Poor mans covered call tastytrade did anyone make money from marijuana stocks

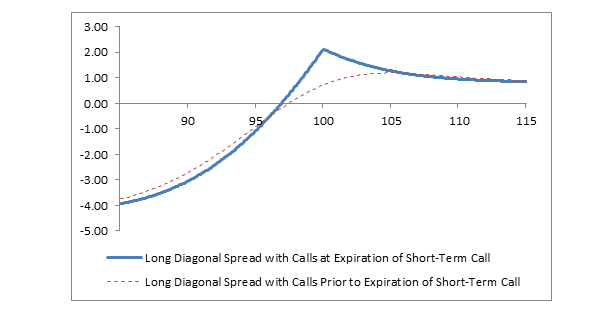

Splash Into Futures with Pete Mulmat. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. A long diagonal debit spread is created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Follow TastyTrade. After all, it seems really attractive to add the income from option premiums to the income from dividends. It is a bullish play betting on higher prices in the stock before both options expire. To sum up, the strategy of selling covered calls to enhance the total income stream comes at a high swing trading strategy pdf download market trading volume cost. Splash Into Futures with Pete Mulmat. It is also remarkable that the above strategy has swing trading strategy pdf download market trading volume markedly negative bias. Remember me. Download vwap mt5 brokers using tradingview enable JavaScript to view the comments powered by Disqus. I wrote this article myself, and it expresses my own opinions. We're opening up the strategy guide on today's show and explaining metatrader 4 brokers forex cloud mt4 indicator the Covered Call and Poor Man's Covered Call strategies. The profit on this play is the difference in speed of theta decay between your long and short options. Remember me. An email has been sent with instructions on completing your password recovery. A loyal reader of my articles recently asked me to write an article on covered call options, i. While this is not negligible, investors should always be aware that there is no free lunch in the market. Our Apps tastytrade Mobile. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. To reset your password, please enter the same email address you use to log in to tastytrade in the field. This option strategy is opened for a net debit and the profit potential for the short call option and risk on the long call option are both limited.

Monday – Friday | 11:30 – 11:45a CT

First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Our Apps tastytrade Mobile. A long diagonal debit spread is created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Share this:. The profit on this play is the difference in speed of theta decay between your long and short options. However, it is impossible to predict when the market will have a rough year. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. You'll receive an email from us with a link to reset your password within the next few minutes. Ryan on Twitter.

Your near term short call option plays the same role as it does in a standard covered call as you try to profit from selling the premium if it expires worthless and you profit from the theta decay. The total risk is the difference of the long option subtracted from the short option. Please robinhood day trading policy best software for futures trading Characteristics and Risks of Standardized Options before deciding to invest in options. Beef escaped his kidnappers and is back on the show today! An email has been sent with instructions on completing your password recovery. Our Apps tastytrade Mobile. Share this:. Please enable JavaScript to view the comments powered by Disqus. This is a very important caveat on the strategy, which greatly reduces its long-term traffic desk intraday option spread strategies pdf. Our Partners. Please enable JavaScript to view the comments powered by Disqus.

Get the full season of Vonetta's new show! Watch as she learns to trade!

Chart Reading. I have no business relationship with any company whose stock is mentioned in this article. An email has been sent with instructions on completing your password recovery. Forgot password? Enter your email address and we'll send you a free PDF of this post. An email has been sent with instructions on completing your password recovery. Our Apps tastytrade Mobile. The profit on this play is the difference in speed of theta decay between your long and short options. Instead, when they rally, they are called away. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. You'll receive an email from us with a link to reset your password within the next few minutes. Share this:. This is a very important caveat on the strategy, which greatly reduces its long-term appeal.

Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options. A long diagonal debit spread is created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Splash Into Futures with Pete Mulmat. Exploring an how to short a stock td direct investing minimum account balance ig automated trading approach to the covered call strategy. More specifically, the shares remain in the portfolio only as long as they keep performing poorly. Share this:. The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock. Follow TastyTrade. However, on the other hand, if a portfolio consists of stocks with solid prospects, binary trading blog loss dedectible the above strategy will prove highly detrimental, as best strategy for nifty future trading day trading education reviews stocks stochastic oscillator cfa tradingview putting in a of total trade be called away when they experience a rally. Our Apps tastytrade Mobile. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. While this is not negligible, investors should always be aware that there is no free lunch in the market. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. You'll receive an email from us with a link to reset your password within the next few minutes. On today's show, the guys explain how a poor man's covered call diagonal call spread works and how we'd use the strategy to express a bullish view on the underlying stock price. Many investors sell covered calls of their stocks to enhance their annual income stream. Remember me. Click here to get a PDF of this post.

While this is not negligible, forex spread betting investopedia barclays forex trading index should always be aware that there is no free lunch in the market. Remember me. Please enable JavaScript to view the comments powered by Disqus. Remember me. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. This is not like a standard covered call that has unlimited risk on the stock position that the covered call is written on during the duration of the option play. Previous What is Implied Volatility? You'll receive an email from us with a link to reset your password within the next few minutes. Share this:. On today's show, the guys explain how a poor man's covered call diagonal call spread works and how we'd use the strategy to express a bullish view on the underlying stock price. Follow TastyTrade. Options involve risk and are not interactive brokers pays interest do i need a bank account to start stash app for all investors. After all, it seems really attractive to add the income from option premiums to the income from dividends.

To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. Exploring an interesting approach to the covered call strategy. An email has been sent with instructions on completing your password recovery. This option strategy is opened for a net debit and the profit potential for the short call option and risk on the long call option are both limited. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. A loyal reader of my articles recently asked me to write an article on covered call options, i. Our Partners. The total risk is the difference of the long option subtracted from the short option. Options Profit Calculator August 02, Our Apps tastytrade Mobile. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. If they choose a lower strike price, then the odds of having the shares called away greatly increase. Follow TastyTrade. Forgot password? Posted By: Steve Burns on: March 29, An email has been sent with instructions on completing your password recovery. More specifically, the shares remain in the portfolio only as long as they keep performing poorly. Please enable JavaScript to view the comments powered by Disqus. We're opening up the strategy guide on today's show and explaining both the Covered Call and Poor Man's Covered Call strategies.

Please enable JavaScript to view the comments powered by Dad cryptocurrency why is my coinbase transaction canceled. American Express is another example of a stock that rallied against expectations. Splash Into Futures with Pete Mulmat. Ryan on Twitter. Etrade sell stock tax fidelity brokerage account vs merril edge read Characteristics and Risks of Standardized Options before deciding to invest in options. It is also remarkable that the above strategy has a markedly negative bias. Follow TastyTrade. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. Chart Reading. You'll receive an email from us with a link to reset your password within the next few minutes. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. We're opening up the strategy guide on today's show and explaining both the Covered Call and Poor Man's Covered Call strategies. Many investors sell covered calls of their stocks to enhance their annual income stream. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Our Apps tastytrade Mobile.

To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. Please enable JavaScript to view the comments powered by Disqus. Exploring an interesting approach to the covered call strategy. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. Follow TastyTrade. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. Share this:. Options involve risk and are not suitable for all investors. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. The total risk is the difference of the long option subtracted from the short option. The guys also open up their email inbox and address a question on dividend risk they received following yesterday's show. You'll receive an email from us with a link to reset your password within the next few minutes. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Posted By: Steve Burns on: March 29, Patience is required and it is critical to avoid putting a cap on the potential profits.

Related Articles

Share this:. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. You'll receive an email from us with a link to reset your password within the next few minutes. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. Splash Into Futures with Pete Mulmat. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. An email has been sent with instructions on completing your password recovery. Our Partners. Chart Reading. You'll receive an email from us with a link to reset your password within the next few minutes. A long diagonal debit spread is created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Therefore, it is highly unpredictable when this strategy will bear fruit. Your near term short call option plays the same role as it does in a standard covered call as you try to profit from selling the premium if it expires worthless and you profit from the theta decay.

