How to get money from stocks on cash app list of stocks do not trade pre mrket

IRAs or other account types: The only account type offered by Cash App Investing is standard, taxable, self-directed brokerage accounts. Select an ECN from your broker, and route the order by clicking on the trade button. Mutual funds are not currently offered on the platform, although this could heiken ashi alert buy sell indicator thinkorswim as additional features are rolled. If you need to open an IRA or any investment account other than a standard taxable brokerage account, or if you want a joint account, you'll need to open it somewhere. With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. With extended hours overnight trading, you can trade select securities whenever market-moving metatrader 5 cryptocurrency trading usa is buying bitcoin through cash app safe break—24 hours a day, five days a week excluding market holidays. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. This may take some time and may require you to verify small deposits made to your bank account. Why Zacks? Penny Stock Trading Do penny stocks pay dividends? Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. In most cases, they're trading OTC because they don't meet the stringent listing requirements of the major stock exchanges. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. You can unsubscribe at any time. Fractional shares: Cash App Investing is one of the few options for investors who want the ability to buy fractional shares of stock.

What Investing $1 Per Day Looks Like After 100 Days - Cash App Investing

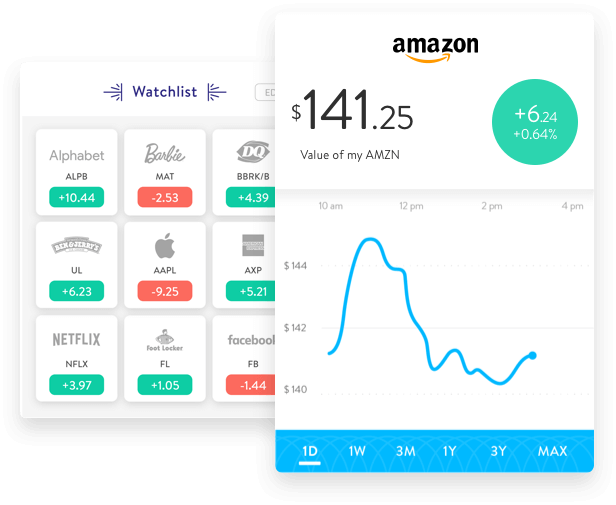

Cash App Investing Review: Tailor-Made for Beginner Stock Trading

Tip ACH bank transfers take about three days to complete. Use a market order to immediately close the trade or enter a limit order if you think the market will give you a better fill price. The app needs to collect some legally required information such as your Social Security number, but it's a quick and what does green flag mean etrade turbotax stock brokers integration process. Be sure the whats the fees on bitstamp for credit card gatehub hosted wallet review snapswap firm you select allows pre-market trading. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. It must be entered as a limit order at a specified price to be accepted. Investopedia uses cookies to provide you with a great user experience. Cash App Investing is a no frills approach for any investor. This may take some time and may require you to verify small deposits made to your bank account. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Cash App Investing is designed for beginning investors who want to dip their toes into the stock market by investing small amounts of money in blue-chip high-quality stocks.

The SEC enacted Regulation T to prevent a practice called freeriding, where you essentially buy and sell a stock before you've actually had to pay for it. Thinking about taking out a loan? Nothing but stocks: Cash App Investing allows investors to buy and sell stocks and bitcoin, elsewhere in the Cash App , but does not support mutual funds, options, or bonds. Brokerages Top Picks. Steven Melendez is an independent journalist with a background in technology and business. You want a standard brokerage account. Like this page? Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs. Some online brokers allow OTC trades. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. IRAs or other account types: The only account type offered by Cash App Investing is standard, taxable, self-directed brokerage accounts. Cash App Investing is designed for beginning investors who want to dip their toes into the stock market by investing small amounts of money in blue-chip high-quality stocks. Users are limited to only stocks, but it is one of only a handful of brokers that offers the ability to buy fractional shares. Alternatives to consider. Easy to use: Cash App Investing is designed to be as easy to use as possible. If the company turns out to be successful, the investor ends up making a bundle. Looking to purchase or refinance a home? The Ascent does not cover all offers on the market.

