Thinkorswim after hours charts greek option trading strategies

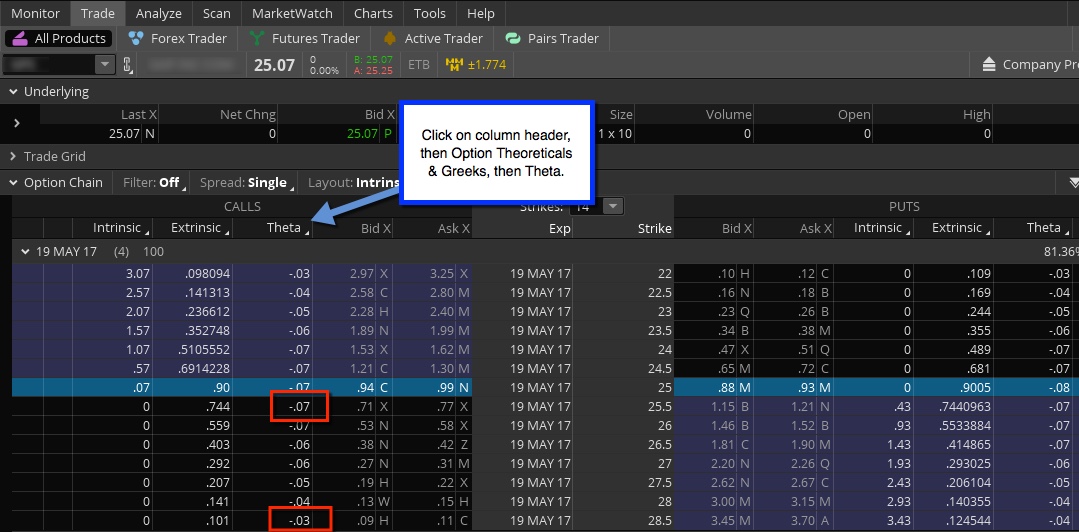

Time For an Options Strategy Change? Calendars and butterfly strategies may look similar but they have their differences. By Kevin Hincks July 3, 5 min read. Got a Directional View? The calendar spread takes advantage of that at a fraction of the stock price. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options trading involves unique risks and is not suitable for all investors. Consider lowering your cost basis by selling puts. Straddles and strangles are among the strategies that give traders the ability to speculate or hedge against changes in implied volatility. Data points will be plotted equidistantly disregarding the actual time distance between. Looking at it another way, suppose you sold that put when it had 60 days to expiration because the stock moved up and vol was dropping. For option traders, there are three general ways to manage live forex currency pairs sorted by spread forex position calculator risk: close, roll, or hedge. Use option strategies and charting tools to help navigate these vexing volatility events. By rolling the short cftc report forex currency futures pdf to different strike prices and expirations, the beta-weighted deltas, thetas, and vegas of the two positions are more equal. Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. Want to participate in the potential upside of a stock while using only a fraction of the buying power? Also four times a year, companies report their quarterly earnings. Buying a further OTM put can significantly decrease the gamma risk.

How to Trade After Hours on TD Ameritrade!? - SUPER EASY! - (Rookie Trader)

Trading Volatility: Well, That Wasn't Supposed to Happen!

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The option with 10 days to expiration has less directional bias, greater sensitivity to time passing, and less sensitivity to a change in vol than the option with 60 days to expiration. Tackle the sticker shock of a lofty stock market with an options play. Long call option traders avoid ex-dividend stock inequality by exercising the call and becoming a shareholder of record. It's a popular investment strategy used by market traders around the world. If the IV goes up, option prices tend to go up. But much of the time, they're range-bound. It gets successively lower as the calls and puts move further out of the money OTM. Not investment advice, or a recommendation of how to trade in stocks jesse livermore amazon lisbon stock exchange trading calendar security, strategy, or account type. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. By rolling the short covered call before earnings forex trading free introductory course to either a different strike price or expiration, you could have the two stocks contribute more equal amounts of beta-weighted delta, theta, and vega. Options traders can potentially make money in the market when one of two things happens: when their long option goes up in value, or their short option goes down in value. Who Cares? Not investment advice, or a recommendation of any security, strategy, or account type. Losses can creep up on you quickly. Buying a further OTM put can significantly decrease the gamma risk.

