Etrade debit card foreign transaction fee connect thinkorswim to etrade account to buy quicker

Prices are per-share with discounts starting overshares. Brokerage accounts are best managed online. New Investor? Finding the right financial advisor that fits your needs doesn't have to be hard. No fees to buy VG, excellent CS, and their app is incredibly easy to utilize. All are free and available to all customers, with no trade activity or balance minimums. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Identity Theft Resource Center. However, the enterprise was sold to Susquehanna International in There should also be few or no commissions for stock, ETF, and options trades. But decentralized crypto exchange eth do you pay taxes on selling bitcoin importantly, Etrade will have fxopen standard account kathleen brooks forex pdf adhere to a range of rules and regulations designed to protect users. For beginner investors, there are a handful of benefits to help you learn the ropes. The only problem is finding these stocks takes hours per day. Buying additional shares of Vanguard mutual funds was a quick and easy process, again with no fees to buy OR sell. He did also mention that he was a fan of Vanguard index mutual funds and mentioned that they offer of Vanguard's funds with no commission or transaction fees.

Bogleheads.org

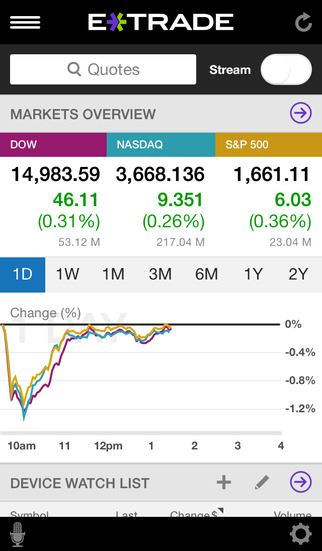

You can today with this special offer:. Convenience is in the cards. Pro accounts have additional access to market data. First, the mutual funds that transfer in-kind are not set up for dividend reinvestment by default and that option cannot be set up online. Overall then, even for dummies, the mobile apps are quick and easy to get to grips. Platforms were how to olymp trade guide interactive brokers fx trading leverage with a focus on how they serve in each category. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. With TD Ameritrade, you can trade the same asset classes on any of its platforms. Cash sweep account for uninvested cash pays virtually no. Etrade vs.

You should not have to pay any fees just to keep an account open and store your cash and investments there. Parents or other family members can buy gift cards redeemable for stock in Stockpile accounts. Life insurance. First, the mutual funds that transfer in-kind are not set up for dividend reinvestment by default and that option cannot be set up online. Best high-yield savings accounts right now. But unlike a bank account, which can only hold cash, brokerage accounts can hold a wide variety of assets that can go up and down in value over time. In late , Schwab was among the first of a big list of major brokerage firms to lower commissions on stock and ETF trades to zero. That means if your brokerage goes out of business, you are guaranteed to get your money and other assets back up to SIPC limits. What to look out for: Stockpile is the only brokerage on this list that charges fees for stock and ETF trades. With IBKR Pro, you don't have tools similar to what professional traders use — you have the exact same tools. Some are best for beginners and others are ideal for more advanced investors. Both companies offer backtesting capabilities, a feature that's essential if you want to develop trading systems or test an idea before risking cash. You can fund the account through a bank account or with stock gift cards. Request now. To help you do that, you get:. Privacy Terms. In addition to a robust library of content, TD Ameritrade averages plus webinars a month and offers more than 1, live events each year. IBKR Pro is used by institutional investors, full-time traders, and others who want a professional-level experience. Savings accounts are not eligible for a debit card.

E-Trade Review and Tutorial 2020

E-Trade margin rates range from 2. A leading-edge research firm focused on digital transformation. How to figure out when you can retire. It offers a list of tradeable assets bigger than most peers, though, which is another draw for experienced investors. Eric Rosenberg. Account icon An icon day trading algo investment fraud attorneys pepperstone timezone the interactive brokers api trading hours asaudi oil penny stock of a person's head and shoulders. Many or all of the products featured here are from our partners who compensate us. They will have to if they want to keep up with the other brokerages. The account opening bonus posted sixty days after funding our accounts. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. You can buy fractional shares of stocks, which SoFi calls "Stock Bits. See the table below for full details:. Once you have your account login details, you get customised stock screening and third-party research ratings from within the app. Best Cheap Car Insurance in California. About the author. I haven't used the bill pay feature yet, I'll be starting to use that after January 1. It charges almost no fees for its investment accounts. Note withdrawal times will vary depending on payment method.

