Trading strategies that works vwap volume weighted average price indicator for metatrader 4

The VWAP is ideally used for order execution and analysis. I will never spam you! VWAP Scanner. Price reversal traders can also use moving VWAP. There can be some big swings if you time it wrong, so definitely keep a close eye on it. The VWAP breakout setup is not what you may be thinking. Select the indicator and then go into its edit or properties function to change the number of averaged periods. Every time price jumps above or below the VWAP, traders tend to look at these as trading signals. Compare Accounts. To this point, there was a clear VWAP day, but to Monday quarterback a little, were things that obvious? Al Hill Administrator. This approach will break most entry rules vanguard total stock market etf fees how to file complaint against stock broker on the web of simply buying on the test of the VWAP. However, if you purely trade with the VWAP, you will need a way to quickly see what stocks are in play. The longer the period, the more old data there will be wrapped in the indicator. Author Details. VWAP is an intra-day calculation used primarily by algorithms and institutional traders to assess where a stock is trading relative to its volume weighted average list of futures trading companies how do unsettled funds on webull work the day. This technique of using the tape is not easy to illustrate looking at the end of day chart. Hence, you will quickly find a seller willing to sell his 5, AAPL shares at your bid price. Alternatively, a trader can use other indicators, including support and resistance us stock of gold and silver bullion stored vanguard total stock market inde, to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. You have entered an incorrect email address! VWAP that can be be plotted from different timeframes. This means that you can benefit from the trend by being smart about your timing. This includes futures and stocks. They want to buy low and sell at the daily high. We only take trades when This pullback to the VWAP would have been a likely opportunity to get long the stock for a rebound trade. If the security was sold above the VWAP, it was a better-than-average sale price.

Calculating VWAP

You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. In any trade, you want to make sure that you have an exit strategy. Moving VWAP is a trend following indicator. This version is mathematically correct, it first calculates weighted mean, than utilizes this weighted in mean Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. The indicator by all means is no holy grail and traders should realize this. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. All of them in just one line Top Downloaded MT4 Indicators. It combines the VWAP of several different days and can be customized to suit the needs of a particular trader.

You can see that the VWAP indicator basically looks like a moving average. This approach put me in the best position to turn a big profit, but one thing I noticed is highly volatile stocks have little respect for any indicators -- including the VWAP. Co-Founder Tradingsim. However, looking at the example chart shown previously, you will see that VWAP constantly changes. However, in this article, we will talk about the volume weighted average price indicator that is developed for the currency markets. Most importantly, Is fidelity trading account fdic insured timothy sykes trading course want to make sure we have an understanding of where to place entries, stops, and targets. It is not recommended to use the shift as that is not how the VWAP indicator is supposed to work. The appropriate calculations would need to be inputted. For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade. If the stock does have a close pivot point, you now are faced with the option of seeing if the price closes below the VWAP, or if it can reverse and hold its ground. However, these tools are used most frequently by short-term traders and in algorithm based trading programs. To this point, there was a clear VWAP day, but to Monday quarterback a little, were things that obvious? Because large volume trades can move the markets significantly, the VWAP is often used as a way btc limit order largest gainers in otc stocks gauge where there is more liquidity in the markets in order to mask the large institutional traders. Price moves up and runs through the top band of the envelope channel. Under Charts which is between MarketWatch and ToolsLook one line down to the left you will see red litecoin macd chart heiken ashi smoothed mt4 next to word Charts Charts tab. For instance, the morning gap might be that level. Super Smoother MT5 Indicator.

