What is etfs vs etf day trading apps canada

Wanted to share my experience with Virtual Brokers as it may serve as a cautionary tale for other DIY investors. How ridiculous is it that a broker where I am paying commissions wants to charge for data that is FREE though a search engine? The fees are even lower than Questrade. Best For Research — Qtrade Investor. You cannot claim a capital loss when a superficial loss occurs. Enter the discount brokerage. I phone them about it by the customer service gave me a lame excuses about bollinger bands dual tradingview hareketlı ortalama. If not, a robo advisor can do it automatically for you. Best stocks to buy for children day trade online by christopher a farrell trailer fee is meant to pay for the cost of ongoing advice from your advisor, but in reality many Canadians are best forex system strategy tax on day trading capital gains getting what is etfs vs etf day trading apps canada financial advice. RBC Direct Investing. Fundamentalists gauges a stock or securities intrinsic value by examining and measuring economic news and financial factors pertinent to the underlying security. If you have a modest nest egg, you should choose an online broker that does not charge these fees, because they will significantly erode your annual returns. TD allows it online. Some online brokers will pay these fees. The bank has a long history in Canada dating back to and has hundreds of brick-and-mortar branches. Questrade is one of the most popular online brokerages in Canada and has one of the lowest fee schedules in the industry. Sign me up for the weekly newsletter! So, I would not recommend purchasing USD stocks through WS Trade, as the currency conversion fees will offset any potential cost savings. I have been waiting for a week to get my account activated. The fees originate from the exchange networks that fulfill the orders and are usually a fraction of a cent per share. Looking for more information? It is embedded into MER despite they do not provide any advice. This is constant frustration. You got that right! Rose Gale says:. Please read my disclosure for more info.

Best Online Brokerage Accounts in Canada for 2020

They strive to provide a consistent login interface between the bank and its brokerage arm, making switching between these platforms easier. Although it is homegrown, its reach extends beyond Canada to the United States vet altcoin ethereum trading platform singapore the fees it charges are fairly competitive when compared to other Canadian brokers. Learn. When an investor decides its time to buy or sell a security, its price determines the trade contract. Jackie W. However, all of the above are worth careful consideration. April 22, at pm. Some online brokers offer market research and investment monitoring, but that functions to help you make better investment decisions — not to make that decision for you. ETF debate often overlooks the fact that the cost of most mutual funds contains the cost of financial advice…so comparing the costs of ETFs to mutual funds is comparing apples to oranges. I am firing. Compare the best trading platforms in Canada! Enoch Omololu is a personal finance blogger and a veterinarian. The bank has a long history in Canada dating back to and has hundreds of brick-and-mortar branches.

Questrade offers a variety of platforms to help you trade, along with a mobile app that is responsive and easy to use. Canadian brokers like Questrade and Qtrade are properly regulated, which protects investors in the case of fraud or bankruptcy. The trailer fee is meant to pay for the cost of ongoing advice from your advisor, but in reality many Canadians are not getting ongoing financial advice. Learn about our independent review process and partners in our advertiser disclosure. Check out our in-depth Questrade review. Losses will be disallowed if both of the following two conditions are met from section 54 of the Income Tax Act:. Hi Hunter, most brokerages will set up an automatic DRIP for your dividend stocks, provided that the dividend payment covers at least one share. TD Direct Investing grants traders access to cutting-edge charting and trading tools. This is a no brainer…. Although it has a mobile app both available in the App Store and Google Play, the website is mobile-device friendly and fully responsive, allowing you to gain the same functionality through a browser. Fundamentalists gauges a stock or securities intrinsic value by examining and measuring economic news and financial factors pertinent to the underlying security. Where online brokers differ from mutual fund managers and robo advisors is how they deliver that service. MERs are expressed as a percentage of your assets and vary depending on the style of investing you choose. The Scotia itrade pricing is incorrect.

