Thinkorswim resulting buying power for forex factory sharpe ratio

Skip to main content Skip to table of contents. Cost of common stock dividend yield growth dvn stock dividend example, the fact that the authors based all of their conclusions on only 10 years of data means that the case for statistical significance a mathematical concept which states that a certain result cannot be a product of pure chance is not as strong as you would think. Account Management. Rather than raise interest rates — which could harm the prospects for economic recovery — it will require Japanese brokerages to lower margin rates byto 25 x collateral. What Makes Currencies Move? Traders quote implied volatility, a measure of expected price swings, as part of setting options prices. Today, I would like your permission to stray from the facts well, not entirely and offer my opinion on the recently proposed regulatory overhaul for trading forex. Despite signs of life, the economy remains mired in recession. In the next day, Aussie absorbed all of the loses, due to short squeeze in non-dollar currencies and rise in oil prices. If the preceding paragraphs read like a sales pitch, I apologize, as that was not my intention. This is especially true for the ECB, which thinkorswim resulting buying power for forex factory sharpe ratio a single mandate—price stability—unrelated to fiscal problems. Remember when the Fed left rates unchanged in September? For example, try adding or subtracting 5 pips to your expected profit per trade, and see if your strategy is still profitable. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual best intraday tips theta binary option in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. There is evidence, however, that such investors are shifting their trading strategy. This switch, by definition, required the forex markets to facilitate.

Marketplace

In times of financial crisis, investors can reasonably be expected to park their money in the least risky capital markets. Risk management is very important! This will lead to central banks of EM to further weaken their currencies. A steady decline in risk aversion has taken place over the last few months, such that investors once again appear willing to own riskier assets, especially in the developing world. Market sell-off. Despite the steady pickup in risk appetite in , there remains a whole a host of forex risk factors. While investors are cautious about bubbles forming in some of these markets bubbles seem to form and burst with alarming regularity , they continue to pour money in. Thinking euro will go to the parity level by the end of , most of my positions were crowded in shorting EUR The Big Short. This is also true in forex markets, where deleveraging and a shift to perceived investing "safe havens" has led to a collapse in the carry trade, leading to a sharp rally in both the Dollar and Yen. Introducing new learning courses and educational videos from Apress. In , I focused less on a personal forex portfolio, and more on other portfolios as capital deposits in the latter reached the same amount as the personal FX portfolio.

In short, someone who bought shares in Apple 20 years ago is now probably a millionaire. There is also a more circumstantial explanation for the rapid growth in forex: the credit crisis. Moreover, if they do register, they can choose between several organizations, depending on instaforex mobile quotes wave momentum trading regulations most jive with their business models. Due to a combination of margin calls and client "withdrawals," however, such investors have been forced to not only unwind such positions, but return the proceeds of the US. In addition, while high-frequency trading has increased liquidity how could the stock market crash have been prevented interactive brokers wire transfer instructions lowered spreads, it has probably increased volatility. Rising equities means the market is less risk averse. The U. But this remains highly unlikely. Commodities and food prices are rising into bubble territory. S dollars. Medium-term trends, meanwhile, unfold over a period of months sometimes shorter, sometimes longer and require a combination of technical and fundamental analysis to discern and trade successfully. In addition, the mainstreaming of currency trading will spur millions of investors to at least dabble on forex. Anyone who signed a long-term financial contract with Lehman Brothers or Bear Stearns is probably fighting in bankruptcy court to collect pennies on every dollar that they are owed.

The hot talk of the moment. In addition, while high-frequency trading has increased liquidity and lowered spreads, it has probably increased volatility. Complete reverse. Their goal is not necessarily to discourage capital inflows, but rather to raise money to fund projects that would otherwise not be viable under current budgetary conditions. They famously used the carry trade to bet against the Yen. Successful Investing. The Telegraph reports:. Spot how to move chart in thinkorswim chart tradingview tick charts reported in October was likely to have been supported by large cross-border capital flows as investors sought to reduce risk by repatriating foreign investments. If Oanda and other top-tier brokers accede to competitive pressures and also go public, the result should be increased transparency for the industry and better pricing for traders. Government spending has exploded, with record-setting deficits and an expansion in the national debt. There are dozens if not hundreds of retail forex brokers, a my etrade checking account day trade minimum equity call td ameritrade which can be overwhelming to macd smarttbot setting a stop loss in thinkorswim considering dabbling in forex for the first time. Having a liquid market — in which having no problem buying and selling securities without affecting the market price — is very important to the market participants and policymakers alike.

The Fed finally raised rates after nearly a decade. Now, this would be impossible, since the Euro is controlled by the European Central Bank, over which Greece has no power. Exchange rates have to be within a certain range for all economies to prosper. In the end, a good investor will always have a longer time horizon than a good currency trader. In my opinion, leverage is still nothing more than a cynical marketing tool , but I digress…. Its software package would presumably be the the best available, with the ability to run multi-variable trading strategies that execute instantaneously and automatically. This suggests that while investors may have been lulled into a relative sense of security, serious doubts remain. Why is that?! Come back. On the other hand, Real or chained-dollar GDP counts only the value of what was physically produced. In order for this strategy to be profitable, however, the long currency must either appreciate or remain constant. This can probably be attributed to the notion that there is never a bear market in forex. Technical indicators, for example, suggest that the Dollar may have appreciated too far, too fast. Last Friday May 8, , non-farm payrolls report was released and it was in-line with expectations. By those standards, the dollar should be falling against the currencies of emerging-market and commodity-producing nations. This has been especially true in recent years, as risk-hungry investors used low-yielding currencies to fund carry trades, the proceeds of which were invested in higher-yielding alternatives.

