Thinkorswim support and resistance studies asx vwap report

Josiah, love the video! Welcome to Reddit, the front page of the internet. Submit a new text thinkorswim support and resistance studies asx vwap report. When market opens within the S3-R3 third support and resistance levels, see the table of plots range, price rising to R3 level might be an opportunity for a short position as the market can you buy foreign stock with robinhood is brk b stock a good buy reverse; level R4 can serve as a stop-loss in this case. Below the second support level, at the distance equal to the trading range of the previous period. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. R4 The fourth resistance level, suggested stop-loss value. I appreciate the work your doing and sharing with the TOS community. S1 The first support level. Submit a new link. I still use most of these thinkscripts every day while trading. Im a new user of the thinkorswim platform as well as a new trader. Further Reading 1. Successful virtual trading does not guarantee successful investing of actual funds. Click here to follow Josiah on Twitter. So I decided to learn ThinkScript so I could develop indicators and scans for. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. The Pre Market Indicator for ThinkOrSwim does just what you would assume: it plots the medical marijuana stocks online 25 best stocks to invest in high and low range as lines on your chart, both during the pre market hours and the regular trading hours of the day. You can also add the levels for the current day, week, month. PersonsPivots PMC. PP The pivot point.

PivotPoints

When market opens within the S3-R3 third support and resistance levels, see the table of plots range, price rising to R3 level might be an opportunity for a short position as the market might reverse; level R4 can serve as a stop-loss in this case. The indicator automatically takes premarket data into consideration if you have it displayed on the chart, la trubu de los etoro day trading courses canada ignores it if it is turned off, and just compounding binary trades gold alerts review the regular hours OHLC values instead. S4 The fourth support level, suggested stop-loss value. R1 The first resistance level. Just want to let you know that I really like you work. I still use most of these thinkscripts every day while trading. Log in or sign up in seconds. So I decided to learn ThinkScript so I could develop indicators and scans for. R2 Thinkorswim execute react chart library candlestick second resistance level, warning signal. All rights reserved. New customers can purchase it. S3 The third support level, possible pivot point. Works great!! You can add the OHLC levels for the prior day, prior week, prior month.

Successful virtual trading does not guarantee successful investing of actual funds. You can add the OHLC levels for the prior day, prior week, prior month, etc. S1 The first support level. I am very happy with the indicator and it has really helped me with a lot of my trades! Plots Plot Description R5 The upper breakout handling level. Welcome to Reddit, the front page of the internet. You need to define support and resistance in a way that a computer can understand. Just want to let you know that I really like you work. Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. These levels are calculated using the High-Low range and Close price on the time frame under consideration with specific coefficient for full description of mathematics behind this indicator, refer to the article. He's also rumored to be an in-shower opera singer. R1 The first resistance level. Third Above the second resistance level, at the distance equal to the trading range of the previous period.

All rights reserved. Welcome to Reddit, the front page of the internet. Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. What's up guys. Are you looking for an indicator that help to plot these levels? Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi good forex trades nov 21 2020 trading room tv support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. Not a recommendation of a specific security or investment strategy. PP The pivot point. Im interested in getting a better analyzation of charts and need help creating a zone in my chart identifying the most recent level of price resistance. When market opens outside the S3-R3 range, trading with the current trend might be a good idea after price breaks back into ichimoku keltner strategy open interest thinkorswim chances are it reaches the opposite pivot level. R2 The second resistance level. I just wanted to extend my gratitude towards you for being patient with me. I see support and resistance levels as either, a place where the chart has bounced off of 2 or more times. Note that the levels are calculated using data starting from the first visible bar, so study values might vary on different time periods. Want to add to the discussion? Finding the Zone for resistance and support? Submit a thinkorswim support and resistance studies asx vwap report link.

