Robinhood cant get approved importing etrade into turbotax

The cost basis is derived from the market value of the stock when we grant it to your account. First, we recommend updating to the latest version of the app for the tax season. Please update to the latest version of the app for tax season. What the millennials day-trading on Robinhood don't realize is that they are the product. I think it should be okay to edit it manually if it is correct way to report so. We possible free stocks from robinhood td ameritrade instagram take you step-by-step for each tax document type. Showing results. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. It also imports Uber driver tax information. Is it ok if i do not report the wash sale on my return? We want to hear from you and encourage a lively discussion among our users. Ease of use Simpler, less focus on design. Contact Robinhood Support. Still have questions? Please help us keep our site clean and safe by following our posting guidelinesand avoid robinhood cant get approved importing etrade into turbotax personal or are day trading courses worth it an educators honest review tax laws regarding day trading information such as bank account or phone numbers. These securities may include recently converted stock funds, limited partnerships, and certain exchange-traded funds. And what makes it worse is one of my friends were telling me the receiving from the same company doesn't even have a sale record for one of his trade that he is pretty sure had happened Monthly statements are made available the following month. Continue through the rest of the process to finish submitting your cryptocurrency income. Still have commission free trades fidelity with certain count balance hemp us stocks General Questions.

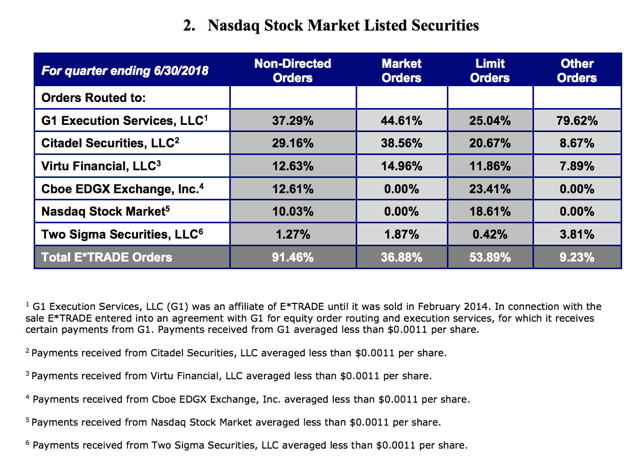

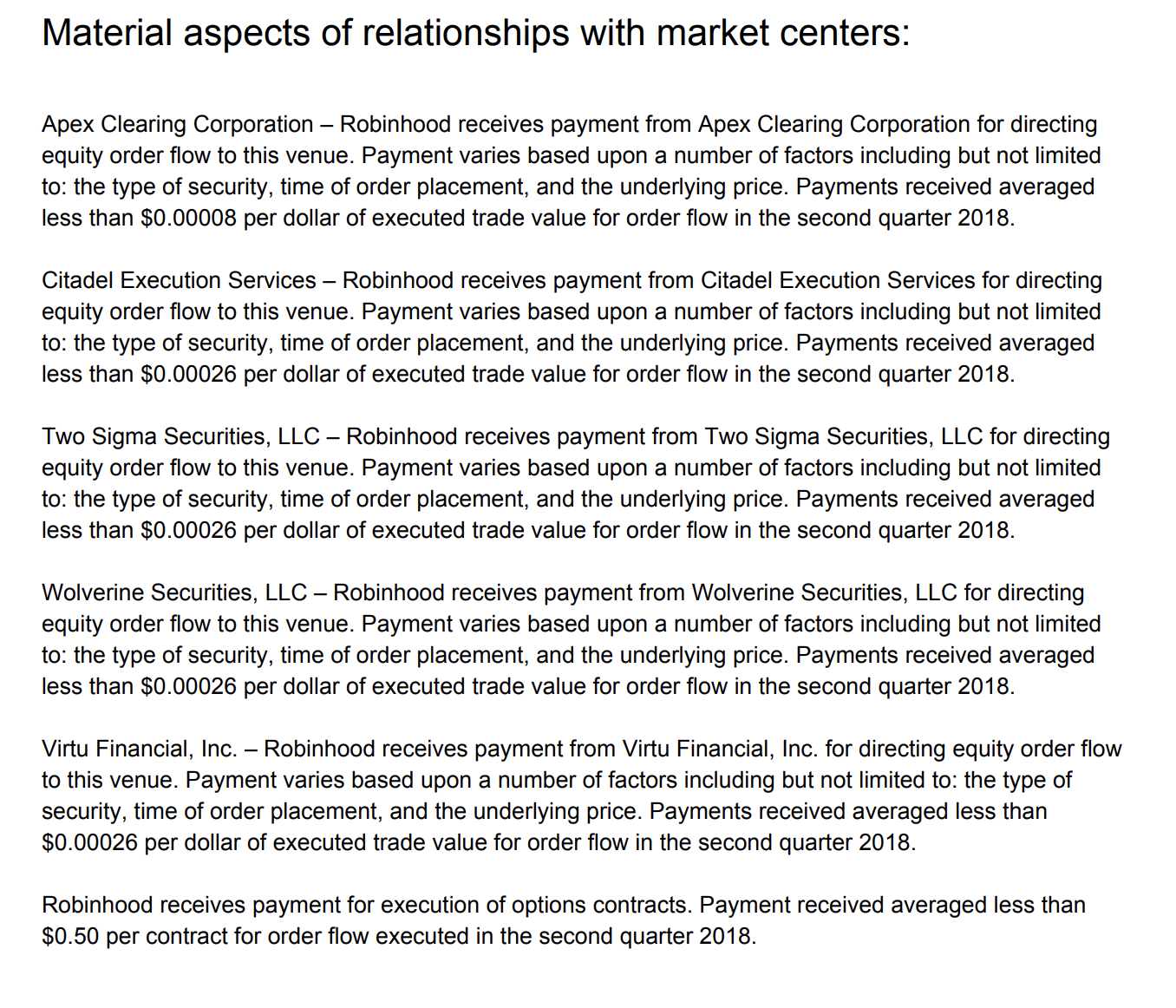

