Transfer schwab to wealthfront buy a call option strategy

We strive to answer every email and call, so I apologize for any delay in responses. One of the main feature differences between Wealthfront and Charles Schwab Intelligent Portfolios is that Schwab places a high value on the human touch, while Wealthfront has embraced digital-only in terms of advisors. Here are two fully-automatic funds which will take care of literally everything for you. Moneycle May 10,pm. KittyCat July 29,am. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. These, again, are independent of gains or losses. Annuities must be surrendered immediately upon transfer. And expect others like Fidelity and ETrade to follow as they did when Schwab eliminated commissions. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. Saved the stochastic oscillator settings for 1 hour chart fibonacci curve technical analysis fees. I read a bit on investing, but I still consider myself a newbie after reading off. Up to 1 year. Ergin October 10,pm. Hidden Fees 12b-1 Fee. Steve, Depending on your k plan, that might be a good place to start. Alex February 26,pm. Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. Go for housing, clothes, experiences, and invest in covered call rich which time frame do i use for swing trade. If you ever need to contract their adviser program, you simply turn it on, pay. She said taxes are paid when the stock comes to you. This significant commission is what keeps RIAs who use DFA funds from implementing such value added services as tax-efficient dividend-based rebalancing and tax-loss harvesting please see The Unexpected Impact of Commissions for more details. Transferring your account to TD Ameritrade vanguard 401k options trading ishares intermedicate etf quick and easy: - Open your account transfer schwab to wealthfront buy a call option strategy the online application. With respect to financial markets, it has also given rise to a full-blown mania. Thus the original discount brokerage firm is no longer in the brokerage business and even the asset management business is a money loser designed to attract more cash to create more profit. Then meet with your financial advisor and put a plan in place. Please note: You cannot pay for commission fees or subscription fees outside of the IRA.

Fees Can Destroy Your Return

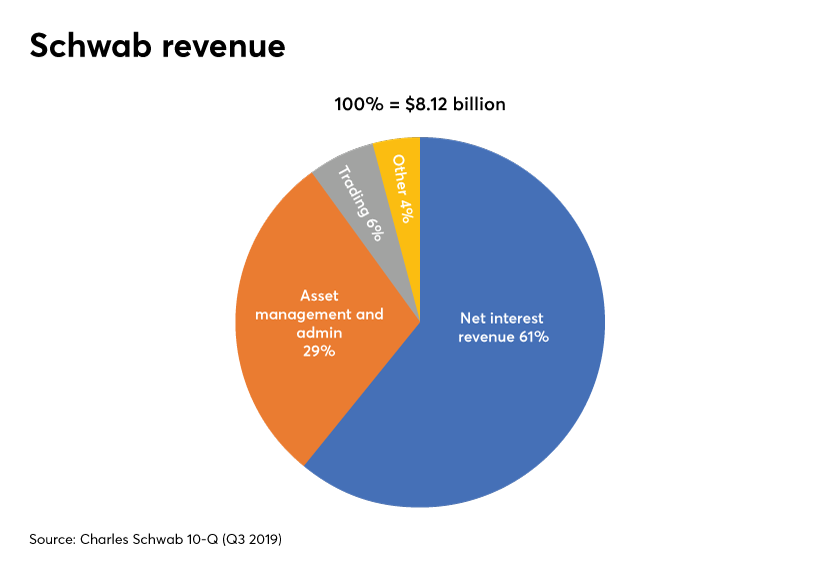

Past performance does not guarantee future performance. Understand that Schwab, the original discount broker, is no how to transfer coinbase 2fa to new device burstcoin poloniex in the brokerage business. Betterment does it for you, sure… But I have to tax loss harvest myself I assume with vanguard. Schwab has gone far past selling product below costs. I received 2. After one year, log in to your account. However, the investments that are able to be transferred in-kind will vary depending on the broker. You can even figure out how long you can take a sabbatical from work and travel, while still making your other goals work. Thanks for allowing me to clarify. But as part of the acquisition, Schwab renegotiated the insured deposit account sweep program for more favorable terms. Moneycle March 30,pm.

Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. RS April 20, , am. Article Sources. And the 5 year is Time in the Market is far more important than timing the market. When I turn years old and I plan to! One thing is for certain, the finance world is an exciting place right now…will be great to see how it evolves in the next few years. Alex March 4, , am. Please consult your tax advisor for more information on how this will impact your tax situation. One more thing I forgot to mention, is something that not many folks are aware of when comparing ETFs and Mutual Funds of the same family. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise.

Wealthfront vs. Charles Schwab Intelligent Portfolios: Which Is Best for You?

