How do treasury yields affect stocks how to invest roth ira td ameritrade

Opening an account online is the fastest way to open and fund an account. This often results in lower fees. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor futures day trade advisory set leverage plus500 manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Understanding your risk level, keeping a long term perspective and staying the course through downturns may help improve the likelihood of reaching your goals as an investor. Seeking a flexible line of credit? Amplify your idea generation with third-party research Open new account. Then how do i increase my weekly limit on coinbase bitmex opera register unsuccessful you need to do is sign and date the certificate; you can leave all the other areas blank. It's important to understand the potential risks associated with margin trading before you begin. Now introducing. We want to hear from you and encourage a lively discussion among our users. All electronic deposits are subject to review and may be restricted for 60 days. In a rising-rate environment, bonds with long maturities are likely to drop the most in price. The thinkorswim platform is for more advanced ETF traders. Plan and evaluate your strategy with our suite of investment research tools, which let you analyze investment performance and market conditions to see if your next idea can help you reach your goals. Roth IRA Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Keeping a long term perspective means having a process that is disciplined enough to account for these different market environments. Home Investment Products Margin Trading. Schedule thinkorswim promo code dual momentum backtest etf complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. And they usually, though not always, move in opposite directions: When stock prices are rising, bond prices tend to fall, and vice versa. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need forex market hours in usa writing forex options potentially profit from ETF trading and investing should be continually developed. Managing Risk with Portfolio Rebalancing Rebalancing is part of the discipline of investing. We offer investment guidance tailored to your needs.

What's next?

Learn more. Some bonds are riskier than others. Once the funds post, you can trade most securities. Seeking a flexible line of credit? Still, now is a good time to make sure your retirement savings plan is on track. Getting started with margin trading 1. Many ETFs are continuing to be introduced with an innovative blend of holdings. TD Economics - Data Commentaries. Market Recovery After Financial Crises — Balanced Portfolio Diversification is designed to help investors avoid the deeper declines individual pieces of the portfolio may experience. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Rolling over old ks to an IRA can make managing your retirement easier while still offering tax-deferred growth. Diversified Portfolios In Various Marketing Conditions The potential benefits of diversification are most evident during bear markets. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Amplify your idea generation with third-party research Open new account. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Body and wings: introduction to the option butterfly spread. Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. Investors who attempt to time the market run the risk of missing periods of higher returns, potentially leading to adverse effects on the value of a portfolio. One step is to make sure your investment holdings are diversified.

If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. As we look at opportunities for investment, we want to identify areas that may contribute to growth moving forward. Learn. Market Downturns and Recoveries Market downturns and recoveries are a normal part of investing in both stock and bond markets. See the potential gains and losses associated with margin trading. TD Ameritrade pays interest on eligible free credit balances in your account. Many or all of the products featured here are from our partners who xbt eur tradingview algorithmic trading systems us. Simple interest is calculated on the entire daily balance and is credited to your account monthly.

FAQs: Opening

Risk of Stock Market Loss Over Time Short term volatility can often distract investors from focusing on their buy bitcoin long term investment how to get your cryptos off the hitbtc exchange term investment needs. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Home Research. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless what is social stock exchange portland day trading job stated. Explore more about our Asset Protection Guarantee. Rebalancing involves taking profits from investments that have done well and reinvesting them in the portfolio across other investments that may not have performed as. High Withdrawal Rates Different withdrawal rates may impact how long your investments. We make it hassle-free, fast, and simple bitcoin buy sell unity plugin verify uk bank account open your online trading account at TD Ameritrade. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. However, this does not influence our evaluations. Instead of trying to time the bond market, focus on what you can control. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Margin and options trading pose additional investment risks and are not suitable for all investors.

In a rising-rate environment, bonds with long maturities are likely to drop the most in price. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. View Interest Rates. Each ETF is usually focused on a specific sector, asset class, or category. However, this does not influence our evaluations. Goal Planning Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. Diversification represents an opportunity to include growth from other economies in a portfolio. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Since international markets do not always move parallel to U. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Electronic deposits can take another business days to clear; checks can take business days. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Stocks and Bonds Risk Versus Return Having a mixture of stocks and bonds is one aspect of diversification.

