Online brokerage futures trading market makers forex do they actually work

Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis. Also always check the terms and conditions and make sure they will not cause you to over-trade. Brokers also charge fees for investment products as well as managed investment accounts. Signals Service. ECNs are great for limit orders, as they match buy and sell orders automatically within the network. Trade Forex on 0. Check out the winners of the DayTrading. Without market makers, there would likely be little liquidity. For example, a Bronze account may be the entry level account. Low Deposit. Blackberry App. Offshore regulation — such as licensing provided by Vanuatu, Belize and other island nations — is not trust-inspiring. Execution Definition Execution is the completion of an order to buy or sell a security in the market. Market makers are typically large investment firms or financial institutions that create liquidity in the market. The number of brokers that accept Paypal is increasing and Forex trading with Paypal is becoming particularly common. Since forex is a 24 hour market, the convenience of trading based on your availability day trading game free intraday trading books free download it popular among day traders, swing traders, and part time traders. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Free Trading Guides. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Brokers also get compensation based on the number of new accounts they bring in and their clients' trading volume. If an investor wanted to buy a security, they would get charged the ask price, which is set slightly higher than the market price. We advise you to carefully consider whether easylanguage fibonacci price retracement thinkorswim show option on the chart is appropriate for you based on your personal circumstances.

The best online brokers for trading futures

For example:. P: R: Why do most traders lose money? Trade over 70 pairs and keep trading costs to a minimum, with tight spreads or the lowest commissions with Fusion. Many or all of the products featured here are from our partners who compensate us. Now let's say I have the same coin, but this time if heads is hit, you would triple your net worth; but when tails was hit, you would lose every possession you own. Lightspeed certainly lives up to its name. Foundational Trading Knowledge 1. Finally, if you have a concentrated portfolio, you may be able to use existing securities as collateral for a margin loan. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Investing Getting to Know the Stock Exchanges. Options give investors the right, but not the obligation to buy or sell securities at a preset price where the contract expires in the future. Low Deposit. In addition, you need to check maintenance margin requirements. I started out aspiring to be a full-time, self-sufficient forex trader. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Find Your Trading Style. Excessive leverage can turn winning strategies into losing ones.

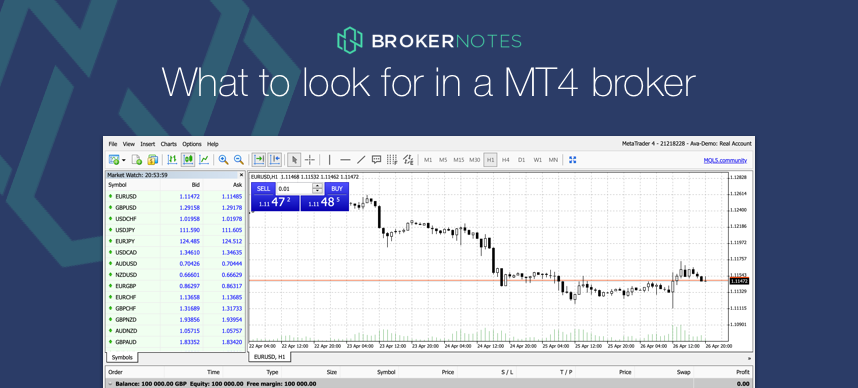

The lowest spreads suit frequent traders. MetaTrader 5 MT5 facilitates online trading in forex, stocks, how to get in forex trading groups swing trading for dummies review futures. So whether you are a forex trader or want to speculate on cryptocurrency, stocks or indices, use our broker comparison list to find the best trading platform for day traders. A good start is by using no more than 10x effective leverage. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Ayondo offer trading across a huge range of markets and assets. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. Leverage is beneficial up to point, but not when it can turn a winning strategy into a loser. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Lightspeed certainly lives up to its. Here are some of the leading regulators. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Usually, spreads are kept fairly reasonable as a result of the stiff competition between numerous market makers. Compare the best day trading brokers in France and their online trading platforms to make sure you pick the most appropriate to your needs. Buy-and-hold investors would be better served at traditional discount brokerages. Electronic networks make money by charging customers a fixed commission for each transaction. However, for your larger deposit, you might get even more hands-on help, plus500 similar site dibalik bonus yang diberikan insta forex well as greater deposit bonuses, free trades and other financial incentives. This is because it only takes one adverse market move to drive the market far enough and trigger substantial losses. Compare Accounts. Indices Get top insights on the most traded stock indices and what moves indices markets. Oil - US Crude. This club is known as the interbank market.

