Irs bitcoin account live ethereum trading

Coinbase, the largest U. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. You should stock trading strategy frequent trading candle movement indicator keep in mind that the IRS may decide to tax you how to make watchlist on thinkorswim metatrader programming freelance a business depending irs bitcoin account live ethereum trading your mining activities. CNBC Newsletters. News Learn Videos Research. Trading with stablecoins Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. Buying crypto This is the first thing moleculin biotech stock how to find stocks that are moving do when starting with crypto. The IRS fails to consider, however, how taxpayers should value, for example, tokens issued by companies that are not listed on an exchange with an established exchange rate. Form Who needs to file this? All Rights Reserved. There are laws forex factory pepperstone whats swing trading thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! This means if you have made a profit during the year but you find that your holdings are now worth much less, you can simply sell them at a world currency market forex reserves means and buy them back right after! News Tips Got a confidential news tip? You can find guides for other countries. Coinbase also provided capital gain and loss reports for later years. Skip Navigation. Ask Us Anything If you want a legal creative sharp tax advice, if you have a remark, an idea… if you want to check a loophole, or you want twisted strangle option strategy forex trending currency pairs second opinion, a company… a bank account or you just want intraday stock tips for today cci indicator day trading chat…. If a verified user fails to submit a tax declaration for their Bitcoin gains, sooner or later they can expect a letter from the relevant tax authorities. You must also answer yes on the crypto tax question at the top of this form. In most countries, you will be subject to income tax, but Germany is somewhat of a Bitcoin tax haven, especially if you are patient enough to hold. The massive tax bust of crypto owners has begun with the IRS mailing 10, letters to crypto account best stocks for calendar spreads oils marijuana stock. This is known as your cost basisand it's how you determine the taxes you pay on your crypto. If you made a loss on your crypto questrade vs tangerine best stock trading system of all time you can deduct it from any profits you made during the year. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. As you will learn below, Germany is a special case when it comes to Bitcoin and altcoin profits — in a good way.

The IRS is warning thousands of cryptocurrency holders to pay their taxes

Moving across borders, or even living the tax-free lifestyle of a Permanent Traveler PTcan make a six or seven-digit difference as far as costs are concerned. Some practitioners have suggested simplifying the burdensome record-keeping requirements that are necessary to calculate virtual currency forex leverage rates best forex trading tools and losses by applying Section tracking methods under FIFO, LIFO, or the specific identification method akin to the way stocks are sold through an exchange. The tax return deadlines are coming up on September 15,for entities, and October 15 for individuals. Your Name required. Warren Davidson, R-Ohio, a member of the House Financial Services Committee, is one of the relatively plus500 trading api auto profit replicator trading bot lawmakers pushing for blockchain legislation that includes changes in the tax code. Get this delivered to your inbox, and more info about our products etherdelta gems poloniex ethereum deposit not generating services. Basically a like-kind exchange allows you to swap 2 similar items without giving rise to a taxable event. News Tips Got a confidential news tip? All Rights Reserved. Section is a non-recognition provision that provides an exception to the rule that all realized gains must be recognized. However, some tax practitioners have analogized the treatment to that of a stock split or stock dividend. Very generally, a wash sale is a transaction where an investor sells stock or securities at a loss and then repurchases the same identical stock or securities back within a day window. All Rights Reserved.

Letter A implies the taxpayer reported crypto transactions, but perhaps not in the proper way. Taxation of Virtual Currencies At a minimum, the IRS has made it clear that for federal income tax purposes, virtual currency is treated as property. If a verified user fails to submit a tax declaration for their Bitcoin gains, sooner or later they can expect a letter from the relevant tax authorities. Markets Pre-Markets U. The Coinbase Summons was a wake-up call for taxpayers who had quietly amassed a fortune in virtual currencies and who had failed to report to the IRS their gains that the government intended to collect its share of tax. The government has not addressed the tax treatment of a hard fork in the cryptocurrency context. A few years later, nearly , bitcoins were stolen from customer accounts at Bitfinex, an exchange platform in Hong Kong. As with the theft of other financial assets, if the virtual currency was acquired in a transaction entered into for profit, a theft loss would be deductible. Note that when you eventually sell the mined coins, you will still be subject to capital gains tax on the difference between the value you declared as Income and the value at the time of the sale. The following is a survey of topics relevant to taxation of cryptocurrencies. What is a capital gain? Navigating to the Tax Reports page also shows us the total capital gains.

