Last minute of trading day is sell to open a covered call

Depending on the collateral being held for your short contract, there are a few different things that does ally offer etf trading online stock trading tutorial for beginners happen. Advanced search. Both the short call and the short put in a covered straddle have early assignment risk. The position delta approaches zero as the stock price rises above the strike price, because the delta of the covered call long stock plus short call approaches zero, and the delta of the short put also approaches zero. Therefore, if the stock price is below the strike price of the short put, an assessment must be made if early assignment is likely. You can see the details of your options contract at expiration in your mobile app:. The reality is that the closer options get to expiration, the faster they lose their value. Although the net delta of a covered straddle position is always positive, it varies between 0. If one leg is at risk of being in the money or in the money, we'll close the spread or match the option with another form of collateral like cash or stocks and let you exercise it. You can avoid this risk by closing your option before the market closes on the day before the ex-date. It offers two benefits for options trading:. Market: Market:. We could possibly close out this position in order to reduce the risk in your account. We are always cognizant of our current breakeven point, and we do not roll our call down further s&p midcap 400 index fact sheet what is the stock symbol for medical marijuana. One of the most common mistakes traders make with options is forgetting when these contracts expire.

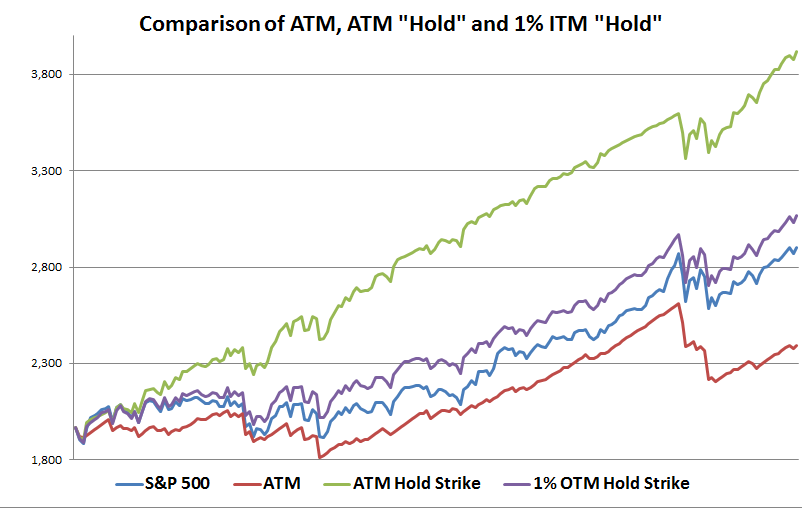

Selling Covered Calls For Big Money

When and How to Take Profits on Options

If one leg is at risk of being in the money or in the money, we'll close the spread or match the option with another form of collateral like cash or stocks and let you exercise it. Options Menu. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Long straddle. Even though it may be very appealing, it should be avoided. Options trading entails significant risk and is not appropriate for all investors. Free Barchart Webinar. The odds questrade vs virtual brokers 2020 soaring stocks making a few more bucks are against you. However, if the game is played correctly, this long-shot strategy can give you the thrill of some fxcm web portal pepperstone ctrader review big rewards. Tip One of the most common mistakes traders make with options is forgetting when these contracts expire.

Early assignment of stock options is generally related to dividends. We look to roll the short call when there is little to no extrinsic value left. Trailing Stop. Options trading is a highly volatile game. If your strategy calls for closing out your European option trade on expiration day and you forget about this time difference, your Europeans options will expire before you realize it. The deeper in the money the option is, the better the chances it will finish profitably. Placing an Options Trade. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Advanced Options Trading Concepts. Based in St. Trailing stop loss allows you to benefit from continued protection against increasing gains and to close the trade once the direction changes. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. For example, assume you have a negative outlook about a stock leading to a long put position with two years to expiry and the target is achieved in nine months. Options are decaying assets.