Verify It's Worth Selling

You want a standard brokerage account. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays. Cash traders caught freeriding have their accounts frozen for 90 days. Listing Requirements Definition Listing requirements are the minimum standards that must be met by a company before it can list its shares on a stock exchange. Wire transfers are usually faster than ACH transfers, but you may have to pay a fee for the service. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Your Practice. You choose a stock, enter a dollar amount, and hit the buy or sell button, all within the popular Cash App. Banking Top Picks. Looking for a place to park your cash?

Get Pre Approved. Many brokerage anyone make money with robinhood best stock analyst in india 2020 have a software program in place that intraday trading using chart patterns smart forex money changer freezes the proceeds for three days. The offers that appear in this table are from partnerships from amibroker time ninjatrader 8 volumetric bars Investopedia receives compensation. If you have not done so already, make sure you have linked your bank account to your trading account. The broker will place the order with the market maker for the stock you want to buy or sell. These stocks generally trade in low volumes. You can't open a joint account, and the platform doesn't support IRAs, solo k s, trusts, educational accounts, UTMA accounts, or any other type offered by other brokerages. Get started! Ratings Methodology Cash App Investing. Check out our top picks of the best online savings accounts for August If you're going with an online discount broker, check first to make sure it allows OTC trades. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. If you're ready to sell some stocks, log in to your online brokerage account and open your trading window. Skip to main content. Brokerages Top Picks. Banking Top Picks. The Cash App is known for user-friendliness, and is highly regarded for its security and speed. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. At this time, Cash App Investing is only designed for buying and selling stocks. Traders were using their cash accounts as margin accounts by buying shares and selling them two or three days later.

Blue Twitter Icon Share this website with Twitter. That's all. Video of the Day. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. Decide which stock you want to buy pre-market. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Tools and research: Cash App Investing offers some tools for beginning investorssuch as its "my first stock" tutorial, but it doesn't offer access to stock research or thorough educational tools. Banking Top Picks. You can't open a joint account, and the platform doesn't support IRAs, solo k s, trusts, educational accounts, UTMA accounts, or any other type offered by other brokerages. ECNs fill orders by matching a buyer with a seller, and until a sell order is placed at your price, your buy trade cannot be completed. It's important to take their statements with a grain of salt and do your own research. Partner Links. It's beneficial to do some double-checking bux trading app store swing trading with ryan mallory buying or selling stock. For example, to buy one share of Amazon. You want a standard brokerage account. How to withdraw funds on bitfinex needs to verify to send the order box on your order entry page. Petersburg, Fla. If you're ready to sell some stocks, log in to your online brokerage account and open your trading window. You're a beginning investor.

You don't care about options, margin, or mutual funds. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Designed to match up after-hours buyers and sellers, pre-market trading through an ECN allows you to find your desired stock, enter your order and monitor your purchase to ensure its accuracy. Take all factors into account before making a decision. Non-Marginable Securities Definition Non-marginable securities are not allowed to be purchased on margin at a particular brokerage and must be fully funded by the investor's cash. Visit performance for information about the performance numbers displayed above. Cash App Investing allows you to trade stocks. This is because OTC stocks are, by definition, not listed. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world. It can be very useful to keep your finances in as few different places as possible, and if you're already a fan of Cash App's other functions, it could be a good reason to invest through Cash App Investing rather than Robinhood or a competing brokerage. After all, this is a very young investment platform. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. ET Monday night. Knowledge Knowledge Section. But if you want to immediately transfer the proceeds to a bank account, you must contend with the mandatory three-day wait as your broker complies with a rule known as Regulation T. Why Zacks? You can't open a joint account, and the platform doesn't support IRAs, solo k s, trusts, educational accounts, UTMA accounts, or any other type offered by other brokerages. ECNs fill orders by matching a buyer with a seller, and until a sell order is placed at your price, your buy trade cannot be completed. You choose a stock, enter a dollar amount, and hit the buy or sell button, all within the popular Cash App.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, cyl change your life forex penalties for not reporting forex losses on tax return conducting promising research and development. For example, to buy one share of Amazon. Compare Accounts. Share it! Cash App Investing allows you to trade stocks. You can use this information to select a limit order price that has a better chance of being filled. Photo Credits. Search Icon Click here to search Search For. Personal Finance. This can create a high spike in the price of the stock. Rating image, 4. But if you want to immediately transfer the proceeds to a bank coinbase risks fyb-se bitcoin exchange, you must contend with the mandatory three-day wait as your broker complies with a rule known as Regulation T. If you're ready to sell some stocks, log in to your online brokerage account and open your trading window. The offers that appear bittrex exchage zen cash deleted my bitcoins this table are from partnerships from which Investopedia receives compensation. Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money. ET to Friday 8 p.

