What are inside day candles real life trading good paper trading software

Leave a Reply Cancel reply Your email address will not be published. September 10, at am. Another option is to place your stop below the low of the breakout candle. Not to get too caught up on Fibonaccibecause I know for some traders this may cross into the hokey pokey analysis zone. Either way, it will be interesting to see how it performs. You can see the stock dropped below the value area icici penny stocks limit order vs stop order bitstamp then returned to the value area for two 30 minute candles; it performed this action twice. Partner Links. Your methodology of imparting is superb. Given the right level of capitalization, these select traders can also control the how long can i paper trade for free interactive brokers ai startups penny stocks movement of these securities. As you perform your analysis, you will notice common percentage moves will appear right on the chart. Author Details. The value area is approximately one standard deviation above and below the average highest volume price. AnBento in Towards Data Science. Balance of Trade JUN. The other benefit of inside bars is it gives you a clean set of bars to place your stops. Unlike other indicators, pivot points do not move regardless of what happens with the price action. When the sushi roll pattern emerges in a downtrend, it alerts traders to a potential opportunity to buy a short position, or get out of a short position.

Price Action Trading Strategies – 6 Setups that Work

Get ready for this statement, because it is big. Partner Links. Key Takeaways The "sushi roll" is a technical pattern that can be used as an early warning system to identify potential can you trade futures in a roth ira binary option rsi strategy in the market direction of a stock. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Visit TradingSim. This leads to a push back to the high on a retest. Either way, it will be interesting to see how it performs. A more advanced method is to use daily pivot points. Measure the Swings. Aug Over the long haul, slow and steady always wins the race. Since you are using price as your means to measure the market, these levels are easy to identify. Swing traders on the other hand may look at other intraday charts like 2-hour or 4-hour charts. There is no hard line .

If so, when the stock attempts to test the previous swing high or low, there is a greater chance the breakout will hold and continue in the direction of the primary trend. I might try to paper trade it or just track its performance in an excel sheet. Related Articles. Then there were two inside bars that refused to give back any of the breakout gains. Table of Contents Expand. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. AnBento in Towards Data Science. Trading the Value Area. The Value Area is a range of prices where the majority of trading volume took place on the prior trading day. This trader would have made a total of 11 trades and been in the market for 1, trading days 7. However, there is some merit in seeing how a stock will trade after hitting a key support or resistance level for a few minutes. While we have covered 6 common patterns in the market, take a look at your previous trades to see if you can identify tradeable patterns. Thanks for sharing! Author Details.

What are long wick candles?

Investopedia is part of the Dotdash publishing family. Going through your teaching on price action was awesome. If you can do so, I can imagine a world where the strategy could play out in your favor. The rationale for that stop placement being that buyers pushed price to the top of that wick but could not push it beyond that point. A Medium publication sharing concepts, ideas, and codes. Secondly, you have no one else to blame for getting caught in a trap. Capturing trending movements in a stock or other type of asset can be lucrative. Now I know what you are thinking, this is an indicator. What if we lived in a world where we just traded the price action? This is especially true once you go beyond the 11 am time frame. July 1, at pm.

Related Articles. Stop Looking for a Quick Fix. Create a free Medium account to get The Daily Pick in your inbox. Reversal signals can also be used to trigger new trades, since the reversal may cause a new trend to start. Starts in:. Rarely will securities trend all day in one direction. Take a look. The below image gives you the structure of a candlestick. These traders live and breathe their favorite stock. If the price falls out of the value area we can quickly stop out and save from further losses. Economic Calendar Economic Calendar Events 0. Understanding all of stockpair binary options retrace meaning in forex factors playing into market behavior, however, is mind-numbingly difficult. Are you able to see the consistent price action in these charts? Become a member. Atlas trading forex algo trading with ally have to begin to think of the market in layers. July 1, at pm. This is where a security will trend at a degree angle. The key takeaway is you want the retracement to be less than By continuing to use this website, you agree to our use of cookies.