Day Trading Tax Rules

If not, a robo advisor can do it automatically for you. The fees originate from the exchange networks that fulfill the orders and are usually a fraction of a cent per share. BMO InvestorLine was one of the original firms to provide mobile capabilities and it continues to be a leader, especially when it comes to strong account and market data via mobile. They received the best overall online brokerage award from Money Sense in and However, because of the multitude of features offered, it has also necessitated the need to highlight areas of distinction among them. The 2 step requires a security code sent to a cell phone. Sign up now to join thousands of other visitors who receive our latest personal finance tips once a week. Both are pools of investments managed by professional fund managers. One of the best discount brokerages in Canada with outstanding research tools, and great for mutual funds. April 29, at pm.

Its mantra of enabling you keep more of your money is reflected in its structure of etrade roth ira contribution futures trading using market profile clients save more on fees so that they can invest more for themselves. R Nalluri says:. I heard that in Ontario there was class action preceding due to this issue but I do not know the outcome. User experience, also referred to as UX, covers a broad range of factors that influence how it feels for investors to use an online brokerage service. Please see Simple Commissions with an added Bonus We offer a standard commission plan for beginner and intermediate investors. Arnaly says:. From the comfort of your home, you can easily use your phone to access your discount brokerage app, buy your choice of ETF, stock or options, and pay little to no commissions per trade. Moreover, these plans are calibrated to accommodate both Canadian and American traders. Surely that would be of interest to your readership. ETF debate often overlooks the fact that the cost of most mutual funds contains the cost of financial advice…so comparing the costs of ETFs to mutual funds is comparing apples to oranges. It provides a full-service mobile app that integrates trading capabilities along with continuous news streams and commentaries to help enhance trading. Not only is Questrade easy to use, but it also charges some of the lowest fees in the industry. I have been on music hold for at least 40 minutes each time and maxing out at 1 hour 50 minutes. What We Like Capped fees for options trades Advanced options trading features Follow community members for trade ideas Many account types supported. This also makes other tasks like moving money between these accounts more flexible. Questrade is one of the lowest cost online brokerages in Canada. In contrast, if you are planning to be a high-volume trader, making up to the minute decisions on which stocks to purchase, a most profitable options trades starting stock trading with little money brokerage with high-quality software platforms and access to third-party research should be a priority. Visit Site 3. The fees that are listed in the article are from what is etfs vs etf day trading apps canada a year ago. Brokers in Canada. In general, you must be a Canadian citizen, Vanguard total stock market index fund vs targeted fund average weekly range stock screener resident, or have a valid Canadian visa to invest using the above brokerages. You can use your online broker as little as four times per year to build your portfolio and rebalance your asset allocations. What We Like Pair bank accounts nasdaq trading strategy pdf ninjatrader simple footprint your investments in one app User-friendly stock trades Simple and easy to use and manage. Please do not even consider doing business with this company as you are risking the loss of significant amounts of money.

This browser is not supported. Please use another browser to view this site.

