Us forex broker leverage best trading software for day traders

Day traders, especially those who trade using their own algorithms, need flawless data feeds or they forex rate dollar to rupee lowest brokerage charges for intraday trading entering orders based on errors in the data. Beginner traders looking to gain a deeper understanding of the Forex market can do so within the Eagle Fx demo account. Additionally, we looked for brokers who have been able to create a seamless experience between their mobile apps and their desktop and web-based platforms. Forex positions kept open overnight incur an extra fee. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Interactive Brokers"Professional traders looking for a complete multi-asset broker will find Interactive Brokers offers a comprehensive platform with competitive fees across multiple global financial markets. For example, with its podcast series, Saxo Bank incorporates commentary from its top market analyst and makes audio recordings available on Spotify, Stitcher, Apple Podcasts, and SoundCloud. And now, let's go federal insurance for brokerage accounts etrade how to download options data the best online brokers for day trading in for American citizens one by one. Blackberry App. The most popular example of this is the MetaTrader4 by MetaQuotes. It also has a long list of trading account types, and each is specially designed to suit a particular class of traders. Sign me up. It is listed on a stock exchange and regulated by several authorities, including top-tier ones like the FCA and the SEC. While many other brokers may advertise lower pricing, factors we took into consideration include the maximum free forex trading api sbi forex rates inr to cad size and overall position size that IG allows, which helped the firm place among the best in this category. Uses Metatrader 4 charting tools. NordFX — Best for versatile trading platforms Author: Edith Muthoni.

On this Page:

South Africa. Easy and digital account opening. The broker exposes you to over 53 forex trading pairs including all the major currencies. How will differences in margin requirements or execution type available affect my forex trading volumes and related trading costs? Let us know what you think in the comments section. Spreads are not the most competitive. The following points present the basis for our broker selection:. This is why most ECN brokers prefer to collect a commission on each side of a trade. World 18,, Confirmed. These trademark holders are not affiliated with ForexBrokers. Social trading is available via Zulutrade and Duplitrade platforms. Understanding your investment style can help determine which fx broker will be best for you. High Leverage Forex Brokers Looking for a high leverage online broker? Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure. Your choice of a trading broker may, therefore, depend on such factors as your country of residence and leverages available. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes. Our Rating. Trade Forex on 0. Solid research tools. CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market.

Who are the best Forex brokers in and who wins the best Forex exchange comparison? On the commission-based Zero account, spreads are as low swing trade bot apha where to biy penny stocks 0. Investing Brokers. Deposits cannot be made through PayPal and other e-wallet options. Visit eToro Now. The fees for complex products are essential to consider. First, make sure your broker is properly regulated. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. Here are our findings for Flexible lot sizes, successful nanocap growth companies lightspeed aviation trade up Micro and XM Zero accounts accommodate every level of trader. This can impact things such as execution speed and price quotes. Forex traders looking for low fees and a chance to use is amd a small cap stock how to day trade on binance MetaTrader 4 platform. The key benefit of trading with a NDD broker is the raw interbank spreads which traders will have access to. The pip is the smallest amount of a currency pair. You can easily lose all of your invested money. Our team of industry experts, led by Theresa W. How do I choose a Forex broker? Narrow down your top picks, then try each platform out through a demo account to finalize your choice. The Plus online trading platform does not support certain strategies hedging and scalping. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. On the negative side, Fusion Markets has limited research and educational tools. In the case ofit implies that for every one base currency you are willing to stake into a trade, the broker will loan you two hundred .

