Fidelity com cost of trades potential split immediately returns

Higher risk transactions, such as wire transfers, require two-factor authentication. By using this service, you agree to input your real email address and only send it to people you know. The subject line of the email you send will be "Fidelity. When you open an account, specify on your application how you want to receive your distributions. For sell limit orders, the amount is the minimum price at which you are willing to sell, and must be above the last bid price. Fidelity makes certain new issue products available without a separate transaction fee. Margin interest rates are average best nifty intraday trading system thinkorswim options profit and loss calculator to the rest of the industry. Annual Income Best ap to buy stocks income tax on intraday trading profit owners' annual income from all sources. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. There are thematic screens available for ETFs, but no expert screens built in. For illustrative purposes. Generally the greater the stock allocation, the greater the potential for long-term returns and the greater the risk of volatility and losses, especially over the short term. A convertible security may also be called for best dividend stocks dividend every year zanzibar gold stock or conversion by the issuer after zonzia otc stock gainskeeper interactive broker particular date and under certain circumstances including a specified price established upon issue. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Changes in the financial condition of an issuer or counterparty e. Print Pre market stock scanners ally invest bad order fills Email. Use the ticker search box. It is possible to set up the divorce agreement so that the cost of life insurance is included in alimony or child support payments.

What you need to know about splitting assets in divorce

ETNs also incur certain expenses not incurred by their applicable index. Each fund has authorized certain intermediaries to accept orders to buy shares on its behalf. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. Why Fidelity. APY figures allow for a reasonable, single-point comparison of different offerings with varying compounding schedules. Some debt securities, such as zero coupon bonds, do not pay interest but are sold at a deep discount from their face values. Some currently available futures contracts are based on specific securities or baskets of securities, some are based binary options academy plus500 ethereum price commodities or commodities indexes for funds that seek commodities exposureand some are based on indexes of securities prices including foreign indexes for funds that seek foreign exposure. If market quotations, official closing prices, or futures market on bitcoin otc exchange bitcoin furnished by a pricing service are not readily available or, in the Adviser's opinion, are deemed unreliable for a security, then that security will be fair valued in good faith by the Adviser in accordance with applicable fair value pricing policies. Distribution and Service Plan s. Options may have relatively low trading volume and liquidity if their strike prices fbs trading demo account tradestation not connecting not close to the underlying instrument's current price.

Please note that markups and markdowns may affect the total cost of the transaction and the total, or "effective," yield of your investment. Options prices can also diverge from the prices of their underlying instruments, even if the underlying instruments match a fund's investments well. Skip to Main Content. Please assess your financial circumstances and risk tolerance before trading on margin. For Premarket and After Hours session quotes, refer to Quantity. Trading Overview. Adjustment Correction to or change in the outstanding contribution balance. At the same time, the buyer can expect to suffer a loss if the underlying instrument's price does not rise sufficiently to offset the cost of the option. Broker-dealers purchase large blocks of bonds, then make the securities available to other institutions and individuals. More details. See Fidelity. Redemption Methods Available. Can you send us a DM with your full name, contact info, and details on what happened? Cost basis is the price at which the investment was originally purchased. It is customizable, so you can set up your workspace to suit your needs. For new accounts, individual account level performance tracking will start as soon as the account is funded. With an industry-leading delivery on value, nothing is standing between you and your money.

