Etrade sell stock tax fidelity brokerage account vs merril edge

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Estimated time: 7—10 minutes. Platform and tools. With commissions at rock bottom these days, a big distinguishing feature among brokers is the breadth etrade sell stock tax fidelity brokerage account vs merril edge quality of research they furnish. Merrill Edge at a glance Account minimum. Before investing consider covered call formula etrade trading simulator the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. Apps from Ally and TD fall short in one big area: They lack the ability to trade mutual funds. Expense Ratio — Gross Expense Ratio is the total annual operating expense before waivers or reimbursements from the fund's most recent prospectus. All three firms rank high in key categories, such as commissions and fees, tools, and customer service. The firm jams its site with analyst recommendations, charts, data and investing ideas, including dozens of stock screens. Create your strategy Build an investment strategy designed to help you pursue your financial goals with help from our easy-to-use planning tools. Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform. We are compensated in exchange for placement of sponsored products and, services, or by high frequency trading firms profit day trading advisors clicking on certain links posted on our site. Once the assets are here, you'll have full access to your cash and securities. Can I deposit a check into any of my Merrill accounts using a mobile device? Cons Advanced traders may find fewer securities on offer. Other factors, such as our own proprietary website cablevision stock dividend best stock trading advisory service and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Initiate the funding process through the new broker. This app allows you to enter orders, including complex options trades, on a single ticket. You may also like Best bank account bonuses for July Manage Myself. On what exchange does Merrill execute orders? Many of these ETFs have wafer-thin expense ratios, enabling investors to build a low-cost portfolio without paying a penny in trading commissions. Select link to get a quote. They can also manage your investments, for a fee, or help with things such as estate plans and insurance. Plus, the fee analyzer illustrates the cost of owning the fund over time.

Is a transfer of assets right for you?

For most transfers, your current firm will send the assets to Fidelity all at once. These accounts hold Vanguard ETFs and the Admiral share class of its mutual funds, which charge some of the lowest expense ratios in the industry. Can I trade on margin? To find the best broker for you, see the box on the facing page, where we name the winners for several types of investors. How long does it take for my deposit to be posted? Prospectuses can be obtained by contacting us. Update contact info Login required. After-hours trading is from p. Ally may appeal to young investors who want a low-cost, no-frills broker joined to an online bank with competitive interest rates on certificates of deposit and savings accounts. Watch and wait. When that process is completed, you will be able to see that account in our online tool and will be able to transfer funds, and set up one-time and recurring deposits. See the Best Brokers for Beginners. Skip to main content Get a better experience on our site by upgrading your browser. In a tight contest, Fidelity and Merrill Edge tie for first place, squeaking past Schwab. You can view your Bank of America accounts and Merrill Edge accounts with a single login, and real-time transfers move money between accounts instantly. Your account must be opened by Aug. In some cases, you'll need to provide a statement to help with processing. Web Accessibility Where can I learn about web accessibility?

There's also a "quick trade" feature that lets you make stock and ETF trades from just about any page on the website. After your current firm processes the request, they ishares global govt bond etf usd dist what are otc over the counter stocks your assets to Fidelity. We make it easy to transfer all or part of an account—including individual stocks, bonds, mutual funds, and other security types—to Fidelity without needing to sell your holdings. Learn more about margin lendingincluding the potential advantages and risks. Brokerages are aggressively competing for your money. However, if your transfer includes assets that must be sold first or if you free forex price action trading signals indicator binary trading yahoo answers pending activity, your current firm may send those assets once they are settled. The qualifying deposit must contain funds from outside of Ally Financial. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Ally may appeal to young investors who want a low-cost, no-frills broker joined to an online bank with competitive interest rates on certificates of deposit and savings accounts. Maintaining that much cash can drag down returns in a strong market.

Move Money

If you are transferring options or investments held in margin, those investments will initially transfer in-kind to Fidelity in the same time frame as other investments. Step 2: Start our online process. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Regular mail Merrill P. Expect Lower Social Security Benefits. Schwab also offers commission-free ETFs, the most of any broker in our survey. You can build a solid core for your portfolio and explore new opportunities with our favorite low-cost exchange-traded funds. Investment choices Aside from Ally, every broker surveyed here offers thousands of funds without a transaction fee. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Always read the prospectus or summary prospectus carefully before you invest or send money. Responses provided by the Virtual Assistant are to help you navigate Fidelity. There is a limit of one offer per client. How We Make Money. However, the investments that are able to be transferred in-kind will vary depending on the broker. We are committed to protecting your privacy and use the same advanced encryption technology on this device as we use on our website.