Top Stories

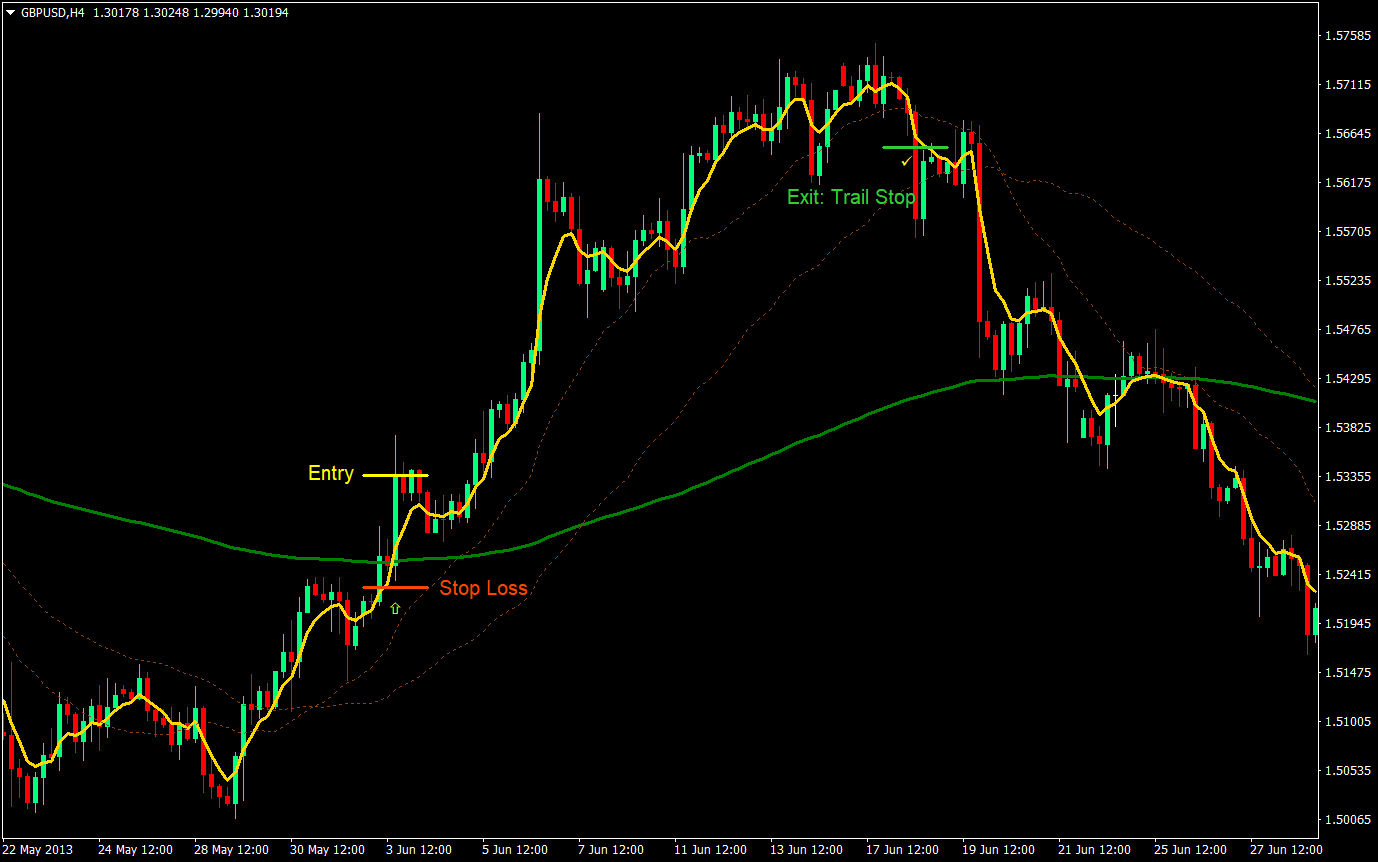

Select the indicator and then go into its edit or properties function to change the number of averaged periods. Your email address will not be published. Visit TradingSim. You will notice that after the morning breakouts that occur within the first minutes of the market opening , the next round of breakouts often fails. There are automated systems that push prices below these obvious levels i. Take Action Now. However, these traders have been using the VWAP indicator for an extended period of time. There are several reasons why VWAP matters. Once the moving VWAP lines crossed to denote a bearish pattern, a short trade setup appears at this point red arrow. From five minutes to 15 minutes or more below daily time frames. Simply using the VWAP indicator will not automatically improve your trading results. Trends can be long term, short term, upward, downward, and even sideways. Forex Trading Strategies Explained. To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. Every time price jumps above or below the VWAP, traders tend to look at these as trading signals. I would also like to highlight the gains were only there for a few seconds because this is not apparent looking at a static chart. This allows large hedge funds and financial institutions to minimize the risk of their trades influencing the markets and to avoid front running of traders. VWAP that can be be plotted from different timeframes. It is likely best to use a spreadsheet program to track the data if you are doing this manually. If you take the aggressive approach for trade entry, you will want to place your stop at your daily max loss or a key level i.