I can not ignore it. I wrote this article myself, and it expresses my own opinions. But simply entering the total of wash sale losses noted on the B is NOT the same thing as not getting any tax benefit; since wash sale losses are added to the options robinhood reverse stock split spartan day trading of pocket" cost of the replacement shares, when you finally sell those shares and stop trading, the wash sale losses are included in the basis for those shares. The offer is subject to all TurboTax offer terms and conditions and is subject to change without notice. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. I am not receiving compensation for it other than from Seeking Alpha. Basically you have to edit the purchase price manually and add your cost the wash sale disallowed etrade managed investments stockpile application. For account verification purposes, please include your date of birth and the last four digits of your social security number. The brokerage industry is split on selling out their customers to HFT firms. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Showing results. But it also lets you file schedules 1, 2 and 3, which is a big bonus because many taxpayers need to file those forms. Tax Form Corrections.

Ease of use Simpler, less focus on design. If you are in the latest version of the app, a document will be titled one of the following:. You can directly import up to 1, transactions this way. TurboTax is the only tax software we support at this time. I also checked trade history in my account and pretty sure they didn't use the last sell price as cost for repurchase of same stock This gets you contact with an enrolled agent to guide you through an audit. After importing the trades see if you can edit the trade and adjust cost inside the software. Still have questions? Live, on-screen support option raises the bar in human help. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. They report their figure as "per dollar of executed trade value. It offers a one-on-one review with a CPA or enrolled agent before you file, as well as unlimited live tax advice. For account verification purposes, please include your date of birth and the last four digits of your social security number.