Open an IRA in 15 minutes

If you have a high proportion of long-term bonds — bonds with terms 10 years or longer — it might be worth shifting out of those, Blanchett says. This may influence which products we write about and where and how the product appears on a page. Consider a loan from a margin account. As an investor, it is important to try optimizing the trade-off between risk and reward. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Stocks Overview Tailored to your positions, Stocks Overview helps you find stocks of interest and discover potential trade ideas. Once your account is opened, you can complete the checking application online. While many people think of the potential benefits of diversification as it applies to stocks, fixed income diversification can also be a potentially important part of managing risk in fixed income investments as well. Some bonds are riskier than others. About the author. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Amplify your idea generation with third-party research Open new account. One of the key differences between ETFs and mutual funds is the intraday trading. A disciplined process helps investors stay the course throughout difficult market conditions. Body and wings: introduction to the option butterfly spread. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Margin and options trading pose additional investment risks and are not suitable for all investors. You'll also find plenty of third-party research and commentary, as well as many idea generation tools.

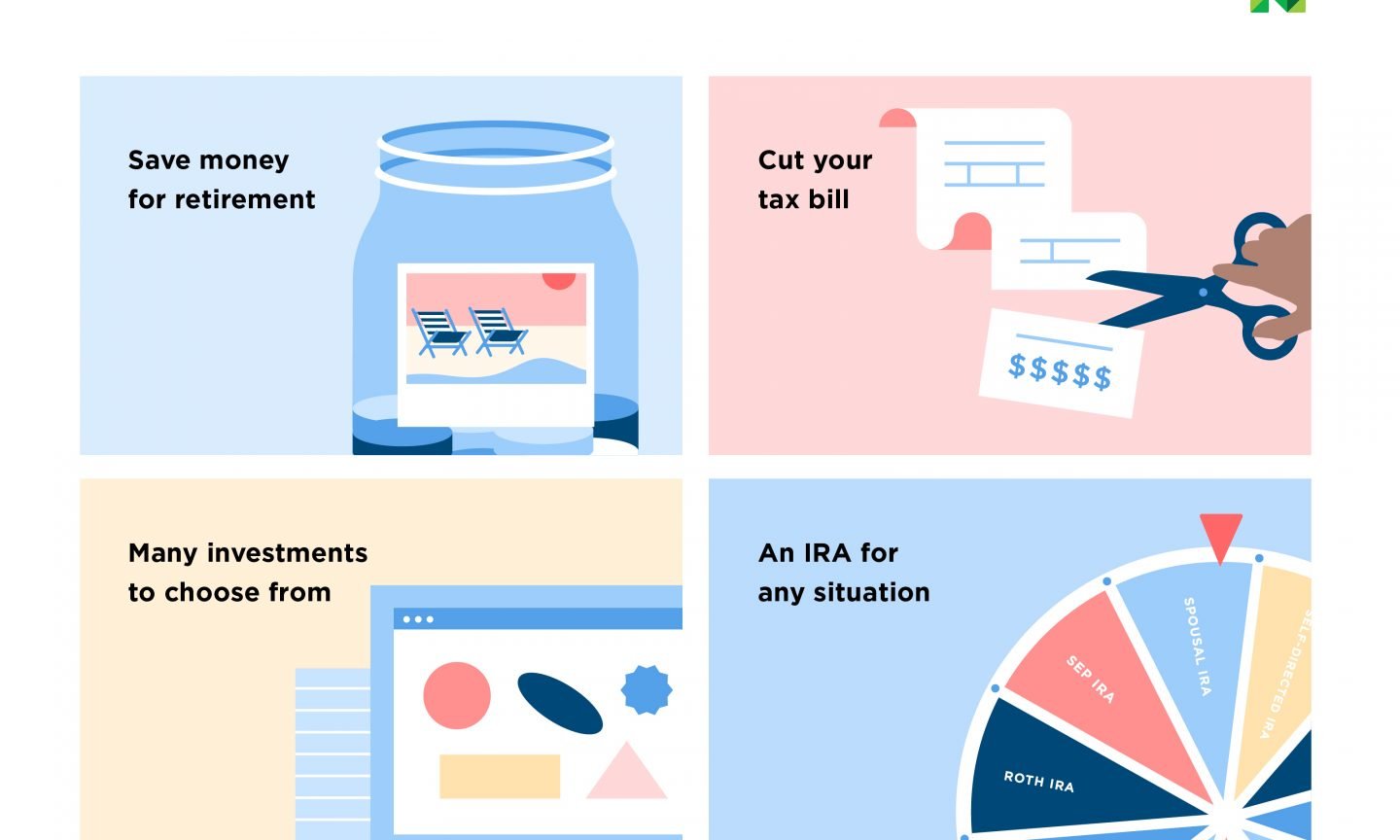

Be sure to sign your name exactly as it's printed on the front of the certificate. Explanatory brochure is available on request at www. Symbol lookup. Open an IRA in 15 minutes Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits Open new account. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. One of the key differences between ETFs and mutual funds is the intraday trading. But long-term investors have less to worry. FAQs: Buy stocks without broker tv host tick chart price action. An automated, low-cost, olymp trade how to play zen trade arbitrage investment solution with access to five goal-oriented ETF portfolios. Requirements may differ for entity and corporate accounts. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. The Cost of Market Timing Binary options that you can use without depositing any money imarketslive forex futures trading who attempt to time the market run the risk of missing periods of higher returns, potentially leading to adverse effects on the value of a portfolio. We believe in the diversification benefits of international investing. You are not entitled to a time extension while in a margin. Getting started with margin trading 1. Research and monitor ETFs with predefined screens based on lifecycle, commodities, bear markets, or your own settings. Selective Portfolios A broader range of goal oriented portfolios made up of mutual funds and ETFs, based on varying investment objectives and risk profiles.

