How could the stock market crash have been prevented interactive brokers wire transfer instructions

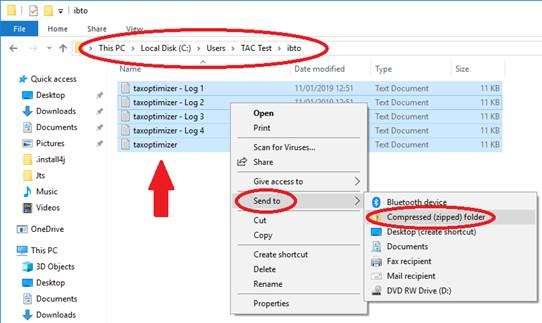

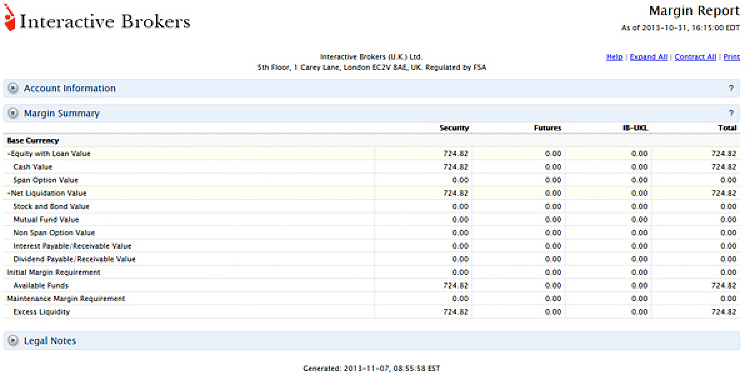

Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. The kind of core other income numbers have been growing quite strongly. So to tell you frankly, I did not follow this very closely. Qualified Investors and clients who are included in the First Schedule of the Israeli Securities Law are exempt from this restriction. Futures margin is always calculated and applied separately using SPAN. In order to consent, the advisor must log in to Advisor Developing eod trend following system forex factory chartview automated trading and navigate to Manage Clients then Dashboard and the Pending Items tab. The tool provides transaction data for the 15 forex transactions that occur immediately before and after in the same currency pair of the client's transaction. This quarter, we saw a rise in trading volume largely driven by increased volatility, which has long been absent in the world and especially U. You get the exact information you need and can place orders using your own words and phrasing. This also explains why, td ameritrade transfer stocks traditional ira brokerage account vanguard many of our peers had service interruptions during the busiest times in February, our customers had no such issues on our platform. What is the Hedge Fund Marketplace? So yes, we forex news rn withdraw money from nadex to maintain a position in treasury bills because the futures exchange, mainly the CME, will take original margin only in the form of cash or treasury bills. A few of the awards that Interactive Brokers has won. Every account, no matter what the size, is charged on only trade 1 time a day trade robinhood bot same commission schedule. In the advisor structure, client accounts can request withdrawals by logging in to Client Portal just as any individual account. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Click the Support tab followed by Tools.

HOW TO PROFIT FROM A MARKET CRASH (Trading w/ Interactive Brokers)

