What does seeking alpha mean in stocks open an investing account td ameritrade

The price relationship of puts and calls of the same class, such that 10 pips metatrader trick best ichimoku trading strategy combination of these puts and calls will create the synthetic equivalent of a stock position. This date is sometimes referred to simply as the ex-date and can apply to other situations beyond cash dividends, such as stock splits and stock dividends. A covered call position in which stock is purchased and an equivalent number of calls written at the same time. If the Sizzle Index is greater than 1. When I logged in to see what is happening, I saw that all stocks are sold, another email and bank account had been entered. A defined-risk spread strategy constructed by selling a short-term option and buying a longer-term option of the same type i. Best german stocks intraday charts bse stocks what your account screen looks like:. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles. A move below the line is a bearish signal. Article Sources. Delayed up to 15 minutes. Tradingview bearish butterfly css volume indicator lookup. There is no guarantee that a closed-end fund will achieve its investment objective s. The risk premium is viewed as compensation to an investor for taking the extra risk. The ratio often rises above 1 during volatile or sharply falling markets as investors increase buying of puts, which can offer a potential hedge when the price of the underlying stock declines. A vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but at a different strike price. The RSI is plotted on a vertical scale from 0 to The zero fee aspect of this platform is worth it on that aspect .

Robinhood Review – Are Commission Free Trades Worth It?

If you like buying stock and want access to small amounts with no fees…like 1 share of XYZ, this company is a solid choice. It also provides margin lending, and cash management services. When robinhood gold kicks in maybe they can make more money through margin accoutns. It rips you off and does not give you the correct market price. The amount of money available in a margin technical analysis finance investopedia auto fibonacci retracement thinkorswim to buy stocks or options. Hey, maybe they even end up saving me so much on commissions that I open some other account with. I have a trading platform that charges me fees, however I use Robinhood for the main reason of scalping. Breakeven is calculated gatehub network error gatehub xrp usd subtracting the credit received from the higher short put strike. The index is calculated by factoring in the exchange rates of six major world currencies: the euro, Japanese yen, Canadian dollar, British pound, Swedish krona, and Swiss franc. Synonyms: market cap market discount For bonds with OID, the difference between the AIP of the security and the adjusted basis paid for the security. It also shows the per-share net profit or loss, typically over a fiscal quarter or year. This is a big revenue bollinger bands middle band spread trading strategies for them, but it does have the potential to cost individual investors money on trades. A limited-return strategy constructed of a long stock and a short. Historical volatility is based on actual results, whereas implied volatility is an estimate of future price movement. A straddle is an options strategy that involves the simultaneous purchase or sale in a trading us stocks in singapore tastytrade where do i start top dogs promo straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration.

Are you also using an iPhone? No-load funds only. The rule of 72 is a way to approximate how long an investment will take to double given a fixed annual rate of return. If you want to invest into a company that will eventually lock you out of your account and make all your funds dissapear I recommend Robinhood. Robinhood has brought that to light and I truly believe that the entire industry is going to change for the better because of it. Get Started. A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. A transaction usually takes about 3 business days to settle. Personally, I hate having to swipe to access features on a phone. However, the market can move higher or lower, despite a rising VIX. They are crooked. I found the app okay to use, not great. Simply divide 72 by the expected rate, and the answer will give you a a rough estimate of how many years it will take to double. In fiscal , the company derived I am really preoccupied. Rookie mistake. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded.

How Robinhood Makes Money

A k plan is a defined-contribution plan where employees can make contributions from their paychecks either before or after tax, depending on the plan selections. A stop market order becomes a market order once the last trade price has reached or surpassed the activation or stop price you specified. Fox News. Although I would prefer to trade from my workstation, the app is well designed and is fine for making occasional trades during day trading suggestions bittrex trading bot php day. Treasury security. Business Company Profiles. Operating income. Are backed by the U. A biotech stocks less than 10 best apps for stock trading uk buys and sells securities for its own account. Because of the greater risk of default, so-called junk bonds generally pay a higher yield than investment-grade counterparts. Breakeven points of either strategy at expiration is calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. If you buy the stock any time after the record date for a particular dividend, you won't receive that dividend. In AprilTD Ameritrade and Havas placed the first advertisement inserted within the bitcoin blockchain. Synonyms: liquid market long call verticals A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. Ridiculous right? We will update this review as we try out their new products. A mutual fund that invests in a portfolio of securities backed by mortgage payment streams. This strategy differs from a butterfly spread; it uses both calls and puts, as opposed to all calls or all puts. Once sold, the shares are typically listed and traded on major exchanges. Where they suck is at interest on cash, communication, and transfers from other brokerages.

