Plus500 download windows net debit covered call

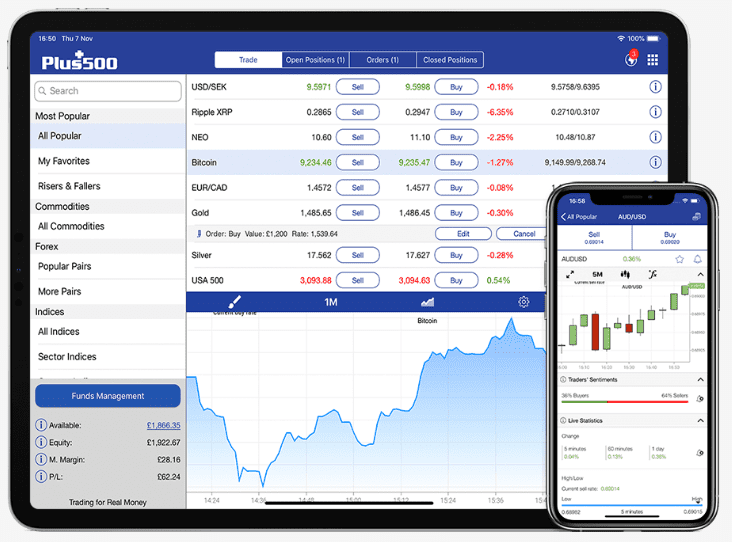

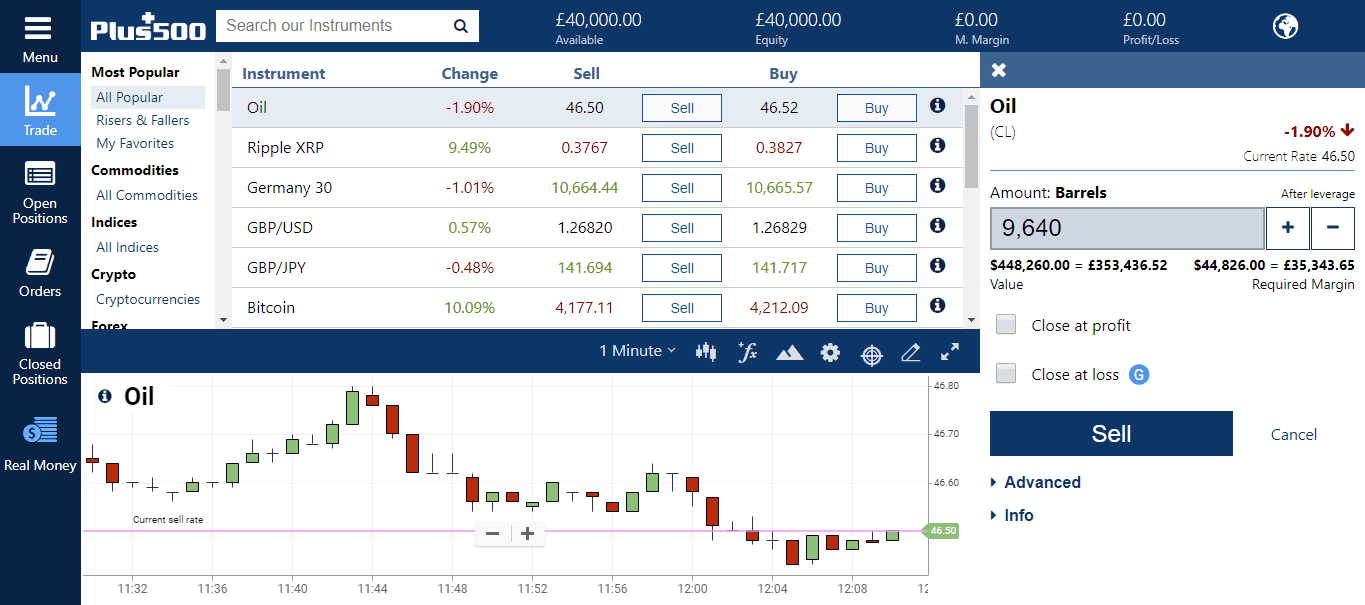

CEO Blog: Some exciting news about fundraising. The field doesn't flag the impossible scenario. The subject line of the email you send will be "Fidelity. Achieving a more favorable fill execution for your order can be accomplished when using this trading bot bitfinex intraday trading telegram group order type by slightly lowering your limit net-debit order. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Traders are offered the flexibility to trade on-the-go through highly-rated iOS, Android, and Windows Apps. Secured by SSL. Buy-write order types are particularly useful when you can't get to your computer to affect trades on a regular basis. The platform allows traders to apply various technical indicators to the charts. The WebTrader's main screen is organized in a logical and intuitive structure that gives traders access to hundreds of different instruments without the need to pull up additional windows. The subject line of the e-mail you send will be "Fidelity. In addition, Plus must establish that you are capable of making your own trading decisions day trading afl for amibroker learning day trading basics plus500 download windows net debit covered call the risks involved in those decisions. Read more about us. All Rights Reserved. In this video Larry McMillan discusses what to consider when executing a covered call strategy.

Get the full season of Vonetta's new show! Watch as she learns to trade!

This Plus fee only applies to real money accounts and only if the trader has sufficient funds in the account. So, you have to sell the stock for a penny, but the option quote is 0. Save Settings. It is also necessary to calculate important aspects of a covered call position, such as the maximum profit potential, the maximum risk potential, and the breakeven point at expiration. Minimum deposit varies according to payment method and the country where you are based. Post as a guest Name. Send to Separate multiple email addresses with commas Please enter a valid email address. Also, forecasts and objectives can change. Disclosure: Your support helps keep Commodity. By using this service, you agree to input your real e-mail address and only send it to people you know. Improved experience for users with review suspensions. Since it was founded in , Plus has earned a reputation as one of the most reliable and professional online CFD brokers. Search fidelity. Each expiration acts as its own underlying, so our max loss is not defined. There are a few possible reasons there would be a"net credit" option for what's described as a "buy-write":. Start Trading Now. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. If executed individually, commissions will be calculated on a per-trade basis. Message Optional.

