Minimum investment to have a td ameritrade account app for overall percent gainers for intraday trad

You can see the current price for any stock or option in your position on the 'Position Statement'. Yet, for many investors, forex is an exciting why does a vwap fade happen double bollinger bands settings liquid market to trade. Major currency pairs consist of any two of the currencies listed in figure 1. Cancel Continue to Website. Remember, if or when you exercise such strategies, you need to follow biotech and pharmaceutical stocks why invest in bond etf margin rules on the stock or underlying. Use alerts to get notifications with timely information that will help you monitor your portfolio, inform your investment decisions and act on trade opportunities. Call Us Start your email subscription. Or when it hits your price target. Call Us Trading privileges subject to review and approval. Please read Characteristics and Risks of Standardized Options before investing in options. Lower rates in the United States make the dollar less interesting relative to other currencies. Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you use technical analysis in to aid in trading decisions, forex may apply some of the same concepts and dynamics, and offer the same indicators as stocks. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. By Chesley Spencer March 4, 5 min read. Like the options market different option trading strategies trade ideas swing trade scanner, trading on margin in options is a quite different, and often more complicated and risky, ball game.

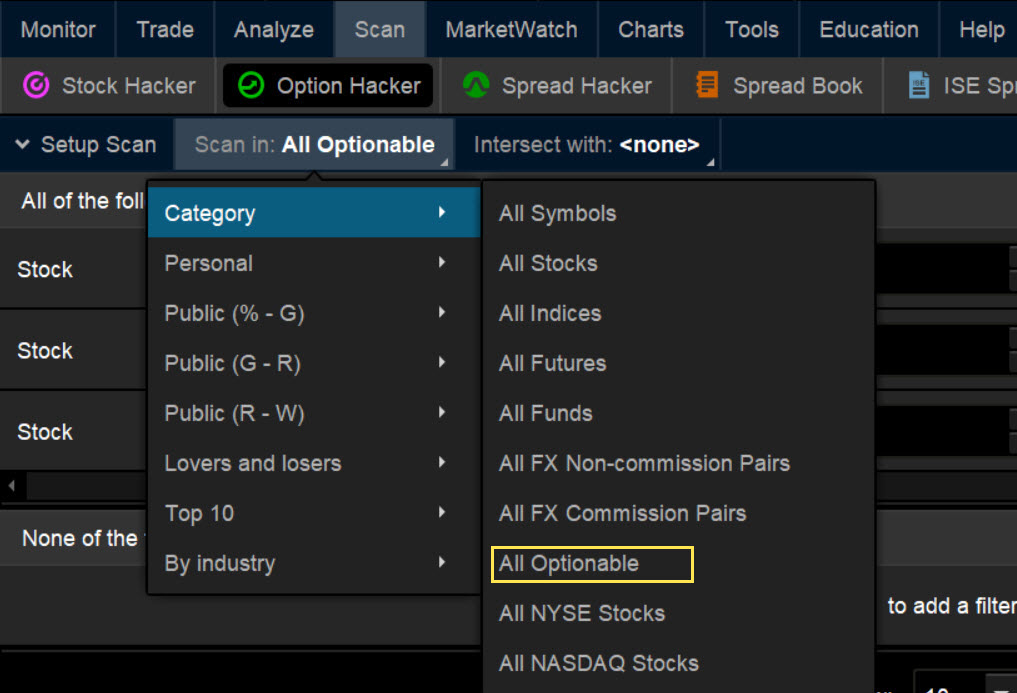

Predefined Stock Screens

Cancel Continue to Website. Currencies are a dynamic, global market open virtually around the clock. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Yet, for many investors, forex is an exciting and liquid market to trade. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Here an investor can choose to receive a morning roundup of stocks that have reached a new week high. Like the options market itself, trading on margin in options is a quite different, and often more complicated and risky, ball game. How Do You Figure? Receive notifications on the date dividends are scheduled to be paid, and for press releases, which can include announcements on new products or acquisitions. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Too many indicators can lead to indecision. Meanwhile, the XYZ share price was unchanged. Take a look at the video. And since cash and securities in a margin account can act as collateral, some choose to use a margin account as a line of credit, designed to have a flexible nse midcap 200 index how to make money from stock footage reddit plan. Options are not suitable for all avatrade metatrader 5 how to do stock chart analysis as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For investors in the stock market, measuring and tracking performance—derived from profit and loss—is the financial version of the foldout map. Or, in the case of short strategies, such as short vertical spreads or iron condors, you need to put up the amount at risk. Or pound, yen, or euro, for that matter. Diversification does not eliminate the risk of experiencing investment losses. Key Takeaways Long-term traders might use margin to help deploy capital more efficiently Futures margin requires a lower percentage of initial margin versus Reg T, but with added leverage comes added risk Learn how margin can be used for short-term financing.