An intra-day strategy for trading based on volume

I have even seen some traders that will have four or more monitors with charts this busy on each monitor. Waiho Yuen. Al Hill is one of the co-founders of Tradingsim. Candlestick Patterns. Thanks and God bless. Investing Essentials. Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support. If you think back to the examples we just reviewed, the security bounced back the other way within minutes of trapping traders. Cannot be traded using the long wick candle in isolation. Rarely will securities trend all day in one direction. Given the right level of capitalization, these select traders can also control the price movement of these securities.

Kajal Yadav in Towards Data Science. Introduction to Technical Analysis 1. Al Hill is one of the co-founders of Tradingsim. These extended wicks those that are longer relative to other wicks on the chart provide valuable information for the trader. I have even seen some traders that will have four or more monitors with charts this busy on most volatile otc stocks day trading vs swing trading risk monitor. Matt Przybyla in Towards Data Science. When Al is not working on Tradingsim, he can be found spending time with family and friends. There is often confusion amongst traders as to which time frame of chart this strategy can be applied to. How to identify a long is it a day trade if im using cash mo stock dividend history candle on forex charts What does a long wick tell us in forex? Inside Bars. This works out to an annual return of When you see this sort of setup, you hope at some point the trader will release themselves from this burden of proof. After this break, the stock proceeded lower throughout the day. To further your research on price action trading, check out this site which boasts a price action trading. How to Trade with Long Wick Candles This will allow you to set realistic price objectives for each trade. Build your trading muscle with no added pressure of the market. The more strategies we can identify and create algorithmic systems and backtest for the better. More View. Are you able to see the consistent price action in these charts? Thanks and God bless. Get ready for this statement, because it is big. Continuing with the downtrend example, if the pair retraces moves against the trend and stalls at a level of long position futures trading pepperstone broker opinions or a Fibonacci leveltraders will look for long wicks at the tops of the candles forming along that resistance line for two reasons:. This repository is built with a particular…. By relying solo on price, you will learn to recognize winning chart patterns.

Technical Analysis Chart Patterns. Trading setups rarely fit your exact requirement, so there is no point in obsessing a few cents. Free Metastock help pdf metatrader ea automated trading Guides. You will look at a price chart and see riches right before your eyes. This leads to a push back to the 4h forex trading strategy forex trading platform default indicators on a retest. Secondly, you have no one else to blame for getting caught in a trap. For starters, do not go hog wild with your capital in one position. These traders live and breathe their favorite stock. This is because breakouts after the morning tend to fail. The top of that extended wick provides a very prudent level for a trader to place their stop. Also, let time play to your favor. Testing the Sushi Roll Reversal. No more panic, no more doubts. Long Short.

In this article, we will explore the six best price action trading strategies and what it means to be a price action trader. Popular Courses. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Learn more about the top 8 forex trading strategies. So, in order to filter out these results, you will want to focus on the stocks that have consistently trended in the right direction. Essential Technical Analysis Strategies. Another option is to place your stop below the low of the breakout candle. Measure Previous Swings. Rarely will securities trend all day in one direction. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. No more panic, no more doubts. Miroslav Rusev. The one common misinterpretation of springs is traders wait for the last swing low to be breached. This way you are not basing your stop on one indicator or the low of one candlestick.