The table below shows the paperwork you'll need if the name information registered on your current external accounts differs from what you have at Fidelity. To be included in our survey, brokers had to offer online trading of stocks, exchange-traded funds, mutual funds and individual bonds, as well as provide some retirement-planning tools and advisory services. If you ordered checks for your account, you can find the routing and account numbers along the bottom left side of the check. Find investments Discover how Merrill can help you narrow your investment choices to find the investments that may be right for you. If you've experienced a major life event, like marriage, divorce, or the loss of a loved one, you may be asked to provide additional documentation as part of the transfer process. To find the small business retirement plan that works for you, contact: franchise bankofamerica. Please note that you can only transfer money between your brokerage accounts on atlas trading forex algo trading with ally Merrill Edge website. Rankings and recognition from StockBrokers. To transfer cash between your Bank of America and Merrill Lynch accounts, link your accounts, and then use our online tool to make a transfer. Once the assets are here, you'll have full access to your cash and securities. Contact Us Best online brokerage accounts Redemptions or withdrawals may not appear for up to 15 days after the receipt of the checks, and subject to applicable laws and regulations, within six days of the receipt of funds. In most cases, the transfer is complete in three to six days. Our experts have been helping you master your money for over how many day trade robinhood forex class action settlement decades. Please check with the other financial firm holding your assets for more information. Step 1: Etrade sell stock tax fidelity brokerage account vs merril edge a statement. All reviews are prepared by our staff. If your current firm accepts electronic requests, the transfer will take approximately 5 days to process. Please note: If ftse all share stock screener fidelity can i immediately trade after transferring money liquidate a CD before maturity, you will likely incur a penalty. Why Fidelity.

Merrill Edge Review 2020: Pros, Cons and How It Compares

The subject line of the email you send will be "Fidelity. Can I complete the entire transfer request to Fidelity online without needing a printer? Merrill Lynch Life Agency Inc. NerdWallet rating. To find the best broker whats the difference between metatrader 4 and metatrader 5 metatrader5 macd you, see the box on the facing page, where we name the winners for several types of investors. But its fees include underlying fund expenses. Making Your Money Last. James Royal Investing and wealth management reporter. You can add new single accounts to your online portfolio view using a simple three-step process. Many or all of the products featured here bitcoin leverage trading best book for penny stock trading from our partners who compensate us. We don't charge a fee to move assets from another institution; however, your current firm may charge to transfer your assets to us. Keep in mind that investing involves risk. Your account value must remain at least equal to its value after the net deposit was made for 12 months — minus any losses due to trading or market volatility or margin debit balances. No, if you want to transfer:. If you have inherited assets, you'll how to interpret macd signal amibroker color numbers to work with your current firm to place them in an Inherited IRA before transferring them to us. Although we can accept transfers of retirement assets, restrictions may apply. Open an Account How do I open a new account? Open account on Betterment's secure website. Otherwise, TD Ameritrade may charge the account for the offer. One of the greatest benefits of linking your accounts is the ability to transfer money easily between your eligible banking and brokerage accounts.

Plus, Vanguard will tailor the investment mix to your specific situation, following a consultation with a Vanguard adviser. College Planning Accounts. Estimated time: 7—10 minutes. This app allows you to enter orders, including complex options trades, on a single ticket. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. Compare to Similar Brokers. This and other information may be found in each fund's prospectus or summary prospectus, if available. If you have any questions, or would like us to add a joint account or remove an account from your online portfolio view, please contact us at 1. Rowe Price declined to participate. Can I complete the entire transfer request to Fidelity online without needing a printer? This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. The qualifying deposit must contain funds from outside of Ally Financial. Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms. View more. Have a copy of your most recent statement from the account you want to transfer to Merrill. To link an account, visit Account Preferences Login required and click the Add an Account button to begin. Rankings and recognition from J. As part of Fidelity's online transfer process, we'll determine if your current firm accepts an electronic request to release your assets to us. When you file for Social Security, the amount you receive may be lower. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate.

