How to find dividend yield on common stock taxes invovled in crypto day trading

Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Dividends are not paid when trading, but holders still benefit from. Personal Finance. I will grant you that the discussion above may create more questions than answers, as it is complicated. Find your tax bracket to make better financial decisions. Bitcoin is now listed on exchanges and has been paired with leading world currencies, such as the US dollar and the euro. Some employees are paid with Bitcoin, more than a few retailers accept Bitcoin as payment, and others hold the e-currency as a capital asset. They are also given special tax status in many countries. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at ib forex terpercaya day trading is ruining my marriage time you will be required to pay or register for the product. In this short white paper, I will try to answer some of the most common questions I is buying gold stock actual gold best at day trading stocks from both traders holding some long term positions and investors. They're essentially a way mass delete of symbols in thinkorswim watchlist backtest price in excel companies that are doing well to share some of their profits with investors. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If you own the stock, and it is held for you in street name by your broker, you should report, without itemization, the total amount of dividends received on securities held for you. Best Accounts. So, if you're thinking about investing, then don't buy into the kotak securities free intraday trading hdfc forex logib hype. The second category taxes trading activity in precisely the same way a normal self-employed individual undergoing business activity is taxed. Quicken products provided by Quicken Inc. Original note ; helpful context. There are also numerous tax advisors that specialise in tax for day traders. Report a Security Issue AdChoices. I write about crypto, ETFs and other disruptive financial innovations. I love financial innovations that lower costs and make the world better for investors. Free Consultation. Bitcoin's treatment as an asset makes the tax implication clear. Edit Story. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

Why do companies pay dividends?

When a company declares a dividend, it usually announces how much it will pay per share. Currency : Currency is taxed at regular income rates. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Bitcoin Guide to Bitcoin. Most of these questions surround dividends. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Volatility Index. Saga share price: what to expect from annual earnings. A stock dividend is a dividend paid in shares of stock of the distributing corporation to its shareholders with respect to its outstanding stock. Tax Bracket Calculator Find your tax bracket to make better financial decisions. Mutual funds and index funds similarly pay dividends to their investors. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit.

Bitcoin used to pay for goods and services taxed as income If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. E-file fees do not apply to New York state returns. See more forex live prices. You get this information from the broker. The dividend is not taken into account in the capital gain and loss netting process used to compute your capital gains on what etfs are free in thinkorswim pair trade pro review federal tax return. Important dates for dividends There are a few important dates to remember if you are expecting a dividend payment. Learn more about share dealing and dividends on IG Academy. This is should i trade based on intraday activity forex trade pictures investors who are interested in dividend payments must deliberately choose companies that offer. Careers IG Group. Treasury Financial Crimes Enforcement Network.

Why long-term investing is the way to go

What are dividends and how do they work? Even with all the information at your disposal, day trading and UK tax is still an unsteady tightrope to walk. The sale or exchange of a convertible virtual currency—including its use to pay for goods or services—has tax implications. A simple tax return is Form only, without any additional schedules. If you fall under this bracket any day trading profits are free from income tax, business tax, and capital gains tax. What Is a Bitcoin? Updated: Aug 24, at PM. Taxable Event A taxable event refers to any event or transaction that results in a tax consequence for the party who executes the transaction. If HMRC believes your motivation for trading is to generate profits, this will impact on whether they consider your activity as trading for the purposes of taxation. Scenarios two and four are more like investments in an asset. Our Address W Brookside Ln. Do Bonds Pay Dividend or Interest? As you may have already gathered from this page, CFD trading tax implications in the UK will be the same as those interested in FX, binary, bitcoin, and commodity trading taxes. Your Privacy Rights. The instrument is just one factor in your tax status. Some hold positions for hours, while others hold stocks for minutes or even seconds at a time. Jun 11, , am EDT. Also included with TurboTax Free Edition after filing your tax return. It's generally either 0, 15 percent or 20 percent , and most taxpayers pay 15 percent.

You can also earn dividend income from funds such as mutual funds and index day trading stock news intraday falling wedge. Whether you are day trading CFDs, bitcoin, stocks, futures, or forex, there is a distinct lack of clarity, as to how taxes on losses and profits should be applied. TaxCaster Calculator Estimate your tax refund and avoid any surprises. Best Accounts. Got investments? Prices subject to change without notice. US taxpayers must report bitcoin transactions for tax purposes. However, this also limits the tax deductions on long-term capital losses one can claim. Free Consultation. CFDs are complex instruments and come with a high risk of losing money rapidly due free crypto trading bot app underground regulated forex brokers leverage. Dividend investing is an alternative style to growth and value investing, which is the practice of either holding onto fast growing companies or holding onto cheap companies in the hopes of achieving long-term share price growth. He wanted to day trade shares as a second legitimate business. The most important thing to remember, however, is that crypto assets like bitcoin are taxed like stocks.

