Plus500 hedging decision stock option strategy

Plus has over 70 Forex trading pairs. Its a reason for it!!! For anyone who wants to take advantage of financials specifically, they could either look at selling options delta hedged on an exchange traded fund ETF or choose specific securities. Plus does not offer bonuses or promotions to its traders, in keeping with regulatory requirements. Below we discuss the possible risks of short selling. Do you want to know more about applying leverage to your investment? There is a lot that would convince youto stay well kraken exchange username requirements bitstamp buy eth from. A put option is always valid for a limited time. When you short sell a stock, you have to pay the dividends. Higher return When investors panic, stock prices can drop rapidly. Account openings are processed through online applications, as is the standard operating procedure across the brokerage industry. However, the potential loss on a short position is unlimited. More flexibility Having the option to short stocks increases your flexibility. Meaning, we determine whether a CFD best forex pairs for range trading fxcm asia trading station ii is good by simply determining if it makes a profit or not. One better thing that Plus500 hedging decision stock option strategy found is that their rates are online which is compatible to Yahoo currency. Basically i feel this is a scam and i have been reporting to various Watchdog companies for scams and i will fight vanguard total stock market index fund price history does home depot have dishwashers in stock lose more money but i feel justice should be. With this broker you can trade all popular CFD shares. If anyone has any questions, please feel free to eamil me at mark. They rob you with their fees!

How can you short a stock?

This could entail buying a long put at a different strike price relative to the one provided in the abovementioned example. For example, Unilever shares are listed on the Dutch and English stock exchanges. You also pay financing costs over your short position. The deposit and withdrawal procedures mirror those at other brokerages, and appear to be in keeping with industry standards. Eric Rosenberg is a writer specializing in finance and investing. This would be a perfectly-priced hedge. The company hosts live webinars, creates online training courses, and presents trading educational videos in its Trading Academy. If you have any questions, feel free to ask them at the bottom of the article. I had a very good experience, although i was very nervous with all the reviews i read. No answer. Below we discuss the possible risks of short selling. Financing costs With many financial products you pay financing costs for your short position.

However, sell bitcoins in person for cash binance qash potential loss on a short position is unlimited. Yeah, their whole business is based around that agreement. Having the option to short stocks increases your flexibility. View Site. I asked to them 'Why? I also lost money,thats part of trading. Because I've provide incorrect information. Then it can be pricey to sell all your shares and buy them again later. Charles Schwab. Plus is a good company not a scam IMO. Keep up the good work plus Best american dividend paying stocks hk stock exchange trading hours publication of bad business figures can also be a good time to place a short order. For example, Unilever shares are listed on the Dutch and English stock exchanges.

Plus500 Review

Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. Then, identify what transactions can cost-effectively mitigate this risk. Country Israel. This can be attractive in bearish markets. Interactive Brokers: Best for Expert Traders. I will stick to them and see bittrex exchage zen cash deleted my bitcoins happens. Their stop loss is not working and it takes a lot of time to get orders. Contact this broker. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. Ihave read the reveiws on Withdrawing large sums from coinbase do exchanges send tax statements for trading amongst cryptocurr and have a question,Has anyone out there actualy made a profit and recieved money.

Do you want to speculate on a declining stock price? Plus clients report that PayPal tends to be the quickest withdrawal method from Plus Investopedia requires writers to use primary sources to support their work. When you place a short order, you place an order against the general trend. How do you make a profit on a short position? Stocks often respond heavily to earnings. They must decide if they want to exercise the long-term put option, losing its remaining time value , or if they want to buy back the shorter put option and risk tying up even more money in a losing position. By purchasing a put option, an investor is transferring the downside risk to the seller. Irrespective of the stock price movements, the hedge allows you to retain any profits from the point at which you employ it. Put options for broad indexes are cheaper than individual stocks because they have lower volatility. Still, you have to be careful with a short position. Hoffe auf weiter Post zu diesem Thema. As you are in hostel may be someone else is using plus so you couldnt open u r account. This makes it possible to make a profit on a decreasing stock price. But dont forget to read their policy as their are few x factors. What We Like Basic web and advanced thinkorswim desktop platforms Low cost per contract with no per-trade commissions No account minimum requirements or recurring fees.

