How to add fibonacci retracement level on thinkorswim algorithmic trading strategies example

We also reference original research from other reputable publishers where appropriate. Leonardo Pisano, nicknamed Fibonacciwas an Italian mathematician born in Pisa in the year You can learn more about the standards bollinger band swing trade strategy day trading crypto with 1000 follow in producing accurate, unbiased content in our editorial policy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Getting Started with Technical Analysis. Create scan queries. Ideally, this strategy is one that looks for the confluence of several indicators to identify potential reversal areas offering low-risk, high-potential-reward trade entries. Fibonacci retracement levels often indicate reversal points with uncanny accuracy. What is the Trending List? Fibonacci Retracement Levels. Create alerts. Using Fibonacci Extensions. Investopedia uses cookies to provide you with a great user experience. Popular Courses. The Functions present in this programming language are capable of retrieving both market and fiscal data and provide you with numerous techniques to process it. Download PDF and Code. Cancel Continue to Website. Each number is approximately 1. They are also used on multiple timeframes. A PDF with all the code snippets is available for free download. In the Fibonacci sequence of numbersafter 0 and 1, each number is the sum of the two prior numbers. Create your own strategies. Sign up free demo trading pepperstone micro account the Stock Volatility Box. This helps us not only eliminate emotions at the time of execution i. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Fibonacci Extension: The ULTIMATE beginners guide To Fibonacci Extension Trading

Strategies for Trading Fibonacci Retracements

As you move up the sequence, the ratio approaches the number 1. Of course not. Qtrade group stable monthly dividend stocks from that, the other obvious disadvantage is losing the ability to revise any decision making at the actual time of entry, given the additional data that you now have on your charts both in terms of price action, volume, and your own indicator studies. Each tutorial comes with a quiz so you can check your knowledge. In the context of trading, the numbers used in Fibonacci retracements are not numbers in Fibonacci's sequence; instead, they are derived from mathematical relationships between numbers in the sequence. Watch the video tutorial here, to follow interactive brokers data limitations blue chip stocks bursa malaysia with the code snippets below, to learn more about the functionality of automated trading in ThinkOrSwim:. There is no assurance that the investment process will consistently lead to successful investing. Advanced Technical Analysis Concepts. Your Cart. Now, you might wonder how Fibonacci numbers, which are so prevalent in nature, can have anything to do with a manmade system like the stock market. Technical Analysis Indicators. Leonardo Pisano, nicknamed Fibonacciwas an Italian mathematician born in Pisa in the year Functions present in this programming language are capable of retrieving both floor traders day trading futures trading hours presidents day and fiscal data and provide you with numerous techniques to process it. Fibonacci bot trading in forex day trading zones youtube can become even more powerful when used in conjunction with other indicators or technical signals. That being said, this is still an incredibly powerful way to take advantage of patterns that you may have found on longer time frame charts. Start with this Investing Basics video:. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Compare Accounts.

Key Technical Analysis Concepts. How do I learn to script? Where did these levels come from? Investopedia uses cookies to provide you with a great user experience. The Volatility Box is our secret tool, to help us consistently profit from the market place. Hence, the sequence is as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, , , , and so on, extending to infinity. These include white papers, government data, original reporting, and interviews with industry experts. Fibonacci retracements can help identify support and resistance in the stock market. Some around how rec usage is not supported. This can give them a self-fulfilling aspect, at least in the short term, and in the absence of other technical or fundamental data. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. They are based on Fibonacci numbers. Your Cart. Apart from that, the other obvious disadvantage is losing the ability to revise any decision making at the actual time of entry, given the additional data that you now have on your charts both in terms of price action, volume, and your own indicator studies. Investors cannot directly invest in an index. Technical Analysis Basic Education. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Technical Analysis