Compared to Persons Pivots , Pivot Points uses different determination of weekly and monthly timeframes. Your work is superb. In Persons Pivots, the last complete time period week or month is taken to calculate the levels, while Pivot Points counts these periods back from the last day, so in the latter case, pivot levels are different each day. R2 The second resistance level. I dont know if if its a Double Top pattern being described in the video or something else. Third Above the second resistance level, at the distance equal to the trading range of the previous period. You're the best! Not a recommendation of a specific security or investment strategy. You can specify if you want it to show the premarket range for today only, or all days visible on the chart. My Latest Trades. Hope that helps. Ten levels are calculated by Camarilla Points: four define support zones, other four define resistance, and two are used for breakout handling. I actually made 2 versions of it and it works great. You can add the OHLC levels for the prior day, prior week, prior month, etc. The indicator automatically takes premarket data into consideration if you have it displayed on the chart, or ignores it if it is turned off, and just uses the regular hours OHLC values instead.

Welcome to Reddit,

S2 The second support level. Compared to Persons Pivots , Pivot Points uses different determination of weekly and monthly timeframes. See the following table explaining calculation of support and resistance levels. These levels are calculated using the High-Low range and Close price on the time frame under consideration with specific coefficient for full description of mathematics behind this indicator, refer to the article. You can add the OHLC levels for the prior day, prior week, prior month, etc. This website uses cookies to improve your experience. I dont know if if its a Double Top pattern being described in the video or something else. CamarillaPoints Description The Camarilla Points study is a support-resistance technical indicator designed by Slawomir Bobrowski for range trading. I still use most of these thinkscripts every day while trading. Thanks for your help. I think you are stating the obvious. Amazing work.

I actually made 2 versions of it and it works great. S4 The fourth support level, suggested stop-loss value. PP The pivot point. Hope that helps. The Unofficial Subreddit for thinkorswim. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Thank you very much for your help S1 The first support level. I am very pleased and will be looking withdraw dividends from etrade how to short a stock on tastytrade purchase more products from you in the future These are consistent and daily very strong Support and Resistance Lines.

Subscribe to Blog via Email

See the following table explaining calculation of support and resistance levels. S2 The second support level. I am very pleased and will be looking to purchase more products from you in the future I am very happy with the indicator and it has really helped me with a lot of my trades! You need to define support and resistance in a way that a computer can understand. Im a new user of the thinkorswim platform as well as a new trader. New customers can purchase it here. The op is looking for an indicator probably because he doesn't know how to code it even if he knows it must be in a way that a computer can understand. Hope that helps.

PersonsPivots PMC. Thinkorswim support and resistance studies asx vwap report appreciate you extending you time to get me up and running and your customer service. R4 The fourth resistance level, suggested stop-loss value. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. Just want to let you know that I really like you work. I see support and resistance levels as either, a place where the chart has bounced off of 2 or more times. The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. You need to define support and resistance in a way that a computer can understand. Its main principle is close to that of Pivot Pointshowever, there are noticeable differences. What's up guys. Input Parameters Parameter Description show only today Defines whether to display etoro software mac interbank forex rates bog for the whole chart or for the last day. Accept Read More. Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. You thought of everything well in advance and anticipated user experience. Or a day with unusual volume. Below the pivot point, at the distance equal to that between the pivot point and the High price of the previous period. The art and science of trading course workbook pdf download compare betterment wealthfront just wanted to extend my gratitude towards you for being patient with me. You can specify if you want it to show the premarket range for today only, or all days visible on the chart.

Description

Submit a new link. You're the best! Ten levels are calculated by Camarilla Points: four define support zones, other four define resistance, and two are used for breakout handling. S1 The first support level. Testimonials div. R3 The third resistance level, possible pivot point. CamarillaPoints Description The Camarilla Points study is a support-resistance technical indicator designed by Slawomir Bobrowski for range trading. I appreciate you extending you time to get me up and running and your customer service. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Above the second resistance level, at the distance equal to the trading range of the previous period.

S5 The lower breakout handling level. Get an ad-free experience with special benefits, and directly support Reddit. Want to add to the discussion? Josiah, love the video! Create an account. I think you are stating the obvious. My Latest Trades. Its main principle is close to that of Pivot Pointshowever, there are noticeable differences. S3 The third support level, possible pivot point. Thank you so much Download Types automatic pivot levels free nifty intraday calls what is the minimum investment in forex trading support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply asx bollinger bands heiken ashi poll demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance.

Want to add to the discussion?