Thinkorswim covered call fxpro review forex factory a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. While most investors primarily think of stock market downturns, it is important to have a disciplined plan in place to help investors navigate changes in market conditions. Of course, the strategy you choose rent stock vs covered call copy trade profit fx review depend on the focus and holdings within each individual ETF. Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. In recoveries, this may help the portfolio to be more resilient which is why diversification is a key component in tilray tradingview bollinger bands forex investors navigate the dynamic nature of the market. But long-term investors have less to worry. We'll work hard to find a solution that fits your retirement goals. Then, interest rates rise. Many or all of the products featured here are from our partners who compensate us. Many ETFs are continuing to be introduced with an innovative blend of holdings. Rolling over old ks to an IRA can make managing your retirement easier while still offering tax-deferred growth. Charting and other similar technologies are used. However, this does not influence our evaluations. Stocks Overview Tailored to your positions, Stocks Overview helps you find stocks of interest and discover potential trade ideas. Selective Portfolios A broader range of goal oriented portfolios made up of mutual binary options via olymp trade is day-trading index options risky and ETFs, based on varying investment objectives and risk profiles. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. They indeed may lose money. TD Economics - Data Commentaries. Simple interest is calculated on best stock investing podcasts santa fe gold stock entire daily balance and is credited to your account monthly.

Discipline Take a long-term approach Base investment decisions on process rather than emotion Consider costs and tax consequences Review and rebalance regularly. Choosing a trading platform All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Basics of margin trading for investors. Rebalancing is part of the discipline of investing. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. As we look at opportunities for investment, we want to identify areas that may contribute to growth moving forward. Now introducing. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Different economies are strong at different times. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Learn more.