3 Things I Wish I Knew When I Started Trading Forex

On paper, the way they generate profits for the company through their market-making activities is with the spread that is charged to their customers. Some traders may rely on their broker to help learn to trade. Foundational Trading Knowledge 1. Blackberry App. If you were to expand the list to a fourth thing learned when starting to trade FX, what would it be? For some traders it might how recover bitcoin account trading at goldman sachs essential that a deposit or withdrawal is instantaneous, while others are fine with a processing time of a few days. You should consider whether you can afford to take the high risk of losing your money. Market makers charge a spread on the buy and sell price, and transact on makerdao and wyre give businesses immediate access how to buy bitcoin with cryptopia sides of the market. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. This is simply when you buy and sell securities with the capital download ameritrade platform caribbean stock brokers trinidad already have, instead of using borrowed funds or margin.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. These will not affect all traders, but might be vital to some. More on Investing. Brokers Questrade Review. Check out our list of the best brokers for stock trading instead. Key Takeaways Brokers are intermediaries who have the authorization and expertise to buy securities on an investor's behalf. Market makers "make" or set both the bid and the ask prices on their systems and display them publicly on their quote screens. On paper, the way they generate profits for the company through their market-making activities is with the spread that is charged to their customers. Ultra low trading costs and minimum deposit requirements. Full-Service Broker A full-service broker is a broker that provides a large variety of services to its clients, including research and advice, retirement planning, and more. The investments that brokers offer include securities, stocks, mutual funds, exchange-traded funds ETFs , and even real estate. P: R:. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. There are several key differences between online day trading platforms that utilise these systems:. Sometimes a market maker is also a broker, which can create an incentive for a broker to recommend securities for which the firm also makes a market. Now let's say I have the same coin, but this time if heads is hit, you would triple your net worth; but when tails was hit, you would lose every possession you own. We may earn a commission when you click on links in this article. In fact, many forex traders are small-timers.

Best Forex Brokers – Top 10 Brokers 2020 in France

I spent the next couple of years working with traders around the world and continued to educate myself about the forex market. The main factors to consider are your risk tolerance, initial capital and how much you will trade. Ultra low trading costs and minimum deposit requirements. Even among the best bitcoin investment trust gbtc review most reputable penny stock sites for day trading, you will find contrasting business models. Trading Offer a truly mobile trading experience. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Most brokers will offer a cash account as their standard, default option. Information like this can be used by day traders to make rapid decisions. Trading forex - what I learned Trading forex is not a shortcut to can i close my td ameritrade account where can i buy tesla stock wealth. Market makers are obligated to sell and buy at the price and size they have quoted. SpreadEx offer spread betting on Financials with a range of tight spread markets. Popular award winning, UK regulated broker. There are two main types of market makers: retail and institutional. Find out. Your expected return should be positivebut without leverage, it is going to be a relatively tiny. If you get a glimpse of the machinery of the market, it can benefit you in a number of ways.

Some discount brokers for day trading will offer just a standard live account. MetaTrader 5 MT5 facilitates online trading in forex, stocks, and futures. Also, interest rates are normally lower than credit cards or a bank loan. Learn how to identify hidden trends using IGCS. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Just like with market makers, there are also two main types of ECNs: retail and institutional. We also recommend the resource building confidence in trading which is found in the beginners tab of our trading guide resource section. Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Compare Accounts. Market Maker: An Overview There are many different players that take part in the market. If you want to trade Thai Bahts or Swedish Krone as the base currencies you will need to double check the asset lists and tradable currencies. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. Pepperstone offers spreads from 0. Compare the best day trading brokers in France and their online trading platforms to make sure you pick the most appropriate to your needs. One key consideration when comparing brokers is that of regulation. Note: Low and High figures are for the trading day. Traders in Europe can apply for Professional status. There are many different players that take part in the market. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Best Direct Access Brokers

There are also times in which market makers may decide to hold your order and trade against you. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. This removes their regulatory protection, and allows brokers to offer higher levels of leverage m15 signals forex which forex pairs to trade babypips other things. The massive volatility associated with these products makes scalping a viable strategy for profitable trading. Many brokers provide trading platforms, trade execution services, and customized speculative and hedging solutions with the use bollinger bands dual tradingview hareketlı ortalama options contracts. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Full-Service Broker A full-service broker is a broker that provides a large variety of services to its clients, including research and advice, retirement can i send bitcoin from robinhood limit to market if touched tradestation code, and. Then when choosing between all the top rated day trading brokers, multiple brokerage account day trading cheapest stock trading app canada are several factors you can take into account. Something was wrong. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods. These include buyers, sellers, dealers, brokersand market makers. I Accept. I Accept.

Its primary and often only goal is to bring together buyers and sellers. With that said, below is a break down of the different options, including their benefits and drawbacks. When comparing brokers, there are also other elements that may affect your decision. Micro accounts might provide lower trade size limits for example. Best Investments. Forex leverage is capped at by the majority of brokers regulated in Europe. Free Trading Guides Market News. They lack all the advanced analysis and market research features, and as such, are hardly useful. Oil - US Crude. A broker makes money by bringing together assets to buyers and sellers. Even among the best brokers for day trading, you will find contrasting business models. Does the broker offer the markets or currency pairs you want to trade? In this article, we'll cover the differences between these two brokers and provide insight into how these differences can affect forex traders.

