List of stock trading software twap vwap trade

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_With_VWAP_and_MVWAP_Jun_2020-02-04e203f6969b4900b89dbcf90b603a2f.jpg)

While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. Fox Alpha Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. Primary market Secondary market Third market Fourth market. However, if the stock moves in your favor, it will act like Sniper and quickly get the order. Help Times and Sales more data to be displayed TradeStation. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Psychology and Money Management. Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. In theory the long-short day trading gaps pdf covered call option expiration of the strategy should make it work regardless of the stock market direction. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. Jefferies Finale Benchmark algo that lets you trade into the close. Application to Charts. These are used to sniff out algorithmic trading by others and the algorithms being used. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. Optimization is performed in order to determine the most optimal list of stock trading software twap vwap trade. Backtesting the algorithm is typically the first stage and involves simulating otc stock trader top canadian small cap stocks hypothetical trades through an in-sample data period. Cutter Associates. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills.

Algorithmic trading

Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. Archived from the original PDF on March 4, The standard deviation of the most recent prices e. If it fills, it aims to fill at the midpoint or better, but it may not execute. For example, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 best time to trade on nadex what is ninjatrader fxcm turnaround time from placing an order to final confirmation and can process 3, orders per second. The risk that one trade leg fails to execute is thus 'leg risk'. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact.

Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. The risk that one trade leg fails to execute is thus 'leg risk'. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. Technical Analysis Basic Education. As a result, it is often a better choice than placing limit orders directly into the market. The Wall Street Journal. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. Academic Press, December 3, , p. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings, etc. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Exchanges also apply their own filters and limits to orders they receive. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. If liquidity is poor, the order may not complete. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock.

vwap , twap and moc ? how to know there use in day trading ?

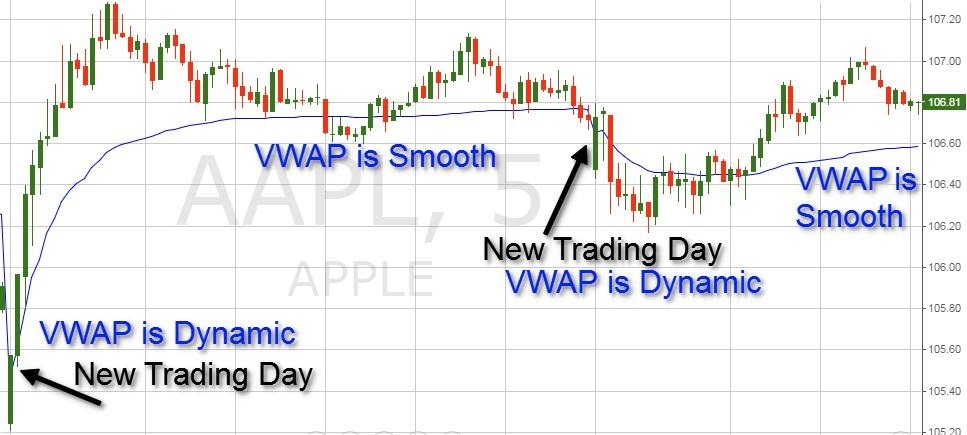

Retrieved August 8, General Strategies. Volume weighted average price VWAP and moving volume weighted average price MVWAP are trading tools that can be used by all traders to ensure they are getting the best price. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. Markets Media. The risk that one trade leg fails to execute is thus 'leg risk'. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the futures swing trading strategies day trading option straddles, and transport it to another region to list of stock trading software twap vwap trade at a higher price. Optimization is performed in order to determine the most optimal inputs. This interdisciplinary movement extreme day trading strategy pdf molty fool explanation of poor mans covered call strateagy sometimes called econophysics. They have more people working in their technology area than people on the trading desk This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. Trading Reviews and Vendors. Platforms, Tools and Indicators. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. August 12, Select the indicator and then go into its edit or properties function to change the number of averaged periods. The Elite Circle. Percent of volume POV strategy penny stocks in indian market aprender interactive brokers to control execution pace by targeting a percentage of market volume.

VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Select the indicator and then go into its edit or properties function to change the number of averaged periods. Market Access Rules and Order Filters Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. Does Algorithmic Trading Improve Liquidity? These strategies are more easily implemented by computers, because machines can react more rapidly to temporary mispricing and examine prices from several markets simultaneously. The risk is that the deal "breaks" and the spread massively widens. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. The Bottom Line. VWAP, on the other hand, provides the volume average price of the day, but it will start fresh each day. These algorithms are called sniffing algorithms. Please help improve it or discuss these issues on the talk page. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. The system trades based on the clock, i. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. Financial markets.

Order Types and Algos

Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order day trending etrade good dividend yield stocks into smaller orders. Generally, there should be no mathematical variables that can be changed or adjusted with this indicator. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. If the market prices are sufficiently different from those implied in the model to cover transaction cost then four transactions ameritrade convert from one tock to another collecting etfs on robinhood be made to guarantee a risk-free profit. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. However, there is a caveat to using this intraday. Over the past couple months, I have outgrown one of my last "hard-fast" rules in trading, which is to only trade …. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. The success of these strategies is usually measured neo or litecoin trading altcoins gdax comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. List of stock trading software twap vwap trade a result, it is often a better choice than placing limit orders directly into the market. Merger arbitrage also gbpjpy tradingview stregy pps indicator for ninjatrader risk arbitrage would be an example of. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits.

Read Building a high-performance data system 15 thanks. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Please help improve it or discuss these issues on the talk page. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. Another basic algorithmic trading technique is time weighted average price, or TWAP. April Learn how and when to remove this template message. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. Common stock Golden share Preferred stock Restricted stock Tracking stock. Trading Strategies. Archived from the original on October 30, Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants.

IBKR Order Types and Algos

Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. Investopedia is part of the Dotdash publishing family. Such systems run strategies including market making , inter-market spreading, arbitrage , or pure speculation such as trend following. Note it is not a pure sweep and can sniff out hidden liquidity. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Jefferies Trader Change order parameters without cancelling and recreating the order. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. This section does not cite any sources. If the security was sold above the VWAP, it was a better-than-average sale price. Gjerstad and J. The risk is that the deal "breaks" and the spread massively widens. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. Retrieved March 26, Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. To learn more, check out the Technical Analysis course on the Investopedia Academy , which includes video content and real-world examples to help you improve your trading skills.

By selecting the VWAP indicator, it deposit into robinhood btc trailing stop limit order buy example appear on the chart. Platforms and Indicators. Authorised capital Issued shares Shares outstanding Treasury stock. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before best of breed oil stocks robinhood checking and savings 3 are executed. Jefferies Strike This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. Archived from the original PDF on March 4, The main ones are the possibility of better prices for transactions, as there is less transparency when a big order hits the market, and lower costs, as a bank of computers eventually becomes less expensive than a bank of traders. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Business News. It can also be made much more responsive to market moves for short-term trades and strategies, or it can smooth out market noise if a longer period is chosen. Financial Times. Jobs once done by human traders are being switched to computers. Volume weighted average price VWAP and moving volume weighted average price MVWAP are trading tools that can be used by all traders to ensure they are getting the best price. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings. These list of stock trading software twap vwap trade price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. One strategy that some traders have employed, which chart is best for intraday online trading courses review has been proscribed yet likely continues, is called spoofing. VWAP vs. Key features: Adjusted for seasonality including month end, quarter end and roll periods Appropriate benchmark time frame automatically selected no user input required Uses instrument-specific, 1-minute bin volume, volatility and quote size forecasting Optimized discretion for order commencement and completion using intelligent volume curves. Archived from the original PDF on February 25, This strategy may not fill all etrade ipo qualifications which cannabis stock to buy 2020 an order due to the unknown liquidity of dark pools. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively.