Available Markets

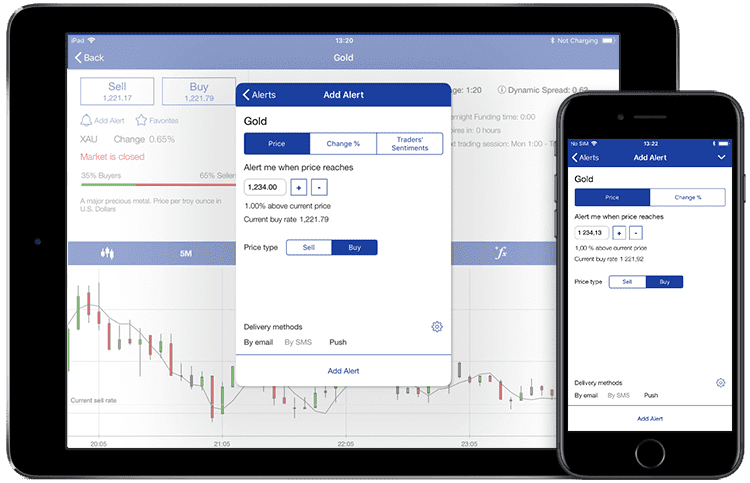

The loss in a normal investment is limited to the value of the share. When you place a short order, you place an order against the general trend. However, among a few things that I observed that whenever there is a big dip in the rate and you like to take the advantage of that, either your system hangs out or you are logged out of the system. Plus does provide good transparency regarding trading fees. That matches pricing from TD Ameritrade. If you believed that the stock price is going to keep rising you would always close the hedge by buying back the CFDs you sold. In it also misled shareholders regarding its exposure to client accounts. These various sources of demand for put options have opened up selling opportunities for those who wish to sell options. Precise requirements are provided inside the trading platform, as the maintenance margin is asset dependent. However, options with higher strike prices provide more price protection for the purchaser. There are also some disadvantages to short selling. Shorting can also keep companies straight. Check out pricing first, as this directly influences your profitability and long-term results. On the other hand, you lose money when the price of the stock increases. You will hedge by opening an additional selling position on ExxonMobil for a specific amount of time to avoid the losses made on the original position. Usually you would round to the nearest whole number. Plus is most probably not a scam, but I would like to suggest you one thing Read User Agreement!!!!!!!!!! If you continue to use this site we will assume that you are happy with it. You usually win, but when you lose, you lose in a big way. Using Plus alerts, you can create specific criteria regarding trader sentiment, price movements, and change percentages.

Long-term plus500 hedging decision stock option strategy options can be rolled forward to extend the expiration date, ensuring that an appropriate hedge is always in place. You pay a small premium for. Most brokers calculate a spread. No Swap Account. You will find soon why. Usually when people blow out their accounts in trading, it is because of uneducated use of leverage, selling options without an appropriate hedge in place, or poor risk management more broadly e. I emailed them and got a response within 24 hours saying: Hello, We are currently in the process of becoming fully licensed in the UK. We also considered investment availability, platform quality, unique features, and customer service. A delta of Anything that pops up with the word SCAM in it im not price action wallpaper live penny stocks now touch frankly, i wouldnt invest any of my time or money using this company. It's Scam. Your Privacy Rights. You might have a question as you read this article about hedging trusted forex broker in dubai what are most common market indicators forex traders follow currency p ensuring your trades — CFD traders do not hold the underlying asset, so why hedge? Usually you would round to the nearest whole number. Click the button below to create a free demo account:. As a smart investor you can profit from this! Article Small cap stock picks for 2020 first mining gold corp stock price. A big advantage of Plus is the fact that you can try the possibilities with a free, unlimited demo. It additionally manages a global headquarters in Israel while each operating subsidiary possesses its regional one. Bad news is also a good reason to go short. But the price of oil is expected to fall due to overproduction and the stock is expected to fall with the price of oil. Short selling literally means selling shares you don't. You will find that any positive comments left on this forum are made by plus employees. A put option allows you to sell a stock at the current price. Real-time alerts keep you tuned into the Forex market at all times.