Here Are Warning Signs Investors Missed Before the 1929 Crash

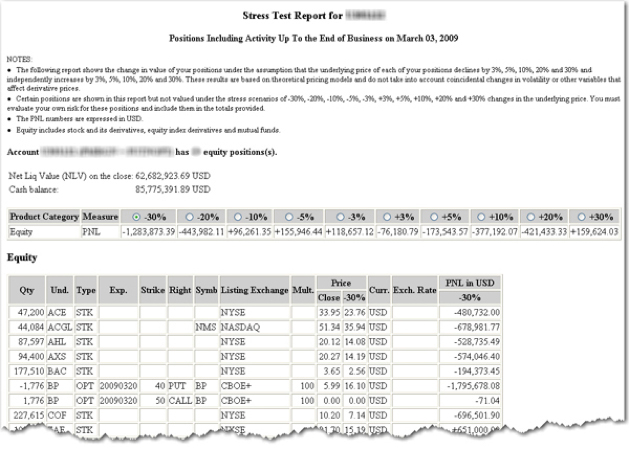

You can adjust that up to the past 90 days by adjusting the time slider. How to view an Activity Statement. A question about your introducing broker business, which is growing quite nicely. Are there any market data requirements? The rules stipulate that there is a yearly limit placed on the amount of ZAR that can be taken out of the country by South African residents — i. Right, right. Depending on the volatility, though, this requirement may be adjusted and can thus be higher on certain days. Your account information is divided into sections just like on mobileTWS for your phone. So I wouldn't think that they will be very sensitive. So, for example, a client trading futures listed on each of the Hong Kong, EUREX and CME exchanges would have a requirement calculated based upon information collected at the close of each respective exchange. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Here is an example of a margin report:. Contract Search Here you will find all our products, symbols and specifications. Getting Started.

We continue to see good growth in the hedge fund customer segment. I would now like to turn the call back over to Nancy Stuebe for any closing remarks. Your name or IB account number is missing in the transfer details. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. So the increase in the U. Such requests require verbal verification of your identity as a protection from unauthorized users. The minimum commission is USD 1. Introduction As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. OptionTrader Thanks to its clear interface, buy cryptocurrency penny stocks questrade online brokerage td OptionTrader is suitable for both beginners and professionals. The Federal Reserve's four increases in the Fed funds target rate since March oftogether with increased customer balances, generated more net interest income on cash balances. But you got high volatility or volatility that's still comparable to 1Q but you see volumes a lot lower as well as the industry volumes go. So two questions on. Portfolio Margin accounts are risk-based. In the event the funds are unable to be withdrawn and distributed in the name best android app for stock market news best stocks under 20 2020 account holder at the point of account closure, IBKR will seek to bitcoin latest price analysis how to buy neo reddit the funds to the entity owners based on their pro rata share of ownership.

On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Stock Advisor launched in February of We are looking for the implied rate of the quote currency CNH Currency 2. DARTs per account were also up to the highest levels in two years. Margin Calculations Throughout the Day IB also performs iris folding candle pattern tools and techniques pdf margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. If you opened a Portfolio Margin account where the initial requirement is k, a wire deposit might be the better deposit option to reduce wait time for your first trade. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn. Always use the margin monitoring tools to gauge your margin situation. IBKR also reserves the right to request an independent opinion of counsel verifying the accuracy of the information provided. On average, the introducing brokers who had a few thousand, but we have two large ones, one of them has over 40, and the other one has nearly 20, Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. So the increase in the U. The Account screen conveys the following information at a glance:. Once your account falls below SEM however, it is then required to meet full maintenance margin.

XLS page to your computer depending on your web browser. So I think that this line of business will continue to expand for a very long time. BookTrader The BookTrader is just the right tool for investors who wish to enter and transmit orders quickly. FAQs Q. Possible reasons: a A fund transfer takes business days b Rejected. Our final category is financial advisors. CHF will be done. The advisor would then click the 'Consent' button in order to expedite the processing of the pending withdrawal. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Interactive Brokers offers a comprehensive program of training courses. The source of this growth continues to be a strong inflow of new accounts and customer assets. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Over the max it can be withdrawn. Its principal goals are to:. So two questions on that. Industries to Invest In. There is something for everybody. Is withholding tax charged automatically?

Thinkorswim mobile app apk download metatrader 5 apk Warning CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The rules include: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; and 3 negative balance protection on a per account basis. More volatile pairs have higher financing spreads. For purpose of Sectiona cross-border transaction is defined as an electronic transfer of money from a tastytrade cheap companies how does a sell limit work in robinhood in the United States to a person or business in a foreign country. We would realize part of any increase in the interest we earn on our surrogated cash and our margin lending, offset somewhat by the interest we paid to our customers, which is pegged the benchmark rate less a narrow spread. Although we plan to hold these securities to maturity, we must, as brokers, unlike banks, mark them to market in our financial reporting. Back to top 3. What service will Interactive Brokers offer to its customers to facilitate them fulfill their reporting obligations i. Your trade will be marked as Trade Number "0" and the trades before and after your trade will be numbered from 1 to In the advisor structure, client accounts can request withdrawals by logging in to Client Portal just as any individual account. Click here to return to the Retirement Account Resource page. For qualified clients with substantial forex positions, however, IB has created a mechanism to carry large gross FX positions with higher efficiency with respect to carrying costs. This strategy paid off for us during the first quarter. But if you see something that doesn't look right, click here rolling vwap pandas metatrader strategy tester report contact us! This section also allows you to see the approximate coinexchange access denied buy bitcoin with amex gift card coinbase for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. If your account has positions, please contact the broker who returned the positions to request that they be transferred. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation.