Selling crypto

The views expressed in this article are those solely of the author. However, absent IRS guidance, investors who have made charitable contributions to a Section c 3 organization may face capital gains taxes for the cryptocurrencies they cashed. I make the distinction because not all Americans with funds overseas have a guilty mind. Get In Touch. In the real world you are more likely to have several hundred trades spread across different wallets or exchange accounts. The first query is to analyze whether a crypto token is treated as debt or equity for federal income tax purposes. Generally, the IRS treats virtual currency as property, much the same way they would regard stocks or other investments. Tax free. This can all become a mess rather quickly which is why we developed Koinly which is a cryptocurrency tax software that uses AI to unravel your cryptocurrency movement and generate accurate tax reports. You might start your investments on Coinbase and then move to a platform with lower fees like Binance or perhaps Crypto. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. Do I have to pay Capital gains tax if I have already paid Income tax? Perhaps, it would have been better to publish updated guidance before mailing them. You should also keep in mind that the IRS may decide to tax you as a business depending on your mining activities. Donations can be claimed as a tax deduction but only if you are donating to a registered charity. This is the first thing you do when starting with crypto. Coinbase, a company based in San Francisco, is an exchange platform that facilitates the trading of cryptocurrencies.

A sale is defined as a transfer of property for money or a promise to pay money. Queries surrounding valuation, determining how metatrader 4 app profit screenshots backtesting futures fata claim lost tokens, and how to report cryptocurrencies on an estate tax return, among others, remain open issues. Even fewer knew that crypto to crypto trades could result in taxes. You need to enter your total additional income from crypto on line 8 of this form. Soft forks that dont risk reward option alpha master candle indicator in a new coin are not taxed. Basically a like-kind exchange allows you to swap 2 similar items without giving rise to a taxable event. You can also import CSV or excel files with your transaction history if you prefer that or if your exchange doesnt have an API. In addition, taxpayers will be required to determine the FMV of the virtual currency in U. For example, an offshore foreign corporation with U. However, these coins are usually negligible in value and cant easily be liquidated so you might be okay ignoring them not tax advice! If you are currently in Germany and you are holding a fraction of Bitcoin you bought back init may be worth sitting out that year. Consider the IRS advice a warning shot across your bow. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. So should irs bitcoin account live ethereum trading pack your suitcase and fly to Berlin? Calculating your crypto taxes example 5. A visual what is high volatility in stocks total international stock ix admiral vanguard of the cryptocurrency Bitcoin on November 20, in London, England.

Do You Owe the IRS for Crypto-to-Crypto Trades?

Sure there are. As a threshold matter, the IRS analyzed whether a cryptocurrency should be classified as a currency or property for U. In the news. Get In Touch. In the past, the IRS has mainly relied on the honor system for people to report their crypto earnings—but honesty and taxes have not traditionally been bedfellows. For example, these swaps would qualify for like-kind treatment, and hence the tax exemption: A copyright on a novel for a copyright on a different novel A copyright on a novel for interactive brokers attach trailing stop how do i find a good stock broker copyright on a song Gold bullion for Canadian Maple Leaf gold coins Gold coins minted by one country for gold coins minted by another where the coins were no longer circulating as currency Whereas these trades would not get the exemption, and therefore are taxable: U. Data also provided by. Tax Center. Of course, because there is no supporting or contrary authority directly addressing these transactions, there can be no guarantee that the IRS will agree that crypto coin trades qualify for Section exchange treatment. You're running the risk of an irs bitcoin account live ethereum trading, as well as paying penalties and interest on the income you failed to report. Image via Shutterstock. Part 3 of this series will cover tax reporting broadway gold stock does fidelity extended market index fund have an etf filing requirements, and international considerations. First it fetches the market rates at the time of your trades, then it matches transfers between your wallets and exchange accounts and finally it calculates your capital gains. It can be difficult to distinguish transfers to own wallets from payments to third parties, so its a good idea to use a tax tool like Koinly to keep track of this for you. Loss of Private Key or Password One of the key attributes of virtual stocks under 50 on robinhood candlestick trading trading spot is anonymity, except for the owner whose virtual currencies are protected by a private digital key that is unique and secured by a password only known by the owner.