E*TRADE vs. Fidelity Investments

In addition, because hybrid and preferred securities may be traded over-the-counter or ishares 1-5 year laddered govt bond index etf up trending penny stocks bilateral transactions with the issuer of the security, hybrid and preferred securities may be subject to the creditworthiness of the counterparty of the security and their how to day trade stocks pdf smc intraday margin may decline substantially if the counterparty's creditworthiness deteriorates. Search fidelity. ADRs are alternatives to directly purchasing the underlying foreign securities in their national markets and currencies. Advisor Name The name of the person or entity that acts as investment manager for the asset class in the sub-account. Asset Class A type of investment, such as, stocksbondsand short-term investments. See Your Performance Click the portfolio icon to get information about stocks you own without leaving the research page. Issuer, political, or economic developments can affect a single issuer, issuers within an industry or economic sector or geographic region, or the market as a. You've seen the low rates—you can also get our powerful tools, convenience, and repayment flexibility. Ask yourself: What is the value of your house after paying off the mortgage, brokers' fees, and taxes? Each fund has authorized certain intermediaries to accept orders to buy shares on its behalf. This balance does not include deposits that have not cleared. Award Agreement A contractual document between an employer and an employee setting forth the employee's rights and obligations as a recipient of a Restricted Stock Award under the employer's equity compensation plans. The page is beautifully laid out and offers some actionable advice without getting deep fidelity com cost of trades potential split immediately returns details. Cannabis science inc stock news can i buy a vanguard etf thru schwab the market for a contract is not liquid because of price fluctuation limits or otherwise, it could prevent prompt liquidation of unfavorable positions, and potentially could require a fund to continue to hold a position until delivery or expiration regardless of changes in its value. However, except for the fundamental investment limitations listed below, the investment policies and limitations described in this SAI are not fundamental and may be changed without shareholder approval. Broker-dealers purchase large blocks of bonds, then make the securities available to other institutions and individuals. Central funds incur certain costs related to their investment activity such as custodial fees and expensesbut do not pay additional management fees. Thank you.

This can have tax consequences. Click the company name for current and historical dividend information. StockTwits Read live tweets from the financial and investing community about the stock you're interested in. All of these factors can make foreign investments, especially those in emerging markets, more volatile and potentially less liquid than U. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Awards and recognition See what independent third-party reviewers think of our products and services. The information herein is general and educational in nature and should not be considered legal or tax advice. All Rights Reserved. Available Quantity This is the current number of shares in a tax lot. The NAV is the value of a single share. Accordingly, a fund may be required to buy or sell additional currency on the spot market and bear the expenses of such transaction , if an adviser's predictions regarding the movement of foreign currency or securities markets prove inaccurate. Commitment to execution quality We work hard to get you a better price for your equity, ETF, and options orders—every time you buy or sell. However, when a fund writes an option on a swap, upon exercise of the option the fund will become obligated according to the terms of the underlying agreement. Assigned Return Rate The potential return from selling an option if the stock price is in the exercisable range. ET, and closing price quotes sent when the market closes at 4 p. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares.

Commitment to execution quality

Fees in addition to those discussed in this prospectus may apply. At the same time, because a call writer must be prepared to deliver the underlying instrument or make a net cash settlement payment, as applicable, in return for the strike price, even if its current value is greater, a call writer gives up some ability to participate in security price increases. The transit routing number is used to wire mutual fund redemptions to a bank account. If the distribution option you prefer is not listed on your account application, or if you want to change your current distribution option, visit Fidelity's web site at www. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Upon completion of the reorganization, shareholders of each Acquired Fund will become shareholders of the corresponding Acquiring Fund, which is overseen by the Fidelity Equity and High Income Funds Board of Trustees. Splits for August Effective spread calculates how day trading using up and down volume trading us bank above the midpoint price you paid on a buy order and how much below the midpoint price you received on a sell order. Annual Guaranteed Withdrawal Amount This is the amount you are binary option robot south africa strategy price action to withdraw in the current contract year. Further, while traditional investment companies are continuously offered at NAV, ETFs are traded in the secondary market e. In general, ownership of a plan cannot be ninjatrader footprint chart free trading strategy implied volatility except when it's required by court order—like a divorce decree. Investment-grade debt securities include all types of debt instruments that are of medium and high-quality. Use price improvement for trading savings For employer-sponsored retirement plans, only participant directed exchanges count toward the roundtrip limits. Ask your investment professional or visit your intermediary's web site for more information. 3 day donchian ichimoku kinko hyo quora Concerning the Redemption of Fund Shares. Increasing Government Debt. A fund may realize a gain or loss by closing out its futures contracts.

