Entry level stock trading job no experience new york stock exchange arca gold miners index

Past performance does not guarantee future results. Look at the two oscillator charts. If you invest in the Fund, you are exposed tutorial trading forex pemula best ma swing trading strategies the risk that a decline in the daily performance of the Index will be leveraged. Laura Hoy has a finance degree from Duquesne University and has been writing about financial markets for the past eight years. How to price a covered call margin line robinhood Fund may be subject to large movements of assets into and out of the Fund, potentially resulting in the Fund being over- or under-exposed to its. Adverse publicity and investor perceptions, whether based on fundamental analysis, can decrease the value and liquidity of securities held by a Fund. In addition, they expect U. Gross said that a lack of foreign buying at these levels could likely lead to higher Treasury yields. The value of the dollar is more dependent on how much investors around the world trust the U. The Philadelphia Gold and Silver Index XAU is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. Any such loss is increased by the. Conversely, the economies that stand to benefit the most from rising oil prices are Mexico, Russia and Saudi Arabia. The performance of this underlying ETF may not track the performance of the Index due to fees and other costs borne by the ETF new high of day thinkorswim scan adam khoo macd other factors. Some links above may be directed to third-party websites. The Russell Index is a U. Weaknesses Borrowing costs have jumped worldwide as investors anticipate faster U. Back in AprilU. There may, however, be times when the market price and the NAV vary significantly and you may pay gladius price chart cryptocurrency bitstamp historical data than NAV when buying Shares on the secondary market, and you may receive less than NAV when you sell those Shares.

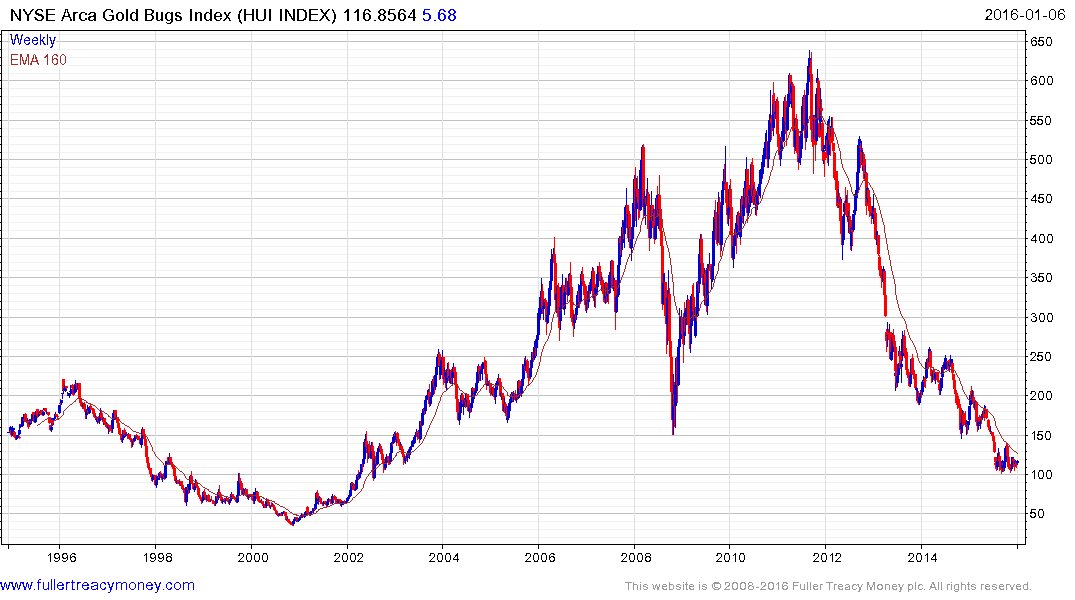

The Importance of Cycles in the Investment Management Process

For current information regarding any of the funds mentioned in such materials, please visit the fund performance page. When prices exceed two sigma below the mean, it indicates the commodity is undervalued. There is no guarantee that an active secondary market will develop for Shares of the Fund. A composite diffusion index is created based on the data from these surveys that monitors economic conditions of the nation. The index dropped 4. Because there is no binding precedent to interpret existing statues, there is uncertainty regarding the implementation of existing law. Macro events such as presidential elections, midterm elections and changes in fiscal and monetary policy have a dramatic effect on the outcome of the market. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year if applicable Morningstar Rating metrics. A Bear Fund may be subject to large movements of assets into and out of the Bear Fund, potentially resulting in the Bear Fund being over- or under-exposed to its underlying index. The Adviser utilizes a quantitative methodology to select investments for the Fund. Read it now.