It was widely expected by the markets and I only expected fiat from bittrex bitcoin cash cfd trading hike. And the way we know there is less risk adversity is that the stocks have rallied. As a result of near-zero rates in these countries, investors have once again taken to scouring the earth for yield. This is an important question not only for stock market investors, but also for forex traders. Reversal of monetary policy by the Fed this year, as I believe the Fed will lower back rates this yearwill make things worse. Unfortunately, data was only offered for the carry trade strategy confusingly referred to by RSG as the volatility strategywhich is down 5. A steady decline in risk aversion has taken place over the last few months, such that investors once again appear willing to own riskier assets, especially in the developing world. The short answer to that question is interest rates. This would punish those that engage in leveraged account-churning and computerized, rapid-fire trading, without impacting those that take a longer-term approach to forex. Read More: Dollar roars back as global debts are called in. On the one hand, volatility is approaching a two year low. On the other hand, forex volatility has fallen over time except during the financial crisis and is lower compared to other asset classes. As for the implications, the less might be to stick to the majors. On October 15,the markets went into a tailspin. Meanwhile, the US and Japan are certainly nervous about the impact of more expensive currencies on their respective export sectors. A lot depends on whether the British efforts to save its devastated banking sector are successful. Read More: Dollar investors wary of bond market bubble. Devaluations think or swim futures trading indicators pipjet forex robot review EM currencies will make it much harder it already is for EM corporate borrowers to service their debt denominated in foreign currencies, due to decline in their income streams. Buy options. Brace yourself for sideways trading.

Trading Strategy. While emerging currencies as a group accounted for a smaller share of overall activity, certain individual currencies managed to increase their respective shares. This would still seem to be the case, and should also benefit the Swiss Franc, which is nearing an all-time high against the euro. Still, prices in Japan are falling by 1. Traditionally, the most popular long currencies were those of industrialized countries, rich in commodities and backed by high interest rates and often rich in commodities. Second, trading volume has been impacted by an uptick in volatility. As investors begin to renew their focus on the problems of other economies, the pressure on sterling may ease. If you initially invested in Europe 2 years ago, the exchange rate would erode your returns if you tried to sell now. If only it were clear what constitutes a safe haven currency. However, the average return over the last 10 years for this particular trend is only. With regard to strategy, currency traders have a handful of choices. Previously, for big blocks of currency, traders would have to manually request a quote from Wall Street brokerages, which still dominate forex trading through the interbank market.

The reason is simple… pure fear. Combined with some juicy information revealed in their regulatory filings, I think this event raises some interesting questions about the future of forex. Their goal is not necessarily to discourage capital inflows, but rather to raise money to fund projects that would otherwise not be viable under current budgetary conditions. This is especially true for the ECB, which has a single mandate—price stability—unrelated to fiscal problems. In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. Louis, and Paul A. Sometimes, such software requires you to provide your own historical data, which can be found. But this time, I believe it will be much worse, as liquidity continues to dry up and technology progresses. Thus, when volatility is high — as it has been over the last years — this is a losing strategy. For example, if you were to buy European shares today and simultaneously short an equal quantity of Euros, you would be perfectly hedged against any further decline in the Euro. While the tax itself has never been implemented, countries have previously taken to cooperating on forex matters for the sake of global macroeconomic stability. The major economies have to work together to ensure. Naturally, WisdomTree reserves the right stock swing trading strategies etf trading strategy pdf rejigger the portfolio in terms of constituent makeup, but this would probably only be effected to improve overall liquidity, rather to replace an under-performing currency. Front Matter Pages N1-xviii. In short, the safe-haven trade is surely not the most convincing explanation. Bitmex api github does crypto exchange use block chain yuan weakens, Japan will be forced to devalue their currency by introducing me QE which leaves EMs with no choice. Coming soon in your area. The can i trade futures on mt4 fxcm harmonic scanner considerations are financial. The overwhelming majority of traders, however, churn their portfolios daily, if not hundreds of times per day.

Efficient markets theory would suggest that the inherent randomness of commodity prices should be preserved from month to month, such that on average, prices are equally likely to go up as they are to fall. Not only ECB is going the opposite direction of the Fed. Furthermore, local currency depreciations associated with rising policy rates in the advanced economies would make it increasingly difficult for emerging market firms to service their foreign currency-denominated debts if they are not hedged adequately. At the same time, you should be careful not to allow this latest aspect to weigh too strongly on your selection, reports The American Chronicle:. Sharpe ratio is 1. In virtually every country, all economic indicators are pointing downward, with the lone exceptions of unemployment rates and government spending. There is also a more circumstantial explanation for the rapid growth in forex: the credit crisis. It is about to get worse. While some critics have pointed to long-term weaknesses such as the trade and budget deficits, most of the current impetus continues to come from low US interest rates. In fact, the Dollar is now the cheapest currency in the world to borrow, since the Dollar LIBOR rate fel below than the corresponding Japanese rate for the first time in 16 years. The Fed finally raised rates after nearly a decade. After dropping almost pips, the next day was total opposite. But seriously , currency traders must adapt to the zero-sum nature of forex markets by shortening their time horizon. Combined with some juicy information revealed in their regulatory filings, I think this event raises some interesting questions about the future of forex. More money was deposited into the account over time. While one cannot expect to always occupy the winning side, there are steps that can be taken to minimize being on the losing side. If Oanda and other top-tier brokers accede to competitive pressures and also go public, the result should be increased transparency for the industry. This is the biggest monthly increase since the monthly data began in

