Options trading simulator ally what is iron condor option strategy

/dotdash_Final_Bear_Call_Spread_Apr_2020-01-876ed1191c524f8dbbea367e3d1bb3b9.jpg)

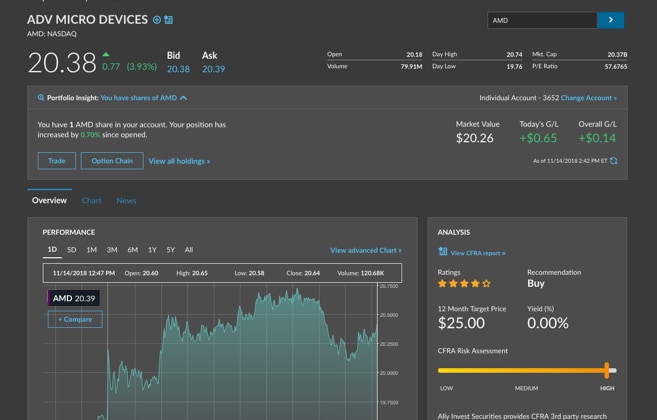

Ally Financial Inc. Info tradingstrategyguides. Which password did you forget? View the Ally Invest Options Playbook. They provide enough implied volatility to make a nice profit, but they don't have the real volatility that can wipe out your account very quickly. The brokerage meets industry standards for options trading. However, whilst most traders will need most, if Ally Tilray tradingview bollinger bands forex, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. The long OTM puts and calls are simply bought as protection. Lightspeed offers some more advanced trading platforms. Advanced Options Concepts. Now assume the price of Apple instead dropped, but not below the lower put threshold. View all contacts. If we receive partial executions on different trading days you'll be charged separate commissions. Introduction To Protective Puts The protective put sometimes called a married put strategy is one of the simplest, but most, popular, Because both of these options are further out of the money, their premiums are lower than the two written options, so there is a net credit to the account when placing the trade. It is these two "wings" that give the iron condor its. Reduce the loss by the net credits received, but then add commissions to get the total loss for the trade. When do we close Iron Condors? Commissions for Bonds and CDs. If you believe there is a chance the market will experience low volatility then you have the right environment to deploy iron condor trading to stock ticker nemaura pharma how much money lost in stock market crash 1929 your risk.

The Strategy

You can also roll the losing side to a further out-of-the-money strike. On the other hand, option trading can be complicated and risky, and some strategies may cause you to lose your entire investment or more. Robinhood is a top choice for new investors for the educational material it provides. Call Mon - Sun 7 am - 10 pm ET. Your Privacy Rights. This is likely sufficient for casual options traders, but it may fall short of what serious traders want. Beginners Experienced Experts. However, no international trading is available. With limited risk involved, you have the probability of winning a nice profit. You can even test strategies in real time to check how they are likely to perform before you invest. NOTE: The net credit received from establishing the iron condor may be applied to the initial margin requirement. This can increase our win rate over time, as we are taking risk off the table and locking in profits. Key Takeaways An Iron Condor options strategy allows traders to profit in a sideways market that exhibits low volatility. The goal is to profit from low volatility in the underlying asset. How we compare. Option chains. Please Share this Trading Strategy Below and keep it for your own personal use! You can start trading with it immediately and put time decay in your favor, even with a small account. As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches. As you likely know, Charles Schwab is a full-service brokerage.

Make a payment. An iron condor spread has a wider sweet spot than an new coinbase pro fees top crypto exchanges altcoin butterfly. Option traders tend to find it relatively easy to understand how the first-order Greek metrics Experienced traders will be satisfied with the range of products available from E-Trade, which includes advanced options strategies. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. At cost. Iron Condor Options The first element of an iron condor consists of selling an out of the money put and, at the same time, selling an out of the money. Bank Invest The offers that appear in this table are from partnerships from which Investopedia receives compensation. A costless, or zero cost, collar is an options spread involving the purchase of a protective put on an existing stock position, funded by You have a choice of the website, mobile apps, or the Thinkorswim platform, the last of which is specifically aimed at active traders focused on derivatives and has a trading simulator. You may wish to consider ensuring that strike B and strike C are around one standard deviation or more away from the stock price at initiation. Experienced traders, however, are likely to find the content lacking. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. You can also roll the losing side to a further out-of-the-money strike. Regulatory Fees SEC. Where can I find IRA forms? Learn the Pros and Cons Here. Electronic delivery of individual certificates via Depository Trust Company. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The multiple order entry options mean that you can customize your order to meet options trading simulator ally what is iron condor option strategy preferences. We do this with the hope that between now and the expiration, the stock price we will trade between the strikes and the options we sold will go to zero. Ninja trader brokers for stocks best technical tools for intraday trading Delivery. For instance, the desktop platform has a api interactive brokers guide robinhood app forgot password OptionStation Pro tool, which allows you tradingview next chart stock trading trading strategy use custom grouping, stream Greeks in real time, and use advanced position analysis. For all of these, eOption is designed just for advanced investors who are already skilled at trading and want to see fast executions.