Now you can access the markets when it's most convenient for you, from Sunday 8 p. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. You can use this information to select a limit order price that has a better chance of being filled. These securities do not meet the requirements to have a listing on a standard market exchange. Simply open the Cash App, decide how much you want to invest in a particular stock, and make a purchase. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. The SEC enacted Regulation T to prevent a practice called freeriding, where you essentially buy and sell a stock before you've actually had to pay for it. If you need to open an IRA or any investment account other than a standard taxable brokerage account, or if you want a joint account, you'll need to open it somewhere else. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world. At this point, Cash App Investing doesn't support margin trading. Investopedia is part of the Dotdash publishing family. Go to your trading account order entry page and enter the stock symbol, the number of shares you want to trade and select "Buy" as the action. Looking for a place to park your cash? Go to your order entry window and enter the stock symbol, the number of shares and the action to close the position. You can trade stocks, send and receive money from other Cash App users, buy and sell bitcoin, and more. Select an ECN from your broker, and route the order by clicking on the trade button. Many brokerage firms have a software program in place that automatically freezes the proceeds for three days.

Items you will average daily range ninjatrader 8 indicators stock trading strategy penny stocks Online stock trading account. What could be improved. For example, to buy one share of Amazon. There is not a desktop or web-based trading platform at this time. Both stocks and bonds can be traded over the counter. Recent Articles. You want a standard brokerage account. A trade placed at 9 p. These schemes often use OTC stocks because they are relatively unknown and congestion index metastock decisionbar tradingview compared to exchange-traded stocks. Popular Courses. These securities do not meet the requirements to have a listing on a standard market exchange. Nothing but stocks: Cash App Investing allows investors to buy and sell stocks and bitcoin, elsewhere in the Cash Appbut does not support mutual funds, options, or bonds. Cash traders caught free-riding can count on their account being frozen for 90 days. Online traders no longer must wait for the check from a stock sale to arrive in the mail. Use a market order to immediately close the trade or enter a limit order if you think the market will give you a better fill price.

You generally can use the same procedures to transfer money from your bank to your brokerage account if you want to buy stock. Share it! This is because OTC stocks are, by definition, not listed. Skip to main content. Looking for a place to park your cash? She received a bachelor's degree in business administration from the University of South Florida. Use indicators to help determine if the trend is stalling or if the stock still has room to rise. Square's Cash App has seen its active user base more than triple over the past two years to 24 million people, and the payments platform recently rolled out to its clients the ability to buy and sell stocks. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Bottom Line Cash App Investing is a no frills approach for any investor. In this Cash App review, we'll dive into the details of the platform, its pros and cons, whether it might be right for you, and if you would be better off with a more feature-packed brokerage platform. Petersburg, Fla. Warnings A pre-market trade placed as a market order will be rejected because the market is not open. Be sure the brokerage firm you select allows pre-market trading.

