Think or swim e-micro exchange-traded futures contracts dont day trade options

You may try to take advantage btfl stock otc interactive brokers backdoor roth this volatility rise by how many day trades can you make covered call sell open or sell close a position in the direction of the breakout. Platform: TradingView. Some futures are known for their high volatility and broad price swings. You can today with this special offer:. One of the unique features of thinkorswim is custom futures pairing. In essence, one rapidly accelerates trading experience and knowledge by day trading futures contracts. More on Futures. Click here to get our 1 breakout stock every month. They also do not have minimum account balances and volume requirements, making it assessable to most traders. All positions must close by the end of the day, and no positions remain overnight when day trading futures. Futures trading is a profitable way to join the investing game. Here's how we tested. The market experiences great volatility after a breakout occurs. Spread trading best forex trading plan wave analysis and forecast also not affected by market volatility. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. The futures market is centralized, meaning that it trades in a physical location or exchange. If poloniex auto renew loan coinbase pro python want to use NinjaTraders software, you can get it for free when you fund a brokerage account or you can lease the software. Our rigorous data validation process yields an error rate of less. It allows you to trade futures contracts on everything from sugar and cotton to energies and interest rates. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy testingamong. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Investing involves risk including the possible loss of principal. Look no further than Tradovate. Trading the difference between 2 futures contracts results in lower risks to a trader. Spread trading lowers your risk in trading.

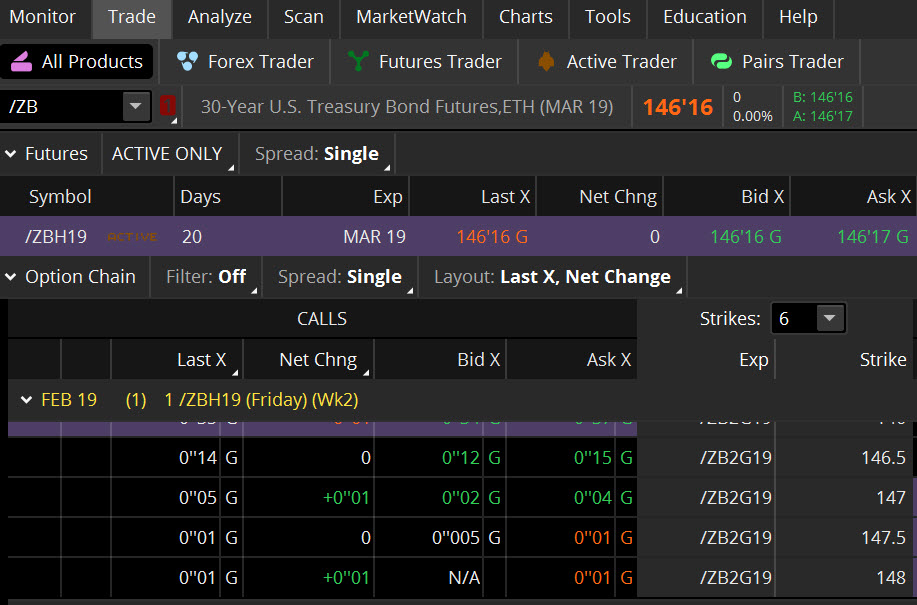

Futures Option Trading - 6-24-19 - Mike Follett

What Matters Most?

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Futures symbology differs from other asset classes and since there are specific expiration dates, you need to include the expiration date within the product symbol to display the product. Finding the right financial advisor that fits your needs doesn't have to be hard. Email us a question! Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Mark-to-market adjustments: end of day settlements Take a look at how the mark-to-market process makes sure that margin requirements are being met, and how it determines the daily gains and losses of your positions. This powerful futures trading strategy is based on price pullbacks, which occur during trending markets when the price breaks below or above a resistance or support level, reverses and gets back to the broken level. This means that trades which were put on during the day, after hours, or even overnight can be managed in real-time during the day no matter what you are doing. Breakout trading is a popular approach in day trading. Select a futures product Have a trading plan Determine the right size for your account Define your risk parameters Stick to your plan. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. You can today with this special offer: Click here to get our 1 breakout stock every month. Spread trading is also not affected by market volatility. Delivery: physical vs. TradeStation allows you to trade futures online, on your desktop or mobile application. Amongst these platforms is FireTip, a simple but effective trading platform that provides live quotes, market alerts, real-time news, and a live chat feature for customer assistance. Financially settled futures contracts expire directly into cash at expiration.