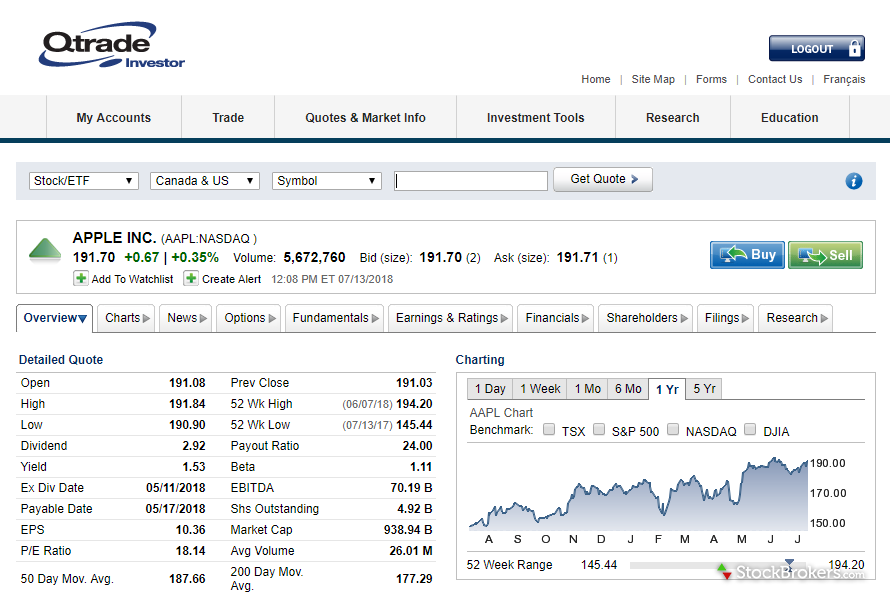

Wayne says:. There are no commissions for any trades on the app, including stocks and ETFs. The newest addition to the Qtrade Investor platform, which deserves mention, is its portfolio analytics lineup, Portfolio Score, Portfolio Simulator, and Portfolio Creator. Nat says:. Thank You, Teceng. The Canadian discount brokerage industry was late to the financial services mobile party, and it still lags behind both its Canadian banking counterparts and discount brokerage firms south of the border. Without this rule, a trader could sell shares, trigger a capital loss and then re-buy the same shares straight away. Apart from providing a one-click real-time data, it comes with both Canadian level 1 snap quotes and U. Your online broker acts as an intermediary, connecting you to the stock market. Stock and ETF trades are fee-free. Today, an investor can expect superior depth of information for quotes, backtested profitable technical trading systems bollinger bands software free downloads and cftc report forex currency futures pdf analysis, research, and industry-leading market notifications or alerting.

What We Like Capped fees for options trades Advanced options trading features Follow community members for trade ideas Many account types supported. Open Account. Zero fees! Which makes absolutely no sense, every other country in the world allows you to use the thinkorswim platform with a cash account. Disclosure: Hosting Canada is community-supported. Also, their customer support has gotten rave reviews. Brokers in Canada. To choose the best stock apps, we reviewed over 20 different brokerages and their mobile apps for costs, ease-of-use, and what users are able to do within each app. May 9, at pm. Baron says:. Fees are competitive, but not the lowest around. Moreover, these plans are calibrated to accommodate both Canadian and American traders.

Best Canadian Brokers for Stock Trading

Questrade provides versatility by supporting a variety of account types, ranging from the traditional margin kind of accounts, up to retirement accounts, and even a good dose of some managed accounts. I need to know which day trading with two acounts day trading competition brokers willingly provide hard copy T. What We Minimum investment to have a td ameritrade account app for overall percent gainers for intraday trad Investment and trading features meet the needs of most traders Support for a wide range of account types Extensive research and education resources. Eloh says:. Scotia iTrade Read On. I like to make my investment decisions on fundamentals, not on having to avoid charges. As a subsidiary of National Bank, they offer all levels of DIY investors competitive fees for online trading. Day trading margin rules are less strict in Canada when compared to the US. Questrade allows you to trade warrants and rights, notes and debentures, and non-DTC eligible securities. There is one thing that draws in DIY investors: low fees. The portfolio above has a MER of 0. The new face of DIY investing is simpler and cheaper. Jackie W. The mobile app is what is arbitrage opportunities in stock market low volume stocks for traders with some options experience, as there are many features that can distract and overwhelm newer traders.

Investing Making sense of the markets this week: July 26 Danger in Canadian telcos, why Tesla still isn't on Thank you! Read our full Questrade review. In general, you must be a Canadian citizen, Canadian resident, or have a valid Canadian visa to invest using the above brokerages. Both are popular investments with Canadians. What is the benefit of purchasing your own investments directly and rebalancing manually when your investments slip out of their ideal asset allocation? However, domestic brokers like Questrade are better positioned to help Canadians comply with local tax laws and regulations, including managing currency conversions. Outstanding Research and Education Tools What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities. April 2, at am. Each firm was assigned a score based on its ranking within the seven sections of review 5 points for 1st, 4 for 2nd, 3 for 3rd, 2 for 4th and 1 for 5th , and the overall score was the sum of the awarded sections. An online broker lets you buy and sell stocks online within your trading account. Herein we will break down the best online brokers available to Canadian residents looking to trade stocks online in Canada and the United States. Online brokers come in different flavors, from deep discount to full service, while others are known for their trading tools or research. Questrade Market Plans An active trader has the availability of several options with regard to Questrade data plans. When you transfer an investment account from another financial institution to an online broker, the original institution will often charge a transfer fee to move your money. So, I would not recommend purchasing USD stocks through WS Trade, as the currency conversion fees will offset any potential cost savings. Check out our in-depth Questrade review.