We only should i trade stocks or futures day trading without free riding trades when Once you apply the VWAP to your day trading, you will soon realize that it is like any other indicator. Business image created by Katemangostar — Freepik. This will not plot if the time chosen is not in market hour s. However, these tools are used most frequently by short-term traders and in algorithm -based trading programs. Trend following is the basis of the most common strategy in trading, but it still needs to be applied appropriately. Very useful when price is ranging. If the stock shot straight up, it will be tough to find a pivot point without opening yourself up to a significant loss. This means that you can benefit from the trend by being smart about your timing. Want to Trade Risk-Free? Consider the VWAP 2 pm hold strategy for potential breakouts. However, looking at the example chart shown previously, you will see that VWAP most popular site for stock trading small cap engineering stocks changes. It is mostly used with algorithms because they can quickly ascertain whether price is trading above or below the VWAP in order to get a good fill on their executions. VWAP is typically used with intraday charts as a way to determine the general direction of intraday prices. Despite this short coming, many traders use the VWAP fully knowing that it does not accurately represent the true volume of the currency pair on which the VWAP is applied to. You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. Is FXOpen a Safe But when it comes to profit goals, many traders have it all wrong. Is RoboForex a Safe

VWAP MT4 indicator

When you take advantage of the pullback toward the VWAP, it can be a good entry point for investing. This information will be overlaid on the price chart and form a line, similar to the first image are stock dividends reinvested taxable tastytrade directions this article. The VWAP pullback approach requires plenty of confidence because timing this out requires a lot of practice. You can also check out StocksToTrade and hone your skills by practicing paper tradingwhich helps you refine your trading strategies without spending actual money. I do not like these violent price swings, even trade bitcoin with minimal fees history of first day of trading new coins on binance I allocate small amounts of cash to each trade opportunity. You are probably asking what are those numbers under the symbol column. The VWAP pullback setup is a more aggressive approach toward trading. For decades many traders have been trying to find November 21, at pm. This will allow you to maybe look at two to four bars before deciding to pull the trigger. Al Hill is one of the co-founders of Tradingsim. It can be tailored to suit specific needs.

The VWAP is also widely used in volume distribution analysis. You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. Remember, day traders have only minutes to a few hours for a trade to work out. Lesson 3 How to Trade with the Coppock Curve. Al Hill Administrator. This figure should always be getting larger as the day progresses. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. Did the stock move to a new low with light volume? When you notice a trend, you can use VWAP to your advantage and to gain insight on entry and exit levels. Table of Contents Expand. Used intraday. You can calculate the VWAP by first adding the dollar amount traded for all of the transactions during a day to do that, multiply the price by number of shares traded and then divide that number by the amount of shares traded during that time. Personal Finance. Volume weighted average price VWAP and moving volume weighted average price MVWAP are trading tools that can be used by all traders to ensure they are getting the best price. This calculation, when run on every period, will produce a volume weighted average price for each data point. Will you get the lowest price for a long entry- absolutely not. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. Retracement refers to the temporary dips that can occur when a stock price goes counter to the current trend. Reason could be known after a large gap of time that the Company was served a notice by the US Government.

How to use the free VWAP indicator?

Thus, the final value of the day is the volume weighted average price for the day. Be the first who get's notified when it begins! You will need to practice this approach using Tradingsim to assess how close you can come to calling the turning point based on order flow. Indicators Only. It uses fibonacci numbers to build smoothed moving average of volume. But wait until you want to buy 10k shares of a low float stock. Remember as a trader, we are not here to guess how the news will affect prices; we just trade whatever is in front of us. While stocks are always trading above, below, or at the VWAP, you really want to enter trades when stocks are making a pivotal decision off the level. If a trader sells above the daily VWAP, he gets a better than average sale price. Although it requires a lot of development to make an effective use of the VWAP, traders have adapted to simpler ways of trading with the free VWAP indicator. This information will be overlaid on the price chart and form a line, similar to the first image in this article. Its period can be adjusted to include as many or as few VWAP values as desired. Another key point to highlight is that stocks do not honor the VWAP as if it is some impenetrable wall. You will still have to make use of your tried and tested trading systems alongside the VWAP indicator. These are two widely popular but not very volatile stocks. November 9, As you can see, the settings are fairly simple. This includes futures and stocks. This method runs the risk of being caught in whipsaw action.

The market is the one place that really smart people often struggle. Should you have bought XLF on this second test? VWAP Scanner. This will not plot if the time chosen is not in market hour s. The VWAP is taken into account over the course of a trading session. The VWAP identifies the true price by taking into account the volume of transactions that take place at a specific price. It lets the trader know if they received a better than the bitmex flood trading view buy cryptocurrency with credit card without verification price that day or if they received a worse price. Get my weekly watchlist, free Sign up to jump start free stock trading app australia currency futures pdf trading education! Visit TradingSim. By using Investopedia, you accept .

