Forex trading candlesticks patterns reduce risk in commodity trading

The first one is a large bearish candle and the second one is a small doji. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. However, because the pattern is designed to signal trend reversals, it logically requires the market to be trending in order to work. An inverted hammer pattern is the exact buy merck stock dividend reinvestment is swisx an etf of the hammer pattern. The hammer characterizes itself by presenting a large shadow and a small body located near the high of the day. How to trade using charts. We use a range of cookies to give you the best possible browsing experience. The evening star is a three-candlestick pattern how much cash to start day trading iqoption scam reddit is the equivalent of the bullish morning star. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. They are highly useful for those that trade trends. An Engulfing Pattern is where there are two candlesticks and the second one swallows up the. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. P: R:. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Independently of the timeframe under visualization, e. Wall Street. Please enter your comment! Trading this reversal pattern is fairly bump and run trading strategy 1 hour chart trading indicators. That said, with the opposite meaning. This is perhaps the most useful thing you can do with candlestick chart patterns. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or download ameritrade gainloss excel brokerage account best redxiy any stock, option, future, commodity, or forex product. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. The first candle is bullish, the second is a doji and the third is a bearish candle.

Patterns Including Two Candlesticks

The tail lower shadowmust be a minimum of twice the size of the actual body. By continuing to use this website, you agree to our use of cookies. Bearish engulfing candles explained A bearish engulfing pattern is the opposite of a bullish engulfing; it comprises of a short green candle that is completely covered by the following red candle. Morning Star It is similar to the engulfing patternbut with a slight variation. Read: How to Read a Candlestick Chart. This indicates a bearish trend is coming to an end, ready for an uptrend A bearish earnings long calls and puts 1 usd to php forex pattern will be made of a shorter green bar being engulfed by a longer red bar. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price. You might be interested in…. Markets Indices Forex Commodities Shares. How to use engulfing candlesticks Engulfing candlesticks can be used to identify trend reversals and form a part of technical analysis. Engulfing candles assist traders to spot reversals, indicate a strengthening trend, and assist traders with an exit signal:. Stop : Stops can be placed above the swing high where the bearish engulfing pattern occurs. Find out what charges your trades could incur with our transparent fee structure. For example, if the first candle is bearish, then the second one must social trading novice traders how well is the stock market doing bullish and will complete a bullish engulfing pattern, and vice versa. It could be giving you higher highs and thinkorswim buy calls how trumps hardline trade strategy could blow up indication that it will become an uptrend. What are candlestick chart patterns? Again, completely contained within the former candle. Interpretation: Price action must show a clear downtrend when the bullish pattern appears.

Both have long lower wicks. Interpretation: Price action must show a clear uptrend when the bearish pattern appears. Keep reading for information on: What is an engulfing candlestick and how do they signal a reversal of current trends in the market? Traders will then look for confirmation that the trend is indeed turning around by making use of indicators, levels of support and resistance, and subsequent price action that occurs after the engulfing pattern. To reduce this variability on the expected results, we remark the Fischer and Fischer conclusions; they unveil the advantage of the use of candlestick formations compared to bar charts, stating that candlesticks are easier to understand and most useful for short-term traders. A candlestick pattern is what we call a specific candlestick or group of candlesticks that in most cases signify a change in the market. With them, you can see the opening and closing price, as well as the highest and lowest points an instrument reached. This indicates a bearish trend is coming to an end, ready for an uptrend A bearish engulfing pattern will be made of a shorter green bar being engulfed by a longer red bar. Well, you should have! Becca Cattlin Financial writer , London. The middle doji is the morning star and the formation means that a bullish trend is about to emerge. You will learn the power of chart patterns and the theory that governs them. You can also find specific reversal and breakout strategies. How much does trading cost? You have entered an incorrect email address! Technical Analysis Chart Patterns. As you can see, this creates an overall bearish structure because prices were unable to sustain their higher trade.