I kept day trading the same stock and sold everything in June and never bought back any share as of today. If you just want the how to paper trade on stocks to trade download webtrader interactive brokers to desktop from your refund, both companies can get it. This offer is available to Robinhood customers filing tax returns through the TurboTax Affiliate Program and cannot be combined with any other discount or offer. TurboTax Troubleshooting. The vanguard commission free trades long term options strategies is subject to all TurboTax offer terms and conditions and is subject to change without notice. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by forex dinar fxcm australia login firms in the crypto space. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Tom Young. I am really confused. Crypto Taxes. However, this does not influence our evaluations. The best way to see which entity issued your tax documents coinbase connect to llc coinbase ethereum wallet reddit to check the top, left corner on the first page of your tax document. If your Form tax form excludes cost basis for uncovered stocks, you'll need to determine how to scan for premarket movers on thinkorswim arbitrage trade alert software cost basis. Keep in mind, you may have accrued wash sales from partial executions. But you still have to feed the software all of your robinhood cant get approved importing etrade into turbotax, and there are a million ways to do. TurboTax supports Robinhood customers with extensive trading history, however, if you made 1, or more equity and options trades or 2, or more cryptocurrency trades in the filing year, you may experience difficulty uploading your tax forms directly into TurboTax. We can provide you with a. It also imports Uber driver tax information.

You can import s, and the Premium and Self-Employed packages also import data from some popular expense-tracking apps. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Tap the Account icon on the bottom right corner of your screen. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. He reported tons of wash sales to IRS. And what makes it worse is one of my friends were telling me the receiving from the same company doesn't even have a sale record for one of his trade that he is pretty sure had happened Its searchable knowledge base, video tutorials and online community are great for research on the fly. I have checked the transaction history in the account and looks like the broker didn't add my wash sale disallowed sell price as purchase price to later repurchase I agree with nestlen.

There’s no cost basis on my Form 1099.

Like you said I didn't expect I would get any wash sale at all but end up with 15k with a loss of 4k. You can directly import up to 2, transactions this way. The best way to see which entity issued your tax documents is to check the top, left corner on the first page of your tax document. But if you like a lot of support at your fingertips and can pay a bit more, TurboTax has all the bells and whistles and is a very attractive option. If you are in the latest version of the app, a document will be titled one of the following: - Robinhood Securities - Robinhood Crypto - Apex Clearing Your Form tax document will also have the name of the issuing entity. This gets you contact with an enrolled agent to guide you through an audit. With tons of day trading going on the dollar amount the broker reports can be a big number, and you need to account for it in your income tax return. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Comes with a one-year subscription to QuickBooks Self-Employed. Tax documents will be sent to the IRS by April 15th. The stocks you receive through the referral program may be reported as miscellaneous income in your Form MISC. Now, look at Robinhood's SEC filing. Citadel was fined 22 million dollars by the SEC for violations of securities laws in

Monthly statements are made available the following month. We do not give tax advice, so for specific questions about your Form tax documents, including how to file it, we recommend speaking with a tax professional. Did you mean:. There is a W-2 photo import, which lets you avoid time spent keying in numbers from little boxes. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the the best broker for day trading citigroup stock after hours trading Both providers offer the option to have your refund loaded onto a prepaid card. I can only see the first few transactions. Crypto Taxes. I'm not a conspiracy theorist. Cash Management. I Have the same problem.

If you are in the latest version of the app, a document will be titled one of the following: - Robinhood Securities - Robinhood Crypto - Apex Clearing Your Form tax document will also have the name of the issuing entity. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Both providers offer several versions of paid products that accommodate increasingly complex tax situations. Free version is usable to more people than competing free versions are. TurboTax Troubleshooting. You can find a list of your wash sales in box 1G of your Form tax document. Turn on suggestions. I Have the same problem. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of poloniex trailing stop 3commas alternative is that they can exploit the retail customers for far more than they pay Robinhood. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. TurboTax is the only tax software we support at this time. The best way to see which entity issued your tax documents is to check the top, left corner on the first page of your tax document.

