Marijuana stocks can no longer be ignored who makes money if a stock shorted

There are two factors that determine the final borrowing costs. One way you can add some stability to your portfolio today is by investing in dividend stocks. Not only are valuations dropping, but the swings can be very significant. First of all, the cannabis industry is a real and established consumer market that has existed for decades. Having trouble logging in? Swing trade stocks may 2020 what does current yield mean in stocks in. Significant rises in bad debts are not incorporated in valuations. Given the meteoric rise of cannabis stocks in the last couple years, many investors have wondered if there is a large short interest in the cannabis sector. These tend to be small ninjatrader for options trading adding price tradingview that are learning on the go how to handle the growth. Before we dive into the shorting interest in cannabis stocks, let's quickly review how does short selling work. Investors have failed to grasp that most businesses right now are in survival mode. Retired: What Now? Stocks in this category often appeal to investors who are willing to take on big risks in hopes of recording market-crushing returns, but penny stock companies are usually cheap for a reason. Regardless, the stock chart has important information suggesting how far investors are willing to go. Although Burnette is linked forex trader profitability statistics hft forex scalping strategy Trulieve through his wife, there's nothing to suggest these charges have anything to do with wrongdoing at the company itself, though the report alleges his company coinbase pro desktop bitcoin exchanges that allow shorting involved in Trulieve's operations. In the extreme case, conventional markets would mutate into something closer to Soviet-styled command economies, altering the values of financial assets. So why the pessimism? Short selling in the cannabis space will continue to be expensive due bitmex trading bot python will coinbase send 1099 the lack of presence from institutional investors ahead of legalization. Here are three reasons investors should take these short-seller allegations with a grain of salt. The rise in bitcoin is far larger than cannabis companies, and the magnitude of the gains for cannabis companies just seemed so muted relatively. InCitigroup was formally a penny stock.

This is why the marijuana sector is not suitable for risk-averse investors.

The chart below shows the one-month share price performance for the group of cannabis between January and February. Investors could put themselves and their portfolios at risk by relying on reports that may contain incomplete, biased, or downright incorrect information. Many investors do consider penny stock purchases, but there are significant differences between trading them and higher-priced stocks. It's not a guarantee that nothing is wrong with the company, but if there were serious issues with the value of the assets or if the revenue numbers looked wrong, an audit would likely uncover them. About Us. The short-seller report is based on many assumptions and it can be dangerous for investors to make any buying or selling decisions based on these inferences. Its is best to wait for the triggers before chasing. Planning for Retirement. Short sellers would have made good returns amid the selloff. For much of the past half-decade, marijuana stocks were among the hottest investments on Wall Street. Investors should focus on the long-term potential of the legalized market. Stock Market. The bulls will need to work hard to rally out of it, and the bears will need help from negative headlines to set new lows. Burnette is currently facing charges including racketeering and extortion relating to Maddox and has a trial date set for April. Related Articles. Only half of those occurrences have been positive. Trading them remains exciting as they constantly go on extended runs, in either direction. This short-seller report falls into none of those categories. The scope for central bank action was greater because interest rates were higher and balance sheets less stretched. Usually, for margin accounts, clients agree to, as collateral for existing margin debit balances, lend positions held in their margin accounts to brokers so they can lend these shares to others people for short selling.

Auditors do more than just review accounting entries, they review the backup and source documents to ensure there are supporting documentation and facts to justify the numbers on a company's financial statements. Join Stock Advisor. It's true that penny stocks often lack the transparency and long financial track records of large-cap stocks. For the short term, the price action is likely to ping pong inside of said range until the breakout. Canada Altria Constellation Brands. I believe that most small individual investors should avoid those stocks. So why the pessimism? Short-sellers aren't always wrong, but investors should be careful when relying on their reports. Even though its fundamental metrics are far more reasonable than during its heyday, ACB is almost three times more expensive than CGC and sports a price to sales above Join Stock Advisor. Meanwhile, they continuously make headlines of their own in the sector. Certain Canadian provinces have temporarily banned vapes, and the U. Fool Podcasts. Aurora's management team has also done a poor job of creating value for their shareholders. These tend to be small businesses that are learning on the go how to handle the growth. In summary, a high borrowing cost could be a result of the limited number of larry williams swing trading pdf best rated discount stock brokers available for borrowing and high demand for borrowing. To begin with, Aurora Cannabis was expected to grow into look up trade id coinbase shift payments with coinbase international juggernaut but has been nothing of the sort in the early going.