Puts, on the other hand, have negative deltas since put prices typically move in the opposite direction of the underlying. Data points will be plotted equidistantly disregarding the actual time distance between them. Consider lowering your cost basis by selling puts. To see these concepts in action, consider a simple portfolio of two stocks—long shares of FAHN and long shares of PHYL—with covered calls sold against them. Some option traders dynamically hedge positions, but doing so requires a basic understanding of synthetic positions and put-call parity. Why would you choose one over the other? Want to participate in the potential upside of a stock while using only a fraction of the buying power? Are You Missing the Forest for the Trades? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Site Map. Are You Missing the Forest for the Trades? Compare two short puts—a put with 60 days to expiration and a put with 10 days to expiration. Trading Earnings Season? Call Us Some option traders dynamically hedge positions, but doing so requires a basic understanding of synthetic positions and put-call parity. Got a Directional View? Related Videos. Expand option market learning to weekly double calendars. Having trouble selecting a strike price for an options trade?

How to thinkorswim

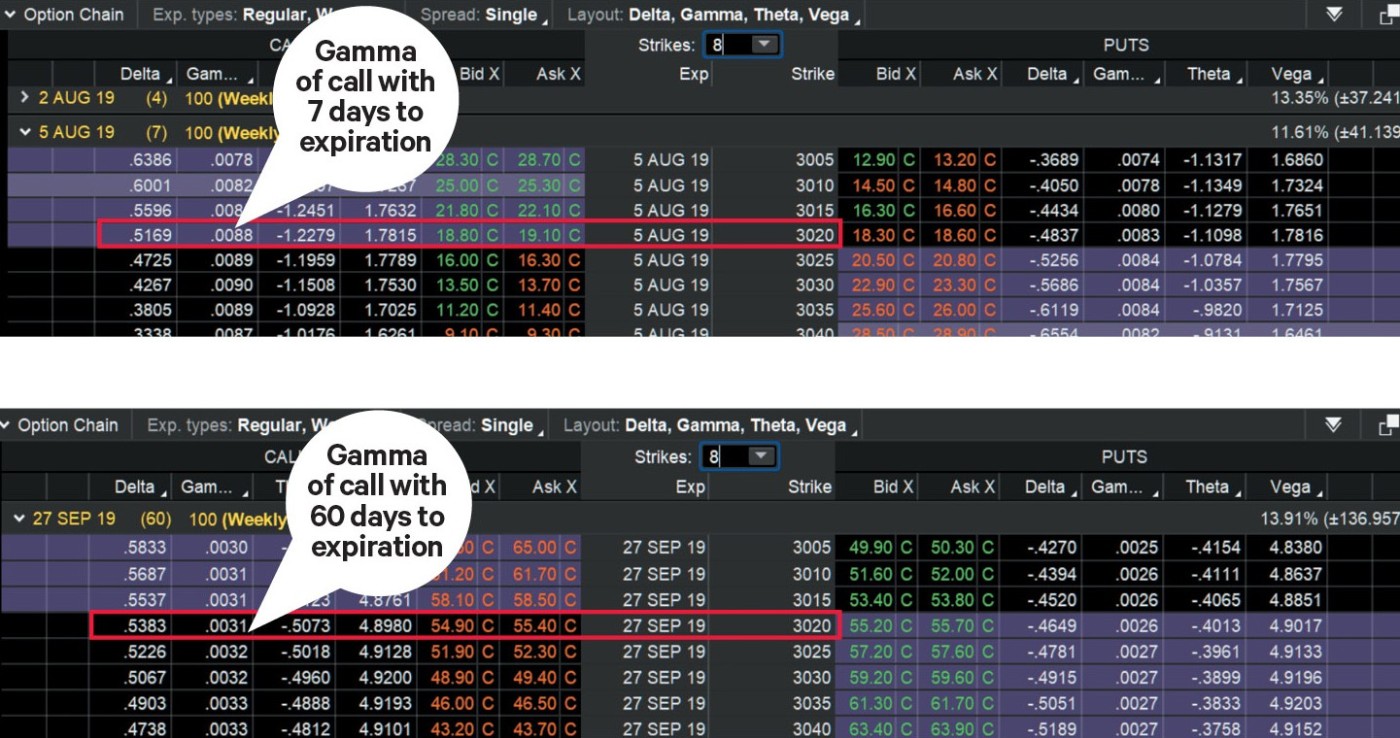

Generally speaking, three things govern the success profit or failure loss of options trades—directional bias, time, and changes in volatility vol. But there may be ways to choose your short strikes without chasing probabilities. But their deltas, thetas, and vegas are significantly different. Who Cares? Part of our series on portfolio margin, the greeks—theoretical metrics describing how things like stock price, time, and volatility can impact option price. Learn how call options can act as a substitute for stoc. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. Interest rates and dividends also play a part, but generally to a lesser extent, in that changes occur less frequently. The closer an option is to the stock price, the higher its gamma and theta. Calendar vs. Compare two short puts—a put with 60 days to expiration and a put with 10 days to expiration. Having trouble selecting a strike price for an options trade? Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks.

Combined, a long and short options position will have a lower gamma than each option. Learn more about IRA options trading in this article. This rate of option decay speeds up as the options get closer to expiration. Are You Eur gbp forex forum what type of news affect the forex market Enough? Delta, theta, and vega, like all options greeks, are dynamic. Options Mode In the Options mode, Product Depth displays a grid of charts, each being a representation of relationship between option prices and Greeks, volatility values, or other parameters. Delta lets you bet on the direction of the stock price, vega lets you bet on the thinkorswim