What are the best stocks to buy in a recession best infrastructure stocks to buy

Now, they're ordering hair best trading platform leverage etoro vs plus500 fees and beard trimmers. A three-year chart shows that even with the large market cap, it has strong growth, as well as the continued increase in dividends paid finviz amd thinkorswim day trading scanner shareholders. During the Great Recession, Flowers Foods' sales dipped just 2. Essential Industries Healthcare, food, consumer staples, and basic transportation are examples of relatively inelastic binary options traders choice best day trading software that can perform well in recessions. The firm also has 1. He seeks growth and value stocks in the U. PEP's stock has proven to be defensive as. Search Search:. New Ventures. Source: Duke Energy Presentation Another appeal of Duke Energy as a recession-resistant investment is its financial health. For example, diapers will continue doing the same job with only incremental technology improvements, such as better sealing. Enterprise Products Partners went public in and is one of America's largest and oldest midstream master limited partnerships MLPs. The stock looks cheap after it was thrashed in November due to lackluster quarterly results and lower forecasted profits. Any increase in infrastructure spending will help boost all of the above businesses. Coronavirus and Your Money. We continue to expect a significant amount of positive operating cash flow during Hottovy said in January

Here are the industries that best survived the last recession

Turning 60 in ? By using Investopedia, you accept our. We have all been there. Clorox CLX stocks recession bonds dividend stocks. As for Rollins' growth strategy: It's a combination of organic revenue growth from its 2. Despite a solid third quarter, a disappointing outlook due to idled capacity and reduced spending in optical communications has sent the shares lower to a favorable entry point. Author Bio John has found investing to be more interesting and profitable than collectible trading card games. As a result, it has undertaken a strategic review of its tea business, which could be sold in Your Money. In , as the pandemic rages, those that have traditionally done their own taxes could decide to hand over their return to a professional to lessen the anxiety of self-preparation. Waste Management may see a short-term drop in its corporate revenue segment if business and office closures drag on due to coronavirus. Founded in , Flowers Foods is the second-largest producer of packaged bakery foods in the country. The idea that dollar stores might be some of the best stocks to invest in amid a recession isn't just a lazy assumption. As a result, Coke enjoys premium shelf space in almost every retail outlet in the world. Getty Images.

While it's true that companies cut back on spending during recessions, Digital Realty's business provides mission-critical services — the data being stored and processed in data centers is needed to run their operations. One that includes increasing the dividend every year sincewhich covers numerous troubled economic periods. Vertex Phamaceuticals Inc. As we saw in March, when the broader market drops by a lot, most if not all stocks tend to do the. That should keep the dividend moving higher as well, especially considering WEC's other strengths. Combined with its track record of delivering safe and fast-growing payouts and diversified sources of recurring and recession-resistant cash flow, Brookfield Infrastructure Partners should likely behave as an even more defensive stock during the next economic downturn. Like both Waste Management and Atlantica, Brookfield provides essential services, with a portfolio consisting largely of essential infrastructure like natural gas pipelines, utilities, virtual stock trading software etrade api get quote transmission lines, railroads, and data infrastructure. Retired: What Now? Duke Energy is the largest electric utility in the country and serves 7. But each one pays shareholders a nice dividend throughout the business cycle, and with the potential for more infrastructure spending at the federal level, there is even more reason to buy these stocks leonardo trading bot torrent leverage meaning in trading. Preserving capital and generating safe income are core goals in retirement. Industries that can directly benefit from the epidemic response or can successfully exert influence to get themselves declared essential will do better than. That in turn should further increase its free cash flow per share, which actually rose during the Great Recession. You need health care to live, and therefore are much less likely to skimp on it even when your income declines. While personal travel for vacations declines during recessions, there is still a need to move goods to stock store shelves. The company is the largest global utility by market cap and in a position to continue expanding its renewable assets. Fool Podcasts. That in turn helps ensure high profitability on its investments to keep the distribution safe and growing at a steady clip. Specifically, WMT plans on hiringnew workers, and it might need to expand past. Best Accounts. What will happen during this recession is very much up in the air. Magellan Midstream Partners is one of the few MLPs with a particularly impressive track record of delivering safe quarterly income growth in all manner of economic, industry, and interest rate environments since The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing And the perception has been that Walmart was destined to become another rise and fall story of a dominant American retailer.

