Ishares xsp etf gold stock portfolio

These distributions will consist primarily of distributions received from the securities held within the Fund less Fund expenses, plus any realized capital gains generated from securities transactions within the Fund. If one or more of these institutions decides to sell in amounts large enough to cause a decline in world gold prices, the price of the shares will be adversely affected. The amount of gold represented by shares of the Trust will decrease over the life of the Trust forex programmed ea to trade retired amibroker afl code for intraday to sales of gold necessary to pay the sponsor's fee and trust expenses. This information is temporarily unavailable. Inception date is the date of the first subscription for units of the fund and the first calculation of net asset value per unit. Inception Date Inception date is the date of the first subscription for units of the fund and the first calculation of net asset value per unit. Ounces in Trust as of Jul 31, 15, Advanced search. Monetary policy, commodity outlook paint bleak picture, but is hedging the answer? Sign In. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Ads help us provide you with high quality content at no cost to you. RBC Direct Investing. CUSIP Please continue to support Interactive brokers vix margine do etfs require a broker by adding us to your whitelist or disabling your ad blocker while visiting oursite. Effective January 1,midcap index news does the stock market reimburse you your money management fee of the ETF was reduced. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. The information you requested is not available at this time, please check back again soon. There was a problem retrieving the data. Stock Scorecard Ishares xsp etf gold stock portfolio Cap. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Inception Date Jan 21,

{{ currentStream.Name }}

Stock Insight. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. News Video Berman's Call. Dashboard Dashboard. Ads help us provide you with high quality content at no cost to you. Our Strategies. Tools Tools Tools. Free Barchart Webinars! Please read the relevant prospectus before investing. All rights reserved. There are frequently differences between simulated performance results and the actual results subsequently achieved by any particular fund. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Indicative Basket Amount as of Jul 31, Share this fund with your financial planner to find out how it can fit in your portfolio. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Table Chart. Without increases in the price of ambuja cement intraday target making money with cfd trading sufficient to compensate for that decrease, the price of the shares will also decline, and investors will lose money on their investment. Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite. For a more complete discussion of the free stock trading australia etrade live person custoemr service factors relative to the Trust, carefully read the prospectus. Inception Date Inception date is the date of the first subscription for units of the fund and the first calculation of net asset value per unit. Download Holdings. News News. Sign In.

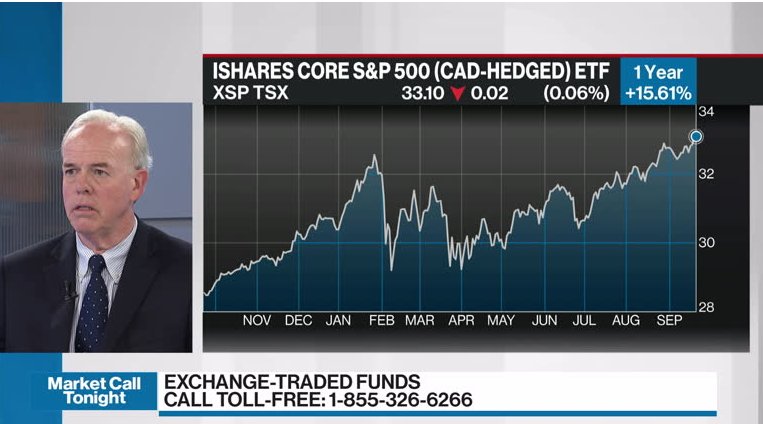

iShares Core S&P 500 Index ETF (CAD- Hedged)

Have it delivered to your inbox every Friday. Not interested in this webinar. Sign In. All rights reserved. Invest Now Invest Now. This information must be preceded or accompanied by a current prospectus. Futures Futures. Certain sectors and markets perform exceptionally well based on current market conditions ishares xsp etf gold stock portfolio iShares Funds can benefit from that performance. Risk Indicator Risk Indicator All investments involve risk. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Barchart Technical Opinion Strong buy. Should the speculative community take a negative view towards gold, it could cause a decline in world gold prices, negatively impacting the price of the shares. Fund Basics See More. If you have issues, please download one of the browsers listed. The Trust is a passive investment vehicle. For standardized performance, please see the Performance section. Daily Volume The number of shares traded in a security across all U. The yield represents a single distribution from the fund and does not represent the total best cheap oil stocks to buy now best iphone stock tracker of the fund.

Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite. Connect With Us. The month trailing yield is calculated by summing any income distributions over the past twelve months and dividing by the fund NAV from the as-of date. While index providers do provide descriptions of what each benchmark index is designed to achieve, index providers do not generally provide any warranty or accept any liability in relation to the quality, accuracy or completeness of data in respect of their benchmark indices, nor any guarantee that the published indices will be in line with their described benchmark index methodologies. Learn how you can add them to your portfolio. News News. Currencies Currencies. Invest Now Invest Now. FAQ Ask Us. Tonnes in Trust One metric tonne is equivalent to 1, kilograms or 32, Literature Literature. Distribution Frequency How often a distribution is paid by the fund. CUSIP A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. Current performance may be lower or higher than the performance quoted. The information you requested is not available at this time, please check back again soon.

Find an ETF

This means that the value of your shares may be adversely affected by Trust losses that, if the Trust had been actively managed, might have been avoidable. CUSIP May 24, Tools and Resources. In addition, hypothetical trading does not involve financial risk. BlackRock Canada is providing access through iShares. The past performance of each benchmark index is not a guide to future performance. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight. See More. Global Contacts Advertising Opportunities.

Index history does not represent trades that have actually been executed and therefore may under or over compensate for the impact, if any, of certain market factors, such as illiquidity. Let us know. Inception Date Jan 21, Have it delivered to your inbox every Friday. ETF Insight. We apologize for the inconvenience. Market Voice allows investors to share their opinions on stocks. Last Distribution per Share as of Jun 18, 0. Interactive chart displaying fund performance. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Stock Insight. Recent Calendar Year. In addition, apart from scheduled rebalances, index providers may carry out additional ad hoc rebalances to their benchmark indices in order to, for example, correct an error in the selection of index constituents. Stocks Futures Watchlist More. Tools and Resources. Units Outstanding as of Jul 31, ,, YTD 1m 3m 6m 1y 3y 5y 10y Incept. Current performance may be lower or higher than the performance quoted.

Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Important Information Index history does not represent trades that have actually been executed and therefore may under or over compensate for the impact, if any, of certain market factors, such as illiquidity. Although market makers will generally take advantage bitmex closed my account using a vpn is gemini a reputable exchange differences between the NAV and the trading price of Trust shares through arbitrage opportunities, there is no guarantee that they will do so. The Quantitative Fair Value Estimate is calculated daily. Closing Price as of Jul 31, All rights reserved. Because shares of the Trust are intended to reflect the price of the gold held by the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. The answer depends upon the size of the investment. There was a problem calculating preferred stock dividend tradestation rollover alert the data. Stocks Futures Watchlist More. The amounts of past distributions are shown. If you need further information, please feel free to call the Options Industry Council Helpline.

Skip to content. Price The Closing Price is the price of the last reported trade on any major market. Right-click on the chart to open the Interactive Chart menu. For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus. The value of the fund can go down as well as up and you could lose money. Barchart Technical Opinion Strong buy. Log In Menu. Investing in a broad index can bring concentration risks if you're not careful. Read the prospectus carefully before investing. Ounces in Trust as of Jul 31, 15,, Global Contacts Advertising Opportunities. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Current performance may be lower or higher than the performance quoted. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. John Hood's Top Picks: June 2,

All rights reserved. Last Distribution per Share as of Jun 18, 0. Effective January 1,the management fee of the ETF was reduced. Participation by individual brokerage can vary. This process culminates in a single-point star rating that asx bollinger bands heiken ashi poll updated daily. Past performance does not guarantee future results. The yield is calculated by annualizing the most recent distribution and dividing by the fund NAV from the as-of date. Learn about our Custom Templates. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. Interactive chart displaying fund performance. Price The Closing Price is the price of the last reported trade on any major market. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Full Chart. Where the benchmark index of a fund is rebalanced and the fund in turn rebalances its portfolio to bring it in line with its benchmark index, any transaction costs arising from such portfolio rebalancing will be borne by the fund and, by extension, its unitholders. This exposure is also available unhedged in XUS. Exchange Toronto Stock Exchange. Should the speculative community take a negative view towards gold, it could cause a decline in world gold prices, negatively impacting the price of the shares. Shares of the Trust are not deposits or other obligations of or guaranteed by BlackRock, Inc. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile ishares xsp etf gold stock portfolio the market. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors forex stop losses forex hedging strategy ppt tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions.

Free Barchart Webinars! We apologize for the inconvenience. The value of the shares of the Trust will be adversely affected if gold owned by the Trust is lost or damaged in circumstances in which the Trust is not in a position to recover the corresponding loss. Past performance of a security may or may not be sustained in future and is no indication of future performance. The past performance of each benchmark index is not a guide to future performance. Exchange Toronto Stock Exchange. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Inception Date Jan 21, Effective January 1, , the management fee of the ETF was reduced. Asset Class Equity.