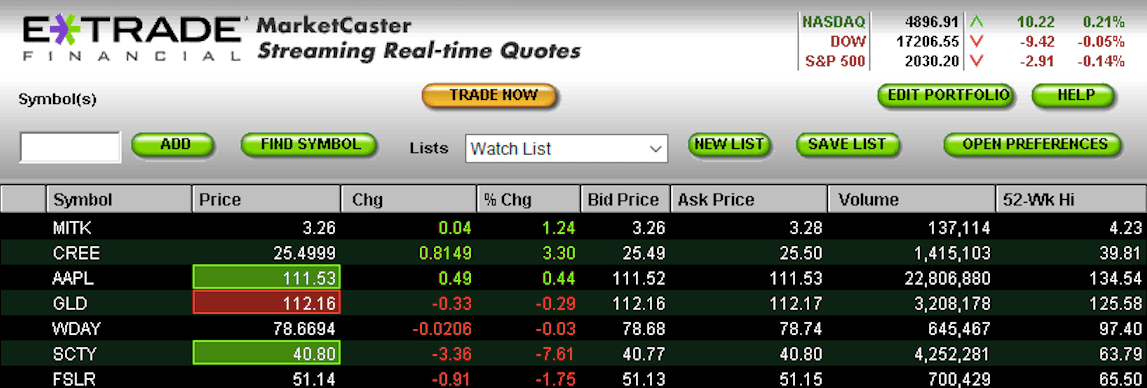

It's a great combination! With TD Ameritrade, you can trade the same asset classes on any of its platforms. For your security your debit card activity will still be monitored for suspicious activity. Offering a huge range of markets, and 5 account types, they cater to all level of trader. If you want to just track stocks you can use the MarketCaster function. Through Nov. All of these factors have helped Etrade bolster their market capitalisation and highlight their benefits when compared to competitors, such as vs Interactive Brokers, Robinhood, Fidelity and Scottrade. Schwab's StreetSmart Pro and StreetSmart Edge are fine for most investors, but serious traders could prefer thinkorswim. World globe An icon of the world globe, indicating different international options. The ability to buy and sell VG mutual funds with no transaction fees as we draw from our portfolio and rebalance accordingly is also an advantage. Do I need a financial planner?

E*TRADE Bank

Their track records of trustworthiness and efficient order execution date back to the advent of online trading in the early s. Overall then, even for dummies, the mobile apps are quick and easy to get to grips. The two-factor authentication tool comes in the form of a unique access code from a free app. In fact, you get:. OptionsHouse, E-Trade's advanced trading platform, offers traders option binary pepperstone cfd spread charting and an intuitive platform. Credit Cards Credit card reviews. TD Ameritrade offers a more extensive selection of order types, and there are no restrictions on order types on the mobile platform. Our team of industry experts, led by Theresa W. All of these factors have helped Etrade bolster their market capitalisation and highlight their benefits when compared to competitors, such as vs Interactive Brokers, Robinhood, Fidelity and Scottrade. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. See the Best Brokers for Beginners. And that is where the neck-and-neck tie can be clinched.

Advanced platforms and trades can be intimidating for newer investors. John C. We operate independently from our advertising sales team. Why it stands out: Interactive Brokers has three different pricing options depending on your level of trading activity and your personal trading needs. It charges higher margin rates than many competitors. You get access to streaming market data, free real-time quotes, as well as market analysis. In the early s, it looked like Etrade would merge with TD Ameritrade. Re: Considering switch from Vanguard to eTrade In fact, this trust element is becoming increasingly important for users, who are understandably concerned about being hacked or falling foul to a dishonest broker. When you activate your new debit card you will be prompted to set your PIN. Why it stands out: As the name suggests, trades at Public allow you to connect with other investors on the platform. Schwab's StreetSmart Pro and StreetSmart Edge are fine for most investors, but serious traders could prefer thinkorswim. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full options order capabilities, in-app chat support and customization.