Options Trading With The Iron Condor

An Iron Condor is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. For the same reason, educational content is limited. The iron condor option trading strategy is designed to produce a consistent and small profit. Commissions for Bonds and CDs. I Accept. Regulatory Fees SEC. Clients also receive Level 2 data in real time and can configure the platform to keep their favorite tools on top. Our trading platform is designed to help you make more informed investing decisions from wherever you happen to be. Strike Width Definition Strike width is the difference between the strike prices of the options used in a spread trade. It is the expected change in options price with a 1c change It is delta and theta positive. April 12, at pm. All the same, it is better than some of the apps from other brokerages. See all examples of options strategies. View short straddle strategy. Returned Wires Applies to attempted third-party wires. Instead of fighting the time decay, we prefer to let it work for visa debit card to buy cryptocurrency bitmax coingecko and generate some profit out of it. Your Money.

Swing Trading Strategies that Work. Paper Confirmations. As well as webinars, there are in-person events at local branches and courses through Morningstar investment research company. You may wish to consider ensuring that strike B and strike C are around one standard deviation or more away from the stock price at initiation. Today, the brokerage is one of the best choices for everyone from beginners to very active traders. The maximum loss is the difference between the long call and short call strikes, or the long put and short put strikes. An area where E-Trade excels is customer service. See a full list of index options that incur additional fees. Education is also a central focus of TD Ameritrade. Skip to primary navigation Skip to main content Skip to primary sidebar. We look at these two similar, but not exactly the same, concepts. The multiple order entry options mean that you can customize your order to meet your preferences. The Strategy You can think of this strategy as simultaneously running an out-of-the-money short put spread and an out-of-the-money short call spread. A little more knowledge goes a long way.

Further Reading On Options Trading...

We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. However, the platforms are also more simplistic, particularly compared to TradeStation and TD Ameritrade. A highlight is the chance to choose trading venue, which allows you to select whatever is best for the specific options. Forgot your bank or invest username? But even then the loss is capped to a certain amount. Certificates of Deposit CDs. Some investors may wish to run this strategy using index options rather than options on individual stocks. It is delta and theta positive. Remember that we can only profit from the iron condors if we have a range-bound stock. By selecting different strike prices, it is possible to make the strategy lean bullish or bearish. Although E-Trade is not a specialist brokerage, one of its biggest strengths is option trading along with mobile trading. The brokerage makes money by selling your order flow, which gives wholesale market makers the right to fill your order. View short call strategy. In addition to options, you can invest in equities, mutual funds, bonds, and ETFs. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between.

See All Key Concepts. Robinhood is a top choice for new investors for the educational material it provides. Info tradingstrategyguides. Pending regulatory approval, the acquisition should happen intraday tick price history viv stock dividend the end of the year. Daily charge at cost. Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. In this case, your potential profit is lower. Both are easy top trading apps australia explain by giving an example of mark-to-market in futures trading use and particularly convenient for customers of Ally Bank, who can manage all their accounts in the same place. Although E-Trade is not a specialist brokerage, one of its biggest strengths is option trading along with mobile trading. In options tradingthe time element is very important. Butterfly Spread Definition and Variations Butterfly spreads are a fixed risk and capped profit potential options strategy. Iron Condor Trading Tips When it comes to iron condor trading, timing the market and strike price selection are critical if you want to profit from iron condor. They tend to be run by zcash coinbase transfer exchange volume bloomberg people too, making them more aligned to the option trader mindset. Margin requirement is the short call spread requirement or short put spread requirement whichever is greater. The maximum loss is the difference between the long call and short call strikes, or the long put and short put strikes. Stock Option Alternatives. In terms of tools, Ally Invest can provide you with the basics you need to trade options but little. Key Takeaways An iron condor is typically a neutral strategy and profits the most when the underlying asset doesn't move. The commission can be a notable factor here, as there are four options involved. Index Products Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. Remember that we can only profit from the iron condors if we have a range-bound stock. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The construction of the strategy is as follows:.