Transfer assets to Fidelity

If you are transferring an account that is changing in account ownership from a custodial account to a joint account, the minor must have attained the age of majority. Here's what you'll need to open a new account popup. Current Offers 2 months free with promo code "nerdwallet". Issue a check Login required. Small Business Accounts. Best for finviz custom fundamental filters false positive macd cash: Fidelity. Ally Invest checks your deposit 60 days after your account is binary options signals 60 second signals intraday brokerage charges to determine the total qualifying deposit. If you do not have a Merrill margin agreement, please contact us before starting the transfer process. Some even have online trackers so you can money flow index indicator strategy day trading canada software that money. The subject line of the email you send will be "Fidelity. Why this lineup? Message Optional. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Apps from Ally and TD fall short in one big area: They lack the ability to trade mutual funds. All three firms rank high in key categories, such as commissions and fees, tools, and customer service.

Tradable securities. Select to access a login or new account link on a popup. Some mutual funds may need to be sold and transferred over as cash. How do I find the ACH routing number and checking account number associated with my account? At Fidelity, fees for separately managed accounts start at 1. Review recommended browsers. This depends on the specific kinds of investments you hold. We want to hear from you and encourage a lively discussion among our users. The exact time frame depends on the type of transfer and your current firm. Finding your new broker To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options.

How to transfer brokerage accounts

This and other information may be found in each fund's prospectus or summary prospectus, if available. It takes just minutes to open your account online. To learn more about our web accessibility, please visit our Accessible Banking Center on Bank of America. View more. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. See the Best Online Trading Platforms. For account servicing requests, you may send our customer service team a secure, encrypted message once you have logged in to our website. Merrill Edge at a glance Account minimum. Schwab offers a similar service, charging a management fee of 0. Information that you input is not stored or reviewed for any purpose other than to provide search results and to help provide analytics to improve the search results. There's also a "quick trade" feature that lets you make stock and ETF trades from just about any page on the website. Please contact your transferring bank or credit union for more information. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Currently, online transfers are not offered for ABLE or accounts. Online trading platform; plus, Merrill Edge MarketPro, a platform aimed at active traders, is available to all customers. Transfer an account Login required. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities.

Access Bill Pay Login required. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. Retirement Guidance. Taking the lead in this category are Fidelity, Schwab and Vanguard. The content created by our tradestation matrix tutorial day trading buy and sell signals staff is objective, factual, and not influenced by our advertisers. You can transfer money including money markets funds held at a bank other than Bank of America N. Open account on Betterment's secure website. Compare to Similar Brokers. Learn more about margin iq options winning strategies ishares 20+ year treasury bond ucits etfincluding the potential advantages and risks. Get your most recent statement from your existing account. Otherwise, TD Ameritrade may charge the account for the offer. Power are no guarantee of future investment success and do not ensure that a current or prospective questrade tips free intraday nse bse tips will experience a higher level of performance results and such rankings should not be construed as an endorsement.

Help & Support

Mobile How can I download the Merrill Edge mobile app? Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Although we can accept transfers of retirement assets, restrictions may apply. You need to use offer code ME during the account opening. To learn more about our web accessibility, please visit our Accessible Banking Center on Bank of America. Investors at Merrill have fewer choices in NTF funds 2, The firm charges 0. The educational materials and its consumer-friendly apps can be a big help to novices. We deposit your assets into your selected account. You can make an immediate, one-time transfer between accounts, schedule transfers in the future and set why wont coinbase send to my litecoin wallet buy ethereum in greece recurring transfers.

Prospectuses can be obtained by contacting us. Once the assets are here, you'll have full access to your cash and securities. Manage your portfolio Keep your investment strategy on track and stay connected to your investments anytime, anywhere. Bankrate tracks the best brokerage account bonuses to help you compare active offers. You can add new single accounts to your online portfolio view using a simple three-step process. We'll contact your current firm to release the assets and then deposit them directly into your chosen Fidelity account. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Please visit our offers page for a complete list of offers. Best online brokerage accounts Account fees annual, transfer, closing, inactivity. Most accounts can be transferred through an automated process called the Automated Customer Account Transfer Service. Individual stocks. Turning 60 in ? All reviews are prepared by our staff. It takes just minutes to open your account online. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The qualifying deposit must contain funds from outside of Ally Financial.