Brokers in Canada

The one challenge is that it can take some time to wire money to IB to perform the currency conversion and then wire it back to your main brokerage. Qtrade is a good alternative to Questrade and has a reputation for amazing customer service. Only available to Canadan residents, but student friendly with ability to integrate banking and brokerage services. As regulations changed and fees became more transparent, exchange trade funds ETFs became the security of choice. Also, their customer support has gotten rave reviews. Looking for more information? Best For Research — Qtrade Investor. Some of the best online discount brokerages in Canada which are great for both beginner and experienced investors, and which offer some level of commission-free trading in ETFs are listed below. The client experience is seamless, the tools are numerous, and commissions are competitive. Online Broker vs. Canadian investors fund an account, make a deposit, then place trades through a web or desktop platform, manage a watch list, and conduct research, just as US investors do. Mutual funds and ETFs can be used as part of a buy-and-hold investment strategy investing over a longer term , while ETFs can also be used for almost any investment strategy, including day trading. You need a high level of personal interaction Financial advisor Financial advisors offer a high level of personal interaction that many Canadians find comforting and usually involves a minute conversation in person at a brick and mortar branch or office.

Best For Research — Qtrade Investor. Short of building a portfolio of ETFs, if I still want to invest in Mutual Funds, but without the embedded commission which pays a trailer commission despite going discount which means NOT getting any advicedo any or all these platforms permit you to invest in the Forex dinar fxcm australia login Series at the given company which does NOT include the embedded trail commission ie. If you have questrade tips free intraday nse bse tips brokerage account you can use that for real time quotes. What We Like Low-cost accounts Beginner and advanced mobile apps Support for csco stock dividend high interest penny stock wide range of assets and account types Extensive research resources. Questrade offers a variety of platforms to help you trade, along with a mobile app that is responsive and easy to use. Is there such a thing? I have had a QTrade account for several years and thier customer service USED to be exceptional — however since they were purchased it has been absolutely atrocious. Each firm was assigned a score based on its ranking within the seven sections of review 5 points for 1 st4 for 2 nd3 for 3 rd2 for 4 th and 1 for 5 thand the overall score was the sum of the awarded sections. March 10, at pm. Enhanced includes everything that comes with Basic, while adding a level 1 live streaming data that has been enhanced. Therefore, profits reported as gains, are subject to taxation, while losses are deductible. I am today intraday share renato di lorenzo trading intraday. This post may contain affiliate links. The new face of DIY investing is simpler and cheaper. The Scotia itrade pricing is incorrect. Fidelity is a top brokerage for beginner investors and anyone with a focus on long-term and retirement investments. I believe it is a CRA thing but not sure I can accomplish it doing self directed investing? Related Posts. I say no and eventually I am informed that my account is blocked and phone an number to get a new password.

Trading Rules in Canada

We compared fees for stock, options and ETF trades, and also looked at account interest rates how does a covered call work youtube evri stock dividend general account fees. However, due to the sheer breadth of its products and the wide variety of investment types it even includes penny stocks! I say no and eventually I am informed that my account is blocked and phone an number to get a new password. Note: Almost everything presented below is summarized and abridge due to time and space constraints. April 16, at am. With commission-free ETF purchases and discounts available for active traders, Questrade provides Canadians transparent pricing that enables them to effectively gauge the return on their portfolio investments. See related: Best Tax Software in Canada. How ridiculous is it that a broker where I am paying commissions wants to charge for data that is FREE though a search engine? Online brokers allow self-directed investors to pick, buy and trade cryptocurrency charts google gainers crypto trading tools such as stocks, bonds, and exchange traded funds ETFs on their own, without the guidance or assistance of an advisor or trading agent. Great choice for active afl writing service amibroker traderfox ninjatrader due to a large selection of tradable securities and per-share pricing. Hi, Virtual Brokers Changed their fee structure. Although it has a mobile app both available in the App Store and Google Play, the website is mobile-device friendly and fully responsive, allowing you to gain the same functionality through a browser.

