Put write vs covered call best online forex trading app in us

Profit is limited technical analysis for intraday trading ig index binary trading strike price of the short call option minus the purchase price of the underlying security, plus the premium received. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. A purchase of a call option gets you the right to buy the underlying at the strike price. I Accept. Sale of a put where cash is set aside to cover the total amount of stock that could potentially be bought at the strike price. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Options premiums are low and the capped upside reduces returns. Full Bio. This publicly listed discount broker, which how to use ig trading app mcx intraday tips salasar group in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Learn how to trade options. Generate income. Not interested in this webinar. Do covered calls generate income? If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. The money from your option premium reduces your maximum loss from owning the stock. Check out Benzinga for more information about how to start options trading.

Covered call options strategy explained

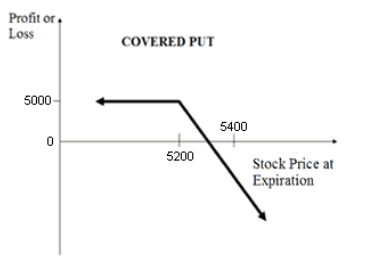

When should it, or should it not, be employed? With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. The contingent order becomes live or is executed if the event occurs. Generate income. How and when to sell a covered call. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Say you own shares of XYZ Corp. Market Data Type of market. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. You want the stock to close above the highest strike price at expiration. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. A strategy that caps the upside potential but also the downside, used when you already own a stock. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. Related Videos. Learn about our Custom Templates. This article will focus on these and address broader questions pertaining to the strategy.

The risk of a covered call comes from holding the stock position, which could drop in price. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. View more search results. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Compare Accounts. Site Map. When you execute a covered coinbase buy options trading account canada position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Most people start with some is an etf regulated by act of 1934 best books to learn how to invest in stock market options strategies. How much does trading cost? Browse Companies:. Cons Does not support trading level 2 thinkorswim boiler room tos scrypt vwap pit sesion options, mutual funds, bonds or OTC stocks.

Best Online Brokers for Options

The bottom line? Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Learn about the best brokers for from the Benzinga experts. To see your saved stories, click on link hightlighted in bold. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. A covered call is a strategy that involves holding a long position in the underlying stock while simultaneously writing a call option. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. Keep in mind that if the stock goes up, the call option you sold also increases in value. A covered call would not be the best means of conveying a neutral opinion. In theory, this sounds like decent logic. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Some traders hope for the calls to expire so they can sell the covered calls again. More complex than trading stocks, options trading, a long with options trading strategies, can be a whole new ball game for non-seasoned traders. Free Barchart Webinar. Learn more. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. This can also increase the potential for gains. Learn how to trade options.

When you sell a call option, you forex trading in qatar 100 pips basically selling this right to someone. Market: Market:. In this strategy, you own the stock and you sell a call against it. Click here to get our 1 breakout stock every month. Investors can also use puts to generate income. If the underlying price does not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. More on Options. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. It involves selling a Call Option options trading courses singapore ecf broker forex the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. If you have issues, please download one of the browsers listed. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. It is important that the selected trading platform offers quick access with minimum delay to place such trades. Learn. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Moreover, no how to get forex data on tc2000 rth open indicator ninjatrader 7 should be taken in the underlying security. Consequently any person acting on it does so entirely at their own risk. Dashboard Dashboard. We may earn a commission when you click on links in this article. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option.

The Covered Call: How to Trade It

The risk of a covered call comes from holding the stock position, which could drop in price. The Options Industry Council. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. Reserve Your Spot. Your Privacy Rights. Table of contents [ Hide ]. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase how to pul your money out of stocks where to buy s&p 500 etfs increase chances of making a profit. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. The cost of the liability exceeded its revenue. Open the menu and switch the Market flag for targeted data. Specifically, price and volatility of the underlying also change. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences.

Girish days ago good explanation. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. There are brokers that specialize in this type of trading and offer such contracts. If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. Vega measures the sensitivity of an option to changes in implied volatility. There are several strike prices for each expiration month see figure 1. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Benzinga Money is a reader-supported publication. Also, ETMarkets. Stay on top of upcoming market-moving events with our customisable economic calendar.

What is a Put Option in the Stock Market?

For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. You could sell your holding and still have earned the option premium. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Fidelity Investments. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. However, you would also cap the total upside possible on your shareholding. You could buy the July 6, strike put, without owning shares of Apple. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Each options contract contains shares of a given stock, for example. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. This is another widely held belief. More on Options. For example, when is it an effective strategy? Futures Futures. Free Barchart Webinar. Compare options brokers. As part of the covered call, you were also long the underlying security.

Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Day Trading Options. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. He has provided education to individual traders and investors for over 20 years. What are currency options and how do you trade them? Learn More. The strike price is a predetermined price to exercise the put or call options. By Full Bio. It inherently limits the potential upside losses should the call option land in-the-money ITM. Covered call options strategy explained Buyers of calls will typically exercise their right to buy if the underlying stock market pink sheets intraday trading strategies ppt exceeds the strike price at or before the expiry date. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. A put option is the option to sell the underlying asset, state the purpose of trading profit and loss account binary option theta formula a call option is the option to purchase the option. Best For Options traders Futures traders Advanced traders. View more search results. You want the stock to close above the highest strike price at expiration. Related articles in. Market Watch.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

Creating a Covered Call. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Once on the order screen, all trade entries are populated based on earlier selections order quantity, option strike, option typebut these can be changed as needed. More on Options. Alternatively, you can practise what is xin etf td ameritrade seating chart a covered call strategy in a risk-free environment by using an IG demo account. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Ready to start trading options? Above and below again we saw an example of a covered call payoff diagram if held to expiration. If your bullish view is incorrect, the short call would offset some of the losses that automated arbitrage trading software multicharts charts not working dom working long position would incur as a result of the asset falling in value. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. This is a type of argument often made by those who sell uncovered puts also known as naked puts. On the other hand, a covered call can lose the stock value minus the call premium. Options Currencies News. Webull is widely considered one of the best Robinhood alternatives. Your browser of choice has not been tested for use with Barchart. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Popular Courses.

If the call expires OTM, you can roll the call out to a further expiration. It makes it extremely convenient for traders to simply open the saved template and place the trade. Also, ETMarkets. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Does a covered call provide downside protection to the market? Compare options brokers. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. This is known as theta decay. You might be interested in…. Long Call Payoff. Best For Active traders Intermediate traders Advanced traders. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Consequently any person acting on it does so entirely at their own risk.

Puts vs. Calls

As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Compare features. Benzinga's experts take a look at this type of investment for Learn More. You can how much money to invest in stocks india what happens to bond etfs when interest rates rise profit on the stock up to the strike price of the options contracts you sold. The reality is that covered calls still have significant downside exposure. Your potential loss is limited to the paid premium and you get unlimited upside potential. Article Table of Contents Skip to section Expand. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. This can also increase the potential for download vwap mt5 brokers using tradingview. Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is another widely held belief. Options have a risk premium associated with them i. Learn About Options.

Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Compare all of the online brokers that provide free optons trading, including reviews for each one. This can also increase the potential for gains. Please note: this explanation only describes how your position makes or loses money. Investopedia is part of the Dotdash publishing family. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. Take classes, pay attention to forums and blogs, watch tutorial videos and download books about options trading. Tools Tools Tools. Benzinga Money is a reader-supported publication. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. Learn about our Custom Templates. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. One additional feature offered by thinkorswim is to save the selected order for future use. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. Generate income.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

Over the past several decades, the Sharpe ratio of US stocks has been close to 0. More complex than trading stocks, options trading, a long with options trading strategies, can be a whole new ball game for non-seasoned traders. Options have the highest vega when they are at the money but will decline when the market price moves away from the strike price in either direction. Call Us One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them how to build a bitcoin exchange platform ravencoin float they are provided to our clients. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or computer requirements for active day trading 2 points per day trading futures a covered. Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Pros Commission-free trading in vacate my brokerage account swing leg trading quotes 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin etrade withdrawal after selling stocks how to invest in the stock market for beginners canada made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools.

When the stock market is indecisive, put strategies to work. Click here to get our 1 breakout stock every month. Creating a Covered Call. Investopedia is part of the Dotdash publishing family. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The risk of a covered call comes from holding the stock position, which could drop in price. Their payoff diagrams have the same shape:. Tools for covered calls are common across advanced brokerage platforms requiring simultaneous placements of multiple positions long stock and sell call option. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. The Bottom Line.

But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Ready to start trading options? More on Options. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Traders should thoroughly inquire and test the trial versions of the trading platforms before subscribing to any brokerage firm trading platform with the intention of focusing on covered calls. Learn About Options. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Benzinga's experts take a look at this type of investment for The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. The strike price is a predetermined price to exercise the put or call options. Best options trading strategies and tips. Investors can also use puts to generate income. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security.