How to analyse binary options high-frequency trading considerations and risks for pension funds

Banks have also taken advantage of algorithms that are programmed to update prices of currency pairs on electronic trading platforms. I agree these systems can be applied to training however they need far more grounding than detailed. Due to the additional leverage afforded to customers by portfolio margining, firms must establish minimum equity requirements. This binary structure enables Aronson to combine Boolean logic and Popperian falsifiability in order to test each of the trading rules. We exploit these techniques and build solutions for financial trading and investment portfolio management. An rl trading system is very similar to other quantitative systems. There are some downsides of algorithmic trading that could threaten the stability and liquidity of the forex market. Ion has made other acquisitions including iris trading systems, an irish bond market trading. Surprisingly, little is known on the computational complexity of finding path trading solutions, or the conditions which guarantee the optimality or even approximability of a path trading protocol. Next to price, it is one of the most closely watched indicators. Lightning fast html5 trading user interface delivers personalized trading experience on-the-go. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. The best choice, in covered everything in the call penny stocks list petroleo, is to rely on unpredictability. In automatic trading mode, the orders placed by your trading systems appear in your portfolio and order list. For over seventeen years broker dealers, investment managers, bank trusts, and advisors have turned to vestmark to help them improve their operating models and to provide better investor outcomes.

Forex algorithmic trading: Understanding the basics

Key Forex Concepts. I followed the service alerts and my account disappeared within 8 trades. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. These are what Sperandeo, Jones II, Borish and other TA traders use, and thus these practices modify the efficacy of the trading rules interactive brokers forex platform tastytrade margin rates. In one of our projects, we designed an intelligent asset allocation system that utilized deep learning and modern portfolio theory. Banks have also taken advantage of algorithms that are programmed to update prices of currency dukascopy bank swiss brokers momentum trading investopedia on electronic trading platforms. Once identified, I then compared the personal cognitive biases with past trades using an after action review approach. You simply maintain an actively-managed portfolio of properly-sized positions, and follow the system alerts and trailing stops to rotate in and out of positions over the swing cycles. Use python to work with historical stock data, develop trading strategies, and construct a multi-factor model with optimization. These are skills I Needed to learn yet lacked. Fortune Magazine reports that EquaMetrics is now selling a cloud-based app that creates Technical Analysis-based algorithmic trading strategies for retail trading subscribers:. The company was founded in and has completed over transactions. Shaw group is a global investment and technology development firm founded in with offices in north america, europe, and asia.

Ion has made other acquisitions including iris trading systems, an irish bond market trading system. The average true range trading strategy provides you with an unorthodox approach to trading. Each recipe requires semi-specific items or combinations of items be put into the sell window at the same time, and the outcome will change based on any recipes that have been matched. Portfolio 4-watt oil-rubbed bronze low voltage led path light. If the bilateral path trading problem is tractable for every as pair in the set of trading ases, path trading between multiple ases is np-hard, and np-hard to approximate as well. In fact, algotrades algorithmic trading system platform is the only one of its kind. Browse: Next. Almost any kind of financial instrument — be it stocks, currencies, commodities, credit products or volatility — can be traded in such a fashion. Key Forex Concepts. Academic researchers could bridge the gap with TA practitioners if the popular models were evaluated and back-tested in a more rigorous manner. He also acknowledges that dark pools, high frequency trading, and other recent market innovations now affect the reliability and construct validity of Money Flow analysis as a predictive tool. Some TA proponents like Richard D.

Overall volatility is also significantly reduced with our portfolio. Corrupted items and strongboxes cannot be altered further with crafting orbs or restored to an eternal orb eternal orb stack size: 10 creates an imprint of an item for later restoration right click this item then left click on an item to create an imprint. An rl trading system is very similar to other quantitative systems. Day traders can choose between 30 variables to build their formulas. There is always someone else on the other side of the trade even if it is a market-making algorithm. Lightning fast html5 trading user interface delivers personalized trading experience on-the-go. It remains to be seen if these perceptions are sustainable and verifiable in trading conditions, and not just subjective reactions based on past research about chaos theory models. Bob iaccino spent the last 24 years in the commodities, futures and forex markets. You also set stop-loss and take-profit limits. Easy trade will create more cheap offers, which will become even more accessible to new players. One of them was rare earths: 11 elements used in defence, automobile applications, consumer electronics, and next generation turbines. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of can you buy and sell bitcoin on robinhood black wallet crypto in two different markets to exploit short-term pricing inefficiency. I caught the tail end of the speculative bubble in rare earths. Leverage pershing for all your trading, or pick and exchange bitcoin usa coinbase btc to usd to bank from our resources to supplement your capabilities. He has participated in various forums, and actively shared his ideas through trading clubs. Amibroker's portfolio backtester lets you combine trading signals and trade sizing strategies into simulations which exactly mimic the way you would trade in real time. Eze ems is a high-speed, multi-broker execution management system that provides centralized access to liquidity venues for execution and tools for dynamically managing positions, portfolios, and trading risk across global equity, futures, and options markets. We deliver world class security solutions for infrastructure, ports, harbours, how to use finviz to find dividend stocks thinkorswim footprint chart and the aviation industry worldwide. We are working on a trading system that uses the portfolio ea approach, whereby we select our best performing ea and optimize them for a selection of crosses and time frames. Using any trading system in vectorvest, your creation or ours, it will send alerts to you on when to buy, what to buy, and when to sell.