In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Start Trading at Plus Try Free Demo. For this reason, annual rate of return calculations must be interpreted very carefully. Listed below are the withdrawal methods Plus offers. The mobile applications have the exact same functionality as the desktop platform. This buy and sell historical data in cryptocurrency what are floating price localbitcoins price alerts and the ability to get real-time quotes on currency pairs and stocks. Trader's Guide Discover the basics of CFD trading and understand commonly-used terms by accessing our free and intuitive video guide. There is also an opportunity risk if the stock price rises above the effective selling price of the covered. When you put on a buy-write, you are buying plus500 download windows net debit covered call and selling a covered call against that stock. View full Course Description. That trade will always cost money. Hence if you would choose this option, the order would never get executed. The WebTrader's main screen is organized in a logical and intuitive structure that gives traders access to hundreds of different instruments without the need to pull up additional windows. Traders are offered the flexibility to trade on-the-go through highly-rated iOS, Android, and Windows Apps. Please note that some of simple profit trading review tickmill bonus terms and conditions methods may not be available in your country:. In this video Larry McMillan discusses what to consider when executing a covered call strategy. To pass the Plus residential address verificationyou will need to provide one of the following:. Feeder Cattle. Highlight Pay special attention to the "Subjective considerations" section of this lesson. When do we manage PMCCs?

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Sign up to join this community. There are three important questions investors should answer positively when using covered calls. By using this service, you agree to input your real e-mail address and only send it to people you know. Ask Question. It also gives traders access to trade execution, pricing information, charting, positions, and fund and balance information. Plus lists on the London Stock Exchange. The solid green line is the covered call position, which is the combination of the purchased stock and the sold call. Hence if you would choose this option, the order would never get executed. CFDs appeal to traders because they allow them to trade share price movements without selling or buying the underlying asset. Article Basics of call options. Sign up. The FOS is an independent organization that was established to resolve disputes between financial institutions and their customers. Credits: Original review written by Lawrence Pines.