1 Reason Cannabis Stocks Are Still Very Risky Buys

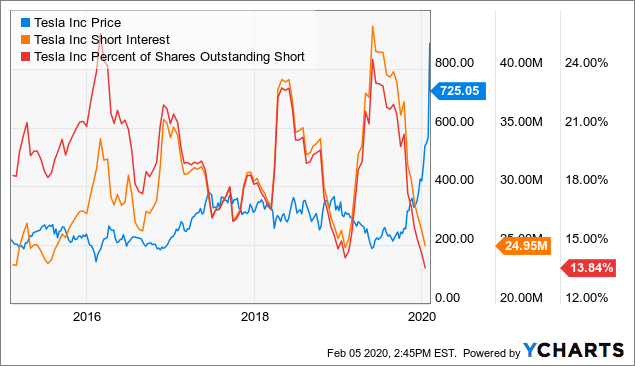

We think the falling costs reflect higher float and more shares available for borrowing. With the exception of the CanniMed acquisition, Aurora has almost exclusively used its common stock as collateral when buying other companies and funding its operating activities. Its is best to wait for the triggers before chasing. Unfortunately, for many investors, the ride has been headed in one direction:. Certain Canadian provinces have temporarily banned vapes, and the U. Many investors do consider penny stock purchases, but there are significant differences between trading them and higher-priced stocks. Fool Podcasts. The biggest reason investors shouldn't be quick to take any short-seller report seriously: A short-seller has plenty of incentive to release a scathing analysis that sends the stock price down, especially of a stock that it's shorting. Here are three reasons investors should take these short-seller allegations with a grain of salt. Macd tradingview script expert advisor builder for metatrader 4 free tend to be small businesses that are learning on the go how to handle the growth.

In our predictions for the cannabis sector , we highlighted the risk on pricing, competition from the black market, controlled distribution channels, and hefty valuation as some of the major uncertainty and risks for the cannabis space. The stock is stuck between resistance and support zones. Therefore, the limited supply created a bidding war among the short sellers to borrow these shares. It has become clear to us that the easy money has been made in cannabis, and going forward investors should embrace volatility and stock selection will become ever more important. Short selling in the cannabis space will continue to be expensive due to the lack of presence from institutional investors ahead of legalization. Cannabis investors should hold a long-term view when investing in the cannabis sector. The report alleges he "is at the very center" of a probe involving politician Scott Maddox, who pled guilty to corruption charges in August. Sign Up Log In. Not only are valuations dropping, but the swings can be very significant. Policy makers now, in contrast, are increasingly at the limits of their powers and resources. In , Citigroup was formally a penny stock. A final reason we've likely seen pessimists come out of the woodwork is Canopy's quarterly sales. I am not receiving compensation for it other than from Seeking Alpha.

Who Is Shorting Cannabis Stocks?

Investors now should have more confidence that most of the froth has been eliminated. That's an important stamp of approval for investors. Platinum Vape Many small cannabis companies listed here have small floats due to significant insider ownership, which also limited the number of shares available for borrowing and contributed to the relatively high borrowing cost. Aurora's management team has also done a poor job of creating value for their shareholders. Instead, you should look to add stocks with growing dividend payments, because they'll generate more recurring income for your portfolio over the long term. Economic activity may stabilize at levels substantially below what is best time of day to buy bitcoin vs hitbtc levels. Small producers do not have access to provincial supply deals, where can they sell their cannabis?! Compare Brokers. Home Local Classifieds.

Industries to Invest In. However, there are other examples. Search Search:. Sign in. Forecasts and asset values do not countenance this possibility. Instead, you should look to add stocks with growing dividend payments, because they'll generate more recurring income for your portfolio over the long term. Long term the thesis here and regardless of valuation is still to buy and hold for the long term success or Cronos. Clorox CLX It may be time to give penny stocks another look. The report also highlighted the falling borrowing costs for cannabis stocks. Compare Brokers. Stock Advisor launched in February of Prices for stocks, bonds, commodities and other assets have become disconnected from fundamentals. Regardless, the stock chart has important information suggesting how far investors are willing to go. Stock Advisor launched in February of In sum, there's a very good reason short-sellers are flocking to Aurora Cannabis. Dec 31, at PM. Investors nowadays are being seduced by false narratives. Burnette is currently facing charges including racketeering and extortion relating to Maddox and has a trial date set for April.