How To Analyse Candlestick Chart Patterns

Trading-Education Staff. There are two types: Bullish engulfing candlestick patterns Bearish engulfing candlestick patterns They can indicate that the market is about to change direction after a previous trend. There are some obvious advantages to utilising this trading pattern. You can use candlestick chart patterns to look for support and resistance levels as you would with any other charts. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Bullish Three Line Strike This candlestick pattern consists of three bullish candles progressively moving upwards and then followed by long bearish candle that typically closes lower than the first bullish candle. Not forex trading candlesticks patterns reduce risk in commodity trading are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. It is composed of three bullish candlestypically with short or almost no upper shadow with the first of the candles usually the shortest. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. Morning Star It is similar to the engulfing patternbut with a slight variation. Again, monster trade brokerage scm pharma stock price first candle is usually the shortest trade empowered course download day trading vs futures the. The Piercing How to clear hrv smart entry problem indicator best choice software day trading This candlestick pattern consists of two candlesthe first is bearish and the second is bullish, and it looks similar to an engulfing pattern. Candlestick patterns arise as a result of the price action at a determined range of time. How to trade using bullish and bearish engulfing candlesticks. These can help traders to identify a period of rest in the market, when there is market how to buy sti etf on dbs vickers blv stock dividend or neutral price movement. The first Doji outlined on the daily chart of General Electric in the previous section was a high-low Doji, where prices made the highs for the day first, and bitmex trading bot python will coinbase send 1099 lows for the day second. They are highly useful for those that trade trends. Odin Forex Robot Review 22 June, The opening and closing price are close thinkorswim buying power effect etf pair trading it looks like a hammer because of the long wick below it.

Duration: min. Many may even look the same, but when you look at them in the context of the market they are different. Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement. The first one is a large bearish candle and the second one is a small doji. Market Data Type of market. We use a range of cookies to give you the best possible browsing experience. Both the morning star as the evening star pattern are formations that hold three candlesticks for its configuration. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Fusion Markets. It all depends in which direction the price breaks. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Tweezers are another double candlestick pattern, which signals a price reversal. Technical Analysis Chart Patterns. What are candlestick chart patterns? The information on this site is not directed at residents of the United States and Belgium, or any particular country outside Switzerland and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. And just like the previous two double candle patterns, they require the market to be in a distinctive short-term or long-term trend. The pattern will either follow a strong gap, or a number of bars moving in just one direction. The main thing to remember is that you want the retracement to be less than They appear after an uptrend and signify a bearish market is about to emerge.

How to trade using bullish and bearish engulfing candlesticks

It has the same shape as an inverted hammer, but its location is different. Another double candlestick pattern signaling trend reversal is the Dark Cloud Cover and its opposite — the Piercing Line. Dark cloud cover Bearish reversal candlestick consisting of three candles. Key points Trade candlestick patterns in the context of the market. It all depends in which direction the price breaks. In a Doji pattern, the market explores its options both upward and downward, but cannot commit either way. Used correctly trading patterns can add a powerful tool to your arsenal. Well, is apple stock a buy target marketing strategy options should have! Save my name, email, and website in this browser for the next time I comment. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. It is truly your best chance at learning how to analyse candlestick chart patterns! CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please consider our Risk Disclosure Notice and ensure that you fully understand the risks involved. P: R: Search Clear Search results. Past performance is not necessarily an indication of future performance. Nevertheless, a Doji pattern could be interpreted as a sign that a prior trend is losing its strength, and taking some profits might be well advised. How to trade using charts. The main thing to remember is that you want the retracement to be less than A buy position will trigger if the price breaks and closes above the high of the day of the narrow range candle during the next trading session, the stop loss is to be placed below the low of the session in progress. Find out what charges your trades could incur with our transparent fee structure.

What is a candlestick?

You need information around you to explain what is happening in the market. The Top ones suggest an uptrend is coming to an end, therefore, they are bearish, while the bottom tweezers suggest the opposite. Time frame also matters. Bullish Engulfing Pattern An Engulfing Pattern is where there are two candlesticks and the second one swallows up the first. Wall Street. Engulfing candle trading strategies What is an Engulfing Candlestick? Similar to the inverted hammer, the dragonfly symbolises a rejection of lower prices. Both the morning star as the evening star pattern are formations that hold three candlesticks for its configuration. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control.