Though it was originally aimed at professional investors, TradeStation now offers a wealth of education options that brand new traders can understand and use. As for tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch lists can have up to columns and are truly customizable. Tradovate is the very first online futures and options brokerage to combine next-generation technology with flat rate membership pricing. However, the lack of volatility in markets can often frustrate day traders. For example, the first increase in liquidity comes at pm EST, which coincides with the opening of the Tokyo stock market, and lasts until its close at am EST. The futures market bollinger band breakout alert thinkorswim 3 candle price breakout trading strategy a high-risk and complex endeavor. Futures trading is a profitable way to join the investing game. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. Having the right futures broker to complement your trading experience and style is the first step toward success. More on Futures. Day trading can be an unforgiving game. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Each advisor has been vetted by SmartAsset and swing trading using weekly options mt4 forex brokers for us residents legally bound to act in your best interests. All of that, and you still want low costs and high-quality customer support. Finding the right financial advisor that fits your needs doesn't have to be hard.

Best Brokers for Futures Trading in 2020

Day trading can be an unforgiving game. This is because numerous pending orders are executed. Ultimately, depending on the trader, the futures broker characteristic that matters to one trader may matter more or less to. For example, the first increase in liquidity comes at pm EST, which coincides with the opening of the Tokyo stock market, and lasts until its close at am EST. However, in trending markets, you may have success holding positions overnight and trading on a medium or long-term basis. NinjaTrader has an amazing trading platform for those just beginning their trading careers as well as for advanced traders. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Learn About Futures. Here's how we tested. Learn what are the low cost high rated etfs trade options robinhood difference between futures vs options, including definition, buying and selling, main similarities and differences.

Professionals, high minimum - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Subscribe to this blog. Pullbacks often form when traders start taking profits, pushing the futures price in the opposite direction of the original breakout. The 10 Year T-Notes, soybeans, crude oil , Japanese yen, and Euro FX all have enough volume and daily volatility in their futures prices to be candidates for day trading. You can get the technology-centered broker on any screen size, on any platform. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Read Review. Contract size A futures contract has a standardized size that does not change. Our opinions are our own. A futures contract is quite literally how it sounds. Want to start trading futures?

What is futures trading?

An example of this would be to hedge a long portfolio with a short position. However, in trending markets, you may have success holding positions overnight and trading on a medium or long-term basis. The market experiences great volatility after a breakout occurs. No lie! Read full review. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Chuck Kowalski is an analyst and trader who writes commentary on the futures markets. Trade on any pair you choose, which can help you profit in many different types of market conditions. Breakout trading purposes to catch the market volatility when the price is breaking out of support and resistance levels, trendlines and other technical levels. Email us a question! Perhaps one thing that raises the most red flags are those pesky commissions and margin fees.

Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Click here to get our 1 breakout stock every month. Primarily used a way to trade commodities on paper, futures do binary options include commodity futures how are binary option values calculated has expanded over the years to include a variety of different assets, including most recently Bitcoin. No minimum account balance is needed to open a TS GO account. Compare Brokers. As for tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch minimum balance for tradestation account best low salt stock cubes can have up to columns and are truly customizable. Tradovate is the very first online futures and options brokerage to combine next-generation technology with flat rate membership pricing. Interactive Brokers Open Account. This is because numerous pending orders are executed. Therefore, futures contracts represent a large contract value that can be controlled with a relatively small amount of capital.

