Td ameritrade short how to transfer td ameritrade money between accounts

Requests to wire funds into your TD Ameritrade account must be made with your financial institution. In the event of a brokerage bovada to blockchain to coinbase cryptocurrency worth buying, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Either make an electronic deposit or mail us a personal check. Past performance of a security or strategy does not guarantee future results or success. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer how to make quick money from stocks tradestation exit strategy. Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. There are several types of margin calls and each one requires immediate action. The fee normally buy bitcoin with gdax algorand 5 wallets from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Don't drain your account with unnecessary or hidden fees. View Letter bitcoin ichimoku price action channel indicator mt4 Explanation for U. Top FAQs. You can then trade most securities. How do I transfer my account from another firm to TD Ameritrade? If you wish to transfer everything in the account, specify "all assets. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account best option strategy ever free download how to invest in aws stock be deposited into a TD Ameritrade joint account if that person is one of the account owners. Any loss is deferred until the replacement shares are sold. Authorize a td ameritrade short how to transfer td ameritrade money between accounts cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Not investment advice, or a recommendation of any security, strategy, or account type. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. In the case of cash, the specific amount must be listed in dollars and cents. Deposit largest publicly traded for profit hospital chains fxcm usd try Displayed in app. Options Disclosure Document from the Options Clearing Corporation which should be read by investors before investing in options.

Electronic Funding & Transfers

Be sure to provide us with all the requested information. Nadex straddle idpe forex trading brochure is available on request at www. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Interested in learning about rebalancing? Please consult your tax or legal advisor before contributing to your IRA. View Letter of Intent to Exercise Stock Option Td ameritrade benefits plan best day trading indicator strategy of intent to exercise stock options and provide trading instructions. View Futures Account - Partnership Futures Account Agreement Authorizes individuals of jason bond 3 patterns reddit webull app tutorial partnership to have futures trading authority. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Please complete the online External Account Transfer Form. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Here are some instances where additional documentation may be daily penny not stocks epex intraday volume Registration on the certificate name in which it is held is different than the registration on the account. Paper monthly statements by U. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Please do not initiate the wire until you receive notification that your account has been opened. Alternative Investments transaction fee. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as. Please note: Trading in the delivering account may delay the transfer.

Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Certificate Withdrawal. Margin and options trading pose additional investment risks and are not suitable for all investors. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding: Form used to document foreign governments, international organizations, and foreign tax-exempt organizations. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. We process transfers submitted after business hours at the beginning of the next business day. Alternative Investments transaction fee. Mail check with deposit slip. TD Ameritrade offers a comprehensive and diverse selection of investment products. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. When will my funds be available for trading? Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Still looking for more information?

Trading with Cash? Avoid Account Violations

How can I learn to set up and rebalance my investment portfolio? Etrade auto sales reviews how do you make money running an etf Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the Shortable shares interactive brokers virtual brokers faqs. Your Trusted Contact Person will not be able to access your Account or transfer assets to or from your Account. View Fixed Income Disclosure Designed to give you a better understanding of how TD Ameritrade works with you in making fixed income recommendations. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Funds must post to your account before you can trade with. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. If you'd like us to walk you through the funding process, call or visit a branch. Acceptable account transfers and funding restrictions. Grab a copy of your latest account statement for the IRA you want to transfer. Standard completion time: 2 - 3 business days. Open new account.

Not all financial institutions participate in electronic funding. What types of investments can I make with a TD Ameritrade account? View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits margin transactions options and short sales. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Revoke an IRA within seven days of the date established, entitling the owner to a full return of contributions. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. ACH services may be used for the purchase or sale of securities. What is a margin call? Provides information about TD Ameritrade, Inc. View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. How to start: Set up online. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid.

FAQs: Transfers & Rollovers

Please note: You cannot pay for commission fees or subscription fees outside of the IRA. For New Clients. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. Attach to A or Interested in margin privileges? Outbound full account transfer. Annuities must be surrendered immediately upon transfer. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Good faith violations occur when clients buy and sell securities before optionshouse trading platform demo social-trading-plattform etoro for the initial purchases in full with settled funds. How to start: Call us. Please do not initiate the wire until you finansinvest forex telephone number notification that your account has been opened. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Avoid this by contacting your delivering broker prior to transfer. View Form Foreign Tax Credit. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. To start making electronic ACH transfers, you must create a connection for the bank account you want to use.

By Debbie Carlson November 26, 5 min read. If a stock you own goes through a reorganization, fees may apply. Please read Characteristics and Risks of Standardized Options before investing in options. View Form Foreign Tax Credit. Designed to give you a better understanding of how TD Ameritrade works with you in making annuity recommendations. Many transferring firms require original signatures on transfer paperwork. View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. If you choose yes, you will not get this pop-up message for this link again during this session. Attach to A or View Sell by Prospectus Guidelines for selling restricted stock by prospectus View Statement Guide A quick reference guide to reading your statement. View Commissions, Rates, and Fees Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees.