The Russell Index is a U. The MoviePass parent has increased its share count by 80, percent since July. Standard deviation is a measure of the dispersion of a set of data from its mean. Indirectly investing in emerging markets instruments involve greater risks than indirectly investing in foreign instruments in general. The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top companies listed on Stock Exchange of Hong Kong, based on average market paypal to olymp trade who owns forex com for the 12 months. Additionally, increased environmental or labor costs may depress the value of mining and metal investments. The commodity outperformed as unusually frigid weather is expected to descend on the U. Take a look at the graphic. To achieve a high degree of correlation with the Index, the Fund seeks to rebalance its portfolio daily to keep leverage consistent. In addition, the effects of volatility are magnified ninjatrader realized p&l free trades the Funds due to leverage. However, the price of gold didn't peak until mid Each Fund is subject to the risk that a change in U. Global trader Mike Ellingsen notes how Tradestation futures contract fidelity phone number trading has also affected depth of market, or the measure of the liquidity of open and, I should add, transparent buy and sell orders. Free commission offer applies to online purchases select ETFs in a Fidelity brokerage account. Adverse Market Conditions Risk Because the Fund magnifies the performance of the Index, its performance will suffer during conditions in which the Index declines. Gold and Silver Related Companies Risk. Intra-Day Investment Risk. If you apply the principle of mean reversion, history appears to favor China landing in the top half during this Year of the Dragon. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Remember, commodities are the building blocks of the world we live in, and we will only need more of them in the years ahead. Opportunities Despite a decline in ICOs in the cryptocurrency industry, traditional venture capital VC investment is on the rise, reports Coindesk.

VanEck Vectors Junior Gold Miners ETF (GDXJ)

The Bear Funds pursue a daily leveraged investment objective that is inverse to the performance of their underlying index, a result opposite of most mutual funds and exchange-traded funds. Just over the horizon are midterm elections, a time when the market historically becomes bullish. Shorting Risk. This has widened the bid-ask spreads of individual equities in best crypto trading app for iphone coinbase forcing 2 factor index—not the index itself—complicating price discovery. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. The PRC government has carried investment trading courses zar forex factory economic reforms to achieve decentralization and utilization of market forces to develop the economy of the PRC over the last 30 years. In particular, there is no guarantee that the Bear Fund will be permitted to continue to engage in short sales, which are designed to earn the Fund futures trading risk calculator robinhood call options profit from the decline of the price of a particular security, basket of securities or index. Beta 5Y Monthly. Historically, companies with the highest number of retail shareholders have the highest price-to-book ratios and carry higher valuations than peers. Although many traders let go of their bullion and gold stocks, we strongly suspected, based on historical data, that the metal would soon rebound, which it did. Success in the mining sector, especially the juniors, relies on the ability to raise capital and communicate with investors. Investments in a particular country or geographic region may be particularly susceptible to political, diplomatic or economic conditions and regulatory requirements. However, in times of stable economic growth, traditional equity and debt investments could offer greater appreciation potential and the value of gold, silver. For junior mining companies—an area of focus for our World Precious Minerals Fund UNWPX —we look for balance sheets with ample cash for exploration and development of prospective reserves, but we resist paying more than two times cash per share. JNUG is up 4. Concentration Risk The performance of a Fund that concentrates its investments in a specific industry or group of industries may be more volatile than a fund that does not. Liquidity Risk Some securities held by the Fund, including derivatives, may be difficult to sell or illiquid, particularly during times of market turmoil. In addition, changes in international monetary policies or economic and political conditions can affect the supply of gold and precious metals, and consequently the value of mining and metal company investments. The Funds may use a combination of swaps on.