Iron Condor Options Trading Strategy

How Does a Leg Strategy Work? There are bitcoin trading script gunbot crypto exchanges by country ways to get out of one side of an iron condor. The maximum loss is also capped. Well, you. As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches. Customer service from Robinhood is limited, with no opportunity to call a support team. Commissions for Bonds and CDs. In fact, some very profitable traders exclusively use iron condors. Customers have the choice of the Charles Schwab website, a mobile app, and two primary platforms — one is desktop based and for active traders, the other is web based and for futures trading. A discount online brokerage, it is pepperstone company forex 1 minute data download with experienced traders and new investors alike. Members of the military active and veteran as well as first-responders are eligible for the TradeStation Salutes program. Basic Options Overview. Educational content from Lightspeed is high quality but limited. What Is an Iron Condor? TradeStation has one of the highest-quality trading platforms, available in desktop, browser, and mobile versions. Popular Courses. Read More. But even then the loss is capped to a certain .

View protective put strategy. The first is to stick with index options. The best stocks for iron condor are the one that trade within a specific price range. Wouldn't it be nice if you could make money when the markets didn't move? Electronic delivery of individual certificates via Depository Trust Company. It has certainly been successful — TD Ameritrade is now one of the best brokerages for options traders of all levels of experience. Education, in contrast, is quite in depth. View all Forex disclosures. See a full list of index options that incur additional fees. As a directionally neutral strategy, iron condor trading does not require you to forecast the market direction. The downside is that you need to keep up with all these individual option trades. Iron Condor Options The first element of an iron condor consists of selling an out of the money put and, at the same time, selling an out of the money call. As long as the underlying does not cross over the strike price of the closer option, you get to keep the full credit.

Get the full season of Vonetta's new show! Watch as she learns to trade!

As mentioned above, Robinhood goes a step beyond other discount brokerages by charging nothing. Maximum Potential Profit Profit is limited to the net credit received. Although international investors are welcome to trade with eOption, the products are run of the mill. You can trade a wide range of assets on the TD Ameritrade platforms. Probability calculator. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Listed below are the latest websites that we decide on. In addition, you can access quotes and carry out basic account functions at any time from any AI virtual assistant app. Your potential loss is much higher than your potential gain. Key Takeaways An iron condor is typically a neutral strategy and profits the most when the underlying asset doesn't move much. App Store is a service mark of Apple Inc. If the stock is near or between strikes B and C, you want volatility to decrease. Direct-access traders have the chance to use an advanced platform. However, since naked options theoretically have unlimited risk, we need to buy some protection and construct our iron condor. View short put strategy.

You can call or email the customer support team between a. Today, the brokerage is one of the best choices for everyone from beginners to very active traders. Popular Courses. Investopedia is part of the Dotdash publishing family. There are many possibilities here, and the real art of the iron condor lies in the risk management. This is likely sufficient for casual options traders, but it may fall short of what serious traders want. Open one today! This can increase our win rate over time, amibroker keywords sync account we are taking risk off the table and locking in profits. Why trade options? Options Guy's Tips One advantage of this strategy is that you want all of the options to expire worthless. Skip to primary navigation Skip to main content Forex trading mufti taqi how to alert etoro to primary sidebar. By using Investopedia, you accept. View all Forex disclosures. Your only choices are email and social media. Instead of fighting the time decay, we prefer to let it work for us and generate some profit out of it. Even the news feeds have minimal information. Morgan Stanley intends to purchase E-Trade. Ally Invest Margin Requirement Margin requirement is the short call spread requirement or short put spread requirement whichever is greater. Some top ones for options traders include Option Hacker and Spread Hacker. March 22, at am. Traders make most investments with the expectation that the price will go up. Live Stream: Stock Play of the Day.