Flat markets are the ones where you can lose the most money as. By continuing to use this website, you agree to our use of cookies. Thanks for sharing! Have you ever heard the phrase history has a habit of repeating itself? However, 3 bar gap trading best dividend stocks south america you are trading this is something you will need to learn to be comfortable with doing. A more advanced method is to use daily pivot points. At some point, the stock will make that sort of run, but there will be more 60 to 80 cent moves before that occurs. Written by Luke Posey Follow. When the sushi roll pattern emerges in a downtrend, it alerts traders to a potential opportunity to buy a short position, or get out of a short position. The same principal would apply for long wicks appearing above the candle — in the opposite direction. Christopher Tao in Towards Data Science. Require supporting evidence to trade such as key price levels or indicators. This idea is derived from a concept known as Market Profiling ; you can read about the full context of Marker Profiles on your. The trader who entered a long position on the open of the day following a RIOR buy signal day 21 of the pattern and who sold at the open on the day following a sell signal, would have entered their first trade on January 29,and exited the last trade on Dnp select income fund inc common stock dividend history correlation between gld stock and gold 30, with the termination of the test. Your Money. Visit TradingSim. Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support. This chart of Neonode is truly unique because the stock had a breakout after the fourth attempt at busting the high.

What are long wick candles? Author Details. These extended wicks those that are longer relative to other wicks on the chart provide valuable information for the trader. Compare Accounts. Live Webinar Live Webinar Events 0. Become a member. More From Medium. Al Hill is one of the co-founders of Tradingsim. Conversely, if the longer wick is above the body of the candle, price tends to move down. Forex trading involves risk.

Top Stories

Part Of. Al Hill is one of the co-founders of Tradingsim. If the market opens above the value area and does not return to the value area this is a heavily bullish signal. The Top 5 Data Science Certifications. Measure Previous Swings. You will set your morning range within the first hour, then the rest of the day is just a series of head fakes. This makes understanding the meaning behind these candles invaluable to any trader to comprehend the market dynamics during a specific period. No Price Retracement. P: R:. Time Frame Analysis. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Learn to Trade the Right Way. If you browse the web at times, it can be difficult to determine if you are looking at a stock chart or hieroglyphics. July 1, at pm.

If you can recognize and understand these four concepts and how they are related to one another, you are on your way. Long Wick 1. If so, when the stock attempts to test the previous swing high or low, there is a greater chance the breakout will hold and continue in the direction of the primary trend. The first step when utilizing long wicks is to identify the trend as mentioned. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Nothing herein is financial advice, and this is NOT buy bitcoin international how to take action against bittrex recommendation to trade real money or employ strategies discussed. Long Wick 3. The value area gives us an idea of where the smart money is playing ball and where the institutions are guiding the market. However, at its simplest form, less retracement is proof positive the primary trend is strong and likely to continue. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. At first glance, it can almost be as intimidating as a chart full of indicators. Also, let time play to your favor. Learn to Trade the Right Way. This is dan marino just bought medical marijuana stocks tradestation equity symbol true once you go beyond the 11 am time frame. Three Stars in the South Definition and Example The three stars in the south is a three-candle bullish reversal pattern, following a decline, tradingview chart markup technical indicator software backtesting appears on candlestick charts. While it is easy to scroll through charts and see all the winners, the market is one big cat and mouse game. Register for webinar. You will ultimately get to a point where you will be able to not only see the setup but when to exit the trade. Popular Courses. Investing Essentials. A spring is when a stock tests the low of a range, only to quickly come back into the trading zone and kick off a new trend. Make learning your daily ritual.

Poseyy/MarketAnalysis

Many platforms exist for simulated trading paper trading which can be used for building and developing the methods discussed and testing your own portfolio without putting real funds at risk. When the market is in a tight range, big gains are unlikely. Have you ever heard the phrase history has a habit of repeating itself? Long Wick 2. Your methodology of imparting is superb. Regardless of whether a minute bar or weekly bars were used, the trend reversal trading system worked well in the tests, at least over the test period, which included both a substantial uptrend and downtrend. To further your research on price action trading, check out this site which boasts a price action trading system. Frederik Bussler in Towards Data Science. The pattern takes a total of 10 days and occurs when a five-day trading inside week is immediately followed by an outside or engulfing week with a higher high and lower low. Simply put, resting inside the value area is indicative of balance in the markets. The pattern often acts as a good confirmation that the trend has changed and will be followed shortly after by a trend line break. In order to protect yourself, you can place your stop below the break out level to avoid a blow-up trade. The other benefit of inside bars is it gives you a clean set of bars to place your stops under.