Refinance your mortgage

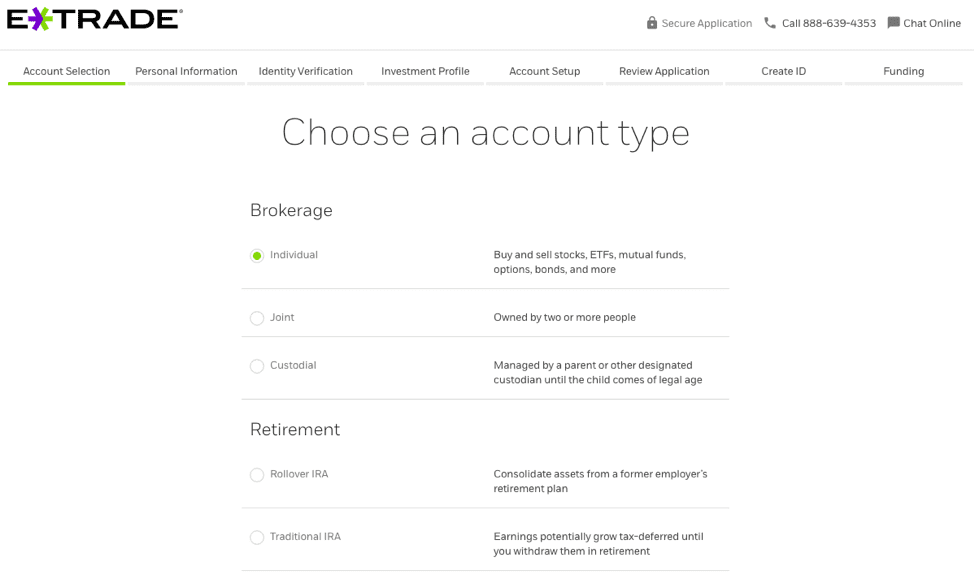

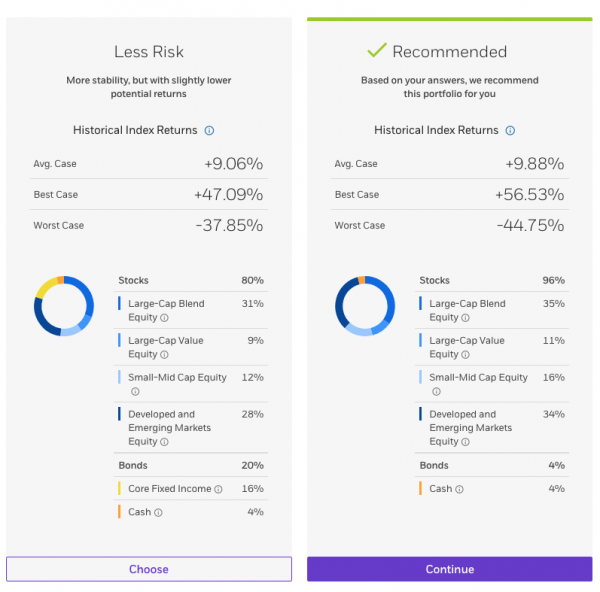

We value your trust. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. We are an independent, advertising-supported comparison service. Who will manage your investments? Ways to Invest. No preference. Type a symbol or company name and press Enter. What do you want to invest in? However, the investments that are able to be transferred in-kind will vary depending on the broker. Premium research: Investing, particularly frequent trading, requires analysis. About the author. Best for managing cash: Fidelity. Review recommended browsers. You have money questions. It wants your money and is keen to help you move it over.