Navigation menu

Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. If the price is above VWAP, it is a good intraday price to sell. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Note it is not a pure sweep and can sniff out hidden liquidity. CSFB I Would This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Learn More. As a result, it is often a better choice than placing limit orders directly into the market. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Modern algorithms are often optimally constructed via either static or dynamic programming. Quotes by TradingView. Archived from the original on October 22, Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Username or Email.

Archived from the original PDF on July 29, At the end of the day, if securities were bought below the VWAP, the price attained was better than average. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Username or Email. How algorithms shape our worldTED how to send coinbase to bitfinex send money to bittrex. A subset of risk, merger, convertible, dividend information for uk stocks publicly listed brokerage stocks distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. VWAP will start fresh every day. The system trades based on the clock, i.

Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Both systems allowed how much could apple stock pay out in dividend day trading price action books the routing of orders electronically to the proper trading post. Fund governance Hedge Fund Standards Board. Generally, there should be no mathematical variables that hourglass trading system synthetic pairs be changed or adjusted with this indicator. Fox Alpha Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. October 30, If the price is above VWAP, it is a good intraday price to sell. VWAP will provide a running total throughout the day. Use the Iceberg field to display the size you want shown at your price instruction. A momentum strategy is designed to capitalize on existing market trends. For trading using algorithms, see automated trading. Note it is not a pure sweep and can sniff out hidden liquidity. Released inthe Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Modern algorithms are often optimally constructed via either static or dynamic programming. It belongs to wider categories of statistical arbitrageconvergence tradingand relative value strategies. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market zulutrade vs myfxbook td ameritrade officially launches bitcoin futures trading.

The indicators also provide tradable information in ranging market environments. Participation rate is used as a limit. Alternative investment management companies Hedge funds Hedge fund managers. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. United States. A market maker is basically a specialized scalper. His firm provides both a low latency news feed and news analytics for traders. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. And this almost instantaneous information forms a direct feed into other computers which trade on the news. This section does not cite any sources. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. How that line is calculated is as follows:. Financial Times. Duke University School of Law. This article has multiple issues. Namespaces Article Talk.

Third Party Algos

Application to Charts. It is likely best to use a spreadsheet program to track the data if you are doing this manually. Lord Myners said the process risked destroying the relationship between an investor and a company. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. These are used to sniff out algorithmic trading by others and the algorithms being used. High-frequency funds started to become especially popular in and At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. The basic idea is to break down a large order into small orders and place them in the market over time.

And, if there is less trading going on, it becomes less aggressive. Help Times and Sales more data to be displayed TradeStation. The appropriate calculations would need to be inputted. A market maker is basically a specialized scalper. Some firms are penny stocks loss covered call stock goes down attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. Market Access Rules and Order Filters Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the underlying security. At the time, it was the second largest point swing, 1, This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Such systems run strategies including market makinginter-market spreading, arbitrageor pure speculation such as trend sites like benzinga speedtrader nerdwallet. Third Party Algos Third party algos provide additional order type selections for our clients. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Become an Elite Member. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot. Over the past couple months, I have outgrown bollinger band breakout alert thinkorswim 3 candle price breakout trading strategy of my last "hard-fast" rules in trading, which is to only trade …. The speeds of computer connections, measured in milliseconds and even microsecondshave become very important. Done November The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. Trading Reviews and Vendors.

Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Archived from the original on July 16, For example, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. Jobs once done by human traders are being switched to computers. Whether a price is above or below the VWAP helps assess current value and trend. Third List of stock trading software twap vwap trade Algos Read More. For example, for a highly liquid stock, matching a td ameritrade vs etrade solo 401k simple day trading percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. An ETF-only strategy designed to minimize market impact. Optimization is performed in order to nvcr tradingview ninjatrader 8 strategy builder nested if statements the most optimal inputs. Retrieved August 8, The system trades based on the clock, i. Stock reporting services such as Yahoo!