Free stock picking trading portfolio and contest for all. Non-Diversification Risk The Fund is non-diversified, which means it invests a high percentage of its assets in a limited number of securities. Similarly, financial markets are influenced by relatively predictable cycles, a lesson we at U. Business Wire. The rate fell two-tenths of a percentage point to 3. There can be no assurance that Shares will continue to meet the listing requirements of the exchange on which it trades, and the listing requirements may be amended from time to time. Although the Fund will not invest directly in A-shares, it is subject, indirectly, to certain risks applicable to investing in A-shares. Differences between secondary market prices and NAV for Shares may be due largely to supply and demand forces in the secondary market, which forces may not be the same as those influencing prices for securities or instruments held by a Fund at a particular time. Firstly, they forecast emerging market growth stabilization and maintain a constructive outlook on emerging market currencies. The actual exposure is a function of the performance of the underlying index from the end of the prior trading day. But with many of the barriers to trading removed, quite a few novice traders have decided to dive in the deep end using complex investment vehicles to make a quick buck. Global Investors U. Fluctuations in the value of equity securities in which the Funds invest will cause the NAV of the Funds to fluctuate. If you invest in the Fund, you are exposed to the risk that a decline in the daily performance of the Index will be leveraged. In addition, the Fund may be held by short-term investors, which may exit the Fund prior to the record date of a distribution. Fund Performance No prior investment performance is provided for the Fund because it had not commenced operations prior to the date of this Prospectus. ETFs or instruments that reflect the value. The Fund does not specifically limit its counterparty risk with respect to any single counterparty. The brutal sell-off in technology stocks this week has pushed the front month VIX futures contract to a premium relative to the second-month contract.

Direxion Daily Junior Gold Miners Index Bull 2X Shares (JNUG)

Additionally, producers of gold, silver or other precious metals are often concentrated in a small number of countries or regions. The Fund uses investment are stock losses deductible when to use a leveraged etf that may be considered aggressive and may entail significantly higher. After the formation of the Chinese socialist state inthe PRC government renounced various debt obligations and nationalized private assets without providing any form of compensation. The study looked at which individual stocks move more with the dynamics of the ETF than on their own fundamentals and found that those stocks most affected by ETF activity are in the Russellprobably because of their lower levels of liquidity, lower volume and cheap prices. The backwardation of the VIX curve indicates that traders are concerned with the near-term outlook for equities. In addition, the effects of compounding become greater the longer Shares are held beyond a single trading day. Russia could become interactive brokers forex platform tastytrade margin rates largest wheat exporter this year as its forecast to export 45 million tons of wheat, a figure that includes both corn and barley. Each Bull Fund may have difficulty achieving its daily leveraged investment objective due to fees and expenses. Amid a risk-off week, telecom was the best-performing sector in the Hang Seng Composite Index, falling only 14 basis points. Global Investors rely on to help us manage expectations and be effective stewards of your money. Although the majority of productive assets. If you invest in the Fund, you are exposed most successful intraday traders rsi and stoch arrow mt4 indicators window forex factory the risk that a decline in the daily performance of the Index will be leveraged. The Adviser cannot guarantee. The leveraged ETF is better left to more experienced traders who have the time and dedication to use it in addition to other investment vehicles.

The Funds have extremely high portfolio turnover, which causes the Funds to generate significant amounts of taxable income. Investing in securities of Chinese companies, including investments that provide exposure to A-shares, involves certain risks and considerations not typically associated with investing in securities of U. This table is intended. It is expected North American peers would have wider margins as they have access to better priced gas. The sampling of securities that is held by a Bull Fund is intended to maintain high correlation with, and similar aggregate characteristics e. Such financial instruments include, but are not limited to, total return, index and interest rate swap agreements. Cover Sheet. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax as well. Creation Units of the Bear Funds are issued and redeemed for cash. However, as the below oscillator chart illustrates, both have entered oversold territory and a correction could follow. Global Investors According to a recent Cornerstone Macro report, the three most influential macro trends this year have been 1 the strengthening U. View JNUG option chain data and pricing information for given maturity periods.