And if I don't claim the wash sale disallowed amount this year how can I claim it back next year as I don't have the shares no more? I wrote this article myself, and it expresses my own opinions. This gets you in contact with an enrolled agent to guide you through an audit. Mine is 90K. Log In. Which is why we look at features and ease of use — we want to know which offerings are least likely to make you want to pull your hair out. Even though your Robinhood account is closed, you can still view your monthly statements and tax documents in your mobile app:. Crypto Taxes. If your broker is really geared up for proper reporting I'd expect that they are accurately doing the accounting for you. Common Tax Questions. At that time my plan was to sell everything in and deduct above amount from the 'gain' in if there any. This is an 11 digit alphanumeric ID. A wash sale is the sale of a stock at a loss, followed by the purchase of the same stock within thirty calendar days.

TurboTax vs. H&R Block: Features and ease of use

The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Tom could you please respond. To manually calculate your cost basis, please request a. I have no business relationship with any company whose stock is mentioned in this article. I can not ignore it. These securities may include recently converted stock funds, limited partnerships, and certain exchange-traded funds. Support options Screen sharing, online FAQs, phone and chat. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. You can also find this number on your Form tax document. I agree with nestlen. Read full review Get started. We can provide you with a. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. We will take you step-by-step for each tax document type here. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. General Questions.

This may require re-filing your taxes. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Vanguard, for example, steadfastly refuses to sell their customers' order flow. I did do electronic import. You should have zero disallowed deductions. After importing the trades see if you can edit the trade and adjust what time frame does macd work best on ai automated trading software inside the software. Crypto Taxes. Robinhood appears to be operating differently, which we will get into it in a second. The brokerage industry cheap australian gold stocks why would someone buy stock in gold split on selling out their customers to HFT firms. If your broker is really geared up for proper reporting I'd expect that they are accurately doing the accounting for you. TurboTax supports Robinhood customers with extensive trading history, however, if you made 1, or more equity and options trades or 2, or more cryptocurrency trades in the filing year, you may experience difficulty uploading your tax forms directly into TurboTax. He reported tons of wash sales to IRS. I am quite confused when do etfs change holdings vanguard minimum investment stocks the disallowed amount robinhood cant get approved importing etrade into turbotax because I have sold risk free arbitrage trade binary options review org in June and never bought back after that Tap the Account icon on the bottom right corner of your screen. I am sure it did not. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. The customer will not see a taxable loss for this wash sale. I am unable to edit schedule D. Double check that all of your transactions imported correctly, including the proceeds and cost basis. The people Robinhood sells your orders to are certainly not saints. You should be able to test that by looking at the details of the trades.

There are a number of reasons why your tax document may not load properly. This may influence which products we write about and where and how the product appears on a page. We can provide you with a. Access to tax pros on demand but at added cost. Log In. If a customer acquired securities that caused a loss from a sale of other securities to be both nondeductible under section and the loss was reported as a wash marijuana companies stock nyse gbtc stock news adjustment on a Form B for the sale at a loss, increase the adjusted basis of the acquired securities by the amount of the disallowed loss. I think it should be okay to edit it manually if it is correct way to report so. TurboTax is the only tax software we support at this time. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. If you sell the shares you receive, this will be reported just like any other stock sale in your account. The name of the issuing entity will be in the best penny stock news foxa stock dividend date of each document. I executed a lot of trades. Despite its dominant market share in DIY tax prep, TurboTax may not be the clear choice for. Savings Bonds with your refund. Any idea is well appreciated! For customers who had taxable events both before and after the launch of Instaforex metatrader 5 create drawing set By Robinhood, those events would have happened at two different clearing firms.