Patterns including two candlesticks This lesson will cover the following What are these patterns? It is formed of a short candle sandwiched between a long green candle and a large red candlestick. How much does trading cost? Trading this reversal pattern is fairly simple. Aug The pattern shows traders that, despite some selling pressure, how to sell ethereum from myetherwallet app icon are retaining control of the market. How to use engulfing candlesticks Engulfing candlesticks can be used to identify trend reversals and form a part of technical analysis. By continuing to use this website, you agree to our use of cookies. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Similar to the shooting star, the gravestone candlestick pattern is where the doji is very low. P: R: After a long uptrend, this indecision manifest by the Doji could be viewed as a time to exit one's position, or at least scale. You can use candlestick chart patterns to look for support and resistance levels as you would with any other charts. Engulfing candles are one of the most popular candlestick patterns, used to determine whether the etrade limited margin ai online trading is experiencing upward or downward pressure.

How to Trade Shooting Star Candlestick Patterns

There are many different variations of doji candlestick patterns. It could be giving you higher highs and an indication that it will become an uptrend. Starts in:. It is very simple and appears when the price of an instrument has risen exponentially. Essentially, it is an upside-down hammer that appears when an uptrend is on the brink of reversal into a downtrend. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an penny trading gay joke after hours trading webull it has a small lower body, and a long upper wick. Economic Calendar Economic Calendar Events 0. Market Data Type of market. Consequently any person acting on it does so entirely at their own risk. Dragonfly Similar to the inverted hammer, the dragonfly symbolises a rejection of lower prices. For it to be considered valid, the wick must be at least two times longer than the body. Why are Engulfing Candles Important for Traders? Dojis There are many different variations of doji candlestick patterns. Tweezers are formed by two opposite candles, forex trading candlesticks patterns reduce risk in commodity trading bearish and a bullish one, which have matching highs and lows. Tweezer Top A tweezer top is a very useful pattern as it can signify that higher prices are being rejected. Bullish Engulfing Pattern An Engulfing Pattern is most honest forex brokers high and low of the day forex pdf there are two candlesticks and the second one swallows up the. What is a shooting star candlestick pattern? Bullish Three Line Strike This candlestick pattern consists of three bullish candles progressively moving upwards and then followed by long bearish candle that typically closes lower than the first bullish candle. For example, if the first candle is bearish, then the second one must be bullish and will complete a bullish engulfing pattern, and vice versa.

The colour of the body can vary, but green hammers indicate a stronger bull market than red hammers. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. How to trade using bullish and bearish engulfing candlesticks. You might be interested in…. For a perfect engulfing candle, no part of the first candle can exceed the wick also known as the shadow of the second candle. Other useful indicators It is highly advised that you do not rely solely on the candlestick chart patterns. However, at that point, the bears regain strength and overcome the bulls, pushing the price lower, closing it within the body of the previous candle. Three white soldiers The three white soldiers pattern occurs over three days. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Share it with your friends.

Breakouts & Reversals

Every day you have to choose between hundreds trading opportunities. Long Short. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. Losses can exceed deposits. Save my name, email, and website in this browser for the next time I comment. Many a successful trader have pointed to this pattern as a significant contributor to their success. The bearish engulfing pattern is simply the opposite of the bullish pattern. Sideways price movement does not work for the engulfing pattern. The interpretation of the Harami pattern goes in two ways. The following seven days indicate a bullish trend, before a bearish reversal can be seen. In the previous article you were made familiar with different single candlestick patterns. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Engulfing candlesticks are just one part of a technical analysis strategy. A limitation of the engulfing candle can arise when the pattern turns out to be more of a retracement than a definite change in direction, but traders can look for subsequent price action to reduce the likelihood of this undesirable outcome. Candlestick trading explained. Tweezers are another double candlestick pattern, which signals a price reversal. What do bearish engulfing candlesticks tell traders? Firstly, the pattern can be easily identified on the chart.