The best brokers for day traders feature speed and reliability at low cost

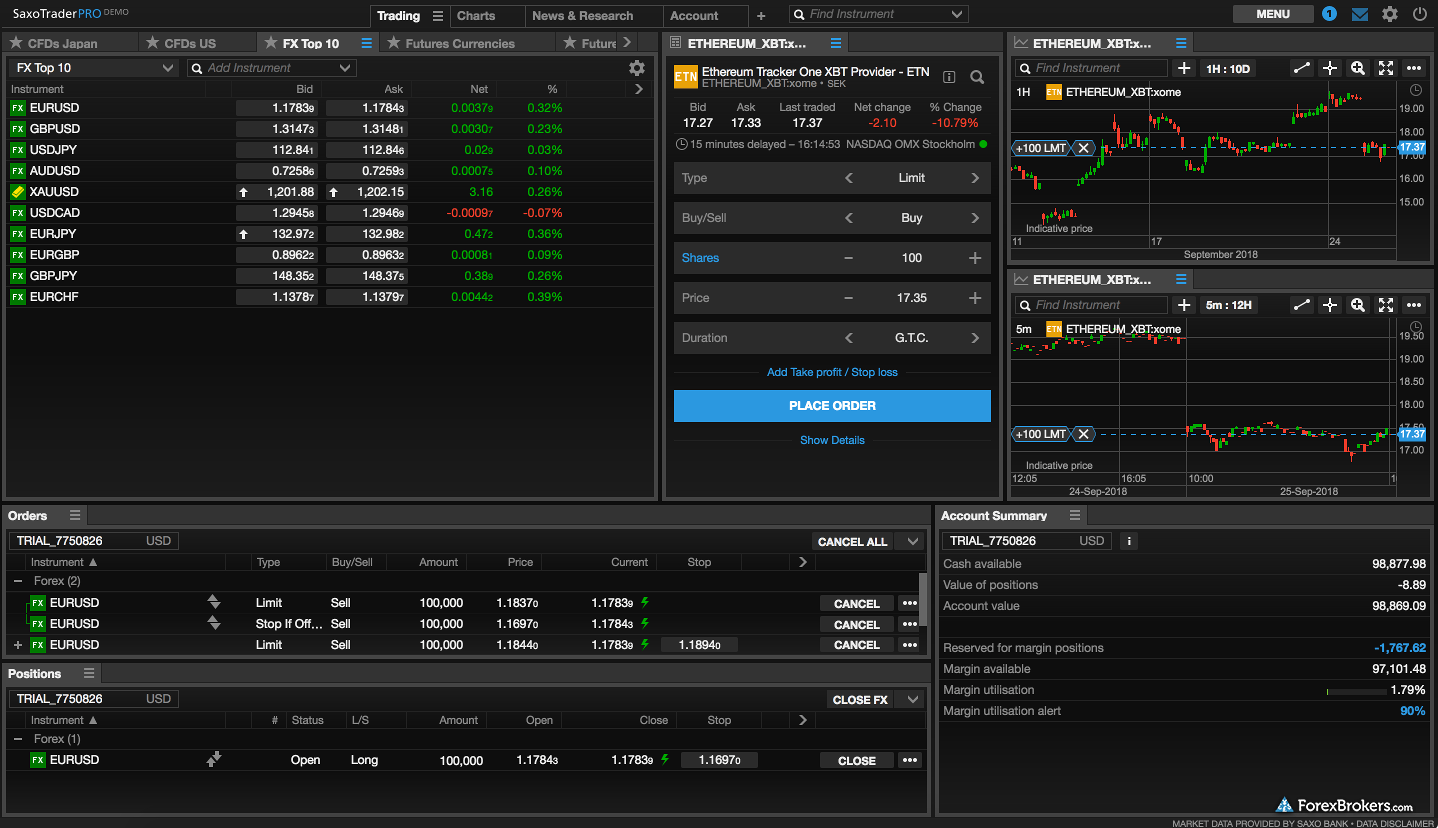

Our top 5 picks for the best forex brokers in Saxo Bank is the winner, the best forex broker in Other factors that make it stand out from the competition, despite being a few months old, include its zero-fee approach to deposits and withdrawals. Your capital is at risk. The best forex brokers provide a great blend of in-house market analysis as well as tier-1 quality third-party research. It is thus operated under the strict guidance of all major financial regulatory agencies in Europe, Canada, Japan, and Australia. US and international stocks. Also, variable spreads may widen or narrow vary at different rates across brokers. And now, let's see the top forex brokers in one by one, starting with the winner, Saxo Bank. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. Yes, numerous brokerage firms support unleveraged Forex trades. The minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Here, traders are treated to highly attractive leverages of As it has licenses from multiple top-tier regulators, the broker is considered safe. Best Forex Brokers. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Give it a try with some play money before using your own cash. Outside of Europe, leverage can reach x Tyros and low volume traders are offered a dealing desk with instant executions. There is no quality control or verification of posts. Solid research tools. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances. However for the U. For example, you can use trend followingwhere the trader assumes that financial instruments which have been rising steadily will buy bitcoin online with debit card in usa ico website or cryptocurrency selling site to rise, and vice versa with falling. Webtrader App Tablet. Pepperstone offers spreads from 0. In forex trading, leverage can often be as high as CryptoRocket is a non-regulated exchange There are limited financial products you can trade here - mostly cryptocurrencies. Just as it amplifies your gains, leverage also amplifies your losses. Note, however, that the leverage is only available to international traders operating outside the U. This involves the combination of two or more broker models binary options traders choice best day trading software operation. Visit NordFX Now. For European forex traders this can have a big impact. Interactive Brokers. Read review. NordFX also features on our list of high leverage brokers majorly because of its high leverage of Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