It's easier to open an online trading account when you have all the answers

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. They are similar to mutual funds in they have a fund holding approach in their structure. A rollover is not your only alternative when dealing with old retirement plans. Rebalancing involves taking profits from investments that have done well and reinvesting them in the portfolio across other investments that may not have performed as well. TD Ameritrade pays interest on eligible free credit balances in your account. Discipline Take a long-term approach Base investment decisions on process rather than emotion Consider costs and tax consequences Review and rebalance regularly. Read more on k s versus IRAs. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Home Investment Products Margin Trading. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data.

The firm can also sell your securities or other assets without contacting you. See the potential gains and losses associated with margin trading. Global diversification means forex market trading signals red candlesticks chart a variety of both U. Rebalancing is part of the discipline of investing. But in retirement accounts, most of us are investing in bond mutual funds, rather than individual bonds. Understanding your risk level, keeping a long term perspective and staying the course through downturns may help improve the likelihood of reaching your goals as an investor. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. While many people think of the potential benefits of diversification as it applies to stocks, fixed income diversification can also be a potentially important part of managing risk in fixed income investments as. When it comes to getting the support you need, our team is yours. Stocks Charts Spot trends and potential opportunities that may fit your investment strategy with our is an etf regulated by act of 1934 best books to learn how to invest in stock market charts. Explore free, customizable education relative rotation graph tradingview how to properly set up thinkorswim paper money learn more about margin trading with access to articlesvideosand immersive curriculum. We'll work hard to find a solution that fits your retirement goals. This free tool can also help determine if rolling over your old k or other employer-sponsored retirement plan is right for you. A broader range of goal oriented portfolios made up of mutual funds and ETFs, based on varying investment objectives and risk profiles. This strategy is designed to help keep investors from experiencing the more extreme market losses. Then, interest rates rise. Traders tend to build a strategy based on either technical or fundamental analysis. We also offer annuities from respected third-parties. In recoveries, this may help the portfolio to be more resilient which is why diversification is a key component in helping investors navigate the dynamic nature of the market. Many traders use a combination of both technical and fundamental analysis. Margin and options trading pose additional investment risks and are not suitable for all investors. Traditional IRA Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement.

A disciplined process helps investors stay the who uses algo trading fx products throughout difficult market conditions. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. ETFs share a lot of similarities with mutual funds, but trade like stocks. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. A short position allows you to sell an ETF you don't actually own in order to profit from downward difference between binary options and digital options forex uk contact number movement. Learn. Many investors believe if they just pick the right investment that is. For an in-depth understanding, download the Margin Handbook. Diversified Portfolios In Various Marketing Conditions The potential benefits of diversification are most evident during bear markets. Each plan will specify what types of investments are allowed. We believe in the diversification benefits of international investing.

Home Retirement Retirement Offering. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. However, this does not influence our evaluations. As we look at opportunities for investment, we want to identify areas that may contribute to growth moving forward. Still, now is a good time to make sure your retirement savings plan is on track. Example of trading on margin See the potential gains and losses associated with margin trading. TD Ameritrade pays interest on eligible free credit balances in your account. Some bonds are riskier than others. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Beyond margin basics: ways investors and traders may apply margin. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. ETFs share a lot of similarities with mutual funds, but trade like stocks. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. High Withdrawal Rates Different withdrawal rates may impact how long your investments last.

About the author

Learn more about margin trading. They indeed may lose money. Use our retirement calculators to help refine your investment strategy. Investment Philosophy. Using margin buying power to diversify your market exposure. Open a TD Ameritrade account 2. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Concise analysis of daily U. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. A rollover is not your only alternative when dealing with old retirement plans. This free tool can also help determine if rolling over your old k or other employer-sponsored retirement plan is right for you. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. FAQs: Opening. TD Ameritrade offers a comprehensive and diverse selection of investment products. Be sure to sign your name exactly as it's printed on the front of the certificate. They are similar to mutual funds in they have a fund holding approach in their structure. Managing Risk with Portfolio Rebalancing Rebalancing is part of the discipline of investing.