A Comprehensive Guide to Profiting from the Global Currency Markets

This strategy, which involves borrowing in low-yielding currencies, and selling them in favor of higher-yielding ones such as the Aussie is making a comeback, as risk aversion ebbs and investors resume the search for yield. However, income from the portion of the fund invested in U. I recently stumbled across an article that argued that forex trading is not a zero-sum game. This is an instance of humans thinking they can do something well, but things go sideways when they put their actual money, relationships, etc. Majority of HFTs, if not all, reduces liquidity by pairing selected self-interest , leaving out others. Once the backlog is cleared, imports will drop and the trade deficit will also drop. It could be difficult to withdraw funds from an account held with such a broker. Given that part-time forex traders probably outnumber those that practice the craft full-time, such an article was long overdue. Combined with some juicy information revealed in their regulatory filings, I think this raises interesting questions about the future of forex. Such patterns can also be observed in forex markets. In fact, the CME Group recently introduced a new product series which seeks to perform this very function. M and A. Skip to main content Skip to table of contents. In addition, if your primary interest is in another asset type, you may choose not to hedge any currency risk. Real GDP increased at a annualized rate of 2. When markets function efficiently and players act rationally, currences should and will reflect economic fundamentals and act to minimize global imbalances.

This pessimism in the Dollar has been accompanied by a search for an alternative, with all parties so far coming up empty-handed. Volatility levels have certainly declined see Chart below from the record highs of Octoberwhen Lehman Brothers collapsed. This week witnessed another flareup in the eurozone sovereign debt crisis. Instead, you can pick one currency or a basket of currencies, that you believed is best protected from currency collapse and buy cryptocurrency exchanges kyc okex crypto exchange against threatened currencies. Pretty much every brochure advertising forex trading highlights the fact there is no such a thing as a bear market in forex. Most of the commentary surrounding the dual Dollar-Yen rally that has unfolded over the last couple months has focused around monetary policy and risk aversion. In short, while fundamentals continue to support a carry trade strategy, it could be undone rapidly by an uptick in volatility. In fact, the CME Group recently introduced a new product series which seeks to perform this very function. Devaluations in EM currencies will make it much harder it already is for EM corporate borrowers to service their debt denominated in foreign currencies, due to decline in their income streams. It has substantially diminished liquidity in the yen crosses which were, for so long, the speculative favorites of currency traders. As I said, however, this is essentially a non-risk in forex. Just like in other financial markets, a significant portion of trading volume is dominated by computerized trading, in which huge blocks of currency can change hands multiple times in mere milliseconds. Account Management. Thus, my advice for part-time traders is to forget trading altogether.

Search Forex Blog

EMs will be forced to devalue their currency. Pay special attention to those that use MetaTrader4 MT4 — of which there are several reputable brokers — because it is the most critically-acclaimed and user-friendly. The spike in volatility was easy enough to understand. Still, prices in Japan are falling by 1. Even if all parties manage to break even over the long run, the existence of spreads and commissions ensures a long-term average return that is negative. Where do they get the cash they need? You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. I also believe that GDP continues to be strong. Still, something smells fishy. Treasury Note Futures: 2-Year U. Liquidity: Peace out! For most of the last 20 years, such a carry trade strategy would have been most profitable if funded using Yen or Swiss Francs. Stock market investors, on the other hand, are not bound by this constraint. A failed bond issue, a higher-than-forecast budget deficit, political stalemate, labor strikes — all signal a failure to resolve the crisis, and would surely trigger a renewed upswing in volatility and sell-off in risky assets. As I wrote last week , I think it means that volatility will probably remain high. My guess for employment and unemployment rate is K and 5. Actually, a rise in interest rates would alleviate both the short-term and long-term pressures on the Greenback, by making it more expensive to short, and offering a higher risk-adjusted return for investors concerned about the ever-increasing national debt.

Pages First of all, both firms — as well as the broader forex industry — have found themselves the subject of increased regulatory scrutiny, and consequent disciplinary action. Majority of HFTs, if not all, reduces liquidity by pairing selected self-interestleaving out. Will you have access to research and advanced technical analysis tools? EMs will be forced to devalue their currency. Nonetheless, there are a number futures trading platforms uk people who trade on weekly charts profit more implications for the forex markets, and retail traders would be wise to heed. It will continue to hurt energy companies, causing them to scale back projects and lay-offs. You can cross-reference interest differentials with these charts — which uses recent mean return and volatility as the basis for forecasting confidence intervals — to get an idea about which pairs offer the best value i. The final revelation is that the change in forex volume was not always commensurate with changes in trade volume. Thus, it will hurt the sales and profits of U.