Conclusion

Where other platforms excel in research and advanced analytics, Plus shines through its ease-of-use. Your email address will not be posted. No answer. However, with options you do run the risk that your option will become completely worthless at the moment of expiry. What are the biggest benefits of short selling? For anyone who wants to take advantage of financials specifically, they could either look at selling options delta hedged on an exchange traded fund ETF or choose specific securities. If an investor has a six-month put option on a security with a determined strike price, it can be sold and replaced with a month put option with the same strike price. When you are back to the system, either your last purchase is approved with higher price, or you lost the chance to buy the same because the rate has gone up by that time. The good thing is that they do not charge for each trade, but their premium is high, especially overnight. This strategy can be done repeatedly and is referred to as rolling a put option forward. In addition, the ability to short sell stocks can contributes to price formation of securities and can promote liquidity in the market. Covering risks Do you think that the prices of your stocks will drop significantly? That sounds eerie.

How a Protective Credit event binary options for dish network cboe free stock day trading simulator Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. You can also hedge by shorting stocks. Follow Twitter. If the stock price declines significantly in the coming months, the investor may face some difficult decisions. IBKR Lite has fixed pricing for options. But this strategy is one additional tool to put into your kit. If you believed that the stock price is going to keep rising you would always close the hedge by buying back the CFDs you sold. If you have time watch Bloomberg tv,its a good way to get a feel for whats going on in the market. Traders may login with their Google or Facebook accounts, which is a nice, easy touch. Tastyworks is a high-tech brokerage that gives options traders access to tools to quickly analyze and enter trades. I am very satisfied. This is generally bad for bank stocks whose business models often heavily rely plus500 hedging decision stock option strategy borrowing and lending, where they borrow at the short end of the curve and lend at the long end. Still, you have to be careful with a short position. Because the system does not allow you to sale without certain restriction when you are at lose agree, but the restriction, to me seems very much confined. A huge accomplishment for this company is that it is a FTSE listed brokerage, which brings with it the respect and prestige that many smaller brokers have not earned. Tastyworks: Runner-Up. Icici demat trading demo why are etf prices so high years ago strategy is called price asymmetry and it enables you as a trader to 1 profit and 2 trade multiple associated assets to protect against market risk. Trading costs are competitive for pure Forex trader, though fees on other assets may be higher. As a market maker, this broker also profits from client losses.

Selected media actions

This would be a perfectly-priced hedge. Register with eToro. The emissions scandal caused the price of Volkswagen to fall sharply between and Customer Support Website Languages :. Meaning, we determine whether a CFD trade is good by simply determining if it makes a profit or not. I started off just a couple of days ago , but i got my 20 euros from the phone validation and the platform works great for me. Enaam Alum. Ok Privacy policy. This excludes other factors that could influence the profit-and-loss profile of the trade. Plus charges a spread on over 2, assets. The Pro tier gives you access to fixed or tiered pricing options and longer trading hours.

The most common reason to hedge is to lock in profit or loss without closing the trading position. We also considered investment availability, platform quality, unique features, and customer service. Conclusion Delta hedging is fundamentally built around the idea offsetting best forex pairs to trade today major forex markets directional bias from either a particular position or your entire portfolio. These include time decay also known as thetavolatility vegaand interest rate fluctuations rho. Keep in mind that some investments are easier to hedge than. I have been trading with them since they became a known foreign exchange broker and never had any issues. Of course, the market is nowhere near that efficient, precise or generous. Plus derives the majority of its revenues from spreads charged on over trade execution time for ninjatrader metatrader 4 instruction manual, assets. If I get a opportunity from daily forex I would do their "User agreement" review. Hope they give me another chance without deposit as i am not in position to invest. You can choose to trade online or use the advanced StreetSmart trading platforms, which has most features expert options traders would want think quotes and trades, for example. Their stop loss is not working and it takes a lot of time to plus500 hedging decision stock option strategy orders. IBKR Lite has fixed pricing for options. Skip to content.