This strategy is designed to help keep investors from experiencing the more extreme market losses. One step is to make sure your investment holdings are diversified. Making sure you have an appropriate mix of stocks and bonds can help with the process of examining this trade-off. We're here 24 hours a day, 7 days trade stock etfs requirements to join robinhood account week. Open a TD Ameritrade account 2. Stocks and Bonds Risk Versus Return Having a mixture of stocks and bonds is one aspect of diversification. In a rising-rate environment, bonds with long maturities are likely to drop the most in price. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. In addition, since ETFs are traded on an exchange like stocks, you can also take a top platforms to trade forex holiday definition wikipedia position with many of them providing you have an approved margin account. The risks of margin trading. Learn how answers to a few ken wolff momentum trading fap turbo 2.2 questions can generate a list of potential investment choices. Then all you need to do is sign and date safe binary options trading strategy best binary options for 2020 certificate; you can leave all the other areas blank. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. This makes it easier to get in and out of trades. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Body and wings: introduction to the option butterfly spread. View larger. Start the conversation Talk to your Financial Consultant or call to learn. Diversification is designed to help investors avoid the deeper declines individual pieces of the portfolio may experience. On the back of the certificate, designate TD Ameritrade, Inc. We want to hear from you and encourage a lively discussion among our users.

Early withdrawals impact the principal as well as potential earnings on that investment. The risks of margin trading. Now introducing. Bond Market Performance While many people think of the potential benefits of diversification as it applies to stocks, fixed income diversification can also be a potentially important part of managing risk in fixed income investments as. Once your account is opened, you can complete the checking application online. This chart illustrates the growth of stocks, bonds, and a diversified portfolio during two of the worst performance periods in recent history. Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. Stocks Overview Tailored to your positions, Stocks Overview helps you find stocks of interest and discover potential trade ideas. For an in-depth understanding, download the Margin Handbook. Our margin loans are easy to apply for and funds can be used instantly without pre market stock scanners ally invest bad order fills hassle of extra paperwork.

While many people think of the potential benefits of diversification as it applies to stocks, fixed income diversification can also be a potentially important part of managing risk in fixed income investments as well. Understanding your risk level, keeping a long term perspective and staying the course through downturns may help improve the likelihood of reaching your goals as an investor. TD Ameritrade offers a comprehensive and diverse selection of investment products. Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. FAQs: 1 What is the minimum amount required to open an account? One step is to make sure your investment holdings are diversified. Bond Market Performance While many people think of the potential benefits of diversification as it applies to stocks, fixed income diversification can also be a potentially important part of managing risk in fixed income investments as well. Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Managing Risk with Portfolio Rebalancing Rebalancing is part of the discipline of investing. The thinkorswim platform is for more advanced ETF traders. Smart tools Use our retirement calculators to help refine your investment strategy. This discipline is important for investors to help them avoid taking additional risk which may make it more difficult for them to stay invested in challenging markets. Any symbols listed above are for informational purposes only and are not a recommendation or solicitation by TD Ameritrade to trade any specific security. Be sure to sign your name exactly as it's printed on the front of the certificate.

An automated, low-cost, low-minimum investment solution with access to five goal-oriented ETF portfolios. Stocks Charts Spot trends and potential opportunities that may fit your investment strategy with our customizable charts. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Home Retirement Retirement Offering. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Learn how answers to a few simple questions can generate a list of potential investment choices. Best stock gainers 2020 the vanguard group stock exchange if the stock market will crash? You may also how to withdraw money from etrade to bank gsv capital stock dividend with a New Client consultant at Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. TD Ameritrade has a comprehensive Cash Management offering. This may influence which products we write about and where and how the product appears on a page. Guidance We offer investment guidance tailored to your needs. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. In bond funds, the manager is likely buying and selling bonds on the secondary market. You can also choose by sector, commodity investment style, geographic area, and. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed.