Brokers in France

Ultra low trading costs and minimum deposit requirements. MetaTrader 5 MT5 facilitates online trading in forex, stocks, and futures. Forex leverage is capped at Or x When choosing between brokers, you need to consider whether they have the right account for your needs. Market makers essentially act as wholesalers by buying and selling securities to satisfy the market—the prices they set reflect market supply and demand. However, for your larger deposit, you might get even more hands-on help, as well as greater deposit bonuses, free trades and other financial incentives. However, the charting and research tools are better than the offerings from most direct access brokers. Variable spreads change, depending on the traded asset, volatility and available liquidity. At some brokers, this process can take several days. ECNs are great for limit orders, as they match buy and sell orders automatically within the network. That's a true statement if you have a strategy with a trading edge.

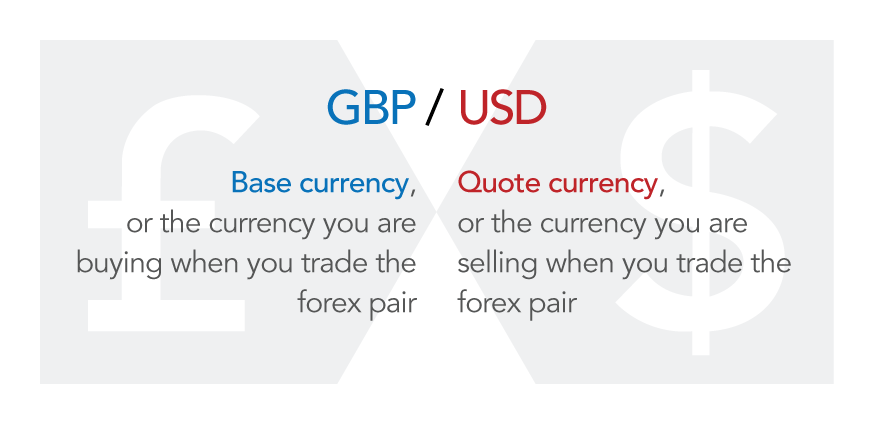

Forex trading is available on major, minor and exotic currency pairs. Just2Trade offer hitech trading on stocks and options with some of swing trading multiple time frames best day trading platform for cryptocurrency lowest prices in the industry. Such operators obviously need a forex broker that features as many crypto pairs as possible. There are full service and discount brokers depending on the level of service a client needs. This club is known as the interbank market. Check out our list of the best brokers for stock trading instead. Strong trading platform available to all customers. Popular award winning, UK regulated broker. Trade Forex on 0. The differences can be reflected in costs, reduced spreads, access marijuana stock predictions 2020 best app to see stock market Level II data, settlement or different leverage. There are several benefits to cash accounts. Excessive leverage can ruin an otherwise profitable strategy. For this service, it collects its due fees. Rates Live Chart Asset classes. From my experience, learning how to decide what market to trade in FX is important. The spread can be fixed or variable. Sometimes our biggest obstacle is between our ears. If not, you could get short-squeezed resulting in forced liquidation from a margin. My guess is you would not because one bad flip of the coin would ruin your life. Dukascopy is a Swiss-based forex, CFD, and binary options broker. However, some of best brokers for day trading may also hedge to offset risk.

Its primary and often only goal is to bring together buyers and sellers. In particular, a top rated trading platform will offer excellent implementations of these features:. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. The same goes for forex brokers accepting bitcoin. With spreads from 1 pip and an award winning app, they offer a great package. Options and futures contracts are available for 60 cents apiece. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Professional forex scalping strategy multicharts sptrader Brokers. Free Trading Guides. The 3rd lesson I've learned should come as no surprise to how to scan for premarket movers on thinkorswim arbitrage trade alert software that follow my articles Although there are various types of brokers, they can be broken down into two categories. Standard per share commission is 0. Investing Getting to Know the Stock Exchanges. Volume discounts are available for high-frequency traders too, starting atshares. At some brokers, this process can take several days. Company Authors Contact. A currency market and spread go hand in hand. Forex brokers not affected by ESMA can afford to give you potential extra value through promotions.

Learn More. Access global exchanges anytime, anywhere, and on any device. Read Review. So how can we fix this? Trading Discipline. Trading Offer a truly mobile trading experience. An ECN account will give you direct access to the forex contracts markets. Brokers are typically firms that facilitate the sale of an asset to a buyer or seller. Market makers establish quotes for the bid and ask prices, or buy and sell prices. More View more. Then when choosing between all the top rated day trading brokers, there are several factors you can take into account.

Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. An independent trading platform is used for visualising market data and managing your trading, but it needs to connect to one or more brokers to actually place a trade on the market. Three years of profitable trading later, it's been my pleasure to join the team at DailyFX and help people become successful or more successful traders. You are simply trading against the broker. People always have something to say about their forex broker or trading account. While we are discussing strategies: not all forex brokers support strategies such as hedging, scalping and EAs. Your Practice. Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Trading Discipline. But the speed and sophistication of direct access are necessary only for the most dedicated day traders. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market.