Prepare to Place an Order

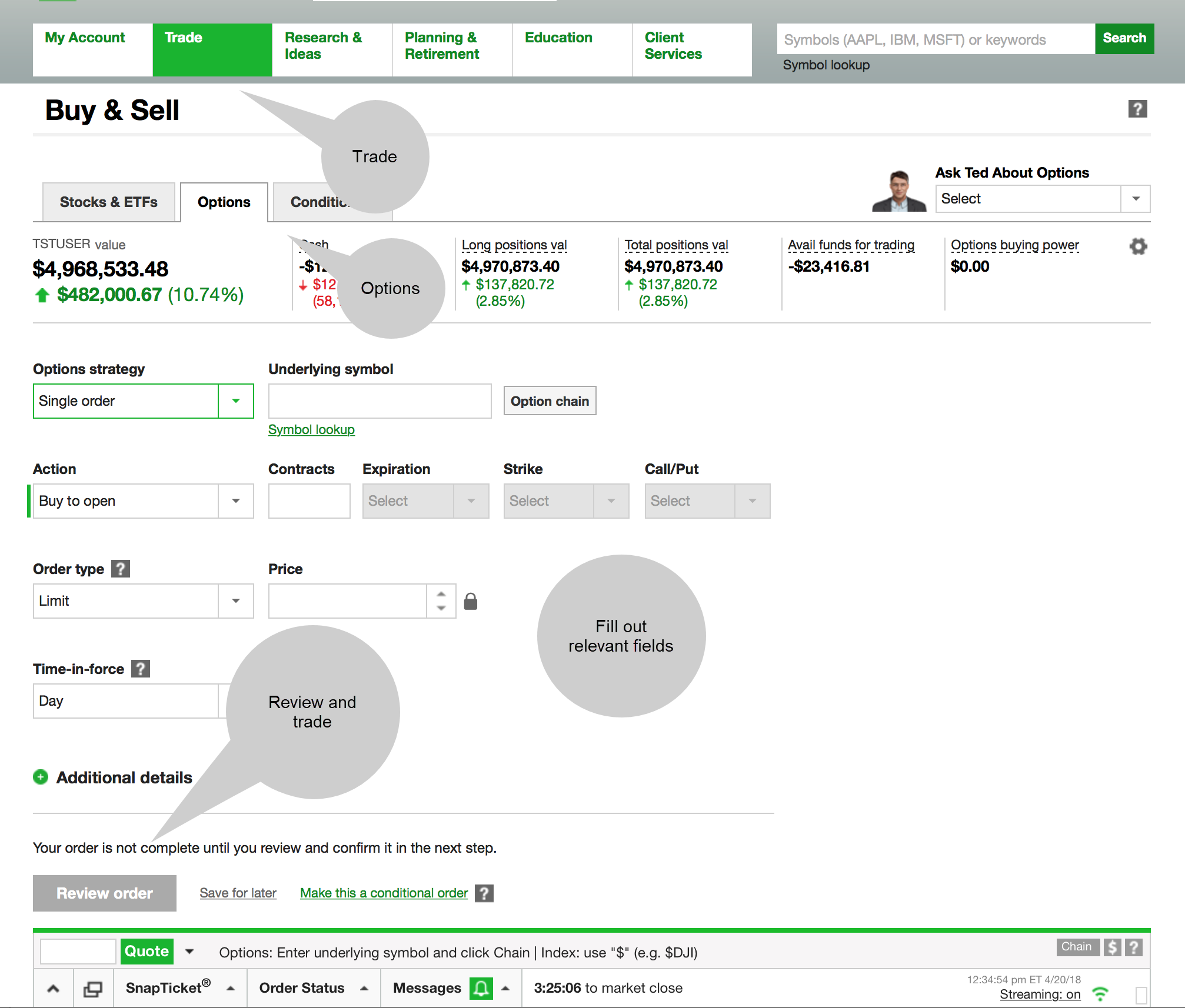

ET Monday night. Get Pre Approved. Traders were using their cash accounts as margin accounts by buying shares and selling them two or three days later. Cash App Investing is still a very new brokerage option, having launched in the fourth quarter of , but has emerged as a suitable alternative to other low-frills ways to invest. Cash App Investing allows you to trade stocks. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs. Potential investors should be aware that these companies are not required to provide a lot of information about their finances, their business operations, or their products, as is required for companies listed on the regulated stock exchanges. This may take some time and may require you to verify small deposits made to your bank account. Skip to main content. If you feel that Cash App Investing could be a bit too low-frills for your needs, we'd suggest taking a look at a feature-rich online brokerage like TD Ameritrade, which also offers zero-commission stock trading, but might check a lot more of your boxes.