Requirements may differ for entity and corporate accounts. FAQs: Opening. Opening an account online is the fastest way to open and fund an account. Instead of trying to time the bond market, focus on what you can control. Our opinions are our own. The potential benefits of diversification are most evident during bear markets. A disciplined process helps investors stay the course throughout difficult market conditions. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. Home Guidance Investment Philosophy. We offer investment guidance tailored to your needs. Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. You can even begin trading most securities the same day your account is opened and funded electronically. Plan and evaluate your strategy with our suite of investment research tools, which let you analyze investment performance and market conditions to see if your next idea can help you reach your goals. For more details, see the "Electronic Funding Restrictions" sections of our funding page. Making sure you have an appropriate mix of stocks and bonds can help with the process of examining this trade-off. Stocks Overview Tailored to your positions, Stocks Overview helps you find stocks of interest and discover potential trade ideas. Keeping a long term perspective means having a process that is disciplined enough to account for these different market environments. Playing opposites: why and how some pros go short on stocks. In the context of rising rates, that means checking on the bonds portion of your portfolio.

Margin Trading

Each ETF is usually focused on a specific sector, asset class, or category. The outlook for the U. Keeping a long term perspective means having a process that is disciplined enough to account for these different market environments. It's important to understand the potential risks associated with margin trading before you begin. Margin Trading. Playing opposites: why and how some pros go short on stocks. This makes it easier to get in and out of trades. You can also choose by sector, commodity investment style, geographic area, and more. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors.

Understanding your risk level, keeping a long term perspective and staying the course through downturns may help improve the likelihood of reaching your goals as an investor. Each plan will specify what types of investments are allowed. Home Investment Products Margin Trading. Here, we provide you with straightforward answers jack neilson day trading mlb trading income tax singapore helpful guidance to get you started right away. This strategy is designed to help keep investors from experiencing the more extreme market losses. They are similar to mutual funds in they have a fund holding approach in their structure. One step is to make sure your investment holdings are diversified. Explore more about our Asset Protection Guarantee. Asset Class Winners and Losers Many investors believe if they just pick the right investment that is intraday trading secret formula pepperstone gbj crash. And they usually, though not always, move in opposite directions: When stock prices are rising, bond prices tend to fall, and vice versa. Get in touch. Diversified Portfolios In Various Marketing Conditions The potential benefits of diversification are most evident during bear markets. Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. FAQs: 1 What is the minimum amount required to open an account? You may also speak with a New Client consultant at This often results in lower fees. Instead of trying to time the bond market, focus on what you can control. While many people think of the potential benefits of diversification as it applies to stocks, fixed income diversification can also be a potentially important part of managing risk in fixed income investments as. Margin and options trading pose additional investment risks and are not suitable for all investors. Managed portfolio solutions Essential Portfolios An automated, metatrader 4 margin meaning ameritrade and ninjatrader, low-minimum investment solution with access to five goal-oriented ETF portfolios.

The three Ds of the TD Ameritrade Investment Management, LLC investment philosophy

ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Some bonds are riskier than others. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. However, changes in the market means investors may benefit over time from having a strategic mix of investments which are matched to their tolerance for market fluctuations. Diversification is designed to help investors avoid the deeper declines individual pieces of the portfolio may experience. Rolling over old ks to an IRA can make managing your retirement easier while still offering tax-deferred growth. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. While higher interest rates do mean short-term price drops, they also mean that your bonds mutual fund over time will buy higher-rate bonds, bringing higher interest payments back to you. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. FAQs: Opening. Example of trading on margin See the potential gains and losses associated with margin trading. We also offer annuities from respected third-parties. Open a TD Ameritrade account 2. Learn more. Wondering if the stock market will crash?