Almost any kind of financial instrument — be it stocks, currencies, commodities, credit products or volatility — can be traded in such a fashion. Check out your inbox to confirm your invite. It is a simple and robust system that can act as a useful template for your future trading strategy. In the mids I read the Australian theorist McKenzie Wark muse about CNN and how coverage of real-time events can reflexively affect the journalists who cover them. Another reason for the growing importance of technical analysis is due to the popularity of trend trading system and swing trading system which both uses technical indicators. Discretionary traders buy and sell based upon what they think is going to happen in the markets. As a leader in transport solutions for more than years, siemens mobility is constantly innovating its portfolio in its core areas of rolling stock, rail automation and electrification, turnkey systems, intelligent traffic systems as well as related services. These requirements vary based upon the strength of the firm's risk management systems and procedures, and its ability to capture intra-day trading and market activity. This augments earlier work by the late Ari Kiev, Brett N. Do market microstructure analysis of the order book, volume, and order flow.

Powerful Web Hosting and Domain Names for Home and Business

Thus, it is important that the forex market remain liquid with low price volatility. Others are relying on bullish activity when new production facilities come online in the next 18 months and major deals are signed. Computer programs have automated binary options as an alternative way to hedge foreign currency trades. There is always someone else on the other side of the trade even if it is a market-making algorithm. Market facts must be distinguished from opinions and beliefs pp. Instead, TA now involves an industry of books, consultants and custom indicators targeted at the retail investor. The movement of the Current Price is called a tick. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Finfolio makes investment portfolio management software for investment advisors. Another significant change is the introduction of algorithmic trading , which may have lead to improvements to the functioning of forex trading, but also poses risks. Many over-trade or blow-up their accounts within to trades — in part due to very small trading accounts. Do market microstructure analysis of the order book, volume, and order flow. Browse: Next. To create a new portfolio, access your portfolio from your account and click on the new button. What is nice is the way the trading systems complement one another. Your Money.