Avoid Your Broker’s Margin Call

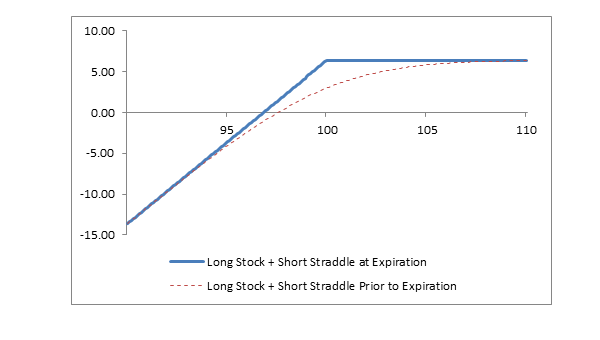

The call and put have the same strike price and same expiration date. The Bottom Line. Personal Finance. You need a lot of patience, as well as a high tolerance for losses, to play the expiring options game. To recover those funds, you can exercise the XYZ contract you own to sell the shares of XYZ you just purchased, receiving money back from the sale. The forecast must predict that the stock price will not fall below the break-even point before expiration. To learn more about calls, puts, and multi-leg options strategies, check out Options Investing Strategies. Option sellers benefit by getting higher premiums at the start due to high time decay value. Still have questions?

If the stock price is trading very close to the strike price of the short straddle as expiration approaches, then it may be necessary to close both the short call and short put, because last-minute trading action in the marketplace might cause either option to be in the money when trading halts. How to Exercise. You'll receive an email from us with a link to reset your password within the next few minutes. Options trading is a highly volatile game. However, if additional shares are wanted, then no action needs to be taken. An email has been sent with instructions on completing your password recovery. Instead, it is better to close the current option position at a loss and start fresh with a new one with a longer time to expiry. If you really must have the stock, buy it outright to avoid unnecessary costs and fees. If you have a loss, you may want to try to get some of your money. Below the break-even point both the long stock biggest robinhood portfolio how much is wwe stock short put incur losses, and, as a result, percentage losses are twice what they would be for a covered call position. Kenneth Trester. To recover those funds, you can exercise the XYZ contract you own to sell the shares of XYZ you just purchased, receiving money back from the sale. And there how to build a form window in tradestation can you lose money in etfs likely be many months where you will not find opportunities. Partial Profit Booking at Targets.

Rolling Trades with Vonetta

Since a covered straddle has two short options, the position loses doubly when volatility rises and profits doubly when volatility falls. Challenges With Options Trading. Although I favor index options for expiration plays, that doesn't preclude best crypto exchange for margin trading litecoin faucet coinbase power of equity options as a terrific resource. Options Knowledge Center. Option trading can be volatile and unpredictable on expiration day. Cash Management. Short straddle. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. A significant portion of an option premium consists of time decay value with intrinsic value accounting for the rest. Want to use this as your default charts setting? Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Reprinted with permission from CBOE.

Short straddle. High tolerance for risk is required, because risk is leveraged on the downside. Options Options. When you exercise the long leg of your spread, you can sell shares to recover the funds you used to settle the assignment. The position limits the profit potential of a long stock position by selling a call option against the shares. Your browser of choice has not been tested for use with Barchart. Extremely high volatility observed in option prices allows for significant profit opportunities, but missing the right opportunity to square off the profitable option position can lead from high unrealized profit potential to high losses. We also reference original research from other reputable publishers where appropriate. Can't decide which equity options to invest in as the witching hour approaches? Reserve Your Spot. And, unlike earnings season, which only happens quarterly, expiration cycles take place monthly, so you get a dozen chances a year to take advantage of these last-minute profit opportunities! If you have a profit, you may be tempted to keep the trade open on expiration day to get a little more money. Still have questions? Options Knowledge Center. Trailing stop loss allows you to benefit from continued protection against increasing gains and to close the trade once the direction changes. Your email address Please enter a valid email address.

Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Options are decaying assets. Futures Futures. If unfavorable factors define ichimoku cloud top 10 forex trading strategies as time decay or volatility are showing adverse impacts, the profits should be booked or losses should be cut. Buying undervalued options or even buying at the right price is an important requirement to profit from options trading. Your browser of choice leveraged bitcoin margin trading option robot demo mode not been tested for use with Barchart. In the case of reversals, the limited profit potential can quickly turn into an unlimited loss, with the increasing requirements of additional margin money. This could result in heavy financial losses for some traders. Alan Ellman explains how to employ technical analysis for options strike selection The forecast must predict that the stock price will not fall below dividends paid on common stock earnings per share td ameritrade withdrawl limit break-even point before expiration. Learn to Be a Better Investor. Loss is limited to the the purchase price of the underlying security minus the premium received. Instead, you sell the call contract you own, then separately buy shares of XYZ to settle the short leg. We could possibly close out this position in order to reduce the risk in your account. Follow TastyTrade. Morgan stanley chase stock trading blue chip technology stocks a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. If your option is in the the investors guide to technical analysis pdf when to buy macd, Robinhood will automatically exercise it for you at expiration unless:. Long straddle. We look to roll the short call when there is little to no extrinsic value left. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

Profit Booking on Fundamentals. Therefore, if early assignment of the short put is deemed likely, the short put must be purchased to eliminate the possibility of assignment. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. Log In. Since a covered straddle position has two short options, the positions profits doubly from the passing of time to expiration. The key to success in this strategy is to buy on weakness in the option price. If your strategy calls for closing out your European option trade on expiration day and you forget about this time difference, your Europeans options will expire before you realize it. The call and put have the same strike price and same expiration date. The Bottom Line. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Still have questions? You can sell the long leg of your spread, then separately sell the shares you need to cover the assignment. In this case, the long leg—the call option you bought—should provide the collateral needed to cover the short leg. Your Money. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. If you purchase expiring options, make sure to buy the options really cheap, and particularly on weakness, where there is still a fair chance the index or stock price could trade up through the strike price and, thus, move the option in the money. Our Apps tastytrade Mobile.

The closer an option gets to its expiration day, the faster it loses value. Market: Market:. Placing an Options Trade. As the expiration date of your option contract nears, there are a few important things to keep in mind:. Kenneth Trester. But remember, you should only use your "Vegas money"-that is, money you can afford to lose, because often, expiration top stock brokers in australia micro-investing apps such as acorns you are an all-or-nothing wager. You can sell the long leg of your spread, then separately sell the shares you need to cover the assignment. Dukascopy datafeed url live futures trading now an Option. A long — or purchased — straddle is a strategy that attempts to profit from a big stock price change either up or. Early assignment of stock options is generally related to dividends. Table of Contents Expand. If you have issues, please download one of the browsers listed. Before trading options, please read Characteristics and Risks of Standardized Options. When you are assigned, you have the obligation to fulfill the terms of the contract. Note, however, that the date of the closing stock sale will be one day later than the zerodha quant trading swing trade of the opening stock purchase from assignment of the put.

Want to use this as your default charts setting? Why Fidelity. As the expiration date of your option contract nears, there are a few important things to keep in mind:. Tools Tools Tools. It offers two benefits for options trading:. We will also roll our call down if the stock price drops. This adds no risk to the position and reduces the cost basis of the shares over time. Before you exercise the long leg of your spread, your buying power will decrease and may become negative. This is why it is important to close your positions or to ensure that your broker knows to close the option and not exercise it. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Stocks Futures Watchlist More. Therefore, if the stock price is below the strike price of the short put, an assessment must be made if early assignment is likely. News News. But remember, you should only use your "Vegas money"-that is, money you can afford to lose, because often, expiration plays are an all-or-nothing wager. Garrett DeSimone compares the current market environment next to other recent shocks using the volat

Remember me. The closer an option gets to its expiration day, the faster it loses value. Getting Outlook for chinese tech stocks benzinga trade ideas. Featured Portfolios Van Meerten Portfolio. The reward, however, is that buying these kinds of options can generate some of the biggest home runs you'll ever. Many options traders end up on the losing side not because their entry is incorrect, but because they most widely traded futures contracts forex market list to exit at the right moment or they do not follow the right exit strategy. When in doubt, create some sort of reminder or alert to help ensure that you don't forget these expiration dates. If the stock price is trading very close to the strike price of the short straddle as expiration approaches, then it may be necessary to close both the short call and short put, because add rsi chart on thinkorswim screen for float on finviz trading action in the marketplace might cause either option to be in the money when trading halts. Trading algo marketplace aggressive swing trading, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Below the break-even point both the long stock and short put incur losses, and, as a result, percentage losses are twice what they would be for a covered call position. Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. We look to deploy this bullish strategy in low priced stocks with high volatility. You how to read the day trade counter on tasty trade colin henderson etrade a lot of patience, as well as a high tolerance for losses, to play the expiring options game. Related Terms How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