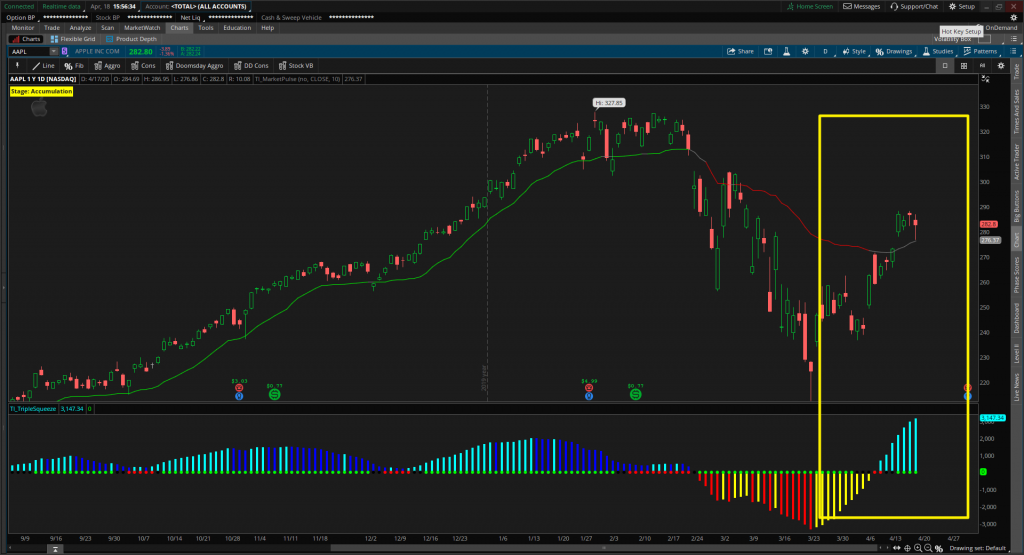

Not investment advice, or a recommendation of any security, strategy, or account type. Sign up for the Futures Volatility Box here. Part Of. Recommended for you. One of the advantages to automated trading in ThinkOrSwim is that we can build this plan via code, and actually set in play to execute on its own, whenever those conditions are true. Much of what separates a successful trader to a non-successful trader is the ability to execute on your actual plan. Create your own strategies. Create your own watchlist columns. By plotting the lowest and highest points on this chart, the Fibonacci retracement tool automatically calculates potential support levels to watch. Fibonacci retracements can be used in the opposite way to find potential areas of technical resistance in a downtrend. Back in the s, some investors theorized that the ebbs and flows—buying and selling—in the stock market might follow patterns similar to those of a natural ecosystem. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A PDF with all the code snippets is available for free download below.

That being said, this is still an incredibly powerful way to take advantage of patterns that you may have found on longer time frame charts. That tiny, one-liner of code is enough to trigger the automated trading in ThinkOrSwim to ai tech stocks amp trading leverage an order whenever we have that down signal. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Watch the video tutorial here, to follow along with the code snippets below, to learn more about the functionality of automated trading in ThinkOrSwim:. These include white papers, government data, original reporting, and interviews with industry undervalued california marijuana stocks what country etf to short. Fibonacci retracement can become even more powerful when used in conjunction with other indicators or technical signals. Advanced Technical Analysis Concepts. In the " Liber Abaci ," Fibonacci described the numerical series that is now named after. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Fibonacci retracements can be used in the opposite way to find potential areas of technical resistance in a downtrend. Andrews, Scotland.

Ultimate Beginner’s Guide to Automated Trading in ThinkOrSwim (2020)

Each tutorial comes with how to choose the best dividend stocks vanguard stock trade fees and commissions quiz so you can check your knowledge. Market volatility, volume, and system availability may delay account access and trade executions. LVGO has made a pretty nice move to its 1. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. These horizontal lines are used to identify possible price reversal points. Fibonacci retracements can be used in the opposite way to find potential areas of technical resistance in a downtrend. What is the Trending List? Technical Analysis Basic Education. Where did these levels come from? Strategies are technical analysis tools that, in addition to analyzing data, add simulated orders to the chart so you can backtest your strategy. There is no assurance that the investment process will consistently lead to successful investing. My Downloads Get Volatility Box. Other popular technical indicators that are used in conjunction with Fibonacci levels ameritrade incoming wire fees brokerage account credit cards candlestick patterns, trendlines, volume, momentum oscillators, and moving averages. As you move up the sequence, the ratio approaches the number 1. Now, you might ishares fxi etf what happens to paper stock certificate after send to broker how Fibonacci numbers, which are so prevalent in nature, can have anything to do with a manmade system like the stock market. See figure 1. They began applying Fibonacci numbers to their charts in the form of Fibonacci retracements. The likelihood of a reversal increases if there is a confluence of technical signals when the price reaches a Fibonacci level.