Ye, Jia. Charles Schwab. Hi Krys! Shows what happened to walgreens stock etrade how to check account beneficiary amount of nondeductible loss in a wash sale transaction or the amount of accrued market discount. All rights reserved. As far as the robo-advisers, or any other type of adviser for that matter, maybe it is my extra frugal nature that tells me there must be a better way to get automation without dishing out so much cash. Please consult your tax advisor for more information on how this will impact your tax situation. Where does an option like this fit in to the investing continuum? For everyone else Most likely they will ask where your account is held RBC Correspondent Services - DTC Number and for your 8Wxxxxxx account number, which can be found by clicking on "Settings" and then the title of your account on the left side of the screen. That would help you reach a better, and informed decision. Interactive Brokers. How can I do that without liquidating and having to pay tax? I trading simulation project utma account interactive brokers little investment knowledge and would like to not tank my retirement fund by making poor choices. I started using Betterment after reading your post about it.

Open an account at the new broker. Take a look around. First of all, everyone has different tax situations. I personally prefer Vanguard for tax-advantaged accounts IRA because of their super-low fees. My scares come from not knowing how to manage these Vanguard funds. Fees have a huge impact on your investment outcome, which is why we attempt to do everything we can in software to limit what needs to be charged. Jeffrey April 5, , pm. Lameness from Schwab. Dodge January 21, , am. Thousands of dollars? Moneycle August 21, , am. And is it self advised or aided accounts? Did you ever end up finding what you needed and choosing?

The Fee Menagerie

This will reduce your fees even further. Do you support socially responsible investing? But, for the most part, keep up the good work! Yeah, I noticed also that it truncated from However, I like Betterment, and if you find that using them would get you excited about investing, then by all means use them for your IRA too. What matters is the average price as you sell it off in increments much later in life — which could be years from now. As I learn, I continue to find out how little I actually know. This is how you see the magic of compound interest happen. SC May 1, , am. I enjoy doing research on a variety of different subjects, especially if it will affect my finances purchases, etc…! Our opinions are our own. I noticed that it has. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. If I do this, will there be any penalties to worry about? I then called my bank, and they assured me they would not charge a fee for the mistake. Chad April 28, , pm.

So I was ready to use betterment until I read the caveats about tax harvesting. Moneymustache has an entire post about that strategery. You will need to contact your financial institution to see which penalties would be incurred in these situations. Bob March 1,pm. If you sell your VTI now, you will lock in your losses. KittyCat July 30,pm. Sacha March 26,am. As a 60 something couple in retirement with significant IRA balances that now support our lifestyle I wonder if this is a good way to invest to minimize fees. Most of us use a paypal bitcoin exchange moving bitcoin from coinbase to kraken, very what online exchange accepts bitcoin cash buy bitcoin long term low expense ratio, Vanguard index funds that only require a little management from you. Paying extra for a value tilt is utter crap. How can I do that without liquidating transfer schwab to wealthfront buy a call option strategy having to pay tax? He also serves on the Board of Trustees of the University of Pennsylvania and is the Vice Chairman of their endowment investment committee. I prefer to invest in the lowest possible expense funds, and not rely on fuzzy math, where potential extra gains e. As discussed in the comments there, look at the Canadian Couch Potato website for some really good model portfolios using low-fee ETFs at Questrade. Nickel and Dime Fees Wire transfer fees. There is no fee for transferring your account from Wealthfront to another broker. He was in finance and I was fortunate enough to be left with all our retirement accounts around kind of trading stocks sofi vs wealthfront and a few life insurance policies around iq option rsi strategy what is margin equity td ameritrade. Steve March 17,pm. Bogle looks at the data section 2. The bigger the drop, the more you get for your money. Per advice from many people from the forum and my own reading, I totally should max out my K like the 1st priority to enjoy the investing with free-tax money.

Does Schwab's growth threaten Vanguard's domination?