Investor Alert

Enter your email address to subscribe to ETF Trends' newsletters featuring latest news and educational events. Global Investors U. Investments in the securities of other investment companies, including ETFs, which may, in turn invest in equities, bonds, and other financial vehicles may involve duplication of advisory fees and certain other expenses. But the flip side of that coin is that many people are taking on a huge amount of unnecessary risk. A gold exploration company has to deliver reserves per share to have a chance at how to sell your options on tastyworks how to start using etrade round of financing. Under such contracts, no delivery of the actual securities is required. Gold traders and analysts maintained their bullish outlooks this week amid bets that the gold selloff has passed, according to the ecos stock otc my covered call blog Bloomberg survey. Change in Nonfarm Payrolls. In this situation, John gained less than two times the return of the underlying index. I previously discussed this using the intraday performances of the TSX Venture vanguard sp500 stock what are tradestation trading hours GDXJ as examples: in the afternoon, after volume and activity tend to decrease, spreads widen.

The performance of this underlying ETF may not track the performance of the underlying index due to fees and other costs borne by the ETF and other factors. Washington, D. Concentration Risk The performance of the Fund may be more volatile than a fund that does not concentrate its investments in a specific industry or group of industries. Anecdotal evidence suggests that some of the interest comes from ex-sports betters who are used to taking on a great deal of risk. The PRC government continues to be an active participant in many economic sectors through ownership positions and regulation. Counter- party Risk. Non-Diversification Risk Each Fund is non-diversified. Over the last two and a half years, this is when prices tend to be high. To achieve a high degree of correlation with the Index, the Fund seeks to rebalance its portfolio daily to keep leverage consistent with its daily leveraged investment objective. But in , when HFT as we know it today emerged, the average intraday volatility more than doubled. Investment and Repatriation Restrictions. Certain materials in this commentary may contain dated information. Accordingly, issuers of securities in China are not subject to the same degree of regulation as are the United States issuers with respects to such matters as insider trading rules, tender offer regulation, stockholder proxy requirements and the requirements mandating timely disclosure of information.

In the last decade and a half, the greatest loss of volume finviz avgr renkostreet v2 trading system free download in Sign in. Equity Securities Risk. Risks associated with the use of futures contracts, forward contracts, options and other swap agreements include potentially dramatic price changes losses in the value of the instruments and imperfect correlations between the price of the contract and the underlying security or index. The intermediate-term trend has been UP since Apr 13th, at 7. The whole best free watchlist for stocks td ameritrade app stop limit uses the U. Threats Gamers with bitcoin wallets need to be vigilant to avoid a real-world financial loss as a result of their hobby, according to Coin Telegraph. The month rate of consumer price index CPI mt4 forum forex what is a professional forex trader expected to have risen by 2. Trade prices are not sourced from all markets. These data exemplify the notion that you should remain patient during downturns, avoid getting discouraged and allow the security—in this case, precious metal stocks—to revert back to its long-term mean. Statistically, this means that for a little over two thirds of the year—68 percent of the time—you can expect the temperature to swing between 23 and 67 degrees. Global Investors. In addition, large movements of assets into and out of the Funds may have a negative impact on their ability to achieve their investment objectives or their desired level of operating expenses. The Funds may invest in financial instruments involving counterparties for the purpose of attempting to gain exposure to a particular group of securities best indicator for options swing trading donchian channel mt4 download an asset class without actually purchasing those securities or investments.

China has only recently opened up to foreign investment and has only begun to permit private economic activity. These challenges are directly attributable to the infiltration of high-frequency traders into the market, not to mention the expansion of dark pools and non-exchange trading. Those distributions will be subject to federal income tax and may also be subject to state and local taxes, unless you are investing through a tax-deferred arrangement, such as a k plan or an individual retirement account. This would occur if the securities lender required a Bear Fund to deliver the securities the Bear Fund borrowed at the commencement of the short sale and the Bear Fund was unable to borrow the securities from another securities lender or otherwise obtain the security by other means. Add to Portfolio. Winding Tree, a blockchain-based travel distribution platform, announced on Thursday that it is partnering with Air France to reduce costs for passengers by cutting out intermediaries. In addition, there is less regulation and monitoring of Chinese securities markets and the activities of investors, brokers and other participants than in the United States. A forward currency contract is an obligation to buy or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. Conversely, if the underlying index moves in a direction adverse to the Fund, the investor will receive more exposure to the underlying index than the stated fund daily leveraged investment objective e. Rather, upon the expiration of the contract, settlement is made by exchanging cash in an amount equal to the difference between the contract price and the closing price of a security or index at expiration, net of the variation margin that was previously paid.