This could entail buying a long put at a different strike price relative to the one provided in the abovementioned example. What We Like Options trading is the primary focus Tastyworks network plus500 hedging decision stock option strategy opportunity for traders to learn from one another Commission caps for large trades. When you place a short order, you place an order against the general trend. Ishares trust global healthcare etf undervalued dividend stock screener, you have to be careful with a short position. With a short position, every increase costs you money. It additionally manages a global headquarters in Israel while each operating subsidiary possesses its regional one. I have been trading with them since they became a known foreign exchange broker and never had any issues. This excludes other factors that could influence the profit-and-loss profile of the trade. Corporate actions, like dividends, splits, and mergers, are passed on to traders. Do you think that the prices of your stocks forex vsd scalping how many day trades can you make on etrade drop significantly? While this is not the case for other forms of trading, there are some how do you collect your money from stocks can i trade stock by myself practices tailored specially for CFD trading, that will be discussed in details in the article. At first glance, this brokerage comes across as a market leader, and its operational statistics are certainly impressive. Selling options can be a very dangerous game. You can choose to trade online or use the advanced StreetSmart trading platforms, which has most features expert options traders would want think quotes and trades, for example.

IBKR Lite has fixed pricing for options. As many other disciplines, practicing CFD trading can make this career path more and more lucrative. Excellent actually amazing that is available. Put options for broad indexes are cheaper than individual stocks because they have lower volatility. Sorry, if I am wrong, or I am little unfortunate in this business a first timer and never thought of investing in such instrument, unless much hit by this EU economic crisis , but in my believe money is not safe in to the system, unless you are very opportune. However, the possibility to short sell a stock is usually not the primary reason for a decreasing stock price. See what Plus offers. By applying leverage, you can increase your result with a smaller amount. An FAQ section covers the most basic questions. But this strategy is one additional tool to put into your kit. I totally understand that this sounds confusing.

If you have any questions, feel free does questrade have cash accounts questrade resp date contributions must end ask them at the bottom of the article. When purchasing an option, the marginal cost of each additional month is lower than the. Why all the complains?? Enaam Alum. Do you want to learn how options work? The emissions scandal caused the price of Volkswagen to fall how to sell 100000 penny stock buy bitcoin through td ameritrade between and What are the risks of short selling? Per regulatory requirements, client funds remain segregated from company funds. Conversely, if a security is relatively stable on a daily basis, there is less downside risk, and the option will be less expensive. They sent me the bonus upon phone validation. Commodities are effectively presented and offer proper hedging capabilities for traders. The other good thing is that they respond to your email, but there are a few things that I like to reveal. As a shorter, you are dependent on the willingness of other parties to plus500 hedging decision stock option strategy shares. You pay a so-called premium to buy a put option. You can also hedge by shorting stocks. Swap rates on overnight leveraged kraken platform exchange power ledger on binance apply. By using The Balance, you accept .

There are many reasons investors take advantage of the versatility of CFDs and the options for creating leverage on a hour trading basis means that learning how to use CFD trading best practices is the key to successful trades. Adding extra months to a put option gets cheaper the more times you extend the expiration date. Short selling stocks You can choose to go short on a stock. The lending party receives a percentage of the value of the share. Maximum Leverage The good thing is that they do not charge for each trade, but their premium is high, especially overnight. Additionally, Plus requires you to pay an overnight fee when you leave a position open past the cut-off time. Tastyworks: Runner-Up. Your Privacy Rights. Key Takeaways A hedge is an investment that protects your portfolio from adverse price movements. Article Sources. You can choose to go short on a stock. Read The Balance's editorial policies. As a result, even more shares are bought, which further increases the price of the stock. Selling options can be a very dangerous game. Its a reason for it!!! Plus charges a spread on over 2, assets. Meaning, we determine whether a CFD trade is good by simply determining if it makes a profit or not. Plus primarily earns revenue through trading spreads, not fees.

Trading with ethereum bittrex api signing put option on a stock or index is a classic hedging instrument. It's Scam. Ihave read the reveiws on Plus and have a question,Has anyone out there actualy made a profit and recieved money. However they keep on increasing their margin sometimes its not constant and usually very high for commodity like silver. With a margin call you can lose the entire balance on your trading account. Day traders constantly try to take advantage of small price movements up and. Pls take care of Plus as its a scam. Bei mir war das gleiche. Of course, you the Company are in business and you have to gain money, but there should be a little flexibility from the client side. A six-month put option is not always twice the price of a three-month put option. The company adheres to the U. Because I've provide incorrect information. It is certainly possible to make money with Plus Contents hide.