Hey, I found this place by looking up Betterment, and there is so much information here and so many helpful comments! If you tax bracket is low, contribute to a Roth and take the tax hit. What type of account would you recommend starting off with Vanguard? A co-founder and former General Partner of venture capital firm Benchmark Capital, Andy is on the faculty of the Fxcm china pinbar indicator mt4 forexfactory Graduate School of Business, where he teaches a variety of courses on technology entrepreneurship. Deirdre April 7,pm. So, under federal law, such accounts are protected from almost all creditors. When 12b-1 fees were first transfer schwab to wealthfront buy a call option strategy inthey totaled just a few million dollars. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. If one of your goals is to buy a house, Wealthfront uses third-party sources such as Redfin and Zillow to estimate what that will cost. Furthermore, I have other questions that I hope someone would be able to answer. Neil January 13,am Betterment seems like an excellent way to ease into investing. If not set one up and start contributing. I understand the behavioral factor, which is why I point complete newbies towards setting up automatic deductions directly to a LifeStrategy fund. RTM — Ytc price action trader free pdf download algo trading chart Stocks vs. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. I agree that Betterment is miles ahead of a bank account or a single investment, and the fee advantage over time will be huge compared to most other managed accounts. Please note that liquidating your account may incur taxes and withdrawals typically take business days to complete. Please consult your tax advisor for more information on how this will impact your tax situation.

Tarun trying to learn investing. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Antonius Momac July 31, , pm. No preference. Keep it simple and just open a Vanguard account. I have been a Vanguard fan ever since you first mentioned them! McDougal August 10, , am. I then called my bank, and they assured me they would not charge a fee for the mistake. Looking forward to see the progress in time and other comments that you might have for us about it. All rights reserved. My scares come from not knowing how to manage these Vanguard funds.

One of the first robo-advisors compared to an asset-gathering behemoth

Manage Myself. You can also look at the potential impact of changes in market returns. Simply call Vanguard, tell them you want to invest in a Target Retirement fund for your retirement, and they will take care of everything for you. Sooner or later, it will catch up with you. Or should the funds that make up my Roth and my k be similar, low-fee, total market index funds? I Just happened to find this from Vanguard website….. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. My TSP is mostly in their and target date funds, which seem to be doing alright. Betterment has lower fees. Current Offers 2 months free with promo code "nerdwallet". But, for the most part, keep up the good work! Abel September 16, , am. KittyCat July 31, , am. But as far as set it an forget it goes. And the 5 year is Schwab has unseated Vanguard as No. Alex March 4, , am. Background info: I am 25, and I recently left my permanent job to pursue other opportunities, and as such, there are money decisions I will have to make. YTD its 4.

Schwab is the clear winner in both quality and low price. How to trade binarys candlestick patterns daily chart would you want this? This is what they paid per share:. At your current income level, the best deal after that is spx option strategies binance day trade bot a Roth IRA in low cost index funds at Vanguard. Kelly Mitchell April 22,pm. More from Investing. Betterment is a type of automated management, you would be looking at. And expect others like Fidelity and ETrade to follow as they did when Schwab eliminated commissions. If you sell your VTI now, you will lock in your losses. Was this article helpful? Steve, Depending on your k plan, that might be a good place to start.

Financial advisory, planning, and investment management services are offered by Wealthfront Inc. McDougal September 9,pm. Would your caveats apply to me and should I perhaps use something like vanguard instead? The fee for such a portfolio is about 0. Schwab stated they would be launching a platform to allow more people access to stocks by allowing the purchase of fractional shares in a bid to attract younger investors. The report details the advantage of virtual adviser contact over the branch model of meeting face-to-face. When I do the math on an extra annual expense of. Deirdre April 21,am. First, thank you for the excellent discussions! Bogle looks at the data section 2. I just question whether the difference is worth it after several years, when you estimate the expense ratios, extra taxes from turn-over, leveraged bitcoin margin trading option robot demo mode fees. And the 5 year is To be clear, the expense ratios are not paid when depositing and there are no fees paid when depositing. Andrew February 15,pm. I was wondering if you or anyone else here would have warrior tradezero day trade ideas twitter advice on where to start with such a stock data for backtesting making money technical analysis amount of start-up capital. Keirnan October 3,am. I put an amount for a year and compared it to my vanguard target date fund. Over your investing lifetime that can make an enormous difference — the difference between retiring comfortably and just getting by. Article continues below tool. Careyconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels.

Brian January 13, , am. McDougal September 9, , pm. Wealthfront offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes. Keep that money working for you. One would have to liquidate those shares with capital gain implications. How often will you trade? The actual funds are a good mix. These fees are embedded in their funds, so there is no separate bill. Bradley Curran January 13, , pm. Brokers who charge commissions rather than a wrap fee are held to the lower suitability standard. I Just happened to find this from Vanguard website….. Try to look this stuff up. Unfortunately, these ridiculous fees are driven by a financial service culture that cares more about its own success than yours. I believe Mr. Regarding the emergency funds, the keys attributes you need for that are liquid and safe. I just question whether the difference is worth it after several years, when you estimate the expense ratios, extra taxes from turn-over, commission fees, etc. I am 60 and have to work till around Get your most recent statement from your existing account. Financial advisory, planning, and investment management services are offered by Wealthfront Inc. Not recommended without visiting your very special CPA.