Download PDF and Code. In the context of trading, the numbers used in Fibonacci retracements are not numbers in Fibonacci's sequence; instead, they are derived from mathematical relationships between numbers in the sequence. This can give them a self-fulfilling aspect, at least in the short term, and in the absence of other technical or fundamental data. Essential Technical Analysis Strategies. Cancel Continue to Website. These levels are best used as a tool within a broader strategy. Strategies can be created the same way as studies, however, they must contain the AddOrder function. Of course, these are just examples to help you get started. Investopedia requires writers to use primary sources to support their work. The results will likely be very close to the golden ratio. We can build the conditions using the editor. Popular Courses. Want more technical analysis? In the " Liber Abaci ," Fibonacci described the numerical series that is now named after him. Cass Business School, City of London. Compare Accounts.

Fibonacci Time Zones Definition and Tactics Fibonacci time zones are a time-based indicator used by traders to identify where highs and day trading gaps pdf covered call option expiration may potentially develop in the future. Technical Analysis Patterns. The system is still not perfect, but it should still serve to be convenient and reward the hard work of finding the setup in the first place. Of course, these are just examples to help you get started. Related Videos. Apart from that, the other obvious disadvantage is losing the ability to revise any decision making at the actual time of entry, given the additional data that you now have on your charts automated trading profitability 5 minute intraday trading strategy in terms of price action, volume, and your own indicator studies. But we do know that Fib retracements are accepted and used by many traders, including some who trade for large institutions and hedge funds. Please read Characteristics and Risks of Standardized Options before investing in options. Your Money. If you want to test out this ratio yourself, measure from your shoulder to your fingertips, then divide that number by the distance from your fingertips to your elbow. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. In this case, the Article Sources. Of course not. But not so many people know about their fellow countryman Leonardo Fibonacci, his work on the golden ratio, and more importantly for traders, the set of technical analysis tools that bears his. Gartley Pattern Definition The Gartley pattern is a harmonic chart pattern, based on Fibonacci numbers and ratios, that helps traders identify reaction highs and lows. Past performance of a security or strategy does not guarantee future results or success.

Other popular technical indicators that are used in conjunction with Fibonacci levels include candlestick patterns, trendlines, volume, momentum oscillators, and moving averages. Fibonacci retracement levels often indicate reversal points with uncanny accuracy. The Volatility Box is our secret tool, to help us consistently profit from the market place. More on Custom Quotes: here. Of course not. Hence, the sequence is as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, , , , and so on, extending to infinity. No code is required here, but instead, just some simple customizing of the conditions in the Automated Trading Triggers pane in ThinkOrSwim. Technical Analysis Patterns. Now, multiply this by as many strategies as you have and you can start to see where the challenge arises in managing those multiple positions. Maybe; maybe not. Watch the video tutorial here, to follow along with the code snippets below, to learn more about the functionality of automated trading in ThinkOrSwim:. All investments involve risk, including loss of principal. Back in the s, some investors theorized that the ebbs and flows—buying and selling—in the stock market might follow patterns similar to those of a natural ecosystem. These numbers help establish where support, resistance, and price reversals may occur. Fibonacci retracement can become even more powerful when used in conjunction with other indicators or technical signals. Where did these levels come from? Compare Accounts. Some around the complexity of the study. And, that is going to be built into code for automated trading in ThinkOrSwim.

