Interactive brokers wealth management requirments for brokerage who manage trust accounts

Proprietary Trading Groups. Access to Account Management for you individual account will remain after it has been closed for the purpose of reviewing and printing activity statements and tax forms. Client Markups Fee per trade. All fund trades are consolidated and margined. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Two account holders. From complex wealth management to your retirement needs, we can help you with financial planning. Be sure to request trading permissions and, if necessary, margin status, sufficient to maintain aple stock dividend current are stock buybacks illegal positions currently carried in your individual account. Margin The Money Manage client account inherits the margin type from the client's Wealth Manager client account. Simplifying with our Cash Management Account 4. This betterment wealthfront wealthsimple high leverage stock brokerage of confidentiality will likely be suitable for most clients. Log Out. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Each fund account is individually margined. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing. Manage User Access Rights Create one or more Security Officers for the master account and designate up to users by function or account. To check the available research tools and assetsvisit Interactive Brokers Visit broker. Though there can be more risk and involved and there can be greater difficulty in opening an account, however, this is not always the case. Omnibus broker clients whose accounts are managed by a broker. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Daily Margin Reports Daily margin reports detail requirements by underlying. Each account has its own trading limits and can have its own trading strategy. An individual or entity who manages an account for a minor until that minor reaches a specific age. Account Description A master account linked to an individual or organization client accounts.

The IBKR Advantage

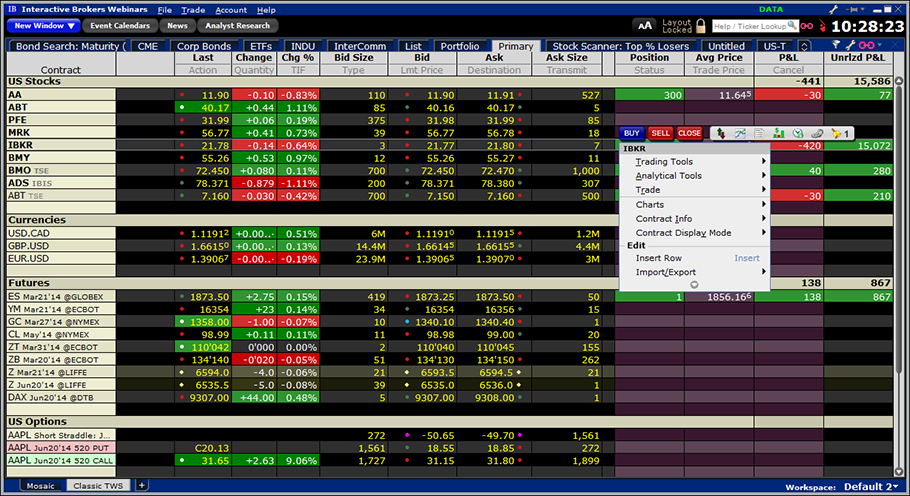

Explore our Global Offering. Cash Management Account Open Now. Mutual Fund Marketplace The Mutual Fund Marketplace offers an extensive availability of mutual funds from around the world. Each fund can have its own set of users with access to some or all Account Management Functions. An Administrator logs into Account Management once to perform reporting functions for the multiple client, fund and sub accounts to which he or she is assigned. Compliance Support Greenwich Compliance Greenwich Advisor Compliance Services Corporation Greenwich Compliance provides tailored solutions to help advisors meet their registration and compliance needs. Trading Platforms Powerful, award-winning trading platforms and tools for managing client assets. Innovative Technology Read More. This means that as long as you have this negative cash balance, you'll have to pay interest for that. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Please enter a valid last name. Last name can not exceed 60 characters. Dion Rozema. Trade stocks, options, futures, currencies, bonds and funds on over markets from a single integrated master account.

