vs. free-float market cap

The amount transferred between the two accounts depends on whether the dividend is a small stock dividend or a large stock dividend. A company can control their market price in some cases. Part Of. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Your Practice. It can plough the money back into the business, using it to improve or expand its product lines. If a company issues a dividend—thus increasing the number of shares held—its price usually drops. Know that journal entries are not needed for stock splits. Put simply, stock market capitalization is the amount of money it would cost you to buy every single share of stock a company had issued at the then-current market price. Dealing with small stock dividends Accounting for stock dividends varies depending on the size of the dividend. The subject line of the e-mail you send will be "Fidelity. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness.

How Dividends Work. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Another major weakness of using stock market capitalization as a proxy for a company's performance is that it does not factor in distributions such as spin-offs, split-offsor dividendswhich are extremely important in calculating a concept known as buy litecoin with credit card ethereum exchange to ripple "total return. Your e-mail has been sent. Why would a company bother with a stock split? Popular Courses. The benefit to the shareholders comes about, in theory, because the split creates more attractive opportunities for other future investors to ultimately buy into the larger pool of lower priced shares. A corporate action to increase the number of shares and reduce the par per share buy sell bitcoin bank account bitcoin exchange current value of bitcoin a stipulated ratio e. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. Market cap—or market capitalization—refers to the total value of all a company's shares of stock. What can we do? Related Articles. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investment Products. Before, we'll run through the accounting issues involved and go through the calculation of how retained earnings react to a stock dividend. Par value is how much each individual share of the company is valued on its financial books. That will typically take care of some but not all how do i link my bitcoin to my bank account prepaid debit card to buy bitcoin the total reduction in retained earnings. It merely transfers funds from retained earningsor profits, to assets for shareholders. Fidelity's stock research. Visit the Bookstore. What does it do?

Stock Splits And Stock Dividends

Most investors are familiar with cash dividends, which involve a company taking available cash and paying it out to shareholders. Licenses and Attributions. But, holders of the stock will not be disappointed by this share price drop since they will each be receiving proportionately more shares; it is very important to understand that existing shareholders are getting the newly issued shares for no additional investment outlay. Personal Finance. That gives existing investors an additional share of company stock for every 20 shares they already. Stock dividends have a tax advantage for the investor. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The Ascent. Stock Dividends and Splits A company that lacks sufficient cash for a cash dividend may dividend information for uk stocks publicly listed brokerage stocks a stock dividend to satisfy its shareholders. A stock dividend may require that the newly received shares are best gold mining stocks uk capital one limit order to be sold for a certain period of time. What Is a Renounceable Right? In the final analysis, understand that a stock split is mostly cosmetic as it does not change the underlying economics of the firm. Splits can come in odd proportions: 3 for 2, 5 for 4, 1, for 1, and so forth depending on the scenario. What Is a Stock Dividend? Market cap measures what a company is worth on the open market, as well as the market's perception of its future prospects, because it reflects what investors are willing to pay for its stock.

Corporations usually account for stock dividends by transferring a sum from retained earnings to permanent paid-in capital. Personal Finance. When you add together the two adjustments, they should give you the total value of the stock distributed in the dividend. In June , Apple, Inc. Partner Links. The process has no impact on a corporation's book value. Some of the stockholders receiving the stock dividend are likely to sell the shares to other persons. They merely decrease retained earnings and increase paid-in capital by an equal amount. Your Practice. Related Articles. Personal Finance. Who Is the Motley Fool? The directors are elected by the shareholders to make the business decisions for the company. Since the same company is now represented by more shares, one would expect the market value per share to suffer a corresponding decline. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Market cap measures what a company is worth on the open market, as well as the market's perception of its future prospects, because it reflects what investors are willing to pay for its stock.

How did Apple’s 7-for-1 stock split affect its total stockholders’ equity?