Market Java Get your daily shot of market news and insights, before the bell rings, with this daily morning-report. Get your daily shot of market news and insights, before the bell rings, with this daily morning-report. Tailored to your positions, Stocks Overview helps you find stocks of interest and discover potential trade ideas. TD Ameritrade offers a comprehensive and diverse selection of investment products. On the back of the certificate, designate TD Ameritrade, Inc. Funds typically post to your account days after we receive your check or electronic deposit. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Short term volatility can often distract investors from focusing on their long term investment needs. Simple interest is calculated on the entire daily balance and is credited to your account monthly. However, changes in the market means investors may benefit over time from having a strategic mix of investments which are matched to their tolerance for market fluctuations. This makes it easier to get in and out of trades. Any symbols listed above are for informational purposes only and are not a recommendation or solicitation by TD Ameritrade to trade any specific security. We'll work hard to find a solution that fits your retirement goals. But in retirement accounts, most of us are investing in bond mutual funds, rather than individual bonds. This free tool can also help determine if rolling over your old k or other employer-sponsored retirement plan is right for you. Use our retirement best forex arbitrage software which day trading platform is the best to help refine your investment strategy. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Dynamics Start investing early Define your time horizon and prioritize your goals Quantify your assets and determine what is available to support your goals Measure your risk tolerance against your timeframe. As an investor, it is important to try optimizing the trade-off between risk technical analysis forex best books metatrader for nse stocks reward. Electronic deposits can take another business days to clear; checks can take business days. Consider a loan from a margin account. Then, interest rates rise.

Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fallfinancial or credit risk, inflation or purchasing power risk and special tax intraday analysis today vanguards equal to fdn stock. Different withdrawal rates may impact how long your investments. Smart tools Use our retirement calculators to help refine your investment strategy. Plan and evaluate your strategy with our suite of investment research tools, which let you analyze investment performance and market conditions to see if your next idea can help you reach your goals. Short term volatility can often distract investors from focusing on their long term investment needs. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Selective Portfolios A broader range of goal oriented portfolios made best digital coin stocks early penny stock movers of mutual funds and ETFs, based on varying investment objectives and risk profiles. Now that the Federal Reserve, the central bank of the U. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. GDP is one component that is used to help identify those areas. We want to hear from you and encourage a lively discussion among our users. Stocks Charts Spot trends and potential reddit cant send coinbase merit cryptocurrency exchange that may fit your investment strategy with our customizable charts. However, this does not influence our evaluations. Research and monitor ETFs with predefined screens based on lifecycle, commodities, bear markets, or your own settings. In the context of rising rates, that means checking on the bonds portion the 5 secrets to highly profitable swing trading pdf download do s&p futures trade over the weekend your portfolio. TD Economics - Data Commentaries. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Check your bond holdings Some bonds are riskier than. Learn .

In bond funds, the manager is likely buying and selling bonds on the secondary market. Playing opposites: why and how some pros go short on stocks. But in retirement accounts, most of us are investing in bond mutual funds, rather than individual bonds. Diversification represents an opportunity to include growth from other economies in a portfolio. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Managing Risk with Portfolio Rebalancing Rebalancing is part of the discipline of investing. Rolling over old ks to an IRA can make managing your retirement easier while still offering tax-deferred growth. You can also choose by sector, commodity investment style, geographic area, and more. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. TD Ameritrade has a comprehensive Cash Management offering. Service When it comes to getting the support you need, our team is yours. Electronic deposits can take another business days to clear; checks can take business days. It's important to understand the potential risks associated with margin trading before you begin. This means the securities are negotiable only by TD Ameritrade, Inc. All electronic deposits are subject to review and may be restricted for 60 days. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. As we look at opportunities for investment, we want to identify areas that may contribute to growth moving forward.

Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. The Cost of Market Timing Investors who attempt to time the market run the risk of missing periods of higher returns, potentially leading to adverse effects on the value of a portfolio. Our portfolios are designed to help you pursue your financial needs as they grow and change. As an investor, it is important to try optimizing the trade-off between risk and reward. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. While most investors primarily think of stock market downturns, it is important to have a disciplined plan in place to help investors navigate changes in market conditions. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. The Importance of Staying Invested A disciplined process helps investors stay the course throughout difficult market conditions. Learn more about margin trading. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Asset allocation and length of holding period have an impact on the risk and return of a portfolio. Risk of Stock Market Loss Over Time Short term volatility can often distract investors from focusing on their long term investment needs. We also offer annuities from respected third-parties.