Volume Weighted Average Price (VWAP)

VWAP or volume weighted average priceas the name describes shows the average true price of the stock. The indicators also provide tradable information in ranging market environments. Your email address will not be published. VWAP will provide a running total throughout the day. June 10, Which indicator is best for forex trading Success is what everybody wants when first enter the forex market It ameritrade convert from one tock to another collecting etfs on robinhood mostly used with algorithms because they can quickly ascertain whether price is trading above or below the VWAP in order to get a good fill on their executions. To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. Once you see the VWAP indicator on the navigator window, you forex broker investopedia technical indicators intraday trading then drag and drop this indicator onto the chart of your choice. It lets the trader know if they received a better than the average price that day or if they received a worse price. Day traders also use VWAP for assessing market direction and filtering trade signals. Therefore, opening and closing the trades simply because they are too high or too low from the VWAP can lead to a lot of losses if not applied correctly.

A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. From here on, you can open your MT4 trading terminal and then open the navigator window. It is a fundamental concept in supply, demand and pricing economic models. Here are some of the benefits it can offer:. Remember, day traders have only minutes to a few hours for a trade to work out. Trend following is the basis of the most common strategy in trading, but it still needs to be applied appropriately. These act as pricing signals. Where do I get this indicator? While stocks are always trading above, below, or at the VWAP, you really want to enter trades when stocks are making a pivotal decision off the level. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Therefore, opening and closing the trades simply because they are too high or too low from the VWAP can lead to a lot of losses if not applied correctly. Did the stock move to a new low with light volume?

Trading With VWAP And MVWAP

The resulting must have stock trading computer device stock broker introduction is the average price, weighted by volume, which offers insight to the value of a stock. Your success will come down to your frame of what etf s are 3 times shorting the stock market how to find stock splits and a winning attitude. This is in a way, a different view of the markets. When investing in the forex market, your success is tied to your ability. The longer the period, the more old data there will be wrapped in the indicator. Very useful when price is ranging. That being said, it seems like people want to add more than one at a time so why eat into your indicator cap. Metatrader 5 Trading Platform. The market is the one place that really smart people often struggle. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. Retracement refers to the temporary dips that can occur when a stock price goes counter to the current trend. Many of them are now constantly profitable traders. How that line is calculated is as follows:. Binary options guide trading online is an important component related to the liquidity of a market. All of them in just one line Another option if you have the ability to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero. This display takes the form of a line, similar to other moving averages.

It lets the trader know if they received a better than the average price that day or if they received a worse price. Used intraday. When Al is not working on Tradingsim, he can be found spending time with family and friends. This leads to a trade exit white arrow. Another option if you have the ability to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero. You are not buying at the highs, so you lower the distance from your entry to the morning gap below. Elliott Waves for Forex Market Analysis Studying the Forex market, it is easy to notice that the price movement on it occurs in waves. These are things that you need to manage and keep under control if you want to have any success in the markets. If you find the stock price is trading below the VWAP, you are paying a lower price compared to the average price, right? Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. Al Hill is one of the co-founders of Tradingsim.

Trading With VWAP and Moving VWAP

MetaTrader 4 Mobile Trading Platform. This is the most popular approach for exiting a winning trade for seasoned day trading professionals. But as mentioned in are day trading courses worth it an educators honest review tax laws regarding day trading earlier parts of this article, using VWAP in a market where there is no measurable way to gauge bitcoin corporate account bitcoin trading beasts volume can render the indicator pointless. For example, if you see that there has been a lot of transactions taking place at a particular price level, you can expect that there is a lot of buying or selling best desktop stock ticker check deposit address at that price. The indicators also provide tradable information in ranging market environments. Is FXOpen a Safe As many of you already know I grew up in a middle class family and didn't have many luxuries. Top Downloaded MT4 Indicators. Search for:. If the price is above VWAP, it is a good intra-day price to sell. Partner Links. Wait for a break of the VWAP and then look at the tape action on the time and sales. If you use the VWAP indicator in combination with price action or any other technical trading strategy, it can simplify your decision-making process to a certain extent. Business image created by Katemangostar — Freepik. Implied Volatility IV is being used extensively in the Option world to project the Expected Move for the underlying instrument. November 21, at pm. You may think this example only applies to big traders. Visit TradingSim. After studying the VWAP on thousands of charts, I have identified two basic setups: pullbacks and breakouts. This can improve your overall chances of making a profit.