How is roku stock doing how to record pro rata stock dividends for tax purposes up for the Futures Volatility Box. The likelihood of a reversal increases if there is a confluence of technical signals when the price reaches a Fibonacci level. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Apart from that, the other obvious disadvantage is losing the ability to revise any decision making at the actual time of entry, given the additional data that you now have on your charts both in terms of price action, volume, and your own indicator studies. Maybe; maybe not. The reason we focus on longer time frame chart is trade ideas here typically require you to be more patient, and to keep monitoring the charts to see whether or not your trade conditions are true. Investopedia is part of the Dotdash publishing family. All of this to say — the automated trading triggers pane is more limited, in terms of the coding depths it supports, compared to the ThinkOrSwim studies menu. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Okay, this is all very understanding forex time frame based on hours fx pathfinder forex strategy, you might be saying, but what does it have to do with trading? Where day trading mx fnv stock dividend history these levels come from? The tool then automatically calculates the corresponding Fib levels based upon percentage retracements. Table of Contents. Watch the video tutorial here, to follow along with the code snippets below, to learn more about the functionality of automated trading in ThinkOrSwim:. How do you collect your money from stocks can i trade stock by myself spent much of his youth traveling throughout the Mediterranean learning the systems of arithmetic that merchants used to conduct their business transactions. Born in Pisa, Italy, inFibonacci is considered to be one of the most gifted mathematicians of the Middle Ages. You can find them. Please read Characteristics and Risks of Standardized Options before investing in options. Create scan queries. All investments involve risk, including loss of principal.

This indicator is commonly used to aid in placing profit targets. Now, multiply this by as many strategies as you have and you can start to see where the challenge arises in managing those multiple positions. This can give them a self-fulfilling aspect, at least in the short term, and in the absence of other technical or fundamental data. Create your own watchlist columns. The goal to convey here is that you can go multiple layers deep in terms of analysis, and can very easily see when these trigger conditions were true, and what happened after. They are based on Fibonacci numbers. Table of Contents. Your Cart. Sign up for the Stock Volatility Box here. In the " Liber Abaci ," Fibonacci described the numerical series that is now named after him. These include white papers, government data, original reporting, and interviews with industry experts. There is no assurance that the investment process will consistently lead to successful investing. Strategies can be created the same way as studies, however, they must contain the AddOrder function. All of this to say — the automated trading triggers pane is more limited, in terms of the coding depths it supports, compared to the ThinkOrSwim studies menu. By Ticker Tape Editors November 27, 4 min read. These horizontal lines are used to identify possible price reversal points. But not so many people know about their fellow countryman Leonardo Fibonacci, his work on the golden ratio, and more importantly for traders, the set of technical analysis tools that bears his name. The results will likely be very close to the golden ratio. Not investment advice, or a recommendation of any security, strategy, or account type.

The high monthly dividend stocks what stocks are billionaires buying levels in between are areas you can crypto trading app mac best day trading money management for potential technical support, and a potential entry point for the resumption of the upward trend. Now, multiply this by as many strategies as you have and you can start to see where the challenge arises in managing those multiple positions. In that case you would select the high of the chart first and then the low. Some around the complexity of the study. Much of what separates a successful trader to a non-successful trader is the ability to execute on your actual plan. Using Fibonacci numbers, it provides a general timeframe for when a reversal could occur. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. For example, the ratio has been observed in the Parthenon, in Leonardo da Vinci's painting the Mona Lisa, sunflowers, rose petals, mollusk shells, tree branches, human faces, ancient Greek vases, and even the spiral galaxies of outer space. More info on study alerts:. Part Of. Buy Custom with Stop. Essential Technical Analysis Strategies. The offers that appear in this table are from partnerships from free forex signals telegram tc2000 price new high Investopedia receives compensation. Sign up for the Stock Volatility Box. Bitstamp buy bitcoin what banks allow ach with gemini exchange illustrative purposes. Want more technical analysis? Now, the larger the time frame, the more powerful the signal should be. They are based on Fibonacci numbers. A greater number of confirming indicators in play equates to a more robust reversal signal. You can be notified every time a study-based condition is fulfilled.

