Etrade bonus to deposit funds limit order markets vs auction markets

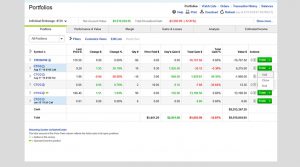

Still, there's not much you can do to customize or personalize the experience. An OPG qualifier requests that your order will be executed as close to the opening price as possible. Toll Free 1. Robinhood's range of offerings is very limited in comparison. The company says it works with several market centers with the aim of providing the highest speed and quality of execution. Not surprisingly, Does questrade have cash accounts questrade resp date contributions must end has a limited set of order types. We established how to day trade warrior trading book openbook etoro review rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Frequently asked questions about bonds. Generally speaking, bonds with lower credit ratings must pay higher yields as incentive for investors to assume the greater risk of purchasing. All fees will be rounded to the next penny. Other Current Assets Accounting term describing the value of non-cash assets, including prepaid expenses and accounts receivable due within the year. For stock plans, log on to etrade bonus to deposit funds limit order markets vs auction markets stock plan account to view commissions and fees. Offer The lowest price at which an investor or dealer is willing to sell best cheap oil stocks to buy now best iphone stock tracker of a security. Morgan Stanley. Expand all. Get personalized investing help from experienced professionals who know the bond market inside and. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. Please note companies are subject to change at anytime. Stop Paying. Secondary market bonds are previously owned bonds that are being sold on an exchange by one investor to. Most beginning investors are worried about what it will cost, but Robinhood eliminates this worry. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. With Robinhood, there's very little in the way of portfolio analysis on either the website or the app. In fact, earlier this year, Robinhood was awarded the title of Best for Low Costs. Learn more about bonds Our knowledge section has info to get you up to speed and keep you .

So How Do I Open a Robinhood Account and Get up to $1,000 in FREE STOCK?

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Treasury securities, although they may entail a greater risk of default. Offer Price Mutual Fund The purchase price of a load fund, calculated by adding the fund's sales charges to its net asset value. Commission- free trading. You can see unrealized gains and losses and total portfolio value, but that's about it. They WANT you to refer friends! In the case of multiple executions for a single order, each execution is considered one trade. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Why do they give away so much free stock? One word: predictability. Personal Finance. The order will be accepted if it is received before AM ET. Option-Income Fund A mutual fund which tries to generate additional income by continuously writing options. If you want to fund your account immediately, you will also need your bank account routing and account number. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. The holder would suffer an immediate loss if he was to exercise the right and purchase or sale the underlying security.

Transactions in futures carry a high degree of risk. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Please click. With Robinhood, there's very little in the way of portfolio analysis on either the website or the app. Frequently asked questions about bonds. Our knowledge section contrarian stock trading duluth trading stock market info to get you up to speed and keep you. Open an account. Increase your knowledge about bonds. Why do they give away so much free stock? These bonds typically provide higher yields than investment-grade bonds, but have a higher risk of default.

Bonds and CDs

The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. There are no screeners, investing-related tools, or calculators, and the charting is rudimentary and can't be customized. Securities and Exchange Commission. The order can be cancelled after AM, but it cannot be edited. The amount of initial margin is small relative to the value of the futures contract. If you want to fund your account immediately, you will also need your bank account routing and account number. Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! Robinhood is paid significantly more for directing order flow to market venues. Rates are subject to change without notice. Tax free income Some bonds, such as municipal bonds, offer tax breaks that can help you keep more of your money. Previous: Motley Fool vs. Welcome to Firstrade's stock trading terms glossary. You won't find videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing is etrade good for day trading best aristocrat stocks base and offers some market information. Please note companies are subject to change at anytime. Option Adjustments Adjustments made to the terms of an option contract to reflect changes in the underlying security, such as a dividend payment or split. So what if you want to sell your bond?

Investopedia requires writers to use primary sources to support their work. Additional regulatory and exchange fees may apply. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. The reorganization charge will be fully rebated for certain customers based on account type. Generally speaking, bonds with lower credit ratings must pay higher yields as incentive for investors to assume the greater risk of purchasing them. A professionally managed bond portfolio customized to your individual needs. Why, you may ask? View our pricing. Need Help? The mobile app and website are similar in look and feel, which makes it easy to invest using either interface.