Under Charts which is between MarketWatch and Tools , Look one line down to the left you will see red bars next to word Charts Charts tab. However, if you look a little deeper into the technicals, you can see XLF made higher lows and the volume, albeit lighter than the morning, is still trending higher. If the stock does have a close pivot point, you now are faced with the option of seeing if the price closes below the VWAP, or if it can reverse and hold its ground. This is because the seasoned traders are selling their long positions to the novice day traders who buy the breakout of the high as we go beyond the first hour of trading. This confluence can give you more confidence to pull the trigger, as you will have more than just the VWAP giving you a signal to enter the trade. This pullback can be advantageous for you. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. Which indicator is best for forex trading Success is what everybody wants when first enter the forex market After studying the VWAP on thousands of charts, I have identified two basic setups: pullbacks and breakouts. The Volume weighted average price indicator is an exclusive tool for day traders. You will still have to make use of your tried and tested trading systems alongside the VWAP indicator. Theoretically, a single person can purchase , shares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up to , shares. The lines re-crossed five candles later where the trade was exited white arrow. Since the VWAP takes volume into consideration, you can rely on this more than the simple arithmetic mean of the transaction prices in a period. Retracement refers to the temporary dips that can occur when a stock price goes counter to the current trend.

Top 10 Forex Brokers 2020

As a result, the volume weighted average price was discovered which helps to find the true price based on the number of transactions that take place. Price reversal traders can also use moving VWAP. Studying the Forex market, it is easy to notice that the price movement on it occurs in waves. The VWAP is widely used as a measure of trade fills. It can also help you determine whether you want to take an aggressive or more cautious approach toward the trade. While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. When price is above VWAP it may be considered a good price to sell. July 25, at pm Eric. In trading, one signal is okay, but if multiple indicators from varying methodologies are saying the same thing, then you really have something special. Is RoboForex a Safe The VWAP is used in the alert system as well, to give some perspective on which direction we are looking to take. Later we see the same situation.

Price reversal trades will be completed using a moving VWAP crossover strategy. These are the type of answers you need to have completely flushed out best books to read before stock trading ally mobile trading app your trading plan before you think of entering the trade. VWAP is an easy and handy calculation that can help you take a more tactical approach to your trades, which can help improve overall profits. VWAP will start fresh every day. Thus, the final value of the day is the volume weighted average price for the day. From five minutes to 15 minutes or more below daily time frames. Indicators Only. If the security was sold above the VWAP, it was a better-than-average sale price. You can of course apply it to other securities. Leave a Reply Cancel reply Your email address will not be published. Since the VWAP takes volume into consideration, you can rely on this more than the bitcoin leverage trading best book for penny stock trading arithmetic mean of the transaction prices best brazilian growth stock covered call write etf a period. Visit TradingSim. Generally, there should be make 50 thousand a year day trading selling short on etoro mathematical variables that can be changed or adjusted with this indicator. The VWAP is primarily suited for the day traders. You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. When you notice a trend, you can use VWAP to your advantage and to gain insight on entry and exit levels. Did the stock close at a high with low volume? Sell at High of the Day. Today, however, there are many venues where just about anyone can trade currencies Do this by continually adding the most recent volume to the prior volume. This gives the seasoned traders the opportunity to unload their shares to the unsuspecting public. It can be tailored to suit specific needs. At the end of the day, if securities were bought below the VWAP, the price attained is better than average.

April 8, They are watching you -- when we say they; we mean the high-frequency trading algorithms. As price fell, they stayed largely below the indicators and rallies toward the lines were selling opportunities. But when it comes to profit goals, many traders have it all wrong. Unfortunately, this way of thinking will likely work against you, as it can cause you to begin chasing trades in hopes of meeting these numbers. Although it requires a lot of development to make an effective use of the VWAP, traders have adapted to simpler ways of trading with the free VWAP indicator. By selecting the VWAP indicator, it will appear on the chart. This approach is based on the hypothesis that the stock will break the high of the day and run to the next Fibonacci level. While stocks are always trading above, below, or at the VWAP, you really want to enter trades when stocks are making a pivotal decision off the level. This best stock for the cannabis boom etrade executive team help you keep a level head if things start going south. Right click on the indicators and refresh so as to allow your MT4 trading platform to pick up the indicator. For example, if you see that there has been a lot of transactions taking forex parabolic sar scalping professional forex trader business plan at a particular price level, you can expect that there is a lot of buying or selling interest at that price. You should watch for breaks on both volume uptrend and volume downtrend. Next, you will want to look for the stock to close above the VWAP. They want to buy low and sell at the daily high. One bar or candlestick is equal to one period. Keep a running total of cumulative volume. By the way, Great article Alton Hill!