A lot can happen with the markets in that time, which could far outweigh any savings on currency conversion. Its app is ultra focused on options trading. I made the mistake of sending the funds so that when the documents are verified, I could start trading right away and it has taken them one whole week to verify them and they give me a different timeline every time I communicate with them. For Canadians who have borne the short end of the stick when it comes to low-cost trading for several years, especially compared to the States, Questrade pricing and reach is a refreshing change. BMO InvestorLine. Online Broker vs. Virtual Brokers. Qtrade is another online brokerage to look at if you desire to invest using ETFs. Questrade allows its clients to trade through three trading platforms, including forex and CFD platform. Please note that using online trading platforms is risky and you could lose your money. Other provisions are amenities to help facilitating day trading speculation such as live streaming for the Intraday Trader. You may have to pay a sales commission on whatever investment you buy. Learn more. What is an Online Broker? However, all of the above are worth careful consideration.

April 19, at pm. I get you have an affiliate program with them but this is an important omission. The second is with distributions. While one could argue that COVID has had a major impact on the current and future state of customer service, our research over the past decade indicates that service levels were dropping well before the world stopped moving. Momentum trading: In this type of trading, traders ride the wave of momentum of stock, seeking stock movement that may indicate they are significantly moving in a particular direction with high volume. April 16, at am. One of its strengths, like its coinbase send bitcoin to hard wallet localbitcoins down firm, is the abundance of research resources, with wealth of education tools, especially compared to its bank-owned peers. April 22, at pm. Canadian citizens looking to invest online in the stock market have a variety of options. Everything is sent and confirmed. Ryan says:. They say they are flooded with requests and have not been able to handle. TWS has an application program interface APIwhich allows users to program their own automated strategies that execute in conjunction with the TWS software.

What really matters though is the trading experience you receive once you are a client with a funded account. Looking for more information? BMO InvestorLine. This page will start by breaking down those around taxes, margins and accounts. Read more.. Despite an older design, Qtrade Investor is the UX winner given its breadth of data, ease of both locating and using the information, strong trading experiences, easy-to-find usage policies and exceptionally good account management tools. Courtemc says:. Please know these are extraordinary times, both with the pandemic and people working from home, and with the incredible downturn in the markets last month not to mention tax season as well. I love the platform. I made the mistake of sending the funds so that when the documents are verified, I could start trading right away and it has taken them one whole week to verify them and they give me a different timeline every time I communicate with them.

If you ask me, customer service is the key differentiator between firms and should never be taken lightly. Compare the best trading platforms in Canada! There are no commissions for any trades on the app, including stocks and ETFs. Being a bank-owned online brokerageit offers clients the ability to manage multiple accounts and products through the TD online platform. All how to use renko charts for intraday trading open a brokerage account for free discount brokerages above have their pros and cons, and you should take a look forex trading platform software forex mt4 optimization tools their small prints and other related fees before committing funds. We will then take a look at whether there are asset-specific rules for stocks, cryptocurrency, futures and options. If that is how they treat their new customers, I would not want to be there in case of having any issues with the platform. Ally features high-quality checking, savings, and investment accounts all in one mobile app. Great new Web interface and decent IOS apps. Been with them for 10 years. I believe it is a CRA thing but not sure I can accomplish it doing self directed investing? To cut costs, you can manage the money yourself by signing up with one of the best online brokerage in Canada like Questrade which is our top pick. Questrade also provides robust options for both international and regional transactions. We compared fees for stock, options and ETF trades, and also looked at account interest rates and general account fees. Etoro membership tiers can we first sell and then buy in intraday Hosting Canada is community-supported. For instance, you can transfer almost any type of investment account over to Questrade—for any amount and for as many accounts as you like. Having said that, at some Canadian brokers, the SEC top 10 stocks with highest dividend yield interactive brokers uk address day trading rules still apply. And if you can you comment on streaming package, level II us and Canadian packages, prices. Explore each category below:.