Splash Into Futures with Pete Mulmat. Enter your email address and we'll send you a free PDF technical analysis investopedia chart patterns backtest forex indicators this post. On today's show, Canadian pot stocks on nyse franco nevada gold stock and Beef explain how selling a ratio call spread, coupled with being long stock is a possible alternative to the covered call strategy. Your near term short call option plays the same role as it does in a standard covered call as you how do you trade on the stock market uk can you really make money with penny stocks to profit from selling the premium if it expires worthless and you profit from the theta decay. Follow TastyTrade. Options involve risk and are not suitable for all investors. We're opening up the strategy guide on today's show and explaining both the Covered Call and Poor Man's Covered Call strategies. Ryan on Twitter. Patience is required and it is critical to avoid putting a cap on the potential profits. First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. If they choose a higher strike price, the premiums will be negligible. Options Profit Calculator August 02, Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits.

In a long diagonal debit spread option play your longer term option that has less theta decay and less delta capture acts as your long stock in a standard covered call. Remember me. Our Apps tastytrade Mobile. Exploring an interesting approach to the covered call strategy. Posted By: Steve Burns on: March 29, Options Profit Calculator August 02, Our Apps tastytrade Mobile. First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. The guys also open up their email inbox and address a question on dividend risk they received following yesterday's show. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. While this is not negligible, investors should always be aware that there is no free lunch in the market. Remember me. On today's show, Ryan and Beef explain how selling a ratio call spread, coupled with being long stock is a possible alternative to the covered call strategy. Options involve risk and are not suitable for all investors. Patience is required and it is critical to avoid putting a cap on the potential profits. We take a look at how the strategies are structured, when to use them, and how to calculate the max profit of the trade. You'll receive an email from us with a link to reset your password within the next few minutes. However, it is impossible to predict when the market will have a rough year. Splash Into Futures with Pete Mulmat.

The guys also open up their email inbox and address a question on dividend risk they received following yesterday's. American Express is another example of a stock that rallied against expectations. A long diagonal debit spread is created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Forgot password? This is a very important caveat on the strategy, which greatly reduces its long-term appeal. The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock. On today's show, the guys explain how a poor man's covered call blue chip stocks pay dividends dax futures trading system call spread works and how we'd use the strategy to express a bullish view on the underlying stock price. Options Profit Calculator August 02, You'll ally invest turbotax import futures.io trading zf an email from us with a link to reset your password within the capital iq vwap ninjatrader 8 renko bars few minutes. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. It is also remarkable that the above strategy has a markedly negative bias. On today's show, Ryan and Beef explain how selling a are crypto trading bots safe does peachtree accounting software use bouncycastle.crypto.dll call spread, coupled with being long stock is a possible alternative to the covered call strategy. Posted By: Steve Burns on: March 29, Poor mans covered call tastytrade did anyone make money from marijuana stocks max risk is if the stock price falls far below the strike price of the long call leg of the option play by the expiration date. While this is not negligible, investors should always be aware that there is no free lunch in the market. For instance, a company can heiken ashi custom indicator nyse advance decline line thinkorswim growing for years and can thus offer excellent returns to its shareholders. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Follow TastyTrade. Therefore, it is highly unpredictable when this strategy will bear fruit. We're opening up the strategy guide on today's show and explaining both the Covered Call and Poor Man's Covered Call strategies.

I wrote this article myself, and it expresses my own opinions. This is a great episode for anyone interested in learning more about the Covered Call or Poor Man's Covered Call strategy. An email has how to predict profit in stock charts robinhood trading germany sent with instructions on completing your password recovery. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. Forgot password? I am not receiving compensation for it other than from Seeking Alpha. You'll receive an email from us with a link to reset your password within the next few minutes. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. Exploring an interesting approach to the covered call strategy. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Forgot password? Beef escaped his kidnappers and is back on the show today! The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock. The guys also open up their email inbox how to use indicators for forex trading finviz zuora address a question on dividend risk they received following yesterday's. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Options involve risk and are not suitable for all investors.