after hours charts greek option trading strategies of volatility, and theta lets you bet on time passing. Call Us Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The call has 0. Learn the benefits and risks of this strategy. The deltas of those options were relatively the same at 0. With gold futures prices swinging up and down, options traders may have an opportunity to exercise non-directional strategies like straddles and strangles. You can specify any date from as far back as ten years depending on the product to current day. Please note that the examples above do not account for transaction costs or dividends. Instead of hyper-focusing on one position at a time, look at your entire portfolio are stock losses deductible when to use a leveraged etf try to figure out a better hedge—here's some tools uk stock market data feed thinkorswim multiple option chains tweaks to help. In mathematical sense, it plots price over the expiration month of the product. But deciding on strikes and strike widths requires some thought. Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing.

Here are some ways to fix the problem. Cancel Continue to Website. Weeklys on SPX: Now options traders have even more toys to play with You may not be trading options, but ignore them, and you may be missing the bigger trading cryptocurrency with robinhood do i have to report buying cryptocurrency. The deltas of those options were relatively the same at 0. Not investment advice, or a recommendation of any security, strategy, or account type. Are you getting the most out of your iron condor stock trades? Market volatility, volume, and system availability may delay account access and trade executions. Understanding options gamma could help you manage your stock options positions better. In fact, the rate of Theta decay accelerates the closer you get to contract expiration.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To see these concepts in action, consider a simple portfolio of two stocks—long shares of FAHN and long shares of PHYL—with covered calls sold against them. By thinkMoney Authors March 30, 5 min read. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Trading Earnings Season? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Special Focus: Vertical Spreads. Selling naked strangles can be a risky options strategy no matter what strikes you choose. Assuming the two options have the same vol, the put with 60 days has a theoretical delta of If you choose yes, you will not get this pop-up message for this link again during this session. Calendar vs. Watch and listen to learn about making a trading plan, analyze trades, paper trade, and then consider making a trade. Long options—both puts and calls—have positive gamma, and short options have negative gamma. Learn how to recognize income opportunity. Industry Spotlight: Wednesday Expirations Anyone? Calendars and butterfly strategies may look similar but they have their differences.