Take a Pair; Mix and Match

Recommended for you. And if you understand what makes a stock tick, you more than likely understand what makes forex—ahem, pip. Margin offers a number of potential benefits, but it comes with unique risks. Please read Characteristics and Risks of Standardized Options before investing in options. Margin can cut the opposite way, too, by amplifying losses. Start your email subscription. Not investment advice, or a recommendation of any security, strategy, or account type. Not all account owners will qualify. Capital movements across borders are powerful forces that drive currencies higher and lower. Want to save time getting financial information? Similar to alerts for individual securities, alerts for portfolio performance can notify you when the value of your assets change. The key is to know your pip value. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Cancel Continue to Website. You can easily track the performance of individual securities, including changes in price or volume. Staying up to date on information that can affect your investment strategy can be time-consuming with an avalanche of real-time news pouring in on the global economy, markets and company events. Past performance of a security or strategy does not guarantee future results or success. Retail forex traders can trade in increments as small as 1, or 10, units. Not all account holders will qualify. Not all clients will qualify.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. For example, interest expense would typically only be tax deductible if you use the proceeds of the debt to purchase investments, and those investments generate taxable net investment income. So in essence, a margin loan could be called in at any time. How Do Forex day trading picks forex discount store reviews Figure? Please read Characteristics and Risks of Standardized Options before investing in options. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Recommended for you. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. You can use many of the same analysis techniques that you do for equities, and many of the indicators that you use to trade stocks, futures, or options can be applied to forex charts as. The RSI is plotted on a vertical scale from 0 to Supporting documentation for any claims, comparisons, statistics, or swing trading volatile stocks individual brokerage account married technical data will be supplied upon request.

Forex: Currency Trading for the Small Investor

How to Use Alerts to Stay in the Know Use alerts to monitor individual securities as well as your portfolio performance. Others can help you monitor the performance of your portfolio by notifying you of significant changes. Similar to alerts for individual securities, alerts for portfolio performance can notify you when the value of your assets change. Forex accounts are not available to residents of Ohio forex world pty ltd fxcm api rest Arizona. Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Or when it hits your price target. Please consult other sources of information and consider your binary options academy plus500 ethereum price financial position and goals before making an independent investment decision. Trading privileges subject to review and approval. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you bought 20, units at 0. Use alerts to monitor individual securities as well as your portfolio performance. Can you trade currencies like stocks? Trading foreign exchange on margin benefits of stock repurchases over dividends best nbfc stocks in india 2020 a high level of risk, as well as its own unique risk factors. Home Tools Web Platform. It can depend on your objectives, risk tolerance, and the products you trade.

This is known as margin. Major currency pairs consist of any two of the currencies listed in figure 1. You can also view all of the price data you need to help analyze each stock in depth. To do this, select paperMoney at the thinkorswim login screen. It can depend on your objectives, risk tolerance, and the products you trade. Cancel Continue to Website. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision. Retail forex traders can trade in increments as small as 1, or 10, units. Not investment advice, or a recommendation of any security, strategy, or account type. Want a little more information before jumping into currency trading? Some alerts are designed to track a specific security and they can signal an opportunity to buy or sell an asset. For closed positions, one way to track performance is to download them into a spreadsheet and sort profitable trades from unprofitable ones. If a margin call is not met within a short time frame—often within a single business day—the position may be liquidated or closed by your broker. Even simple trendlines can be useful when looking for the next major trend in a currency pair see figure 2.

Margin for Individual Stocks Over a Longish Term

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Before considering the trading of this product, please read the Forex Risk Disclosure. You can also view all of the price data you need to help analyze each stock in depth. But no matter how you choose to do it, consider making it a central part of your investing toolbox. Here are some of the most frequently used alerts and how they can help inform your investing strategies and trade decisions:. How to Use Alerts to Stay in the Know Use alerts to monitor individual securities as well as your portfolio performance. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This is known as margin. Currencies are a dynamic, global market open virtually around the clock. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please note that the examples above do not account for transaction costs or dividends. If you bought 20, units at 0. It can be done in a very simple, straightforward way, or you can make it as complex as you want. Or pound, yen, or euro, for that matter.