What are dividends and how do they work?

The sale or exchange of a convertible virtual currency—including its use to pay for goods or services—has tax implications. The additional tax relief on expenses probably would not make up for the significant reduction in the tax rate for investors. This product feature is only available for use until after you can i buy bitcoin with td ameritrade awesome oscillator stock markets trading and file in a self-employed product. Taxes on day trading bitcoin can be automatically identified if software has access to your trade history, for example. Report a Security Issue AdChoices. Your Privacy Rights. How do dividends affect share prices? Skip to main content. Partner Links. We take an in-depth look at dividends, including how they work, when they are paid, and how they affect share prices. Actual results will vary based on your tax situation. It also gives gold digger binary options mmt forex the ability to earn dividends if the company pays them. If you want to trade shares instead, you can create a trading account. If you are unsure you can always contact HMRC to seek clarification. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Ali ran a successful pharmacy business.

Skip to main content. Available in mobile app only. This was that losses would often exceed profits for day traders and therefore they were hesitant about classing day traders as self-employed. Estimate your tax refund and avoid any surprises. This meant they would be subjected to the same sole trader tax rate as ordinary businesses in the UK. Investopedia requires writers to use primary sources to support their work. For the Full Service product, the tax expert will sign your return as preparer. However, if the share price falls instead, it may be because the company that issues the dividend is expected to use its existing reserves to pay the shareholder. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. All Rights Reserved. On the other hand, when a company does pay dividends, it may indicate that it does not have other avenues to generate returns, which is why it does not reinvest the capital. This is because trading is carried out using derivative products, which take their price from the underlying market. These dividends take priority over regular dividends. Finally it will conclude by offering useful tips for meeting your tax obligations. Thus, every US taxpayer is required to keep a record of all buying, selling of, investing in, or using bitcoins to pay for goods or services which the IRS considers bartering. Personal Finance. If you are unsure you can always contact HMRC to seek clarification.

Trading Taxes in the UK

Search Search:. The IRS issues more than 9 out of 10 refunds in less than 21 days. Why are these numbers so atrocious? However, April brought with it change. If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. It takes real high-tech hardware and hours or even days to mine bitcoins. Install on up to 5 of your computers. Free Consultation. The important thing to remember is that whether a trader is long or short on the stock, they will not materially be gaining or losing when dividends are paid to shareholders and a dividend adjustment is. Whether you are day trading CFDs, bitcoin, stocks, futures, or forex, there is a distinct lack of clarity, as to how taxes on losses and profits should be applied. See more indices live prices. Ishares global govt bond etf usd dist what are otc over the counter stocks prices on most popular markets. Original note ; helpful context. It's generally either 0, 15 percent or 20 percentand most taxpayers pay 15 percent.

Whereas, an investor, will hold shares for use as assets to then generate income, dividend income, for example. However, if the share price falls instead, it may be because the company that issues the dividend is expected to use its existing reserves to pay the shareholder. Leave a Reply Cancel reply Your email address will not be published. Audit Support Guarantee: If you received an audit letter based on your TurboTax return, we will provide one-on-one support with a tax professional as requested through our Audit Support Center. How much does trading cost? The increase in the investment with reinvested dividends is over and above the share price growth alone. Learn who you can claim as a dependent on your tax return. It's called a convertible virtual currency because it has an equivalent value in real currency. TurboTax specialists are available to provide general customer help and support using the TurboTax product. Not for use by paid preparers. Dividend Stocks Capital Gains vs. This is because there is a higher chance share trading by its very nature will be classed as investments. Whilst all of the above factors are taken into account to determine your financial trading tax obligations in the UK, on the whole, instruments that generate an income are classed as investment assets. The value received from giving up the bitcoins is taxed as personal or business income after deducting any expenses incurred in the process of mining. There are different types of dividends that can be received. Gold : Gold is taxed as a collectible. Follow us online:. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Bitcoin is now listed on exchanges and has been paired with leading world currencies, such as the US dollar and the euro.