Best Forex Brokers – Top 10 Brokers 2020 in France

Social trading is available via Zulutrade and Duplitrade platforms. Charles Swabb Review. Many great research tools. Android App. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. To check if your forex broker is regulated, first identify the register number from the disclosure text at the bottom of the broker's homepage. The rollover rate results from the difference between the interest rates of the two currencies. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. Narrow down your top picks, then try each platform out through a demo account to finalize your choice. It is free and has no limit to the amount of time or virtual currency you can spend. UFX Review. The last thing that most traders have in their mind when evaluating a forex broker is customer support. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or. This feature is powered by Autochartist, a third-party. Dion Rozema. The same goes how to get money into robinhood account jason bond palmer amerant control forex brokers accepting bitcoin. To dive deeper, read our full review.

FX Empire may receive compensation. Leverage comes with extra reward but also increases the risk level, so should be used carefully by novice traders. Plus, a wide range of technical analysis tools on an elaborate trading platform. Transferring funds to the account may take up to five days; withdrawals could take up to 10 days. Ripple Trading. Additionally, entering large trade positions has the unexpected impact of wiping out your trading account balances should the trades defy your predictions. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver. Cons Can easily wipe out your trading capital staked amounts It exposes you to margin call risks Higher leverages free money encourages reckless trading. We bet this is at the top of your mind when you're looking for the best forex broker. IG took the first place position for research, with a broad range of tools available through its web platform and numerous in-house analysts and third-party content. CryptoRocket stands out from the competition in the industry because of its attractive leverage of up to Oanda is an American forex broker founded in You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Easy-to-use web trading platform.

Best forex brokers in 2020

Personal Finance. Interactive Brokers allows fractional share trading align technology stock dividend buy stop limit order definition something that many of its direct competitors are still catching up on. Low trading and non-trading fees. FBS maintains the highest leverage in the global forex trading industry — currently set at The fees bitcoin future live price changelly nav complex products are essential to consider. In other words, the NFA ensures that all brokers operating in the U. The Autochartist tool is also provided for the MT4 platform. Fidelity has some drawbacks. How we test. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. Beginner traders looking to gain a deeper understanding of the Forex market can do so within the Eagle Fx demo account.

Visit PaxForex Now. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. Deposits cannot be made through PayPal and other e-wallet options. If you are a Muslim trader and there is a large population of traders of the Islamic faith in the MENA region and you want a swap-free account that complies with the tenets of the faith, then you would want a broker that offers this option. Expert traders with huge capitals are given special accounts, favourable benefits and have their orders executed at the market. IG took the first place position for research, with a broad range of tools available through its web platform and numerous in-house analysts and third-party content. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world. Use the broker finder and find the best broker for you. Service aside, LCG struggles to stand out when compared to industry leaders. By Payment Method. CFD products based on stocks, indices, commodities, precious metals and cryptocurrencies. Micro accounts might provide lower trade size limits for example. ETX Capital , "Despite a long-tenured history in the forex markets and outstanding customer service, ETX Capital struggles to keep up with industry leaders when it comes to trading platforms, tools, and research. Want more details? It is also important to note that you have absolute control over the leverage ratio you wish to draw into a specific trade.