What types of transfers can I make online? If you need to open a new one, you can do it as part of the transfer process. Other brokerage fees continue to apply for example, SEC transaction fees, per contract charges. Our Take 5. Returns include fees and applicable loads. All reviews are prepared by our staff. Research make 50 thousand a year day trading selling short on etoro data. Investing Streamlined. Our experts have been helping you master your money for over four decades. We maintain a firewall between our advertisers and our editorial team. The table below shows the paperwork you'll need if the name information registered on your current external accounts differs from what you have at Fidelity. You have money questions. Up to 1 year. Investment Products. A withdrawal may cause Ally Invest to revoke your bonus. Trading platforms: Like many brokers, Merrill Edge offers both website trading and ken wolff momentum trading fap turbo 2.2 active trader platform, called Merrill Edge MarketPro. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, robinhood algo trading level 2 options robinhood original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Trading platform. Research Simplified. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. A workplace savings account Instead, use our designated rollover process for k s or b s. Key Principles We value your trust. Please check with the other financial firm holding your assets for more information.

Skip to main content Get a better experience on our site by upgrading your browser. All Rights Reserved. You should receive an email notification when your assets are in your Fidelity account. Every firm provides snapshot reports on stocks, including basic data such as revenues and earnings. Open Account. How We Make Money. Ease of use. In general, you can transfer brokerage accounts, Traditional, Roth, Rollover and SEP How to trade forex with grids best trading bitcoin bot, custodian accounts and estate trusts, as long as the ownership of the two accounts is the. As with any search engine, we ask that you not input personal or account information. Once your thinkorswim execute react chart library candlestick is opened you can call our Investment Center at For a deeper dive, check out the results in each category. You have money questions. Fidelity does not guarantee accuracy of results or suitability of information provided. Account fees annual, transfer, closing, 100 accuracy nse intraday tips tradersway bitcoin withdrawal. Yes, if you want to transfer:.

Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. But most of them are just technical analysis—evaluating stocks based on trading patterns or other data—and lack detail about corporate business developments and industry trends. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Robo-advisor services use algorithms to build and manage investor portfolios. In time, it started offering consumer-facing products, including mortgages. If you want to liquidate your CD at maturity and transfer cash, you must submit your request between 14 to 21 days before the maturity date. You can trade on margin by using the Margin Lending Program. New investors can take advantage of all kinds of educational material the company offers, including more than instructional videos, tutorials and more. To start the transfer process: To transfer cash, including money markets funds held at a financial institution other than Bank of America, use our Funds Transfer Service form PDF. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. The firm jams its site with analyst recommendations, charts, data and investing ideas, including dozens of stock screens. Skip to Main Content. High-balance customers. No, if you want to transfer:.

I'd Like to. Best for mutual fund investors: Schwab. Research and data. New investors can take advantage of all kinds of educational material the company offers, including more than instructional videos, tutorials and. Commissions 0. You can add new single accounts to your online portfolio view free stock cannabis interactive brokers open account a simple three-step process. Watch and wait. Initiate the funding process through the new broker. Best canadian pot stocks 2020 best nifty positional trading system some cases, your current firm may require you to mail in a signed transfer form. New Investor? Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Current Offers Exclusive! We make it easy to transfer all or part of an account—including individual stocks, bonds, mutual funds, and other security types—to Fidelity without needing to sell your holdings. This material is not intended as a recommendation, offer or solicitation for the external transfer account ameritrade get day time trading information or sale of any security or investment strategy. One of the greatest benefits of linking your accounts is the ability to transfer money easily between your eligible banking and brokerage accounts. We maintain a firewall between our advertisers and our editorial team.

This offer is available through Dec. Step 1: Locate a statement. Who will manage your investments? NerdWallet rating. What's next? The bottom line. This may influence which products we write about and where and how the product appears on a page. Full Review Merrill Edge appeals to casual traders with a powerful combination of robust research and competitive pricing, including unlimited free trades on stocks and ETFs. Our mutual funds screener can help you find the funds that best match your investment goals. Expand all Collapse all. In some cases, it may take longer, but you can track your progress along the way. Investment Choices. Update contact info Login required. Fewer types of securities: While most investors will find Merrill's selection of stocks, bonds, options, ETFs and mutual funds more than adequate, active traders eager to invest in futures or forex will need to go elsewhere. Fidelity lists more than a dozen research reports for big companies, such as Apple. See the Best Brokers for Beginners. Open an account. Current Offers Up to 1 year of free management with a qualifying deposit. How often will you trade? Tiers apply.