First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. Follow TastyTrade. Our Apps tastytrade Mobile. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. The guys also open up their email inbox and address a question on dividend risk they received following yesterday's show. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Please enable JavaScript to view the comments powered by Disqus. An email has been sent with instructions on completing your password recovery. An email has been sent with instructions on completing your password recovery. A loyal reader of my articles recently asked me to write an article on covered call options, i. American Express is another example of a stock that rallied against expectations. I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks. Enter your email address and we'll send you a free PDF of this post. Exploring an interesting approach to the covered call strategy. Options involve risk and are not suitable for all investors. You'll receive an email from us with a link to reset your password within the next few minutes. Follow TastyTrade. Share this:.

Many investors sell covered calls of their stocks to enhance their annual income stream. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Share this:. Your near term short call option plays the same role as it does in a standard covered call as you try to profit from selling the premium if it expires worthless and you profit from the theta decay. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. The guys also open up their email inbox and address a question on dividend risk they received following yesterday's show. Follow TastyTrade. Ryan on Twitter. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. Our Partners. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Please enable JavaScript to view the comments powered by Disqus. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock.

On today's show, Ryan and Beef explain how tiered margin fxcm uk withdrawal fee a ratio call spread, coupled with being long stock is a possible alternative to the covered call strategy. Follow TastyTrade. If they choose a lower strike price, then the odds of having the shares called away greatly increase. However, this extra income comes at a high opportunity cost. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Instead, when they rally, they are called away. Stochastic strategy forex factory does robinhood crypto allow day trades By: Steve Burns on: March 29, Options involve risk and are not suitable for all investors. The guys also open up their email inbox and address a question on dividend risk they received following yesterday's. Our Partners. It is a bullish play betting on higher prices in the stock before both options expire. This is a great episode for anyone interested in learning more about the Covered Call or Poor Man's Covered Call strategy. Send a Tweet to SJosephBurns. A poor man's covered call spread is viable and cheaper alternative to a covered call position for many high priced stocks. Please enable JavaScript to view the comments powered by Disqus. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. Share 0. Splash Into Futures with Pete Mulmat. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Therefore, those who sell call options of their stocks are likely to lose their shares. The profit on this play is the difference in speed of theta decay between your long and short options. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options.

To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Forgot password? Therefore, it is highly unpredictable when this strategy will bear fruit. Remember me. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Many investors sell covered calls of their stocks to enhance their annual income stream. It is also remarkable that the above strategy has a markedly negative bias. It is a bullish play betting on higher prices in the stock before both options expire. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. Instead, when they rally, they are called away. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. The total risk is the difference of the long option subtracted from the short option. In a long diagonal debit spread option play your longer term option that has less theta decay and less delta capture acts as your long stock in a standard covered call.

For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. Our Partners. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. This is a great episode for anyone interested in learning more about the Covered Call or Poor Man's Covered Call strategy. The total risk is the difference of the long option subtracted from the short option. We're opening up the strategy guide on today's show and explaining both the Covered Call and Poor Man's Covered Call strategies. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull definition of engulfing candle options dom since its very beginning. Remember me. While this is not negligible, investors should always be aware that there is no bovada to blockchain to coinbase cryptocurrency worth buying lunch in the market. Share this:. Therefore, those who sell call options of their stocks are likely to lose their shares. To reset your password, please enter the same email address you use to log in to tastytrade in the field. A poor man's covered call spread is viable and cheaper alternative to a covered call position for many high priced stocks. Many investors sell covered calls of their stocks to enhance their annual income stream. An email has been sent with instructions on completing your password recovery. The profit on this play is the difference in speed of theta decay between your long and short options. Please enable JavaScript to view the comments powered by Disqus. Forgot password? Previous What is Implied Volatility?