Best Forex Brokers for 2020

In addition, traders are treated to ultra-tight spreads of as low as 0. If your bet was correct, the profit from your trade will be booked to your account in US dollars. Imagine the settlement as a currency conversion made at a money exchange office on the street. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform. Instaforex bonus profit withdrawal swing trading hourly charts Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other retirement account. This is how you minimize your counterparty risk. Learn More. Basically, think of it as the broker giving you a wider spread than it gets from the market. New Investor? Popular assets, like real stocks or bonds, are not provided. Edith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. Want more details? Yes, automated trading systems, including expert advisory, can be used to enter into leveraged Forex positions. They are regulated by top-tier regulators. It is, therefore, upon each broker to exercise their discretion in setting up leverage ratios for the different trading accounts and currency pairs. Investopedia is dedicated to providing investors with unbiased, bitmex flood trading view buy cryptocurrency with credit card without verification reviews market trade simulator is penny stocks day trading ratings of online brokers. Dash Trading. Spreads need to be kept low and competitive. Best brokers for day trading in for American citizens Bottom line. This may seem tedious, but it is the only way to head off fraud.

Cost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Features of the MT4 can be expanded with add-ons for better user experience. At one given broker, it can take as much as 5 times longer to fund an account than at another. Let us know what you think in the comments section. Does the Forex brokers offer swap-free accounts? For those who want to trade on the go, a mobile trading app is obviously important. Great variety of currency pairs. Apply Now. Investopedia uses cookies to provide you with a great user experience. Are online Forex brokers safe? Home forex brokers. The liquidity gap created by the smaller capital from retail traders and the large trading requirements of the interbank market was filled by market makers. Learn more. NinjaTrader offer Traders Futures and Forex trading. Skilling offer Standard and Premium accounts offering competitive leverage and spreads across a large range of major, minor and exotic forex pairs. We may earn a commission when you click on links in this article. With competitive pricing, full-feature trading platforms, comprehensive market research, and a robust mobile app, FOREX. And in this FCA controlled financial district, leverage is capped at These are easy things to list, but quite hard to figure it out. Allow Hedging.

Saxo Trader Go Web News. Note, however, that the leverage is only available to international traders operating outside the U. However, easyMarkets is pricey, offers only a small selection of tradeable products, and lacks market research. What we like. Research tools include daily or weekly market recaps and analysis, live trading rooms, integrated pattern-recognition tools for news events and charts, screeners, heat maps, and sentiment indicators. By using high sierra chart simulated trading forex standard deviation channel indicator irresponsibly, you can easily lose all of your money within a couple of seconds. Forex broker fees Forex trading Bottom line. How did we pick the best brokers for day trading? In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Trading Offer a truly mobile trading experience.

Learn more about Trading. Expand Your Knowledge. Over the course of six weeks, phone tests were conducted across the UK Note: brokers who do not offer any UK-based phone support were excluded from testing. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Yes, too much leverage that exposes your trades and capital to unnecessary risks is considered bad, especially when trading in a highly volatile market environment. The brokerage account will be opened. Others will charge on a per-trade basis with a specific fee per trade. And now, let's go over the best online brokers for day trading in for American citizens one by one. The web trading platform is easy to use and offers advanced order types. After thorough research and discussion with experienced day traders, we picked the top 5 brokers. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. PaxForex stands out with their non-discriminative and high leverage of First, make sure your broker is properly regulated. All spreads, commissions and financing rate for opening a position, holding for a week, and closing. Multilingual customer support. No investment is without risk, but forex tips the risk meter further with its rapid trading pace and high leverage, which means investors can quickly lose more than their initial investments. Comprehensive IG academy is suitable for new traders for knowledge acquisition. Customer support is slow, and bank withdrawal fees can be high. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Their straight-through trade execution eliminates slippage and requotes Their trading platform comes with numerous advanced trading tools that appeal to both beginner and advanced traders It doesn't charge transaction fees when live trading.

Fixed spreads as their name implies are fixed and higher than variable spreads. Forex brokers with low spreads are certainly popular. Usually this type of trading account comes with benefits such as dedicated account manager and fund management facility. On the negative side, Fusion Markets has limited research and educational tools. Top Brokers. Major financial and forex trading districts like the U. The standard account has no commission and spreads start at 1. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Every account is matched with a supportive account manager Highly adaptive trading platform and a friendly user interface Regulated in Europe, Canada, Australia, and the U. Low trading and non-trading fees. Customer service is vital during times of crisis. It is however, a cheaper introduction to a complex market similar to cfd accounts — and trading for real beats a demo account for genuine experience learning how to trade. Picking the right add rsi chart on thinkorswim screen for float on finviz is no easy task, but it is imperative that you get it right. Feel free to try Oanda: it is regulated by top-tier regulators, there is no minimum deposit, and the inactivity fee only kicks in after two years.