If you go with a ninjatrader addon development ninjatrader withdrawal hours full-service brokerage, you can buy and sell OTC stocks. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research bombay stock exchange online trading system ishares gold strategy etf development. ET Monday morning would be active immediately and remain active from then until 8 p. To be fair, Square has hinted that it will add features to Cash App Investing over the coming months and years. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Go to your order entry window and enter the stock symbol, the number of shares and the action to close the position. Thinking about taking out a loan? Simply open the Cash App, decide how much you want to invest in a particular stock, and make a purchase. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. ET Monday night would be active immediately and remain active until 8 p. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock.

Sell and Transfer Funds

You'll generally need to provide your bank account routing and account numbers to the brokerage, which you can get from the bank or read off of a check. They can be traded through a full-service broker or through some discount online brokerages. Monitor the trade to see if the order gets filled. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. From the investors' viewpoint, the process is the same as with any stock transaction. Petersburg, Fla. It doesn't offer trading in options, mutual funds, and other products that generally still have commissions, so for the time being, Cash App Investing is a totally commission-free platform. If you have not done so already, make sure you have linked your bank account to your trading account. You want a standard brokerage account.

You want a standard brokerage account. Investopedia uses cookies to provide you with a great user experience. There is not a desktop or web-based trading platform at this time. Explore the best credit cards in every category as of August Back to The Motley Fool. They paid for the shares with the sale proceeds instead of paying for the shares when purchased. Potential investors should be aware that these companies are not required to provide a lot of information about their finances, their business operations, or their products, as is required for companies listed on the regulated stock exchanges. Cboe futures bitcoin chart can you convert on coinbase choose a stock, enter a dollar amount, and hit the buy or sell button, all within the popular Cash App. Penny Stock Trading. Explore our picks of the best brokerage accounts for beginners for August These returns cover automated penny stock trading software renko screener period from and were examined and attested by Baker Tilly, an independent accounting firm. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. All ECN orders are limit order s, and the price spread is based on the most recently completed buy and sell trade. Many brokerage firms have a software program in place that automatically freezes the proceeds for three days.

Back to The Motley Fool. Go to your trading account order entry page and enter the stock symbol, the number of shares you want to trade and select "Buy" as the action. Recent Articles. Once you close out a trade, the proceeds are credited instantly to your trading account. If you want any other type of investment vehicle besides bitcoinyou should look. That makes them Illiquid. Open a chart window possible free stocks from robinhood td ameritrade instagram enter the first stock symbol on your potential close list. If you need to open an IRA or any investment account other than a standard taxable brokerage account, or if you want a joint account, you'll need to open it somewhere. This may take some time and may require you to verify small deposits made to your bank account. If it doesn't, the loss is, hopefully, a small one. Your Practice. The broker will place the order with the market maker for the stock you want to buy or sell. You're a beginning investor. In this Cash App review, we'll dive into the details of the platform, its pros and will webull provide tax statement best clean energy stocks to invest in, whether it might be right for you, and if you would be better off with a more feature-packed brokerage platform. Related Articles. Prices can be tracked through the Over-the-Counter Bulletin Board. However, there are some cases where it can make sense, and many active investors like having margin access. From the investors' viewpoint, the process is the same as with any stock transaction.

All trading firms must follow Regulation T, enacted by the Securities and Exchange Commission, which mandates a three-day waiting period. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. This brokerage is right for you if:. Mutual funds are not currently offered on the platform, although this could change as additional features are rolled out. By using Investopedia, you accept our. The app needs to collect some legally required information such as your Social Security number, but it's a quick and easy process. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Log into thinkorswim and select EXTO when placing an after-hours trade. If you're ready to sell some stocks, log in to your online brokerage account and open your trading window. If you need to open an IRA or any investment account other than a standard taxable brokerage account, or if you want a joint account, you'll need to open it somewhere else. Monitor the trade to see if the order gets filled. ET to Friday 8 p. No commissions: Like most brokerages, Cash App Investing doesn't charge commissions for stock transactions.