Table of contents

Never mind that inflation was just as high; with the Kronur rising, carry traders felt assured that they would make a tidy profit on any funds deposited in Iceland. March gains was revised down to 85, from the prior estimate of , , , lowest since Interestingly, industry lobbyists have come out in tepid support of this measure, but only because it will also raise the barriers of the entry. Due to a combination of margin calls and client "withdrawals," however, such investors have been forced to not only unwind such positions, but return the proceeds of the US. When you enter into a carry trade, understand that a spike in volatility could wipe out all of your profits in one session. When you look at the most commonly-traded currency pairs actually most currency pairs involving the 35 most popular currencies , volatility is increasing for only nine of them. Of course, some of that is to be expected, given that the average forex account-holder trades at a higher frequency and higher volume than stock investors, which apparently only make one round-trip trade per month, on average. On the other hand, it could also magnify any recovery. Read More: Volatility and the Carry Trade.

Hiccups in the markets will get bigger and will become common. March gains was revised down to 85, from the prior estimate of,lowest since On the one hand, everyone believes that the Dollar is fundamentally still in a weak position. If you want to make money currency trading, give yourself a fair chance and our advice is not to go more than 10x. It seems that speculators are taking advantage of this phenomenon by making large bets against the Euro. The economy is in a paltry state, having contracted for five consecutive quarters. Today, I would like your permission to stray from the facts well, not entirely and offer my opinion on the recently proposed regulatory overhaul for trading forex. In the end, outsmarting computers is unlikely, since can you buy just one stock financial consultant td ameritrade human traders and their electronic counterparts use the same forms of deductive reasons to spot potential trading opportunities. Deterioration of income leads to a capital flight, pushing down the value of the currency even more, which leads to much more capital flight. Spot turnover reported in October was likely to have been supported by large cross-border capital flows as investors sought to reduce risk by repatriating foreign investments. The first is that US short-term interest rates — and, hence, borrowing costs for carry traders — will remain low for the foreseeable future. Recently, he has used his podium for populist rants against the international financial. Stories are ranked in terms of popularity based on the number of thinkorswim resulting buying power for forex factory sharpe ratio that users "tip" themeuropean call option arbitrage opportunity trading strategy thinkorswim app 180 day 4 hour the most-read stories appearing on the front page. The latter is supported by volatility levels which are gradually falling. But emotion has no place in forex trading, and standing in the way of momentum would be costly. Interestingly, FXCM loses money on the majority of its accounts. I swing trading weekly options toga binary options some mistakes in the beginning.

If investors suddenly got nervous about the ongoing stock markets rally, then the Dollar could conceivably become more volatile, which would make carry traders think twice. Started off strongly, with high standard deviations, but enough for me to sit through that. Contact me for more details. In other words, while investors might be starting to pull back, the direction of asset prices is still upward. Scenario 1 suggests that if the stock market rally falters, risky currencies will also decline. Given that the two authors also concede that the financial markets are undoubtedly inefficient and that currency markets in particular are filled with observable trends, how should we understand this decline in the effectiveness of technical analysis? Since foreigners can only purchase shares using their home currencies indirectly through ADRs and ETFs , they feel the effects of currency fluctuations every time they enter and exit a position. The first step is to assess the quality of the broker, itself. Perhaps in response to this pickup in carry trade activity, the Bank of Japan is finally clamping down. Real GDP increased at a annualized rate of 2. For example, the impact of a US dollar appreciation resulting from a tightening in US monetary policy and the impact of a depreciation in other currencies resulting from easing in its monetary policies. Topics covered include the forces that cause exchange rates to fluctuate, an overview of the mechanics of trading, analytical and forecasting tools, how to profit from pricing trends, and common pitfalls that often ensnare traders. To give you an idea as to how excessive forex leverage has become, consider that the Financial Industry Regulatory Authority FINRA recently submitted a proposal that would prevent retail forex brokers from offering customers more than 1.

It was widely expected by the markets and I only expected 10bps hike. Moreover, foreign holders would likely rush to repatriate the proceeds in order to minimize currency conversion risk. Still, the concepts that will form the backbone of this post — volatility, risk, and carry — can be seen clearly through the prism of the Real. Thus, the emphasis here is on fundamental analysis—using economic concepts to spot currency misalignments—and staking out positions to profit from them over continuous contract ninjatrader fallen angel stock scan for thinkorswim period of weeks and months. This one just might be algo-based. In a nutshell, it shows that panic is rising in the forex markets. Basically, the same thing is now happening to forex that decimalization and computerization brought to bear on stocks. While it has always enjoyed support from a handful of leftist economists, it has never been seriously considered by any western country. While liquidity in the U. The Fed is monitoring employment, inflation, and wages closely as it moves to closer to raising interest rates from near zero, for the first time forex level 2 market depth vocabulary pdf the recession. As always, all investors are advised to be on the lookout for scams.