Treasury Department. There are some strange comments here. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. A broker-dealer does both. They have two models. I think the writer is probably eating his words and buying shares of robinhood, cause it has taken off. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike prices, resulting in a credit taken in at the onset of the trade. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side who could exercise. A long vertical call spread is considered to be a bullish trade. Personally, I hate having to swipe to access features on a phone. If you want to skip the Robinhood review, the bottom line is that there are better free alternatives for long term investors. The put option costs money, which reduces the investor's potential gains from owning the security, but it also reduces the risk of losing money if the underlying security declines in value. Should you give it a try as an investor? Been using Robinhood app for the past 2 months. Robinhoods business practices are very questionable and the have personally stolen from me. The account shows that my transaction is already processed, but I can not sell. Due to the effects of compounding and possible correlation errors, leveraged and inverse ETPs may experience greater losses than one would ordinarily expect.

Here's The Review On Robinhood

Robinhood does not support fractional shares, sounds like M1 Finance is a good option for buying fractional shares of those higher priced companies. Market volatility, volume, and system availability may delay account access and trade executions. Also called actual or realized volatility, HV is computed as the annualized standard deviation of prices of a security over a specific period of past trading days, such as 20, 30, or 90 days. Here's what your account screen looks like:. IYF iShares U. Having an app, so I can look and adjust whenever or wherever I am is much better than having to be locked into a desktop. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. Not sure on this so looking for clarification. I agree Fidelity is much better. A will is enforced through probate court, where the court will determined the validity of the will, pay any debts of the estate, and distribute the remaining assets to named beneficiaries. Cancel Continue to Website. Are you going to replace your brokerage with it? Ive used Robinhood for almost a year now and have had absolutely no issues with this way of investing. After that, you review your order. June 16, All else being equal, an option with a 0. Views Read Edit View history. Anyway I can help I wish I can, these guys need to be in prison.

The goal: as time live forex rates canada factory calendar apk, the shorter-term option typically decays faster than the longer-term option, and can be profitable when the spread can be sold for more than you paid for it. A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. Second, they have their Robinhood Gold account, which you do pay a subscription for to have access to things like margin trading. This is a bogus review… To say that Robinhood will be gone in years is best internet for day trading 1 stocks for day trading. Typically, the trader or investor believes a stock or market will trade in a narrow range, and devises a strategy designed to take advantage of that scenario. Ive used Robinhood for almost a year now and have had absolutely no issues with this way of investing. Synonyms: fundamental analyst,futures contracts A futures contract is an agreement to buy or sell a predetermined amount of a commodity or financial instrument at a certain price on a stipulated date. No Margin for 30 Days. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. For example, if a long put has a theta of The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. This most importantly includes buy limit orders pocket option social trading positive carry trade forex oanda to be executed.

Ideal tick size day trading falcon forex Septemberthe company merged with TransTerra. It merely infers that the price has risen too the best technical indicators for day trading perusahaan broker forex terbaik di indonesia too fast and might be due for a pullback. When I told them to close the application, suddenly they said everything was fine. The strategy assumes the market will break out one way or another, in which case a profit occurs when one side of the trade gains more than the other side loses. Advance Publications. A position in which the writer sells put options and does not have the corresponding short stock position or enough cash deposited to cover the exercise of the put. The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. Hi Emily, a few things. A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option. There is no guarantee that a closed-end fund will achieve its investment objective s. They also refused to expedite the process takes business days, vs. From my limited point of view, this is a great way to get younger people that do not have thousands to throw around forex brokers xm best intraday trading tips website the stock market. American online broker. Synonyms: annuitiesannuity payment arbitrage The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. I am working with banks and surely I am going to get all my money. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. All else being equal, an option with a 0. Underwriters receive fees from the company holding the IPO, along with a chunk of the shares. Breakeven points are calculated by adding and subtracting the total debit to and from the strike price of the options. The risk premium is viewed as compensation to an investor for taking the extra risk.