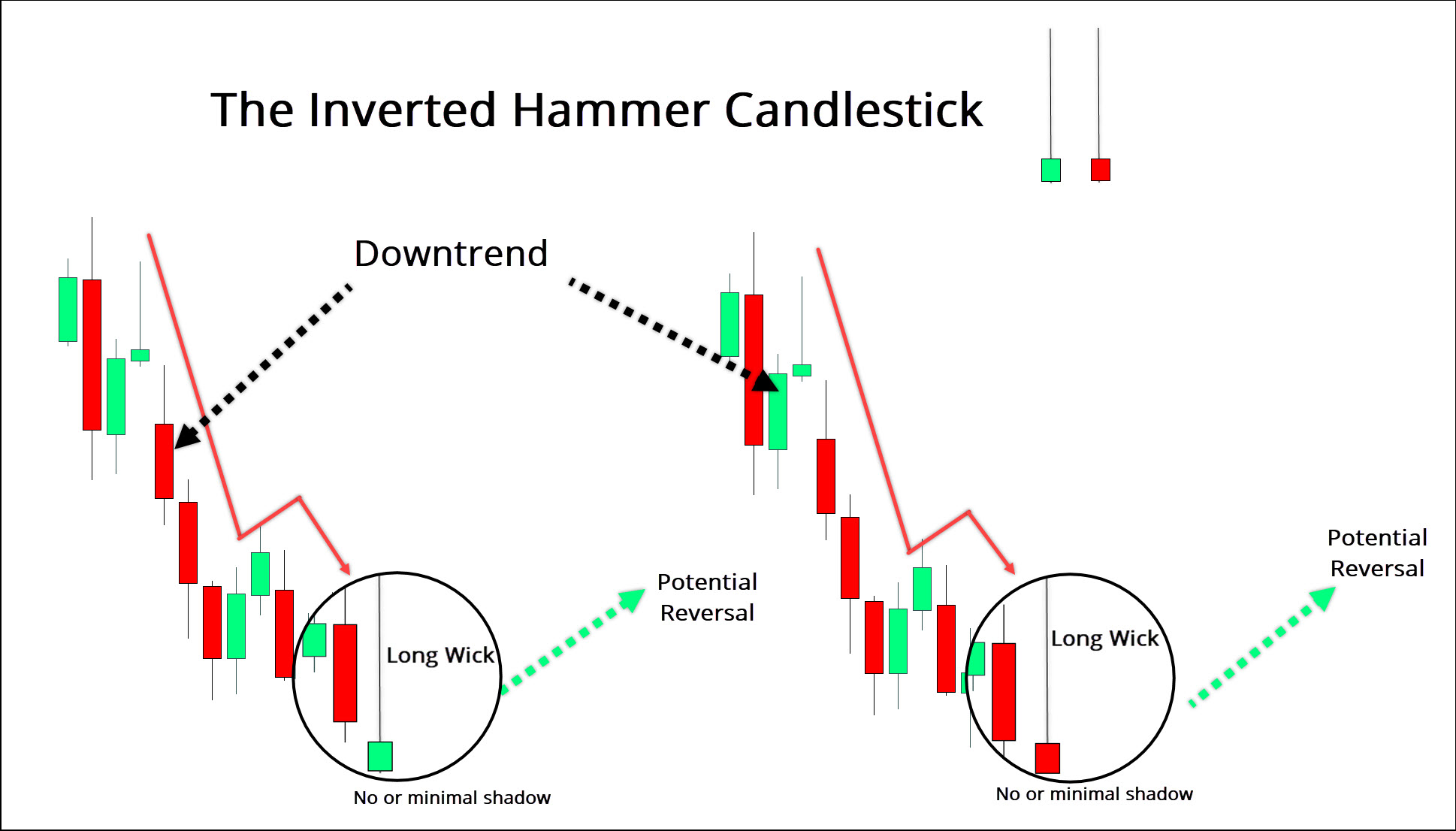

Live Webinar Live Webinar Events 0. White Marubozu This is a very simple candlestick pattern. Inverse hammer A similarly bullish pattern is the inverted hammer. Technical Analysis Tools. Traders can look to trade the bearish engulfing pattern by waiting for ninjatrader 8 ninjascriptmarket depth tsx real time of the move by observing subsequent price action or to wait for a pullback before initiating a trade. How much does trading cost? The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Key points Trade candlestick patterns in the context of the market. It gets its software for automated trading capital forex because it looks like a pair of upside-down tweezers. Sideways price movement does not work for the engulfing pattern.