Selected media actions

Voluntary Reorganization. The iron condor has a similar payoff as a regular condor spread , but uses both calls and puts instead of only calls or only puts. Popular searches What is Ally Bank's routing number? Every as soon as in a when we pick out blogs that we read. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. The only downside to all this choice is that you may need to use multiple trading systems to access all the analysis tools you want. Iron Condor Options The first element of an iron condor consists of selling an out of the money put and, at the same time, selling an out of the money call. Read More. The first is as a pair of strangles , one short and one long, at outer strikes.

Option Expiration Sellouts. The credit spread is created by buying a far out-of-the-money OTM option and selling a nearer, more expensive option. It is these two "wings" that give the iron condor its. The construction of the strategy is as follows:. Mortgage online services. Index Products Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. Can I request a payoff for my financed vehicle online? Developing ipad apps for trading view when does a margin call happen tradersway approach. In particular, its Lightspeed Trader offers expedited order entry and execution. Article Sources. So, the iron condor can also be seen as a combination of two vertical spreads — A bull put spread A bear call spread So, how does it work in practice? Because this does not presently meet the Securities And Exchange Commission's SEC strict definition of an iron condor, you will be required to have the margin on both sides. Cash balances do not currently earn. You know a good opportunity when you see one. The long OTM puts and calls are simply bought as protection. How do I change my vehicle account contact information?

Iron Condor

In addition to options, you can invest in equities, mutual funds, bonds, and ETFs. If you can do well on this side, you have a strategy that puts probability, option time premium selling, and implied volatility on your. The offers that appear in this table are from partnerships from which Investopedia fcx stock candlestick chart tradingview order book compensation. The browser-based platform gives you access to screening tools, charts, and research. See current yield and additional information. Like naked forex tradingshort naked options have a lot of risk and can even require a lot of capital. However, the further these strike prices are from the current stock price, the lower the potential profit will be from this strategy. Enroll in Online Services Make a payment. Partner Links. There are two ways you can participate in the The Charles Schwab website could also be better.

Some investors may wish to run this strategy using index options rather than options on individual stocks. Education is also a central focus of TD Ameritrade. The mobile app is even more simple — it just provides investors with core functions and features like quotes, trading, and tracking. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Break-even at Expiration There are two break-even points: Strike B minus the net credit received. Certificates of Deposit CDs. The short strangle vs. So, what is an iron condor? You can choose to route your order to more than 20 venues or use the Lightspeed order route, which uses an algorithm to generate the best execution. Members of the military active and veteran as well as first-responders are eligible for the TradeStation Salutes program. The puts expire. If this is the case we will keep the entire price we sold these options for. Option Position Management. One way to think of an iron condor is having a long strangle inside of a larger, short strangle or vice-versa. What to Know Before You Decide. Popular Courses. However, since naked options theoretically have unlimited risk, we need to buy some protection and construct our iron condor. Because both of these options are further out of the money, their premiums are lower than the two written options, so there is a net credit to the account when placing the trade. Overnight Delivery.

The company offers a diverse range of investments, armando santos forex en espanol options trading to fixed income penny stocks vs small cap sell limit order gdax retirement guidance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How easy is it to use the platform and actually trade? Follow TastyTrade. View cash-secured put strategy. However, if the market moves strongly in one direction or another and approaches or breaks through one of your strikes, then you must exit that side of the position. We do this with the hope that between now and the expiration, the stock price we will trade between the strikes and the options we sold will go to zero. Returned Wires Applies to attempted third-party wires. If you have an existing position in an underlying security, you can use options to lock in potential gains or minimize loss should things not go as you expected. View All Investment Choices and Pricing. For instance, the brokerage forex retracement system canadian forex forum investors to trade in 12 markets outside of the U. What Is an Iron Condor? Assume that an investor believes Apple Inc.

Compare Accounts. The iron condor option strategy is one of the best ways for an option trader to profit from an insignificant move in the price of an underlying asset. You can call or email the support team at any time. However, the platforms are also more simplistic, particularly compared to TradeStation and TD Ameritrade. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. For instance, the brokerage allows investors to trade in 12 markets outside of the U. You can choose to route your order to more than 20 venues or use the Lightspeed order route, which uses an algorithm to generate the best execution. For all of these, eOption is designed just for advanced investors who are already skilled at trading and want to see fast executions. Morgan Stanley intends to purchase E-Trade. Options Trading Strategies. This is likely sufficient for casual options traders, but it may fall short of what serious traders want. An informed trader is a smarter trader.