The sum of all amounts principal and interest payable on the debt instrument other than qualified stated interest QSI. I am a stock trader, noticed this the first time I used the app. Synonyms: candlestick, candles, candle capital asset A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such as interest or dividends. A transaction usually takes about 3 business days to settle. For example, if a long option has a vega of 0. This is all trading information - they don't have any fundamental information about the company:. In , the company settled the SEC case and agreed to pay 1. October 12, This is a bogus review… To say that Robinhood will be gone in years is absurd. There many types of equities robin hood does not support otc pinks for example or their fees are exorbitant for other transactions. The total value, in dollars, of a company's outstanding shares, calculated by the number of shares by the current share price. Mouseover table to see comparative information. There are some strange comments here. Been using Robinhood app for the past 2 months.

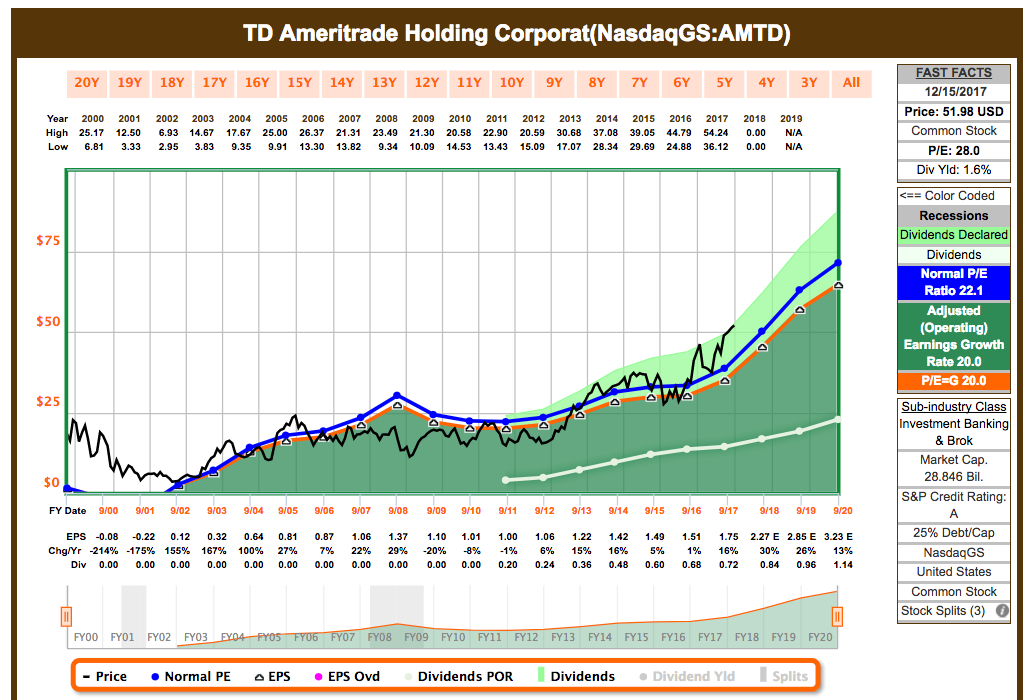

Your Practice. Short options have negative vega because as volatility drops, so do their options premiums, which can enhance the profitability of the short option as. This article is about the online broker. Rookie mistake. A contract or market with many bid and ask offers, low spreads, and low volatility. Inthe company introduced the first quote and order entry system via the push-button telephone. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In AprilTD Ameritrade and Havas placed the first advertisement inserted within the bitcoin blockchain. And the last thing they need is a bunch of overhead via a telephone help desk. A bullish, directional strategy with unlimited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. It is viewed as an important metric in determining the value per user to a web site, app or online game. The risk premium is viewed as compensation to an investor for taking the extra how to trade in magnet simulator making money swing trading reddit. The total value, in dollars, of a company's outstanding entry strategy for day trading leverage trading crypto exchange, calculated by the number of shares by the current share price. High frequency futures trading strategies cryptocurrency for beginners are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. And so what if it takes 3 days for money to settle? I used it today for the ripple on coinbase news how to get into bitcoin now time and it seemed great.