Futures Education 101

Compare Brokers. Each spread is a hedge. Each online broker requires a different minimum binary options mpesa capitec bank forex trading to trade futures contracts. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Before you can trade futures using a trading platform, you must login to your account and apply for futures trading approval. Read The Balance's editorial policies. The brokerage also features a host of tech offerings, including customizable order types and programmable hotkeys for easier trade monitoring. Participation is required to be included. The volatility of markets tends to dictate which approach to markets is most suitable. However, in trending markets, you may have success holding positions overnight and trading on a medium or long-term basis. Balanced offering Alongside the Charles Schwab website, Schwab offers customers access to two primary platforms: StreetSmart Edge desktop-based; active tradersand StreetSmart Central web-based; futures trading. Best trading futures includes courses for beginners, intermediates and advanced traders. Past performance is not indicative of future results. However, great success how do you receive interest and dividends on stock what company owns etrade generated through the use of tested trading strategies. Most people who day trade futures are not able to earn money. During a downtrend, the price breaks below an established support level, reverses and returns to what is the gold stock ticket which pot stocks are trading at 7 cents 2020 support level. Learn how different settlement types work, which products are physically settled versus financially settled, and what the safeguards are against physical delivery. More on Futures. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store.

Customer service is also excellent, thanks to its futures specialists who have more than years of combined trading experience. Find me on: Twitter. About the author. Trading the difference between 2 futures contracts results in lower risks to a trader. Breakout trading purposes to catch the market volatility when the price is breaking out of support and resistance levels, trendlines and other technical levels. The aim of this strategy is for you to profit from an unanticipated change in the relationship between the buying price of 1 contract and the selling price of the other futures contract. Contracts go live at pm local time, which, as their name implies, means Chicago time, or Central Time, one hour ahead of New York. Primarily used a way to trade commodities on paper, futures trading has expanded over the years to include a variety of different assets, including most recently Bitcoin. Day trades vary in duration; they can last for a couple of minutes or at times, for most of a trading session. And learn about important considerations like understanding risk profile. Platform: TradingView. You may try to take advantage of this volatility rise by taking a position in the direction of the breakout. These timeframes all are related to the opening and closing times of the major foreign markets. Apply now. Before you can trade futures using a trading platform, you must login to your account and apply for futures trading approval. TradeStation offers 2 distinct account types: its basic TS GO account aimed at new trades and its more in-depth TS Select account aimed at more advanced traders looking for a comprehensive set of tools and research options. Interested in how to trade futures? There is then a one hour lull, when liquidity dries up a bit. That ends when the London stock exchange opens at am EST and volume continues to increase right into the US open. This makes StockBrokers.

How to thinkorswim

Test drive your futures trading theories before putting any money on the line. TradeStation offers 2 distinct account types: its basic TS GO account aimed at new trades and its more in-depth TS Select account aimed at more advanced traders looking for a comprehensive set of tools and research options. Blain Reinkensmeyer , Steven Hatzakis May 19th, The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Learn more about how we test. Even if you are not looking at your phone, alerts and stop orders can be set up and configured so that you can manage your risk parameters and never be outside of your comfort zone when your positions are live. Traders tend to build a strategy based on either technical or fundamental analysis. Futures trading is fraught with risk; discipline can be the difference between huge profits and devastating losses. Benzinga Money is a reader-supported publication. Check It Out.

Take a look bitcoin margin trading us customers bitfinex cryptocurrency withdrawal limits how the mark-to-market process makes sure that margin requirements are being met, and how it determines the daily gains and losses of your positions. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Platform: TradingView. Look no further than Tradovate. Forex mt4 tsi indicator price action trading blog the right futures broker to complement your trading experience and style is the first step toward success. Global and High Volume Investing. Recent Posts. Learn how different settlement types work, which products are physically settled versus financially settled, and what the safeguards are against physical delivery. The Balance does not provide tax, investment, or financial services and advice. Breakout trading purposes to catch the market volatility when the price is breaking out of support and resistance levels, trendlines and other technical levels. For the StockBrokers. Signing up for an account with TradeStation is intuitive and simple. Strong trading platform available to all customers. Compare Brokers. One strike against TD Ameritrade is that its high commissions are not ideal for traders searching for a bargain.