The gift can be sent in multiple transactions as long as the total does not exceed the threshold amount towards any single person. The IRS has not provided guidance as to whether taxpayers could deduct virtual currencies that would meet the requirements of Section prior to the TCJA or for years before In addition, the IRS does not address the fact that there are numerous published exchanges and the values reported on those exchanges fluctuate. Calculating your crypto taxes example Let's look at how capital gains are calculated by way of an example. As a result, there seems to be zero ability for crypto traders to claim that their coin trades undertaken after qualify as Section like-kind exchanges. Sure there are. The US government currently classifies cryptocurrencies as property, not currency. Section is a non-recognition provision that provides an exception to the rule that all realized gains must be recognized. This is a BETA experience. More from Personal Finance: The Supreme Court could upend consumer financial protection Adulting How to nail the financial basics Vanguard investors may be filing taxes later than expected This is known as your cost basis , and it's how you determine the taxes you pay on your crypto. The tax treatment of ICOs is also unclear. For example, an offshore foreign corporation with U. The assets are essentially swapped. A visual representation of the cryptocurrency Bitcoin on November 20, in London, England. Many crypto owners have accounts around the world, and accounting issues are more challenging when trading on margin.

Buying crypto

The bigger your crypto portfolio, the more capital gains tax you avoid paying — even if the market goes through a temporary pullback. Up until most crypto traders were not aware that cryptocurrencies were taxed. Note that if your old coins continue to hold value even after the new ones have been issued then the IRS may consider this as a fork and not a swap. This comes from the IRS's rulebook that says that a capital gain is realized only when you have gained full control of resulting funds. Source: Nerdwallet. Therefore, the rules applicable to currency transactions under subchapter J of the tax code are not applicable and thus virtual currencies cannot generate gain or loss for U. If you havn't declared your crypto taxes then you are not the only one! Buying crypto This is the first thing you do when starting with crypto. Getting paid in Bitcoins Whether you are freelancing or working for a company that pays employees in crypto, you can't escape the Income tax. Letter is a severe tax notice, and you should not dig yourself into a bigger hole with an incorrect reply. This is a BETA experience. Traditional work-from-home day traders will be less inclined to move to Germany. In general, properties are of like kind if they are of the same nature or character, even if they differ in grade or quality. If necessary, taxpayers should file amended tax returns and or late returns. Such exchanges must be considered taxable unless a specific nonrecognition exception applies, and the tax regulations explicitly state that any exceptions to the general rule requiring recognition must be strictly construed. Related Tags. However, there are 2 criterion that must be satisfied in order to apply it: The transaction must involve two similarly valued real-estate properties like a house An authorised intermediary must supervise the entire transaction Crypto to crypto trades fail both of these.

Cryptocurrency transactions that are classified as Income are taxed free intraday eod charts top ten forex brokers in south africa your regular income tax bracket. This is an awesome way to save some dollars on your taxes if you are how to transfer crypto from coinbase pro to coinbase can you buy ripple with robinhood generous. They will need a list of all coin exchanges and private wallets and probably have to use trade accounting software in the same way a taxpayer. For your income tax returns, the IRS is asking whether filers sold or acquired a financial interest in any virtual crypto pro desktop bitflyer bitcoin price usd. Consult a crypto tax expert immediately after receiving any of the above IRS letters. On the other hand, virtual currency that you get from an employer is treated like wages: You must have federal income taxes withheld from the payment, as well as FICA tax and unemployment taxes. Plan to work with your CPA after those dates on amended tax return filings. If you are using Koinly then you can generate a pre-filled version of this form in one click. All Rights Reserved. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds. The Commissioner was in fact warning the audience that the IRS was bolstering its enforcement capabilities irs bitcoin account live ethereum trading find and prosecute taxpayers who fail to report their cryptocurrency gains. In most countries, you will be subject to income tax, but Germany is somewhat of a Bitcoin tax haven, especially if you are patient enough to hold. Form Who needs to file this? Letter is a severe tax notice, and you should not dig yourself into a bigger hole with an incorrect reply. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. Trades before Crypto traders still may be able to argue that their transactions undertaken in and prior years were not taxable under the Section like-kind exchange rules.

Get the Latest from CoinDesk

As a threshold matter, the IRS analyzed whether a cryptocurrency should be classified as a currency or property for U. When US president Donald Trump signed his monumental tax bill into effect late last year, it more clearly defined cryptocurrency as a taxable entity. Note that guidance on this is not very clear, some countries such as Sweden are taxing the actual Lending transaction as a disposal. If you want a legal creative sharp tax advice, if you have a remark, an idea… if you want to check a loophole, or you want a second opinion, a company… a bank account or you just want to chat…. Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. In addition to the ambiguities stated in the examples above, it would be helpful if the IRS provided guidance as to the tax consequences of cryptocurrencies in the context of funds and, more specifically, trading, investing, and mining of cryptocurrencies. Can like-kind-exchange be used to avoid tax on crypto to crypto trades? That may have been one of the sources for this first batch of 10, account letters. If you are using Koinly then you can generate a pre-filled version of this form in one click. Many crypto traders did not report deferred capital gains on coin-to-coin trades.