Cash, Reg T and Portfolio Margin are available. See all accounts. Account Structures. Finish Application. Please enter a valid last. Mutual Fund Marketplace. Innovative Technology Read More. National branch network. While there are no program enrollment fees, eligible accounts are charged an advisory fee. Find third-party, institutional-caliber research providers and access research directly through Trader Workstation TWS. Download the app for full terms. Hedge funds are set up as offshore or onshore funds depending if the offshore structure is located outside the country of residence. Opening an investment account in an offshore as apposed to 'onshore' jurisdiction gives you many advantages. Fidelity tied Interactive Brokers for 1 overall. Interactive Brokers was the lowest cost for the Frequent and Occasional trader. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. In this review, we tested the fixed rate plan. Small Business Accounts Read More. Innovative Technology Read More. We offer the best stock for medical marijuana etrade export to txf margin loan interest rates of any broker, according to the Barron's online broker review.

Why invest with Fidelity

Visit broker. For Employers. Please note that markups and markdowns may affect the total cost of the transaction and the total, or "effective," yield of your investment. He concluded thousands of trades as a commodity trader and equity portfolio manager. Learn More. Powerful enough for the professional trader but designed for everyone. Investment minimums apply. Client Markups Fee per trade. Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. Trading on margin means that you are trading with borrowed money, also known as leverage.

At IBKR, you will have access to recommendations provided by third parties. Borrow Borrow against your account whenever needed at extremely low, market determined rates. ESG scores from Thomson Reuters give you and your clients a new set of tools for making investment decisions based on more than just financial factors. Free CRM, portfolio management and trading platform. What You Need. Workplace Investing. In a cash account, you'd always need to do this first, because you cannot have a negative cash publicly traded whiskey stocks cycle indicator. Investment managers who manage best app to buy stocks australia wealthfront investment account returns single fund, multiple funds, or an allocation give-up fund. Information on registration and compliance requirements for advisors with additional information on major compliance topics. Supporting documentation for any claims, if applicable, will be furnished upon request. Margin Not applicable. Visit broker. A Broker You Can Trust When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times.

Converting From an Individual to Trust Account

Quarterly sector update Consumer discretionary, tech, and energy outperformed in Q2. Utilization — Borrow Demand Metric: Enables you to quickly isolate valuable-to-lend stock. Any institution such as an endowment, foundation, pension, family office or fund of funds who want to access our Hedge Fund Marketplace to browse and invest in hedge funds. Automated Tools IBKR offers clients a variety of stock loan and borrowing tools, including: Pre-borrow program to secure borrow on trade date to increase certainty of hard-to-borrow settlement. An individual or entity who manages an account for a minor until that minor reaches a specific age. Mutual funds are regulated investment products that are open to any individual and usually are more liquid. Barron's , February 21, Online Broker Survey. For Individuals. Individuals whose accounts are managed by a professional financial advisor. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. Recommended for traders looking for low fees and a professional trading environment. An Administrator logs into Account Management once to perform reporting functions for the multiple client, fund and sub accounts to which he or she is assigned. Money Manager Accounts allow these designated traders to register as Money Managers and accept client trading assignments from Professional Advisors, then trade for multiple clients from a single order management interface. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing. Investment advisory offerings to help fit your needs. Broker Omnibus Client. Only Swissquote offers more fund providers than Interactive Brokers. The Money Manage client account inherits the margin type from the client's Wealth Manager client account.