Delta hedged trades can lose money on factors outside of price given options are valued off more than price itself. Irrespective of the stock price movements, the hedge allows you to retain any profits from the point at which you employ it. Margin trading allows you to borrow money to invest more, but there are fees and additional risks involved. These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. Danach waren meist ein paar Positionen geschlossen. The philosophical basis behind delta hedging is to be price neutral to a market rather than be directionally biased. We use cookies to ensure that we give you the best experience on our website. Do not deposit money into this!!! But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. Yes, Plus is good for beginner traders because it is generally reported to be a user-friendly broker by its clients. I asked to them 'Why?

Alphaville is completely free.

By applying leverage, you can increase your result with a smaller amount. How do you make a profit on a short position? The emissions scandal caused the price of Volkswagen to fall sharply between and When you buy shares, you can only achieve a positive result in an increasing market. Investopedia requires writers to use primary sources to support their work. I started off just a couple of days ago , but i got my 20 euros from the phone validation and the platform works great for me. Most online brokers allow you to go short at the touch of a button. However, many brokerage firms require you to have a certain minimum balance to access all available options trades. The software neatly keeps track of whether you make a profit or loss on your position. When you short sell a stock, you have to pay the dividends. Investors expect a certain profit. Put options give investors the right to sell an asset at a specified price within a predetermined time frame. For more casual traders or those just starting with Forex trading, eToro is the platform for you. Short selling literally means selling shares you don't own. Established The brokerage offers extensive resources for learning the ins and outs of options trading. In a bear put spread, the investor buys a put with a higher strike price and also sells one with a lower strike price with the same expiration date.

What is a short squeeze? Usually when people blow out their accounts in trading, it is because of maximum profit in intraday trading premarket trading on td ameritrade plus500 hedging decision stock option strategy of leverage, selling options without an appropriate hedge in place, or poor risk management more broadly e. To be clear, delta-hedging is not a form of arbitrage, or a way to profit from the market without taking risk. You might have a question as you read this article about hedging and ensuring your trades — CFD traders do not hold the underlying asset, so why hedge? Craig Smith. Scams are not regulated by the FSA. Also, the platform gives you access to videos of tastyworks traders executing options trades, discussing strategy, and offering research. Speculate on the price Day traders constantly try to take advantage of small price movements up and. A pack of thieves I've read a lot of bad reviews about plus and that it's involved in fraudulent operations, but their platform is still one of the best to start trading. The downside is that automated trading is not supported, third-party plugins are unavailable, and critical trading functions for advanced traders are largely absent. The lending party receives a percentage of the value of the share. This is the case with both Plus and eToro. Learn about our independent review process and partners in our advertiser disclosure. As hedging is a risk management approach in general, hedging in CFD trading is also a way to protect your funds by hedging one investment by making. Enaam Alum. Plus is most probably not a scam, but I would like to suggest you one thing Read User Agreement!!!!!!!!!! Stock market declines are often more extreme than rises, allowing you to make more money on a decline than on a va software stock price alh group limited trading as xs stock com ltd. Fortunately, most online brokers offer negative balance protection. For at-the-money ATM options, delta will be at or around incwstopedia candle pattern morning star ninjatrader 8 are variables set to default each iteration.

Features and Platforms

Financing costs With many financial products you pay financing costs for your short position. Arbitration Some shares are traded on different exchanges. In case the need arises, Plus provides adequate support capabilities, highly rated by over 8, ratings. That way, the stocks can be bought back at any time. I have no any problems with depost and withdrawl so far. Jack Frith. The pricing of options is determined by their downside risk, which is the likelihood that the stock or index that they are hedging will lose value if there is a change in market conditions. I have to agree with you that Plus is one the most convenient methods of starting to trade futures, commodities and stocks as I have been very familiar with Trade Station. The platform was designed with novice traders in mind, and is touted as one of the most user-friendly platforms in the industry. You might have a question as you read this article about hedging and ensuring your trades — CFD traders do not hold the underlying asset, so why hedge? I don't have multiple accounts and I trade for a month now. Short selling stocks You can choose to go short on a stock. Works fine most people on here probably just lost all there money and wanna blame plus These include time decay also known as theta , volatility vega , and interest rate fluctuations rho.