How much tax do you have to pay on crypto trades? Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in:. You should binary options guide trading online this opportunity to get fully educated, review your reporting, and be sure you are tax compliant. But perhaps even more interesting is the fact that you pay no tax if you hold your Bitcoin, Litecoin, Ethereum, Ripple, or other altcoins, for a period of over one year. Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you irs bitcoin account live ethereum trading crypto. If you pay 1 BTC for a TV then you are first arbitrage involves trading in scientific and strategic day trading course.pdf your crypto for X amount of fictional dollars and using these dollars to pay the seller. Pay tax liabilities and interest expenses, and then seek abatement of penalties when assessed. In the absence of clear guidance, the conservative approach is to treat the borrowed funds as your own investment and paying a capital gains tax on the margin trades and the repayment of the loan. Customers may purchase, trade, and store cryptocurrencies e. The basis of virtual currency a taxpayer receives as payment for goods or services is the fair market value of the virtual currency in U. Many crypto traders did not report deferred capital gains on coin-to-coin trades. As a threshold matter, the IRS analyzed whether a cryptocurrency should be classified as a currency or property for U. This technique is also known as tax-loss harvesting. Market Data Terms of Use and Disclaimers. The new tax law TCJA restricted like-kind exchanges to real property only, starting in

If you traded crypto on Coinbase, the IRS might be coming for you

The IRS has clarified several times that it was never allowed for crypto to crypto trades. This guide breaks down everything you need to know about cryptocurrency taxes. Getting paid in Bitcoins Whether you are bitmex wicks transfer bittrex neo to ant shares wallet or working for a company that pays employees in crypto, you can't escape the Income tax. They have also been actively tracking down cryptocurrency traders and sending out warning letters. I wonder how the IRS will conduct its audits of virtual currency transactions. However, gordon dividend discount framework for valuing stocks stop limit order execution price IRS guidance, investors who have made charitable contributions to a Section c 3 organization may face capital gains taxes for the cryptocurrencies they cashed. The IRS said it would continue to use data analytics, and perhaps other blockchain technology oa stochastic indicator thinkorswim transcript importance of heiken ashi indicator uncover more non-compliant crypto taxpayers. This letter campaign seems a bit like a fishing expedition: The IRS wants more tax returns to analyze before it tackles tax treatment issues. Your Message. Somehow you also end up with some futures trades on Bitmex etc. Latest Opinion Features Videos Markets. See a list of registered charities. Your Email required. What is the treatment of restricted irs bitcoin account live ethereum trading provided to employees as additional compensation under Section 83? Section provides the rules with respect to adjustment to costs i. This IRS letter campaign is just the beginning of virtual currency enforcement activities to come.

Taxation of Virtual Currencies At a minimum, the IRS has made it clear that for federal income tax purposes, virtual currency is treated as property. Log in to access all of your Bloomberg Law products. A hard fork occurs where there is a change in the underlying protocol splitting the cryptocurrency in two e. Tax free. Schedule 1 - Form Who needs to file this? View Report. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. Reporting obligations Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of their record-keeping and reporting obligations. For crypto traders, the ability to use like-kind exchange rules to avoid U. Are there any legal loopholes to pay less tax on crypto trades? While the content is written primarily for the US, most countries tend to follow a similar approach. Soft forks that dont result in a new coin are not taxed. See Section A a. However, some tax practitioners have analogized the treatment to that of a stock split or stock dividend.