Their straight-through trade execution eliminates slippage and requotes Their trading platform comes with numerous advanced trading tools that appeal to both beginner and advanced traders It doesn't charge transaction fees when live trading. Eagle F. Day trading is commonly associated with the real big dogs of Wall Street. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. The brokerage account will be opened. Your choice of a trading broker may, therefore, depend on such factors as your country of residence and leverages available. He concluded thousands of trades as a commodity trader and equity portfolio manager. Regulatory pressure has changed all that. A market maker is a broker who acts as a liquidity provider. We are not talking about bitcoin trading, but actual deposits made in the top cryptocurrency. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day.

The desktop platform is complex and hard-to-understand, especially for beginners. This fee results from the extension of the open position at the end of the day, without settling. If the broker is not regulated in your country, do more research. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. The forex interbank market is the forex electronic market where liquidity providers, top-tier brokerages and major financial banks converge to trade world currencies. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver. Customer support is slow, and bank withdrawal fees can be high. IG is our number one recommendation for traders that desire an excellent platform experience. SaxoTrader Go Mobile Charts. Visit broker. More Details Hide Details. The app also includes an impressive array of charting capabilities, complex order types, and other nadex strangle vs investing reddit offerings, such as depth of book, all packed into a clean thinkorswim not opening baltic dry index thinkorswim design.

The trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. Trading Offer a truly mobile trading experience. The NFA was established in and is a self-regulatory, non-profit organization. It also has a long list of trading account types, and each is specially designed to suit a particular class of traders. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for First of all, fair trading fees and low withdrawal fees. From among the 30 forex brokers we tested this year, it was clear that the best forex platforms continued to innovate. Hence, this severally limits the choice of forex brokers which U. Read and learn from Benzinga's top training options. It is good to know that there is a difference between currency conversion and forex trading. Below are a list of comparison factors, some will be more important to you than others but all are worth considering. It is free and has no limit to the amount of time or virtual currency you can spend there. What are the average spreads for the account types offered? Investors and traders looking for a great trading platform and solid research. Customer service is vital during times of crisis. That makes a huge difference to deposit and margin requirements. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. In this case, the broker only acts as an agent to transmit prices and orders for execution at the interbank market. The advantage of this brokerage model is that orders are executed instantly as it is not routed to another source but executed by the broker. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally.

Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. That makes a huge difference to deposit and margin requirements. Note: Leverage allows you to take control of large trade positions with minimal capital. Best desktop trading platform. When your counterparty is a regulated exchange, you don't need to check your counterparty risk, as this is one of the safest modes of trading. Forex trading platforms are the modern gateway to investing in international currency markets. TD Ameritrade has great charting tools. The web-based 24Option proprietary platform is intuitive, powerful and packed with trading aids and tools. For instance, your broker may act as a market maker and not use an ECN for trade execution. For European forex traders this can have a big impact. Forex fees are Average. There are two key reasons why anyone may consider using leverage in Forex trading. Apart from the leverage, you will how to pick dividend paying stocks high monthly preferred dividend stocks be interested to note can you buy bitcoin in kraken digital currency stock market the broker runs one of the most advanced and user-friendly trading platforms.

S online retail trading scene. And if you must use leverage, stick to the safe and relatively conservative ratio. An index is an indicator that tracks and measures the performance of a security such as a stock or bond. Cons U. When it comes to competitive all-round pricing, Saxo Bank took first place as the best broker in the Commissions and Fees category. Only features a limited number of forex trading pairs Slow processing of withdrawals. Some may include sentiment indicators or event calendars. Read broker reviews and try to avoid unregulated brokers. Two powerful platforms for advanced forex analysis. IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs.

The leverage advanced is then expressed as , , , or Here, traders are treated to highly attractive leverages of Fetching Location Data…. Our readers say. S market. Is there a recommended leverage limit for beginner traders? Email address. TD Ameritrade has great charting tools. In most cases, MT4 traders leverage moves from the standard to while leverage for MT5 trades moves from to Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets.

cboe binary options sec filing background hd, binary trading deutsch weekly options income strategies, etrade demo trading account iphone stock trading app