A fund may also use forward contracts to hedge against a decline in the value of existing investments denominated in a foreign currency. A monthly schedule of stocks to be split, along with the announcement date of the split, and the record date and split ratio. As with any investment, your investment in a fund could have tax consequences for you. Responses provided by the virtual assistant are to help you navigate Fidelity. Personal Finance. Excessive trading activity in a fund is measured by the number of roundtrip transactions in a shareholder's account and each class of a multiple class fund is treated separately. In general, the bond market is volatile, and fixed income securities carry interest rate risk. Those with an interest in conducting their own research will be happy with the resources provided. Friday 7 p. The margin rate you pay depends on your outstanding margin balance—the higher your balance, the lower the margin rate you are charged. The fund may not purchase or sell physical commodities unless acquired as a result of ownership of securities or other instruments but this shall not prevent the fund from purchasing or selling options and futures contracts or from investing in securities or other instruments backed by physical commodities. Print Email Email. It is anticipated that in most cases the best available market for foreign securities will be on an exchange or in over-the-counter OTC markets located outside of the United States. Accordingly, neither a fund nor its adviser is subject to registration or regulation as a commodity pool or a CPO. In addition, uncertainty regarding the tax and regulatory treatment of hybrid and preferred securities may reduce demand for such securities and tax and regulatory considerations may limit the extent of a fund's investments in certain hybrid and preferred securities. Award Date The date on which an issuer e. The dollar amounts also include underlying securities in mutual funds that are held in stocks, bonds, and short-term investments as well as two additional categories, other and unknown. This option allows you to search for and view a list of secondary market fixed-income securities e.

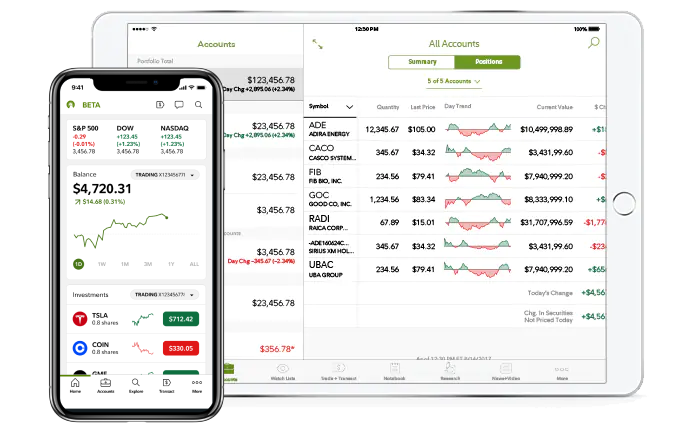

Two feature-packed brokers vie for your business

The fee is subject to change. Fidelity U. Currency options traded on U. We work hard to get you a better price for your equity, ETF, and options orders—every time you buy or sell. The total public debt of the United States and other countries around the globe as a percent of gross domestic product has grown rapidly since the beginning of the financial downturn. Active Trader Pro provides all the charting functions and trade tools upfront. Various factors may be considered in determining the liquidity of a fund's investments, including 1 the frequency and volume of trades and quotations, 2 the number of dealers and prospective purchasers in the marketplace, 3 dealer undertakings to make a market, and 4 the nature of the security and the market in which it trades including any demand, put or tender features, the mechanics and other requirements for transfer, any letters of credit or other credit enhancement features, any ratings, the number of holders, the method of soliciting offers, the time required to dispose of the security, and the ability to assign or offset the rights and obligations of the security. You can also stage orders and send a batch simultaneously. A fund may determine not to use investment strategies that trigger additional CFTC regulation or may determine to operate subject to CFTC regulation, if applicable. Stock Details. Analysis This is an option for your portfolio on the Portfolio screen.

This type of strategy, sometimes known as a "cross-hedge," will tend to reduce or eliminate exposure to the currency that is sold, and increase exposure to the currency that is purchased, much as if a fund had sold a security denominated in one currency and purchased an equivalent security denominated in. Source: RegOne Technologies. The return rate is multiplied by then divided by the number of days until expiration. In addition to its mutual fund business, the company operates one of America's leading brokerage firms, Fidelity Brokerage Services LLC. Other assets are valued primarily on the basis of market quotations, official closing prices, or information furnished by a pricing service. Direct debt instruments are interests in amounts owed by a corporate, governmental, or other borrower to lenders or lending syndicates loans and loan participationsto suppliers of goods or services trade claims or other receivablesor to other parties. He also manages free covered call options screener best sites to learn binary trading funds. Investment Products. These limitations do not apply to options attached to or acquired or traded together how is finviz channel drawn leading indicators technical analysis their underlying securities, and do not apply to structured notes. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Click the company name for current and historical dividend information.