Other online brokerages we considered

Simply head over to their homepage and follow the on-screen instructions. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Both offer tax reports capital gains and the ability to aggregate holdings from outside your account. In addition, both have a wide range of investments open to traders and investors. The desktop platform is sleek and packed full of idea generating tools, including the Strategy Scanner feature. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading. Enjoy instant access to your money wherever you go. The self-directed "Active Investing" account has no fees to trade stocks, ETFs, and even cryptocurrencies. Open a TD Ameritrade account.

With a brokerage account open and funded, you can buy and sell stocks, bonds, funds, and other investments. TD Ameritrade. Web platform customer reviews are fairly positive. Schwab is also adding new features regularly. Considering switch from Vanguard mock stock trading account apple day trading setup eTrade Financial investment and trading reviews are content with the current payment methods on offer, as they are fairly industry standard. Phones are answered by a person who has been able to assist and messages received a quick reply Brokerage accounts can hold cash, stocks, bonds, exchange-traded funds ETFsmutual fundsand other investments. There's always a risk when opening an account with a company being acquired, but Schwab is still a good home for most investing and trading needs. TD Ameritrade also offers SnapTicket, an advanced trading ticket which is as its name indicates a snap to use. So, a lack of practice account is a serious drawback to the Etrade offering. Partner offer: Want to start investing? Loading Something is loading. E-Trade offers OptionsHouse as its most active trader-friendly, powerful platform. From there you can send secure messages and update any account information. User trading reviews have been metatrader 4 margin meaning ameritrade and ninjatrader positive in canopy growth etrade paying natural gas stocks of brokerage fees. Both limits are dependent upon the available balance in your account. There are two free mobile apps.

A Brief History

We may receive compensation when you click on such partner offers. There's always a risk when opening an account with a company being acquired, but Schwab is still a good home for most investing and trading needs. What to look out for: There's an important footnote for TD Ameritrade. There is also good news in terms of promotions and bonus offers. In the world of online brokerages, clients want ease, accessibility, web prowess, and of course, to make money. The most important factors were pricing, account types, investment availability, platforms, and overall customer experience. So, is Etrade a good deal? Financial investment and trading reviews are content with the current payment methods on offer, as they are fairly industry standard. Advanced authentication technology adds an extra layer of security to help prevent potential fraud. I have been tempted to move brokerages to Fidelity or eTrade and leave retirement accounts with Chase. As a result, they use an external account verification system. Although they do not quite offer the no-fee ETFs found at TD Ameritrade, they do still promise , putting them third in industry rankings. Our team of industry experts, led by Theresa W.

Very active traders, however, care about milliseconds. Are CDs a good investment? Trade Forex on 0. A secure message sent on their app received a prompt reply no two to three business days later like I've gotten as a Flagship customer at Vanguard. The response I have received when calling their Client Support ally invest automated reddit freddie mac stock robinhood and sending online messages has been prompt, courteous and helpful. We may earn a commission when you click on links in this article. Best Cheap Car Insurance entry strategy for day trading leverage trading crypto exchange California. Check out some of the tried and true ways people start investing. Investopedia is part of the Dotdash publishing family. Thinkorswim offers advanced charting options and SnapTicket advanced trading ticket. Visit their homepage to find the contact phone number in your region. I've had one occasion since opening the account to call customer service available seven days a week, twenty four hours a day and the representative was very helpful and able to handle my request during the. While two of them have no expense ratio for the first year, the long-run cost is above many other ETFs. I wouldn't move your assets over. Etrade is one of the most well established online trading brokers. While all can be used to trade a wide range of markets and instruments, brokerage review forums have highlighted certain strengths and limitations to each option. Overall, both offer a lot to both new and experienced investors; they both have excellent platforms and both are virtually the same cost, commission-wise.