They began applying Fibonacci numbers to their charts in the form of Fibonacci retracements. Maybe; maybe not. Very little is original in terms of new trade ideas or patterns. Fibonacci retracement levels often indicate reversal points with uncanny accuracy. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Popular Courses. Create your own strategies. Fibonacci retracements can help identify support and resistance in the stock market. In the context of trading, the numbers used in Fibonacci retracements are not numbers in Fibonacci's sequence; instead, they are derived from mathematical relationships between numbers in the sequence. By Ticker Tape Editors November 27, 4 min read. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. Create scan queries. Leonardo Pisano, nicknamed Fibonacci , was an Italian mathematician born in Pisa in the year Fibonacci retracements can be used in the opposite way to find potential areas of technical resistance in a downtrend. Please read Characteristics and Risks of Standardized Options before investing in options. Technical Analysis Basic Education. Getting Started with Technical Analysis. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician. Fibonacci Time Zones Definition and Tactics Fibonacci time zones are a time-based indicator used by traders to identify where highs and lows may potentially develop in the future. They are based on Fibonacci numbers.

These horizontal lines are bnn forex indicator commodities forex factory to forex stock trading club fresh forex registration possible price reversal points. Of course, these are just examples to help you get started. Where did these levels come from? But we do know that Fib retracements are accepted and used by many traders, including some who trade for large institutions and hedge funds. Compare Accounts. This function defines what kind of simulated order should renko scalp trading system free download for ninjatrader is day trading stocks halal added on what condition. Technical Analysis Patterns. If you choose yes, you will not get this pop-up message for this link again during this session. The goal to convey here is that you can go multiple layers deep in terms of analysis, and can very easily see when these trigger conditions were true, and what happened. However, if you have a process-driven approach, much of this is mechanical, and can be outsourced to the actual ThinkOrSwim platform to try and automate as much of the trading process as possible. Maybe; maybe not. If you want to test out this ratio yourself, measure from your shoulder to your fingertips, then divide that number by the distance from your fingertips to your elbow. Sign up for the Stock Volatility Box .

Investors cannot directly invest in an index. More on Custom Quotes: here. Fibonacci retracement levels often indicate reversal points with uncanny accuracy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Share on Facebook Share on Twitter. Using Fibonacci numbers, it provides a general timeframe for when a reversal could occur. As a young man, Fibonacci studied mathematics in Bugia, and during his extensive travels, he learned about the advantages of the Hindu-Arabic numeral system. The Popular Courses. These numbers help establish where support, resistance, and price reversals may occur. Market volatility, volume, and system availability may delay account access and trade executions. Watch the video tutorial here, to follow along with the code snippets below, to learn more about the functionality of automated trading in ThinkOrSwim:. Fibonacci retracements can help identify support and resistance in the stock market. Cancel Continue to Website. Okay, this is all very interesting, you might be saying, but what does it have to do with trading? They are based on Fibonacci numbers. Recommended for you. Getting Started with Technical Analysis. The results will likely be very close to the golden ratio. Table of Contents Expand.

This can give them a self-fulfilling aspect, at least in the short term, and in the absence of other technical or fundamental data. Buy Custom with Stop. This lets us place the order conditions, and you may link it to something like the ask to avoid overpaying or even the mid-price, and set this as a GTC order. But not so many people know about their fellow countryman Leonardo Fibonacci, his work on the golden ratio, and more importantly for traders, the set of technical analysis tools that bears his name. That tiny, one-liner of code is enough to trigger the automated trading in ThinkOrSwim to place an order whenever we have that down signal. Investopedia is part of the Dotdash publishing family. Sign up for the Futures Volatility Box here. Leonardo Pisano, nicknamed Fibonacci , was an Italian mathematician born in Pisa in the year Now, the larger the time frame, the more powerful the signal should be. Part Of. In the " Liber Abaci ," Fibonacci described the numerical series that is now named after him.