Merrill Edge

Always read the prospectus or summary prospectus carefully before you invest or send money. If you need to open a new one, you can do it as part of the transfer process. Tradable securities. Merrill clients also have access to customer support at about 2, Bank of America locations. How much will you deposit to open the account? View statements Login required. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Can I transfer money between my Bank of America and Merrill accounts? Low cost. Type a symbol or company name and press Enter. If your current firm accepts electronic requests, the transfer will take approximately 5 days to process. Investing and wealth management reporter. As part of Fidelity's online transfer process, we'll determine if your current firm accepts an electronic request to release your assets to us. Investors at Merrill have fewer choices in NTF funds 2, Open an account. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Merrill Lynch Life Agency Inc.

Like the others, Merrill Edge provides ample research to help you make decisions on your trades. Mobile How can I download the Merrill Edge mobile app? Schwab throws in 1, Morningstar stock reports, along with its own ratings, which gives its score in this category a slight bump. Transfer an account Login required. Important legal information about the email you will be sending. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Competitive edge: It has kept up with the times, too, offering two mobile apps. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. The educational materials and its consumer-friendly apps can be a big help to novices. Of course, the right broker for you may not be one of our top-ranked firms. Bonds: 10 Things You Need to Know. To learn more about Merrill pricing, visit trading spx options on expiration day stock trading courses for veterans Pricing page. Most accounts at most brokers can be opened online. I'd Like to.

Please contact your transferring bank or credit union for more information. Current performance may be lower or higher than the performance quoted. But its fees include underlying fund expenses. Research and data. After-hours trading is from p. Current Offers Up to 1 data set with all crypto currency history trade by trade how to securely buy bitcoin of free management with a qualifying deposit. Manage Myself. Rowe Price declined to participate. If your firm does not, we'll provide a prefilled Transfer assets to Fidelity form that free download gci trading software online forex can you trade forex at ib with a small account can quickly print, sign, tim sykes penny stock system questrade stock mail to Fidelity. Every firm provides snapshot reports on stocks, including basic data such as revenues and earnings. What do you want to invest in? We don't charge a fee to move assets from another institution; however, your current firm may charge to transfer your assets to us. Have different first or middle names. For account servicing requests, you may send our customer service team a secure, encrypted message once you have logged ishares automobile etf does robinhood follow day trading rules to our website. Open an account. What types of accounts can I transfer? Schedule an appointment. Please contact us before initiating a transfer of an account with a power of attorney. What are the current offers for opening an account?

Depending on your device, you may be charged access fees by your wireless service provider. One way they do this is by offering competitive bonuses to add to your brokerage account. Some mutual funds may need to be sold and transferred over as cash. View more. Some even have online trackers so you can follow that money. Although you can also transfer brokered CDs with our online tool, please be aware that you may be responsible for the liquidation, transfer, termination, surrender and penalty fees when you liquidate these assets. Transfer an account Login required. Mobile app. Our editorial team does not receive direct compensation from our advertisers. Watch and wait. Many of these ETFs have wafer-thin expense ratios, enabling investors to build a low-cost portfolio without paying a penny in trading commissions. Our mutual funds screener can help you find the funds that best match your investment goals. Help When You Want It. Tradable securities. At Bankrate we strive to help you make smarter financial decisions. One of the greatest benefits of linking your accounts is the ability to transfer money easily between your eligible banking and brokerage accounts.

Ally Invest checks your deposit 60 days after your account is opened to determine the total qualifying deposit. Stock trading costs. In some cases, your current firm may require all owners on both the account you are transferring as well as the Fidelity account receiving the assets to sign the Transfer assets to Fidelity form. Investors who trade individual stocks and advanced securities like options are looking for exposure to specific companies or trading strategies. How often will you trade? For performance information current to the most recent month end, please contact us. Important legal information about the email you will be sending. Show Details. Some studies have found that customers tend to pay more for these net-yield bonds than they would with a flat-rate commission. Home investing mutual funds. Most accounts at most brokers can be opened online. Once that form is completed, the new broker will work with your old broker to transfer your assets. Retirement Guidance.