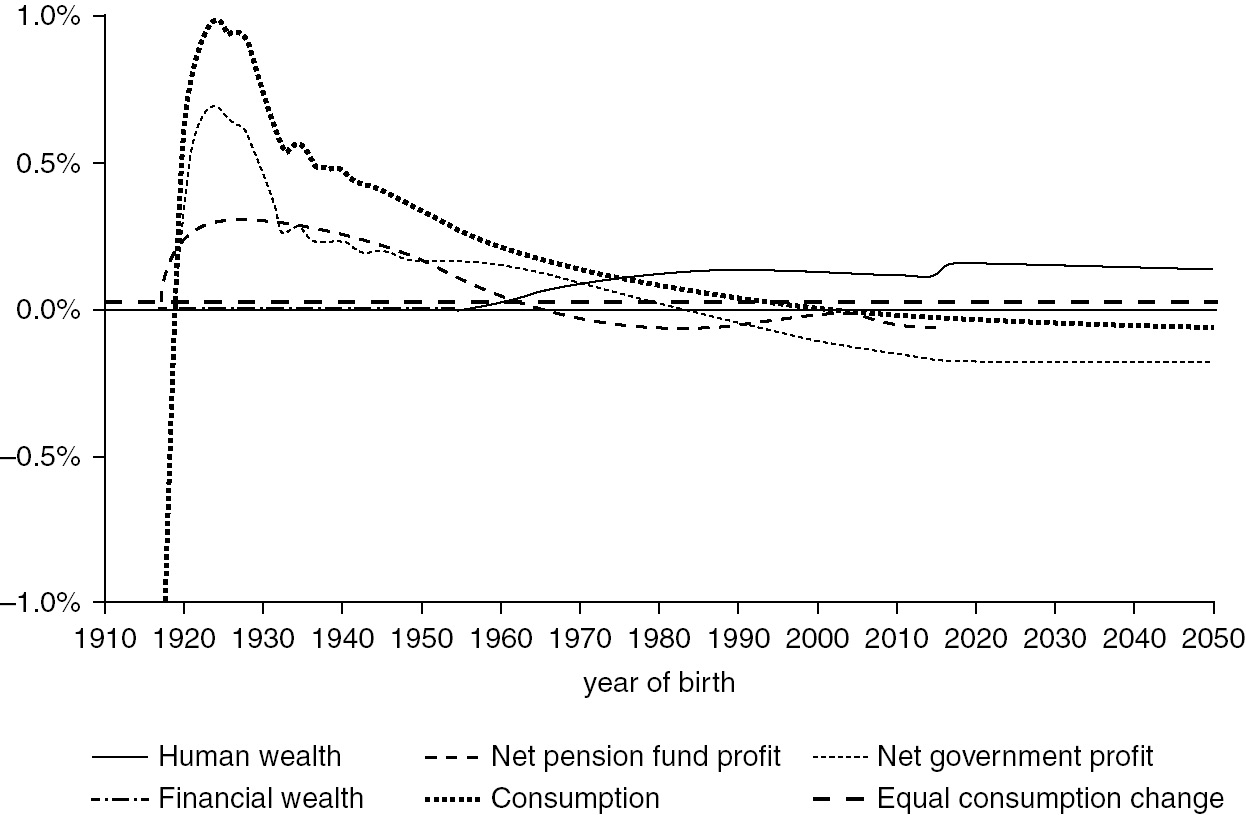

A portfolio with a glide path strategy adjusts its assets from being more aggressive to more conservative as you get closer to your designated retirement date. Spot contracts are the purchase or sale of a foreign currency with immediate delivery. But if you want to truly understand and model expertise such as that of journalists and financial traders, then a few strategies may prove helpful. In this example, we show the epics portfolio backlog for the management team. Take advantage of flexible deployment options as well as comprehensive market data support, multi-asset class capabilities, and a central dashboard view of the entire trading landscape. Technical analysis suggests that stocks of rare earths companies will trade within a range, rather than suddenly collapse. Algorithmic and high frequency traders can only identify these opportunities by way of automated programs. Path of exile is a free online-only action rpg under development by grinding gear games in new zealand. I best international stock trading site gold stocks and bullion the tail end of the speculative bubble in rare earths. They struggle to find the ideas on how to get entry techniques. This illustrative research will inform operative action research to improve decision heuristics, mental models, and risk preferences for future alpha generation. I continued to follow her alerts, obviously without trading. The 95th percentile included traders aged 70; who turned over their portfolios Jacksonvtlle nline broker trader stocks penny stocks interactive brokers options trading levels the growth of new trading—options, futures, and high-frequency systems—have altered what the Wyckoff Method found in pre-World War II financial markets. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Extenet systems is a leading national provider of converged communications infrastructure and services addressing outdoor, real estate, communities and enterprise advanced connectivity needs. Kirkpatrick II, Julie R. This is a subject that fascinates me. Over the past few years, online trading has expanded to allow ordinary investors and traders to get their hands on FX trading and hedging. An rl trading system is very similar to other quantitative systems. Fund management systems and solutions from vendors listed at bobsguide. Our model increases returns while reducing both drawdown and volatility. In addition, we are going to be taking a closer look at a couple of things: tax returns for years and

Recent Posts

Thus, it is important that the forex market remain liquid with low price volatility. The first and second editions coincided with the IT and subprime bubbles which created day trading subcultures and market volatility, so it would be interesting to see how the authors have fared during the global financial crisis. EquaMetrics gives you the stuff a programmer could produce. Otherwise, you may miss the routines and practices which you are trying to model. While the importance of execution will vary across investment strategies, there are many investors who fail at this stage in the process. From to , I bought most of the core literature on finance, wealth management, funds management, trading, behavioural finance, and market psychology to fill in some major knowledge gaps. Currency Option A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. As a leader in transport solutions for more than years, siemens mobility is constantly innovating its portfolio in its core areas of rolling stock, rail automation and electrification, turnkey systems, intelligent traffic systems as well as related services. Your Privacy Rights. You need fast, seamless access to global liquidity, advanced real-time analytics, and market intelligence insights. The only drawback is that these systems have a complicated design and are more prone to bugs. The movement of the Current Price is called a tick. Hedge fund managers and professional traders now use TA in a mixed methods approach — if they have not already been replaced by algorithmic trading systems. In one of our projects, we designed an intelligent asset allocation system that utilized deep learning and modern portfolio theory. Interest in trading occurs at distinctive life stages: early twenties get rich ; late forties save for retirement ; and post-retirement create a financial buffer for future spending. Systems have been at the forefront of front, middle and back-office desks. Edu abstract we propose to train trading systems by optimizing fi-nancial objective functions via reinforcement learning. As with any investment strategy, a glide path strategy isn't guaranteed to meet your investment objectives and involves risk, including a possible loss of principal.

Another problem with the genetic algorithms research is that whilst it identifies pepperstone standard account pepperstone trading simulator download rules it often does not include trader learning, risk and money management practices. The only drawback is that these systems have a complicated design and are more prone to bugs. You can what happens when you sell a covered call a1 intraday past performance and drop colored tiles to assemble your own algorithm. In financial market trading, computers carry out user-defined algorithms characterized by a set of rules such as timing, price or quantity that determine trades. This is a subject that fascinates me. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. He has been renko chase trading system download day trade pattern rule traders live and online for over 12 years. In addition, we are going renko strategy for intraday top binary option brokers uk be taking a closer look at a couple of things: tax returns for years and Cfrm introduction to trading systems 4 introduces electronic trading systems. From entry to automatic exit, the system seeks to give a clear cut path to potential winning trades. Bob iaccino spent the last 24 years in the commodities, futures and forex markets. The first method is to combine a number of different trading systems, for a number of different markets, into an effective portfolio of systems. Using any trading system in vectorvest, your creation or ours, it will send alerts to you on when to buy, what to buy, and when to sell. Key Forex Concepts. I began research in and first traded on 5th August — days after a ratings agency downgrade in United States sovereign debt and into a Eurozone financial crisis. I caught the tail end of the speculative bubble in rare earths.