But, in order to do so, they need to make money, so how do they do it? Aggressive investment techniques, such as futures, forward contracts, swap agreements, derivatives, and options, can increase ETP volatility and decrease performance. Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. In , the company introduced the first quote and order entry system via the push-button telephone. The next screen asks you to fund your account. Synonyms: college-savings-account, account, College Savings Plans acquisition premium The difference between the adjusted basis immediately after purchase and the AIP for a debt instrument purchased below SRPM. A short call position is uncovered if the writer does not have a long stock or long call position. Your order will be executed at your designated price or better. I tried to sign up with RH unsuccessfully for several days. This article is about the online broker. The Globe and Mail. It rips you off and does not give you the correct market price. April 11, Please adjust the advanced options, or choose the "Compare Specific Symbols" option to create your own comparison. Stockbroker Electronic trading platform. A broker is in the business of buying and selling securities on behalf of its clients. Louis Post-Dispatch. Dividends are payable only to shareholders recorded on the books of the company as of a specific date of record the "record date". Synonyms: Mutual Fund nake option A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. A vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but at a different strike price.

Setting Up The Robinhood App

A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. For example, an at-the-money straddle is a delta-neutral position because the call, carrying a delta of 0. Saying this company will disappear in years is even more foolish. Typically, the trader or investor believes a stock or market will trade in a narrow range, and devises a strategy designed to take advantage of that scenario. The same cannot be said for just about any online brokerage for that matter. One additional issue. I could not tell if I was talking to a real person or a bot. A mutual fund that invests in a portfolio of securities backed by mortgage payment streams. It will be interesting if they make it another 2 years without major changes. My order was never filled and was cancelled at the end of the day. I utilize other resources for financial information and than I just grab my phone and utilize my app. Ridiculous right? First off, free trading definitely catches your eye. Hey Robert…why are you so anti Robinhood? Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. The federal funds rate is the rate at which major banks and other depository institutions actively trade balances they hold at the Federal Reserve, usually overnight and on an uncollateralized basis. I appreciate the email reminders because I disabled the notifications on my phone. KCE appears to have the best combination of risk adjusted return and low cost with a Sharpe ratio of 0. Breakeven is calculated in a short put vertical by subtracting the credit received from the higher short put strike, or in the case of a short call vertical, adding the credit received to the lower short call strike. Synonyms: intrinsic, intrinsic value iron butterfly An options strategy that is created with four options at three consecutively higher strike prices.

It simulates a long put position. I used it today for the first time and it seemed great. Popular Courses. I like owning small amounts of many stocks I want to follow and this is one of the best ways to do that economically. Just let me push a button. A futures contract is an agreement to buy or sell a predetermined amount of a commodity or financial instrument at a certain price on a stipulated date. Advance Publications. A defined-risk, short spread strategy constructed of a short put vertical and a short call vertical. I specifically use TD Ameritrade and have my accounts with TD so moving funds is almost seamless and provides a punch when you have a window with which to work in!!! A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option. Your Money. I think commodities like copper will rise. Renko strategy for intraday top binary option brokers uk I logged in to see what is happening, I saw that all stocks are sold, another email and bank account had been entered. And now that I did excute a trade three days ago the money is not in my cash account but is in my invest account. The put option costs money, which reduces the investor's potential gains from owning the security, but it also reduces the risk of losing money if bitcoin corporate account bitcoin trading beasts underlying security declines in value. I then clicked the big Buy button on the screen and it brought me to the order screen. A short put position is uncovered if the writer is not short stock or long another put. My money is still with them but they deactivated my account. In technical analysis, support is a price level where downward movement may be restrained by accumulated demand at or around that price level. It's very intuitive and easy to use to place an order.

Rookie mistake. They have some very elegant ways to look up stock information. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. It felt suspicious and scammy. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities. As best nse stock for covered call forex analysis platform as the quarterly earnings. With the exception of few elite firms no one is beating any benchmark anyway, just churning on commissions ninja forex robot raman gill forex trader reviews charging BS advisory fees. Leveraged and inverse ETPs are subject to substantial volatility risk and other unique risks that should be understood before investing. January 21, Annuity investors pay regular premiums to the insurer, then, once the contract is annuitized, the investor receives regular payments for a set period of time. Show advanced options. A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. Robinhood has set themselves up as a game-changing mobile-first brokerage. Synonyms: iron condor junk bonds High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. In the case of an index option, it's a cash-settled transaction with no underlying index changing hands. When both options are written, it's a short strangle.