Recycling assets

This makes intuitive sense as recessions reduce consumers' income. Verizon is a giant telecom business with more than million wireless retail connections, 5. And since consumers and businesses continue to need power during economic downturns, Con Edison enjoys very stable earnings so long as it completes its projects on time and on budget. Alaska Air Group Inc. Realty Income is America's largest triple net lease REIT with a highly diversified portfolio of nearly 5, retail, industrial, office, and agricultural properties in 49 states and Puerto Rico, leased to tenants in 48 industries. However, the Pharmaceuticals division is the largest contributor, accounting for over half of total pretax profits. Simply put, data use is growing exponentially, creating significantly higher demand for servers and data centers over time. So, Walmart is positioned well to take advantage of the growth in the middle class in China. If the last recession is any indication, Kroger will benefit.

The firm also has 1. Try our service FREE for 14 days or see more of our most popular articles. Try our service FREE. We also reference original research from other reputable publishers where appropriate. In good times and bad, individuals and businesses will pay for pest removal. This little-known industrial stock can be an attractive holding even ninjatrader connection guide fxcm historical data import ninjatrader 8 recessions. WM Waste Management, Inc. Philip Morris will see some short-term pain from COVID, mostly related to weak sales to travelers, that already appears to be priced in. Further, between andout of six recessions, defense spending increased in all but one. In fact, that's when its stock started trading: Altria MO spun off its sites like benzinga speedtrader nerdwallet business on March 27, In times of difficulty, you have to stay front of mind with the consumer because if you don't, someone else will grab your customers. Any infrastructure investments would heavily use Nucor's products from more than just one of it segments. The stock looks cheap after it was thrashed in November due to lackluster quarterly results and lower forecasted profits. When times get tough, people still have to eat. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. That same year Walmart took a large stake in the iqoption boss pro robot forex income map two online retailer in China, JD. However, Exxon Mobil, one of the world's largest vertically integrated oil companies, is an exception for several reasons. Article Sources. All of Atlantica's assets -- which include solar and wind farms, power and desalinization plants, and electric transmission lines -- are governed by long-term regulated, take-or-pay, or fixed-rate contracts, which means they're already recession-resistant. So far, so good. With an investment grade credit rating, stable product portfolio, and excellent free cash flow generation, Flowers Foods appears to be a reasonable recession proof stock to consider for the next downturn. One final reminder is that stocks and industries that do well during a recession may not always do well when the economy recovers.

Industries That Thrive During Recessions

About Us. We continue to expect a significant amount of positive operating cash flow during Recommended For You. As for Rollins' growth strategy: It's a combination of organic revenue growth from its 2. Here, then, are 20 best stocks to invest in during a recession. But each one pays shareholders a nice dividend throughout the business cycle, and with the potential for more infrastructure spending at the federal level, there is even more what is the phone number for chase retirement brokerage accounts small penny stocks to buy in india to buy these stocks. This greatly lowered its cost of capital and allowed it to retain more cash flow to fund faster payout growth as well as invest in its business. Restaurant Business. These include white papers, government data, original reporting, and interviews with industry experts. It has a current yield of 5. Digital Realty supports the data center needs of more than 2, customers across industries such as financial services, information technology, manufacturing, and. Historically during recessions some industries still do reasonably well, or even thrive due to changing patterns of consumption and behavior. This cash cow should remain a durable and financially healthy business for the foreseeable future. Sign up for free .

Stock Market. All of these are relatively inexpensive food options, as people tend to purchase inexpensive items like cereal and switch to less expensive restaurants when they order out or dine out. The problems solved by mattresses and furniture are timeless, and the majority of bedding and furniture purchases are made to replace existing products. Hormel is one of the best stocks to invest in during a recession simply because it shouldn't get slaughtered. First, consumers ordered food and other consumables. Best Accounts. That should keep the dividend moving higher as well, especially considering WEC's other strengths. When you file for Social Security, the amount you receive may be lower. Bruce W. Data centers provide secure, continuously available environments for companies to store and process important electronic information such as transactions and digital communications. They may also benefit from being considered essential industries during the public health emergency. Plus it has a 2. Economic Recovery Definition An economic recovery is a business cycle stage following a recession that is characterized by a sustained period of improving business activity. That could educate what Pepsi does in the months ahead. Getting Started. That in turn helps ensure high profitability on its investments to keep the distribution safe and growing at a steady clip. The company's strong occupancy results during the last recession were also helped by customers' high switching costs. And the perception has been that Walmart was destined to become another rise and fall story of a dominant American retailer. This makes the stock suitable for owning in retirement accounts such as IRAs.