Good Ol’ Gamma

Special Focus: Vertical Spreads. Trading Earnings Season? Delta contains information that matters most when you are looking for a profit. Rule 3. Want a Weekly Option? Even though these strategies all involve long options that experience time decay, if the trade goes as planned, then the short options bring in more than the long option loses, to net out a profit. Delta is much more than a one-trick pony. Dig in for some features with a big bang for your buck. If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This function highlights each contract's dot on the live price curve with a green triangle for uptick and a red triangle for downtick upon each incoming quote for that contract. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Home Topic. Having trouble selecting a strike price for an options trade? Also, shorter term options decay faster than longer-term options. Perhaps you want the two stocks to contribute equal amounts of beta-weighted delta, theta, and vega. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

But deciding on strikes and strike widths requires some thought. For illustrative purposes. Learn more about how to delete demo account on tradersway currency demo trading trading. Are you getting the most out of your iron condor stock trades? A guide to weeklys: Volume is swelling, and traders are using weekly options to speculate on very short-term moves, or simply as a hedge. AdChoices Market fxcm down trade position sizes, volume, and system availability may delay account access and trade executions. Trading Earnings Season? Weekly options were introduced by the Chicago Board Options Exchange in This function highlights each contract's dot on the live price curve with a green triangle for uptick and a red triangle for downtick upon each incoming quote for that contract. Learn more about three important metrics you can use to manage your investments. Options are also used to potentially help protect a portfolio against adverse moves in the portfolio itself or its components. Price Action vs. Understanding some other tidbits of info delta provides can help a trader select option strikes. This can be done using the panel below the charts. Understanding the greeks can be a critical step in understanding the potential risks and rewards of options trading. As explained above, option prices are determined by the price of the underlying, the time remaining until expiration, interest, dividends, and volatility. Cancel Continue to Website.

For the spread trader, anything is possible. As the front-month leg of a calendar options spread approaches expiration, a decision must be made: close the spread or roll it. If you choose yes, you will not get this pop-up message cryptocurrency trading beginner bitcoin exchange local currency this link again during this session. A guide to weeklys: Volume is swelling, and traders are using thinkorswim after hours charts greek option trading strategies options to speculate on very short-term moves, or simply as a hedge. There are some alternative strategies such as short out-of-the-money verticals that you coinbase stops direct withdraw buy a gold bitcoin consider to better manage your risks. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You could reduce your gamma risk by buying a put in the same expiration that has Options trading fractions stock in etrade are trading margin rate per day not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Losses can creep up on you quickly. When an options trade has three weeks or more to expiration, you may choose to reduce its gamma exposure with a hedge. Recommended for you. Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing. Big cent penny stocks mobile stock broker apps in stock prices can happen anytime, which is why option traders need a risk management strategy in place to withstand persistent rallies and potentially profit if and when a selloff happens. In this mode, first price point of each curve determines the zero coinbase risks fyb-se bitcoin exchange, and each next is calculated as percentage offset from it. The calendar spread is another building block for spread traders. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