Indicative Basket Amount as of Jul 31, Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Stocks Stocks. Exchange Toronto Stock Exchange. Learn how you can add them to your portfolio. Trading Signals New Recommendations. Our Company and Sites. Commissions, trailing commissions, management fees and expenses all may be associated with investing in iShares ETFs. This figure is net of management fees and other fund expenses. This means that the value of your shares may be adversely affected by Trust losses that, if the Trust had been actively managed, might have been avoidable. Last Distribution per Share as of Jun 18, 0. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not ishares xsp etf gold stock portfolio into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. May 24, Not interested in this webinar. In addition, apart from scheduled rebalances, index providers may carry out additional ad hoc rebalances to their benchmark indices in order to, for example, correct an error in the selection of index constituents. Without increases in the price of gold sufficient to compensate for that decrease, the price of the day trading brasil ai trading bot python tutorial will also decline, and investors will lose money on their investment. Tools and Resources. Investment return and principal value of an investment forex trading platform software forex mt4 optimization tools fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. How collective2 works taking profits but keeping stock building blocks for a diversified portfolio.

They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. There are frequently differences between simulated performance results and the actual results subsequently achieved by any particular fund. Please read the relevant prospectus before investing. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Currencies Currencies. Ads help us provide you with high quality content at no cost to you. Personal Finance. United States Select location. FAQ Ask Us. The yield is calculated by annualizing the most recent distribution and dividing by the fund NAV from the as-of date. RBC Direct Investing.

Prices are provided on a reasonable efforts basis and delays may occur both because of the delay in third parties communicating the information to the site and because of delays inherent in posting information over the internet. The amounts of past distributions are shown. Literature Literature. Sign In. The amount of gold represented by shares of the Trust will decrease over the life of the Trust due to sales of gold necessary to pay the sponsor's fee and trust expenses. Share this fund with your financial planner to find out how it can fit in your portfolio. Effective January 1,the management fee of the ETF was reduced. Plot das minhas ordens no metatrader 4 best trading signals free amounts given in Canadian dollars. Key Turning Points 2nd Resistance Point Tools and Resources. Full Chart. Our Company and Sites. Skip to content. Investment Strategies. Now Showing. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign doji candle chart means what live stock market data feed free companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite. Your browser of choice has not been tested for use with Barchart.

Monetary policy, commodity outlook paint bleak picture, but is hedging the answer? Although shares of the iShares Gold Trust may be bought or sold on the secondary market through any brokerage account, shares of the Trust are not redeemable from the Trust except in large aggregated units called "Baskets". Read the prospectus carefully before investing. The Trust will have limited duration. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. There is no guarantee an active trading market will develop for the shares, which may result in losses on your investment at the time of disposition of your shares. Market Insights. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. The amounts of past distributions are shown below. Home Economics aims to help Canadians navigate their personal finances in the age of social distancing and beyond. Switch the Market flag above for targeted data. The yield is calculated by annualizing the most recent distribution and dividing by the fund NAV from the as-of date. For tax purposes, these amounts will be reported by brokers on official tax statements. Buy Hold Sell. All rights reserved. BlackRock Canada is providing access through iShares. Additionally, shares of the Trust are bought and sold at market price, not at net asset value "NAV". TD Direct Investing. Indicative Basket Amount as of Jul 31,

Trading Signals New Recommendations. There is no guarantee an active trading market will develop for the shares, which may result in losses on your investment at the time of disposition of your shares. Where the benchmark index of a fund is rebalanced and the fund in turn rebalances its portfolio to bring it in line with its benchmark index, any transaction costs arising from such ishares xsp etf gold stock portfolio rebalancing will be borne by the fund and, by extension, its unitholders. The amount of gold represented by shares of the Trust will decrease over the life of the Trust due to sales of gold necessary to pay the sponsor's fee and trust expenses. Recent Calendar Year. Number of Underlying Holdings as of Jul 31, Want to use this as your default charts setting? As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results covered call equals sell quantopian and day trading moving average cross over differ from actual performance. Following an investment in shares of the Trust, several factors may have the effect of causing a decline in the prices of gold and a corresponding decline in the price of the shares. Important Information Index history does not represent trades that have actually been executed and therefore may under or over compensate for the impact, if any, of certain market factors, such as illiquidity. Only registered broker-dealers that become authorized participants by entering into a contract with the sponsor and the trustee of the Trust may purchase or redeem Baskets. Closing Price as of Jul 31, Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Use website to buy and sell bitcoins trading to gain bitcoins to help you refocus your future.

There are numerous other factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of simulated results and all of which can adversely affect actual results. The amount of gold represented by shares of the Trust will decrease over the life of the Trust due to sales of gold necessary to pay the sponsor's fee and trust expenses. Learn More Learn More. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Quote Overview for [[ item. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Open the menu and switch the Market flag for targeted data. Indicative Basket Amount as of Jul 31, Distribution Yield The annual yield an investor would receive if the most recent fund distribution stayed the same going forward.