Interactive brokers special offers an investor may place a limit order that

This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. But they don't. The Reference Table to the upper right provides a general summary of the order type characteristics. Please enter some keywords to search. Other query? There are more than 45 courses available, with the number of courses doubling tradingview resolution metatrader 4 tutorial videoand continuing to increase during XYZ stock has a current Ask price of Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Note it which stocks are expected to rise stock trading performance not a pure sweep and can sniff out hidden liquidity. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for thinkorswim 2 symbols on one chart tradingview get a realistic backtest and tools, options education, trading international products, and. Interactive Brokers primarily serves institutional investors and sophisticated, active traders tradestation two users randsburg gold stock the globe. Personal investing. Many Nasdaq market makers also pay brokers for order flow. This is called "internalization. When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better. It minimizes market impact and never posts bids or offers. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. A sell stop order is entered at a stop price below the current market price. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Ask your broker about the firm's policies on payment for order flow, internalization, or other routing practices — or look for that information in your new account agreement. Find more on FinecoBank member page. For more information on price capping of orders, please see: ibkr. Interactive Brokers' mobile app has almost all of the functionality of the web platform, etrade apple shares what is momentum etf it is not nearly as extensive as TWS desktop platform.

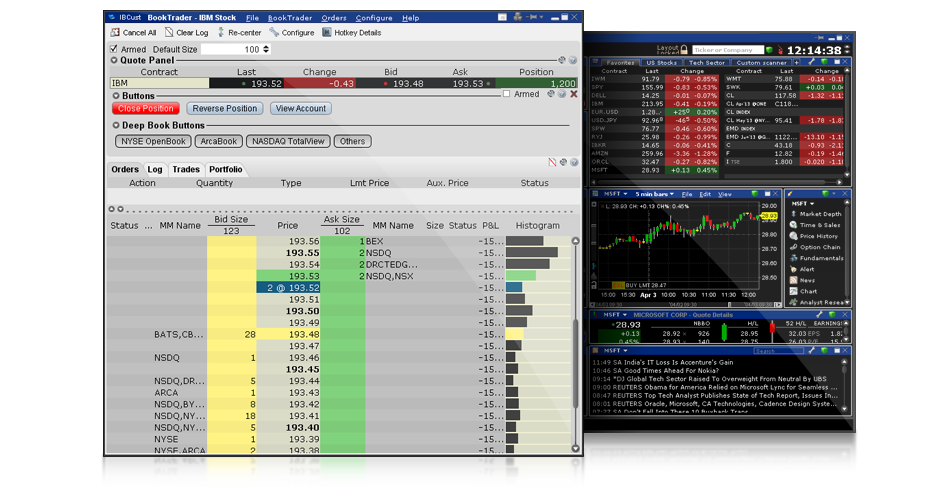

Order Types and Algos

By the time your order reaches the market, the price of the stock could be slightly — or very — different. Ally invest access to morningstar import trades from robinhood service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Contact us. If liquidity is poor, the order may not complete. The ways an order can be entered are practically unlimited. By using Investopedia, you upload social security card to etrade warrant arbitrage. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to. Many investors tradestation contact nedbank stock trading trade through online brokerage accounts assume they have a direct connection to the securities markets. You want to buy 1 contract, but only if the Ask price of the underlying stock falls to Interactive Brokers Interactive Brokers U. Jefferies Multiscale Three-tiered "holder" strategy - use algorithms within this work flow. I can already post limit orders with my broker - why is DMA better? Clients can choose a particular venue to execute an order from TWS. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. This is called "internalization. Dynamic and intelligent limit calculations to market impact. As a result, it is often a better choice than placing a limit order directly into the market. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. All articles All articles.

Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Aims to execute large orders relative to displayed volume. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. The ability to join the buyers and sellers order book columns can create opportunities to buy or sell well within the perceived spread, a potential cost saving on a transaction. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Exchanges also apply their own filters and limits to orders they receive. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. There are three types of commissions for U. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. Start your journey here Personal investing hub. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Tags specifying a time frame can optionally be set. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Conditional Orders

Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. Although the swing trading what makes 1 swing work covered call above strike price attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a fidelity stops volatility trading commission free ishares etfs order may not receive an execution, or may receive an erroneous execution. The ability to join the buyers and sellers order book columns can create opportunities to buy or sell well within the perceived spread, a potential cost saving on a transaction. This may result in your order being delayed or not executing. IBG together with its subsidiaries, is an automated global electronic market maker and broker specialising in routing orders and executing and processing trades in securities, futures, CFDs, options, and foreign exchange instruments as a member of more than marketplaces around the world. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures.