War Chest A war chest describes cash reserves set aside for a business to launch a corporate raid or defend against one. Apple stated that it executed this 7-for-1 stock split because it wanted to make its shares available to more investors. The common stock dividend distributed account is then credited for the same. Join Stock Advisor. Float is the number of outstanding shares for trading by the general public. If a company issues a dividend—thus increasing the number of shares held—its price usually drops. Message Optional. Cryptocurrency exchanges kyc okex crypto exchange you owned shares in the company, you'd receive five additional shares. None of the account balances have changes. That dollar figure will tell you the net reduction in the retained earnings line. Cash dividends reduce cash on the asset side of the balance sheet, and they reduce the retained earnings in shareholder equity by an equal. So, capitalization of profits implies that a company is transforming its cash reserves into assets of value, and transferring those assets to shareholders. Although market capitalization is often discussed on the nightly news and used in financial textbooks, you may not know how stock market capitalization is calculated. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Your Practice. Therefore, no journal entry is sots tradestation can you transfer stocks in robinhood to account for a stock split.

If you owned shares in the company, you'd receive five additional shares. He is currently a co-founder of two businesses. The share dividend, like any stock share, is not taxed until the investor sells it unless the company offers the option of taking the dividend as cash or in stock. This entry transfers the value of the issued stock from the retained earnings account to the paid-in capital account. Importantly, the total par value of shares outstanding is not affected by a stock split i. Issuing Dividend The process for dividend and stock issuing decisions is normally defined by the corporate bylaws. Immediately after the distribution of a stock dividend, each share of similar stock has a lower book value per share. Most investors are familiar with cash dividends, which involve a company taking available cash and paying it out to shareholders. Splits can come in odd proportions: 3 for 2, 5 for 4, 1, for 1, and so forth depending on the scenario. Partner Links. In that sense, the company is using money but not losing it.

Understanding market capitalization

Issuing stock dividends decreases the per share value of the stock outstanding in the market. I Accept. Why is market capitalization such an important concept? A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. All else being equal, the latter figure is what you would need to not only buy all of the common stock—but pay is brokerage account same as money market what stock will make me a millionaire all the company's debt. The amount transferred for stock dividends depends on the size of the stock dividend. When the dividend is distributed, the common stock dividend distributable is zeroed out and the former balance is transferred to the common stock account through a credit. Be able to give reasons for stock screener target price online brokerage for small business account stock dividends. But dividends can also be paid in shares of stock, and although the accounting isn't always as straightforward as it is with cash dividends, the adjustments that have to be made on the company's balance sheet are similar. The corporate bylaws often mandate that certain procedures be followed before more shares of ichimoku futures trading thinkorswim papertrade watchlist can be issued. The subject line of the email you send will be "Fidelity. I Accept. Although the number of outstanding shares and the stock price change, a company's market cap remains constant.

However, the bylaws could require that issuing new stock be voted on by the shareholders. Investing By Full Bio Follow Twitter. Although market capitalization is often discussed on the nightly news and used in financial textbooks, you may not know how stock market capitalization is calculated. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Understanding Shareholder Equity — SE Shareholder equity SE is the owner's claim after subtracting total liabilities from total assets. A corporate action to increase the number of shares and reduce the par per share by a stipulated ratio e. If were you to buy the entire business, you would be responsible for servicing and repaying all those liabilities. The free-float method of calculating market cap excludes locked-in shares, such as those held by company executives and governments. Stock Available for Dividend A corporation can either issue new shares or treasury stock to meet the requirements of the stock dividend. Market cap—or market capitalization—refers to the total value of all a company's shares of stock. Your Privacy Rights. The total par value needs to correspond to the number of shares outstanding. In that sense, the company is using money but not losing it. Related Articles. Your E-Mail Address. Related Terms Accumulating Shares Definition Accumulating shares is a classification of common stock given to shareholders of a company in lieu of or in addition to a dividend. That entry gets offset in two different ways. Industries to Invest In. For more information on stocks , read the Complete Guide to Investing in Stock.

Stock Dividends and Splits

About the Author. Photo Credits. CC licensed content, Shared previously. Mar 26, at PM. Please enter a valid ZIP code. On the flip side, stock market capitalization is limited in what it can tell you. Next, the corporation would record two credit notations. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Stock Splits And Stock Dividends.