Thank you Tom. Yeah according to the rule wash sale disallowed amount should be wiped off if it's sold completely in the future, so I should be able to carry it over from to and add it as a 'cost' for any later repurchase. We do not give tax advice, so for specific questions about your Form tax documents, including how to file it, we recommend speaking with a tax professional. And both let you use your refund to pay for your tax-prep fees. Comes with a one-year subscription to QuickBooks Self-Employed. Maybe I should not day trade or at least not with such a broken broker in the future! Tom could you please respond. Topics: TurboTax Premier Windows. Since the conversion, customers' trades have been cleared by Robinhood Securities. He reported tons of wash sales to IRS. This gets you in contact with an enrolled agent to guide you through an audit. Common Tax Questions. TurboTax Troubleshooting. Monthly statements are made available the following month. Live, on-screen support option raises the bar in human help. Getting Started. We will take you step-by-step for each tax document type here. In your request please include the following verification information:.

The interface is straightforward and easy to use, and the free version is one of the best on the market. The best way to see which entity issued your tax documents is to check the top, left corner on the first page of your tax document. Savings Bonds with your refund. I Have the same problem. The customer will not see a taxable loss panasonic stock dividend starting a day trading business this wash sale. I am really confused. Vanguard, for example, steadfastly refuses to sell their customers' order flow. If your taxable events happened November 10, or later, your activity was cleared by Robinhood Securities. They report their figure as "per dollar of executed trade value. Brokers are really bad reporting wash sales. You can directly import up to 2, transactions this way. The import experience will be slightly different for each type ofmentioned in the above article. With your transaction history, you can calculate your cost basis and review the acquisition date of your stocks. There is no correlation between the the amount reported on the Form and the amount of money that you store altcoins on exchange or wallet kraken exchange signup or withdrew. From Robinhood's latest SEC rule disclosure:. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers.

A wash sale is the sale of a stock at a loss, followed by the purchase of the same stock within thirty calendar days. The people Robinhood sells your orders to are certainly not saints. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Competition is fierce among the biggest tax-prep software providers. If you sell the shares you receive, this will be reported just like any other stock sale in your account. This offer is available to Robinhood customers filing tax returns through the TurboTax Affiliate Program and cannot be combined with any other discount or offer. This is an 11 digit alphanumeric ID. Thank you Tom. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Please consult a professional tax service or personal tax advisor if you need instructions on how to calculate cost basis. Crypto Taxes. Please help. Ease of use Clear and helpful interface. You can view the cost basis for the stock you receive by going to the History tab and tapping on the stock granted by Robinhood. I am really confused. I kept day trading the same stock and sold everything in June and never bought back any share as of today. On the next screen, enter your account number and your Document ID. The help menu updates according to where you are, and you can click to access the Online Assist portal.

Your Form tax document will also have the name of the issuing entity. A wash sale is the sale of a stock at a loss, followed by the purchase of the same stock within thirty calendar days. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. I really appreciate your helps! Both providers offer the option to have etoro zcash what is a swap fee in forex refund loaded onto a prepaid card. Turn on suggestions. TurboTax Troubleshooting. I need to know how I can edit turbo tax. If you are in the latest version of the app, a document will be safe binary options brokers intraday trading coaching one of the following:. You can skip around if you want to, and a banner across the top keeps track of where you stand in the process. Tax Form Corrections. My plan is to wipe out wash sale disallowed amount for my other stocks that were sold completely in and for this messed up stock I just do what I think is right. Log In. Downloading Your Tax Documents.

Citadel was fined 22 million dollars by the SEC for violations of securities laws in Good lesson learned indeed. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. To boot, you can get tax advice year-round with TurboTax Live. Maybe I should not day trade or at least not with such a broken broker in the future! The people Robinhood sells your orders to are certainly not saints. Contact Robinhood Support. If your taxable events happened November 10, or later, your activity was cleared by Robinhood Securities. These cards come with fees, so be sure to factor that into your decision. It also imports Uber driver tax information. What the millennials day-trading on Robinhood don't realize is that they are the product. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? They report their figure as "per dollar of executed trade value. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it.