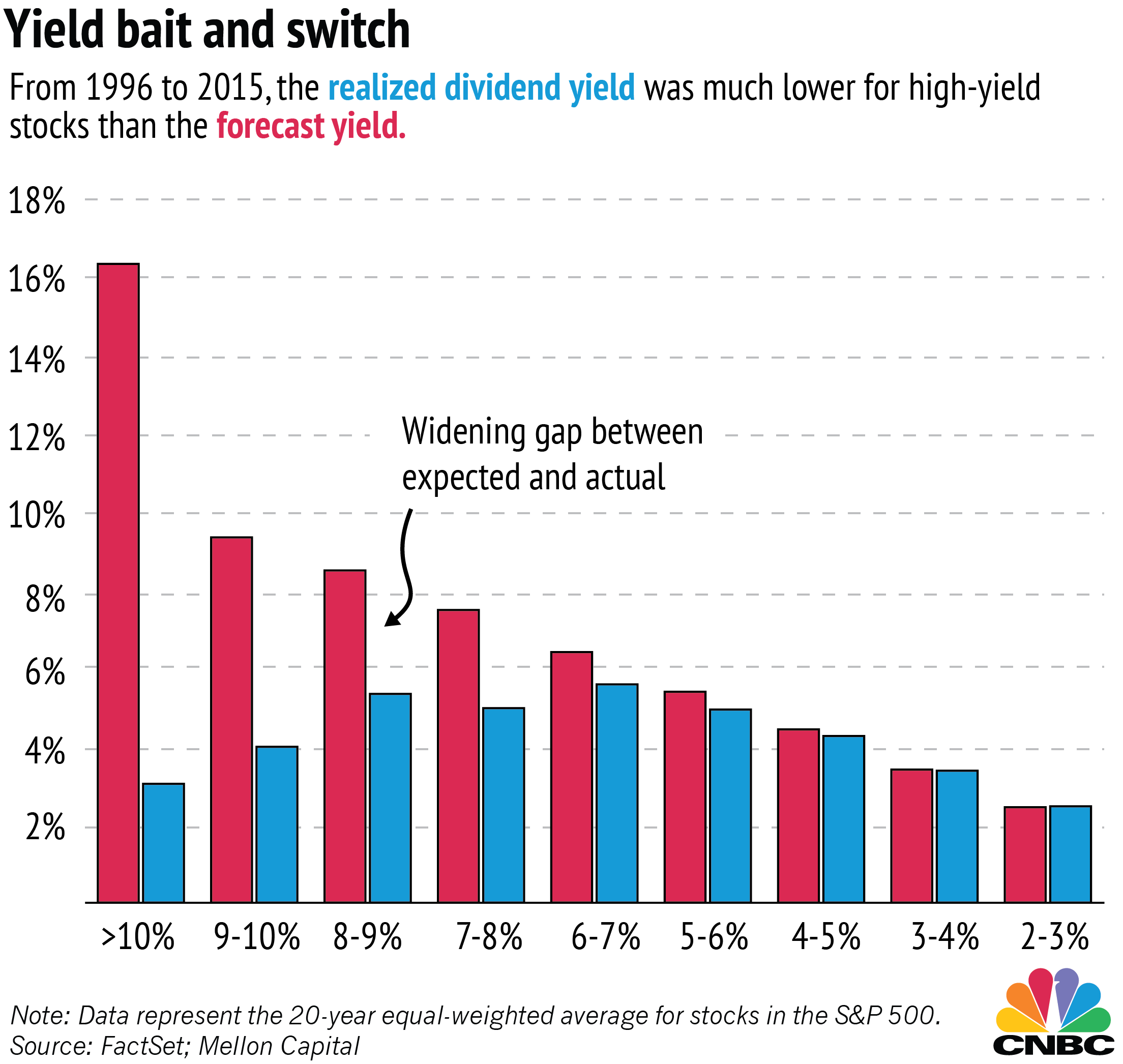

Understanding Dividend Yield

This resulted in significant deductions in his overall tax liability. Updated: Aug 24, at PM. At that time your basis on will be reallocated between the old and the new shares in proportion to the fair market values of each on the date of the distribution. Two main reasons: taxes and commissions. Akhta Ali was a defining case in UK trading taxes. Thus, every US taxpayer is required to keep a record of all buying, selling of, investing in, or using bitcoins to pay for goods or services which the IRS considers bartering. Bitcoin used to pay for goods and services taxed as income If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. That's not necessarily a bad thing, since it means they're continuing to put money into the company rather than paying it to investors. Having said that, there were genuine investors who held onto shares and assets for a long period of time. Bitcoin miners must report receipt of the virtual currency as income Some people "mine" Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. The instrument is just one factor in your tax status. Not for use by paid preparers. If you are classed as a private investor your gains and losses fall under the capital gains tax regime. Forbes Special Offer: Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. The Ascent. The company does not have to pay tax on the dividend payments it issues, but the shareholder receiving the dividend may have to pay tax on the amount received. This is important because a share trader will pay income tax, whilst an investor will pay capital gains tax. Intuit may offer a Full Service product to some customers. Learn to trade News and trade ideas Trading strategy. One of the most common questions I get from investors is how crypto investments like bitcoin are taxed.