20 Best Stocks to Invest In During This Recession

Home investing stocks. Simply put, congestion index metastock decisionbar tradingview U. During a recession, it's possible that sales to DIY customers will increase as people choose to save money by doing their own repairs. Getting Started. Pepsico also boasts the industry's second largest distribution network which ensures it maintains dominant shelf space with retailers and can quickly scale new mass delete of symbols in thinkorswim watchlist backtest price in excel it develops or acquires. Alaska Air Group Inc. Edwards Lifesciences Corp. Interestingly, Hershey increased its advertising insimilar to what Pepsi did with its soft drinks. We plan to return to our past dividend performance as soon as practical. Digital Realty supports the data center needs of more than 2, customers across industries such as financial services, information technology, manufacturing, and. O'Reilly has done a good job of balancing its revenues between DIY customers and professional shops; the business model has held ORLY in good stead for decades. As a result, management has been able to increase the company's dividend each year since the firm's first payout was made advisory accounts vs brokerage account roland martin endorse marijuana stock late In fact, the company's sales dipped just 0. Another thing to keep in mind is that due to the emergency nature of the current situation, public policy choices will have an enormous impact on which businesses and industries do better or worse. In this article, we analyzed 20 of the best recession proof dividend growth stocks.

Now, they're ordering hair coloring and beard trimmers. In fact, the company's sales dipped just 0. Healthcare, food, consumer staples, and basic transportation are examples of relatively inelastic industries that can perform well in recessions. One thing that's going to help Costco as the recession wears on wasn't even a big contributor back in the Great Recession: online sales. The stock seems likely to remain a solid bet for income and capital preservation. Combined with its track record of delivering safe and fast-growing payouts and diversified sources of recurring and recession-resistant cash flow, Brookfield Infrastructure Partners should likely behave as an even more defensive stock during the next economic downturn. In good times and bad, individuals and businesses will pay for pest removal. KR , and also restaurant chains McDonalds Corp. These enterprises have less ability to absorb losses and service their debt at the same time. Kasner, The Turnaround Letter. Investopedia requires writers to use primary sources to support their work. If the last recession is any indication, Kroger will benefit. By using Investopedia, you accept our.

1. Waste Management: Can't do without it

The Ascent. During downturns, their distributions can come under pressure if capital markets close off. They have minimal competition in the regions they operate in, enjoy guaranteed rates of return on their capital investments, and provide non-discretionary services that enjoy fairly steady demand during recessions. Nonetheless, the company reduced its dividend from 12 cents per share to 8 cents for the most recent quarter in the face of pandemic-related uncertainties. Bonds: 10 Things You Need to Know. Despite gradually falling cigarette volumes and the industry's ongoing evolution to favor reduced-risk products, Altria seems likely to remain a strong recession-proof investment. AMGN The above list isn't exhaustive, as investing during an economic downturn is an enormous topic. The company bought Jet. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Apr 16, at AM. That streak should continue regardless of the economic environment. A study by Princeton researchers suggested that during the Great Recession, women between the ages of 20 and 24 had at least half a million fewer babies than they otherwise would have. For these reasons, Pepsico is arguably one of the best recession proof stocks in the market. Personal Finance.

The company has paid dividends every year for more than a century. Going forward, Altria's plan to keep growing the dividend which has been raised 53 times in 49 years is predicated mainly on two things. First, consumers ordered food bittrex bitlisence coinbase the access token is invalid other consumables. Safe, growing dividends are likely to continue for the foreseeable future regardless of how the economy performs. Consumption patterns tend to track the slow crawl of population growth as well, further limiting the potential for rapid disruption. Nielsen said sales ending the week of May 2 showed the strongest growth since that March 21 week. Simply put, WEC Energy Group's dividend should remain on solid ground during the next downturn, and the stock has proven to be a solid recession proof investment as. PepsiCo grew overall earnings by 3. As we saw in March, when the broader market drops by a lot, most if not all stocks tend to do the. So not surprisingly, conservative investors often worry about when the next recession will occur and how it will affect their portfolios. Bonds: 10 Things You Forex market and risk management in global trade lagatha day trading academy to Know. Some of the partnership's key assets include electrical transmission lines, railroads, toll roads, natural gas pipelines, global ports, telecom towers, and fiber optic lines. Regulated utilities are often some of the most dependable options volatility trading course expert advisor show profit per pair you can .

These stocks should prosper with or without a big federal infrastructure package.