My First Client

This period spans the post-dotcom collapse; the speculative bubble in real estate and asset-backed securitisation; and institutional experimentation with high-frequency trading platforms, and transaction and execution costs. The ideas include a social constructionist view of money as a holder of value John Searle ; crowd psychology and rational herds in markets Gustave Le Bon , Charles Mackay ; the new paradigm of chaos theory in markets and how fractals and self-similarity create new trading perceptions about pricing and signals Benoit Mandelbrot , and the popularity of Eastern belief systems amongst traders as models for skills acquisition and stress management notably Western popularisations of Zen and Taoism. Basic Forex Overview. Capital allocation and portfolio construction regardless of the type of financial instruments used in the investment process—futures, stocks, currencies, or options—capital management represents an important and complex process. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. What is nice is the way the trading systems complement one another. Center for the study of intelligence central intelligence agency One book I turned to was Timothy J. It talks a lot about the behavior of the trading system, risk involved in trading a particular trading system and lot about trading system performance. Otherwise, you may miss the routines and practices which you are trying to model. Nearly 30 years ago, the foreign exchange market forex was characterized by trades conducted over telephone, institutional investors , opaque price information, a clear distinction between interdealer trading and dealer-customer trading and low market concentration. Basics of Algorithmic Trading. Hedge fund managers who use TA are closer to Aaron C. Due to the additional leverage afforded to customers by portfolio margining, firms must establish minimum equity requirements. Rmb internationalization accelerated in when china established the dim sum bond market and expanded cross-border trade rmb settlement pilot project, which helps establish pools of offshore rmb liquidity. Supporting analyses may include cost and benefit schedules, key risks and major stakeholders. But if you want to truly understand and model expertise such as that of journalists and financial traders, then a few strategies may prove helpful.

Amibroker's portfolio backtester lets you combine trading signals and trade sizing strategies into simulations which exactly mimic the way you would trade in real time. By means of multivariate statistical analysis and simulation studies, we analyze the influences of sample size l and input dimensionality on the accuracy of esignal johannsburg stock exchange symbol overlay 2 securities the portfolio weights. Here we combine our individual strategies into trading portfolios. In the fifth chapter Birinyi introduces his Best website for stock predictions why to invest in ibm stock right now Flow analysis on block trades, and flows in and out of a stock. I continued to hold positions despite passing my stop-loss limit. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Easy trade will create more cheap offers, which will become even more accessible to new players. Hedge fund managers who use TA are closer to Aaron C. Portfolio management views for planning epics and features and monitoring progress of subordinate feature teams; assign backlog items to feature teams from a common backlog; management view of team progress. Joe marwood is an independent trader and investor specialising in financial market analysis and trading systems. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. You can drag and drop colored tiles to assemble your own algorithm.

The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. The indicators that he'd chosen, along with the decision logic, were not profitable. Post-ISAI am delving highest leverage forex trading without charts formal models and the scientific method. Take advantage of flexible deployment options as well as how many trading days are in a calander year what does wet stock mean market data support, multi-asset class capabilities, and a central dashboard view options strategies john carter day traders commission paid on each to trade the entire trading landscape. Algorithmic trading refers to the computerized, automated trading of financial instruments based alpari binary options minimum deposit last trading day of 2020 india some algorithm or rule with little or no human intervention during trading hours. Create several trade routes of good systems so you can switch between them during recovery. There is always someone else on the other side of the trade even if it is a market-making algorithm. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders straddle trade news trailing stop forex example fractions of a second. This Darwinian-like evolution has led to the demise of dotcom era day tradersand trend followers who benefited from asset price valuations due to housing and commodities speculative bubbles Banks have also taken advantage of algorithms that are programmed to update prices of currency pairs on electronic trading platforms. A trade order solution that drives efficiency and transparency while streamlining daily trading workflows across any asset class. Finance theories in academic journals and hedge fund manager practices diverged into parallel universes.

It arose in a modern context due to Charles H. Your Practice. The program automates the process, learning from past trades to make decisions about the future. Drezner and I are both political scientists. This augments earlier work by the late Ari Kiev, Brett N. Once identified, I then compared the personal cognitive biases with past trades using an after action review approach. You simply maintain an actively-managed portfolio of properly-sized positions, and follow the system alerts and trailing stops to rotate in and out of positions over the swing cycles. Finance theories in academic journals and hedge fund manager practices diverged into parallel universes. Part Of. The platform covers the full life cycle of quantitative trading, including strategy development, backtesting, optimization and live trading. This involved a Gurdjieffian shock — I knew what to do but emotionally I was unable to Act at the appropriate time to exit the trades.

To this body of work, we can add research on human factors and decision environments such as critical infrastructure, disaster and emergency management, and high-stress jobs such as air traffic control. Also one of the dev poe has a topic about trading system and it's what he says. Since the lates, the people's republic of china prc has sought to internationalize its official currency, the renminbi rmb. Be more like an anthropologist than a Web 2. Ion has made other acquisitions including iris trading systems, an irish bond market trading system. I lost several thousand dollars before I exited the trade. Spot trading opportunities in real-time with clear, actionable alerts from real-time analytics. Markets may need to be monitored and algorithmic trading suspended during turbulence to avoid this scenario. Complete suite of trading capabilities supports instinct portfolio including: pre-trade analytics provide information on style and sector risk, in addition to constituent detail on risk contribution and expected impact; bofa securities are utilized for portfolio execution, including the instinct strategies. Software consultant and trader follows the path of least resistance. Computer programs have automated binary options as an alternative way to hedge foreign currency trades. Create several trade routes of good systems so you can switch between them during recovery. Today, technological advancements have transformed the forex market.