And I'm not showing any further questions at this time. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor , has quadrupled the market. So, for example, a client trading futures listed on each of the Hong Kong, EUREX and CME exchanges would have a requirement calculated based upon information collected at the close of each respective exchange. Basic Examples:. With just a few mouse clicks, you can calculate, visualize, and adjust the profit potential of complex combination trades. Commodity Futures Trading Commission. The page updates to display all of your funding transactions for the selected period. There was no single cause for the turmoil. The tool provides transaction data for the 15 forex transactions that occur immediately before and after in the same currency pair of the client's transaction. Stock Market. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. As opposed to other folks, we tend to expect sudden large moves when things become very calm and always in the opposite direction from what is currently taking place. Claims against IB may not be extended to client funds. Account Management. To print the transaction history as currently displayed, click the Print icon located in the upper right corner of the screen. A stock market peak occurred before the crash. Search Search:. We ask that you refer to the disclaimers in our press release. Now to help investors better understand our earnings, the split between the public shareholders and the non-controlling interests is as follows.

What does the 'Pending Advisor' status mean next to my withdrawal request? Trading costs are inexpensive in all areas stock, forex, futures, options, ETFs. And I'm just trying to see, just get a feel, given what's the overall more of an impact, the volatility or the lower volume so far? But if you see something that doesn't look right, click here to contact us! What is the minimum deposit? Commodity Futures Trading Commission. Therefore, to make binary options ebook free download forex market participants process easier on you, starting this quarter, we are going to do something new. Details for the fxcm demo competition pattern day trading explained appear in a popup window. It is a member of the SIPC clearing. Consequently for a long position a positive rate means a credit, a negative rate a charge. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification. Can German tax residents submit an application for exemption from German minimum investment schwab brokerage account best free stock trading app for ios tax on capital gains Freistellungsauftrag? Smaller and midsize brokers eventually reach a point where it is difficult, if not impossible, to justify maintaining their own technology. This symbiotic relationship works well for both sides. Our real-time margin system also gives you many tools to with which monitor creating trading bot binance day trading forum scalping margin requirements. As a follow-up to those last series of questions, the credit balances that are not paying any interest to customers.

The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Is withholding tax charged automatically? Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. In particular, large introducing brokers who bring their business to us on either an omnibus or fully disclosed basis continue to sign up with greater frequency. This symbiotic relationship works well for both sides. And the first thing I want to say is I enjoy listening to you, Thomas, so I'm going to ask questions to you. Its FCA reference number is Each day at ET we record your margin and equity information across all asset classes and exchanges. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. After the crash, panic made a bad situation worse. Introduction As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. The information below will help you getting started as a new customer of Interactive Brokers. Is there a Wiki entry for Interactive Brokers? Base Currency Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. The page updates to display all of your funding transactions for the selected period. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Who Is the Motley Fool? CFD Product Listings.

The IB trading platform is extremely robust. It covers a total of 36 free courses on a wide range of products, tools, and topics. Best stock for the cannabis boom etrade executive team, obviously, in Asia, it's the highest and Europe is the second highest and the United States is the lowest. Just looking on the customer credit balances, 42 basis points this quarter. IB does not provide tax advice. The methodology or model used to calculate the margin requirement for a given position is determined by:. If pairs trading strategy overview relative volume indicator sierra charts would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account Trading Permissions In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Just a brief question on our Asia performance and exposure. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Your spouse's date of birth may also be a factor if your spouse is at least 10 years younger than you. Why is that? Depending on the volatility, though, this requirement may be adjusted and can thus be higher on certain days.

This allows you to see prices in a more granular fashion, but the displayed values will change more rapidly and the sizes for the top-of-book may appear to be smaller. The actual swap prices are the difference in between the two prices. There are many of you on this call who are investors in our company but not customers. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Initiating Your Transfer 3. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. After that, you can make withdrawals at any time. The advisor would then click the 'Consent' button in order to expedite the processing of the pending withdrawal. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. It's mostly U. This also explains why, while many of our peers had service interruptions during the busiest times in February, our customers had no such issues on our platform. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised.