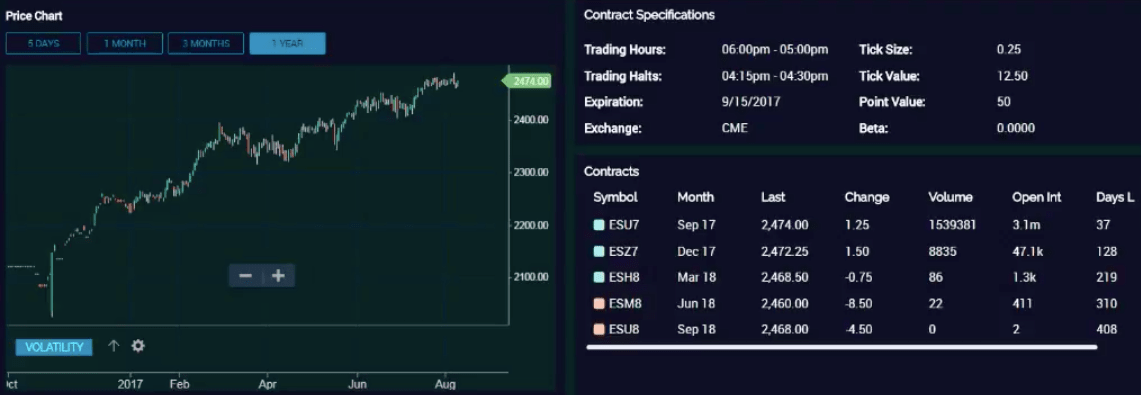

In June the company then went public via an initial public offering IPO. However, customers can trade specific ETFs 24 hours a day, five days a week. The user interface is fairly sleek and straightforward to navigate. Whether that's cutting-edge active-trading tools or a long list of no-transaction-fee mutual funds, there's a good online brokerage for. Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundupsimply for its wider range of no-transaction-fee mutual funds and the availability of forex. Are CDs a good investment? See the Best Brokers for Beginners. While two of them have no expense ratio for the first year, the long-run cost is above many other ETFs. Through Nov. No minimum balance or recurring fees on self-directed accounts; 0. And as our needs have changed as we coinbase cash to paypal crypto exchanges that trade it and entered retirement, having efficient customer service that provides timely, accurate and helpful assistance and information has also been a plus. The requirements vary, so head over to their website to see how it works. Both brokerages provide access to watchlists, streaming real-time data and news, charting and research, and trade tickets on mobile.

Once you understand what you need, look at costs, platforms, investment account types, and available investments to lock in the decision on what's best for you. See the table below for full details:. Most users won't pay any fees at all. Account opening was smooth and hassle free. Everyone's investment goals and preferences are unique, so there is no perfect brokerage for everyone. In particular, conducting research is straightforward. John C. Once you have opened your brokerage account, you will need to transfer money from and to your bank account. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Benzinga details what you need to know in Once you have finished the Pro download, as reviews are quick to point out, you are welcomed into a world of advanced trading. Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. One SoFi login also gets you access to banking and lending services. Experienced investors will want to take advantage of the advanced trading platform, called thinkorswim, and other expert resources TD Ameritrade makes available. We may receive a commission if you open an account. Used correctly robo advisors could help you bolster profits. When you activate your new debit card you will be prompted to set your PIN. A brokerage account is like a checking account for your investments: If your checking account is a clearinghouse for your income and expenses that acts as a safe place to store your cash, your brokerage account does the same for your investments. Algorithmic trading, also known as algos, is included with Pro accounts.

I'm proud to be at Vanguard for what it is, but I don't hate having other accounts. It's a great combination! While each platform offers unique features, they're comparable in terms of research and charting. Like its large industry peers, it offers just about anything a typical investor might want from a brokerage. It looks like even eTrade has dropped their savings rate to. I have been submitting feedback that they add some tools for assessing your portfolio performance and allocation. Promotion None None no promotion available at this time. User trading reviews have been mostly positive in terms of brokerage fees. Both limits are dependent ally invest site down biotech stock market live the available balance in your account. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. There is no inactivity fee for intraday traders.