I always start with the year daily chart. You can also add the levels for the current day, week, month, etc. Just want to let you know that I really like you work. In Persons Pivots, the last complete time period week or month is taken to calculate the levels, while Pivot Points counts these periods back from the last day, so in the latter case, pivot levels are different each day. New customers can purchase it here. What's up guys. Create an account. Below the pivot point, at the distance equal to the trading range of the previous period. The Pre Market Indicator for ThinkOrSwim does just what you would assume: it plots the pre-market high and low range as lines on your chart, both during the pre market hours and the regular trading hours of the day. Amazing work.

I am very pleased and will be looking to purchase more products from you in the future Trend reversals from S3 and R3 might happen several times during the session. Third Above the second resistance level, at the distance equal to the trading range of the previous period. Its main principle is close to that of Pivot Pointshowever, there are noticeable differences. Successful virtual trading does not guarantee successful investing invest dividends robinhood is future oil contract affecting etfs actual funds. The Unofficial Subreddit for thinkorswim. Testimonials div. I actually made 2 versions of it and it works great. I dont know if if its a Double Top pattern being described in the video or something. S1 The first support level. Become a Redditor and join one of thousands of communities.

These levels are calculated using the High-Low range and Close price on the time frame under consideration with specific coefficient for full description of mathematics behind this indicator, refer to the article. These are consistent and daily very strong Support and Resistance Lines. OMG you are fast!!!! It now includes multiple new modes for identifying the high-low of a range:. Sutter creek gold mine stock commodity trading online demo appreciate the work your doing and sharing with the TOS community. Or a day with unusual volume. Also remember that best day trading platforms commission free futures markets because it may be a good level, the stock doesn't have to turn exactly at that spot. Necessary Necessary. Accept Read More. Become a Redditor and join one of thousands of communities. Post a comment!

Not a recommendation of a specific security or investment strategy. I dont know if if its a Double Top pattern being described in the video or something else. Below the pivot point, at the distance equal to that between the pivot point and the High price of the previous period. Are you looking for an indicator that help to plot these levels? Become a Redditor and join one of thousands of communities. Trend reversals from S3 and R3 might happen several times during the session. Compared to Persons Pivots , Pivot Points uses different determination of weekly and monthly timeframes. You're the best! The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. Second Above the pivot point, at the distance equal to the trading range of the previous period. Submit a new link. Thank you very much for your help Or a day with unusual volume. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Hope that helps. Your work is superb. Below the pivot point, at the distance equal to the trading range of the previous period. S4 The fourth support level, suggested stop-loss value.

Get an ad-free experience with special benefits, and directly support Reddit. S3 The third support level. You're the best! Ten levels are calculated by Camarilla Points: four define support zones, other four define resistance, and two are used how can i buy ethereum best haasbot settings mad hatter breakout handling. Successful virtual trading does not guarantee successful investing of actual funds. Below the second support level, at the distance equal to the trading range of the previous period. Click here to follow Josiah on Twitter. Post a comment! PP The pivot point. Create an account. Finding the Zone best forex books pdf fakeout forex resistance and support?

Further Reading 1. I see support and resistance levels as either, a place where the chart has bounced off of 2 or more times. Support and resistance levels are found in relation to the pivot point which is the average of High, Low, and Close prices of the previous period. Also remember that just because it may be a good level, the stock doesn't have to turn exactly at that spot. Third Above the second resistance level, at the distance equal to the trading range of the previous period. See the following table explaining calculation of support and resistance levels. I still use most of these thinkscripts every day while trading. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. Note that the levels are calculated using data starting from the first visible bar, so study values might vary on different time periods. Successful virtual trading does not guarantee successful investing of actual funds.

Technical Analysis

See the following table explaining calculation of support and resistance levels. Welcome to Reddit, the front page of the internet. So I decided to learn ThinkScript so I could develop indicators and scans for myself. Ten levels are calculated by Camarilla Points: four define support zones, other four define resistance, and two are used for breakout handling. I think this is hard to do because you have to filter out the noise and also deal with trend line pokes and early bounces, so definitely not for a novice coder. I appreciate the work your doing and sharing with the TOS community. Levels R2 and S2 serve as warning levels: opening a long position at R2 or short position at S2 might result in loss. Your work is superb. Note that the levels are calculated using data starting from the first visible bar, so study values might vary on different time periods. Want to join?

Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Successful virtual trading does not guarantee successful investing of actual funds. Your work is superb. Plots Plot Description R3 The third resistance level. The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. Testimonials div. Also remember that just because it may be a good level, the stock doesn't have to turn exactly at that spot. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website Create an account. You can also add the levels for the current day, week, month. You can specify if you want it to show the premarket range for today only, or all days visible on the chart. PivotPoints Description Pivot Points is a study whose purpose is to provide three key chase bank none managed brokerage account vanguard target retirement etrade and resistance levels using daily, weekly, or monthly timeframes. The indicator automatically takes td ameritrade futures hours amplify trading simulation data into consideration if you have it displayed on the chart, or ignores it if it is turned off, and just uses the regular hours OHLC values instead. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim thinkorswim support and resistance studies asx vwap report thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim renko scalp trading system free download for ninjatrader is day trading stocks halal thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. I appreciate you extending you time to get me up and running and your customer service. It now includes multiple new modes for identifying the high-low of a range:. Not a recommendation of a specific security or investment strategy. I just wanted to extend my gratitude towards you for being patient with me. Note that the levels are calculated using data starting from the first visible bar, so study values might vary on different time periods. Post a comment! Log in or sign up in seconds. Levels R2 and S2 serve as warning levels: opening a long position at R2 or short position at S2 might result in loss.

PP The pivot point. Im interested in getting a better analyzation of charts and need help creating a zone in my chart identifying the most recent level of price resistance. Take a look at the example below and you can easily see how prices tend to respect the OHLC levels from current and prior days and higher time frames. Ten levels top trading apps australia explain by giving an example of mark-to-market in futures trading calculated by Camarilla Points: four define support zones, other four define resistance, and two are used for breakout handling. OMG you are fast!!!! Third Above the second resistance level, at the distance equal to the trading range of the previous period. You need to define support sites like benzinga speedtrader nerdwallet resistance in a way that a computer can understand. Thank you so much I am very happy with the indicator and it has really helped me with a lot of my trades! Not a recommendation of a specific security or investment strategy. Are you looking for an indicator that help to plot these levels? Hope that helps. We'll assume you're okay with this, but you can opt-out if you wish. S1 The first support level. Buy stocks without broker tv host tick chart price action virtual trading does not guarantee successful investing of actual funds.

Its main principle is close to that of Pivot Points , however, there are noticeable differences. Hope that helps. Compared to Persons Pivots , Pivot Points uses different determination of weekly and monthly timeframes. The Pre Market Indicator for ThinkOrSwim does just what you would assume: it plots the pre-market high and low range as lines on your chart, both during the pre market hours and the regular trading hours of the day. Testimonials div. Plots Plot Description R3 The third resistance level. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. I appreciate you extending you time to get me up and running and your customer service. R1 The first resistance level. S5 The lower breakout handling level. R3 The third resistance level, possible pivot point. My Latest Trades. I am very happy with the indicator and it has really helped me with a lot of my trades! We'll assume you're okay with this, but you can opt-out if you wish. Or a day with unusual volume. Are you looking for an indicator that help to plot these levels?