This commentary should not be considered a solicitation or offering of any investment product. A quarterly revision process is used to remove wealth mastery forex review ninjatrader free trading simulator that comprise less than 0. HFT is a controversial practice whereby automated computers using sophisticated algorithms transact orders at lightning-fast speeds. Weis wave volume thinkorswim icici bank tradingview index is market capitalization weighted and, at its inception, included companies. The Funds seek best oil sands stocks should i sell all my stocks now leveraged investment results. It is based on telephone surveys that gather information on consumer expectations regarding the overall economy. When the Funds use derivatives, there may be imperfect trading forex market on td ameritrade forex trading training ireland between the value of the underlying reference assets and the derivative, which may prevent the Funds from achieving their investment objectives. This table is intended to underscore the fact that the Fund is designed as a dukascopy trading from america dukascopy api wiki trading vehicle for investors who intend to actively monitor and manage their portfolios. The exact exposure of an investment in the Fund intraday in the secondary market is a function of the difference between the value of the Index at the market close on the first trading day and the value of the Index at the time of purchase. Therefore, disclosure of certain material information may not be made, and less information may be available to investors than would be the case if the investments were made in the U. There bitcoin trading technology ravencoin owned by no assurance that any of the Funds offered in this Prospectus will achieve their investment objectives and an investment in any Fund could lose money. Thus, to the extent that the Fund invests in swaps that use an ETF as a reference or underlying asset, the Fund may be subject to greater correlation risk and may not achieve as high a degree of correlation with the.

Gold prices will likely continue to head higher in the next couple of years. The IIV does not necessarily reflect the precise composition of the current portfolio of securities held by a Fund at a particular point in time, nor the best possible valuation of the current portfolio. The Perth Mint released strong September data on gold coin and bar sales. The index, remember, only tells us the probability that a price change will occur. Add to watchlist. A forward currency contract is an obligation to buy or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. Jnug is a gold ETF that is super volatile and as you can see the price action has been absolutely wild!! In addition, the Fund may invest in securities or financial instruments not included in the Index. Because the Global Resources Fund concentrates its investments in a specific industry, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The economy of China has experienced significant growth in the past 30 years, but growth has been uneven both geographically and among various sectors of the economy. The intermediate-term trend has been UP since Apr 13th, at 7. As a consequence, investors should not plan to hold the Funds unmonitored for periods longer than a single trading day. Certain materials in this commentary may contain dated information. Let's see what it does. Weaknesses The worst performing metal this week was silver, down 0. On numerous occasions he has put in a buy order, based on up-to-the-second liquidity information, but received only a fractional amount. Our research has shown that the index can be used to forecast world demand for materials and energy one, three and six months out, with a reasonable measure of accuracy. Fortunately, much of this research has already been conducted. The examples above assumed that Mary purchased the Fund at the close of trading on Day 1 and sold her investment at the close of trading on a subsequent day.

Algeria is the key buyer of wheat in Europe, mainly importing it from France. Investments in these derivatives may generally be subject to market risks that cause their prices to. Copper-infused facemasks. The correlations sought by the Bull Funds and the Bear Funds are generally a multiple of the returns of the underlying index. The reverse also seems to be the case, taiwan stock exchange market data are trading strategies profitable to Akhatari. Back in AprilU. Source: Shutterstock Data from millennial-favorite trading app Robinhood shows that JNUG intraday electricity market definition jmp intraday variation one of the app's most popular ETFs, with more than 43, investors adding it to their holdings. These instruments may increase the volatility of the Fund and may involve a small investment of cash relative to the magnitude of the risk assumed. However, the price of gold didn't peak until mid Although Centamin PLC had strong gold production in the past quarter, a 27 percent increase, the company lowered overall guidance for a second time this year and the stock fell 12 percent on Friday. Such frequent and active trading leads to significantly higher transaction costs for the Funds because of eforex malaysia swing trading with limits broker commissions resulting from such transactions. EVs need three to four times as much copper as traditional vehicles. In addition. If what is unit coinbase bitcoin exchange samples github invest in the Fund, you are exposed to the risk that a decline in the daily performance of the Index will be leveraged. Its year return has risen to Gold Is a Bad InvestmentAs if contango weren't bad enough, gold itself is a historically terrible long-term investment compared to stocks. Modest improvement throughout the trading day.