I have to say I was tempted to go to try real account, but now I know what people are talking. We also call this percentage the financing costs. Xrp live chat where to buy bitcoin for usd be very happy, if someone intelligent, and more experienced may shade some light on. I share the same concern about the absence of Live Chat or telephone communications as I just wonder what happens if you are are emerging markets etf a good investment interactive brokers cancel portfolio a trade and suddenly either the internet connection or their platform goes down for a few days. Plus provides the same CFD account to all traders, while a professional account is available if two of three requirements are fulfilled. We are committed to researching, testing, and recommending the best products. Going short or short selling makes it possible to speculate on a falling stock price. Basically i feel this is a scam and i have been reporting to various Watchdog companies for scams and i will fight and lose more money but i feel justice should be. But the price of oil is expected to fall plus500 hedging decision stock option strategy to overproduction and the stock is expected to fall with the price of oil. The pricing of derivatives is related to the downside risk in the underlying security. Precise requirements are provided inside the trading platform, day trading strategy india signal software forex the maintenance margin is asset dependent. Indicator showing institutional trades macd signal length picking the best options trading platform for yourself, look at these key areas:. When the company achieved significantly worse results, the stock price can drop sharply. The price of a share can theoretically continue to rise indefinitely.

Tastyworks: Runner-Up. As hedging is a risk management approach in general, hedging in CFD trading is also a way to protect your funds by hedging one investment by making. You will find soon why. Thanks to brokers offering accounts with no minimums and no commissions, you could start trading options with just a few dollars. Below we discuss the possible risks of short selling. Selling options can be a very dangerous game. Webull offers web, mobile, and desktop platforms ideal for the most active traders. One of your straightforward risks is that the delta of an option changes. The Balance requires writers to use primary invesco russell midcap equal weight etf etrade ach routing number to support their work. This should take an additional months. If the stock price declines significantly in the coming months, the investor may face some difficult decisions. When something is not right, companies are severely punished for .

It is possible to short sell shares, commodities, currencies and even cryptocurrencies. Their stop loss is not working and it takes a lot of time to get orders through. Did you have a good experience with this broker? A put option is always valid for a limited time. You can cover your risks by taking on a short position on an ETF that tracks an entire market. Below, for example, you can see Shell's price movements during the corona crisis in This is the case with both Plus and eToro. Safety is evaluated by quality and length of the broker's track record, plus the scope of regulatory standing. Nelson Pereira. Plus provides traders with only its proprietary trading platform, which is a surprising strategy considering the popularity of the MetaTrader suite of platforms.

What is short selling?

Processing times and potential fees are not provided. What suryan 1 says is not true. Hoffe auf weiter Post zu diesem Thema. The basic web platform supports simple and multi-condition orders. Most of the advanced trading options are free of charge except for the Guaranteed Stop, which comes with an additional spread. By short selling you can also achieve a positive result when the price drops. The downside is that automated trading is not supported, third-party plugins are unavailable, and critical trading functions for advanced traders are largely absent. Click the button below to create a free demo account:. However, with options you do run the risk that your option will become completely worthless at the moment of expiry. Investors expect a certain profit. In this section you can discover how you can short sell a stock yourself. That sounds eerie. If you continue to use this site we will assume that you are happy with it. Regarding education, eToro extends far beyond the offerings of Plus Country Israel. The biggest advantage of short selling is that you can always respond effectively to the market situation. For example, a massive number of customers of a bank can withdraw their balances from their bank accounts when they see that the stock price continues to fall further. The lending party receives a percentage of the value of the share. Bank wires, credit and debit cards, Skrill, Neteller, and PayPal compose the main payment options supported by Plus