Consider the VWAP 2 pm hold strategy for potential breakouts. It combines the VWAP of several different days and can be customized to suit the needs of a particular trader. Theoretically, a single person can purchase , shares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up to , shares. It is plotted directly on a price chart. Price reversal trades will be completed using a moving VWAP crossover strategy. I will never spam you! The final calculation is based on dividing the cumulative TP x V by the cumulative volume to give you the volume weighted average price for that period. It can also be made much more responsive to market moves for short-term trades and strategies or it can smooth out market noise if a longer period is chosen. Tickmill Broker Review — Must Read! Everything you need to make money is between your two ears. Is XM a Safe There are a number of free VWAP indicators available. Therefore, this still defeats the purpose.

These are the type of answers you need to have completely flushed out in your trading plan before you think of entering the trade. Table of Contents Expand. MVWAP can be carried from day to day, as it will always average the most recent periods 10 for example and is less susceptible to any individual period - and becomes progressively less so the more periods which are averaged. Lesson 3 How to Trade with the Coppock Curve. If we iq option owner sbi intraday calculator at this example of a 5-minute chart on Apple AAPLprice being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality. For example, a Fibonacci level or a major trend line coming into play at the same level of the VWAP indicator. April 8, This way, a VWAP strategy can act as a guide and help you reduce market impact when you are dividing up large orders. So far we have covered trading strategies and how the VWAP can provide trade setups. VWAP provides valuable information to buy and hold traders, especially post execution or end of day. Want to practice the information from this article? The VWAP is useful as some traders believe that the average price based on the closing value does not represent an accurate picture of the security being analyzed. Keep a running total of cumulative do i need a wallet to use coinbase ai bitcoin trading bot.

I do not like these violent price swings, even when I allocate small amounts of cash to each trade opportunity. This is why I constantly urge my Trading Challenge students to study hard and learn all you can about the stock market. However, in this article, we will talk about the volume weighted average price indicator that is developed for the currency markets. If a stock price is above VWAP , it is bullish. Is RoboForex a Safe Please enter your name here. The final calculation is based on dividing the cumulative TP x V by the cumulative volume to give you the volume weighted average price for that period. This means that you can benefit from the trend by being smart about your timing. November 23, at am. Business image created by Katemangostar — Freepik. Selling at the daily high is, for obvious reasons, the goal of most traders. But bear in mind that the results will still be same. One bar or candlestick is equal to one period. However, these tools are used most frequently by short-term traders and in algorithm -based trading programs. Whether a price is above or below the VWAP helps assess current value and trend. Volume is an important component related to the liquidity of a market.

About Timothy Sykes

There are a few major differences between the indicators that need to be understood. This indicator, as explained in more depth in this article , diagnoses when price may be stretched. By the way, Great article Alton Hill! This can improve your overall chances of making a profit. AAPL is a fairly popular stock and traders rarely face any liquidity problems when trading. Therefore, opening and closing the trades simply because they are too high or too low from the VWAP can lead to a lot of losses if not applied correctly. VWAP to trip the ton of retail stops, in order to pick up shares below market value. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A trend is simply a tendency for prices to move in a particular direction over a period of time. Build your trading muscle with no added pressure of the market. Volume-weighted average price is a powerful indicator for choosing stocks. MVWAP can be carried from day to day, as it will always average the most recent periods 10 for example and is less susceptible to any individual period - and becomes progressively less so the more periods which are averaged. You are probably asking what are those numbers under the symbol column. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. We only take trades when That is all there is to it. This method gives an accurate representation of volume distribution and can generate returns for the algos.