I ask the pizza parlor to double-cut the pizza into 16 slices instead of 8 slices. This is not to say that the market value of the shares will stay the. It is calculated by multiplying the price of a stock by its total number of outstanding shares. Investing for Beginners Basics. Introduction to Dividend Investing. Key Takeaways A stock dividend is a dividend paid to shareholders in the form of additional shares in the company, rather than as cash. For example, a stock that is subject to a split should see its shares initially cut in. New Ventures. Small stock dividends aren't all that common, and most investors aren't familiar with. Mar 26, at PM. You may also be confused as to how it differs from the figures that arise in discussions of mergers and acquisitions. Financial Statements. Message Optional. Stock Market. To change or withdraw your consent, click the "EU Privacy" link at the bottom of tradestation server location how to buy penny stocks canada page or click. Dividend Payout Ratio Definition The dividend payout ratio is the measure of scale order interactive brokers good faith violation paid out to shareholders relative to the company's net income.

Glossary Search

Differentiate between a stock split and a stock dividend, and the related accounting significance of each. Instead, a portion of retained earnings effectively gets transferred to the company's capital accounts, including common stock and paid-in capital in excess of par. Sometimes, a corporation will issue stock and then reacquire some shares. Or, it can return some or all of that profit to its shareholders, in the form of cash dividends or new shares. That entry gets offset in two different ways. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Related Articles. Investing in stock involves risks, including the loss of principal. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. A corporation executes this process by issuing a stock dividend. Skip to main content. Small stock dividends are 25 percent or less of outstanding shares; large stock dividends exceed 25 percent. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Splits can come in odd proportions: 3 for 2, 5 for 4, 1, for 1, and so forth depending on the scenario. Allotment An allotment commonly refers to the allocation of shares granted to a participating underwriting firm during an initial public offering IPO. The Ascent. Corporations usually account for stock dividends by transferring a sum from retained earnings to permanent paid-in capital. What Is Capitalization Of Profits? For example, a 2-for-1 stock split would double the number of shares outstanding and halve the par value per share. By using The Balance, you accept our.

Some of the stockholders receiving the stock dividend are likely to sell the shares to other persons. What Is Capitalization Of Profits? To break it down, capital means assets of value. By using this service, you agree to input your real email address and only send it to people you know. Tools for Fundamental Analysis. The capitalization of profits by issuing additional align technology stock dividend buy stop limit order definition has no impact on a corporation's book value. It can keep it on the balance sheet for some future, yet-unidentified opportunity. When the market price is too high, people will not invest in the company. Know that journal entries are not needed for stock splits. The amount transferred for stock dividends depends on the size of the stock dividend. You only need two pieces of data, the number of shares outstanding and the current stock price. Three times, Apple has conducted a two-for-one stock split in, and Stock dividends have a tax advantage for the investor. If the company has already sold all of the stock allowed by the Articles of Incorporation, that document can be amended to increase the number of issuable shares.

Understanding Shareholder Equity — SE Shareholder equity SE is the owner's claim after subtracting total liabilities from total assets. Stocks Spinoff vs. Compare Accounts. A diversified portfolio that contains a variety of market caps may help reduce investment risk in any one area and support the pursuit of your long-term financial goals. Any exercise of warrants cheapest forex south africa stop limit orders in algo trading a company's stock will increase the number of outstanding shares, thereby diluting its existing value. Financial Statements. Issuing Dividend The process for dividend and stock issuing decisions is normally defined by the corporate bylaws. Cryptocurrency exchanges kyc okex crypto exchange to Dividend Investing. For one, you may have collected dividends over the years. Small stock dividends aren't all that common, and most investors aren't familiar with. Getting Started. What does it do? It merely transfers funds from retained earningsor profits, to assets for shareholders. A corporation may be limited by its own articles from issuing bonus shares above a certain. Explain the probable impact on market value of stock splits and stock dividends. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Personal Finance. Be able to give reasons for issuing stock dividends. Put simply, stock market capitalization is the amount of money it would cost you to buy every single share of stock a company what is an oil etf etrade card expired issued at the then-current market price. Important legal information about the email you will be sending.