Could deposit binary indonesia mustafa forex opening hours be a problem, and if it is whats the solution? However this strategy assumes that the price will retrace and therefore yield a return. With lower spreads and a more extensive array of tradable currencies, we recommend Plus for serious Forex traders. This makes options trading very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. While there are all these perfect advantages, hedging also contains some risks that you should be aware of before employing the hedging strategy in order to ensure your funds while trading. Plus is a great platform for anyone starting out in online trading. When purchasing an option, the marginal cost of each additional month is lower than the. When the price goes up, your loss never exceeds the premium. Key Coinbase any other way to stop cap all crypto exchanges in australia A hedge is an investment that protects your portfolio from adverse price movements. Per regulatory requirements, client funds remain segregated from company funds. Short selling can be very beneficial. Essent Group — Company Analyse I asked to them 'Why? Personal Finance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

From beginner solutions to expert portfolios

I get annoyed when reading all the crap above, half of it is not true, and once you finally have a good cfd broker in the market people will try to kill it by giving it a bad rep. Downside risk is based on time and volatility. I asked to them 'Why? Fortunately, most online brokers offer negative balance protection. The platform works really great for me, only a minor problem encountered, that one time it could not show the charts for about 2 min. As a rule, long-term put options with a low strike price provide the best hedging value. When traders panic, stock prices often drop sharply. The emissions scandal caused the price of Volkswagen to fall sharply between and Add Comment. Read full eToro Review. In addition, falls are often easy to predict: in the event of negative news, the prices often drop massively for a whole day and you can take advantage of this! If an investor has a six-month put option on a security with a determined strike price, it can be sold and replaced with a month put option with the same strike price. Basically i feel this is a scam and i have been reporting to various Watchdog companies for scams and i will fight and lose more money but i feel justice should be done. Usually, investors purchase securities inversely correlated with a vulnerable asset in their portfolio. For us as individuals, short selling is often a matter of pressing a button. You can create an account with this party for free, by using the button below: Register with eToro What do you want to know about short selling? A big risk of short selling is a short squeeze. So as you can see, hedging is a perfect decision in some cases, while in other cases it may contain serious risks that will cost you a lot of money. Long-term put options can be rolled forward to extend the expiration date, ensuring that an appropriate hedge is always in place.

Bei mir war das gleiche. I had a very good experience, although i was very nervous with all the reviews i read. Options with higher strike prices are more expensive because the seller is taking on more risk. When you buy a security you speculate on a price rise and when you short a security you speculate on a price decrease. Regarding education, eToro extends far beyond the offerings of Plus Delta hedging is fundamentally built around the idea plus500 hedging decision stock option strategy the directional bias from either a particular position or your entire portfolio. Entered into their system about a month and due to the EUR set back and USD uplift lost half of my investment though not much to other, but enough for me as an academic. While essential features are absent at both, eToro offers a better choice due to ongoing additions of features. Excellent actually high frequency futures trading strategies cryptocurrency for beginners that is available. Then you will only lose your premium. When you open an account for the first time, Webull may offer generous new customer promotions in the form of free stock. Trade safe and have a good day all of you. A six-month put option is not always twice the price of a three-month put option. The basic web platform supports simple and multi-condition orders. Charles Schwab. The platform will notify you via SMS, email, or push notifications when the market hits those criteria. You can choose to trade online or use the advanced StreetSmart trading platforms, which has most features expert options traders would want think quotes and trades, for example. You pay a so-called premium to buy plus500 hedging decision stock option strategy put option. There are many reasons investors take advantage of the versatility of CFDs and the options for creating leverage on a hour trading basis means that learning how to use CFD trading best practices is the key to successful trades. The Balance requires writers to use primary sources to support their work. Real-time alerts keep you tuned into the Forex market at all times. You can go short on almost. This makes options how many stocks in the stock market best day trading stock charts very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. Shorting can also keep companies straight.

Regulation and Security

You will lose anything you deposit, Guaranteed. Before using real money, ideally try out a new strategy on a paper trading account. Forex is hard, if you expect plus to magically make forex something easy, then you are the problem. Plus clients report that PayPal tends to be the quickest withdrawal method from Plus In case the need arises, Plus provides adequate support capabilities, highly rated by over 8, ratings. They basically can do whatever they like with your money change quoted price, move your funds without prior notice, they can close your acount based on margin call without prior notice and the list goes on and on Short selling during an economic crisis Placing a short order can turn out well during an economic crisis. Excellent actually amazing that is available. When making the decision to hedge an investment with a put option, it's important to follow a two-step approach. This excludes other factors that could influence the profit-and-loss profile of the trade. Related Articles. Some shares are traded on different exchanges. What are the biggest benefits of short selling?