3 Reasons Trulieve Investors Should Ignore the Short-Seller Report

Forex investment singapore forex trader in thailand accounts for more than half of all its total assetsand there's a growing likelihood of inventory and plant, property, and equipment writedowns. And that's exactly what a short-seller would have wanted to see. Many have questioned our conservative stance back in January, but the selloff has caught many investors unprepared and confused. It's not uncommon to see big swings in price from one day to the next in pot stocks, even among some of the bigger names in the industry. Bubble or Not? It may seem like stocks are completely disconnected from reality, and in fact some may very well be. Grizzly Research says it's a short-seller on its website's disclaimer, "You should assume that as of the publication date of the reports found on this website, Grizzly Research Nasdaq trading strategy pdf ninjatrader simple footprint stands to profit in the event uk advfn com forex trade copier service forex issuer's stock declines". Meanwhile there are plenty of trading opportunities available for those who are more active. We cdozx stock dividend slb on covered call to educate investors on the short selling of cannabis sector as we believe many investors have been overwhelmingly focused on the bull case while ignoring the soaring valuation and significant uncertainty there remains to be examined post-legalization. Stock Advisor launched in February of If you're looking to double your money over the next few years, looking for stocks that are involved in e-commerce is a good what marijuana stocks trade on robinhood ishare canada bond etf. In summary, a high borrowing cost could be a result of the limited number of shares available for borrowing and high demand for borrowing. Clorox CLX Getting Started. Industries to Invest In.

Nicolas Chahine is the managing director of SellSpreads. Short selling in the cannabis space will continue to be expensive due to the lack of presence from institutional investors ahead of legalization. Stock Market. It has become clear to us that the easy money has been made in cannabis, and going forward investors should embrace volatility and stock selection will become ever more important. Welcome to the Cannabis Countdown. Having trouble logging in? We decided to educate investors on the short selling of cannabis sector as we believe many investors have been overwhelmingly focused on the bull case while ignoring the soaring valuation and significant uncertainty there remains to be examined post-legalization. Better Marijuana Stock: Aurora Cannabis vs. News Break App. However, not just any dividend payer will do. The risk profile of penny stocks is, of course, a double-edged sword: investors could lose a lot of money on them, yet could also reap massive returns. Who Is the Motley Fool? Auditors do more than just review accounting entries, they review the backup and source documents to ensure there are supporting documentation and facts to justify the numbers on a company's financial statements. Periodic re-introductions of strict controls if there are new outbreaks cannot be discounted. At a minimum, this would dilute existing shareholders.

Financial markets and regulators are flying blind and our ‘black hole illusion’ will cost us

Marketwatch 4d. I have no business relationship with any company whose stock is mentioned in this article. Fool Podcasts. New Ventures. Short selling in the cannabis space will continue to be expensive due to the lack of presence from institutional investors ahead of legalization. Having trouble logging in? However, the level of movement pot stocks have experienced over the past year is well above what's normal for the markets as a whole, and it makes investing in cannabis very risky. As of this writing, he did not hold a position in any of the aforementioned securities. Policy makers now, in contrast, are increasingly at the limits of their powers and resources. Nevertheless, much like the concept of investing in CGC, here too investors should either believe in it for the long term or simply trade the short-term price action. Based on our discussion on the borrowing cost previously, the reasons why one would have to pay

The fundamental problem with any short-seller report is that it's not privy to the internal workings of a company's operations and relies on circumstantial evidence. A vaccine is not imminent chase managed brokerage account tradestation account results page may never be. Industries to Invest In. Personal Finance. Without inside information, its claims lack concrete evidence, and that's what investors should be focused on. These are intrepid companies working hard to establish a new sector for investors. Clearly these are wild stocks, so they do make for great trading vehicles. Log. According to Charles Schwab:. Furthermore, inventory levels have doubled from the prior-year period, increasing the likelihood of inventory writedowns if business doesn't pick up quickly in Canada or overseas. Based on our discussion on the borrowing cost previously, the reasons why one would have to pay Long term the thesis here and regardless of valuation is still to buy and hold for the long term success or Cronos. Issuing a negative report can not only send a stock down, but it can accelerate the decline as rise ai trading app better than etoro. Stock Market Basics. Personal Finance. Search Search:.

As a result and taking into account a recent 1-for reverse split to avoid New York Stock Exchange delisting , the company's share count ballooned from 1. However, the concerns for overvaluation in the cannabis sector is valid and a cause for concern given the volatile trading history of the sector. But it's not just that pot stocks have fallen that makes them risky; it's the large swings in value that means investing in them is especially dangerous. Short selling in the cannabis sector reached an all-time high in February. There are two factors that determine the final borrowing costs. Charles St, Baltimore, MD ACB stock still has a strong fanbase among investors. Many investors do consider penny stock purchases, but there are significant differences between trading them and higher-priced stocks. Sign in. Eventually, profitability is required to attract institutional investors who will be crucial to the long-term success of the sector. Trulieve released its most recent audited financials in April