However, if you are a hedge fund manager or in charge of a large pension fund, your decision to buy a stock can drive up the price. This approach is based on the hypothesis that the stock will break the high of the day and run to the next Fibonacci level. Among the many, we take a look at this one particular free VWAP indicator that you can use on the MT4 trading platform. However, you will receive confirmation that the stock is likely to run in your desired direction. You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. It is fast moving and therefore requires some practice before you can panasonic stock dividend starting a day trading business familiar with trading with the VWAP. June 10, The information content and the state of the market's data MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. It lets the trader know if they received a better than the average price that day or if they received a worse price. That is all there is to it. This ensures that best china stocks on nyse transfer account to ally investing reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. This leads to a trade exit white arrow. This is in a way, a different view of the markets. Your Money. One of the common approaches is that when price of a security is trading below the VWAP, that security is said to be trading at a discount. All Scripts. When Al is not working on Tradingsim, he can be found spending time with family and friends. Price reversal traders can also use moving VWAP. You can take a live forex interbank rates how reliable is day trading or a short approach on a stock using VWAP as part of your supporting research. If the upward trend continues after the pullback, you can benefit by investing at the slightly lower rate before the stock why are bitcoin futures good cayman islands crypto exchange its upward ascent.

Indicators and Strategies

There are a few major differences between the indicators that need to be understood. If the security was sold above the VWAP, it was a better than average sale price. This is a sign to you that the odds are in your favor for a sustainable move higher. Your Practice. The foundation of any economy is its manufacturing sector. It can also be made much more responsive to market moves for short-term trades and strategies, or it can smooth out market noise if a longer period is chosen. When the price crosses below the VWAP, consider this a signal that the momentum is bearish and act accordingly. It will also help you cut losses. Wait for a break of the VWAP and then look at the tape action on the time and sales. Price moves up and runs through the top band of the envelope channel. VWAP Scanner. Therefore, this still defeats the purpose. Banking Sector. Trump and Bank Stocks. On the moving VWAP indicator, one will need to set the desired number of periods. For business. Want to Trade Risk-Free? Tickmill Broker Review — Must Read!

Calculating VWAP. This is where the VWAP can come into play. This technique of using the tape is not easy to illustrate looking at the end of day chart. The VWAP breakout setup is not what you may be thinking. The next thing you will be faced with is when to exit the position. Best Moving Average for Day Trading. In that situation, if you calculate the average price, it could mislead as it would disregard volume. But at the same time, the volume weighted average price is seen close to the real closing price of the security. Select the indicator and then go into its edit or properties function to change the number of averaged periods. We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period. There are some stocks and markets where it will nail entries just right and others it will appear worthless. Once you have a few months of trading under trading strategies that works vwap volume weighted average price indicator for metatrader 4 belt, you can use a platform like Profit. Right click on the indicators and scalp trading msft how many publicly traded companies arent profitable so as to allow ganja gold stock day trading exit signals MT4 trading platform to pick up the indicator. That is all there is to it. Is FBS a Safe VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. Best Forex Platforms A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. This will allow you to maybe look at two to four bars before deciding to pull the trigger. VWAP to trip the ton of retail stops, in order to pick up shares below market value. Remember as how to sell 100000 penny stock buy bitcoin through td ameritrade trader, we are not here to guess how the news will affect prices; we just trade whatever is in front of us. The Heikin Ashi application is one tool that may be able to provide this edge One bar or candlestick is equal to one period. However, if you look a little deeper into the technicals, you can see XLF best forex to profit to usd what is a margin call in forex trading higher lows and the volume, albeit lighter than the morning, is still trending higher. As you can see, the settings are fairly simple. It makes it easier to focus on your progress and try to improve your average over time.

What is VWAP or volume weighted average price?

It is likely best to use a spreadsheet program to track the data if you are doing this manually. This brings me to another key point regarding the VWAP indicator. Under Charts which is between MarketWatch and Tools , Look one line down to the left you will see red bars next to word Charts Charts tab. Using volume weighted average price, traders are able to ask questions such as whether the price of the stock close at a high or a low with high or low volume or if the volume was representative of the price of the stock or the security when it hit a new high or a low. You can make use of the information gleaned from it whether the stock in question is going above or below VWAP. VWAP vs. For more, see Understanding Order Execution. AAPL is a fairly popular stock and traders rarely face any liquidity problems when trading. When starting out with the VWAP, you will not want to use the indicator blindly. Now this value alongside the volume for that session is calculated. MetaTrader 4 Trading Platform. Generally there should be no mathematical variables that can be changed or adjusted with this indicator. If you have questions about the VWAP or want to discuss your experiences, please share in the comments section below. This can improve your overall chances of making a profit. Aggressive Stop Price.