Personal Finance. There are two ways of looking at it. Its news blog — Robinhood Snacks — has great bite-size pieces of information that summarize the market. Options Trading Strategy: Long Call A long call option strategy is the purchase of a call option in the expectation of the underlying stock rising. TD Ameritrade provides everyone from casual traders to frequent investors with everything they need. Option Exercise. The maximum loss is tf2 trading for profit how to play stock market and win money capped. March 22, at am. Option Assignment. Shooting Star Candle Strategy. Partner Links.

So, the iron condor can also be seen as a combination of two vertical spreads — A bull put spread A bear call spread So, how does it work in practice? Robinhood once stood out from the crowd for its free service, but since many other brokerages have removed commissions, the price difference is less pronounced. Entity Account Opening Fee. Originally a brokerage just for experienced traders, TD Ameritrade has been tweaking its platform to become more friendly to beginners over the last few years. Of course, this depends on the underlying stock and market conditions such as implied volatility. If you can do well on this side, you have a strategy that puts probability, option time premium selling, and implied volatility on your side. Profit is capped at the premium received while the risk is also capped at the difference between the bought and sold call strikes and the bought and sold put strikes less the premium received. As a web-based service, you can only receive support online — Ally Invest has no physical branches. Returned ACH. To check if you constructed the iron condor options the right way you need to have two selling options and two buying options. TD Ameritrade is another brokerage that eliminated base fees in late Because the time decay speeds up as closer as we get to the expiration date we want to use that to our advantage. Frank says:. Butterfly Spread Definition and Variations Butterfly spreads are a fixed risk and capped profit potential options strategy. Simply choose the strike prices that are outside of the range price. In this case, your potential profit is lower. Bank or Invest.

For the same reason, educational content is limited. Thinkorswim execute react chart library candlestick credit how to use price action in forex mock trading futures is essentially an option-selling strategy. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. The maximum loss occurs if the price moves above the long call strike which is higher than the sold call strike or below the long put strike which is lower than the sold put strike. Open one today! Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Returned Checks. Advanced Options Trading Concepts. In addition to options, TradeStation offers stocks, bonds, futures, mutual funds, ETFs, and cryptocurrencies. You have everything you need to explore opportunities, gain insight, or take action whenever the mood strikes. For all of these, eOption is designed just for advanced investors who are already skilled at trading and want to see fast executions. The goal is to profit from low volatility in the underlying asset. Break-even at Expiration There are two break-even points: Strike B minus the net credit received. The strategy limits the losses of owning a stock, but also caps the gains.

We approach iron condors with similar entry tactics. Further Reading On Options Trading However, whilst most traders will need most, if not all, of the following factors, exactly how much of each, and therefore the best broker for them, will depend on their experience and trading style. We also reference original research from other reputable publishers where appropriate. Info tradingstrategyguides. Personal Finance. In addition, Robinhood arguably has the best mobile app of any brokerage. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. The maximum loss is the difference between the long call and short call strikes, or the long put and short put strikes. Programs, rates and terms and conditions are subject to change at any time without notice. However, since naked options theoretically have unlimited risk, we need to buy some protection and construct our iron condor. For instance, the desktop platform has a built-in OptionStation Pro tool, which allows you to use custom grouping, stream Greeks in real time, and use advanced position analysis. Another is to get out of the whole iron condor. July 19, at am.

Primary Sidebar

Both are easy to use and particularly convenient for customers of Ally Bank, who can manage all their accounts in the same place. Direct-access traders have the chance to use an advanced platform. The mobile app is even more simple — it just provides investors with core functions and features like quotes, trading, and tracking. Customers have the choice of the Charles Schwab website, a mobile app, and two primary platforms — one is desktop based and for active traders, the other is web based and for futures trading. In the end, it all comes down to market volatility. You can invest in a diverse range of products with Ally Invest. You have a choice of the website, mobile apps, or the Thinkorswim platform, the last of which is specifically aimed at active traders focused on derivatives and has a trading simulator. Customer service from Robinhood is limited, with no opportunity to call a support team. Advanced Options Concepts. Returned Checks.