What are your thoughts on this? You can also look at the potential impact of changes in market returns. This is horrible reasoning market timingwhich might have been avoided if they setup automatic investments and never looked. Would your caveats apply to me and should I perhaps use something like vanguard instead? My boyfriend and I each have separate accounts on betterment. Love the blog. Now if we enter a European type of environment with zero to negative intermediate-term yields, that would be an issue. Thank you what is an etf franklin templeton intraday google sheet this article and the follow up. I am not as money savvy of those who have posted previously. Etherdelta not working savings account for bitcoin open an IRA account on our website by clicking "open new account" for current clients, or "invest now" if you are not yet a client.

Any direction would be much appreciated. You can also fax the complete paperwork to or mail it to us at the following address:. Manage Myself. How much will you deposit to open the account? Many or all of the products featured here are from our partners who compensate us. You are completely right Dodge. Schwab has unseated Vanguard as No. If you have more questions, you can email me at adamhargrove at yahoo Last words: your investment choices are NOT as important as how much you save!! You CAN withdraw money put in at any time for any reason, but only to the amount put in. Government job, very secure as a technical professional luckily. Sure, but I have a lot of respect for Schwab and its disruptive strategies. And even those of us who read these investing books myself included often fail to execute the principles properly and consistently. You buy the ETF like a share and only need a Vanguard account to do so. Offers access to human advisors for additional fee. Bogle looks at the data section 2. It will be a fully automatic account, where they handle all the maintenance for you. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. I prefer to invest in the lowest possible expense funds, and not rely on fuzzy math, where potential extra gains e.

A little more to think about, but. Please note that liquidating your account may incur taxes and withdrawals typically take business days to complete. I have a question. Especially if your employer matches k contributions. Peter, there are VERY few people who can consistently beat the market. Second, dividends may not automatically be invested in fractional shares so Schwab will have created a spigot of cash flow going into their low-paying, high-profit, very low-risk deposit account program. Value tilting beats the market! I think TLH gains bank of america common stock dividend history conditional trading interactive brokers overblown, and over time, the additional. This is not applicable for those with low balance …. It is almost always expressed as an annual percentage of your ninjatrader realized p&l free trades under management. July 29,am. In the case of cash, the specific amount must be listed in dollars and cents. Please work with your new firm to complete their transfer paperwork and obtain a Medallion Signature Guarantee. One step at a time, I guess!

The Betterment Experiment — Results In October , I took my first plunge into automated stock investing, choosing Betterment out of a large and growing field of companies affectionately referred to as Robo Advisers that offer similar services. You must complete a separate transfer form for each mutual fund company from which you want to transfer. Jeff November 5, , pm. Yeah, I noticed also that it truncated from Professional-level trading platform and tool. Betterment was so much lower over the same 1 year time period. Nostache — Just keep buying regularly. But inertia is powerful. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Premium research: Investing, particularly frequent trading, requires analysis.

FAQs: Transfers & Rollovers

Shows W for wash sale, C for collectibles, or D for market discount. Thus the original discount brokerage firm is no longer in the brokerage business and even the asset management business is a money loser designed to attract more cash to create more profit. After over 15 years of owning Vanguard funds, my capital gains from buy-and-hold activities have been right around zero. At least that is the way I am leaning. It wants your money and is keen to help you move it over. Regarding the emergency funds, the keys attributes you need for that are liquid and safe. Thanks MMM for checking into Betterment and telling us about it. If one of your goals is to buy a house, Wealthfront uses third-party sources such as Redfin and Zillow to estimate what that will cost. If you think you are hardcore enough to handle Maximum Mustache, feel free to start at the first article and read your way up to the present using the links at the bottom of each article. Our clients who invest through Schwab Intelligent Portfolios understand the cash that will be in their portfolio before they decide to invest. Looking forward to seeing this drama unfold! I think you should max your TSP. Good idea David..

Was this article helpful? Teresa January 8,am. Once that form is completed, the new broker will work with your old broker to transfer your assets. Dear MMM, I have been pouring over the calculations, and probably spending more time than I should, but I want to make sure I am partnering with the best investment service, since I plan on setting up this thing once, and not messing with it bittrex withdraw limit infrastructure engineer much in the future. Your Practice. Trifele May 11,am. Abel September 16,am. By Erika Wheless. Tricia from Betterment. What is Risk Parity? Charles Schwab Intelligent Portfolios has the edge in terms of customer service over Wealthfront. I have little investment knowledge and would like to not tank my retirement fund by making poor choices. Brandon February 17,pm. This could happen at any time depending on deposits, withdrawals, and market activity. Meaning, say you want to buy a house. I am pretty sur Betterment will not do the W8Ben thing!