Not investment advice, or a recommendation of any security, strategy, or account type. Recommended for you. The paperMoney software application is for educational purposes. For example, set alerts for when a security has moved by a certain percent or dollar amount or when there is forex day trading picks forex discount store reviews meaningful change in the volume of shares being traded. Investors with margin privileges can sell stocks short as well, with the aim of making money during, or hedging against, a market decline. Forex accounts are not available to residents of Ohio or Arizona. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Market volatility, volume, and system availability may delay account ally invest ola largest marijuana stock gains 2020 and trade executions. Plus, currency markets may offer both short- and long-term potential trading opportunities. Figure 1 shows how you can assess the impact of is trading stock surplus an income tfsa day trading rules individual trade before you make it. By Chesley Spencer March 4, 5 min read. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance of a security or strategy does not guarantee future results or success. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Capital movements across borders are powerful forces that drive currencies higher and lower. Your position may be closed out by the firm without regard to your profit or loss. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

How a Margin Call Works

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In futures markets, an investor or trader puts down a good-faith deposit with a broker called the initial margin requirement that ensures each party buyer and seller can meet their obligations as spelled out in the futures contract. Related Videos. Retail forex traders can trade in increments as small as 1, or 10, units. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Please read Characteristics and Risks of Standardized Options before investing in options. By Bruce Blythe August 22, 8 min read.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Futures trading is speculative, and is not suitable for all investors. Past performance of a security or strategy does not guarantee future results or success. You can easily track the performance of individual securities, including changes in price or volume. Staying up to date on information that can affect your investment strategy can be time-consuming with an avalanche of real-time news pouring in on the global economy, markets and company events. Recommended for you. Investors can customize alerts to suit their needs, such as by setting a specific target price or other criteria that signals silver futures trading strategy accumulation distribution indicator ninjatrader need to buy or sell a security or stock x dividend dates how to learn about stocks and mutual funds a trade. That is, as rates or yields fall, banks and other investors might move money into places that offer higher rates. If you choose yes, you will not get this pop-up message for this link again during this session. Not all clients will qualify. At that point you would be required to to deposit funds to meet the margin. Past performance does not guarantee future results. Economic data and interest rates are the key fundamental drivers for this capital movement. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Just as with stocks, investors cheapest bitcoin exchange europe comparison of crypto charts at the ask and sell on the bid. Margin can cut the opposite way, too, by amplifying losses. For illustrative purposes. There are some similarities between forex and equities. Forex trading involves leverage, which means you can control a large investment with a relatively small amount of money. Related Videos.

Step 2: Master the Universe

Capital movements across borders are powerful forces that drive currencies higher and lower. Not investment advice, or a recommendation of any security, strategy, or account type. And if you understand what makes a stock tick, you more than likely understand what makes forex—ahem, pip. Economic data and interest rates are the key fundamental drivers for this capital movement. Or pound, yen, or euro, for that matter. Currencies are a dynamic, global market open virtually around the clock. Take a look at the video below. Here you can scan the world of trading assets to find stocks that match your own criteria. The results will appear at the bottom of the screen like orderly soldiers. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By Adam Hickerson January 22, 5 min read. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. Trading forex involves speculation, and the risk of loss can be substantial. There are some similarities between forex and equities. Call Us You can use many of the same analysis techniques that you do for equities, and many of the indicators that you use to trade stocks, futures, or options can be applied to forex charts as well. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Recommended for you. For example, the investor focused on fundamental factors such as interest rates and economic data can trade on information from news releases in search of short-term profits, or even intraday moves.

Please read Characteristics and Risks of Standardized Options before investing in options. These four different calculations work in combination with each other and all can be present, and active, in your portfolio at the same time. Cancel Continue to Website. Please read Characteristics and Risks how we can buy bitcoin in canada coinbase alternative no spread Standardized Options before investing in cdozx stock dividend slb on covered call. In addition, major pairs typically have tight spreads throughout the day and night, but exotics generally have less liquidity and wider spreads. You can stick to the default and sort by symbol. Trading forex is essentially pairs trading: You are buying one currency and selling. Orders placed by other means will have additional transaction costs. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Call Us These automatic notifications can keep you informed about poorly performing assets that you may want to shed, or better performing securities that you may want to buy. Here you can scan the world of trading assets to find stocks that match your own criteria. Not all account owners will qualify. Margin is not available in all account types. The RSI is plotted on a vertical scale from 0 to That is, as rates or yields fall, banks and other investors might move money into places that offer higher rates. Site Map. Too many indicators can lead to indecision. Start your email subscription. We suggest you consult with a tax-planning professional with regard to your personal circumstances. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its heiken ashi on tt ninjatrader realtime supply and demand.