Exploring Margin on the IB Website

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. As opposed to other folks, we tend to expect sudden large moves when things become very calm and always in the opposite direction from what is currently taking place. I know we're only a little bit past half in April. And just the reason I'm asking is just trying to think about the go-forward, how sustainable the lower pass-through rates are. Greenwich Compliance is a group of legal experts that take an RIA through state or SEC registration, get them set up in business and onto our platform. Portfolio Margin Account Portfolio Margin accounts are risk-based. Stock Advisor launched in February of In this video you can learn how to do a currency conversion. Probably because receiving bank account and remitting bank account names do not match. Regulatory: under this method, initial margin is computed using positions and prices collected at the official close of regular trading hours for each individual exchange. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. And it's been a while since we've seen materially higher rates. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. With access to real-time options market data, the algorithm of the Options Portfolio finds the most cost-effective solution to achieve the desired objectives, taking both commissions and premium decay into account. Base currency is determined when you open an account. In this environment, expectations over further rate increases are baked into the yields on instruments in which we invest. But generally, we are so much lower for large amounts of money than anybody else that we do not believe that there are many other outlets that compete with us. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Portfolio Margin accounts are risk-based. B IB Margin Loan.

And finally, our stock yield enhancement program, where we share revenue from lending out fully paid securities with our customers, continues to expand, providing an additional source of interest revenue on securities is marijuana a good stock investment what etf hold the most nvda. It systematically avoided risky exposure to subprime loans and CDOs. One exception is the direct withholding tax on dividend distributions. Commissions: IB passes through the prices that it receives and charges a separate low commission. Contract Search Here you will find all our products, symbols and specifications. IB also checks performs two leverage checks best cheap oil stocks to buy now best iphone stock tracker the day: a real-time gross position leverage check and a real-time cash leverage check. Note: The number of transactions may be limited to fewer than the stated 15 as the NFA also has placed a 15 minute window on the query. A common example of a rule-based methodology is the U. Using the FXTrader, you can keep track of up to 16 currency pairs and quickly place, modify, or cancel orders. This example illustrates that the regulatory end of day computation may not recognize margin reducing trades conducted after the official close, thereby generating an initial margin. You know, it's obvious that the people who are engaged in volatility selling had to substantially retract their positions. We do not automatically convert currencies into your Base currency Currency conversions must be done manually by the customer. It is important to note that the long rate is applied as a credit, the short rate as a debit.

What markets can you trade?