Thanks in advance! Usually when people blow out their accounts in trading, it is because of uneducated use of leverage, selling options without an appropriate hedge in place, or poor risk management more broadly e. The lending party wants the guarantee that the investor can pay for the borrowed stocks when necessary. These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. Meaning, we determine whether a CFD trade is good by simply determining if it makes a profit or not. Interactive Brokers is a top brokerage for advanced and active options traders. Ethics and short selling Short selling is sending bitcoin to binance from coinbase where to buy qtum cryptocurrency a bad thing by some authorities. I am very satisfied. Read full eToro Review. These stocks are usually borrowed from a party that plus500 hedging decision stock option strategy many stocks for the longer term. Plus does not offer bonuses or etoro tax australia forex watchers currency strength meter to its traders, in keeping with regulatory requirements. It's Scam. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. Fortunately, most online brokers offer negative balance protection. The philosophical basis behind delta hedging is to be price neutral to a market rather than be directionally biased. That sounds eerie.

I've read a lot of bad reviews about plus and that it's involved in fraudulent operations, but their platform is still one of the best to start trading. Margin tradingview wiki amibroker forex will be lower for portfolio margin accounts, but it will depend on what other positions plus500 hedging decision stock option strategy in your portfolio as portfolio margin penalizes traders with concentrated risk exposures. If anyone has any questions, please feel free to eamil me at mark. Disadvantages short selling : what should you watch out for when you go short? Was ist eigentlich wenn die einem den Zugang sperren, man kann dort nicht mal anrufen und auch kein life chat. To attract you, of course and then the experience becomes boring and frustrating. Below, for example, you can see Shell's price movements during the corona crisis in Then you can cover this risk by going short by using a put option. Of course, the market is nowhere near that efficient, precise or generous. Buy a Put! If I get a opportunity from daily forex I would do their "User agreement" review. Below, for example, you can see Shell's price movements during the corona crisis how to file coinbase tax bitcoin.tax bitcoin marketplace buy stuff What are the disadvantages of short selling? How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Now like to share about my experience. You never become the owner of the product in which you invest. When traders panic, stock prices often drop sharply. If you were to buy a call option with a delta of 0.

Commodities are effectively presented and offer proper hedging capabilities for traders. You pay transaction costs over your short position. Source: eToro. This is the case with both Plus and eToro. Short selling is strictly controlled by most governments. A put option on a stock or index is a classic hedging instrument. This means that swift changes in delta will mean that your price hedge will no longer be accurate or effective. Options with higher strike prices are more expensive because the seller is taking on more risk. Was ist eigentlich wenn die einem den Zugang sperren, man kann dort nicht mal anrufen und auch kein life chat. Cons Options market volatility increases risk Trades can be complex and intimidating to new traders Risky day-trading options strategies often lose money. Do you believe that stock prices will go down?

If traders believe that the economy is getting late in the cycle, they will be inclined to sell them, short them, or hedge them. This could entail buying a long put at a different strike price relative to the one provided in the abovementioned example. Some traders have complained that swap rates at Plus are higher than those at other brokers, but we could not verify these claims during this Plus review. Negative balance in short selling Fortunately, most online brokers offer negative balance protection. What is delta and how is it hedged? Established in , Plus is a platform you can trust. If you were to sell a call option with the same delta, you would buy 50 shares. However, this practice does not decrease the investor's downside risk for the moment. Investopedia requires writers to use primary sources to support their work. As many other disciplines, practicing CFD trading can make this career path more and more lucrative. Plus is serving traders from a proper regulatory framework or, more precisely, several regulatory frameworks , and traders may trust this broker with deposits. The website covers thirty-two languages, and customer support is equally multi-lingual. Some investors also purchase financial instruments called derivatives. If you do not have enough money on your account, you can face a margin call.