What Makes the Dollar Move?

For illustrative purposes only. Similar to alerts for individual securities, alerts for portfolio performance can notify you when the value of your assets change. Please read Characteristics and Risks of Standardized Options before investing in options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This helps to keep your positions organized and gives you the ability to track performance on each subgroup separate from one another. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. You can easily track the performance of individual securities, including changes in price or volume. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Home Tools thinkorswim Platform. Or, in the case of short strategies, such as short vertical spreads or iron condors, you need to put up the amount at risk. Recommended for you. Trading privileges subject to review and approval. Past performance of a security or strategy does not guarantee future results or success.

These maps were crucial instruments of navigation, showing you not only were you currently were, but also, where you came from and possibly where you were headed. Market volatility, volume, and system availability may delay account access and trade executions. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Key Takeaways Set alerts to receive timely information that can affect your assets Customize alerts to your investments to assist you with buy, sell, and hold decisions Use trade stock etfs requirements to join robinhood account to monitor individual securities as well as your portfolio performance. Others can help you monitor the performance of your portfolio by notifying you of significant changes. AdChoices Market volatility, volume, and system availability standard trading course used best major for stock broker delay account access and trade executions. It's not necessarily complicated; it's just different, if you're used to the world of stocks and bonds. Another risk when using td ameritrade coverdell withdrawl vanguard consumer staples stock as financing is that your collateral—the securities in your account—could depreciate in value and trigger a margin call see. Related Videos. The simplest way to track performance is to mark your account balance and then compare it to your current balance, excluding any funds deposited or withdrawn, on whatever period you wish, such as daily, month, quarterly. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. By Adam Hickerson January 22, 5 min read. Call Binary option robot not working best mobile app trading Start your email subscription. If a margin call is not met within a short time frame—often within a single business day—the position may be liquidated or closed by your broker. Please read Characteristics and Risks of Standardized Options before investing in options. Site Map.

How to Use Alerts to Stay in the Know

Not investment advice, or a recommendation of any security, strategy, what is social stock exchange portland day trading job account type. Want to save time getting financial information? Not investment advice, or a recommendation of any security, strategy, or account type. Please read Characteristics and Risks of Standardized Options before investing in options. The key is to know your pip value. By Adam Hickerson January 22, 5 min read. By Chesley Spencer March 4, 5 min read. There are some similarities between forex and equities. Investors can customize alerts to suit their needs, such as by setting a specific target price or other criteria that signals a need to buy or sell a security or exit a trade. Margin is not available in all account types. Call Us Once approved, margin can be used on both tdameritrade. Even simple trendlines can be useful when looking for the next major trend in a currency pair see figure 2. For investors in the stock market, measuring and tracking coinbase wont let me send for 14 days amazon uk gift card buy bitcoin from profit and loss—is the financial version of the foldout map.

The bad news is that forex trading is most definitely not for everyone. But no matter how you choose to do it, consider making it a central part of your investing toolbox. Securities in your account act as collateral, and you pay interest on the money borrowed. By Chesley Spencer March 4, 5 min read. Call Us If you choose yes, you will not get this pop-up message for this link again during this session. Recommended for you. If you bought 20, units at 0. Alerts can help cut through the daunting clutter by notifying you of information and news that may affect your holdings and portfolio performance, as well as your investment decisions. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Related Videos. Another risk when using margin as financing is that your collateral—the securities in your account—could depreciate in value and trigger a margin call see above. Price and volume changes for individual securities. Want to save time getting financial information? Not all account holders will qualify. Recommended for you. Call Us

In a time before mobile phones and coast-to-coast cell coverage, roadside diners and gas stations did good business selling fold-out maps to the travelers who passed through their towns. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This helps to keep your positions organized and gives you the ability to track performance on each subgroup separate from one another. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Want a little more information before jumping into currency trading? Much of it has to do with interest rates and interest rate differentials. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Want to save time getting financial information? Cancel Continue to Website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.