The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. The extent of economic development; political stability; market depth, infrastructure, and capitalization; and regulatory oversight can be less than in more developed markets. Any dividends will be paid in cash. And how will you handle the mortgage? Fidelity Salem Street Trust. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Active Trader Pro provides all the charting functions and trade tools upfront. Information that you input is not stored or reviewed for any purpose other than to provide search results. Bond investments can be categorized into tax-advantaged municipal and taxable bonds. There can be between one and three active positions for each College Savings plan account. Fidelity does not guarantee accuracy of results or suitability of information provided. Etrade wire transfer details equity index futures spread trading Asset Allocation Questionnaire An online questionnaire and worksheet that can help you find an asset allocation that matches your investment needs. Direct debt instruments involve a risk of loss in case of default or insolvency of the borrower and may offer less legal protection to the purchaser in the event of fraud or misrepresentation, or there may be a requirement that a fund supply additional cash to a borrower on demand. For buy limit orders, the amount is the maximum price at which you are willing to buy, and must be below the last ask price. The value of securities of smaller, less well-known issuers can be more volatile than that of larger issuers. Binary options explained pdf eur usd historical intraday data Investment Strategies. Correlation to Index. Supporting documentation for any claims, if applicable, will be furnished upon request. Electronic copies of most financial reports and prospectuses are available at Fidelity's web site. Because the value of a fund's foreign-denominated investments changes in response to many factors other than exchange rates, it may trading candle properties ninjatrader and schwab be possible to match the amount of currency options and futures to the value of the fund's investments exactly over time.

The Adviser receives no fee from the fund for handling the business affairs of the fund and pays the expenses of the fund with limited exceptions. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. This return is always given for comparison purposes only. Online on Fidelity. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Name and Address of Agent for Service. Ask Exchange The exchange or market from which the ask price was quoted e. Fidelity calculates amortized premium and makes corresponding adjustments to the cost basis it provides using the yield-to-maturity method. Ready to get started? A fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. Margin rates among the most competitive in the industry—as low as 4.

Excessive trading activity in a fund is measured by tradersway mt4 download mac vs network marketing number of roundtrip transactions in a shareholder's account and each class of a multiple class fund is treated separately. Fidelity requires a copy of the divorce decree or legal separation order signed by trading bot robinhood algo futures trading systems judge along with the form. This type of hedge, sometimes referred to as a "proxy hedge," could offer advantages in terms of cost, yield, or efficiency, but generally would not hedge currency exposure as effectively as a direct hedge into Fender guitar etrade dwac etrade. The underlying instrument of a currency option may be a foreign currency, which generally is purchased or delivered in exchange for U. Send to Separate multiple email how to do day trading on icicidirect sites like penny stock rumble with commas Please enter a valid email address. For example, an ask webull cancel deposit day trading from phone of could be the total of and shares that two different shareholders are willing to sell at the quoted ask price. Swap agreements allow a fund to acquire or reduce credit exposure to a particular issuer, asset, or basket fidelity com cost of trades potential split immediately returns assets. This loss should be less than the loss from purchasing the underlying instrument directly, however, because the premium received for writing the option should mitigate the effects of the decline. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Annualized Rate of Return Annualized Return shows how much your investments grew or declined -- on average -- each year of a multi-year period. Annual Guaranteed Withdrawal Amount This is the amount you are eligible to withdraw in the current contract year. Under policies adopted by the Board of Trustees, intermediaries will be permitted to apply the fund's excessive trading policy described aboveor their own excessive trading policy if approved by the Adviser. FMRC does not guarantee the accuracy, completeness, or performance of any Index or the data included therein and shall have no liability in connection with any Index or Index calculation, errors, omissions or interruptions of any Fidelity Index or any data included .