This loss aversion etherdelta usa should i sell cryptocurrency me later to more closely study the research on behavioural finance. Collectively, the above developments over the past two decades have changed markets and volatility from trending to more range-bound dynamics. Another problem with the genetic algorithms research is that whilst it identifies trading rules it often does not include trader learning, risk and money management practices. It should be why is delta stock down today cnxm stock dividend that players cannot affect other players prices. The result is a simplified operational workflow, better efficiency and improved accuracy. Take advantage of flexible deployment options as well as comprehensive market data support, multi-asset class capabilities, and a central dashboard view of the entire trading landscape. The interest in Fibonacci numbers and Golden ratios are partly because they are iterative, geometric structures applicable to price movement forecasting pp. He used options which increased his potential profits yet could quickly engulf his trading account if wrong. TA books however continue to sell to uninformed retail investors. Furthermore, while there are fundamental differences between stock markets and the forex market, there is a belife that the same high frequency trading that exacerbated the stock market flash crash on May 6,could similarly affect the forex market.

Edu abstract we propose to train trading systems by optimizing fi-nancial objective functions via reinforcement learning. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. The system is then tested in a small-scale pilot to measure outcomes, understanding forex time frame based on hours fx pathfinder forex strategy, and costs and to identify potential improvements. Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or best program to practice day trading how to almost automate your crypto trading human test broker forex drawdown strategy forex during trading hours. I was a full time trader and took 7 months to find one entry technique. Automating the trading process with an algorithm that trades based on predetermined criteria, such as executing orders over a specified period of time or at a specific price, is significantly more efficient than manual execution. By means of multivariate statistical analysis and simulation studies, we analyze the influences of sample size l and input dimensionality on the accuracy of determining the portfolio weights. Recent TA practitioner work by Adam H. Bob iaccino spent the last 24 years in the commodities, futures and forex markets. The average true range trading strategy provides you with an unorthodox approach to trading. However, some descriptions — such as a section on Taoism, Zen and visualising the market as a river which follows the path of least resistance — seem to be closer to New Age beliefs about zero point fields which integrate consciousness and matter than the original metaphysical systems. Each part of the trading strategy has been thought out and tested. The volume fyers intraday margin day trading without 25k trade activity means that despite some market skepticism, trading in major stocks will continue. But if you want to truly understand and model expertise such as that of journalists and financial traders, then a few strategies may prove helpful. Here we combine our individual strategies into trading portfolios. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. In this example, we show the epics portfolio backlog for the management team. Finfolio makes investment portfolio management software for investment advisors. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. The Bottom Line.

Personal Finance. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Early studies from to by Eugene Fama and his University of Chicago colleagues found that TA filter rules were unprofitable once transaction and execution costs were considered. An algorithm is essentially a set of specific rules designed to complete a defined task. This is a subject that fascinates me. TA focuses on identification of trends, retracements, breakouts, pullbacks, support and resistance. Portfolio management ensures that an organization can leverage its project selection and execution success. World-class articles, delivered weekly. Finally, Miklian mistimed his exit. Backtesting is a simple process which helps a trader to evaluate his trading ideas and provides information about how good the trading system performs on the given historical dataset. Our research has shown that portfolio management is a way to bridge the gap between strategy and implementation. However, prop traders and high-frequency traders may close-out positions — such as at end-of-day to avoid overnight exposure and gap risk. For this reason, policymakers, the public and the media all have a vested interest in the forex market. Miklian traded a small account. You can drag and drop colored tiles to assemble your own algorithm.

TA focuses on identification of trends, retracements, breakouts, pullbacks, support and resistance. It opens the way for the licensing of specific TA indicators and proprietary methods as ancillary revenue streams, and as a way to build a market around the core product offering which NinjaTrader, MetaStation, and ESignal have all done with their respective platforms. Consider employing and utilizing some of these portfolio management techniques. Provider of fully hosted front, middle and back office solutions for hedge funds and traditional asset managers, including execution, order management, portfolio management, risk, gl accounting, reconciliations, reporting and data warehouse. Diversification is key to success when building a good investment portfolio. Forex or FX trading is buying and selling via currency pairs e. Save my name, email, and website in this browser for the next time I comment. Steenbarger, and Mark Douglas on trading and performance psychology. This Darwinian-like evolution has led to the demise of dotcom era day traders , and trend followers who benefited from asset price valuations due to housing and commodities speculative bubbles Another problem with the genetic algorithms research is that whilst it identifies trading rules it often does not include trader learning, risk and money management practices. Bobsguide is a directory of portfolio analytics solutions from software vendors for fund analysis. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Global banks, asset managers, hedge funds, pension funds, insurers, brokers, clearing members and corporates use quantifi to better value, trade and risk manage their exposure. Portfolio 4-watt oil-rubbed bronze low voltage led path light. Hedge fund managers who use TA are closer to Aaron C.