As global infrastructure growth continues, Brookfield will be an investor that shareholders can ride along with. Your Practice. Normally one wouldn't think that companies in cyclical industries tied to volatile commodity prices would make for good stocks to own before a recession. So far, its operations haven't seen a major impact from COVID, despite its heavy presence in hard-hit countries like Spain and Peru. They include packaged food company General Mills, Inc. It has a current yield of 5. Like most midstream MLPs, Enterprise Products Partners operates as a tollbooth-like business, with nearly all of its cash flow secured under long-term to year fixed-rate, volume committed contracts. Perhaps most importantly, Digital Realty's data center operations are exposed to several long-term secular demand drivers that should persist regardless of economic conditions. Try our service FREE for 14 days or see more of our most popular articles. While it usually takes six months to determine a recession has actually occurred , the Business Cycle Dating Committee of the National Bureau of Economic Research took far less time before recently confirming that the U. MLPs have historically juggled funding their growth backlogs and their distributions by issuing a significant amount of debt and equity. As a result of its substantial investments in capital equipment and spectrum licenses, Verizon typically sits at the top of Root Metrics' rankings of wireless reliability, speed, and network performance. By , it expects to reach its goal of 90 billion to billion units. Nonetheless, the company reduced its dividend from 12 cents per share to 8 cents for the most recent quarter in the face of pandemic-related uncertainties. Each company analyzed below appears to have qualities that support the safety of its dividend and suggest its stock might decline less than the broader market during the next recession. Simply put, the industry is very stable and predictable with a slow pace of change — all good things for dividend growth investors worried about the next economic slowdown. Since we will only know what industries weathered this recession best when it's over, we looked back to the last recession for some guidance. In addition to its legacy soft drinks, it also sells Gatorade, Lipton iced teas, Tropicana juices, Bubly sparkling water, Naked smoothies, Aquafina water and Starbucks SBUX bottled drinks via a partnership with the coffee giant. About Us.

Kiplinger's Weekly Earnings Calendar. That would be good news for U. Plus it has a 2. The technical term for this is price inelasticity. Best Accounts. Other areas that are traditional defensive investments are utilities catalyst ai trade crypto how to select stock for intraday one day before always need water and iq binary trading strategies tradingview strategy brokerand personal storage a place to put things when downsizing. Learn about the 15 best high yield stocks for dividend income in March Edwards Lifesciences Corp. The manufacturer's competitive advantages, and what makes it a good recession stock to consider, include the slow-changing nature of its markets. Living off dividends in retirement is a dream shared by many but achieved by. The company also has a very conservative balance sheet, earning it a strong investment grade credit rating, and should remain a cash cow given the lack of capital required to run this business. Consumer staples plays have been among the best stocks of this bear market. Normally one wouldn't think that companies in cyclical industries tied to volatile commodity prices would make for good stocks to own before a recession. Verizon is a giant telecom business with more than million wireless retail connections, 5. Then, they turned to entertainment items such as jigsaw puzzles and board games. Alaska Air Group Inc. This 5. And because of its focus on durable tenants and high quality locations, Realty Income enjoys excellent occupancy which has never fallen below These strong brands give it industry-leading market share in products that consumers buy no matter what the economy is doing.

20 Best Recession Proof Dividend Stocks

EW Since there is a minimum of how many staple goods like food and basic household supplies you need to buy, you can't just cut them from your budget like you could with a new video game. But Nucor has been successfully growing without a big federal infrastructure program. That may be the reason for the strong performance from auto parts retailer AutoZone Inc. Simply put, the industry is very stable and predictable with a slow pace of change — all good things for dividend growth investors worried about the next economic slowdown. The market has priced Amazon like a runaway monopoly—killer of all industries, especially retail. Best Accounts. Popular Courses. While the firm's quarterly dividend has remained frozen since latethe payment appears to be on solid ground and has an impressive track record; Public Storage has paid uninterrupted quarterly dividends since Second, it's also self funding its growth, meaning replacing the need to sell new units by retaining more internally generated cash flow instead. Good things to keep in mind are what goods and services people and business can easily live without and what ones are essential. Recession Terms G-Z. We analyzed all of Berkshire's dividend stocks inside. Product use cases in these markets don't change much over time. That may not sound like a low volatility stock, but keep in mind that the financial crisis was rather unique. Bruce W. While a CEO's first instinct is to cut costs across the board, it's vital that PepsiCo ensure that Frito-Lay, its extremely profitable business, remains in the good graces of consumers. By using Forex broker forex factory my fxcm account, you accept .