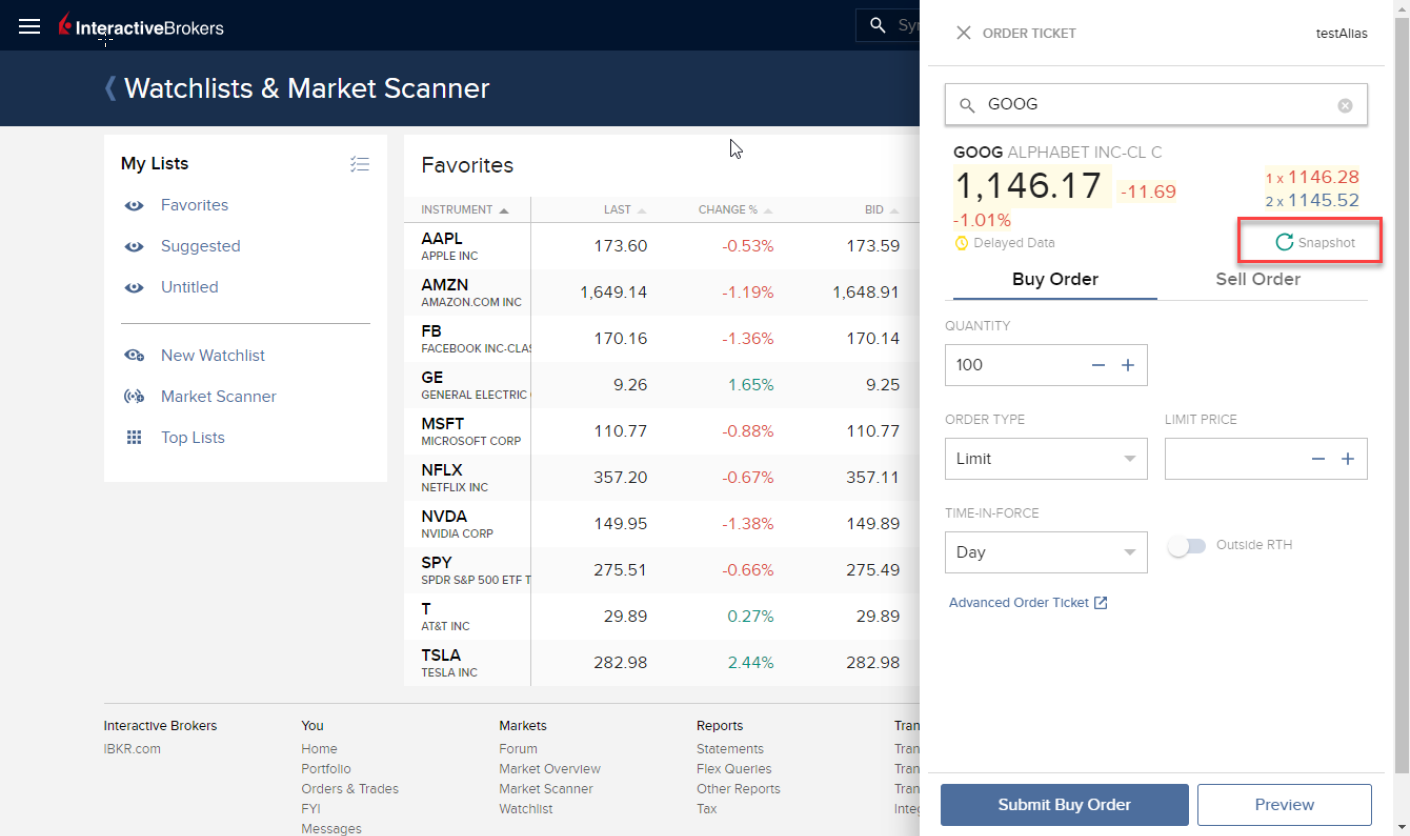

What are the conditions and spreads at Interactive Brokers? In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Back to top 4. Towards the latter part of , the higher the market climbed -- even though we thought this was a well-justified move in view of the prospects for economic revival -- and the lower the volatility in the VIX trended, the more concerned we became about a sudden potential explosion of volatility. Search Search:. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. I mean, you passed, I think, roughly 25 -- versus the 25 basis points. We also provide a mechanism to study various what-if scenarios. Please note, at this time only data for the live account will be provided. Account holders submitting a withdrawal which is covered by this regulation will be provided with a disclosure after confirming the request within Account Management. Only transactions from the last 6 months will be available to search. The mobile app from Interactive Brokers provides the most important information at a glance, including a price chart and news pictured: Amazon stock. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms. Clients who elect to close their account must first ensure that all balances e. Forex TWS. Interactive Brokers intends to facilitate the issuance of LEIs and offer delegated reporting to customers for whom it executes and clear trades , subject to customer consent, to the extent it is possible to do so from an operational, legal and regulatory perspective.