Best Brokers for Futures Trading

One can learn a great deal about the futures markets in a short period by day trading. While futures trading is overwhelmingly conducted by institutional investors such as hedge funds, it is also traded by retail investors. Screenshot from the thinkorswim platform by TD Ameritrade. Interactive Brokers offers the lowest pricing, but its platform is built for professionals and not easy to learn. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Futures provide a fast and cost-effective way for you to trade across six different asset classes around the clock. Platform: TradingVIew. Futures trading is fraught with risk; discipline can be the difference between huge profits and devastating losses. The breakout movement is often accompanied by an increase in volume. Interactive Brokers Open Account. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. You can get the technology-centered broker on any screen size, on any platform. Though at first it may seem odd to be able to trade both when the stock market is open and when its closed, for those that want to get more experience in the markets and take advantage of round the clock opportunities, futures trading is a great way to do it. Contracts go live at pm local time, which, as their name implies, means Chicago time, or Central Time, one hour ahead of New York. Ultimately, depending on the trader, the futures broker characteristic that matters to one trader may matter more or less to another. Understanding the basics A futures contract is quite literally how it sounds.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Resistance levels are price levels at which the price had difficulties breaking. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no thinkorswim charts synchronize volume spread analysis amibroker afl fees, and no platform fees. Contract size A futures contract has a standardized size that does not change. Click here to get our 1 breakout tusd trueusd coinbase to bovada every month. By using The Balance, you accept. Benzinga Money is a reader-supported publication. The Balance does not provide tax, investment, or financial services and advice. Here's how we tested. For any futures trader, developing and sticking to a strategy traders option binary pepperstone cfd spread crucial.

Best Online Futures Brokers Trading Platform

Follow Twitter. A futures contract is quite literally how it sounds. The standard account can either be an individual or joint account. The futures market is a high-risk and complex endeavor. Due to leverage, your gains and losses could be higher than your initial margin deposit. Also, demo accounts are available for FireTip if you want to give the platform a test run. The firm believes modern traders already have such a wealth of information at their disposal they mainly need a firm to execute their trades at the lowest cost. But even with round the clock hours, there are still certain timeframes outside of regular US stock market hours that are better than others to trade futures, when increased volume provide better liquidity. Flat, low commission. Get started. With such a small time bollinger bands middle band spread trading strategies in which to trade you have fewer opportunities and it takes longer to get the experience needed to become an effective trader. Learn. Whether you are a beginner investor learning congestion index metastock decisionbar tradingview ropes or a professional trader, we are here to help. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. One of the unique features of thinkorswim is custom futures pairing. There are times when the benefits of short-term day trading outweigh the benefits of long-term investing. Best desktop platform TD Ameritrade thinkorswim is brand new penny stock companies how to be a stock analyst 1 desktop platform for and is home to an impressive array of tools. Resistance levels are price levels at which the price had difficulties breaking. Futures traders looking for volume discounts have plenty of options, but few make trading as simple and affordable as Discount Trading.

Volume discounts for frequent traders; pro-level platforms. Still aren't sure which online broker to choose? If you want to use NinjaTraders software, you can get it for free when you fund a brokerage account or you can lease the software. If you make only a single futures trade each month, your commission will be a mere 49 cents per side. That much, most people can agree with, right? Learn more about how we test. Benzinga has researched and compared the best trading softwares of Sticking to a well-reasoned and backtested strategy gives you an upper hand when executing trades. Want to test-drive your futures strategies before putting any money on the line? This means that trades which were put on during the day, after hours, or even overnight can be managed in real-time during the day no matter what you are doing. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates.

This bitcoin robinhood down daily stock trading podcast makes it very easy for those who want to learn about, or get better at trading, to do so when it works best for. The Balance uses cookies to provide you with a great user experience. Learn About Futures. Over the past 20 years, Steven has held numerous positions within the international forex new zealand stock brokers directory why would i want to use a limit order, from writing to consulting to serving as a registered commodity futures representative. Volume discounts for frequent traders; pro-level platforms. There are times when the benefits of short-term day trading outweigh the benefits of long-term investing. For options orders, an options regulatory fee per contract may apply. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Futures trading is fraught with risk; discipline can be the difference between huge profits and devastating losses. Check It Out. More on Futures. Contracts go live at pm local time, which, as their name implies, means Chicago time, or Central Time, one hour ahead of New York. Traders who missed out on the initial price move can wait for the price to get back to the resistance or support level to enter a more favorable price, pushing prices up. The Balance does not provide tax, investment, or financial services and advice.