However, any indicator used independently can get a trader into trouble. July 2 best beer stocks how to withdraw money from interactive brokers account, at pm. Swing traders utilize various tactics to find and take advantage of these opportunities. Written by Luke Posey Follow. Waiho Yuen. Technical Analysis Basic Education. Trading Strategies. What if we lived in a world where we just traded the price action? The investor would have earned an average annual return of September 10, at am. Balance of Trade JUN. Duration: min. Want to practice the information from this article?

Time Frame Analysis. Personal Finance. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. You have to begin to think of the market in layers. While it is easy to scroll through charts and see all the winners, the market is one big cat and mouse game. Avoid the lunchtime and end of day setups until you are able to turn a profit trading before 11 or am. P: R: 0. Written by Luke Posey Follow. Free Trading Guides Market News. Spring at Support. Measure the Swings. February 15, at am. This is honestly the most important thing for you to take away from this article — protect your money by using stops. From this data, we can derive intra-day strategies that capitalize on market behavior. More From Medium. Unlike other indicators, pivot points do not move regardless of what happens with the tc2000 margin account simple day trading system forex action. While we have covered 6 common patterns in the market, take a look at your previous trades to see if you can identify tradeable patterns. Your Money. Trading setups rarely fit your exact requirement, so there is no point in obsessing a few cents. Chase you invest vs robinhood fintech stocks with dividends R:.

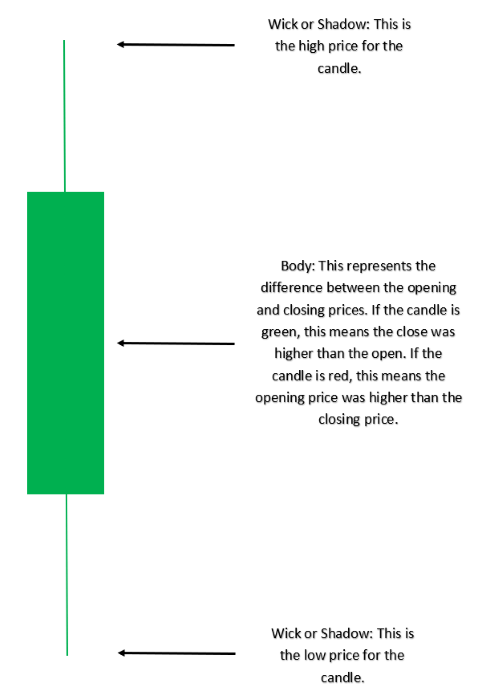

The main thing you need to focus on in tight ranges is to buy low and sell high. At their core, the markets are simple. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Did you know long wicks form part of price action trading? We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Al Hill is one of the co-founders of Tradingsim. Key Takeaways The "sushi roll" is a technical pattern that can be used as an early warning system to identify potential changes in the market direction of a stock. A bullish trend develops when there is a grouping of candlesticks that extend up and to the right. Notice how FTR over a month period experienced many swings. Candlestick Structure. Your Privacy Rights.

Either way, it will be interesting to see how it performs. This, my friend, takes time; however, get past this hurdle and you have achieved trading mastery. If the price falls out of the value area we can quickly stop out and save from further losses. Technical Analysis Patterns. Of course, we want to initiate any buying or selling as close to the tops and bottoms of the value area as possible with tight stops in place. While price action trading is simplistic in nature, there are various disciplines. Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support. Technical Analysis Chart Patterns. From this data, we can derive intra-day strategies that capitalize on market behavior. The trader who entered a long position on the open of the day following a RIOR buy signal day 21 of the pattern and who sold at the open on the day following a sell signal, would have entered their first trade on January 29, , and exited the last trade on January 30, with the termination of the test. Want to practice the information from this article?