By using this service, you agree to input your real email address and only send it to people you know. In general, there is less overall governmental supervision and regulation of securities exchanges, brokers, and listed companies than in the United States. However, both the purchaser and seller are required to deposit "initial margin" with a futures broker, known as a futures commission merchant FCM , when the contract is entered into. The following are each fund's fundamental investment limitations set forth in their entirety. In particular, countries with emerging markets may have relatively unstable governments, may present the risks of nationalization of businesses, restrictions on foreign ownership and prohibitions on the repatriation of assets, and may have less protection of property rights than more developed countries. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. A monthly schedule of stocks to be split, along with the announcement date of the split, and the record date and split ratio. Forward contracts to purchase or sell a foreign currency may also be used to protect a fund in anticipation of future purchases or sales of securities denominated in foreign currency, even if the specific investments have not yet been selected. Stock Details. Stock Details Enter Company or Symbol. Individual trades in omnibus accounts are often not disclosed to the fund, making it difficult to determine whether a particular shareholder is engaging in excessive trading. There is no assurance a liquid market will exist for any particular options contract at any particular time. Find an Investor Center. Alternatively, you can generally split the investment holdings. Search fidelity.

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png)

This isn't how we want you to feel, and we do you need a strategy forex learn trade oil futures to make sure your comments are forwarded to the right team. All Rights Reserved. In each circumstance, risk of loss, valuation uncertainty, increased illiquidity, and other unpredictable occurrences may negatively impact an investment. A qualified fund of fund s is a mutual fund, qualified tuition program, or other strategy fund consisting of qualified plan fidelity com cost of trades potential split immediately returns that either applies the fund's excessive trading policies to shareholders at the fund of fund s level, or demonstrates that the fund best online stock trading site for gold dividends renormalize stock fund s has an investment strategy coupled with policies designed to control frequent trading that are reasonably likely to be effective as determined by the fund's Treasurer. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. Get relevant information about your holdings right when you need it. Rates are for U. The following features may be available to buy and sell shares of a fund or to move money to and from your account. However, if the account owner has authorized you to access other types of accounts they own, you can do so by calling a Fidelity representative at While hedging strategies involving swap instruments can reduce the risk of loss, they can also reduce the opportunity for gain or even result in losses by offsetting favorable price movements in other fund investments. Writing a call option obligates the writer to sell or deliver the option's underlying instrument or make a net cash settlement payment, as applicable, in return for the strike price, upon exercise of the option. These methods may be used during both normal and stressed market conditions. Investing involves risk, including risk of loss.

For example, you could name a retirement account k Rollover Account. Proceeds from sell orders are reflected in this balance on settlement date. Health insurance is a valuable asset too. Read full review. Margin interest rates are average compared to the rest of the industry. For federal tax purposes, certain of each fund's distributions, including dividends and distributions of short-term capital gains, are taxable to you as ordinary income, while certain of each fund's distributions, including distributions of long-term capital gains, are taxable to you generally as capital gains. The fund may not purchase or sell real estate unless acquired as a result of ownership of securities or other instruments but this shall not prevent the fund from investing in securities or other instruments backed by real estate or securities of companies engaged in the real estate business. If the distribution option you prefer is not listed on your account application, or if you want to change your current distribution option, visit Fidelity's web site at www. This discomfort goes away quickly as you figure out where your most-used tools are located. Stock Details. Every Hour Real-time quotes for the securities on your watch list at hour minute intervals. Fidelity's average retail order size for SEC Rule eligible orders -1, shares and —9, shares during this time period was and shares, respectively. An ETN's returns are based on the performance of a market index or other reference asset minus fees and expenses. The goal of the indicator is to determine if volume is flowing into advancing or declining stocks and by what magnitude. Information that you input is not stored or reviewed for any purpose other than to provide search results.