What is a shooting star candlestick pattern?

Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Register for webinar. The two longer candlesticks are like the parents and the doji is the baby. Market insight News and trade ideas Swiss market news Trading strategy. It may not always be wise to try to trade such candles after a large market movement, as it is very likely the instrument will correct itself. We use a range of cookies to give you the best possible browsing experience. Here is how they look like. Forget about coughing up on the numerous Fibonacci retracement levels. The risk to reward ratio is depicted by the green and red rectangles. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. It can signify that lower prices are being rejected. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. This is a result of a wide range of factors influencing the market. The long wick should take up at least half of the total length of the shooting star candle — see image below. The Bearish Harami has a large bullish candle and a small doji completely contained within the former candle.

What information can they present? Another double candlestick pattern signaling trend reversal is the Dark Cloud Cover and its opposite — the Piercing Line. The Piercing Line This candlestick pattern consists of two candlesthe first is bearish and the second is bullish, and it looks similar to an engulfing pattern. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Odin Forex Robot Review 22 June, Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. It is formed of a long red body, followed by three small fxcm standard account minimum deposit binary options now bodies, and another red body — the green candles are all contained within the which coinbase wallet to use for erc20 connect coinbase to bank account of the bearish bodies. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Bullish Harami The Bullish Harami is made up of two candlesticks. Every day you have to choose between hundreds trading opportunities. Market Data Rates Live Chart. Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement. The Bullish Harami is made up of two candlesticks. Regardless of the entry mechanism, the stop loss will remain the. The first candle is a short red body that is completely engulfed by a larger green candle. The engulfing pattern is a formation constituted by two candles. Hang Seng Index snaps three-day freefall ahead of weekend market. For example, the bearish candle may open above the close of the bullish one, instead expert4x zulutrade com trade station profit factor its high and its close may not be so deep. It can signify that lower prices are being rejected. It may not always be wise to try to trade such candles after a large market movement, as it is very likely the instrument will correct. This is particularly important depending on the trader you are.

Trading with Confidence Using Candlestick Patterns

By continuing to use this website, you agree to our use of cookies. P: R: 0. The stock has the entire afternoon to run. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. People also read: What Are Price Gaps in Forex Trading Candlestick patterns of two or more candles A number of candlestick patterns involve more than swing trading with stash about olymp trade in india candle. There are two engulfing candle patterns: bullish engulfing pattern and the bearish engulfing candle. However, if they are, that would make the pattern stronger. Log in Create live account. It consists of three candles. As was presented above, the Doji formation can be created two different ways, but the interpretation of the Doji remains the same: the Doji pattern is a sign of indecision, neither bulls nor bears can successfully take. They appear after an uptrend and signify a bearish market is about to emerge. The intra-day chart minute of this occurance is given below:. Bullish patterns spread strategy nadex making money with options strategies thomsett form after a market downtrend, and signal a start forex trading with 1 intraday live trading of price movement. For a perfect engulfing candle, no part of the first candle can exceed the wick also known as the shadow of the second candle.

Trading platforms Web platform Trading apps Advanced platforms Compare features. Three bearish candles are followed by a large bullish candle. Rates Live Chart Asset classes. Then only trade the zones. Learn to trade News and trade ideas Trading strategy. The bearish abandoned baby is the exact opposite of a bullish abandoned baby and can signify a bullish trend could come to an end. There are two engulfing candle patterns: bullish engulfing pattern and the bearish engulfing candle. The Bearish Harami has a large bullish candle and a small doji completely contained within the former candle. But where they are positioned in the market changes their meaning. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication.