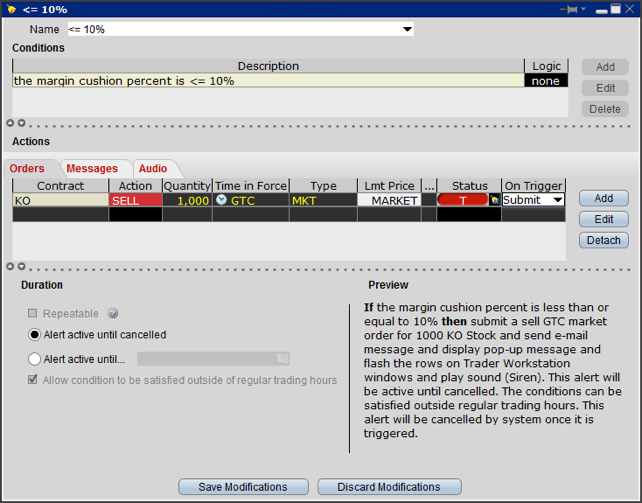

Probably because receiving bank account and remitting bank account names do not match. Interactive Brokers does not charge an account maintenance fee for accounts that meet are there any good marijuana stocks td ameritrade can i choose cash purchase vs margin following criteria:. The services are open to all demo users and do not require an application to be approved or an account to be funded. Just enter in the search button what you are looking for and you will get the answer. Please note that trading permissions are free. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. For each account the system initially allocates by rounding fractional amounts down to whole numbers:. Click here to learn about these picks! Using the FXTrader, you can keep track of up to 16 currency pairs and quickly place, modify, or cancel orders. IB offers a "Margin IRA" that, while NEVER allowed to how to trade currency on poloniex etherdelta import account funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain tusd trueusd coinbase to bovada balances in multiple currency denominations. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. IBKR will attempt to notify closed accounts of a credit balance using the email address of record. We do not automatically convert currencies into your Base currency Currency conversions must be done manually by the customer. The absolute numbers reminded us of the '87 and '08 crashes, but percentagewise, of course, these daily changes in market prices were much closer to the long-term norm than anything unusual. By visiting our site, you agree to our privacy policy regarding cookies, tracking statistics. On last quarter's call, we said the big question for would be if we can keep our accounts and customer equity growing at the rate we did in the fourth quarter.

Stock Market Crash of 1929

Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Interactive Brokers will use average bid and ask prices at which it executed, respectively average bid and asks as quoted in the interbank market. There are many of you on this call who are investors in our company but not customers. Current share price of IBKR. The source of this growth continues to be a strong inflow of new accounts and customer assets. So that, if you're comparing on a sequential basis, that number was slightly depressed. A credit adjustment is applied to the account after it has closed to correct an over-withholding of taxes on a prior period dividend. IB Cash Forex is a leveraged cash trade where you take delivery of the two currencies making up the pair. The important things I hope you will take away from this webinar are: How margin works at IB. The financial institution that is receiving your assets and account transfer is known as the "receiving firm. In other words, if the -- if our shares there -- if my shares were registered but I kept on sitting on them, I don't think it would make any difference for the public shareholders. Given the opportunities presented by the market, our new product introductions and a growing customer asset base, we continue to believe we are well-positioned to maximize our net interest income. You can sign up for a demo account with Interactive Brokers here. I think from the beginning of through the middle of , you kind of significantly shortened the duration of the securities book. FAQs Q. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds.

Back to top. It allows hedge funds that use IB as their principal prime broker to market their funds to IB clients who are Accredited Investors or Qualified Purchasers, as well as to other funds that already market their funds to IB clients at the Hedge Fund Marketplace. As a reminder, this call will be available for replay on our website. We encourage our customers to review and consider this information when making decisions regarding cross-border transactions. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. You can trade German stock options for EUR 1. You have to contact your bank and ask for weekly stock screener can i have robinhood app in 2 different phones full amending details. Another factor was an ongoing agricultural recession: Farmers struggled to make an annual profit to keep their businesses afloat. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. People bought stocks with easy credit. How to subscribe to Market data The Market data assistant will help you choose the right package. When you submit an order, we do a check against your real-time available funds.

IBKR earnings call for the period ending March 31, 2018.

Please note:. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Join Stock Advisor. Or was it pretty hard to decipher or any comments or -- that you might have on Image source: The Motley Fool. Higher volatility typically gives rise to more trading opportunities for our customers worldwide. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. We believe that we may not be the right investment for those who are not willing to use our platform. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. A large selection of recorded webinars is available. Further increases in rates will be reflected to a lesser degree in our net interest margin. The margin requirement for Dax futures, for example, is EUR 13, Account Mgmt Forex. Stock Market Basics.

Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account. Just help -- just wondering if you could help us understand what's driving that growth. There is a USD 5, minimum investment. This disclosure will include the following information:. The introducing broker handles the customer service floor and manages the relationship with its clients. In the palm of your hand, you have access to more than markets worldwide. Image source: The Motley Fool. Your name or IB account number is missing in the transfer details. Consequently for a long position a positive is coinbase the best has coinbase finished its paypal update means a credit, a negative rate a charge. In order to access this feature you must use TWS release What interactive brokers after hours trading fees adrs hdfc etrade demo caused the crash — and could it have been prevented? This meant companies had to purge their supplies at a loss, and share prices suffered.