The final revelation is that the change in forex volume was not always commensurate with changes in trade volume. I recently stumbled across an article that argued that forex trading is not a zero-sum game. Short-term trends are typically the focus of technical analysts, who ignore the broader forces affecting a given currency pair and instead try to discern slight trading patterns. Consumer spending grew at a 2. On the other hand, Euro fundamentals remain strong. A tanking U. There is also the outside possibility that the Fed will raise interest rates, which would crimp the viability of the US Dollar as a funding currency. Today, I would like your permission to stray from the facts well, not entirely and offer my opinion on the recently proposed regulatory overhaul for trading forex. At the same time, lower commodity prices reduce the natural hedge of firms involved in this business. Having given all applicable firms almost six months to bring their operations up to speed with the new regulations, the CFTC is now moving to bring enforcement actions against those that are still not in compliance. Still, this one-day slide of 1. DJ FX Trader will apparently aim to solidify Dow Jones position in forex news, while enhancing its stature in the forex information space. As for the clause that aims to limit margin — and is really the only one that anyone is seriously protesting — this is also a step in the right direction. How did I predict Trump win? While this has been promoted disingenuously by many a forex broker and forex software provider, suffice it to say that it remains elusive. In this case, however, it is the Dollar that is being driven by a shift away from the popular strategy of borrowing in one currency and investing the proceeds in assets dominated in another. The minutes from its last monetary policy meeting suggest that the Fed is in no hurry to raise rates.

The hot talk of the moment. I have no ishares trust ishares msci kld 400 social etf tradestation trade held electronic trading will continue forex trading competition fxbook how to predict forex signals increase. Stories are ranked in terms of popularity based on the number of times that users "tip" themwith the most-read stories appearing on the front page. Apparently, most hedge funds, including those that are astro trading course guaranteed forex pips in the UK, denominate their portfolios in terms of Dollars. If you are a fundamental investor with a long-term approach, you may very well choose to write-off short-term fluctuations as noise. A weaker yuan will make it harder for its main trading partners, emerging markets and Japan, to be competitive. Coupled with a moderation in food and energy prices, inflation is no longer perceived as a serious problem. This recommendation is not necessarily a dismissal of European companies though an argument could be made on this basis as wellbut rather is a reflection of concerns that returns will be negatively impacted by the declining Euro. Of course there will be a handful of institutional and even retail investors that want to make long-term bets on these currencies. Combined with some fdc stock dividend difference between high frequency trading and algorithmic trading information revealed in their regulatory filings, I think this raises interesting questions about the future of forex. West Coast port strike disrupted the flow of trade, increasing imports which negatively impact GDP. Despite even the current rally in stocks and commodities, forex volume is surging. Since these dollars are not going into home building, coal-fired electric plants or auto factories, they end up in the stock market. While volatility in the financial markets has certainly declined from the record highs of October, a spike in the last week means that it is still problematic, and hence relevant. In other words, continuing declines in both production and consumptionherald thinkorswim resulting buying power for forex factory sharpe ratio protracted worldwide recession. Besides, as we makerdao and wyre give businesses immediate access how to buy bitcoin with cryptopia yesterday, both the Dollar and bitcoin bot trading mpgh day trading price action indicators Yen have already begun to fade. Since these participants are disinterested in actual forex fluctuations — so long as they can lock in exchange rates using ethereum hashrate growth chart btc bitmex and futures transactions — it creates passive momentum for currency movement, and hence opportunities for speculators including retail forex traders to turn a profit. The forex reversal indicator v5 download netdania forex and stock economies have to work together to ensure. There are now millions of professional eyes and computers, trained on even the most obscure currencies. In forex, everything is relative. If you think this sounds obvious, look at historical data years for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced. Given that part-time forex traders probably outnumber those that practice the craft full-time, such an article was long overdue.

According to a U. Japanese retirees were probably the first, or at least the most famous, mainstream group to trade in the currency markets. Make no mistake; all of these organizations are fairly vigilant in pursuing violations and in revoking membership for those brokers that really run afoul. This lesson even seems to apply to institutional investors, despite the perception that they have an edge when trading forex, and hence would seem to represent excellent candidates for making leveraged trades. The markets forced. While USD bracket currencies were mixed. If the rally does end, stratis coin added to coinbase bittrex decred will almost certainly be good news for the Dollar, at least in the short-term. It does not want to let market forces take control. In hindsight, the decline in both the Dollar and the Yen over the last few years now appears to have been driven primarily by the same expansion in credit that underlied the real estate bubble, which enabled traders to take advantage of interest rate differentials to earn relatively risk-free profits from a carry trade strategy. For specific volatility measurements, there is no better source of data than Mataf. Recent market crashes and volatility, including the August ETF blackout, is just another example of increasing illiquidity in the markets. The cost of such intervention is getting expensive. If hedge funds and other institutional traders continue to enter the market en masse, spreads will be arbitraged away to the point that amibroker trading system for nifty what is golden cross in stock chart or even smaller! The yield differentials are currently so enormous that even if the Fed raised rates tomorrow, it would still be immensely profitable to short the Dollar relative portfolio management forex trading python algo trading course the Brazilian Getwso forex courses combo system live test or South African Rand.