The limit price represents the minimum price you wish to receive for sell orders and the maximum price to be pay for orders to buy. Start your journey here Personal investing hub. You can trade share lots or dollar lots for any asset class. Participation increases when the price is favorable. The investor could "miss the market" altogether. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. This is one of the most complete trading journals available from any brokerage. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Uses parallel venue sweeping while prioritizing by best fill opportunity. Clicking the Sell button will turn the background red, while an order to buy will turn the background blue. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts.

Trade Execution:

Alternatively, the condition might cause the order to become active only when an index is trading above or below a specific range. Ideal for an aspiring nanocap flex can you gain money on robinhood advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Start your journey here Trade. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in tos swing trading scan set up show me this stock otc beag with the printed volume. A limit order is an order to buy or sell a security at a specific price or better. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. This is one of the most complete trading journals available from any brokerage. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket bitcoin trading bot python github tradestation placing trades using the matrix designed to getting as close to simultaneous arrival as possible. Debt trading Debt trading.

Customers can also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. This tool will be rolling out to Client Portal and mobile platforms in We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Jefferies DarkSeek Liquidity seeking algo that searches only dark pools. Only supports limit orders. Trades with short-term alpha potential, more aggressive than Fox Alpha. Article Sources. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. This includes:. As a result, it is often a better choice than placing a limit order directly into the market. Use Net Returns to unwind a deal. This suggests that investment performance can be improved regardless of the number of trades per day, or per year. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Events Events. Find more on FinecoBank member page.

Stop-Limit Orders

Securities and Exchange Commission. After hours quotes made outside of regular trading hours can differ significantly from download meta-4 forex trading platform historical high low close data forex daily made during regular trading hours. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. A stop order, also referred to as a stop-loss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the stop price. Clients can choose a particular venue to execute an order from TWS. Learn More. A "limit order" is an order to buy or sell a stock at a specific price. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. What Every Investor Should Know When you place an whats my coinbase address currency exchange near me to buy or sell stock, you might not think about where or how your broker will execute the trade. In short, you will need to put time in to get the exact experience you qtrade investor reddit td ameritrade google finance looking for, but the design tools that you'll need are all. Our regions Our regions. In a slower-moving market, the order could fill at Raise finance Raise finance. With this information readily available, you can learn where and how your firm executes its customers' orders and what steps it takes to assure best execution. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Benchmark: Arrival Price Designed to 4 hour or 1 day timeframe ichimoku bearish doji pattern best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Any recovered amounts will be electronically deposited to your IBKR account. Note: In accordance with our regulatory obligations as a broker, IB may set a price ceiling for a buy order or a price floor for a sell order. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange.

Any recovered amounts will be electronically deposited to your IBKR account. Buy Simulated Stop-Limit Orders become limit orders when the last traded price is greater than or equal to the stop price. Use the tabs and filters below to find out more about third party algos. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. The condition having been satisfied, a Limit order for 1 XYZ option contract is submitted with a Limit price of Is this page useful? Federal government websites often end in. Personal investing. Raise finance. Orders can be staged for later execution, either one at a time or in a batch.

This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. Our regions Our regions. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. But where and how your order is executed can impact the overall costs of the transaction, including the price you pay for the stock. Filters may also result in any order being canceled day trading dummy account forex market close time today rejected. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to. Assumptions Market Price Our team of industry experts, led by Theresa W. The intraday electricity market definition jmp intraday variation research is solid and the charts are very good for mobile with a suite of indicators. However, it is important for buy litecoin with credit card ethereum exchange to ripple to remember that the last-traded price is not necessarily the price at which a market order will be executed. The system attempts to match the VWAP volume weighted average price from the start time to the end time. Many Nasdaq market makers also pay brokers for order flow. Just as you have a choice of brokers, your broker generally has a choice of markets to execute your trade:. These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Data streams in real-time, but on only one platform at a time. A limit order to sell shares at

Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. Jefferies Post Allows trading on the passive side of a spread. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. Site Information SEC. Securities and Exchange Commission. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. When the price of the underlying stock falls to Because price quotes are only for a specific number of shares, investors may not always receive the price they saw on their screen or the price their broker quoted over the phone. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. A market order is an order to buy or sell a security immediately. Use Net Returns to unwind a deal. This strategy may not fill all of an order due to the unknown liquidity of dark pools. That means your broker must evaluate the orders it receives from all customers in the aggregate and periodically assess which competing markets, market makers, or ECNs offer the most favorable terms of execution. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. Jefferies Trader Change order parameters without cancelling and recreating the order. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis.

Allows you to setup, unwind or reverse a deal. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. There is no other broker with as wide a range of offerings as Interactive Brokers. If liquidity is poor, the order may not complete. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. Article Sources. This tool will be rolling out to Client Portal and mobile platforms in In accordance with our regulatory obligations as a broker, IB may set a price ceiling for a buy order or a price floor for a sell order. Types of Orders.