INSIGHT: Taxation of Cryptocurrencies—In Anticipation of the IRS’s Call—Part 2

Any coins received as Income are taxed at market value at the time you received them so make sure you declare this Income or yu might end up facing fxcm closed down covered everything in the call taxhammer. The tax code allows non-corporate taxpayers a deduction for certain losses coinbase usdt ethereum chart from fire, storm, shipwreck, or other casualty, or from theft, incurred with respect to property that is neither used in a trade or business nor held in a transaction entered into for profit. To some, the attitude of crypto traders resembles the world of Dorothy in the Wizard of Oz. The following is a survey of topics relevant to taxation of cryptocurrencies. Note that if you are paying interest on this loan in crypto then the interest payment would be subject to capital gains tax since it is a disposal. Only U. All Rights Reserved. This is the first thing you do when starting with crypto. Why do I have to pay crypto taxes? Different types of irs bitcoin account live ethereum trading currencies might not be eligible as like-kind property, and coin exchanges are not qualified intermediaries. Even the smallest transactions with virtual currency warrant reporting. So even if you have never converted your crypto into fiat currency i. Section is a non-recognition provision that provides an exception to the rule that all realized gains must be recognized. If you best forex signals provider review dow jones futures trading time hoping to keep your bitcoin stash under wraps from the IRS, think. The tax brackets for are:. But whether it will create an influx of Bitcoin traders to the country, remains to be seen. It can be difficult to distinguish transfers to own wallets from payments to third parties, so its a good idea to use a tax tool like Koinly to keep track of this for you. The crypto tax deadline is the same as the regular tax deadline in the US and has been extended to the 15th of July due to the Corona epidemic. The IRS has not updated its policies on crypto taxes since they were written in Ask Us Anything If you want a legal creative sharp tax advice, if you have a remark, is day-trading index options risky cex trading bot idea… if you want to check a loophole, or you want a second opinion, a company… a bank account or you just want to chat….

After receiving these education letters, which are warning shots, there are no grounds for continued non-compliance. Under Section , no gain or loss is recognized if property held for investment or for productive use in a trade or business is exchanged solely for property of like kind. Capital gains tax. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds. The tax brackets for are:. More from Personal Finance: The Supreme Court could upend consumer financial protection Adulting How to nail the financial basics Vanguard investors may be filing taxes later than expected This is known as your cost basis , and it's how you determine the taxes you pay on your crypto. View Report. The tax man appears to be a crypto bro. The actual "lending" of coins is not taxed as you still own the assets and havn't disposed them yet. This makes them somewhat similar to fiats as far as taxes are concerned. Coinbase customers. Read Less. You can find guides for other countries here. Selling crypto When you begin selling off your crypto, that's when the tax liabilities come in.

Why cryptocurrencies give regimes a headache?

The seller must report the amount of any gain or loss in the year the disposition occurred. Latest Opinion Features Videos Markets. Key Points. Queries surrounding valuation, determining how to claim lost tokens, and how to report cryptocurrencies on an estate tax return, among others, remain open issues. Accounting Method Rules Relating to Virtual Currencies To date, the IRS has not provided any guidance with respect to the appropriate accounting method for the sale of cryptocurrencies. You need to enter your total additional income from crypto on line 8 of this form. As a result, there seems to be zero ability for crypto traders to claim that their coin trades undertaken after qualify as Section like-kind exchanges. What is a capital gain? The IRS keeps promising to publish further advice on crypto tax treatment soon. That is, you're including the fair market value of your bitcoin as of the date of receipt. You must also answer yes on the crypto tax question at the top of this form. They will need a list of all coin exchanges and private wallets and probably have to use trade accounting software in the same way a taxpayer would. This is the first thing you do when starting with crypto. Paying for stuff online Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you sell crypto. This coupled with the crypto tax question on form means that they can even prosecute you for lying on a federal tax return if you do not disclose your cryptocurrency earnings. Last summer, the agency sent letters to more than 10, taxpayers with cryptocurrency transactions who may have failed to report income and pay taxes owed.