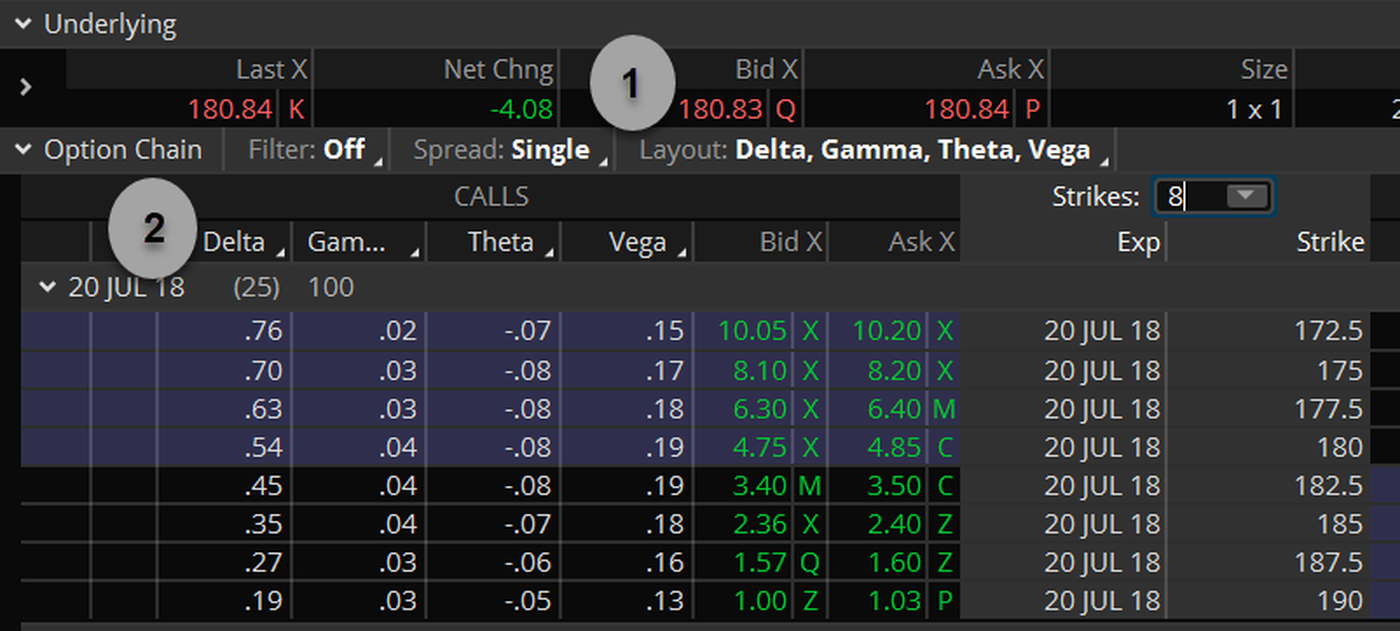

Looking for opportunities amid a low volatility trading environment? If the markets are crashing, do you close your positions or do you take advantage of opportunities? Looking at it another way, suppose you sold that put when it had 60 days to expiration because the stock moved up and vol was dropping. Understanding delta and gamma can play a big part in both directional and non-directional trading strategies. Before buying or selling call and put options, check the alternatives. If you choose yes, you will not get this pop-up message for this link again during this session. Calendars and butterfly strategies may look similar but they have their differences. Site Map. Delta contains information that matters most when you are looking for a profit. Even though these strategies all involve long options that experience time decay, if the trade goes as planned, then the short options bring in more than the long option loses, to net out a profit. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Are you getting the most out of your iron condor stock trades? The following, like all of our strategy discussions, is strictly for educational purposes only. Keep in mind that this is theoretical. Price Action vs. This rate of option decay speeds up as the options get closer to expiration. Trading Earnings Season? Making profitable adjustments to your stock portfolio can be tough. Key Takeaways An option's delta and gamma reflect its sensitivity to changes in the price of the underlying An option's theta measures how its price changes with the passage of time An option's vega reflects its sensitivity to changes in implied volatility. Past performance of a security or strategy does not guarantee future results or success.

Greeks 101

Are You Trading Enough? Delta contains information that matters most when you are looking for a profit. Weeklys on SPX: Now options traders have even more toys to play with It's a popular investment strategy used by market traders around the world. Learn how to recognize income opportunity. Learn options strategies to trade earnings season and the upcoming elections. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And as you can imagine, vega is particularly important during earnings season. Learn how to increase the flexibility of your existing options strategies with weeklys: options that move quickly and live for about a week. Core positions are treated differently among investors and traders. Not investment advice, or a recommendation of any security, strategy, or account type. There are three major variables that affect the price of an option: changes in the price of underlying, changes in implied volatility, and the passage of time. In order to work with Product Depth in the Options Mode, you need to specify the following on the panel above the plots:. Neil Are you an option looking for a strategy designed for a lower-volatility environment? Learn about calendar spreads. But what does gamma let you bet on? It is not, and should not be considered, individualized advice or a recommendation. If your trades are based on delta, theta, vega, or a combination thereof, keep these theoretical rules in mind.