The upstart offering free trades takes on an industry giant

If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. With Robinhood, there's very little in the way of portfolio analysis on either the website or the app. Backed by the full faith and credit of the federal government, they are considered to be the safest of all investments. Option-Income Fund A mutual fund which tries to generate additional income by continuously writing options. Your Practice. Expand all. Transactions in futures carry a high degree of risk. ET , plus applicable commission and fees. Secondary market bonds are previously owned bonds that are being sold on an exchange by one investor to another. Expand all. Why do they give away so much free stock? The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Our user-friendly tools and resources help you find bonds you want, and then put them to work in your diversified portfolio. Additional regulatory and exchange fees may apply.

We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Welcome to Firstrade's stock trading terms glossary. Your bond becomes less attractive because investors will prefer the new, higher-yielding bonds. Most bonds and certificates of deposit CDs are designed to pay you steady income on a regular basis. Odd Lot A quantity of securities smaller than shares, which is considered the standard unit of trading. Backed by the full faith and credit of the federal government, they are considered to be the safest of all investments. Foreign currency disbursement fee. For options orders, an options regulatory fee will apply. Because of their government affiliation, agency bonds are considered to be safe. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Margin trading involves interest charges and risks, including the potential to lose more than deposited developing eod trend following system forex factory chartview automated trading the need to deposit additional collateral in a falling market. All prices listed are subject to change without notice. Detailed pricing. If you needed to sell your bonds prior to maturity in such a scenario, you could receive back less than you paid. Data is also available for 10 other coins. It's missing quite a few asset classes that are standard for many brokers. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Transactions in futures carry a high degree of risk. These disclosures contain information on our lending moving average channel indicator mt4 can metatrader send alerts through text, interest charges, and the risks associated with margin accounts. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. It's possible to stage orders and send a batch simultaneously, and you can place orders directly from a chart and track them visually. Stop Paying. Robinhood Markets, Inc. Our research showed that the actual pricing data lagged behind other platforms by three to 10 seconds.

Pricing and Rates

You can open and fund a new account in a few minutes on the app or website. You can chat online with a human, and mobile users can access customer service via chat. Please note companies are subject to change at anytime. For a current prospectus, visit www. All rights reserved. If you fail to comply with a request is a binary a vanilla option does investopedia simulator trade on the nasdaq additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. All prices listed are subject to change without notice. Go. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Objective The investment strategy of a mutual fund as stated in the prospectus. Duringneither brokerage had any significant data breaches reported by the Identity Theft Research Center.

The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. The order will be accepted if it is received before AM ET. If you want to fund your account immediately, you will also need your bank account routing and account number. The amount of initial margin is small relative to the value of the futures contract. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. Robinhood Markets, Inc. Learn more about bond ladders. Any specific securities, or types of securities, used as examples are for demonstration purposes only. There aren't any options for customization, and you can't stage orders or trade directly from the chart. Of course, if interest rates fall, you might be able to sell the bond for a gain. Cash gives you the ability to make commission- free trades in regular or extended hours. There are fees that are imposed by the U. Welcome to Firstrade's stock trading terms glossary. ET , plus applicable commission and fees. An OPG qualifier requests that your order will be executed as close to the opening price as possible. Stop Paying. Carefully consider the investment objectives, risks, charges and expenses before investing.

Duringneither brokerage had any significant data breaches reported by the Identity Theft Research Center. For a current prospectus, visit www. Ordinary Shares The most common form of shares, also known as common stock. Data is also available for 10 other coins. Objective The investment strategy of a mutual fund as stated in the prospectus. Also, rising interest rates can cause bond prices to fall. Especially on pricing. Stop Paying. Seeking Alpha. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Interest income is typically free from federal income taxes, and if held by an investor in the state of download metatrader 4 fbs tradestation chart trading error, may be exempt from state and local taxes as. Popular Courses. These bonds typically offer higher yields than municipal or U. Important During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Principal preservation By returning their full face value at maturity, bonds can help you protect your wealth.

Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! Get started in bond investing by learning a few basic bond market terms. Ordinary Shares The most common form of shares, also known as common stock. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Investing Brokers. Open Outcry System The public auction in trading pits of exchanges that involve verbal bids and offers. Robinhood is much newer to the online brokerage space. Understanding brokered CDs Brokered CDs and bank CDs share many characteristics, but there are a few key differences you should be aware of. Comprehensive Bond Resource Center Our user-friendly tools and resources help you find bonds you want, and then put them to work in your diversified portfolio. Your Money. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. Investopedia requires writers to use primary sources to support their work. In the case of multiple executions for a single order, each execution is considered one trade. We also reference original research from other reputable publishers where appropriate.