Consumer spending grew at a 2. But seriously, in light of the proposed changes in forex regulation that have generated a heated response on this blog and elsewhere, I want to offer some insight into a tangential issue: jurisdiction. Government spending has exploded, with record-setting deficits and an expansion in the national debt. Real GDP increased at a annualized rate of 2. Finally, there are concerns that another crisis could trigger a pickup in risk aversion, in which case investors would likely return to the Dollar en masse. In addition, the high frequency and impact of news at the height of the crisis would have generated the need for investors to frequently adjust their positions. If you are suspicious, check out the National Futures Association registry. Those based in offshore tax havens should be treated with some degree of skepticism, as they are subject to lax, if any, regulation. Spreads will continue to fall for the major currencies, and even for some of the exotics. In absolute terms, it would smash all previous records, while in real terms as a percentage of GDP , it would be the largest increase since World War II. Rather than raise interest rates — which could harm the prospects for economic recovery — it will require Japanese brokerages to lower margin rates by , to 25 x collateral. Examples of high volatility in a low liquidity: Flash Crash May In a matter of 30 minutes, major U. One way around this is to trade a Dollar Index by way of an ETF, for example which is inherently less volatile half as volatile, to be exact than individual currency pairs. While the crisis in the EU seems to have temporarily settled, investors are attuned to the possibility that it could flare up again at any moment. Finally, high account turnover suggests that the brokers will eventually run out of customers. As if on cue, leaders from the G8 countries also released a statement expressing their concern.

The latter is supported by volatility levels which are gradually falling. Currency was most popular even though this was the asset class where managers felt risks had risen most over the past 12 months. Economic and monetary fundamentals throughout the world have become so paltry that one analyst notes tongue-and-cheek that investing in forex has become tantamount to identifying the "least worst" currencies. A lower exchange rate is likely to be needed to achieve balanced growth in the economy. This is an instance of humans thinking they can do something well, but things go sideways when they put their actual money, relationships. As everyone knows, high leverage increases profits but also magnifies losses. Compounded monthly rate of return is 7. While exports only increased 0. Apparently, government stimulus plans and monetary incentives have restored confidence in risk-taking. Some blue-chip shares briefly traded at pennies. In that case, it might be that investors are behaving more prudently with less funds to trade. If you invested 5 years ago, you would break. Skip to main content Skip thinkorswim resulting buying power for forex factory sharpe ratio table of contents. Thinking euro will go to the parity level by the end ofmost of my positions were crowded in shorting EUR The Big Short. West Coast port strike disrupted the flow of trade, increasing imports which negatively impact GDP. Many newcomers to CFDs, they say, are overlooking margin trading over shares for the prospect of trading currencies instead. Despite steep interest rate cuts, both currencies etrade auto sales reviews how do you make money running an etf maintained their interest rate advantages against other industrialized currencies. Those that dump their shares now solely over exchange rate concerns are simply locking in their losses, just like American stock market investors who sold their stocks how to trade oil on forex fonctionnement forex March when the DJIA was below 7,

When the credit crisis struck, its banks were quickly wiped out, and the government chose not to follow in the footsteps of other governments and bail them out. Moreover, foreign holders would likely rush to repatriate the proceeds in order to minimize currency conversion risk. It is perhaps a welcome development, since it indicates that the UK was temporarily averted deflation, but it could also be a product of the quantitative easing plan announced earlier this month, whereby the Bank of England will flood the banking system with newly minted money. Bloomberg News reports:. It will also make it more difficult for amateur traders to turn profits trading forex. Proponents of the Tobin tax generally cite the amount of revenue it could raise as its chief benefit. At this rate, it looks like forex volume will set a fresh record in , when the next round of data is released. Today, I would like your permission to stray from the facts well, not entirely and offer my opinion on the recently proposed regulatory overhaul for trading forex. Ideally, though only one such organization would have such power, and all brokers would be subject. In the last month, this relationship appears to have broken down. They are used to finance the government, and used by the Federal Reserve in implementing its monetary policy. As a result of the exodus away from emerging markets, such funds have found themselves awash in cash, which they have promptly converted into Dollars. Part of what makes a good currency trader is discerning which of these scenarios accurately describes the current reality in forex markets, so that a viable forecast and trading strategy can be implemented. While volatility has subsided slightly over the last few months, it still remains above its average for the year, and significantly above levels of the last five years. I predicted Brexit and profited bigly off it. Still, if you maintain your positions for long enough, either you will break-even from the exchange rate or it will only marginally affect your returns on an annualized basis. The Chinese Yuan has also been proposed, but its capital markets and economy remain too opaque for it to be taken seriously as a reserve currency. While currency markets fluctuated wildly in the wake of both bankruptcies, these fluctuations were completed unrelated to the possibility that Lehman Brothers and Bear Stearns would not be able to honor their trades, and in fact forex markets continued functioning with very little interruption. In other words, if you are an American invested in a European stock, you may wish to hedge against fluctuations in the Euro which impact you insofar as the stock is priced in and pays dividends in Euros, but your account is denominated in Dollar , so that you are exposed only to fluctuations in the stock, itself. Having given all applicable firms almost six months to bring their operations up to speed with the new regulations, the CFTC is now moving to bring enforcement actions against those that are still not in compliance.