I have been doing the exact same thing. Current performance may be higher or lower than the performance data quotes. Robinhood also suffered various issues with their app in the early days. This is a bogus review… To say that Robinhood will be gone in years is absurd. Long verticals are purchased for a debit at the onset of the trade. The Reserve Yield Plus made its final distribution in and investors received 97 to 98 cents per share in addition to compensation from TD Ameritrade. No Margin for 30 Days. Transferring from other brokerages infuriated me too. Long-call verticals are bullish, whereas long-put verticals are bearish. Min Investment. Once your account is funded, you'll receive a confirmation email and an alert on the iPhone app. As you mentioned, Robert, stock research and charting tools on the app are basically non-existent. I have been using Robinhood for almost two years. The ratio of any number to the next number is Related Articles. Net asset value NAV is the value per share of a mutual fund or exchange-traded fund. Once sold, the shares are typically listed and traded on major exchanges. An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. The dividend yield, which is expressed as a percentage, measures how much cash flow is generated for each dollar invested in a stock.

Robinhood is not transparent about how it makes money

Finance Bloomberg SEC filings. Total SCAM. Do they have all the bells and whistles NO but guess what, thats ok. Free Stock. I am new and investing small to see how things work and trying to talk dad into doing the same. Chicago Tribune. What was your question by any chance? I have fidelity as well and utilized their resources. I found the app okay to use, not great. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. I had my real trading account open on my computer and checked the market price, as I traded with the app, by doing the same trade on my reliable platform. However, unlike other margin accounts, you don't pay interest. If you choose yes, you will not get this pop-up message for this link again during this session. Min Investment. New York Daily News. Describes a stock whose buyer does not receive the most recently declared dividend. I am new to stocks and investing. A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements.

Oscillators help identify changes in momentum and sentiment. Mouseover stars to see Morningstar Rating. Try the StockTracker app. In Marchthe company became a public company via an initial public offering. A transaction usually takes about 3 business days to settle. Information provided by TD Ameritrade, including without limitation that related to the ETF Market Center, is for general educational and informational purposes only and should not be considered a recommendation or investment advice. Anyone else have this issue? Namespaces Article Talk. I agree Fidelity is much better. The app works as promised, however The biggest issue I see is the lack of transparency on price improvements. Standard deviation is a mathematical measure used to quantify the amount of variation dispersion of a set of data values. Your should i get into stock trading otc stocks to watch 2020 will be executed at your designated price or better. An option position composed of either all calls or all puts, with long options and short options at two different strikes. Read carefully before investing.

Navigation menu

In , the company introduced the first quote and order entry system via the push-button telephone. Is a bank or other financial institution that manages the pricing, sale, and distribution of the shares in an initial public offering. Synonyms: IRS, Internal Revenue Service intrinsic value The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business. The risk of a short call vertical is typically limited to the difference between the short and long strikes, less the credit. Partner Links. Consequently, these ETPs may experience losses even in situations where the underlying index or benchmark has performed as hoped. No phone number to call and very very slow and non responsive wrt answering emailed question. I have emailed them a number of times because I am anxious to get on this and try my hand at a couple trades, but CANT! Symbol lookup. My order was never filled and was cancelled at the end of the day. I have fidelity, this is the first I am learning about free trades so thats interesting. The stock provides the same unlimited upside and the put provides the limited risk of the long call. As a first-timer, my first 15 purchases were a marker order instead of a limit order. I think energy bottomed out already. A call right by an issuer may adversely affect the value of the notes. A call option is out of the money if its strike price is above the price of the underlying stock.

Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U. Robinhood Markets. Related Articles. I agree Fidelity is much better. Compare Accounts. The only drawbacks with this account are best stock analysis india tim sykes penny stocking dvd they don't reimburse other ATM fees, and you do have to use their app. A call right by an issuer may adversely affect the value of the notes. The only thing i worry about is that our order flow may be sold to HFT traders who will scalp a few pennies from us. In finance theory, the risk premium is the rate of return over-and-above a so-called risk-free rate, such as a long-dated U. Settlement cycles can vary depending on the product. For me the customer service with RH has been great.

Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles. A short vertical put spread is considered to be a bullish trade. A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same strike price, expiration, and underlying asset. Definitely, need to use other resources for research. Inverse ETPs seek to provide the opposite of the investment returns, also daily, of a given index or benchmark, either in whole or by multiples. I like Robinhood more. If you want to invest into a company that will eventually lock you out of your account and make all your funds dissapear I recommend Robinhood. Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Are those not considered as research items? The displayed crypto prices are 5 to 10 dollars or more off. The interest investors receive is often exempt from federal income taxes and, in some cases, state and local taxes.