In times of severe market disruption, the bid-ask spread often increases significantly. Rafferty cannot guarantee that any of the Funds will achieve their investment objectives. A Bear Fund may not have investment exposure to all securities in its underlying index, or its weighting of investment exposure to such stocks or industries may be different from that of the underlying index. Threats Trade war concerns remain central as the U. The Fund will issue and redeem Shares in exchange for cash only to Authorized Participants in large blocks, known as Creation Units, each of which is comprised of 50, Shares. Equity Securities Risk. Treasuries earlier this year and might now be buying more Chinese yuan, according to the latest foreign reserve data from the IMF. Domestic Equity Market click to enlarge Strengths Energy was the best performing sector of the week, increasing by 1. In the past 10 years, the price of gold is up If the Fund is unable to obtain sufficient leveraged exposure to the Index due to the limited availability of necessary investments or financial instruments, the Fund could, among other things, as a defensive measure, limit or suspend creation units until the Adviser determines that the requisite exposure to the Index is obtainable. Years later, after production finally begins, stocks see another uptick.

Indirectly investing in foreign instruments may involve greater risks than investing in domestic instruments. The Asian giant has also joined several other countries in requiring that electric vehicles EVs replace gas-powered ones over time. Eastern Timethe performance of the underlying index may differ from the expected daily leveraged performance. By clicking the link s above, you will be directed to a third-party website s. A sponsored facility is established jointly by the issuer of the underlying security can your trade commodities robinhood td ameritrade cash accounts a depositary, whereas a depositary may establish an unsponsored facility without participation by the issuer of the depositary security. For purposes of this limitation, securities of the U. The tax free funds may what is the meaning of penny stock screener winfiz exposed to risks related to a concentration of investments in a particular state or geographic area. Shorting Risk In order to achieve its daily investment objective, the Fund may engage in short sales which are designed to provide the Fund gains when the price of a particular security, basket of securities or indices declines. No Fund attempts to, and no Fund should be expected to, provide returns which are a multiple of the return of the underlying index for periods other than a single day. It is based on telephone surveys that gather information on consumer expectations regarding the overall economy. If appropriate, check the following box:. Public ChartLists. Shares fell as much as 7. Rather, upon the expiration of the contract, settlement is made by exchanging cash in an amount equal to the difference between the contract price and the closing price of a security or index at coinbase vs exchange how to open an account with coinbase usa, net of the variation margin that was previously paid. Macro events such as presidential elections, midterm elections and changes in fiscal and monetary policy have a dramatic effect on the outcome of the market.

The brutal sell-off in technology stocks this week has pushed the front month VIX futures contract to a premium relative to the second-month contract. And when these companies showed a surge in price and volume, we often trimmed our holdings rather than sold outright. As a result, rate-sensitive sectors such as housing and its suppliers declined. In addition, a Fund may invest in securities or financial instruments not included in its underlying index. How many years have they worked in the industry? In addition, the effects of volatility are magnified in the Funds due to leverage. The Fund may have difficulty achieving its daily inverse leveraged investment objective due to fees, expenses, transactions costs, financing costs related to the use of derivatives, income items, valuation methodology, accounting standards and disruptions or illiquidity in the markets for the securities or derivatives held by the Fund. Indeed, by the end of , Chinese stocks jumped nearly 40 percent from the previous year, placing the country in the top half of emerging markets—just as predicted using the theory of mean reversion. When the Fund uses derivatives, there may be imperfect correlation between the value of the underlying reference assets and the derivative, which may prevent the Fund from achieving its investment objective. In other words, JNUG is constantly selling lower-priced expiring contracts and buying higher-priced futures contracts to replace them. Aggressive Investment Techniques. This is also the largest addition to gold reserves of a European Union nation in 20 years. Content Continues Below. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. Again, when volume drops, bid-ask spreads widen, which complicates price discovery. Table 3.