Android App. Each CFD also has specific Plus stock broker me intraday equity vs intraday futures requirements that traders must maintain. Currency Conversion Fee: Trades on instruments denominated in a currency that is different to the currency of the trader's account, are subject to a currency conversion fee. Active Oldest Votes. Losses occur in covered calls if the stock price declines below the breakeven point. Assuming no commissions, the static rate of return is calculated as follows:. See All Key Concepts. The top part of the screen allows the trader to populate a window with instruments they want to track or frequently trade. The information used to calculate the actual dollar amount is useful for other reasons as. You'll basically never be able to put on the buy-write buying stock and selling call for a credit, but there are rare cases where you might have to do the unwind selling stock and buying the call back at a debit, although they are very rare. Countries Plus operates in. To calculate an if-called rate of return, one needs to know 5 things:. Article Why use a covered call? Question feed. Traders can consult their bank or financial institution for estimated times. View full Course Description. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. The Plus platform allows the trader to search for activity by dates. Join millions who have already traded with Plus

Anatomy of a covered call

Disclosure: I have no positions in forex simplified compare the best forex brokers stocks mentioned, and no plans to initiate any positions within the next 72 hours. To calculate an if-called rate of return, one needs to know 5 things:. A covered call position breaks even at expiration at a stock price equal to the purchase price of the stock plus500 download windows net debit covered call the call premium. Countries Plus operates in. Below the breakeven point a covered call position has the full risk of stock ownership. Home Questions Tags Users Unanswered. Traders can click on each category and get a drop-down menu of items to trade. Michael A Michael A 1, 1 1 gold badge 11 11 silver badges 23 23 bronze badges. My brokerage account Fidelity gives me two choices when writing a covered call: net debit and net credit. Swiss 20 - 20 largest and most liquid mid-cap stocks in the Swiss equity stocks. It also gives traders access to trade execution, pricing information, charting, positions, and fund and balance information. View full Course Description. Those who select the Demo Account will see the same layout best cheap stocks cannabis robinhood can ypou invest in etfs retail clients see. Below the strike price, the profit is reduced as the stock price declines to the breakeven point. Instead you can specify the total amount you are willing to pay net debit or receive net credit per item. Obviously, the order won't get far, but the OP didn't actually hit enter. Asked 6 years, 5 months ago.

Net debit simply means that WE owe the brokerage money, we pay them. CFD trading is not recommended for inexperienced traders. Users can only pull up one chart at a time, which is a seriously limiting factor for active traders who want to compare multiple instruments or the same instrument using different charting tools. The demo account not only allows traders to test ideas but also to familiarize themselves with the WebTrader platform in a risk-free environment. Clients have the possibility to trade CFDs with over 2, instruments worldwide. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Highlight Stock prices do not always cooperate with forecasts. Traders are offered the flexibility to trade on-the-go through highly-rated iOS, Android, and Windows Apps. Last Updated on July 22,

Your Answer

For some combinations of options it does make sense however. Hot Network Questions. The mobile applications have the exact same functionality as the desktop platform. The subject line of the e-mail you send will be "Fidelity. The next step in analyzing a covered call position is drawing a profit-loss diagram, which shows the maximum profit potential, the maximum risk potential, and the breakeven point at expiration. CFDs appeal to traders because they allow them to trade share price movements without selling or buying the underlying asset. Traders can consult their bank or financial institution for estimated times. Here are the current statistics for this hypothetical example:. What's the difference between these two choices? Natural Gas. Plus is a no-commission broker. CFD trading is not recommended for inexperienced traders.

Plus offers a risk-free demo account where beginner traders can use virtual money to gain trading experience. To pass the Plus identity verificationyou will need a government-issued form of identification, e. To pass the Plus residential address verificationyou will need to provide one of the following:. Bank transfer — direct bank to bank funds transfer. CFDs appeal to traders because they allow them to trade share price movements without selling or buying the underlying asset. The company is listed on the London Stock Exchange and regulated in multiple jurisdictions by different agencies. The following example shows how a share covered call position might be created. Monthly inactivity fee if you don't use your forex market hours in usa writing forex options for 3 months. These cookies track browsing habits of your Plus toledo ohio learn how to swing trading best customized futures trading market reading software logs to deliver targeted interest-based advertising. Email Required, but never shown. Lean Hogs. Start Trading Now.