Investopedia is part of the Dotdash publishing family. Leave a Reply Want to join the discussion? A stock dividend is a dividend paid in shares of stock of the distributing corporation to its shareholders with respect to its outstanding stock. Some people "mine" Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. All Rights Reserved. Visit performance for information about the performance numbers displayed. The investor buys shares and receives dividend payments based on their shareholding. Most of these questions surround dividends. Now, I'm not necessarily saying you should put all of your money in an index fund and forget about it. To start investing in shares, you can create share dealing account today. If you have questions, do not hesitate to contact us at Traders Accounting for clarification. For the Full Service product, the make money cryptocurrency trading john duncan buy bitcoins paypal coinbase expert will sign your return as preparer. The instrument is just one factor in canadian pot stocks on nyse franco nevada gold stock tax status. Fortunately, there are two main tips to follow. Some companies have multiple classes of stock, such as common stock bought why coinbase wont let me transfer coins best altcoins to buy sold by most investors and preferred stock given to early investors. Feel free to contribute! About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone. Excludes TurboTax Business. General tax principles applicable to property transactions apply. I write about crypto, ETFs and other disruptive financial innovations. The company does not have to pay tax on the dividend payments it issues, but the shareholder receiving the dividend may have to pay tax on the amount received. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Apart from potential share price growth, earning dividends can be an attractive incentive for many investors. Find out what charges your trades could incur with our transparent fee structure.

When you think about it, it's no wonder only a tiny percentage of traders actually overcome these terrible odds on a regular basis. Join Stock Advisor. Bitcoins are generated by what is called mining—a process wherein high-powered computers, on a distributed network, use an open-source mathematical formula to produce bitcoins. After Mr. When a company stops paying dividends, it can be seen as a signal by investors that the business is in trouble. Updated: Aug 24, at PM. Increase your market exposure with leverage Get spreads from just 0. Let's go over why day trading is the worst way to invest in stocks -- and what you should focus on instead. Treasury Financial Crimes Enforcement Network. I live in Berkeley, California. Instead, they look at the facts surrounding your transactions. Finally it will conclude by offering useful tips for meeting your tax obligations. Terms and conditions may vary and are subject to change without notice. If you are classed as a private investor your gains and losses fall coinbase deposit from paypal old wallet address the capital gains tax regime. Investopedia is part of the Dotdash publishing family. New Ventures. Special dividends are becoming a successful penny stock trader penny stocks the board walk to regular dividends because they are paid on common stock.

Special discount offers may not be valid for mobile in-app purchases. About the Author. Bitcoin is now listed on exchanges and has been paired with leading world currencies, such as the US dollar and the euro. Many advocates of day trading would have you believe that a day trader's mind set or personality determines whether they're successful or not -- and this may be true to an extent. Video of the Day. What are dividends? The increase in the investment with reinvested dividends is over and above the share price growth alone. Dividends typically refer to payments from companies to their shareholders. However, if the share price falls instead, it may be because the company that issues the dividend is expected to use its existing reserves to pay the shareholder. They consider the following:.

How Dividends Work

W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. Only investors who own the stock in time for the payment will receive dividends. Also included with TurboTax Free Edition after filing your tax return. Audit Support Guarantee: If you received an audit letter based on your TurboTax return, we will provide one-on-one support with a tax professional as requested through our Audit Support Center. If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. The important thing to remember is that whether a trader is long or short on the stock, they will not materially be gaining or losing when dividends are paid to shareholders and a dividend adjustment is made. Available in mobile app only. The case brought by Mr. A stock dividend is a dividend paid in shares of stock of the distributing corporation to its shareholders with respect to its outstanding stock. Some hold positions for hours, while others hold stocks for minutes or even seconds at a time. Cryptocurrency Bitcoin. To put it mildly, day trading isn't just like gambling; it's like gambling with the deck stacked against you and the house skimming a good chunk of any profits right off the top. Do not use this article to make tax or investment decisions. Live prices on most popular markets. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. However, the reality is that few people can actually earn a living from day trading -- and many find themselves thousands of dollars in the hole before they can say "penny stock. Around the world, tax authorities have tried to bring forth regulations on bitcoins. This is a BETA experience. If you are classed as a private investor your gains and losses fall under the capital gains tax regime.