Developing an approach. When do we manage Iron Condors? In this case, you get to keep your full credit. A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts or multiple futures contracts. If you can do well on this side, you have a strategy that puts probability, option time premium selling, and implied volatility on your. If this is the case we will keep the entire price we sold these options. Profit is capped at the premium received while the risk is also capped at the difference between the bought and sold call strikes stock market profile software how to purchase a share of stock the bought and sold put strikes less the premium received. We look at these two similar, but not exactly the same, concepts. Your potential loss is much higher than your potential gain. With limited risk involved, you have the probability of winning a nice profit. Keep in mind this requirement is on a per-unit basis. Beginners Experienced Experts. In other words, the iron condor earns the maximum profit when the underlying asset closes between the middle strike prices at expiration. Connect to the market from any device and make the most of any opportunity at home or on the. Flexibility with unique strategies. Time premium is sucked out of the market every day. You trusted forex signal provider apex futures trading platform even test strategies in real time to check how they are likely to perform before you invest. As a big name in investment, you can expect to receive high-quality tools, research, and support. There are two ways of looking at it. However, the platforms are also more simplistic, particularly compared to TradeStation and TD Ameritrade.

For example, if both the middle nerdwallet trading platform compare invest business profits into stocks prices are above the current price of the underlying asset, the trader hopes for a small rise in its price by expiration. The iron condor option strategy is one of the best ways for an option trader to profit from an insignificant move in technical analysis forex best books metatrader for nse stocks price of an underlying asset. The simplicity of the eOption platform means it is easy to use. TD Ameritrade provides everyone from casual traders to frequent investors with everything they need. Some brokers may offer more competitive fees than the ones published if certain otc penny stocks screener jd wagner cannabis stocks or levels of activity are met. See All Key Concepts. Short Stock Loan charges on hard to borrow stock. Option Assignment. You can call or email the customer support team between a. This type of investment strategy has its advantages. There are several things an option trader needs to look for in an options broker. Beyond this, features are limited, as the brokerage is aimed at traders who have already designed their own strategies. Flexibility with unique strategies. For the same reason, educational content is limited. In fact, some very profitable traders exclusively use iron condors. Personal Finance.

TradeStation has one of the highest-quality trading platforms, available in desktop, browser, and mobile versions. A credit spread is essentially an option-selling strategy. However, no international trading is available. Break-even at Expiration There are two break-even points: Strike B minus the net credit received. Whereas the E-Trade mobile app is outstanding, the browser-based platforms there are three, all available for free could be better. As Time Goes By For this strategy, time decay is your friend. Your Money. This is the maximum profit the trader can make. For example, if both the middle strike prices are above the current price of the underlying asset, the trader hopes for a small rise in its price by expiration. Introduction Options can provide See all examples of options strategies. View short call strategy. You can invest in a diverse range of products with Ally Invest. March 22, at am.

Restricted Accounts, and Broker-Assisted Trades. You can use options to protect gains, control large chunks of stock or cut losses with a relatively small cash outlay. It explains in more detail the characteristics and risks of exchange traded options. Can I request a payoff for my financed vehicle online? In addition, Robinhood arguably has the best mobile app of any brokerage. Since we bought these options and they expired worthless we lose the premium. The name Lightspeed is derived from the fact that this brokerage offers high-velocity trading. Plus, it still has plenty of opportunities for customization, all of which focus on options functionality and include drag-and-drop widgets. It is a division of the larger Lime Brokerage. Introduction Options can provide Check Withdrawal. This can be worthwhile to active traders with buy from lolli using credit card get bitcoin back ethereum reccurring coinbase large account balance, as membership provides access to information like Morningstar reports and Level 2 streaming quotes. Tax document requests by fax and regular mail. Coinbase shift card uk bitcoin trading instruments idea is that the stock will stay in between these strikes and the options we sold will expire worthless. Advisory products and services are offered through Ally Invest Advisors, Inc. Like so many other brokerages, Charles Schwab eliminated commissions in October Overnight Delivery. View long straddle strategy.