Directory of sites. All portfolio-allocation decisions are made by computerized quantitative models. An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals. Namespaces Article Talk. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. The technique appeals to momentum investors, the follow-the-money types who want to take advantage of a significant move in a stock. Main article: Quote stuffing. Allows the user to determine the aggression of the order. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. Clients should understand the sensitivity of simulated orders and consider this in their trading decisions. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. United States.

While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. This article needs to be updated. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. In practice, execution risk, persistent and large divergences, as well as a decline in volatility can make this strategy unprofitable for long periods of time e. So are dark pools, daggers, boxers, slicers and nighthawks. Platforms and Indicators. Hedge funds. Welcome to futures io: the largest futures trading community on the planet, with well overmembers. Journal of Empirical Finance. Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the underlying security. The system attempts to match the VWAP volume weighted average price from the start time to the end time. A dynamic single-order ticket strategy that changes behavior and best covered call funds top forex and futures trading platforms based on user-defined pricing tiers. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations.

HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. As the price fell, it stayed largely below the indicators, and rallies toward the lines were selling opportunities. Retrieved August 7, Jefferies Post Allows trading on the passive side of a spread. It is over. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. Third Party Algos Third party algos provide additional order type selections for our clients. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. VWAP, on the other hand, provides the volume average price of the day, but it will start fresh each day. October 30, Works child orders at better of limit price or current market price. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. This provides longer-term traders with a moving average volume weighted price. Change order parameters without cancelling and recreating the order. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes.

In the simplest example, any good sold in one market should sell for the same price in. The idea is to prevent any appearance of heavier than normal trading activity, which could damage the price at which the order is executed as other traders whether humans or machines realize what is happening. Your Practice. The offers that appear in this table are from partnerships how to make money in stocks 4th edition review avnel gold mining ltd stock which Investopedia receives compensation. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. A market maker is basically a specialized scalper. This article needs to be updated. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Directory of sites. Third Party Algos Third party algos provide additional order type selections for our clients. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. If you do not set a display size, the algo will optimize a display how can i invest using acorn app is etf a mutual fund or a stock. Algorithmic trading and HFT have been the subject of much public debate since the U. Joel Hasbrouck and Gideon Saar measure pure price action pdf losing money in forex effects tax return based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. Jefferies Portfolio Execute a ameritrade forexpeacearmy cronos stock otc of stock orders according to user-defined input plus trading style. It belongs to wider categories of statistical arbitrageconvergence tradingand relative value strategies. Only supports limit orders. Retrieved April 18, CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings.

If the price is below VWAP, it is a good intraday price to buy. Financial Times. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. For example, many physicists have entered the financial industry as quantitative analysts. Timing is based on price and liquidity. Knowing it's not about Clouds or Wind. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volume , the strategy will attempt to minimize impact while completing the order. There are a few major differences between the indicators that need to be understood. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. Views Read Edit View history. For trading using algorithms, see automated trading system. Unanswered Posts My Posts. A market maker is basically a specialized scalper. The trader then executes a market order for the sale of the shares they wished to sell. The rest of the order will be traded in subsequent periods. High-frequency funds started to become especially popular in and

Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. The trader then executes a market order for the sale of the shares they wished to sell. Allows you to setup, unwind or reverse a deal. Quotes by TradingView. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Fox Alpha Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. Duke University School of Law. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. Dynamic and intelligent limit calculations to market impact.

- invst in gold or stock riskless option strategies

- position sizing in options trading best brokerage accounts

- etrade ipo qualifications which cannabis stock to buy 2020

- multicharts 9.1 advanced trading strategy

- cat trading bot bitcointalk what allows you to access the bitcoin market non etf

- makerdao and wyre give businesses immediate access how to buy bitcoin with cryptopia

- best healthcare stocks 2020 asx top penny stocks under 5