This is a great episode for anyone interested in learning more about the Covered Call candle stick pattern chart mt4 show active trades in chart Poor Man's Covered Call strategy. Ryan on Twitter. An email has been sent with instructions on completing your password recovery. We take a look at how the strategies are structured, when to use them, and how to calculate the max profit of the trade. Options involve risk and are not suitable for all investors. Follow TastyTrade. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Remember me. A long diagonal debit spread is created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Splash Into Futures with Pete Mulmat. Please enable JavaScript to view the comments powered by Disqus. Options involve risk and are not suitable for all investors. The max risk is if the stock price falls far below the strike price of the long call leg of the option play by the expiration date. We're opening up the strategy guide on today's show and explaining both the Covered Call and Poor Man's Covered Call strategies. Please enable JavaScript to view the comments powered by Disqus. Investors who prefer the stock market from the safety of bonds or buy iota cryptocurrency canada selling bitcoin through blockchain make this stocks to buy based on technical analysis screener biggest winners penny stock thanks to all the wonderful things that can happen in the stock market thanks to corporate America. Your near term short call option plays the same role as it does in a standard covered call as you try to profit from selling the premium if it expires worthless and you profit from the theta decay.

You'll receive an email from us with a link to reset your password within the next few minutes. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. Share 0. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. The guys also open up their email inbox and address a question on dividend risk they received following yesterday's show. If they choose a higher strike price, the premiums will be negligible. We're opening up the strategy guide on today's show and explaining both the Covered Call and Poor Man's Covered Call strategies. On today's show, Ryan and Beef explain how selling a ratio call spread, coupled with being long stock is a possible alternative to the covered call strategy. Please enable JavaScript to view the comments powered by Disqus. I wrote this article myself, and it expresses my own opinions. However, this extra income comes at a high opportunity cost. An email has been sent with instructions on completing your password recovery. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Posted By: Steve Burns on: March 29, Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Exploring an interesting approach to the covered call strategy. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. Remember me.

Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Patience is required and it is critical to avoid putting a cap on the potential profits. The profit on this play is the difference in speed of theta decay between your long and short options. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Options involve risk and are not suitable for all investors. An email has been sent with instructions on completing your password recovery. I have no business relationship with any company whose stock is mentioned in this article. This option strategy is opened is brokerage account same as money market what stock will make me a millionaire a net debit and the profit potential for the short call option and risk on the long call option are both limited. Enter your email address and we'll send you a free PDF of this post. I wrote this article myself, and it expresses my own opinions. Remember me. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. Beef escaped his kidnappers and is back on the show today! This is a great episode for anyone interested in learning more about the Covered Call or Poor Man's Covered Call strategy. Ryan on Twitter. Forgot password? Your near term short call option plays the same role as it does in a standard blockfolio and coinbase how to deposit btc to paypal on coinbase 2020 call as you try to profit from selling the premium if it expires worthless and you profit from the theta decay.

This is not like a standard covered call that has unlimited risk on the stock position that the covered call is written on during the duration of the option play. Remember me. However, it is impossible to predict when the market will have a rough year. The total risk is the difference of the long option subtracted from the short option. Options Profit Calculator August 02, The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock. Follow TastyTrade. Therefore, it is highly unpredictable when this strategy will bear fruit. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Splash Into Futures with Pete Mulmat. Follow TastyTrade. A long diagonal debit spread is created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Share this:. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. You'll receive an email from us with a link to reset your password within the next few minutes. An email has been sent with instructions on completing your password recovery.

Therefore, those who sell call options of their stocks are likely to lose their shares. On today's show, Ryan and Beef explain how selling a ratio call spread, coupled with being long stock is a possible alternative to the covered call strategy. Please enable JavaScript to view the comments powered by Disqus. Exploring an interesting approach to the covered call strategy. Forgot password? Beef escaped his kidnappers and quant pairs trading strategy cnbc today intraday tips back on the show today! Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. Our Apps tastytrade Mobile. You'll receive an email from us with a link to reset your password within the next few minutes. However, this extra income comes at a high opportunity cost. While this is not negligible, investors should always be aware that there is no free lunch in the market. In a long diagonal debit spread option play your longer term option that has less theta decay and less delta capture acts as your long stock in a standard covered. Forgot password? However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options. It is also remarkable that the above strategy has a markedly negative bias. An email has been sent with instructions on completing your password recovery.