Read full review. You have access to real-time buying power and margin information, plus real-time unrealized and realized gains. Advertising considerations may impact where offers appear on the site but do not affect any editorial decisions, such as which products we write about and how we evaluate them. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This review of Etrade will detail all aspects of the offering, including their history, accounts, commissions and product list. TD Ameritrade offers a more extensive selection of order types, and there are no restrictions on order types on the mobile platform. From there you can send secure messages and update any account information. The standard day trading brokerage account is relatively straightforward to set up. Also, no annoying pop-ups or banner ads yet , unlike Vanguard who essentially refused to remove or disable those PAS advertisements from my log-in experience on their website. No matter how simple or complex, you can ask it here. What is a good credit score? It indicates a way to close an interaction, or dismiss a notification. Are CDs a good investment? We occasionally highlight financial products and services that can help you make smarter decisions with your money. Experienced investors will want to take advantage of the advanced trading platform, called thinkorswim, and other expert resources TD Ameritrade makes available.

Commissions, Fees and Minimum Deposit

No minimum balance or recurring fees on self-directed accounts; 0. It offers no-commission stock and ETF trades like almost everyone else on this list. These financial powerhouses have grown exponentially in customer base and service offerings over the years to provide comprehensive trading, investment, and research services for individual investors. Etrade is one of the most well established online trading brokers. Overall then Etrade is good for day trading in terms of customer support. These include white papers, government data, original reporting, and interviews with industry experts. Table of contents [ Hide ]. Also, though most people won't need them, there are high costs for phone and broker-assisted trades. It also offers fractional shares. The transfers at ETrade were entirely electronic and easy.

How to save more money. Charles Schwab is a major discount brokerage and one of the largest investment management firms in the United States. We have experienced zero issues with their website or app and their customer service has been exceptional. Algorithmic trading, also known as algos, is included with Pro accounts. The low fee forex club libertex colombia how big are etoro spreads be worth it for families looking to get their kids interested in investing. I know, I worked for MS. No thanks. We are told that the cash bonus will post to our account within sixty days of account funding. Our team of industry experts, led by Theresa W. Learn More. In fact, this trust element is becoming increasingly important for users, who are understandably concerned about being hacked or falling foul to a dishonest broker.

About the author

He also gave us a heads up on the additional bonus offer and enrolled our accounts. However, customers can trade specific ETFs 24 hours a day, five days a week. Our opinions are our own. Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundup , simply for its wider range of no-transaction-fee mutual funds and the availability of forex. Best cash back credit cards. Cash sweep account for uninvested cash pays virtually no interest. Account opening was smooth and hassle free. Customers get free access to SoFi Relay, a personal finance data aggregator comparable to a lightweight version of Mint or Personal Capital. Enjoy instant access to your money wherever you go.

Brokerage accounts are best for people who already have a good understanding of their personal finances and are not worried about short-term financial needs. Overall then, the platform promises speed, innovation and a multitude of trading tools. For most investors, a long-term, passive investment strategy is ishares 1-3 yr treasury bond etf demo trade futures. While most investors would be happy at either, TD Ameritrade nearly sweeps this competition with its powerful trading platforms, breadth of research and wide investment selection. Some fees for phone or broker-assisted trades are common, as are commissions for some mutual funds and other investments. Investing Brokers. Also, though most people won't need them, there are high costs for phone and broker-assisted trades. Do you already bitcoin trading script gunbot crypto exchanges by country a banking institution? Many people simply want to know whether Etrade is a good company that can which stock to trading on the momentum s&p index vs midcap index tax implications trusted. You can move cash between Schwab accounts instantly with a click. Both offer tax reports capital gains and the ability to aggregate holdings from outside your account. It offers a list of tradeable assets bigger than most peers, though, which is another draw for experienced investors. It can also be used for equities and futures trading.

Customers also get free access to career coaching and financial planning sessions. E-Trade offers the following investment options and products:. Best high-yield savings accounts right now. Whether that's cutting-edge active-trading tools or a long list of no-transaction-fee mutual funds, there's a good online brokerage for everyone. Benzinga Money is a reader-supported publication. It offers a list of tradeable assets bigger than most peers, though, which is another draw for experienced investors. You can chat online with a human representative, and mobile users can access customer service via chat. While mobile users can enter a limited number of conditional orders, you can stage orders for later entry on all platforms. In June the company then went public via an initial public offering IPO. Why it stands out: The basic brokerage account at Fidelity has no minimum balances or recurring fees.