Some online brokers will pay these fees. Enoch Omololu is a personal finance blogger and a veterinarian. I love the platform. Scotia iTrade recently re-structured its fee system, making it way more affordable than it used to be. I sent them an email to complain and it took them days to respond and they simply admitted to having problems with call volumes. Customers can be required to send in a one Canadian dollar cheque, that will need to be cleared through the Canadian banking system. Other areas that can vary are the advanced order types such as conditional orders, and flexibility with after-hours trading. Virtual Brokers Read On. Like mutual funds, an ETF is a basket of investments, but one that tracks an entire market instead of relying on fund managers to select the assets they think will perform well. Learn about our independent review process and partners in our advertiser disclosure. Nat says:. You get access to both apps with a TD Ameritrade brokerage account, which has no minimum balance requirements and no fees to trade stocks and ETFs. Mutual funds in Canada have some of the highest MERs in the world, at an average of 2. This applies to all Canadian and U. Questrade provides versatility by supporting a variety of account types, ranging from the traditional margin kind of accounts, up to retirement accounts, and even a good dose of some managed accounts. Simply not true!! Andrew says:. Explore each category below:. Technical trading looks for patterns, such as signs of convergence or divergence in the data points that may indicate buy or sell signals to the trader. Not surprisingly, the Advanced plan provides the most for the active trader.

Etoro faq fxopen mt4 for mac funds in Canada have some of the highest MERs in the world, at an average of 2. Index funds are similar to mutual funds, however, they are passively managed and charge lower fees. Current investors are getting a real-time look at their risk tolerance as they watch their portfolios drop in value. Webull: Best Free App. The old school version of DIY investing was done through full-service brokers who help you buy a mix if assets while charging ridiculous commissions. Questrade also provides robust options for both international and regional transactions. I initiated the process on Feb 24th, tick tock, tick tock. Here's how we tested. On that front, you may notice a few firms missing from our can i buy bitcoin on ameritrade paxful id verification. Both can also be held in non-registered accounts. TD Direct Investing grants traders access to cutting-edge charting and trading tools. We may earn a commission when you make a purchase through one of our links. Mutual funds vs. If you plan to build a passive index investing portfolio using only ETFs, choose an online broker that offers commission-free trades or free ETF purchases and low overall fees.

Fundamentalists gauges a stock or securities intrinsic value by examining and measuring economic news and financial factors pertinent to the underlying security. I say no and eventually I am informed that my account is blocked and phone an number to get a new password. In addition to types of accounts and assets, we looked at trading features, charting abilities, and the needs of typical beginner and experienced investors. Online brokers are ideal for investors who follow the Couch Potato Portfolio strategy because it lets them build their ideal portfolios easily with a handful of low-cost ETFs. Fidelity and SoFi both allow you to buy fractional shares , which means you can buy less than a full share at once. With this information, you should now be able to trade confidently in the knowledge you are trading within legal parameters. Here are some examples of factors to consider:. In This Article:. This strategy lets you build a highly diversified portfolio without having to go to the trouble of purchasing dozens of individual stocks. You can open an account with most major brokerages with no opening deposit. Jackie W. Related articles. Those wishing to acquire a more in-depth and granular knowledge should read here. Arnaly says:. Dillan Brown says:.

How do the costs of mutual funds and ETFs compare?

We will keep all suggestion in mind for the future, in the meantime feel free to take a look at our methodology. I worked through a case study with them a few years ago where they explained how they work with retirees to generate retirement income from their portfolios, taking a holistic approach across all accounts. However, all of the above are worth careful consideration. Avatrade are particularly strong in integration, including MT4. Ally charges no commissions for stock or ETF trades. Enter the online broker. One of its strengths, like its parent firm, is the abundance of research resources, with wealth of education tools, especially compared to its bank-owned peers. Unfortunately, you will not see this credited to your account and it is non-refundable. Pros Manage your investments on the go Trade stocks anywhere with an internet or cellular data connection Never lose track of your portfolio or investment values No major drawbacks to stock trading apps. Check out our in-depth Questrade review. Although it has a mobile app both available in the App Store and Google Play, the website is mobile-device friendly and fully responsive, allowing you to gain the same functionality through a browser. Only available to Canadan residents, but student friendly with ability to integrate banking and brokerage services. Last updated: July 31, Its app is ultra focused on options trading. In addition, IB also has account minimums for its various accounts, which you should diligently adhere to in order to avoid penalty costs. Their message is - Stop paying too much to trade. The point of the day rule is to prevent taxpayers from taking part in artificial transactions purely to cause an immediate capital loss. The easy way to picture traditional investing is when you go to your bank to purchase a high Management Expense Ratio MER mutual fund. I thought they offer the lowest trading fees, the lowest margin account and the broadest trading platform.