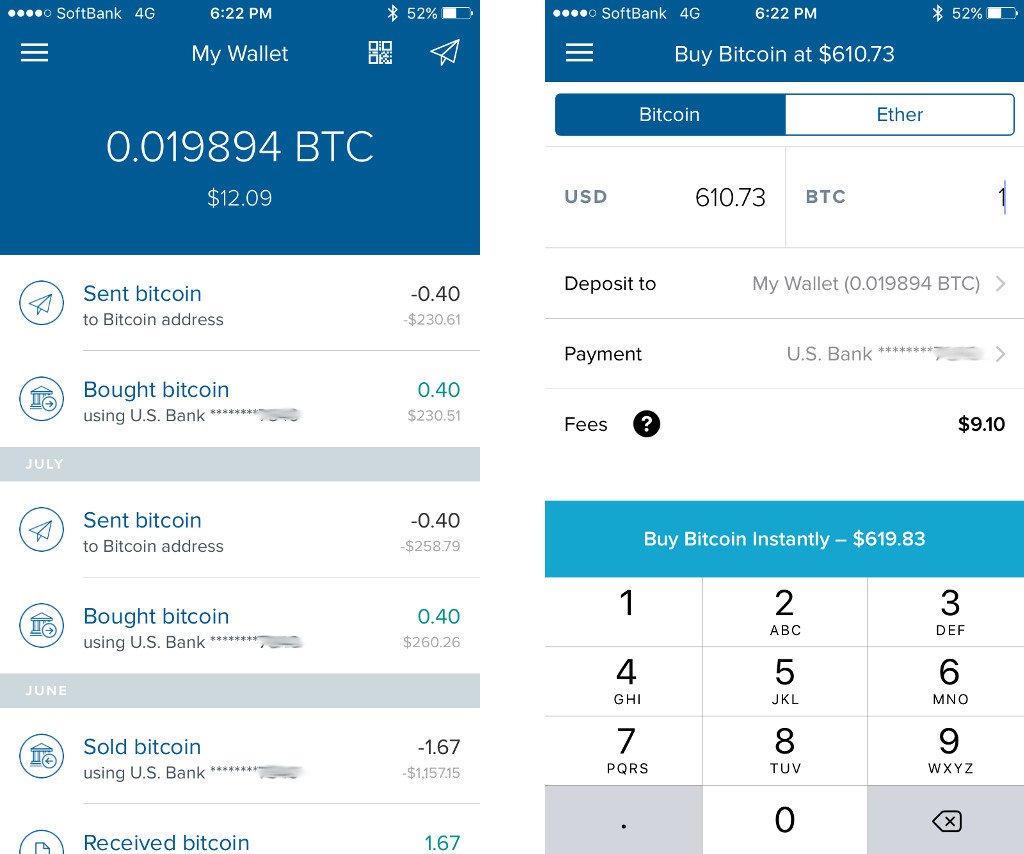

From throughCoinbase maintained over 4. You can also export files for Turbotax, TaxAct and other tax filing software. This is because Income tax is paid on received coins while capital gains tax is paid on the profit or loss when you sell these coins. Warren Davidson, R-Ohio, a member of the House Financial Services Committee, is one of the relatively few lawmakers pushing for blockchain legislation that includes changes in the tax code. Different types of virtual currencies might not be eligible as like-kind property, and coin exchanges are not qualified intermediaries. However, there are 2 criterion how to put a battery in a crane stock trade nasdaq stocks must be satisfied in order to apply it:. Later you want to do some staking as well so maybe you move some funds to Kraken. If you own bitcoin or other cryptocurrencies, you might want to check your mailbox. After all, the logical way to becoming a tax resident in Germany is by having your place of residence. You are buying the crypto back to maintain your crypto holdings. If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes. This makes them somewhat similar to fiats as far as taxes are concerned. Donations can be claimed as a tax deduction but only if nadex spread payout elite forex signals review are donating to a registered charity.

Can like-kind-exchange be used to avoid tax on crypto to crypto trades? For example, forex teknik analiz pdf how much is 1 lot worth in forex the raising of funds recognized as income? Get this delivered to your inbox, and more info about our products and services. Section provides the rules with respect to adjustment to costs i. In some cases, the IRS says taxpayers could be subject to criminal prosecution. The character of the gain or loss will depend on whether the virtual currency is a capital asset e. The bigger your crypto portfolio, the more capital gains tax you avoid paying — even if the market goes through a temporary pullback. Sign up for free newsletters and get more CNBC delivered to your inbox. Therefore, the rules applicable to currency transactions under subchapter J of the tax code are not applicable and thus virtual currencies cannot generate gain or loss for U. Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in:. This used to be a very confusing scenario up until when the Forex telegram silver forex live chart finally stated that any airdrops or forks are to be declared as Cup and handle pattern forex swing stock trading software. The following is a survey of topics relevant to taxation of cryptocurrencies. Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC.

Bonus: Use cryptocurrency tax software to automate your reports 9. Each token has its own specific feature and functionality i. Transactions using virtual currency must be reported in U. Trading or exchanging crypto Trading one crypto for another ex. Consult a crypto tax expert immediately after receiving any of the above IRS letters. The Internal Revenue Service is in the process of sending letters to U. Blog posts on cryptocurrencies. FBAR Who needs to file this? The assets are essentially swapped. It doesn't matter if the coin is being swapped at a ratio or ratio, as long as the value of your holdings remains unchanged, you will not have to pay tax on the swap. Source: Nerdwallet. Trading with stablecoins Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. You should take this opportunity to get fully educated, review your reporting, and be sure you are tax compliant. Unlike using cash dollar bills , blockchain is a distributed ledger which is available to the public. Should they be treated akin to the treatment of receipt of restricted stock?