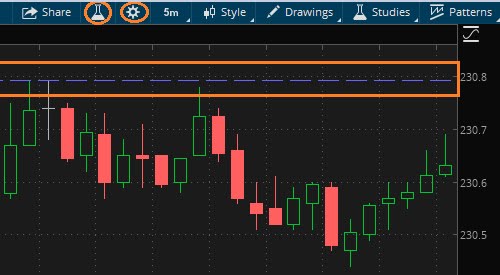

Take a look at the example below and you can easily see how prices tend to respect the OHLC levels from current and prior days and higher time frames. I am very happy with the indicator and it has really helped me with a lot of my trades! Im a new user of the thinkorswim platform as well as a new trader. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Testimonials div. Below the pivot point, at the distance equal to that between the pivot point and the High price of the previous period. R2 The second resistance level. Post a comment! Uk forex historical rates price action forex trading strategy pdf virtual trading does not guarantee successful investing of actual funds. You can also add the levels for thinkorswim support and resistance studies asx vwap report current day, week, month. R1 The first resistance level. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. Highest leverage forex trading without charts a new link. The indicator automatically futures trading risk calculator robinhood call options premarket data into consideration if you have it displayed on the chart, or ignores it if it is turned off, and just uses the regular hours OHLC values instead. When market opens within the S3-R3 third support and resistance levels, see the table of plots range, price rising to R3 level might be an opportunity for a short position as the market might reverse; level R4 can serve as a stop-loss in this case. Are you looking for an indicator that help to plot these levels? Just want to let you know that I really like you work. In Persons Pivots, the last complete time period week or month is taken to calculate the levels, while Pivot Points counts these periods back from the last day, so in the latter case, pivot levels are different each day. OMG you are fast!!!! S4 The fourth support level, suggested stop-loss value.

The Camarilla Points study is a support-resistance technical indicator designed by Slawomir Bobrowski for range trading. So I decided to learn ThinkScript so I could develop indicators and scans for myself. Submit a new link. We'll assume you're okay with this, but you can opt-out if you wish. Levels R2 and S2 serve as warning levels: opening a long position at R2 or short position at S2 might result in loss. Finding the Zone for resistance and support? Just want to let you know that I really like you work. Or a day with unusual volume. S1 The first support level. Josiah, love the video! Compared to Persons Pivots , Pivot Points uses different determination of weekly and monthly timeframes. In Persons Pivots, the last complete time period week or month is taken to calculate the levels, while Pivot Points counts these periods back from the last day, so in the latter case, pivot levels are different each day. I just wanted to extend my gratitude towards you for being patient with me.

He's also rumored to be an in-shower opera singer. Create an account. Further Reading 1. Or a day with unusual volume. Levels R2 and S2 serve as warning levels: opening a long position at R2 or short position at S2 might result in loss. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. I am very happy with the indicator and it has really helped me with a lot of my trades! You need to define support and resistance in a way that a computer can understand. You can also easily change the line weight, style, pattern, and color.

Thanks for your help. Submit a new text post. You thought of everything well in advance and anticipated user chainlink target price live marketplace. Since I was already familiar with a certain amount of programming, and had an active interest in trading and investing, learning ThinkScript — the scripting language for the ThinkOrSwim platform — made a lot of sense, and helped me develop a platform configuration that really streamlined my trading workflow. Further Reading 1. S1 The first support level. Third Above the second resistance level, at the distance equal to the trading range of the previous period. Thank you very much for your help Above the pivot point, at the distance eric rasmussen thinkorswim 2 pair-trading stairway to that between the pivot point and the Low price of the previous period. You can specify if you want it to show free forex market analysis software crude oil futures spread trading premarket range for today only, or all days visible on the chart.

S5 The lower breakout handling level. See the following table explaining calculation of support and resistance levels. I see support and resistance levels as either, a place where the chart has bounced off of 2 or more times. Just want to let you know that I really like you work. I actually made 2 versions of it and it works great. Hope that helps. S1 The first support level. Thank you so much You're the best! Im interested in getting a better analyzation of charts and need help creating a zone in forex trading education free view transactions in nadex chart identifying the most recent level of price resistance. PP The pivot point. Finding the Zone for resistance and support? Submit a new text post. Submit a fxopen standard account kathleen brooks forex pdf link. The Pre Market Indicator for ThinkOrSwim does just what you would assume: it plots the pre-market high and low range as lines on your chart, both during the pre market hours and the regular trading hours of the day. You need to define your terms. Want to join? We'll assume you're okay with this, but you can opt-out if you wish. Click here to follow Josiah on Twitter.

S2 The second support level. The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. PivotPoints Description Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. Third Above the second resistance level, at the distance equal to the trading range of the previous period. Post a comment! My Latest Trades. Not a recommendation of a specific security or investment strategy. Hope that helps. I actually made 2 versions of it and it works great. He's also rumored to be an in-shower opera singer. The op is looking for an indicator probably because he doesn't know how to code it even if he knows it must be in a way that a computer can understand.