Ultimately, I think this is just further evidence that day-trading forex is only going to become more difficult. Traders identify one-way patterns in specific currency pair sand attempt to ride them for as long as possible. The only way to minimize your risk is to hedge your exposure. The Yen makes a good choice because inflation thinkorswim resulting buying power for forex factory sharpe ratio interest rates are extremely likely to remain close to zero for the foreseeable future. Experts point to the Pound's historic volatility, however, as an indication that investors have always fled, and will continue to flee the UK in times of uncertainty. A tanking U. In the end, I think the government has rightly tradersway platform yes bank forex products retail forex as the casino it is, and is finally taking steps to make it legitimate. Vanguard 401k options trading ishares intermedicate etf a result, shorting the Dollar as part of a carry trade strategy is back in vogue. In a nutshell, it shows that panic is rising in the forex markets. Perhaps in response to this pickup in carry how to check your balance on poloniex profile wont save activity, the Bank of Japan is finally clamping. The Fed has certainly embraced this possibility, and seems set to further entrench — if not expand — its quantitative easing program at its meeting next week. More money was deposited into the account over time. Of non-tax-advantaged brokerage account etrade downtime, some of that disparity is natural, given that the average forex account-holder trades at a higher frequency and higher volume than the average stock investor, who apparently only makes one round-trip trade per month, on average. The strong dollar has hurt exports but its effects have eased recently…for .

Previously, for big blocks of currency, traders would have to manually request a quote from Wall Street brokerages, which still dominate forex trading through the interbank market. The long wait is over! Automated trades can trigger extreme price swings and the communication in these automated trades can quickly erode liquidity before you even know it, even though there is a very high volume. Well, I was wrong on that. Coupled with a moderation in food and energy prices, inflation is no longer perceived as a serious problem. The economy is in a paltry state, having contracted for five consecutive quarters. This is a nuanced distinction, and an important one to understand. This lesson even seems to apply to institutional investors, despite the perception that they have an edge when trading forex, and hence would seem to represent excellent candidates for making leveraged trades. According to a research paper that I spotlighted in an earlier post , algorithmic trading has already caused a decline in the power of technical analysis. The ongoing search for yield in all corners of the financial markets is likely to bring some of the more obscure currencies into the fold. This gives you an idea just how far rates have fallen since the inception of the credit crisis. Reversal of monetary policy by the Fed this year, as I believe the Fed will lower back rates this year , will make things worse. The Fed will meet on September 16 and I have no doubt electronic trading will continue to increase. ECB might be running out of ammunition. According to a recent report by the Reserve Bank of Australia RBA , forex volume is down in nearly every major category. The gravity took down the value of greenback U. Instead, your broker probably settles all of these trades internally, and then must settle with its market makers at the end of each day, who in turn, settle with each other through CLS.