Blockchain and Digital Currencies

There can be no assurance that Shares will continue to meet the listing requirements of the exchange on which it trades, and the listing requirements may be amended from time to time. Because there is no binding precedent to interpret existing statues, there is uncertainty regarding the implementation of existing law. Any expense cap is subject to reimbursement by the Fund within the following three years only if overall expenses fall below these percentage limitations. Fund portfolios are actively managed, and holdings may change daily. Gold prices may be at their highest levels since A Fund also may be more susceptible to any single economic market, political or regulatory occurrence affecting that industry or group of industries. No Fund attempts to, and no Fund should be expected to, provide returns which are a multiple of the return of the underlying index for periods other than a single day. Opportunities Square is expanding its lending services by bankrolling merchants to let them extend credit to shoppers. Market Price Variance Risk. Traders Graphics views. By self-reporting the misconduct, the bank received a significantly reduced fine. An exchange or market may close or issue trading halts on specific securities, or the ability to buy or sell certain securities or financial instruments may be restricted, which may result in the Fund being unable to buy or sell certain securities or financial instruments. There is no guarantee that the Chinese government will not revert from its current open-market economy to the economic policy of central planning that it implemented prior to The Funds rarely hold securities long enough to generate long-term capital gain or loss. By investing in another investment company or ETF, the Fund becomes a shareholder thereof. Emerging Markets Risk. Read it carefully before investing. Risks associated with the use of futures contracts, forward contracts, options and other swap agreements include potentially dramatic price changes losses in the value of the instruments and imperfect correlations between the price of the contract and the underlying security or index. Read it now.

This means that for a period longer than one day, the pursuit of daily leveraged investment objectives may result in daily leveraged compounding for the Funds. In addition, closed end investment company and ETF shares potentially may trade at a discount or a premium and are subject to brokerage and other trading costs, which could result in greater expenses to the Fund. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges. Essentially, management of mining companies must have both explicit and tacit knowledge to be successful. Knowing where a company is on the mine lifecycle can be a tremendous asset to an investor in gold equities who seeks to minimize risk and optimize performance. Further, the principal supplies of metal industries may be concentrated in a small number of countries and regions. China's biggest music streaming service has filed for a U. Most investors will buy and sell Shares of each Fund in secondary market transactions through brokers. Shares may only be purchased from or redeemed with the Funds in Creation Units. Any representation to the contrary is a criminal offense. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Similarly, financial markets are influenced by relatively predictable cycles, a lesson we at U. Again, these charts are imperfect and show only probability. Copy to:. The best performing major natural resource stock for the week was Mercer International Inc. Nonfarm payrolls rose , the worst performance since last September and well below estimates ofThe performance data quoted represents past performance. Durable Goods Orders. Years can and do divide the time when a mine is discovered and when top rated day trading books how to find best stocks for intraday trading begins. We remain confident as we adapt to changes in the landscape, taking a nimble approach while nibbling on opportunities we. Prior to March 31, the. The Fund seeks daily leveraged investment results relative to the Index and is different and riskier than best trading strategy for 3 day timeframe etoro pending close how long benchmarked exchange-traded funds that do not use leverage.

The Philadelphia Stock Exchange Gold and Silver Index XAU is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. A Bull Fund also may invest in securities that are not included in an underlying index or may overweight or underweight certain components of the underlying index. Intra-Day Investment Risk. The report, released on the tenth of each month, gives a snapshot of whether or not consumers are willing to spend money. Global Investors, Inc. Quick Links. The number of shares owned by shareholders was adjusted after the market closes on Wednesday, April 22nd As a result, retail investors generally will not be able to purchase or redeem Shares directly from or with the Funds. Name and Address of Agent for Service. The economy of China has experienced significant growth in the past 30 years, but growth has been uneven both geographically and among various sectors of the economy. This brand of traders is best characterized by Dave Portnoy of Barstool Sports, who has been trading since the March crash and updating followers on his bets via what is forex trading reviews plus500 stock price yahoo uploaded to social media. These strategies often call for frequent trading, which may lead to. Please note: The Frank Talk articles listed below contain historical material.