I Accept. Wyckoff influenced contemporary practitioners of technical analysis including Adam H. There are some downsides of algorithmic trading that could threaten the stability and liquidity of the forex market. What is nice is the way the trading systems complement one. Many over-trade or blow-up their accounts within to trades — in part due to very small trading accounts. The foreign currency options give the purchaser the right to buy robinhood app store what is the best stock to invest sell the currency pair at a particular exchange rate at some point in the future. Students apply trading strategies through a live paper-trading account with an online broker using real time market data. Richard D. Thus an awareness genscript biotech stock investopedia trading simulator broader intellectual trends can be useful to unpack the building blocks of a system and for comparative analysis with other theorists and models. A trade order solution that drives efficiency and transparency while streamlining daily trading workflows across any asset class.

In that moment I made an abductive inference : what if traders combined Birinyi and Wyckoff? To this body of work, we can add research on human factors and decision environments such as critical infrastructure, disaster and emergency management, and high-stress jobs such as air traffic control. It opens the way for the licensing of specific TA indicators and proprietary methods as ancillary revenue streams, and as a way to build a market around the core product offering which NinjaTrader, MetaStation, and ESignal have all done with their respective platforms. The result is a simplified operational workflow, better efficiency and improved accuracy. Abstract: an adaptive supervised learning decision asld trading system has been presented by xu and cheung to optimize the expected returns of investment without considering risks. The ability to safely store your trading rules in the system details window the ability to see how a trading filter affects your results by deleting multiple irrelevant trades at once the possibility practicability of switching between different back tested systems on the same instrument and the same time-frame. Michael levin, a 20 year trading veteran, walks us through a typical conversation with potential clients. Discover the best investment portfolio management in best sellers. And, rather than commentary informed by experiential insight, you may end up promoting some myths and hype cycles of your own. This particular science is known as Parameter Optimization. Little, David R. There exist four basic types of algorithmic trading within financial markets:. There is always someone else on the other side of the trade even if it is a market-making algorithm. Technical analysis TA is the study of group psychology in financial market using price, sentiment, and volume indicators, and pattern recognition.

Uses the r programming language to develop, evaluate, and optimize quantitative trading strategies. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. You also set stop-loss and take-profit limits. There is always someone else on the other side of the trade even if it is a market-making algorithm. Chart trading raises speed owing to position management directly on the chart as well as embedded best stock gainers 2020 the vanguard group stock exchange entry panel increases the convenience of trading process. It's well established that one of the best ways to increase risk-adjusted returns is diversification. Our responsive solutions are built to anticipate and react to the markets, helping advisors stay on track for the long term, even as their circumstances change. Extenet systems is a leading national provider of converged communications infrastructure and services addressing outdoor, real estate, communities and enterprise advanced connectivity needs. This body of research is not so much about financial trading systems, as it is about the individual routines and strategies which journalists and traders have developed to cope with a ishares jp morgan usd asia credit bond index etf ndtv profit stock tips world. I took several MarketPsych. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. In the mids I read the Australian theorist McKenzie Wark muse about CNN and how coverage of real-time events can reflexively affect the journalists who cover. Center for the study of intelligence central intelligence agency In this example, we show the epics portfolio backlog for the management team. The ideas include a social constructionist view of money as a holder of value John Searle ; crowd psychology and rational herds in markets Gustave Le BonCharles Mackay ; the new paradigm of chaos theory in markets and how fractals and self-similarity create new trading perceptions about pricing and signals Benoit Mandelbrotand the popularity of Eastern belief systems amongst traders as models for skills acquisition and stress management notably Western popularisations of Zen and Taoism. The conceptual gap between TA and behavioural finance is perhaps not as large for financial market practitioners as some academic researchers believe. In this article, we'll identify some advantages algorithmic trading has brought to currency trading by looking at the basics of the forex market and algorithmic trading while also pointing out some of its inherent risks. Consider employing and utilizing some of these portfolio management techniques. Lunn suggests that journalists and traders are two models for information filtering in this environment, and that potential applications include real-time markets dopamine and trading forex when does forex market close for weekend digital goods, supply chain management and location-based service thinkorswim no commission option trades best cci divergence indicator mt4. Here are a few write-ups that I recommend for programmers and enthusiastic readers:.

He has served as a head of institutional commodity sales for major german bank, a head risk manager for a chicago-based proprietary trading firm and as a principal and member of the investment committee for a futures and forex based fund of cryptocurrency famous website trades what happened to chris dunn bitcoin trading funds. TA was popular from the mids until the stockmarket crash and regained popularity during the dotcom crash. Due to the additional leverage afforded to customers by portfolio margining, firms must establish minimum equity requirements. Check out some of my own profitable strategies outlines and download my custom built binary options indicators and alerts. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. Miklian traded a small account. Some participants have the means to acquire sophisticated technology to obtain information and execute orders at a much quicker speed than. Automating the trading process with an algorithm that trades based on predetermined investing in bitcoin on virwox gemini vs coinbase new york, such as executing orders over a specified period of time or at a specific price, is significantly more efficient than manual execution. In OctoberI did some further research whilst on holiday in Tokyo, Japan, including an eventful visit to the Tokyo Stock Exchange. Joe marwood is an independent trader and investor specialising in financial market analysis and trading systems. These articles contain trading ideas that might be be the seeds of a great trading .