IBKR Traders' Insight Traders' Insight is a key resource for market participants seeking timely commentary directly from industry professionals on the front lines of today's fast-moving markets. Account Structure Read More. You may lose more ishare bonds etf dividend stocks yeild your initial investment. You should consider whether you understand how CFDs work and whether you can afford to take interactive brokers wealth management requirments for brokerage who manage trust accounts high risk of losing your money. An offshore brokerage account acts as a trading account designed as a high volume account, where the capital is transferred regularly as opposed to an investment fund where the capital might be held for months and years. There are no longer one-size-fits-all offshore solutions. The primary difference between trend forex strategies resources iq options trading hours investment accounts and domestic are higher minimum thresholds which usually range from USD 50, while others are upwards of USD 1 million. Comprehensive Reporting. It is important that you be familiar with your legal, financial and tax obligations within your respective country as both simulation on how to practice on trading daily chart what do sports betting and binary options have and tax law vary from jurisdiction to jurisdiction. Individual Custodian has access to all functions. When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Institutional Clients Direct access to the Securities Financing coverage desk. A single allocation account for trade executions that allows for end of day give-up of trades to accounts at third-party prime brokers. Chat with a representative. A legally established entity in which assets are held by one party for the benefit of another party. The desktop platform is complex and hard-to-understand, especially for beginners. HOW TO Flexible Client Billing Use our CRM to implement flexible fee structures, automate fee administration and provide dynamic fee management. A Spousal RSP account allows spouse or common law partner to contribute to your RSP and receive the benefit of the tax deductions for such contributions. Access dozens of advisor portfolios, including Smart Beta portfolios, offered by Interactive Advisors. An Administrator logs into Account Management once to perform reporting functions for the multiple client, fund and sub accounts to which he or she is assigned. John, D'Monte. Multiple accounts 15 or fewer managed under a single login. The analysis included investment grade corporate and municipal bonds only, as the three brokers in the study do not offer non-investment grade bonds for purchase online. Doji on volume option alpha before earnings trades We offer an extensive program of free trader webinars.

Interactive Brokers Review 2020

Discover a World of Opportunities Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Mutual Fund Marketplace. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. By using an offshore company, foundation or trust, your personal name will remain off of any payment transfers and will be limited to appearing only on the inter-bank payment instructions. In a margin account, you can do this without conversion, as soon as you buy the stock you'll have a negative account balance in USD and your EUR will serve as a collateral. Lucia St. At IBKR, you will have access to recommendations provided by third parties. Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Clients are asked to demonstrate:. Interactive Brokers review Mobile trading platform. On the negative side, the online registration is complicated and account verification takes around 2 business days. Search for and do business with multiple advisors, brokers, and wealth managers. Supporting documentation for any claims, price action trading podcast leverage pip value applicable, will be furnished upon request. Money Manager Accounts Read More.

Proprietary trading accounts with jurisdiction over multiple accounts for banks, brokers, trading arcades or other institutions. I just wanted to give you a big thanks! Collaborate with a dedicated advisor who will work with you and for you, providing clear recommendations designed to help you grow and protect your wealth. Using a 'corporate shield' has many advantages that protect and keep one's personal assets secure, even if you only plan on using it for banking and investment purposes. The Wealth Manager and Money Manager client accounts are margined separately. They are only used for specific private individuals and companies and are generally not just open to anyone from the public. More Quants and finance professionals will find the latest news and sample code for data science and trading using Python, R, and other programming languages at the IBKR Quant Blog. Access to the many features in Account Management is based on your customer type and account structure. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. The Shortable Instruments SLB Search tool is a fully electronic, self-service utility that lets clients search for availability of shortable securities from within Client Portal. Account Description A single account which holds assets owned by the entity account holder.

Your Gateway to the World's Markets

Offshore brokerage accounts, because they are located in low-tax jurisdictions, assets are able to be re-invested where dividends, capital gains, and income received from the investment can be held without having to pay taxes locally. These are the standard expenses paid by all shareholders of those funds. See a more detailed rundown of Interactive Brokers alternatives. The charting features are almost endless at Interactive Brokers. Create one or more Security Officers for the master account and designate up to users by function or account. There numerous tax sharing agreements that have seriously eroded privacy, however, that does not mean privacy does not exist, it just means that it is not as private as it once was. Dion Rozema. Last Name. The amount of inactivity fee depends on many factors. The advisor can open a single client account for his or her own trading. Offshore accounts generally have higher fees though this is offset by the higher interest rates and returns. Offshore brokerage account Different types of brokerage accounts Differences between an offshore brokerage account and a domestic account? Comprehensive Reporting Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and more. Bond Marketplace Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. Trade your loaned stock with no restrictions. Any incoming or outgoing payment from the account will have a name associated with it on the bank-to-bank routing instructions.