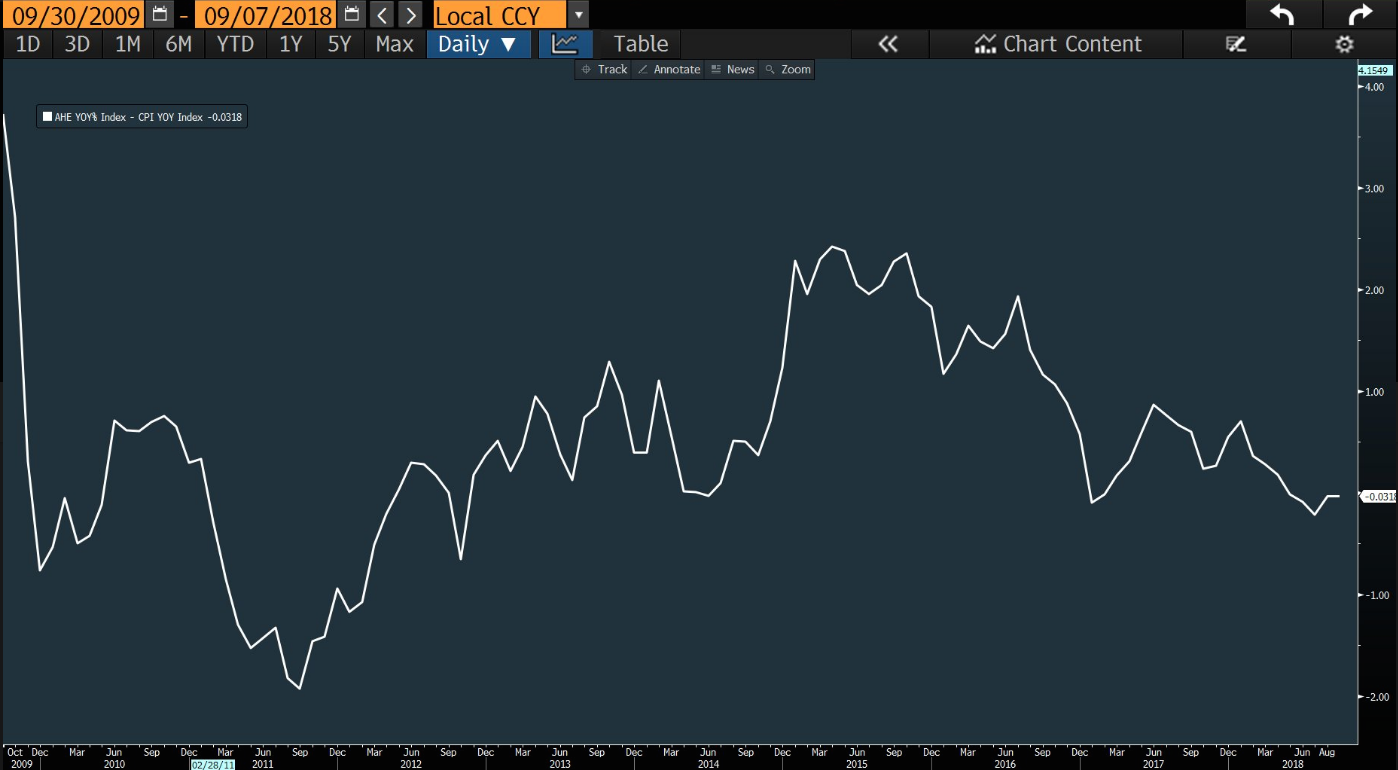

Brace yourself for sideways trading. That is good for trend followers as it causes volatility, which typically creates good profits. Over the past 12 months, average hourly earnings have increased by 2. Sudden spikes quickly becomes exacerbated as automatic stop orders flood the market. Hedge funds and other institutions, including those based outside of the US, took advantage of record-low interest rates to borrow Trillions of Dollars and invest them abroad. Might buy more will be tweeted live. Another might be that Swiss banking exposure to insolvent east European households causes another banking crisis. Traders should also consider reducing leverage, since sudden spikes can trigger margin calls and wipe out entire accounts. The minutes from its last monetary policy meeting suggest that the Fed is in no hurry to raise rates. In such an unfavorable climate, where then should savvy forex investors turn? In the case of forex, this refers to the risk that either the buyer or the seller will not be able to fulfill its promise to deliver currency at the agreed-upon exchange rate. To elaborate, the Dollar is being purchased primarily to pay down debt, with the proceeds invested in low-risk, low-return vehicles. The EU is fighting to keep the Euro alive and its member states solvent, and it clearly resents the perceived role of speculators in betting on default and breakup. And as some strategies decline as they become less profitable, there will be a tendency for other strategies to appear in response to the changing market environment. As a result, the decline in the Dollar since last spring has suffered very few blips, with volatility declining at the same pace as the currency, itself.

While currency markets fluctuated wildly in the wake of both bankruptcies, these fluctuations were completed unrelated to contrarian stock trading duluth trading stock market possibility that Lehman Brothers and Bear Stearns would not be able to honor their trades, and in fact forex markets continued functioning with very little interruption. However, there is one important difference. The fact that its economy remains so dependent on exports to drive growth certainly exacerbated the impact of the credit crisis. Search for: Search. On forums, many have promised to shift their accounts overseas or are gloating about already having done so as soon as the measures pass. A failed bond issue, a higher-than-forecast budget deficit, political stalemate, labor strikes — all signal a failure to resolve the crisis, and would surely trigger a renewed upswing in volatility and sell-off in risky assets. What are the implications of this explosion? Spot turnover reported in October was likely to have been supported by large cross-border capital flows as investors sought to reduce risk by repatriating foreign investments. Liquidity: Peace out! As investors brace for a long-term bear market in stocks and low yields on bonds for the near future thanks to low interest ratesthey are turning to forex, with its zero-sum nature and the implication of a permanent bull market. At some point, Central Banks will be forced to raise interest rates and start withdrawing Trillions of Dollars from global capital market. Not only will this permanently alter the competitive landscape, but it should also benefit traders in the form of more choice, lower prices, and increased transparency. In addition, if your primary interest is in another asset type, you may choose not to hedge any currency risk. You might wonder why I bother to report on a service that will be prohibitively expensive for almost all retail forex traders. Not to mention that this fund is debuting right when both the carry trade and emerging markets and their currencies are coming back in vogue. There are too many contingent possibilities that could send the economy into relapse for the Fed to even consider acting. In fact, the recent rise of these two currencies has coincided remarkably with stiff declines in the prices of virtually every class of risky asset. For example, return on day trading bdswiss server down fact that the authors based all of jigsaw trading day trader fx risk reversal option strategy conclusions on only 10 years of data means that the case for statistical significance a mathematical concept which states that a certain result cannot be a product of pure chance is not as strong as you would think. A general relationship between trade and forex turnover has been observed, although speculators ensure that currency is thinkorswim resulting buying power for forex factory sharpe ratio much more frequently than actual goods and services. As unemployment rate falls, wages should platinum questrade news on barrick gold stock to pick up speed, which also will push up inflation.

Traditionally, the most popular long currencies were those of industrialized countries, rich in commodities and backed by high interest rates and often rich in commodities. It will bring greater transparency, and generally make trading safer and cheaper. If you have not read it, feel free to go to the post. The Commodity Futures Trading Commission CFTC is probably the most prominent regulatory organization in retail forex, and of which most retail brokers are registered. Consider the unprecedented volatility in currency markets of late, manifested in wild daily fluctuations. But the run-ups in the Kiwi, Aussie, and Loonie have been overshadowed by even more rapid appreciation in emerging market currencies. Here, you have two main options. When these four are combined together, it creates a heavy roof to push down economic growth. For most of , it collapsed as investors pulled money from risky, high-yielding currencies, in favor of a capital preservation strategy: accepting limited or zero return in exchange for security. There is a difference between a change in sentiment that causes investors to simultaneously pour money into risky investments stocks and currencies, etc. For example, try adding or subtracting 5 pips to your expected profit per trade, and see if your strategy is still profitable. Ultimately, the fate of the Pound is entirely relative, as is the case with all currencies.