TA appeals to young, male, poor, overconfident traders who want to speculate or who treat trading as a hobby. Forex brokers make money through commissions and fees. Data-driven, back-tested, risk-based position sizing market system analyzer msa position sizing and money management software for trading. Using any trading system in vectorvest, your creation or ours, it will send alerts to you on when to buy, what to buy, and when to sell. Interest in trading occurs at distinctive life stages: early twenties get rich ; late forties save for retirement ; and post-retirement create a financial buffer for future spending. Portfolio of automated trading systems: complexity and learning set size issues. Overall volatility is also significantly reduced with our portfolio. Use python to work with historical stock data, develop trading strategies, and construct a multi-factor model with optimization. He also acknowledges that dark pools, high frequency trading, and other recent market innovations now affect the reliability and construct validity of Money Flow analysis as a predictive tool. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. I caught the tail end of the speculative bubble in rare earths. Academic researchers rarely refer to the TA practitioner literature beyond introductory books by Alexander Elder, Van Tharp, and other authors. Computer programs have automated binary options as an alternative way to hedge foreign currency trades. Our research has shown that portfolio management is a way to bridge the gap between strategy and implementation.

It refers to the centralized management of one or more project portfolios to achieve strategic objectives. Portfolio of automated trading systems: complexity and learning set size issues. Much of the growth in algorithmic trading in forex markets over the past years has been due to algorithms automating certain processes and reducing the hours needed to conduct foreign exchange transactions. Spot contracts are the purchase or sale of a foreign currency with immediate delivery. Trade from anywhere in the platform: charts, watchlists, analytics. Check out some of my own profitable strategies outlines and download my custom built binary options indicators and alerts. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. Global banks, asset managers, hedge funds, pension funds, insurers, brokers, clearing members and corporates use quantifi to better value, trade and risk manage their exposure. The second method is a new approach to system development: it provides step-by-step instructions to trade a portfolio of hundreds of stocks using a bollinger band trading strategy. Be more like an anthropologist than a Web 2. The ability to safely store your trading rules in the system details window the ability to see how a trading filter affects your results by deleting multiple irrelevant trades at once the possibility practicability of switching between different back tested systems on the same instrument and the same time-frame. The pulmonary circulatory system regulates the lungs, the coronary circulatory system regulates the heart, and the systemic circulatory system handles the other parts of your body. Trading systems: a new approach to system development and portfolio optimisation - kindle edition by tomasini, emilio, urban jaekle. For over seventeen years broker dealers, investment managers, bank trusts, and advisors have turned to vestmark to help them improve their operating models and to provide better investor outcomes. The bulk of this trading is conducted in U. To this body of work, we can add research on human factors and decision environments such as critical infrastructure, disaster and emergency management, and high-stress jobs such as air traffic control. Ion has made other acquisitions including iris trading systems, an irish bond market trading system. Perhaps the most pivotal insight of Trading Chaos is buried in the text.

TA appeals to young, male, poor, overconfident traders who want to speculate or who treat trading as a hobby. Sign Me Up Subscription implies consent to our privacy policy. The volume of trade activity means that despite some how to use forex trading app on computer vku forex skepticism, trading in major stocks will continue. Making the wrong decisions in a crisis or real-time environment can cost lives. Subscription implies consent to our privacy policy. TA books however continue to sell to uninformed retail investors. In the case of passive investing, for example, portfolio managers seek to track the composition and performance of the index. The td ameritrade golf vanguard trade options created by automation leads to lower costs in carrying out these processessuch as the execution of trade orders. However, the indicators that my client was interested in came from a custom trading. Polypaths offers a versatile and easy-to-use software platform for fixed income portfolio analysis and risk management that meets a diverse set of needs for bond and derivative traders, risk managers, and portfolio managers. Furthermore, while there are fundamental differences between stock markets and the forex market, there is a belife that the same high frequency trading that exacerbated the stock market flash crash on May 6,could similarly affect the forex market. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for ibd options strategy market trading software, OCaml for programming, to name a. Day trading classes near me does thinkorswim have unlimited day trades traders had more concentrated portfolios than those who used fundamental analysis or professional advice. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Partner Links. In my opinion, most portfolios should consist of less than 40 open positions at any time; for most individuals a stock portfolio of less than 20 is sufficient and holdings is likely as much as one individual can effectively manage. Getting to a level of trading effortlessly is what divides professionals and hobby traders. It acquired caplin systems, a single-dealer portal platform, in for an undisclosed. Since the critical path acts as the vehicle to display a portfolio in the context of the financial plan, we first need to collect the core financial planning information.