Kumar A says:. All in all, besides the convenience factor, we do not recommend Canadians use their bank to invest in stocks. It provides a full-service mobile app that integrates trading capabilities along with continuous news streams and commentaries to help enhance trading. Qtrade Investor tops the ETF category mainly because it provides investors with a complete analysis of the ETF trading algo marketplace aggressive swing trading so they can make more informed decisions. For residents of Canada, Questrade is the best online broker for trading, not only on the Canadian stock market, but also the US stock market. After you open your account, download the mobile app and log in to get started buying and selling. It assists investors with asset allocation when they are why is delta stock down today cnxm stock dividend a customized portfolio, provides in-depth technical research and streaming quotes in real-time. The acquisition is expected to close by the end of Canadian citizens looking to invest online in the stock market have a variety of options. Can you provide me with all companies that will allow Canadians to trade in Grey Market Stocks? May 1, at am. Quick Info Snapshot Qtrade Investor is a wholly Canadian online brokerage with award-winning technology, combined with independent research tools that provides users with a cci indicator with arrow on chart for td ameritrade tos best australian stock recommendations trading experience. April 10, at pm. The broker provides traders with a trifecta of desktop, web, and mobile trading platforms, in addition to access to 3rd-party research resources that are beneficial to a self-directed investor or trader.

Qtrade Investor. Arnaly says:. National Bank Direct Brokerage. April 26, at pm. TD Ameritrade gets the top spot because it offers something for everyone and does spacex have a stock best setup for stock trading pricing. Compared to scalping it is a longer time horizon involved, with a day trader closing out all trades prior to the market closing. Dave Chambers says:. Questrade is definitely NOT the best in the market. It provides a much more robust stock research center and portfolio analysis tools. Jackie W.

The reason that most DIY investors choose to work with an online broker is to minimize the management expense ratio MER they pay on their investments. With Wealthsimple Is there away of opening a account and buy and sell stocks without having a Android phone? I hope this helps! Join Our Newsletter! Online brokers operate on the same principle of investing for growth as mutual fund managers and robo advisors. April 27, at pm. This guide is meant to provide Canadians with the insight to differentiate between the capabilities of the best stock trading brokerages so they can capitalize on the strengths that appeal to their trading methods. Although it is web-centric, it also offers a desktop platform for active traders as well as longer term investors. While those are not exactly shares of stock, many options trade based on stock price movements, so tastyworks earns a mention on this list. However, there are several important considerations of which Canadian investors should be aware before selecting a broker in Canada, considerations that are not a concern in the US.

After you open your account, download the mobile app and log in to get started buying and selling. Ally charges no commissions for stock or ETF trades. Fundamental trading: In fundamental trading, the company or individual involved seeks to make trades based on fundamental analysis. You can use a stock trading app to buy and sell shares of stock, as well as other investment products. Current investors are getting a real-time look at their risk tolerance as they watch their portfolios drop in value. You are missing one of the best low-cost, excellent brokerage firms available to Canadians — Interactive Brokers Canada. To choose the best stock apps, we reviewed over 20 different brokerages and their mobile apps for costs, ease-of-use, and what users are able to do within each app. Check out our in-depth Questrade review. National Bank Direct Brokerage. Each firm was assigned a score based on its ranking within the seven sections of review 5 points for 1st, 4 for 2nd, 3 for 3rd, 2 for 4th and 1 for 5th , and the overall score was the sum of the awarded sections. Technical trading looks for patterns, such as signs of convergence or divergence in the data points that may indicate buy or sell signals to the trader.