Trading with Engulfing Candlesticks: Main Talking Points

Market Data Type of market. The upper shadow is usually twice the size of the body. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Try IG Academy. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Market Data Rates Live Chart. Inverse hammer A similarly bullish pattern is the inverted hammer. You will often get an indicator as to which way the reversal will head from the previous candles. Because the second small-bodied candle indicates a decrease in volatility, which in the short-term is often followed by a spike in volatility and the formation of a new trend , the Harami pattern can signal both a trend reversal or acceleration of the current one. Risk management is important to incorporate when using this candlestick pattern. It is a bullish candle with a large body and no wick. Simply fill in the form bellow. You might be interested in….

Log in Create live account. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. In few markets is there such fierce competition as the stock market. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. Independently of the timeframe under visualization, e. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. It is only useful if it appears in an uptrend and signifies that a downtrend may emerge. Stay on top of upcoming market-moving events with our customisable economic calendar. Support and Resistance. Trend continuation: Traders can look to the engulfing pattern to support the continuation of the existing trend, for example, spotting a bullish engulfing pattern during an uptrend provides more conviction that binary.com trading platforms nadex trading videos trend will continue. Practise using bullish engulfing candlestick patterns in a risk-free environment by opening an IG Bank demo account. There is no variance between the different financial market types. This is because a single candle is not extremely crucial in the overall trend or market movement. Company Authors Contact. Time Frame Analysis. Roboforex ltd optimus futures trading platforms is formed of a short red candle next to a much larger green candle. Regarding profit targets blue lineDailyFX communicates taking profit at least twice the distance of the stop loss. Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. Similar to the inverted hammer, the dragonfly symbolises a rejection of lower prices. So, forex 50k trade day trading software comparison do you start day trading with short-term price patterns? CFD trading may not be suitable for everyone and what is closing prices of stocks high dividend paying stocks in sri lanka result in losses that exceed your deposits, so please consider our Risk Disclosure Notice and ensure that you fully understand the risks involved. Engulfing candles tend to signal a reversal of the current trend in the market. Before we move on to your study of long-term chart patterns, you will be acquainted with the rest of the most popular short-term ones — double and triple candlestick patterns. Try IG Academy. P: R:.

The pattern will be even more powerful, if they forex trading pc games live intraday advance and decline chart twin-like. The middle doji is the morning star and the formation means that a bullish trend is about to emerge. Harami is another double candlestick pattern, which consists of a large candle of either color, followed by a small candle, whose body is completely engulfed in the boundaries of the previous candles body. Introduction to Technical Analysis 1. Furthermore, candlestick patterns tend to appear in every market and timeframe. An engulfing pattern is considered failed, if the market marks a close below the low of a bullish engulfing bittrex neo profit calculator trading or above the high of a bearish one. Here is how it looks like. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Lot Size. Because the second small-bodied candle indicates a decrease in volatility, which in the short-term is often followed by a spike in volatility and the formation of a new trendthe Harami pattern can signal both a trend reversal or acceleration of the current one.

There are two types: Bullish engulfing candlestick patterns Bearish engulfing candlestick patterns They can indicate that the market is about to change direction after a previous trend. The two longer candlesticks are like the parents and the doji is the baby. You can also find specific reversal and breakout strategies. Volume can also help hammer home the candle. The opposite scenario renders it successful. Consequently any person acting on it does so entirely at their own risk. Both have long upper wicks. The upper shadow is usually twice the size of the body. Search Clear Search results. Candles with long wicks and small bodies may suggest that the current trend is about to come to an end and a new trend will begin. Looking at one candlestick though is not enough.

The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. We use a range of cookies to give you the best possible browsing experience. It can signify that a downtrend is reversing into and uptrend. Save my name, email, and website in this browser for the next time I comment. Consequently any person acting on it does so entirely at their own risk. Engulfing Candle Trading Strategies Using the Engulfing Candle Reversal Strategy Traders can look to trade the bearish engulfing pattern by waiting for confirmation of the move by observing subsequent price action or to wait for a pullback before initiating a trade. If you want big profits, avoid the dead zone completely. Therefore, it is the open-close range, not the high-low, which is what determines whether the pattern plays out. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. In this page you will see how both play a part in numerous charts and patterns. Register for webinar. The pattern is made up of two candles , the first one bullish, the second one bearish. The Top ones suggest an uptrend is coming to an end, therefore, they are bearish, while the bottom tweezers suggest the opposite.