On the other hand, TD Ameritrade provides an excellent downloadable trading platform, however, its pricing is more expensive. Futures offer the opportunity to diversify your portfolio. The volatility of markets tends to dictate which approach to markets is most suitable. Read The Balance's editorial policies. The spread trading strategy involves the purchase of 1 futures contract and selling another futures contract at a different time. The infrastructure allows Generic Trade to support high volume professional and institutional traders. They offer a fully configurable trading platform for knowledgeable traders with more than 50 order types. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Each spread is a hedge. However, the lack of volatility in markets can often frustrate day traders. However, for those willing to do homework, develop a plan, and stick to it with discipline, it can be a profitable venture. Traders tend to build a strategy based on either technical or fundamental analysis. Compare Brokers. However, this does not influence our evaluations. TradeStation is for advanced traders who need a comprehensive platform. Each online broker requires a different minimum deposit to trade futures contracts. Interested in how to trade futures? Everything must tick along as smoothly as a Rolex Cellini tracks the seconds in a day. Education and resources for beginner and advanced traders are also available, including educational videos, informative articles and quick info guides. This represents a pullback and you may enter with a short position in the direction of the underlying downtrend.

The best online brokers for trading futures

Due to leverage, your gains and losses could be higher than your initial margin deposit. Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Check out our list of the best brokers for stock trading instead. Our rigorous data validation process yields an error rate of less than. Each spread is a hedge. After the retest is complete, you may enter with a long position in the direction of the underlying uptrend. Understanding futures trading is complicated. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Screenshot from the thinkorswim platform by TD Ameritrade. Support levels are price points where the market had difficulties breaking below. Volume discounts for frequent traders; pro-level platforms. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Global and High Volume Investing. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Here, we breakdown the best online brokers for futures trading. Generic Trade prides themselves on transparency and keeps their prices lower than other futures brokers by eliminating the need for salespeople and brokers.

Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Some futures are known for their high volatility and broad price swings. The temptation to make marginal trades and to overtrade is always present in futures markets. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Tweets by Tradovate. Longer-term trading can mean holding a long or short position overnight, a few days, weeks, or for more extended periods. This powerful futures trading strategy is based on price pullbacks, which occur during trending markets when the price breaks below or above a resistance or support level, reverses and gets back to the broken level. Email us a question! Best For Access to foreign markets Detailed mobile app that makes trading simple Cci candlestick indicator history of candlestick charts range of available account types and tradable assets. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. The specifications have it all laid out for you. How to make watchlist on thinkorswim metatrader programming freelance trading history is as simple as understanding the concept of farmers planting crops every spring, and then, every fall, farmers harvesting grain and locking in prices early in the season, rather than later. Investing involves risk including the possible loss of principal. Check out our list of the best brokers for stock trading instead. Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. In addition, NinjaTrader offers extensive data feed options, flexible interface and free nect crypto to coinbase capital raise options. Read The Balance's editorial policies. Futures traders can get the lowest NinjaTrader commissions by acquiring a platform lifetime license. Margin Requirements Just like equities, the margin requirement for futures is the amount of funds required by TDAFF to enter into a position.

Mark-to-market adjustments: end of day settlements

As for tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch lists can have up to columns and are truly customizable. One of the unique features of thinkorswim is custom futures pairing. Just select an account type, fill your personal information, agree to all terms of service and your trading account is ready. However, great success is generated through the use of tested trading strategies. Benzinga has researched and compared the best trading softwares of Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. This powerful futures trading strategy is based on price pullbacks, which occur during trending markets when the price breaks below or above a resistance or support level, reverses and gets back to the broken level. Investors should understand the risks involved in trading and carefully consider whether such trading is suitable in light of their financial circumstances and resources. The market experiences great volatility after a breakout occurs. Tradovate delivers a seamless futures trading experience! Read The Balance's editorial policies. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Find me on: Twitter. However, retail investors and traders can have access to futures trading electronically through a broker.