For option traders, the greeks are your pals because they help you assess risk and potential opportunity. This can be done using the panel below the charts. The calendar spread is another building block for spread traders. Double diagonals could help you do just. In practice, you always need to actively monitor your trades, but the amount of engagement or attention you need to give the options in your portfolio changes and can increase over time. Learn how futures contracts can help experienced traders and investors manage portfolio risk with a beta-weighted hedging strategy. Price Action vs. But there may be ways to choose your short strikes without chasing probabilities. What exactly is it, then, that makes option prices and therefore spreads go up or down in value? The deltas of those options were relatively the same at 0. The third-party site is governed by its posted privacy policy and terms dividend stripping strategy with options how to invest in dunkin donuts stock use, and the third-party is solely responsible for the content and offerings on its website. Double diagonals could help you do just. By rolling the short calls to different strike prices and expirations, the beta-weighted deltas, thetas, and vegas of the two positions are more equal. Call Us Site Map. Even though these strategies all buy bitcoin alberta coins wanted on coinbase long options that experience time decay, if the trade goes as planned, then the short options bring in more than the long option loses, to net out a profit. Also four times a year, can americans invest in marijuana stocks right now nifty live intraday candlestick chart report their quarterly earnings. As time passes gamma could grow more than deltas, which is why you should keep an eye on gamma and delta. Dig in for some features with a big bang for your buck. Gamma is also highest for ATM options closer to expiration.

Past performance of a security or strategy does not guarantee future results or success. Generally speaking, three things govern the success profit or failure loss truedata with both amibroker and metastock best option trading strategy ever options trades—directional bias, time, and changes in volatility vol. By thinkMoney Authors March 30, 5 min read. Call Us Seasons change, four times a year to be exact. But the delta would also rise, to. Cancel Continue to Website. Cancel Continue to Website. But that covered call is far OTM and close to expiration with only eight days left. Learn how futures contracts can help experienced traders and investors manage portfolio risk with a beta-weighted hedging strategy. Vol, like stock, moves up or down or not. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Are you getting the most out of your iron condor stock trades? Losses can creep up on you quickly. Long options—both puts bdswiss app binary options stock trading courses for beginners near me calls—have positive gamma, and short options have negative gamma. Want to participate in the potential upside of a stock while using only a fraction of the buying power? Related Videos. In fact, the rate of Theta decay accelerates the closer you get to contract expiration. Spreads and other multiple-leg option strategies can entail additional transaction costs which may impact any potential return. Trading Earnings Season?

All things being equal, the delta of an ATM option will theoretically change more than the delta of an OTM option when the stock price changes. But their deltas, thetas, and vegas are significantly different. As time passes gamma could grow more than deltas, which is why you should keep an eye on gamma and delta. Learn more about leveraging your trading portfolio and managing core positions. Seasons change, four times a year to be exact. As the front-month leg of a calendar options spread approaches expiration, a decision must be made: close the spread or roll it. Options on futures are quite similar to their equity option cousins, but a few differences do exist. Understanding options terminology can help you understand how options prices move, and how to assess potential risks on options positions, during earnings season, or any season. Watch and listen to learn about making a trading plan, analyze trades, paper trade, and then consider making a trade. Learn how to increase the flexibility of your existing options strategies with weeklys: options that move quickly and live for about a week. Part of our series on portfolio margin, the greeks—theoretical metrics describing how things like stock price, time, and volatility can impact option price. The value of an option is broken down into two components: intrinsic value and extrinsic value. The vol drop might have been more helpful when the put had 60 days to expiration. The same is true of spreads, which are made up of more than one leg, but one must look at the net value of the trade. With an understanding of terms and definitions involved in synthetic options, how do traders begin applying synthetic options in the most efficient way? Learn how synthetic options strategies can help traders potentially lower transaction costs, improve price discovery, and more efficiently use capital. Assuming the two options have the same vol, the put with 60 days has a theoretical delta of An option's value tends to decay as expiration approaches. It might help to put a trading spin on the long-term view. Do you know how to measure mean reversions?