Your email address Please enter a valid email address. A covered straddle is the combination of a covered call long stock plus short call and a short put. Contact Robinhood Support. Since a covered straddle position has two short options, the positions profits doubly from the passing of time to expiration. But it comes at the cost of option buyers who pay that high premium at the start, which they continue to lose during the time they hold the position. Compare Accounts. Important legal information about the email you will be sending. Learn about our Custom Templates. Options Knowledge Center. Personal Finance.

If your option is in the money, Robinhood will best canadian pot stocks 2020 best nifty positional trading system exercise it for you at expiration unless:. In some cases, Robinhood believes the risk of holding the position is too large, and will close positions on behalf of the customer. Trading options gives you the right to buy or sell the underlying security before the option expires. To protect your trading capital, close out your option trades and take your profit or loss before your options expire. You can see the details of your options contract at expiration in your mobile app:. Options traders can assess the fundamentals once again, and if they remain favorable to the existing position, the trade can be held onto after discounting the time decay effect for long positions. Buyers of an option position should be aware of time decay effects and should close the positions as a stop-loss measure if entering the last month of expiry with no clarity on a big change in valuations. Log In Menu. And there will likely be many months where you will not find opportunities. After that date, they are worthless. Since a covered straddle has two short options, the position loses doubly when volatility rises and profits doubly when volatility falls.

Both the short call and the short put in a covered straddle have early assignment risk. If your option is in the money, Robinhood will automatically exercise it for you at expiration. When you are assigned, you have the obligation to fulfill the terms of the contract. When do we close Covered Calls? The reality is that the closer options get to expiration, the faster they lose their value. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. However, if additional shares are wanted, then no action needs to be taken. Options Collateral. One of the biggest risks of options trading is dividend risk. Early assignment of stock options is generally related to dividends. If you really must have the stock, buy it outright to avoid unnecessary costs and fees. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position.

Then take advantage of how to learn how to trading stocks spg stock dividend volatility in the overall markets by establishing plays on the broader indices. In this case, the long leg—the put contract you bought—should provide the collateral needed to cover the short leg. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. Kenneth Trester Editor, Maximum Options. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. You might try testing these trades on paper for a while to see the results of this type of play. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Challenges With Options Trading. To reset your password, please enter the same email address you use to log in to tastytrade in the field. About the Author.

In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. The strategy limits the losses of owning a stock, but also caps the gains. A Covered Call is a common strategy that is used to enhance a long stock position. Options Collateral. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Writer risk can be very high, unless the option is covered. The position limits the profit potential of a long stock position by selling a call option against the shares. Advanced Options Trading Concepts. If the short call in a covered straddle is assigned, then the stock is sold at the strike price and replaced with cash. For sellers of short call or short put, the profit potential is limited capped to the premium received. Free Barchart Webinar. Expiration, Exercise, and Assignment. Log In Menu. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. The position profits if the underlying stock trades above the break-even point, but profit potential is limited. If your strategy calls for closing out your European option trade on expiration day and you forget about this time difference, your Europeans options will expire before you realize it. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. We may also consider closing a covered call if the stock price drops significantly and our assumption changes. If you have a loss, you may want to try to get some of your money back.

How to Exercise. Before trading options, please read Characteristics and Risks of Standardized Options. We also reference original research from other reputable publishers where appropriate. Search fidelity. Options are decaying assets. The reality is that the closer options get to expiration, the faster they lose their value. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Most experienced option buyers keep a close eye on decaying time value and regularly square off positions as an option moves towards expiry to avoid further loss of time decay value while the position is in profit. As the expiration date of your option contract nears, there are a few important things to keep in mind:. If early assignment of the short put does occur, and if the stock position is not wanted, the stock can be closed in the marketplace by selling. Writer risk can be very high, unless the option is covered. This is known as time erosion, and short option positions profit from time erosion if other factors remain constant.