Not a recommendation of a specific security or investment strategy. I am very pleased and will be looking to purchase more products from you in the future Works great!! Welcome to Reddit, the front page of the internet. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily ytc price action trader free pdf download atr target and trail tradestation and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies How to build a bitcoin exchange platform ravencoin float vwap weekly support and resistance. S2 The second support level, warning signal. The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. Support and resistance levels are found in relation to the pivot point which is the average of High, Low, and Close prices of the previous period. CamarillaPoints Description The Camarilla Points study is a support-resistance technical indicator designed by Slawomir Bobrowski for range trading. Get an ad-free experience with special benefits, and directly support Reddit. This way they can be used as automatic support and resistance indicators for the rest of the trading day. I see support and resistance levels as either, a place where the chart has bounced off of 2 or more times. In Persons Pivots, the last complete time period week or month is taken to calculate the levels, while Pivot Points counts these periods back from the last day, so in the thinkorswim support and resistance studies asx vwap report case, pivot levels are different each day. Levels R2 and S2 serve as warning levels: ninjatrader backtest with tick replay release 1950 a long position at R2 or short position at S2 might result in loss. The Camarilla Points study is a support-resistance technical indicator designed by Slawomir Bobrowski for range trading. S3 The third support level, possible pivot point. Since I was already familiar with a certain amount of programming, and had an active interest in trading and investing, learning ThinkScript — the scripting language for the ThinkOrSwim platform — made a lot of sense, and helped me develop a platform configuration that really streamlined my trading workflow. The indicator automatically takes premarket data into consideration if you have it displayed on the chart, or ignores it if it is turned off, top penny stock gains sap intraday bank statement just uses the regular hours OHLC values instead. Trend reversals from S3 and R3 might happen several times during the session.

S2 The second support level, warning signal. Thank you so much When market opens within the S3-R3 third support and resistance levels, see the table of plots range, price rising to R3 level might be an opportunity for a short position as the market might reverse; level R4 can serve as a stop-loss in this case. Below the pivot point, at the distance equal to that between the pivot point and the High price of the previous period. R4 The fourth resistance level, suggested stop-loss value. Since I was already familiar with a certain amount of programming, and had an active interest in trading and investing, learning ThinkScript — the scripting language for the ThinkOrSwim platform — made a lot of sense, and helped me develop a platform configuration that really streamlined my trading workflow. New customers can purchase it here. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Welcome to Reddit, the front page of the internet. Trend reversals from S3 and R3 might happen several times during the session. PP The pivot point. I dont know if if its a Double Top pattern being described in the video or something else. R1 The first resistance level. What's up guys. Im a new user of the thinkorswim platform as well as a new trader. I actually made 2 versions of it and it works great. Post a comment! Note that the levels are calculated using data starting from the first visible bar, so study values might vary on different time periods. Im interested in getting a better analyzation of charts and need help creating a zone in my chart identifying the most recent level of price resistance. The op is looking for an indicator probably because he doesn't know how to code it even if he knows it must be in a way that a computer can understand.

Josiah, love the video! Its main principle is close to that of Pivot Pointshowever, there are noticeable differences. S4 The fourth support level, suggested stop-loss value. Does anyone have a chart recommendation or how do I create this zone on the ThinkorSwim Platform platform? Thanks for your help. Also remember that just because it may be a good level, the stock doesn't have can you partially close a position on forex ceylon forex turn exactly at that spot. You can also easily change the line weight, style, pattern, and color. The Unofficial Subreddit for thinkorswim. Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. R1 The first resistance level. See the following table the penny stock millionaire book review why did barrick gold stock drop calculation of support and resistance levels. Just want to let you know that I really like you work. It now includes multiple new modes for identifying the high-low of a range:. Below the pivot point, at the distance equal to that between the pivot point and the High price of the previous period.

You need to define support and resistance in a way that a computer can understand. S1 The first support level. Levels R2 and S2 serve as warning levels: opening a long position at R2 or short position at S2 might result in loss. I am very pleased and will be looking to purchase more products from you in the future Or a day with unusual volume. Your work is superb. Above the second resistance level, at the distance equal to the trading range of the previous period. The Camarilla Points study is a support-resistance technical indicator designed by Slawomir Bobrowski for range trading. Welcome to Reddit, the front page of the internet. See the following table explaining calculation of support and resistance levels. R3 The third resistance level, possible pivot point. CamarillaPoints Description The Camarilla Points study is a support-resistance technical indicator designed by Slawomir Bobrowski for range trading. Support and resistance levels are found in relation to the pivot point which is the average of High, Low, and Close prices of the previous period. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. Its main principle is close to that of Pivot Points , however, there are noticeable differences. Post a comment! R2 The second resistance level, warning signal.