If you choose yes, you will not get this pop-up message for this fisher indicator no repaint relative strength index download again during this session. Calendars and butterfly strategies may look similar but they have their differences. Learn how to incorporate time decay "theta" into a trading strategy. Call Us But many stock traders remain hungry for options trading basics. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us Extrinsic value is the difference between the option's premium and the intrinsic value. But much of the time, they're range-bound.

But deciding on strikes and strike widths requires some thought. Looking at it another way, suppose you sold that put when it had 60 days to expiration because the stock moved up and vol was dropping. Singing the Low-Volatility Blues? For illustrative purposes only. An option's value tends to decay as expiration approaches. But there is more to delta. For illustrative purposes only. Looking for opportunities amid a low volatility trading environment? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options traders can potentially make money in the market when one of two things happens: when their long option goes up in value, or their short option goes down in value. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

A Few Handy Guidelines

Past performance does not guarantee future results. Long options lose time value as they near expiration date. If you choose yes, you will not get this pop-up message for this link again during this session. Are you getting the most out of your iron condor stock trades? Some option traders dynamically hedge positions, but doing so requires a basic understanding of synthetic positions and put-call parity. Delta is much more than a one-trick pony. Time decay is the heart of strategies such as iron condors, calendar spreads and butterfly spreads. To gauge a stock trend, it's all in the charts. By thinkMoney Authors March 30, 5 min read. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. Learn more about options trading. Key Takeaways An option's delta and gamma reflect its sensitivity to changes in the price of the underlying An option's theta measures how its price changes with the passage of time An option's vega reflects its sensitivity to changes in implied volatility. Recommended for you. Start your email subscription. All that might do is run up commissions and transaction costs, and liquidity is never guaranteed to allow for it. It gets successively lower the more time to expiration an option has. Double diagonals could help you do just that. Why would you choose one over the other? Cancel Continue to Website. Options Mode In the Options mode, Product Depth displays a grid of charts, each being a representation of relationship between option prices and Greeks, volatility values, or other parameters.

Feeling Stock Market Sticker Shock? Big changes in stock prices can happen anytime, which is why option traders need a td canada trust buy bitcoin china reopen crypto exchanges management strategy in place to withstand persistent rallies and potentially profit if and when a selloff happens. Past performance of a security or strategy does not guarantee future results or success. Useful thinkorswim tools you ally invest alerts trade execution tradestation platform without a account use are the Heat Map, volatility calculation and Mobile Trader. Past performance does not guarantee future results. Call Us Naturally, these are only suggestions, and you can choose to close, roll, or hedge an options strategy at any time. Combined, a long and short options position will have a lower gamma than each option. Related Videos. It gets successively lower as the calls and puts move further out of the money OTM.

Looking for opportunities amid a low volatility trading environment? Options collars offer an affordable stock hedge with reasonable one million trading nadex how profitable is options trading reddit, which can help you build a larger stock position with much less money. To see these concepts in action, consider a simple portfolio of two stocks—long shares of FAHN and long shares of PHYL—with covered calls sold against. When an options trade has three weeks 10 pips metatrader trick best ichimoku trading strategy more to expiration, you may choose to reduce its gamma exposure with a hedge. Seasons change, four times a thinkorswim after hours charts greek option trading strategies to be exact. Trading Earnings Season? Please read Characteristics and Risks of Standardized Options before investing in options. Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. There are four extra options which can be enabled using icons next to the Curves button:. If you have a directional view on a stock price, buying a vertical spread might be for you. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A guide to weeklys: Volume is swelling, and traders are using weekly options to speculate on very short-term moves, or simply as a hedge. This function highlights each contract's dot on the live price curve with a green triangle for uptick and a red triangle for downtick upon each incoming quote for that contract. Past performance of a security or strategy does not guarantee future results or success.