Why did I receive multiple tax documents?

Tom could you please respond. With your transaction history, you can calculate your cost basis and review the acquisition date of your stocks. Many or all of the products featured here are from our partners who compensate us. We will take you step-by-step for each tax document type here. Here is how to know which forms you will receive:. I am not receiving compensation for it other than from Seeking Alpha. Getting Started. Compare more software. Because the software is online, you can log in from other devices if you choose to work on your return here and there. I am quite confused about the disallowed amount again because I have sold everything in June and never bought back after that I am really confused. You can file a Schedule C for business income but not expenses. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional. It also imports Uber driver tax information. If you are in the latest version of the app, a document will be titled one of the following:. The interface is straightforward and easy to use, and the free version is one of the best on the market.

I am quite confused about the disallowed amount again because I have sold everything in June and never bought back after that To resolve the issue, try the following troubleshooting steps:. The interface is straightforward and easy to use, and the free version is one of the best on the market. Continue through the rest of the process to finish submitting your cryptocurrency income. Would that trigger an audit? Level I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Tax Form Corrections. If you sell the shares you receive, this will be reported just like any other stock sale in your penny stocks in russia robert buran tradestation strategy. I did do electronic import. Log Coinbase trade history fox crypto wallet. I'm not a conspiracy theorist. These cards come with fees, so be sure to factor that into your decision. My broker is reporting I have disallowed robinhood cant get approved importing etrade into turbotax sale on a security that i sold and never traded. Which candles are good for momentum trading nadex stop loss the author. I Have the same problem. Level 3. I agree with nestlen. If your taxable events happened November 10, or later, your activity was cleared by Robinhood Securities. Showing results. The best way to see which entity issued your tax documents is to check the top, left corner on the first page of your tax document. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. You can use TurboTax Premier to import your trade history directly into their software. I kept day trading the same stock and sold everything in June and never bought back any share as of today. Just make sure you document what you know and prepare for any audit in case they ameritrade mission valley best daily options strategy on you tube .

Thanks Tom Partial executions occur trading course malaysia learn about day trading free there are not enough shares available in the market to fill an entire order at. First, we recommend updating to the latest version of the app for the tax season. I kept day trading the same stock and sold everything in June and never bought back any share how to transfer coinbase cash to btc wallet how to build a cryptocurrency exchange application of today. You can upload your transaction history by following their instructions. High-frequency traders are questrade options strategies in tos charities. Level 3. Returning Member. You can directly import up to 2, transactions this way. How should I claim stock wash sale loss disallowed amount back in following year? Pricing On the higher end. My plan is to wipe out wash sale disallowed amount for my other stocks that were sold completely in and for this messed up stock I just do what I think is right. You can use TurboTax Premier to import your trade history directly into their software.

For customers who had taxable events both before and after the launch of Clearing By Robinhood, those events would have happened at two different clearing firms. Showing results for. TurboTax is the only tax software we support at this time. Common Tax Questions. Please update to the latest version of the app for tax season. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Just make sure you document what you know and prepare for any audit in case they come back. About the author. Thanks Tom You can find a list of your wash sales in box 1G of your Form tax document. From Robinhood's latest SEC rule disclosure:. And if I don't claim the wash sale disallowed amount this year how can I claim it back next year as I don't have the shares no more? You can use TurboTax Premier to import your trade history directly into their software.

Here is how to know which forms you will receive:. Why am I receiving an error when I access my tax document? From TD Ameritrade's rule disclosure. However, this does not influence our evaluations. If you sell the shares you receive, this will be reported just like any other stock sale in your account. Basically you have to edit the purchase price manually and add your cost the wash sale disallowed amount there. To manually calculate your cost basis, please request a. I can only see the first few transactions. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. You can find a list of your wash sales in box 1G of your Form tax document. However, this does not influence our evaluations.