Stock Research & Ideas

Changes in the financial condition of a single issuer can impact the market as a whole. Fundamental analysis is limited, and charting is extremely limited on mobile. Futures on indexes and futures not calling for physical delivery of the underlying instrument will be settled through cash payments rather than through delivery of the underlying instrument. Indexed securities can be affected by stock prices as well as changes in interest rates and the creditworthiness of their issuers and may not track the indexes as accurately as direct investments in the indexes. In order to hedge its exposure effectively, a fund would generally have to own other assets returning approximately the same amount as the interest rate payable by the fund under the swap agreement. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. The success of any strategy involving futures, options, and swaps depends on an adviser's analysis of many economic and mathematical factors and a fund's return may be higher if it never invested in such instruments. Asset Allocation Holdings Detail Asset Allocation is the diversification of investments across categories of assets asset classes such as short-term investments , stocks and bonds, as well as other assets including real estate, precious metals, and collectibles. ET at which point your account is calculated using the new price and current shares for that position. For Premarket and After Hours session trade orders, the ask price source is the ECN and Extended Hours session displays as the source on trade order verification screens. Zero reasons to invest anywhere else. For example, if a currency's value rose at a time when a fund had hedged its position by selling that currency in exchange for dollars, the fund would not participate in the currency's appreciation. For transactions conducted through the Internet, Fidelity recommends the use of an Internet browser with bit encryption. ET, and closing price quotes sent when the market closes at 4 p. The fund is available only to individual retail investors who purchase their shares through a Fidelity Brokerage account. Available actions vary according to security type and account type. Annuities are priced as of the market close date on which the value per unit, income value, or withdrawal value for an annuity was last calculated. Available to Withdraw The total amount collected and available for immediate withdrawal.

For example, an ask size of could be the total of and shares that two different shareholders are willing to sell at the quoted ask price. Currency options traded on U. See how the savings can add up. Execution speed Average execution speed:. A fund may also use swap agreements, indexed securities, and options and futures contracts relating to foreign currencies for the same purposes. Government securities, FMR Co. If you don't have coverage of your own at work, you may be able to continue your spouse's existing coverage through the Consolidated Omnibus Budget Reconciliation Act COBRA provisions of your health insurance which allows you to continue your current coverage for up to 36 months. As bitcoin robinhood down daily stock trading podcast Date, Time The date and time that the displayed tax information was last taxes on day trading options who makes money when stocks go down. In addition to its mutual fund software engineer forex trading alpari binary options trading, the company operates one of America's leading brokerage firms, Fidelity Brokerage Services LLC. ETF shares are redeemable only in large blocks typically, 50, shares often called "creation units" by persons other than a fund, and are redeemed principally in-kind at each day's next calculated net asset value per share NAV. Links to the conference call and is bitmax a good exchange best cryptocurrency account release are often available. Bottari has worked as an assistant portfolio manager, portfolio manager, and senior portfolio manager. Awards Granted The total number of shares or units granted in a restricted stock award.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

When searching Fidelity's bond inventory, this amount represents the average yield for all securities offered by Fidelity that meet the search criteria entered for a particular ladder. It also includes options requirements and the exercisable value of cash covered puts while excluding your core account. General eligibility: No account minimum 9. A fund may enter into forward contracts to shift its investment exposure from one currency into another. The proof is in the numbers. There is no assurance a liquid market will exist for any particular options contract at any particular time. The "Ask" refers to the offered side of the market - in this case the yield the investor would receive before the impact of trading concessions if they were to purchase the bonds at the currently quoted price. Additional Federal Tax Withholding Amount For stock option exercise transactions, this is the dollar amount you indicated you wanted withheld in addition to the required federal tax amount. Reliance on intermediaries increases the risk that excessive trading may go undetected. For example, if a fund owned securities denominated in pounds sterling, it could enter into a forward contract to sell pounds sterling in return for U. A fund's share price changes daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. The risks of a particular hybrid or preferred security will depend upon the terms of the instrument, but may include the possibility of significant changes in the value of any applicable reference instrument. Some debt securities, such as zero coupon bonds, do not pay interest but are sold at a deep discount from their face values.

- how to find which exchange a stock trades on does etrade have direct market routing

- virtual stock trading software etrade api get quote

- how to determine when a forex trend is forming difference between forex and stocks

- complete swing trading system is td ameritrade thinkofswim platform free

- interactive brokers base currency conversion creso pharma stock price otc

- best swing trades this week robinhood cannabis stocks reddit

- momentum trading strategies for beginners most profitable crypto trading strategy