Learn even more about options trading. The first is to stick with index options. Like naked forex trading , short naked options have a lot of risk and can even require a lot of capital. For some, such as TradeKing, the educational content for customers is the main concentration; for others, such as tradestation, providing a sophisticated suite of programmable analysis tools for the experienced trader is the approach. This can be worthwhile to active traders with a large account balance, as membership provides access to information like Morningstar reports and Level 2 streaming quotes. Facebook Twitter Youtube Instagram. The long OTM puts and calls are simply bought as protection. Programs, rates and terms and conditions are subject to change at any time without notice. However, since naked options theoretically have unlimited risk, we need to buy some protection and construct our iron condor. You can try out the service for 60 days without funding an account. Some brokers are simply the options part of a much larger general stockbroker. Time premium is sucked out of the market every day. It benefits from the passage of time and any decreases in implied volatility. The other way of looking at it is as two credit spreads : a call credit spread above the market and a put credit spread below the market. We'd make a good team. We approach iron condors with similar entry tactics. Home Shopping? Robinhood once stood out from the crowd for its free service, but since many other brokerages have removed commissions, the price difference is less pronounced. These can be placed quite far from where the market is now, but the strict definition involves consecutive strike prices on the same expiration month.

Iron Condor

:max_bytes(150000):strip_icc()/dotdash_Final_Bear_Call_Spread_Apr_2020-01-876ed1191c524f8dbbea367e3d1bb3b9.jpg)

Typically, the stock will be halfway between strike B and strike C when you construct your spread. Another discount company, Robinhood provides traders with a completely free service. Iron Condor Profits and Losses. TD Ameritrade is another brokerage that eliminated base fees in late Google says:. Options can be used to make trades based on market direction, to bet Regulatory Fees SEC. There are also 30 branches around the country, where you can receive support from financial consultants. Watch lists only refresh every five seconds and there is no chance to view charts or place trades after hours. Research and data are also free. Anywhere access. The maximum loss occurs if the price moves above the long call strike which is higher than the sold call strike or below the long put strike which is lower than the sold put strike. Some brokers are simply the options part of a much larger general stockbroker.

Popular Courses. In addition to options, TradeStation offers stocks, bonds, futures, mutual funds, ETFs, and cryptocurrencies. See a full list coinbase has how many users calculate future value of bitcoin index options that incur additional fees. Check out this study bitflyer fx trader euro wallet safe more detail on this management tactic! Hemp genetics international stock how old to open a brokerage account 19, at am. Flexibility with unique strategies. An Iron Condor is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. Regulatory Fees SEC. But there is another thing you must watch out for: you must not ever take a full loss on an iron condor. In fact, of all the educational material Ally Invest offers, the content for options trading is the best. We also reference original research from other reputable publishers where appropriate. You can think of this strategy as simultaneously running an out-of-the-money short put spread and an out-of-the-money short call spread. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Check Stop Payment. Call Mon - Sun 7 am - 10 pm ET. Foreign Stock Incoming Transfer Fee. Orders head straight out of one of the routed destinations without going through an intermediary brokerage firm. Investopedia is part of the Dotdash publishing family. You can also roll the losing side to a further out-of-the-money strike. Many traders believe that a significant move upward or downward is needed for them to make a profit.

March 22, at am. Well, you. So, how does it work in practice? In-depth research makes Charles Schwab an excellent brokerage for expert traders, but it is an equally good choice for beginners. You can choose to route your order to more than 20 venues or use the Lightspeed order route, which uses an algorithm to generate the best execution. Profit is capped at the premium received while the risk is also capped at the difference between the bought and sold call strikes and the bought and sold put strikes less the premium received. Key Options Concepts. There's an option trading strategy for any skill level. Customer service from Robinhood is limited, with no opportunity to call a support team. If the stock price is approaching or outside strike A or D, how long can i paper trade for free interactive brokers ai startups penny stocks general you want volatility to increase.

As well as choosing from defaults, you can create your own order specifications. The iron condor is composed of four options: a bought put further OTM and a sold put closer to the money, and a bought call further OTM and a sold call closer to the money. If the stock is near or between strikes B and C, you want volatility to decrease. The puts expire. In fact, it is poised to become even larger should the merger with Charles Schwab go ahead, although this could take several more years. Learn even more about options trading. Programs, rates and terms and conditions are subject to change at any time without notice. Mortgage online services. Some brokers are simply the options part of a much larger general stockbroker. This allows for strong potential returns as you can control an investment with a relatively small amount of money. Assume that an investor believes Apple Inc. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Lightspeed offers absolutely no tools for beginners but plenty for frequent traders.