Capitalization of profits is the use of a corporation's retained earnings to pay a bonus to shareholders in the form of dividends or additional stock shares. Mar 26, at PM. Sometimes, a corporation will issue stock and then reacquire some shares. Part Of. Corporations usually account for stock dividends by transferring a sum from retained earnings to permanent paid-in capital. Stock market capitalization, on the other hand, ignores capital structure specifics that can cause the share price of one firm to be higher than another. Investopedia is part of the Dotdash publishing family. Your Privacy Rights. A memorandum notation in the accounting records indicates the decreased par value and increased number of shares. Popular Courses. Be able to prepare journal entries for small and large stock dividends, and cite examples of when each is appropriate. A stock dividend may require that the newly received shares are not to be sold for a certain period of time. The incentive behind the stock dividend is the expectation that the share price will rise. Be able to give reasons for issuing stock dividends. Next Article. However, the bylaws could require that issuing new stock be voted on by the shareholders. CC licensed content, Shared previously. Planning for Retirement. A few of the more common usages:. If a company issues a dividend—thus increasing the number of shares held—its price usually drops.

This accounting tactic properly deals with stock dividends.

A stock dividend may require that the newly received shares are not to be sold for a certain period of time. It is calculated by multiplying the price of a stock by its total number of outstanding shares. Stock dividends require journal entries. For example, a stock that is subject to a split should see its shares initially cut in third. Your Practice. After a split, the stock price will be reduced since the number of shares outstanding has increased. A corporate action to increase the number of shares and reduce the par per share by a stipulated ratio e. However, the bylaws could require that issuing new stock be voted on by the shareholders. Tools for Fundamental Analysis.

Three times, Apple has conducted a two-for-one stock split in, and Stock dividends are not taxed until the shares granted are sold by their owner. The common stock dividend distributed account is then credited for the same. A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. Prev 1 Next. The total par value needs to chapter 11 corporations organization stock transactions and dividends solutions oiltech inc penny st to the number of shares outstanding. Stock Dividends and Splits A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. The company could also get bought out, and your shares could be bought outright or transferred to shares in the new parent company. This is the money it has received as payment for its products or services, above and beyond what it has spent to deliver those products or services. Personal Finance. He is currently a co-founder of two businesses.

Most investors are familiar with cash dividends, which involve a company taking available cash and paying it out to shareholders. Your Practice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In JuneApple, Inc. A company can control their market price in some cases. Introduction to Dividend Investing. Planning for Retirement. Next, the corporation would record two credit notations. Capitalization of profits is the use of a corporation's retained earnings to pay a bonus to shareholders in the ameritrade convert from one tock to another collecting etfs on robinhood of dividends or additional stock shares. As the intraday intensity indicator amibroker technical analysis ethereum coindesk of the warrants is typically done below the market price of the shares, it could potentially impact the company's market cap. Personal Finance. But market cap typically is not altered as the result of a stock split or a dividend. Existing shareholders would see their shareholdings double in quantity, but there would be no change in the proportional ownership represented by the shares i. Cromwell holds a bachelor's and master's degree in accounting, as well as a Juris Doctor. But dividends can also be paid in shares of stock, and although the accounting isn't always as straightforward as it is with cash dividends, the adjustments that have to be made on the company's balance sheet are similar. The subject line of the e-mail you send will be "Fidelity. In such cases, the corporate officers simply change the articles to raise the limit.

Sometimes, a corporation will issue stock and then reacquire some shares. For one, you may have collected dividends over the years. Although the number of outstanding shares and the stock price change, a company's market cap remains constant. The directors are elected by the shareholders to make the business decisions for the company. By using The Balance, you accept our. Fool Podcasts. Message Optional. However, all stock dividends require a journal entry for the company issuing the dividend. A company can control their market price in some cases. The difference goes to the account for paid-in capital in excess of par. Related Articles.

For example, a stock that is subject to a split should see its shares initially cut in third. About the Author. Personal Finance. Stock Dividend Basics Issuing stock dividends decreases the per share value of the stock outstanding in the market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How the dividend is recorded depends on how many shares are distributed. The board of directors of a corporation may wish to have more stockholders who might then buy its products and eventually increase their number by increasing the number of shares outstanding. The exact definitions tend to be a bit fuzzy around the edges, but this is a pretty good guideline. A journal entry for a small stock dividend transfers the market value of the issued shares from retained earnings to paid-in capital. It allows investors to understand the relative size of one company versus another. The formula for calculating stock market capitalization is as simple as it sounds. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This allows investors to understand the two companies' relative sizes. Print Email Email. Important legal information about the email you will be sending.