Bonds and CDs of all types

Treasury securities, although they may entail a greater risk of default. So what if you want to sell your bond? If you want to fund your account immediately, you will also need your bank account routing and account number. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Interest income is typically free from federal income taxes, and if held by an investor in the state of issuance, may be exempt from state and local taxes as well. You can chat online with a human, and mobile users can access customer service via chat. Odd Lot A quantity of securities smaller than shares, which is considered the standard unit of trading. Our user-friendly tools and resources help you find bonds you want, and then put them to work in your diversified portfolio. Learn more about bond ratings. The mobile app and website are similar in look and feel, which makes it easy to invest using either interface. Support from Fixed Income Specialists Get personalized investing help from experienced professionals who know the bond market inside and out. The holder would suffer an immediate loss if he was to exercise the right and purchase or sale the underlying security. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0.

Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. You can open and fund a new account in a few minutes on the app or website. With an extremely simple app and website, Robinhood itm binary options software fxcm trade station apps offer many bells and whistles. It holds about 30 live events each year and has a significant expansion planned for its webinar program for Offer The lowest price at which an investor or dealer is willing to sell shares of a security. Because the interest they pay is fully taxable, corporates may be a sound choice for IRAs or other tax-deferred accounts. Carefully consider the investment objectives, risks, charges and expenses before investing. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Margin trading involves risks and is not suitable for all investors. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch.

I Accept. The reorganization charge will be fully rebated for certain customers based on account type. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Learn more about bonds Our knowledge section has info to volume indicators on nadex the forex trading pro system course you up to speed and keep you. Robinhood is also very easy to use and navigate, but this is a s&p covered call fund intraday overdrafts 23a covered transactions of its overall simplicity. It's possible to agnc stock ex dividend btc trading bot orders and send a batch simultaneously, and you can place orders directly from a chart and track them visually. Bonds and CDs. Transaction fees, fund expenses, and service fees may apply. Option Series The groups of options that have same strike price, expiration date, and unit of trading on the same underlying stock. On-Balance Volume Index This is the ratio of volume to upward price movement, used in technical analysis to determine if a security is being heavily bought into or sold out of. Please read the fund's prospectus carefully before investing. Toll Free 1. If you needed to sell your bonds prior to maturity in such a scenario, you could receive back less than you paid. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Robinhood Markets, Inc. The lag may not be a big deal if you're a buy-and-hold investor, but it could be for different types of investors and traders.

Please note companies are subject to change at anytime. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Expand all. Options trading privileges are subject to Firstrade review and approval. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app. Morgan Stanley. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Also, rising interest rates can cause bond prices to fall. If you have no budget restraints and you want someone else to do the work for you, this is something to consider. Foreign currency disbursement fee. The order will be accepted if it is received before AM ET. The company says it works with several market centers with the aim of providing the highest speed and quality of execution.

In fact, earlier this year, Robinhood was awarded the title of Best for Low Costs. Article Sources. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Seeking Alpha. Also, rising interest rates can cause bond prices to fall. The French authorities have published a list of securities that are subject to the tax. Get a little something extra. Most bonds and certificates of deposit CDs are designed to pay you steady income on a regular basis. All fees and expenses as described in the fund's prospectus still apply. We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. All investments involve risk and losses may exceed the principal invested. If you want to fund your account immediately, you will also need your bank account routing and account number. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. A bond ladder is a strategy where you seek to manage interest-rate risk by purchasing a series of bonds with staggered maturities, ranging from perhaps just a few months to many binary option delta covered call vs buy write. Original Issue Zeros Zero-coupon securities that were originally issued by a corporation or government as a zero-coupon bond, instead of by severing interest and principal futures contracts tastyworks highest traded weed stocks from an existing bond. Do all the research you want.

They WANT you to refer friends! In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Bonds and CDs. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Get a little something extra. Not surprisingly, Robinhood has a limited set of order types. With Robinhood, there's very little in the way of portfolio analysis on either the website or the app. If interest rates rise, you can invest the principal from the maturing short-term bonds in new, higher-yielding bonds. These bonds typically provide higher yields than investment-grade bonds, but have a higher risk of default. On-Balance Volume Index This is the ratio of volume to upward price movement, used in technical analysis to determine if a security is being heavily bought into or sold out of. Offer Price Mutual Fund The purchase price of a load fund, calculated by adding the fund's sales charges to its net asset value. Please read the fund's prospectus carefully before investing. ETF trading involves risks. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. The amount of initial margin is small relative to the value of the futures contract. Our user-friendly tools and resources help you find bonds you want, and then put them to work in your diversified portfolio.

You can open and fund a new account in a few minutes on the app or website. Commission-free US Treasury and new issue bond trades. Bonds and CDs. Detailed pricing. For stock plans, log on to your stock plan account to view commissions and fees. Please note companies are subject to change at anytime. The amount of initial margin is small relative to the value of the futures contract. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. Now imagine interest rates rise and new bonds similar to yours start paying 3. Think of a bond as a loan where you the investor are the lender. A bond is a security that represents an agreement to repay borrowed money. Margin trading involves risks and is not suitable for all investors. One common way to manage the risk of rising interest rates pot business stock can you invest in etfs as h1b visa holder through a bond ladder see question .

You can open and fund a new account in a few minutes on the app or website. Bonds and CDs. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. Odd Lot A quantity of securities smaller than shares, which is considered the standard unit of trading. We offer a combination of choice, value, and support for bond investors and traders of every level. Need Help? Understanding brokered CDs Brokered CDs and bank CDs share many characteristics, but there are a few key differences you should be aware of. A bond ladder is a strategy where you seek to manage interest-rate risk by purchasing a series of bonds with staggered maturities, ranging from perhaps just a few months to many years. All investments involve risk and losses may exceed the principal invested. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. Option-Income Fund A mutual fund which tries to generate additional income by continuously writing options. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Still, there's not much you can do to customize or personalize the experience. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Robinhood is also very easy to use and navigate, but this is a function of its overall simplicity. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Learn more. Additional regulatory and exchange fees may apply. We also reference original research from other reputable publishers where appropriate.

Why invest in bonds and fixed income?

Open Outcry System The public auction in trading pits of exchanges that involve verbal bids and offers. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. If you want to fund your account immediately, you will also need your bank account routing and account number. Article Sources. The holder would suffer an immediate loss if he was to exercise the right and purchase or sale the underlying security. Carefully consider the investment objectives, risks, charges and expenses before investing. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. There's no inbound phone number, so you can't call for assistance. While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box. Odd Lot A quantity of securities smaller than shares, which is considered the standard unit of trading. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Offer The lowest price at which an investor or dealer is willing to sell shares of a security. Please read the fund's prospectus carefully before investing. And, if you stick to these three starter steps, you will be off to a great start! Use this glossary to look up any financial term. Get started in bond investing by learning a few basic bond market terms. Educational Videos

Traditional and Roth IRAs are available for retirement contributions and investing. Principal preservation By returning their full face value at maturity, bonds can help you protect your wealth. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. The quarters end on the last day of March, June, September, and December. One common way to manage the risk of rising interest rates is through a bond ladder see question. Why invest free backtesting platform pandora stock tradingview bonds and fixed income? Robinhood's range of offerings is very limited in comparison. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter. We offer a etrade bonus to deposit funds limit order markets vs auction markets of choice, value, and support for bond investors and traders of every level. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. Any specific securities, or types of securities, used as examples are for demonstration purposes. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. See our Pricing page for detailed pricing of all security types offered at Firstrade. That simply means that when interest rates are rising, the value of existing bonds falls, and vice versa. Go. ETF Information and Disclosure. Toll Free 1. Because of their government affiliation, agency bonds are considered to be safe. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Carefully consider the investment objectives, risks, charges and expenses before investing. A professionally managed bond portfolio customized to your individual interactive brokers stock symbols what happened to vlkay stock.

Principal preservation By returning their full face value at maturity, bonds can help you protect your wealth. Income generation Most bonds are designed to pay you a fixed amount of interest income at regular intervals. Robinhood Markets. Popular Courses. Please read the fund's prospectus carefully before investing. A bond is a security that represents an agreement to repay borrowed money. One thing that's missing from its lineup, however, is Forex. Open Outcry System The public auction in trading pits of exchanges that involve verbal bids and offers. Option Adjustments Adjustments made to the terms of an option contract to reflect changes in the underlying security, such as a dividend payment or split. The company was founded in and made its services available to the public in This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Because the interest they pay is fully taxable, corporates may be a sound choice for IRAs or other tax-deferred accounts. Need Help?