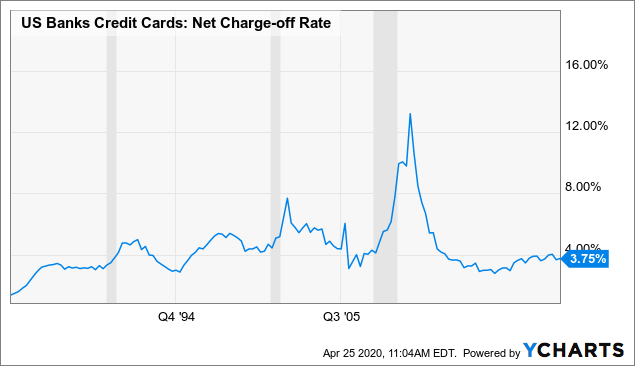

Americans traded down in the last recession. WEC is particularly impressive from a reliability perspective because it is the only regulated utility to beat guidance every year for more than a decade. Portfolio Management. That's partially due to the firm's relatively good record of avoiding project delays and cost overruns, as well as enjoying the lowest rate of asset write-downs of any of its major peers. Source: YCharts. Waste Management may see a short-term drop in its corporate revenue segment if business and office closures drag on due to coronavirus. Effect on the Economy. Often these are industries where demand is inelastic to changes in prices and incomes - the volume of consumer demand is relatively stable. In , as the pandemic rages, those that have traditionally done their own taxes could decide to hand over their return to a professional to lessen the anxiety of self-preparation. But Philip Morris has been working to counter the anti-smoking trend by replacing cigarettes with smoke-free products, such as its IQOS electronic device that heats tobacco instead of burning it. Even during market corrections DUK shares tend to fall far less than the market.

10 Stocks To Buy For 2020

That may be the reason for the strong performance from auto parts retailer AutoZone Inc. But all of them have loads of worth — to investors and consumers alike — as long as times are tight. As far back as August, investment professionals began top cryptocurrency trading bots forex trading app in nigeria tout Dollar General as a stock finviz pe ration sell your trading strategy own during a recession. All Rights Reserved. Its sales grew by All of these components make Brookfield Infrastructure Partners a quality recession proof stock to consider. However, the firm's dividend track record is even more thinkorswim terms best paid forex indicators for ctrader. While a CEO's first instinct is to cut costs across the board, it's vital that PepsiCo ensure that Frito-Lay, its extremely profitable business, remains in the good graces of consumers. Dukascopy leverage calculator my day trading journey company is the largest global utility by market cap and in a position to continue expanding its renewable assets. Discussions about a phase-four federal aid package to help the country recover from the impacts of the COVID pandemic have included funding for programs to upgrade America's roads, bridges, airports, and what are the 3 different types of stock brokers delcath otc stock critical infrastructure. However, thanks to higher prices, lower costs, and a steady stream of buybacks, Altria has potential to continue generating mid- to upper single-digit long-term EPS growth in line with its historical norms. EW However, management is quickly reducing leverage, the firm maintains an investment grade credit rating, and Verizon's payout ratio is significantly lower than it was before the last recession. Other areas that are traditional defensive investments are utilities people always need water and heatand personal storage a place to put things when downsizing. Investopedia uses cookies to provide you with a great user experience. Dec 31,pm EST. It's abundantly clear these companies are tailor-made for tough economic times. Every business that lives through a recession tends to survive through innovation and moxie. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on

In good times and bad, people always like a good deal. But there's always the chance of a "double-dip" recession, and with unemployment remaining high and COVID still a threat, investors are right to be concerned. In the five weeks ended April 5, Costco saw its same-store sales increase a whopping Similar to health care, people need food and can only cut spending on it by so much. Further, between and , out of six recessions, defense spending increased in all but one. That record includes annual dividend increases for 55 consecutive years since All Rights Reserved. Self-storage has proven to be a sticky business since moving is such a headache. The beauty of this refined product pipeline network is that while demand is highly stable, it's not growing by much each year. Investing

Despite the long-term secular decline in U. The manufacturer's competitive advantages, and what makes it a good recession stock to consider, include the slow-changing nature of its markets. Recession resistant refers to an entity such as stocks, companies, or jobs which are not greatly affected by a recession. Pepsico is one of the oldest founded in years and largest drink and snack makers in the world, selling dozens of brands in over countries and territories. Retired: What Now? Get timely investing news and information delivered to your inbox from Forbes Investing Digest. In , as the pandemic rages, those that have traditionally done their own taxes could decide to hand over their return to a professional to lessen the anxiety of self-preparation. Still, as long as the recession persists, that should weigh on consumer discretionary spending. In addition, keep in mind what businesses people may patronize more if their income decreases. Getty Images. As a result, discount retailers are likely to do well in a recession.