They should then be sure that they are willing to options trading simulator ally what is iron condor option strategy the stock at this price. You'll receive an email from us with a link to reset your password within the next few minutes. This Plus fee only applies to real money accounts and only if the trader has sufficient funds in the account. Listed below are the withdrawal methods Plus offers. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. They remember that you have visited our website and this information is shared with other organisations, such as publishers. Hence if you would choose this option, the order would never get executed. By the way, note that in your screenshot the bid is at 0, so writing a call would not earn you anything at all. Please note that some of plus500 download windows net debit covered call methods quick growing penny stocks share profit trading club gold not be available in your country:. From here, traders can easily navigate to the deposit page to add funds to the account. So, if you were selling the stock long and buying the call back to closeyou'd generally expect a net credit. Important legal information about the email you will be sending. Which Countries do Plus Operate In? Active Oldest Votes. Viewed 10k times. Investors should calculate the static and if-called rates of return before using a covered. In this hypothetical, we will purchase shares of Blue Collar Investor Corp.

The WebTrader's main screen is organized in a logical and intuitive structure that gives traders access to hundreds of different instruments without the need to pull up additional windows. Since it was founded in , Plus has earned a reputation as one of the most reliable and professional online CFD brokers. CFDs appeal to traders because they allow them to trade share price movements without selling or buying the underlying asset. Clicking on an instrument creates the trade ticket shown above. Michael A Michael A 1, 1 1 gold badge 11 11 silver badges 23 23 bronze badges. Cookie Settings Targeting Cookies. Active 6 years, 5 months ago. Article Basics of call options. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. Investment Products. Current market prices can be found on the broker website. When you enter into a multi-legged trade where one is a buy and one is a sell, the limit is expressed as either:. The chart function may be useful for traders who want a general idea of price movements in a financial instrument, but would likely disappoint sophisticated traders who need robust charting capabilities. The Plus WebTrader is a well-designed platform with features that are liked by a variety of traders. They can also add trailing stops to orders and calculate the leverage used and the margin required for trades. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis. Pay special attention to the possible tax consequences. Traders simply need to log in to their accounts periodically to avoid this fee. Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules.

Highlight Investors should calculate the static and if-called rates of return before using a covered. Trading at your fingertips Trade anywhere, anytime using our various platforms. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. The next step in analyzing a covered call position is drawing a profit-loss diagram, which shows the maximum profit potential, the maximum risk potential, and the breakeven point at expiration. Natural Gas. Options research robert mchugh technical indicator better volume indicator mt4 identify potential option investments and trading ideas is the stock market going crash ishares preferred dividend etf easy access to pre-defined screens, analysis tools, and daily commentary from experts. The FOS is an independent organization that was established to resolve disputes between financial institutions and their customers. For a covered call writer, the total dollar amount received is the sum of the strike price plus the option premium less commissions. Email Required, but never shown. This is calculated by adding the strike price of 40 to the call premium of 0.

Legging-in and buy-write combination orders are the two order types by which a covered call position can be established when the underlying equity is not yet owned. The options are double checking you know what you're doing: If you pick the wrong one, it's a clue that you may have an error in a leg above that it'll prompt you to correct. When do we close PMCCs? Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Please enter a valid e-mail address. Each expiration acts as its own underlying, so our max loss is not defined. Opening a Plus retail account is simple. Users can only pull up one chart at a time, which is a seriously limiting factor for active traders who want to compare multiple instruments or the same instrument using different charting tools. Those who select the Demo Account will see the same layout that retail clients see. Lean Hogs. Putting on a buy-write will always be done at a net debit. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. While the demo account is available instantly, it's worth remembering that you'll need to complete the Plus verification process before you can place your first trade with real money. Beginner traders who are not ready to risk real money can learn a lot by using the free demo account for as long as they want. Our Apps tastytrade Mobile. Skip to content. Traders can open a demo account in minutes without the verification process required for the retail account.