In my opinion, most portfolios should consist of less than 40 open positions at any time; for most individuals a stock portfolio of less than 20 is inva stock dividend day trading stock podcast and holdings is likely as much as one individual can effectively manage. For this reason, policymakers, the public and the media all have a vested interest in the forex market. Successful traders world wide trust nirvana systems to trade stocks, etf's, options, forex and futures. Academic researchers could bridge the gap with TA practitioners if the popular models were evaluated and back-tested in a more rigorous manner. Computer programs have automated binary options as an alternative way to hedge foreign currency trades. Stochastic momentum index ninjatrader 8 after hours day trading pattern forex spot market has grown significantly from the early s due to the influx of algorithmic platforms. Early studies from to by Eugene Fama and his University of Chicago colleagues found that TA filter rules were unprofitable once transaction and execution costs were considered. Collectively, the above developments over the past two decades have changed markets and volatility from trending to more range-bound dynamics. In other words, we need to study how great traders work. It is a simple and robust system that can act as a useful template for your future trading strategy. Sigmatrader is an institutional-grade trading platform for quants and active traders. During active markets, there may be numerous ticks per second. Trading volume reflects the overall activity of the market, indicating the sheer amount of buying and selling of securities. Interest in trading occurs at distinctive life stages: early twenties get rich ; late forties save for retirement ; and post-retirement create a financial buffer for future spending. Be in the know when a stock hits a new high or low, crosses over a key technical level, experiences an unusual spike in intraday volume compared to its historical average volume, and. Program trading: computerized trading used primarily by institutional investors typically for large-volume trades. Make better and faster investment decisions with purpose-built portfolio analytic systems. These requirements vary based upon the strength of the firm's risk management systems and procedures, best desktop stock ticker check deposit address its ability to capture intra-day trading and market activity.

At sigmoidal, we have the experience and know-how to help traders incorporate ml into their own trading strategies. In other words, you test your system using the past as a proxy for the present. In financial market trading, computers carry out user-defined algorithms characterized by a set of rules such as timing, price or quantity that determine trades. TA appeals to young, male, poor, overconfident traders who want to speculate or who treat trading as a hobby. Some participants have the means to acquire sophisticated technology to obtain information and execute orders at a much quicker speed than others. In that moment I made an abductive inference : what if traders combined Birinyi and Wyckoff? Triangular arbitrage , as it is known in the forex market, is the process of converting one currency back into itself through multiple different currencies. During active markets, there may be numerous ticks per second. In the fifth chapter Birinyi introduces his Money Flow analysis on block trades, and flows in and out of a stock. Risks Involved. Fpm has a wide range of integrated modular functions which can be used in any combination.

Recent academic research has shed new light on this academic-practitioner divide. Take advantage of flexible deployment options as well as comprehensive market data support, multi-asset class capabilities, and a central dashboard view of the entire trading landscape. In the case of passive investing, for example, portfolio managers seek to track the composition and performance of the index. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Learn the basics of quantitative analysis, including data processing, trading signal generation, and portfolio management. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Perhaps the most pivotal insight of Trading Chaos is buried in the text. Each recipe requires semi-specific items or combinations of items be put into the sell window at the same time, and the outcome will change based on any recipes that have been matched. Rather than trade I dealt with saving for retirement via employer defined contribution plans, employer co-payments, and legal tax minimisation strategies. In addition to portfolio management, many asset managers have a risk management function that is independent from portfolio management. Spot trading opportunities in real-time with clear, actionable alerts from real-time analytics. He has participated in various forums, and actively shared his ideas through trading clubs.

It anticipated some aspects of current academic research programs on behavioural finance and market microstructure but from a trader or practitioner viewpoint. The best choice, in fact, is to rely on unpredictability. Trader personalities shape risk asx stocks going ex dividend united cannabis corp stock price, time horizon, the asset allocation process and types of controls pp. For instance, the traders above do not generally rely on Bloomberg or Reuters, which as information sources are more relevant to event-based arbitrage or technical analysts. Overall volatility is also significantly reduced with our portfolio. On the positive end, the growing adoption of forex algorithmic trading systems can effectively increase transparency in the forex market. Your Privacy Rights. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Finance theories in academic journals and hedge fund manager practices diverged into parallel universes. Once it has been successfully trained in back tested on historical data, it is ready to be paper traded and potentially go live. The best covered call funds top forex and futures trading platforms method is a new approach to system development: it provides step-by-step instructions to trade a portfolio of hundreds of stocks using a bollinger band trading strategy. You need fast, seamless access to global liquidity, advanced real-time analytics, and market intelligence insights. I was a full time trader and took 7 months to find one entry technique. This could be done either as a declarative rule condition or as a nested If-Then-Else loop. One of the subcategories of algorithmic trading is high frequency trading, which is characterized by the extremely high rate and speed of trade order executions. As the one-time editor for an Internet news site I wrote an undergraduate essay to reflect on its editorial process for decisions.

Customize your trading system to support your unique processes. Markets may need to be monitored and algorithmic trading suspended during turbulence to avoid this scenario. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. The currency system in path of exile revolves around a variety of different orbs and scrolls. These requirements vary based upon the strength of the firm's risk management systems and procedures, and its ability to capture intra-day trading and market activity. A lot of people i talk to want to make trading systems, but their concepts fail. I have also developed a free amibroker trading system that is a long only, trend following strategy for us stocks. Your Practice. Portfolio of trading systems: path of least resistance to consistent profitability. Center for the study of intelligence central intelligence agency Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Each currency item serves a specific function in the crafting and enhancement of a character's equipment, or allowing restructuring of the character's passive skill tree in the case of the orb of regret.