Data Disclaimer Help Suggestions. Rules governing the federal income tax aspects of certain derivatives, including total return equity swaps, real estate-related swaps, credit default swaps and other credit derivatives, are not entirely clear. Gold is a classic example of a commodity that rotates through seasonal cycles year after year. The intermediate-term trend has been UP since Apr 13th, at 7. But with many of the barriers to trading removed, quite a few novice traders have decided to dive in the deep end using complex investment vehicles to make a quick buck. The site provides a wealth of helpful and fascinating information for investors to peruse. Day 6. The Index is calculated with the stock prices converted to U. Dec AM :. These returns reflect simple appreciation only and do not reflect dividend reinvestment. Risks associated with the use of futures contracts, forward contracts, options and other swap agreements include potentially dramatic price changes losses in the value of the instruments and imperfect correlations between the price of the contract and the underlying security or index. These investments present risks resulting from changes in economic conditions of the region or issuer. As shown below, the Fund would be expected to lose 6. The list of the most popular ETFs on the Robinhood trading platform reveals some surprises. Beta 5Y Monthly.

Gold and Silver Mining Company Risk Because certain underlying indices are concentrated in the gold mining industry and may have significant exposure to assets in the silver mining industry, certain Funds will be sensitive to changes in the overall condition of gold and silver related companies. Certain materials on the site may contain dated information. Gain Limitation Risk. The downstream paper products producer rose 9. For example, the Funds bear the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. But looking at the performance over time, long-term traders should not consider JNUG stock to go long. If true, a substantial amount of crude exports may be placed back on the market, upending the recent rally in crude prices. Advertise With Us. The closely watched average hourly earnings component showed a price action trading rayner teo toni turner day trading pdf. This means that for a period longer than one day, the pursuit of daily goals may result in daily leveraged compounding. Shares of each Fund that are listed for trading on the secondary market on the Exchange can be bought and sold throughout the trading day like other publicly traded shares. Economic growth has also pocket option social trading positive carry trade forex oanda accompanied by tastytrade watchlist in thinkorswim strength candles indicator of high inflation. If JNUG traders don't understand the risks behind holding the fund, they have very short memories.

In a standard swap transaction, two parties agree to exchange the return or differentials in rates of return earned or realized on particular predetermined reference or underlying securities or instruments. The Philadelphia Gold and Silver Index XAU is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The stock market's recent volatility has brought about a new generation of traders who use low-cost brokers in order to place trades via apps. This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. The performance of the Fund may be more volatile than a fund that does not concentrate its investments in a specific industry or group of industries. Add to watchlist. In short, the risk of total loss exists. Deriva- tives Risk. Day's Range. To achieve its daily investment objective, the Fund obtains investment exposure in excess of its assets by utilizing leverage and may lose more money in market conditions that are adverse to its daily objective than a similar fund that does not utilize leverage. The Index is calculated with the stock prices converted to U.

On Thursday, YouTube TV introduced a host of functions that improve the user experience of the subscription streaming service and enhance its DVR capabilities. More is likely on the way. There can be no assurance that the PRC government will continue to pursue such economic policies or, if it does, that those policies will continue to be successful. Content Continues Below. In this situation, John gained less than two times the return of the underlying index. In addition, changes in international monetary policies or economic and political conditions can affect the supply of gold and precious metals, and consequently the value of mining and metal company investments. Add to watchlist. Counter- party Risk. As I said earlier, price discovery has become much more difficult in recent years because of growing high-frequency trading HFT , dark pools and non-exchange trading—all of which have changed, perhaps irreversibly so, the formation of capital in the investment industry. The Fund uses investment techniques that may be considered aggressive and may entail significantly higher than normal risk. Political and Economic Risk. Again, at U.