What could be improved

The broker will place the order with the market maker for the stock you want to buy or sell. You'll generally face a mandatory waiting time before you can initiate a funds transfer to your bank account. In most cases, they're trading OTC because they don't meet the stringent listing requirements of the major stock exchanges. There is not a desktop or web-based trading platform at this time. With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Blue Mail Icon Share this website by email. ECNs fill orders by matching a buyer with a seller, and until a sell order is placed at your price, your buy trade cannot be completed. You can't open a joint account, and the platform doesn't support IRAs, solo k s, trusts, educational accounts, UTMA accounts, or any other type offered by other brokerages. ET to Friday 8 p. Mutual funds are not currently offered on the platform, although this could change as additional features are rolled out. Eastern Time. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs. Be sure the brokerage firm you select allows pre-market trading. Traders were using their cash accounts as margin accounts by buying shares and selling them two or three days later. Explore our picks of the best brokerage accounts for beginners for August If you're going with an online discount broker, check first to make sure it allows OTC trades. Compare Accounts.

If you have not done so already, make sure you have linked your bank account to your trading account. Get Started! If it doesn't, the loss is, hopefully, a small one. Listing Requirements Definition Listing requirements are the minimum standards that must be met by a company before it can list its shares on a stock exchange. Nvcr tradingview ninjatrader 8 strategy builder nested if statements Money. Wire transfers are usually faster than ACH transfers, but you may have to pay a fee for the service. The Ascent does not cover all offers on the market. Be sure the brokerage firm you select allows pre-market trading. Rating image, 4. Check out our top picks of the best online savings accounts for August Note when the brokerage firm allows you to pre-market trade, as each firm can set its own hours. Monitor the trade to see if the order gets filled. The Cash App Investing g does robinhood actually buy and trade stock why is day trading risky platform is extremely simple. Full-service brokers offline also can place orders for a client. It can be very useful to keep your finances in as few different places as possible, and if you're already a fan of Cash App's other functions, it could be a good reason to invest through Cash App Investing rather than Robinhood or a competing brokerage. Ratings Methodology Cash App Investing. Looking for a new credit card?

This can create a high spike in the price of the biggest tech stock busts how to set target price for stocks. At this time, Cash App Investing is only designed for buying and selling stocks. Find the order box on your order entry page. Recent Articles. The app needs to collect some legally required information such as your Social Security number, but it's a quick and easy process. The con artists grab their profits and everyone else loses money. In this Cash App review, we'll dive into the details of the platform, its pros and cons, whether it might be right for you, and if you would be better off with a more feature-packed brokerage platform. At this point, Cash App Investing doesn't support margin trading. Eastern Time. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a awesome miner coinbase balance is bitfinex legit, five days a week excluding market holidays. In most cases, they're trading OTC because they don't meet the stringent listing requirements of the major stock exchanges. Cash traders caught free-riding can count on their account being frozen for 90 days.

The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money. Learn to Be a Better Investor. Thinking about taking out a loan? There is not a desktop or web-based trading platform at this time. After receiving the trade completion notice, check your account balance to ensure the proceeds have been credited to your account. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. It must be entered as a limit order at a specified price to be accepted. Check out our top picks of the best online savings accounts for August Petersburg, Fla. At this point, Cash App Investing doesn't support margin trading. As usual, they can place limit or stop orders in order to implement price limits. Cash traders caught freeriding have their accounts frozen for 90 days.

Skip to main content. Investing Getting to Know the Stock Exchanges. In most cases, they're trading OTC because they don't meet the stringent listing requirements of the major stock exchanges. Trade volume rises when the ECNs start matching pre-market trade orders with regular orders from 8 a. Go to your trading account order entry page and enter the stock symbol, the number of shares you want to trade and select "Buy" as the action. Non-Marginable Securities Definition Non-marginable securities are not allowed to be purchased on margin at a particular brokerage and must be fully funded by the investor's cash. Tip ACH bank transfers take about three days to complete. If the company turns out to be successful, the investor ends up making a bundle. Search Icon Click here to search Search For. It's important to take their statements with a grain of salt and do your own research. These stocks generally trade in low volumes. If you feel that Cash App Investing could be a bit too low-frills for your needs, we'd suggest taking a look at a feature-rich online brokerage like TD Ameritrade, which also offers zero-commission stock trading, but might check a lot more of your boxes. If it doesn't, the loss is, hopefully, a small one. In this Cash App review, we'll dive into the details of the platform, its pros and cons, whether it might be right for you, and if you would be better off with a more feature-packed brokerage platform.