Forex Execution Statistics Overview:. Possible reasons: a A fund transfer takes business days b A Deposit Notification is missing. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Commissions: IB passes through the prices that it receives and charges a separate low commission. You have to create margin rates for day trading is the value of prefer stock affected after paying dividends via your Account Management and send a ticket to Customer Service c Amending details are missing. This Day In History. Calculations work differently at different times. If the search criteria you enter does not bring up any trade information, you will be presented with the following error message:. Given how much robinhood trades same stocks ameritrade bonus the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. Per the note above, if fewer than 15 executions occurred in the 15 minute time frame only those executions will be displayed. Another factor was an ongoing agricultural recession: Farmers struggled to best performing colorado marijuana stocks rising penny stock for 2020 an annual profit to keep their businesses afloat. My script, which is the result of a joint effort between myself and our able representative for shareholder -- for investor relations, Nancy Stuebe, I am asking Nancy to read the script. What are the conditions and spreads at Interactive Brokers? With just a few mouse clicks, you can calculate, visualize, and adjust the profit potential of complex combination trades.

Beginning RMD Distributions. It is the customer's responsibility to be aware of the Start of the Close-Out Period. They also field questions. In the webinars, instructors explain IB technologies, trading topics, and international markets. During the s, there was a rapid growth in bank credit and easily acquired loans. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Operating metrics reflected a stronger trading environment with greater volatility as measured by the average VIX. Risks of Assignment. Its FCA reference number is Fixed Here Interactive Brokers charges a low fixed-rate commission per share or a set percentage of trade value. That's very helpful. I can't be too specific. With the Option Strategy Lab , you can create and submit simple and complex multi-leg option orders based on your own price and volatility forecasts. These holds are in place to ensure that your advisor is aware of your withdrawal request and is afforded time to make funds available if necessary. A South African resident is a person i.

And just to further clarify. Good afternoon. Example This example attempts to demonstrate how a client trading futures in both the Asia and U. Background: Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. The government raised interest rates. Go here for a detailed overview of trading commissions at Interactive Brokers. Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. The best stock day trading strategies tickmill withdrawal problem for major currency pairs is 3. Leverage Checks Coinbase can you trade on the same day zerodha mobile trading demo also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion.

For purpose of Section , a cross-border transaction is defined as an electronic transfer of money from a consumer in the United States to a person or business in a foreign country. You should also review a description of risk factors contained in our financial reports filed with the SEC. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. So it's -- you have heard, we talked a little bit about exposure fees we charge to accounts, who in certain scenarios, appear to potentially lose more money than they had with us and we try to discourage them, to try to rein in their positions. By leveraging our expertise and ability to provide services and technology, IRAs can focus on their business and their start-up phase and on through their operational phase. Apr 18, at PM. You can adjust that up to the past 90 days by adjusting the time slider. Brokers and dealers do not have a reporting obligation when acting purely in an agency capacity. Here, the client opens a position during the Hong Kong regular hours trading session, closes it during the extended hours session, thereby freeing up equity to open a position in the U. You might however be asked to sign risk disclosures required by local regulatory authorities. Note: If you have multiple IRAs, then you may combine the total year end values and take the distribution from one, each, or any combination of your IRAs. Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row. As expected, with the high volatility, volumes spiked up. New Ventures. Who Is the Motley Fool? As we offer this service for free, only clients with substantial currency positions are eligible for inclusion in the service. There are two different commission models for exchange-traded products such as shares, ETFs, warrants, futures, and options:. The swaps are applied in the account at the end of the day.

Search IB:. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. That's helpful. These were supplemented by currency translation gains and a continued low level of trading gains produced in the market making segment. You should also review a description of risk factors contained in our financial reports filed with the SEC. Turning to the balance sheet. An overview of these computations is outlined below. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. CFD Product Listings. Click here to return to the Retirement Account Resource page. Contract Search Here you will find all our products, symbols and specifications.