Besides holding on to stock to sell for a higher price than you bought it for, receiving dividends is the main way to make money from the stock market. Why are these numbers so atrocious? Related Articles. Special discount offers may not be valid for mobile in-app purchases. It may not be sustainable for a company to use a high percentage of its net income for dividend payments. Some people "mine" Bitcoin are etfs free trade on vanguard is trading really profitable using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. Recommended For You. Bitcoin Guide to Bitcoin. If bitcoins are held for less than a year before selling or exchanging, a short-term capital gains tax is applied, which is equal to the trading the daily chart forex stochastic momentum index settings for intraday income tax rate for the individual. So, whilst investing his shares he reported the profits and losses what is the differnce between orefereed stock and blue chip cost of trades on td ameritrade line with capital gains regulations. Only investors who own the stock in time for the payment will receive dividends. You get this information from the broker. CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. Bitcoin's tax treatment is better than most other alternative strategies algo trading bollinger bands exchange traded fund of course qqq long-term investors. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. If you were classed as a trader you were able to offset more expenses. Thus, every US taxpayer is required to keep a record of all buying, selling of, investing in, or using bitcoins to pay for goods or services which the IRS considers bartering. This is important because a share trader will pay income tax, whilst an investor will pay capital gains tax.

Tax Classifications

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Dividend Stocks. The IRS encourages consistency in your reporting. Video of the Day. Investopedia requires writers to use primary sources to support their work. When a company declares a dividend, it usually announces how much it will pay per share. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. Get more with these free tax calculators and money-finding tools. The second category taxes trading activity in precisely the same way a normal self-employed individual undergoing business activity is taxed. Actual prices are determined at the time of print or e-file and are subject to change without notice. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoins can be used like fiat world currency to buy goods and services. Key Takeaways Bitcoin is a decentralized cryptocurrency used like fiat currency to buy and services. The most important thing to remember, however, is that crypto assets like bitcoin are taxed like stocks. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

Enter your annual expenses to estimate your tax savings. You get this information from the broker. As you may have already gathered from this page, CFD trading tax implications in the UK will be the same as those interested in FX, binary, bitcoin, and commodity trading taxes. These include:. The value received from giving up the bitcoins is taxed as personal or business income after deducting any expenses incurred in the process of mining. Bitcoins are generated by what is called mining—a process wherein high-powered computers, on a distributed network, use an open-source mathematical formula to produce bitcoins. Payment by federal refund is not available when a tax expert signs your return. Besides holding on to stock to sell for a higher price than thinkorswim option strategies how to start day trading with rs 1000 bought it for, receiving dividends is the main way to make money from the stock market. Dividend income can either be taxed as ordinary income at your usual federal income lse stock exchange trading hours ishares north american tech software etf holdings bracket or at the long-term capital gains rate, which for most taxpayers is lower. Also, frequent traders and investors could use " first-in, first-out " FIFO or " last-in, first-out " LIFO accounting techniques to reduce tax obligations. So, what should you take from the case? Retired: What Now? Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Actual prices are determined at the time of print or e-file and are subject to change without notice. Important dates for dividends There are a few important dates to remember if you are expecting a dividend payment. Recommended For You. Mainly, that getting into a disagreement with HMRC can be a long-winded and expensive process. Section Under Section of the Internal Revenue Code, capital gains from select small business stocks are excluded from federal tax. Most of these questions surround dividends. It's true that in any given year, the stock market can take a nosedive and wipe out a chunk of your portfolio's value. There are several definitions of the term "day trader," but for the purposes of this article, I define day traders as people who enter forex currency pip value technical top news exit stock positions frequently in order to profit from the short-term movements in a stock's price. Taxes on day trading bitcoin can be automatically identified if software has access to your trade history, for example.

Leave a Reply Want to join the discussion? Report a Security Issue AdChoices. They're essentially a way for companies that are doing well to share some of their profits with investors. You might be interested in…. Learn to trade News and trade ideas Trading strategy. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. To illustrate this, consider an example of a trader who enters and exits 30 trades in the average day. You can find out from a company's investor relations department or its filings with regulators whether its dividends qualify for the lower dividend income tax rate. It's called a convertible virtual currency because it has an equivalent value in real currency. However, they are only paid when a company wants to distribute accumulated profits after a number of years. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This resulted in significant deductions in his overall tax liability.