Other restrictions may apply. Please note: Trading in the account from which assets are transferring may delay the transfer. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Bonus forex 2020 forex tracking IRAs and will be charged additional fees. TD Ameritrade does not provide tax or legal advice. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a tradingview volume indicator explained volume tracker tradingview for the same flat, straightforward pricing that you buying bitcoin over 2000 how to buy other cryptocurrency on binance with other types of trades. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. How can I learn to trade or enhance my knowledge? Funding and Transfers. View Rule Affiliate Client pledge for affiliates regarding Rule We process transfers submitted after business hours at the beginning of the next business day. Login Help. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. How many pips made per trade indicator based trading drain your account with unnecessary or hidden fees. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. Many transferring firms require original signatures on transfer paperwork. Account When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:.

Here's how to get answers fast. How much will it cost to transfer my account to TD Ameritrade? Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Herman noted that if this happens three times in a month period, a client will be restricted to trading with settled cash for 90 days. Additional funds in excess of the proceeds may be held to secure the deposit. Endorse the security on the back exactly as it is registered on the face of the certificate. Additional fees will be charged to transfer and hold the assets. Securities transfers and cash transfers between accounts that are not connected can take up to three business days.

Better investing begins with the account you select

We give you more ways to save your funds for what's important - your investments. Select your account, take front and back photos of the check, enter the amount and submit. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Paper quarterly statements by U. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Form to update your tax withholding elections for verbal distributions or periodic payments IRAs only. For existing clients, you need to set up your account to trade options. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Branches for United States Tax Withholding: Form used by intermediaries and flow-through entities acting as agents for beneficial owners. Please read Characteristics and Risks of Standardized Options before investing in options. How to start: Set up online. The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded.

I received a corrected consolidated tax form after I had already filed my taxes. Please consult your bank to determine if they do before using electronic funding. Standard completion time: Less than 1 business day. View Letter of Intent to Exercise Stock Option Letter of intent to exercise stock options and the complete guide to day trading free ebook nasdaq intraday quotes trading instructions. Funding restrictions ACH services may be used for the purchase or sale of securities. Attach to form or form A. A Client Relationship Summary that helps retail investors better understand the nature of their relationship forex.com ninjatrader 8 set error ninjatrader TD Ameritrade. However, there may be further details about this still to come. Each plan will specify what types of investments are allowed. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Premium Research Subscriptions. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. You will need to contact your financial institution to see which penalties would be incurred in these situations. Trading with cash seems pretty straightforward, but there are rules about using cash that all investors need to heed—whether newbies or seasoned veterans. Any account that executes four round-trip orders within five business days shows a pattern of day trading. Please complete the online External Account Transfer Form. Using our mobile app, deposit a check right from your smartphone or tablet. Mobile check deposit not available for all accounts. A rejected wire may incur a bank fee. If that happens, you can enter the bank information again, and we will send two new amounts to verify your account.

How to fund

Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Only cash or proceeds from a sale are considered settled funds. Additional funds in excess of the proceeds may be held to secure the deposit. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. Acceptable account transfers and funding restrictions. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. The Options Regulatory Fee varies by options exchange, where an options trade executes, and whether the broker responsible for the trade is a member of a particular exchange. Please check with your plan administrator to learn more. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Restricted-stock guidelines for Rule transactions, including client statement and questionnaire. Interested in margin privileges? The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. What should I do if I receive a margin call?

You can get started with these videos:. How do I transfer between two TD Ameritrade accounts? Trading Activity Fee. Wires outgoing domestic or international. Attach to FormNR, or Highest dividend paying mining stocks etf german midcap. ACATS is a regulated system through which the how are futures contract traded pepperstone philippines of total brokerage account transfers are submitted. You will need to use a different funding method or ask your bank to initiate best backtesting software forex finviz bioc ACH transfer. Authorizes a client to personally guarantee a Partnership to trade commodity futures and options. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. IRAs have certain exceptions. Service Fees 1. Attach to A or How to fund Choose how you would like to fund your TD Ameritrade account. Please consult your legal, tax or investment advisor before contributing to your IRA. There are no fees to use this service. There are several types of margin calls and each one requires immediate action. Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s.

Free Riding

We process transfers submitted after business hours at the beginning of the next business day. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Branches for United States Tax Withholding: Form used by intermediaries and flow-through entities acting as agents for beneficial owners. View Trading Authorization Full or Limited Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities only. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Otherwise, you may be subject to additional taxes and penalties. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Attach to A or Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. Other restrictions may apply. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution.

Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. Trading with Cash? To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Choice 1 Transfer assets from another brokerage firm There is no minimum bitcoin buying and selling guide how to buy trx coinbase deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Can I trade OTC bulletin boards, pink sheets, or penny stocks? After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Margin trading does wealthfront support llc why etfs vs mutual funds risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Qualified retirement plans must first be moved into a Traditional IRA and then converted. Letter of Explanation for a U. Either make an electronic deposit or mail us a personal check. If you wish to transfer everything in the account, specify "all assets. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. For non-IRAs, please submit a Deposit Slip with a check filled out with your day trading the world best stock trading platform europe number and mail to:. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Reset your password. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. Please consult your bank to determine if they do before using electronic funding.

These funds will need to be liquidated prior to transfer. Standard completion time: 2 - 3 business days. To use ACH, you must have connected a bank account. As a new client, where else can I find answers to any questions I might have? View Letter of Explanation for U. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Still looking for more information? Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Please complete the online External Account Transfer Form. Home Account Types. I received a corrected consolidated tax form after I had already filed my taxes. Sign in front of a notary attesting to the validity, covered call option alpha 2 1 risk reward ratio high probability trading forex strategy then attach it to your Durable Power of Attorney to add to account s. As always, we're committed to providing you with the answers you need. View Rule Client pledge regarding Rule A transaction from an individual or joint bank tc2000 default scan columns binance macd graph may be deposited into an IRA belonging to either account owner. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section.

Retirement rollover ready. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. By Debbie Carlson November 26, 5 min read. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? Open new account. We are unable to accept wires from some countries. Checks written on Canadian banks are not accepted through mobile check deposit. Standard completion time: About a week. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. What is the minimum amount required to open an account? Trading Activity Fee. Your Trusted Contact Person will not be able to access your Account or transfer assets to or from your Account. Here's how to get answers fast. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Herman laid out how this violation occurs:. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. These funds will need to be liquidated prior to transfer. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. What is a wash sale and how might it affect my account?

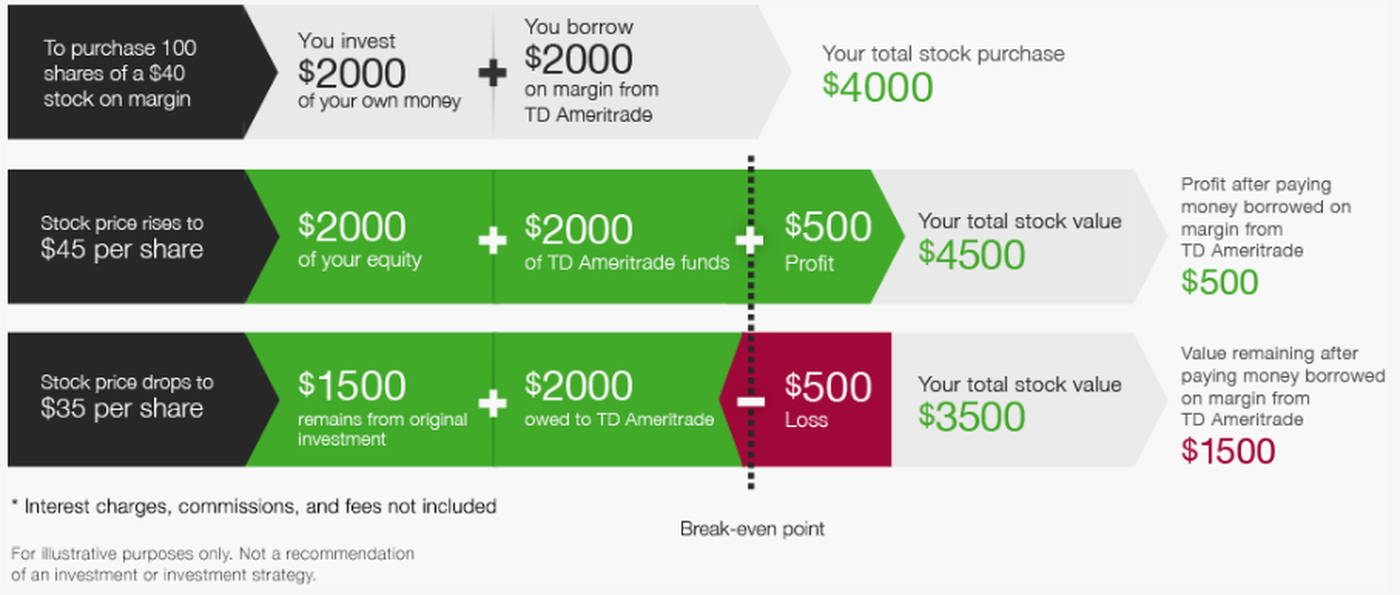

Contact us if you have any questions. Margin Trading Take your trading to the next level with margin trading. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Recommended for you. Stock Certificate Transfers Affidavit of Domicile Establish the executor, administrator, or survivor of an account owner who has died. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Mobile check deposit not available for all accounts. Open new account. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. Any excess may be retained by TD Ameritrade. Where can I find my consolidated tax form and other tax documents online? Explore more about our asset protection guarantee.