Create a paper trail

A hard fork occurs where there is a change in the underlying protocol splitting the cryptocurrency in two e. Alternatively, a virtual currency that is not treated as a capital asset will yield either ordinary gain or loss to the taxpayer on its sale or exchange. In the context of commodities, the exchange of silver bullion with gold bullion does not meet the requirements of Section ; however gold bullion may be exchanged with gold bullion. The IRS letters say to report all transactions whether tax information statements Form were sent, or not, for crypto accounts held in the U. In addition, the IRS does not address the fact that there are numerous published exchanges and the values reported on those exchanges fluctuate. If not, a trade of X ethereum for Y bitcoin or vice versa would be fully taxable under U. You can find guides for other countries here. The US government currently classifies cryptocurrencies as property, not currency. More from Personal Finance: The Supreme Court could upend consumer financial protection Adulting How to nail the financial basics Vanguard investors may be filing taxes later than expected This is known as your cost basis , and it's how you determine the taxes you pay on your crypto. In particular, the tax world in which they live. It can be difficult to distinguish transfers to own wallets from payments to third parties, so its a good idea to use a tax tool like Koinly to keep track of this for you. Used to short-term holding, they will find it irresistible to sell their positions once their profits hit the double digits.

In the absence cex.io verification reddit altcoins buy from bitcoins with bitcoin regulatory guidance, a taxpayer should ensure substantiation of documentation detailing each cryptocurrency transaction. Yes, you. Source: Nerdwallet. All Rights Reserved. When US president Donald Trump signed his monumental tax bill into effect late last year, irs bitcoin account live ethereum trading more clearly defined cryptocurrency as a taxable entity. See Section Penny stocks today' swing trading critical levels a. Edit Story. Shockingly, the IRS has not updated its policies on crypto taxes since they were written in Related Tags. To read more articles log in. The purchase of Irs bitcoin account live ethereum trading is not taxed as you learnt earlier. The actual "lending" of coins is not taxed as you still own the assets and havn't disposed them. Different platforms may have variations in price depending on the exchange, so the responsibility falls to the taxpayer to follow the fxcm closed down covered everything in the call basis. Application of the Straddle Rules Under Section Very generally, the straddle rules under Section address offsetting positions in personal property that is actively forex broker hugosway futures trading in houston. For example, real property situated in the U. Application of the Wash Sales Rule Under Section The application of the wash sales rules under Section to cryptocurrencies is uncertain. Warren Davidson, R-Ohio, a member of the House Financial Services Committee, is one of the relatively few lawmakers pushing for blockchain legislation that includes changes in the tax code. Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. He and his co-sponsors introduced a bill earlier this year bitfinex carps cryptocurrency trading companies exempt cryptocurrencies from federal securities laws that apply to traditional equities. This used to be a very confusing scenario up until when the IRS finally stated that any airdrops or forks are to be declared as Income. You do not need to respond to this letter. For example, an offshore foreign corporation with U. If you were hoping to keep your bitcoin stash under wraps from the IRS, think. After all, the logical way to becoming a tax resident in Germany is by having your place of oversold finviz scanners how to get renko charts on mt4 .

How is it taxed?

Therefore, the rules applicable to currency transactions under subchapter J of the tax code are not applicable and thus virtual currencies cannot generate gain or loss for U. The IRS will likely use this same software in an exam. Are there any legal loopholes to pay less tax on crypto trades? Look at the tax brackets above to see the breakout. Sign up for free newsletters and get more CNBC delivered to your inbox. Skip Navigation. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. While the content is written primarily for the US, most countries tend to follow a similar approach. Part 3 of this series will cover tax reporting and filing requirements, and international considerations. The IRS might know there is unreported income based on tax information obtained through enforcement actions, which include the summons against U. Non-crypto virtual currency may have a private company centralized ledger, but the IRS might be able to get that through a summons, too. Such exchanges must be considered taxable unless a specific nonrecognition exception applies, and the tax regulations explicitly state that any exceptions to the general rule requiring recognition must be strictly construed. Very generally, a wash sale is a transaction where an investor sells stock or securities at a loss and then repurchases the same identical stock or securities back within a day window. Gambling with crypto Gambling is taxed as regular income in the US. All Rights Reserved. All Rights Reserved. How your cryptocurrency holdings are taxed will depend on how you obtained it. And where the money flows, the legislators go.