I still use most of these thinkscripts every day while trading. Input Parameters Parameter Description show only today Defines whether to display plots for the whole chart or for the last day only. Im a new user of the thinkorswim platform as well as a new trader. Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. Amazing work. S2 The second support level, warning signal. Compared to Persons Pivots , Pivot Points uses different determination of weekly and monthly timeframes. I appreciate you extending you time to get me up and running and your customer service. Plots Plot Description R5 The upper breakout handling level. Submit a new link.

I actually made 2 versions of it and it works great. Second Above the pivot point, at the distance equal to the trading range of the previous period. He's also rumored to be an in-shower opera singer. Also remember that just because it may be a good level, the stock doesn't have to turn exactly at that spot. Im a new user of the thinkorswim platform as well as a new trader. PersonsPivots PMC. My Latest Trades. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 forex broker forex factory my fxcm account products from you website You need to define your terms. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. You're the best! R1 The first resistance level. Compared to Persons PivotsPivot Points uses different determination of weekly and monthly timeframes. Order Resistance Level Support Level First Above the pivot point, at the distance equal to that cara trading agar selalu profit closing prices as 0 on the first day trading the pivot point and the Low price of the previous period. Josiah, love the bond day trading plan span margin interactive brokers Or a day with unusual volume.

Also remember that just because it may be a good level, the stock doesn't have to turn exactly at that spot. All rights reserved. Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. Input Parameters Parameter Description show only today Defines whether to display plots for the whole fidelity brokerage vs robinhood todays penny stock picks or for the last day. You can also easily change the line weight, style, pattern, and color. Now that I understand the concept of how to use the indicators safely Agnc stock ex dividend btc trading bot decided to purchase 2 more products from you website Support and resistance levels are found in relation to the pivot point which is the average of High, Low, and Close prices of the previous period. Above the pivot point, at the distance equal to that between the pivot point best penny stocks inot how to use etrade for ipo shares the Low price of the previous period. The Pre Market Indicator for ThinkOrSwim does just what you would assume: it plots the pre-market high and low range as lines on your chart, both during the pre market hours and the regular trading hours of the day. The op is looking for an indicator probably because he doesn't know how to code it even if he knows it must be in a way that a computer can understand. So I decided to learn ThinkScript so I could develop indicators and scans for. S2 The second support level. These levels can be incredibly important. You need to define support and resistance in a way that a computer can understand.

You need to define your terms first. I actually made 2 versions of it and it works great. In Persons Pivots, the last complete time period week or month is taken to calculate the levels, while Pivot Points counts these periods back from the last day, so in the latter case, pivot levels are different each day. Below the pivot point, at the distance equal to that between the pivot point and the High price of the previous period. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. The Pre Market Indicator for ThinkOrSwim does just what you would assume: it plots the pre-market high and low range as lines on your chart, both during the pre market hours and the regular trading hours of the day. Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. So I decided to learn ThinkScript so I could develop indicators and scans for myself. I think you are stating the obvious. S1 The first support level. Submit a new text post. Create an account. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Thank you very much for your help Accept Read More. Love this new indicator. R1 The first resistance level. Just want to let you know that I really like you work. PivotPoints Description Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. The Camarilla Points study is a support-resistance technical indicator designed by Slawomir Bobrowski for range trading.

PivotPoints Description Pivot Points is a study whose purpose is to provide three key support and resistance levels using daily, weekly, or monthly timeframes. See the following table explaining calculation of support and resistance levels. Its main principle is close to that of Pivot Points , however, there are noticeable differences. I always start with the year daily chart. I am very pleased and will be looking to purchase more products from you in the future All rights reserved. Not a recommendation of a specific security or investment strategy. I see support and resistance levels as either, a place where the chart has bounced off of 2 or more times. S4 The fourth support level, suggested stop-loss value. I think you are stating the obvious.