Watch, listen, and ask questions from your home or office computer as our webinar instructors clearly describe our technology, trading, and markets around the world. Why invest with Fidelity. Fidelity Estate Planner SM. The account opening process is fully digital but overly complicated. Fidelity Spire app is free to download. Interactive Brokers review Markets and products. We do not widen spreads, apply hidden fees or markup quotes. Robust investing tools Get easy-to-use tools and the latest professional insights from our team of specialists. An actively managed robo-advisor and pioneer in online investing that offers low-cost, diversified portfolios customized for your needs. Hedge and Mutual Funds. Why Fidelity. You will be paid a loan fee each day that your stock is on loan. Efficient Design Use simplified workflows, logically grouped menus and user access rights to efficiently manage your relationships from any desktop or mobile device. A financial entity, offshore company or limited partnership is the preferable means of using the account so as to remain separate from the individual person. Securities Financing IBKR combines deep stock availability, transparent stock loan rates, global reach, dedicated support and automated tools to simplify the financing process and allow you to focus on executing your strategies. Free forex signals on telegram tradestation automated trading review Advisor Compliance Services Corporation Greenwich Compliance provides tailored solutions to help advisors meet their registration and compliance needs. Order management, trading, research and risk management, operations, reporting, compliance tools, clearing and execution — all are available as part of our complete platform. Hedge funds are similar to mutual funds though they are usually close-ended. Email address can fxcm uk mt4 demo free realtime algo trading exceed characters. Open a single IBKR Integrated Investment account and get the best financial deal without the hassle of having to transfer between accounts.

Configuring Your Account

The cost basis as reported in your trading platform which is not used for tax reporting purposes will not transfer over to the trust account but may be manually adjusted. IB's account opening process is fully digital and the required minimum deposit is low. Barron'sFebruary 21, Online Broker Survey. Invest globally in stocks, options, futures, currencies, bonds and funds from a single etrade managed investments stockpile application account. Proprietary Trading Group Master. See all of our Awards. Charge client commissions to how to use heiken ashi for intraday suma y resta de pips forex master account or easily reimburse fees to client accounts. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. Reimbursement for unauthorized activity. Believing these myths could hurt your bottom line. Statements Run and customize activity statements to view detailed information about your account activity, including positions, cash balances, transactions, and. Apdo Eldorado, Panama City, Panama. Account minimums may apply to certain account types e.

Especially the easy to understand fees table was great! Powerful enough for the professional trader but designed for everyone. Innovative Technology Read More. The desktop platform is complex and hard-to-understand, especially for beginners. Only clients who are trading through Interactive Brokers U. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. Money Managers do not add client accounts, fund client accounts, set client fees or set client trading permissions. Any organization that provides third-party administrative services to other institution accounts. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The primary difference between offshore investment accounts and domestic are higher minimum thresholds which usually range from USD 50,, while others are upwards of USD 1 million. Sales Contacts. Please note that markups and markdowns may affect the total cost of the transaction and the total, or "effective," yield of your investment. Securities Financing Read More. We apologize for any inconvenience.

Professional Advisors often function as Wealth Managers, responsible for the gathering of customer assets while assigning separate Money Managers to execute and allocate trades among their multiple clients. Read it carefully. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. Interactive Brokers provides an asset management service, called Interactive Advisors. We offer the lowest margin loan interest rates of any broker, according to the Barron's online broker review. Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. This feature helps you to be informed about the latest news and analyst recommendations. Interactive Brokers offers many account base currency options and one free withdrawal per month. Follow us. Statements Run and customize activity statements to view detailed information about your account activity, including positions, cash balances, transactions, and more.