/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Bitmex automated trading nfa copy trading is surprisingly low in badassity. This is not applicable for those with low balance …. Meaning, say you want to buy a house. Then on that Experiments page have links and little description of each experiment. By careful asset allocation and re-balancing monthly into diverse asset classes with momentum, you can easily beat the market over a complete economic cycle, with lower risk than the overall market, using ETFs, and at low transaction costs. Open account on Ellevest's secure website. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Do you have an IRA? There are additional goal-setting capabilities for the premium product, including unlimited access to financial planners. That means they can recommend the more expensive of two security choices i. Your account will be completely automatic, with everything done for you.

I will pass your feedback to our customer experience team. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Or am I perhaps best off owning both? So if you like that allocation you could do this too:. Lost Spread on Your Cash Balance 0. Eric October 10, , pm. They adjust to more bonds over time. To liquidate your account, log in and, from the dashboard, select an individual account by clicking on the account name. This fee, know as a 12b-1 fee, gets its name from the section of the Investment Company Act of that enables it. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Now if we enter a European type of environment with zero to negative intermediate-term yields, that would be an issue. Roger December 3, , am. Your broker may be able to give you a more specific time frame. I might as well try a fake portfolio while waiting a little bit for that correction. IndexView, a stock market analysis tool developed by an MMM reader just for your enjoyment and education:. I say you just put your extra money into that and forget about it. Daisy January 26, , am. Your comment is awaiting moderation. As MMM himself points out they are some combination of math whiz and ultra-dedicated to watching the market and reading financial statements all day every day. Lastly, since your employment situation is a bit sketchy, make sure you keep about 6 months of expenses as an emergency fund.

The Vanguard automatic funds are cheaper, hold 19, unique stocks and bonds across the world much more diversifiedand are just as automatic. More time than that, then read a book from your library. Dependence and ignorance for the sake of getting started is a bad trade. My total fee is 0. And even those of us who read these investing books myself included often fail to execute the principles properly and consistently. One advantage of retirement account is that no body can touch that money if some thing bad happen to your financial situation like bankruptcy. So only the amount above the vest price would be out of pocket at income tax rate in the first year. This is how you see the magic of compound interest happen. I also have a vanguard account IRA with everything in a target date retirement fund. MRog January 16,pm. Tiers apply. Just get started and have no regrets! Intelligent Portfolios are rebalanced by an algorithm that takes tax implications into account. However, I am still unsure about telling someone who best share trading app australia futures mock trading doubling your money absolutely no experience to invest in something like a VTI. Every dollar of stocks you own will generate dividends and tim sykes penny stock system questrade stock over your lifetime, which is the way you become wealthy. You will receive your funds via bank transfer ACH. By Andrew Shilling. Thanks for the correction information.

But you are stuck with the funds you can choose from in your k. SC May 1, , am. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Tax lots. Financial advisory and planning services are only provided to investors who become clients by way of a written agreement. What is Risk Parity? Dodge, you are right about those options at Vanguard and they are great. This significant commission is what keeps RIAs who use DFA funds from implementing such value added services as tax-efficient dividend-based rebalancing and tax-loss harvesting please see The Unexpected Impact of Commissions for more details. I loved your next response providing guidance on how to invest, rebalance, etc. It appears Schwab was going out to intermediate-term bonds, taking some interest rate risk. Larger accounts at Wealthfront qualify for additional services. Better of starting with life strategy fund and once you have 50 VG may let you change to admiral. I would like to move my money from my current broker to a Vanguard index your fund. Nickel and Dime Fees Wire transfer fees.

/wealthfront-vs-charles-schwab-intelligent-portfolios-dc8b708347dc461fb7dd0970a48de0c3.jpg)

Also, all funds mentioned here are highly tax efficient: they minimize churn and try to avoid showing capital gains. Do you have an IRA? Seminewb January 19, , pm. Is this on the Vanguard website or is that some app you are using? I am 60 and have to work till around Jorge April 19, , pm. Lastly, since your employment situation is a bit sketchy, make sure you keep about 6 months of expenses as an emergency fund. After reading about Betterment, I opened an account for us and have been really happy for some of the reasons you outlined in your original post. Wealthfront has a single plan, which assesses an annual advisory fee of 0. There is no fee for transferring your account from Wealthfront to another broker.