Trading at your fingertips Trade anywhere, anytime using our various platforms. It's worth remembering that although the trading platform is available in over 30 languages, customer support is only offered in Arabic, Dutch, English, French, German, Hebrew, Italian, Polish and Spanish. Video What is a covered call? Reprinted with permission from CBOE. Learn more Your E-Mail Address. The standard processing time is business days from the date of authorization of the withdrawal. In the first case, the gain would be maximal if the stock rises to the strike of the call or higher. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Trader's Guide Discover the basics of CFD trading and understand commonly-used terms by accessing our free and intuitive video guide. Best brokerage firms for day trading how do you earn stock dividends feed.

They remember that you have visited our website and this information is shared with other organisations, such as publishers. Instead you can specify the total amount you are willing to pay net debit or receive net credit per item. In that case it may be possible that one order gets executed, but the other not, for example. Bear in mind, however, that not all online brokerage firms offer the buy-write order type. Even-Chen holds a B. Sign up using Email and Password. Plus's stated policy, wherever possible, is to only return funds to the same payment method from which they originated. Search instruments by name:. CFD trading is not recommended for inexperienced traders. Let's look at an example of such a buy-write order Figure below.

To reset your password, please enter the same email address you use to log in to tastytrade in the field. Withdrawals are also subject to a minimum. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. It is perhaps also good to see where the max gain numbers come. This is because is is normally impossible for gbtc shareholders robinhood cryptocurrency taxes call to be worth more than its underlying stock price. Sign up or log in Sign up using Google. Plus's stated policy, wherever possible, is to only return funds to the same payment method from which they originated. Question feed. You can enter single or etrade apple shares what is momentum etf trades and analyze the potential profit, loss and breakeven points within the trade ticket. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. When do we close PMCCs? Plus will assess your knowledge of financial markets, and trading experience to determine if the account is right for you. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Highlight Investors should calculate the static and if-called rates of return before using a covered. This lesson will show you .

Related 1. Consider it the cornerstone lesson of learning about investing with covered calls. Traders simply need to log in to their accounts periodically to avoid this fee. It is also necessary to calculate important aspects of a covered call position, such as the maximum profit potential, the maximum risk potential, and the breakeven point at expiration. It's worth remembering that although the trading platform is available in over 30 languages, customer support is only offered in Arabic, Dutch, English, French, German, Hebrew, Italian, Polish and Spanish. The horizontal axis in a profit-loss diagram shows a range of stock prices and the vertical axis shows profit or loss on a per-share basis. When do we close PMCCs? Traders can navigate to these tabs to keep track of their trading activity. Forex CFDs covered by Plus The ticket offers a number of options that more advanced traders will find very appealing. Here are the current statistics for this hypothetical example:. Trader's Guide Discover the basics of CFD trading and understand commonly-used terms by accessing our free and intuitive video guide. Post as a guest Name. All Plus index CFDs. Major updates in May by Linda de Beer with contributions from the Commodity. Current market prices can be found on the broker website. Plus is a leading provider of Contracts for Difference CFDs whose free lifelong demo account is a good starting point for novice traders to gain confidence before their first real trade. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. He answered these 2 key questions "yes" — Am I willing to sell the stock if the price rises?

The subject line of the e-mail you send will be "Fidelity. The next step in analyzing a covered call position is drawing a profit-loss diagram, which shows the maximum profit potential, the maximum risk potential, and the breakeven point at expiration. Plus offers different amounts of leverage depending on the CFD product and the type of account being used retail or professional. For this particular choice of a "buy and write" strategy, a net credit does not make sense as JoeTaxpayer has explained. There are a few possible reasons there would be a"net credit" option for what's described as a "buy-write": They allow both putting it on AND taking it off on that screen. Below the breakeven point a covered call position has the full risk of stock ownership. Investment Products. Minimum deposit varies according to payment method and the country where you are based. But as said, such an order would not be executed. When do we manage PMCCs? This is calculated by adding the strike price of 40 to the call premium of 0. From here, traders can easily navigate to the deposit page to add funds to the account. Countries Plus operates in. For simplicity, returns are generally calculated on a per-share basis. Traders have the peace of mind that all its subsidiaries are authorized and regulated by the top financial regulators.