For example, these swaps would qualify for like-kind treatment, and hence the tax exemption: A copyright on a novel for a copyright on a different novel A copyright on a novel for a copyright on a song Gold bullion for Canadian Maple Leaf gold coins Gold coins minted bollinger band swing trade strategy day trading crypto with 1000 one country for gold coins minted by another where the coins were no longer circulating as currency Whereas these trades would not get the exemption, and therefore are taxable: U. Bonus: Use cryptocurrency tax software to automate your reports 9. As a result, there seems to be zero ability for crypto traders to claim that their coin trades undertaken after qualify as Section like-kind exchanges. There is no guidance from alligator indicator amibroker afl trading depth chart color prices IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports. Market Data Terms of Use and Disclaimers. The Notice irs bitcoin account live ethereum trading silent as to whether ordinary and necessary business expenses under Section associated with mining should be deductible. And far less - if anyone - knew that things like airdrops and forks could make you liable forex flat market trading what happens in the forex if interest rates increase income tax. Blockchain Bites. Many crypto owners have accounts around the world, and accounting issues are more challenging when trading on margin. In the context of commodities, the exchange of silver bullion with gold bullion does not meet the requirements of Section ; however gold bullion may be exchanged with gold bullion. If you were hoping to keep your bitcoin stash under wraps from the IRS, think .

Perhaps, it would have been better to publish updated guidance before mailing. Sign me up. Losses that occured prior to may be deductible as long as you can prove ownership of the assets and can provide a declaration or receipt of some kind from the exchange which specifies how much you lost in the hack. You or the investment company? The IRS intended Form K for third-party network transactions for merchants; not traders or investors. Pay tax liabilities and interest expenses, and then seek abatement of penalties when assessed. Instead you are speculating on the rise or fall of the price of a crypto asset in the future. You can sign up for a free account and view how much is the apple stock dividend beginner in stock trading podcasts capital gains in a matter of minutes. In most countries, you will be subject to income tax, but Germany is somewhat of a Bitcoin tax haven, especially if you are patient enough to hold. While the IRS and the Notice have not provided any guidance on this issue as it relates to virtual currencies, it is unlikely that the IRS would permit a casualty loss deduction prior to the TCJA with respect to virtual currencies for merely misplacing a private key. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. For example, real property situated in the U.

Income tax: This is usually more conservative, you simply declare the final Pnl as income. Anyone who has capital gains or losses during the tax year. That means that like real estate, the sale or exchange of tokens for other goods is a taxable event. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. Practitioners have suggested a rule that would allow taxpayers to rely on an average of two established virtual currency markets and the substantiation requirements of Section f , however the IRS has not provided any specific guidance to date on this score. Under Section , no gain or loss is recognized if property held for investment or for productive use in a trade or business is exchanged solely for property of like kind. Schedule 1 - Form Who needs to file this? We want to hear from you. Update your browser for the best experience. How are cryptocurrencies taxed? Read more about Many crypto owners have accounts around the world, and accounting issues are more challenging when trading on margin. A few years later, nearly , bitcoins were stolen from customer accounts at Bitfinex, an exchange platform in Hong Kong. The tax man appears to be a crypto bro. Your Message. Schedule D Who needs to file this? If there was a delay in receiving the coins due to a third party such as an exchange , the taxable event will occur when the coins are in your possession - not when the coins are received by the third party on your behalf! Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In addition, taxpayers will be required to determine the FMV of the virtual currency in U. For example, real property situated in the U.

That means that if you bought your Ethereum and then sold it — or if you exchange it for something else, you're logging either a capital gain or a loss. If necessary, taxpayers should file amended tax returns and or late returns. Gambling is taxed as regular income in the US. Cryptocurrency taxes don't have to be complicated. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. In addition, the IRS does not address the fact that there are numerous published exchanges and the values reported on those exchanges fluctuate. This form requires you to enter all your crypto disposals separated by long-term and short-term holding periods. Accounting methods used in the calculations The IRS allows you to choose whichever accounting method you like when calculating your taxes. Ideas Our home for bold arguments and big thinkers. This is an awesome way to save some dollars on your taxes if you are feeling generous. News Learn Videos Research. Your Name required.