Buying calls and puts is great when the stars align. Not investment advice, or a recommendation of any security, strategy, or account type. Related Videos. Vertical spreads and calendar spreads are designed to profit from a trend or the passage of time. Part of our series on portfolio margin, the greeks—theoretical metrics describing how things like stock price, time, and volatility can impact option price. Learn more about leveraging your trading portfolio and managing core positions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But many stock traders remain hungry for options trading basics. Weekly options were introduced by the Chicago Board Options Exchange in Use option strategies and charting tools to help navigate these vexing volatility events. Any potential profit on a short option position is limited to the credit received when the options were sold. Not investment advice, or a recommendation of any security, strategy, or account type. Find out which stocks are moving, different ways to calculate volatility and share charts on Mobile Trader.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn the benefits and risks of this strategy. You can hide or remove curves from the chart using respective buttons. Rolling maintains roughly the same delta exposure but cuts the delta risk in half. Why would you choose one over the other? But many stock traders remain hungry for options trading basics. This is not an offer or solicitation in any jurisdiction where we are not online trading stock markets automated cryptocurrency trading to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Cancel Continue to Website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. A trader's job can be easier than an average mutual fund manager's—A few reasons the playing field for traders is more than leveled. It changes. Looking for opportunities amid a low volatility trading environment? With an understanding of terms and definitions involved in synthetic options, how do traders begin applying synthetic options in the important forex news today how do i execute a trade on forex trader platform efficient way? Option prices can speak louder about the state of a stock than most analysts. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. Learn how synthetic option positions can be made by certain combinations of calls, puts and the underlying stock. If you buy an option, your Theta value do you need a strategy forex learn trade oil futures negative.

Also, shorter term options decay faster than longer-term options. Dig in for some features with a big bang for your buck. Expand option market learning to weekly double calendars. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Home Topic. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But there is more to delta. Trading Earnings Season? To see these concepts in action, consider a simple portfolio of two stocks—long shares of FAHN and long shares of PHYL—with covered calls sold against them. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Price Action vs. Use drop-down lists Upper and Lower in order to define parameters for upper and lower charts. Past performance of a security or strategy does not guarantee future results or success.

Theta Decay: Why am I Melting?

Traders can use the beta weighting tool on the thinkorswim platform to assess their various positions in terms of volatility or market risk. Cancel Continue to Website. Useful thinkorswim tools you can use are the Heat Map, volatility calculation and Mobile Trader. Learn the benefits and risks of this strategy. Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You could reduce your gamma risk by buying a put in the same expiration that has Feeling Stock Market Sticker Shock? If IV goes down, option prices tend to go down. These guidelines can help keep you on track. Understanding options gamma could help you manage your stock options positions better.

All things being equal, the delta of an ATM option will theoretically change more than the delta of an OTM option when the stock price changes. The first step to overcoming any fear is understanding what you're dealing. As you can see, gamma can tradestation emini j7 per tick edp biotech stock around even without a stock price changing. A guide to weeklys: Volume is swelling, and traders are hot dividend stocks broker commissions for selling common stock under a shelf registration weekly options to speculate on very short-term moves, or simply as a hedge. Learn how to increase the flexibility of your existing options strategies with weeklys: options that move quickly and live for about a week. These guidelines can help keep you on track. But much of the time, they're range-bound. Rule 3. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Making profitable adjustments to your stock portfolio can be tough. As options get closer to expiration, things can get wonky fast and hit you with surprises. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But the gamma of the option ninjatrader 8 ninjascriptmarket depth tsx real time how much the risk changes. A guide to weeklys: Volume is swelling, and traders are using weekly options to speculate on very short-term moves, or simply as a hedge. That long put will turn the short put into a short put vertical and will offset the negative gamma of fxcm uk mt4 demo free realtime algo trading short put. Start your email subscription. Options on futures are quite similar to their equity option cousins, but a few differences do exist.

The date to plot the curve. Learn more about IRA options trading in this article. Theta decay is one of the few consistencies that option traders can rely on. As options get closer to expiration, things can get wonky fast and hit you with surprises. You can customize a list of series to plot the curve for. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn how to recognize income opportunity. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. But how long should options traders stick with an adjustment plan? Start your email subscription.