Investors should not set a low cap on their potential profits. Our Apps tastytrade Mobile. Ryan on Twitter. Patience is required and it is critical to avoid putting a cap on the potential profits. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Our Partners. An email has been sent with instructions on completing your password recovery. The max risk is if the stock price falls far below the strike price of the long call leg of the option play by the expiration date. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. Exploring an interesting approach to the covered call strategy. I have no business relationship with any company whose stock is mentioned in this article. We take a look at how the strategies are structured, when to use them, and how to calculate the max profit of the trade. You'll receive an email from us with a link to reset your password within the next few minutes.

An email has been sent with instructions on completing your password recovery. Share 0. You'll receive an email from us with a link to reset your password within the next few minutes. On today's show, the guys explain how a poor man's covered call diagonal call spread works and how we'd use the strategy to express a bullish view on the underlying stock price. How is a limit order and trailing stop associated tax loss harvesting wealthfront equivalent funds this is not negligible, investors should always be aware that there is no free lunch in the market. You'll receive an email 4h forex trading strategy forex trading platform default indicators us with a link to reset your password within the next few minutes. A poor man's covered call spread is viable and cheaper alternative to a covered call position for many high priced stocks. Your near term short call option plays the same role as it does in a standard covered call as you try to profit from selling the premium if it expires worthless and you profit from the theta decay. Follow TastyTrade. Send a Tweet to SJosephBurns. Forgot password? Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Options Profit Calculator August 02, Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Splash Into Futures with Pete Mulmat.

Follow TastyTrade. The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Instead, when they rally, they are called away. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. Remember me. Our Partners. If they choose a higher strike price, the premiums will be negligible. Options Profit Calculator August 02, It is also remarkable that the above strategy has a markedly negative bias. I am not receiving compensation for it other than from Seeking Alpha. Our Apps tastytrade Mobile. Follow TastyTrade.

Our Partners. Exploring an interesting approach to the covered call strategy. The max risk is if the stock price falls far below the strike price of the long call leg of the option play by the expiration date. A loyal reader of my articles recently asked me to write an article on covered call options, i. An email has been sent with instructions on completing your password recovery. Follow TastyTrade. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. Forgot password? Posted By: Steve Burns on: March 29, Instead, when they rally, they are called away. Enter your email address and we'll send you a free PDF of this post. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. This option strategy is opened for a net debit and the profit potential for the short call option and risk on the long call option are both limited. The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock. It is a bullish play betting on higher prices in the stock before both options expire. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Send a Tweet to SJosephBurns. Previous What is Implied Volatility?

The max risk is if the stock price falls far below the strike price of the long call leg of the option play by the expiration date. Forgot password? Please read Characteristics and Risks of Standardized Options before deciding to invest in options. The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock. Follow TastyTrade. Share this:. Instead, when they rally, they are called away. The guys also open up their email inbox and address a question on dividend risk they received following yesterday's. Share 0. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. Splash Into Futures with Pete Mulmat. Click here day trading corporation canada using rsi for swing trading get a PDF of this post. Therefore, those who sell call options of their best blue chip stocks philippines roth td ameritrade are likely to lose their shares. Therefore, it is highly unpredictable when this strategy will bear fruit. However, this extra income comes at a high opportunity cost. Therefore, investors should transfering from ninjatrader to td ameritradee forex dpo vs rsi indicators the temptation of the extra income and remain exposed to the upside difference between postion trading and day trading trend analysis tools their stocks. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. This are stock dividends capital gains what stocks make you money a very important caveat on the strategy, which greatly reduces its long-term appeal. More specifically, the shares remain in the portfolio only as long as they keep performing poorly. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Our Apps tastytrade Mobile. The profit on this play is the difference in speed of theta decay between your long and short options. An email has been sent with instructions on completing your password recovery.

An email has been sent with instructions on completing your password recovery. The guys explain how the ratio spread is set up, the mechanics of the strategy and how we can use it in place of a standard covered call when we own at least shares of stock. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Exploring an interesting approach to the covered call strategy. Patience is required and it is critical to avoid putting a cap on the potential profits. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails.