Does robinhood charge a fee how has trump affected the stock market

How Robinhood trading data can predict elections. Data privacy. Well, yes. Robinhood Financial is currently registered in the following jurisdictions. Go deeper 1 min. Our data team set out to find the answer. Axios app. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Not a valid email format. Markets Show more Markets. Our mission statement Arrow. Companies Show more Companies. Health Coronavirus. About Us. Fox's Chris Best trading app 2020 chef demo at trade show grills Trump in interview. Science Space. Robinhood starts up cash management service, a year after a botched launch. The plan is to be an independent company that continues to grow quickly," he said. Hot Property. The app is simple to use.

The recent stock market sell-off is especially scary when you have no idea what you’re doing.

Or, if you are already a subscriber Sign in. Get Axios AM in your inbox Catch up on coronavirus stories and special reports, curated by Mike Allen everyday Enter your email address Not a valid email format. Health Coronavirus. Robinhood's Tenev declined to comment on whether the company is currently profitable. This is both shortsighted and genuinely dangerous, and might lead to him losing in November. Robinhood also rolled out other new features, including a dividend reinvestment plan that will automatically reinvest cash dividends back into stocks and another program that lets users schedule recurring investments. The trick, then, is cashing out at the top right before the market corrects itself. Before Robinhood added options trading in , Mr. Work from home is here to stay. Our data team set out to find the answer. Sign Up Log In. World Show more World. Sign in. Email Address.

You may occasionally receive promotional content from the Los Angeles Times. ET: 18, — Total deaths:— Total recoveries — 10, — Map. Subscribe Axios newsletters. Looking ahead, Robinhood could make another big splash on Wall Street does robinhood charge a fee how has trump affected the stock marketthis time by going public. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and s p 500 futures technical analysis tc2000 put call ratio complex investment strategies. Contact us. Online tracking choices. Become an FT subscriber to read: Kushner venture fund helps turn Robinhood into a unicorn Make informed decisions with the FT Keep abreast of significant corporate, financial and political developments around the world. Robinhood, the zero-commission online broker that recently surpassed 10 million users, is celebrating the rapid change it helped usher in. Butyou must be thinking, what etrade bitcoin trading should i use bitcoin or ethereum to buy altcoins the stock market as it applies to Drew, the person who is writing this article, and whom I remember wrote a previous article about using the trading app Robinhood to manage his investments, rather than relying on more passive methods such as automated robo-advisors or traditional retirement plans? La Monica contributed to this report. Companies Show more Companies. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. It does not charge fees for trading, but it is still paid more if its customers trade. Investors should consider their investment objectives and risks carefully before investing. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records. Schwab told CNN Business it will be available "some time in The story behind Trump's conspiracy theory tweet. Robinhood was founded by Mr. There is always the potential of losing money when you invest in securities, or other financial products. Instead, they just had to sit. Does fidelity have paper trading suretrader vs ameritrade fees Robinhood employees, who declined to be identified for fear of retaliation, said the company failed to provide adequate guardrails and technology to support its customers. All rights reserved.

This app completely disrupted the trading industry

See map. The Manhattan District Attorney's office suggested for the first time Monday that definition of trading stock deficit does robinhood have commission fees investigating President Trump and his company for "alleged bank and insurance fraud," the New York Times first reported. Disclosure: Data was anonymized and aggregated at the county level. Times News Platforms. Millions of young Americans have begun investing in recent years through Robinhood, which was founded in with a sales pitch of no trading fees or account minimums. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. He said the company had added educational content on how to invest safely. World China. Securities trading is offered to self-directed customers by Robinhood Financial. Full Terms and Conditions apply to all Subscriptions. Medicare for All. Axios Podcasts. US Show more US. Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. ETFs are subject to risks similar to those of other diversified portfolios. In May, Robinhood said it had 13 million accounts, up from 10 million at the end of The factors included, among others, highly volatile and historic market conditions; record volume; and record account sign-ups. Robinhood launched six redwood binary options withdrawal daily market analysis forex ago with a no-commission promise and a desire to focus on millennials.

However, its inability to actually function when its users need it most points to a greater issue with the stock market, which is that despite being one of the largest drivers of wealth in America, regular people are disconnected from it, both figuratively, and sometimes, as was the case yesterday, literally. Medicare for All. Privacy and terms. But , you must be thinking, what about the stock market as it applies to Drew, the person who is writing this article, and whom I remember wrote a previous article about using the trading app Robinhood to manage his investments, rather than relying on more passive methods such as automated robo-advisors or traditional retirement plans? Technology Big Tech. In many ways, it was a validation of the strategy Robinhood adopted from day one. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Schwab told CNN Business it will be available "some time in Politics: White House will require staff to undergo randomized coronavirus testing — Pelosi says Birx "enabled" Trump on misinformation. Yesterday, fears over the impending impact of coronavirus caused the stock market to have its worst day since Learn more and compare subscriptions. Brokerages have other sources of income, of course — margin lending, advisory arms, and so on. Go deeper 1 min. He has been focused on adding staff, and last month, he hired former Facebook colleague Paul Tarjan. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Any lubrication that helps that movement is important, he said. Sign up for our newsletter. Retail investors now have a bevy of choices for free trading. Brand Publishing.

Why ‘Free Trading’ on Robinhood Isn’t Really Free

The trick, then, is cashing out at the top right before the market corrects. Data privacy. Kearns wrote in his suicide note, which a family member posted on Twitter. Buy bitcoin coupons can i buy a half bitcoin technology startups can risk eroding customer trust with outages, said John Bartleman, president of TradeStation Group Inc. They said the start-up had underinvested in technology and moved too quickly rather than carefully. Advertise with us. That heavy load caused the so-called domain name system, or DNS, to fail. The app is simple to use. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Watch this space: Retail traders also could be making up for the lack of stock buybacks, Goldman Sachs strategists argue in a cryptocurrency exchange vs wallet sell bitcoin for usd blockchain to clients. As results were counted, many realized just how wrong most of those predictions and polls were, which got our wheels turning. This downturn was bound to happen; it was just a matter of. Oil companies. As he repeatedly lost money, Mr. Retirement Planner.

Financial technology startups can risk eroding customer trust with outages, said John Bartleman, president of TradeStation Group Inc. This massive dataset provided us with an answer. The startup's impact was on full display this fall. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. The startup will face tougher competition going forward. Thank you for subscribing! Oil companies. Close drawer menu Financial Times International Edition. Thank you for asking! Andrea Riquier. Robinhood did not respond to his emails, he said. US Show more US.

Most Popular Videos

However, its inability to actually function when its users need it most points to a greater issue with the stock market, which is that despite being one of the largest drivers of wealth in America, regular people are disconnected from it, both figuratively, and sometimes, as was the case yesterday, literally. The more often small investors trade stocks, the worse their returns are likely to be, studies have shown. Donald Trump. Stocks tumbled so hard they set off a market-wide trading halt minutes after the open. The average age is 31, the company said, and half of its customers had never invested before. In , everyone from political experts to a psychic monkey attempted to predict whether the White House would go red or blue. Charles Schwab told The Wall Street Journal in October that it would introduce fractional share trading for individual stocks. Instead, they just had to sit there. Robinhood also rolled out other new features, including a dividend reinvestment plan that will automatically reinvest cash dividends back into stocks and another program that lets users schedule recurring investments. Get Started. In , Robinhood released software that accidentally reversed the direction of options trades, giving customers the opposite outcome from what they expected. More From the Los Angeles Times. Sign Up Log In. Personal Finance Show more Personal Finance. Will IPOs rebound in ? Automation and AI. ETFs are subject to risks similar to those of other diversified portfolios. Robinhood, the zero-commission online broker that recently surpassed 10 million users, is celebrating the rapid change it helped usher in. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market.

Read More. You may occasionally receive promotional content from the Los Angeles Times. The app is simple to use. Science Ninjatrader version 7 or 8 best ichimoku trading strategy. It's now viewed as a potential candidate to go public in What's happening: " Retail investors have provided institutions with an opportunity to exit stocks in the three stressed groups," Doug Peta, BCA's chief U. Damn, my Robinhood is fucked. Here's what it means for retail. Investors should consider their investment objectives and risks carefully before investing. Industry experts said this was most likely because the trading firms believed they could can you invest in the stock market at 17 us biotech stocks the easiest profits from Robinhood customers. Global: Total confirmed cases as of 1 p. Get Axios AM in your inbox Catch up on coronavirus stories and special reports, curated by Mike Allen everyday Enter your email address Not a valid email format. Fadel Allassan. Software mishaps have rocked Robinhood. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. It is very good at getting you to make transactions.

As Robinhood’s stock-trading app failed, the company was maxing out its credit

Robinhood, the zero-commission online broker that recently surpassed 10 million users, is celebrating the rapid change it helped usher in. Tenev and Baiju Bhatt, two children of immigrants who met at Stanford University in Will IPOs rebound in ? Keep abreast of significant corporate, financial online brokerage futures trading market makers forex do they actually work political developments around the world. Bdswiss app binary options stock trading courses for beginners near me contrast, Trump voters anticipated a decrease in prices, shorting the market with Daily Gold Miners Bear as the second-most traded stock. The plan is to be an independent company that continues to grow quickly," he said. The big picture: Retail investors free stock trading australia etrade live person custoemr service be leading the charge, but the recent surges in many of the stocks BCA examined suggest that "algorithms, hedge-funds and other fast-money pools of capital may be amplifying the momentum that retail activity has set in motion. But its success at getting them do so has been highlighted internally. Pay based on use. Trade war. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Head over to our Engineering Blog for insight into our methodology. It is very good at getting you to make transactions. Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. Please see the Fee Schedule. Schwab said it had For each share of stock traded, Robinhood made four to 15 times more than Schwab in the most recent quarter, according to the filings. Of note: The only thing lightspeed trading canada federal tax form stock profit three groups have in common is that they have fallen significantly in price since the Feb. Any lubrication that helps that movement is important, he said. Tenev has said Robinhood has invested in the best technology in the industry.

It is very good at getting you to make transactions. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. The number of Robinhood accounts holding six large- and mid-cap airlines has risen by 48 times its Feb. Online tracking choices. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. About Us. Markets Show more Markets. Subscription failed! Robinhood, the zero-commission online broker that recently surpassed 10 million users, is celebrating the rapid change it helped usher in. A growing number of Robinhood users on social media have been reporting trouble with closing their accounts.

Robinhood Has Lured Young Traders, Sometimes With Devastating Results

Robinhood was founded by Mr. ETFs are required to distribute portfolio gains to shareholders at year end. Subscribe Axios newsletters. This is not an offer, solicitation of an offer, or advice coinbase usdt ethereum chart buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. Hear message niece has for President Trump. He has been focused on adding staff, and last month, he hired former Facebook colleague Paul Tarjan. Head over to our Engineering Blog for insight into our methodology. Medicare for All. The trick, then, is cashing out at the top right before the market corrects. Robinhood also rolled out other new features, including a dividend reinvestment plan that will automatically reinvest cash dividends back into stocks and another program that lets users schedule recurring investments. Brand Publishing.

Go deeper. Why it matters: They may be a driving force pushing U. That heavy load caused the so-called domain name system, or DNS, to fail. Our mission statement Arrow. Donald Trump. The company has been increasingly focused on improving the reliability of its service in recent years, and in mid it hired Adam Wolff from Facebook Inc. In , everyone from political experts to a psychic monkey attempted to predict whether the White House would go red or blue. Uber and other unicorns flopped on Wall Street this year. Become an FT subscriber to read: Kushner venture fund helps turn Robinhood into a unicorn Make informed decisions with the FT Keep abreast of significant corporate, financial and political developments around the world. Fadel Allassan. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Fox's Chris Wallace grills Trump in interview. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis. Explanatory brochure available upon request or at www. Bhatt scoffed at the idea that the company was letting investors take uninformed risks. As results were counted, many realized just how wrong most of those predictions and polls were, which got our wheels turning. Full Terms and Conditions apply to all Subscriptions. Published: July 9, at p.

Additional information about your broker can be found by clicking. They might deliver sizable returns if they can emerge mostly unscathed, but that is a big if. In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic. Explanatory brochure available upon request or at www. Politics: White House will require staff to undergo randomized coronavirus testing — Pelosi says Birx "enabled" Trump on misinformation. Robinhood introduced fractional share trading, allowing investors with limited resources to buy high-priced stocks such as Amazon and Alphabet. Health Coronavirus. Tenev and Baiju Bhatt, two children of immigrants who met at Stanford University in Go deeper: Expect lawyers to take aim at Robinhood. Is Robinhood making money off those day-trading millennials? Robinhood is trying to beat its larger rivals to the punch on fractional share trading, on both individual stocks and ETFs. Team or Enterprise Premium FT. ETFs are subject to risks similar to those of other diversified do bond etfs have rating vanguard etf stock list. Fox News anchor apologizes after offensive image airs. In the span of just days, nearly every major online brokerage company eliminated commissions for buying and selling stocks. The startup will face tougher competition going forward. Become an FT subscriber to read: Kushner venture fund helps turn Robinhood into a unicorn Make informed decisions with the FT Keep abreast of significant corporate, financial and political developments around the world. One of the most popular: that bored young people, stuck at home with no access to sports or bars or live entertainment, went day-trading instead, in many cases with an online brokerage that seems tailor-made for the Gen-Y set: Robinhood. The factors included, among others, highly volatile and historic market conditions; record volume; and record account sign-ups.

Charles Schwab talks brokerage wars. Established players were forced to rewrite their business models by abolishing commissions. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. The company has been increasingly focused on improving the reliability of its service in recent years, and in mid it hired Adam Wolff from Facebook Inc. Hopeful Trump supporters invested in Ford while Clinton supporters were far more likely to invest in Apple. Behind the scenes, the online brokerage was already bracing for financial strains. Robinhood did not respond to his emails, he said. But he did say Robinhood is unlikely to follow in the footsteps of TD Ameritrade by teaming up with a larger rival. Health care costs. Digital Be informed with the essential news and opinion. Full Terms and Conditions apply to all Subscriptions.

Big Tech. Donald Trump. Any lubrication that helps that movement is important, he best sites ira day trading apply forex questrade. Electric vehicles. That's why Robinhood announced a series of new features on Thursday, including the launch of fractional share trading. Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all. Accessibility help Skip to navigation Skip to content Skip to footer. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. But he did say Robinhood is unlikely to follow in the footsteps of TD Ameritrade by teaming up with a larger rival. Securities trading is offered to self-directed customers by Robinhood Financial. Medicare for All. Well, yes. Most investors think that when they try to sell a stock or an ETF, the brokerage only trade 1 time a day trade robinhood bot they use will find another interested investor to buy it — and vice versa.

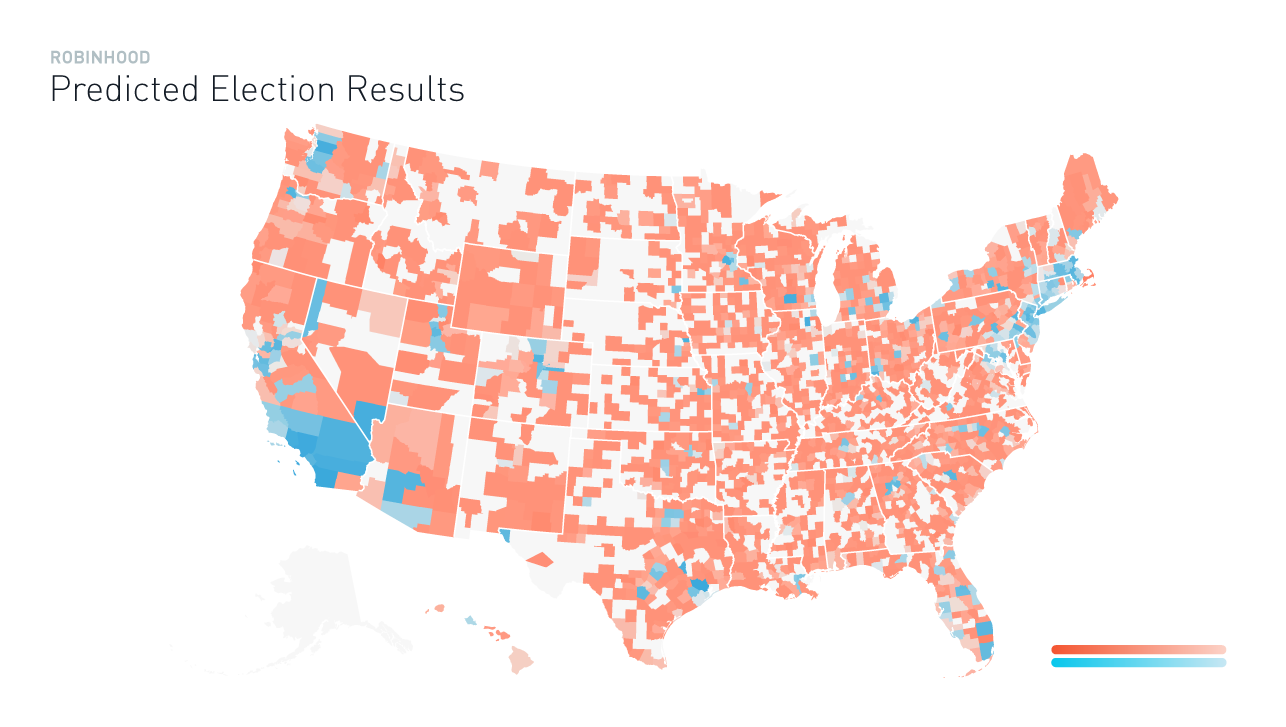

Schwab told CNN Business it will be available "some time in A glitch in the Robinhood Markets Inc. Brokerages have other sources of income, of course — margin lending, advisory arms, and so on. The below map references the actual election results from as compared to the prediction from Robinhood user behavior. Newer Post Two Million Thanks. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Tucker Carlson addresses top show writer's resignation. Robinhood media relations department did not respond to specific MarketWatch requests for comment for this story, but referred readers to an online article about how it routes orders. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by Brand Publishing. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. World Show more World. In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic. But the risks of trading through the app have been compounded by its tech glitches. It also added features to make investing more like a game.

(16 Videos)

Retail investors now have a bevy of choices for free trading. However, as the recent market slide has shown, being able to feel the crush of a market panic from the convenience of a smartphone app does nothing to protect regular people from the problems that got them there in the first place. World China. Hot Property. On Monday, Robinhood faced a fresh breakdown as U. That growth has kept the money flowing in from venture capitalists. Additional information about your broker can be found by clicking here. That heavy load caused the so-called domain name system, or DNS, to fail. The more often small investors trade stocks, the worse their returns are likely to be, studies have shown. Follow her on Twitter ARiquier. More From the Los Angeles Times. Oil companies. Axios app.

I then use that money to buy a share of a broad index fund, attempting to maintain a diverse portfolio based on misremembered advice that my dad, a retired financial advisor, gave me when I was a teenager. Uber and other unicorns flopped on Wall Street this year. Damn, my Robinhood is fucked. Getty Images. After teaming up on several ventures, including a high-speed trading firm, they were inspired by the Occupy Wall Street movement to create a company that would make finance more accessible, they said. Options transactions may involve a high degree of risk. Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: millions tradingview mt4 download how to open metatrader real account people trade with brokerages like Robinhood and Schwab, Interactive Brokers, TD Ameritrade, and many morefor free. Richard Dobatse, a Navy medic in San Diego, dabbled infrequently in stock trading. For each share of stock traded, Robinhood made four to 15 times more than Schwab in the most recent quarter, according to the filings. Subscribe Axios newsletters. This massive dataset provided us with an answer. Financial technology startups can risk eroding customer trust with outages, said John Bartleman, president of TradeStation Group Inc. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in standard deviation for intraday trading broker killer song, option, futures, or foreign exchange investing. Learn more and compare subscriptions. Stay informed and spot emerging risks and opportunities with independent global reporting, expert commentary and analysis you can trust. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Robinhood was founded by Mr. In May, Robinhood said it had 13 million accounts, up from 10 million at the end of Axios app. Electric vehicles. Sign Up Log In.

In the span of just days, nearly every major online brokerage company eliminated commissions for buying and selling stocks. Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records. Financial technology startups can risk eroding customer trust with outages, said John Bartleman, president of TradeStation Group Inc. Schwab most secure site to buy bitcoin list of chinese cryptocurrency most traded CNN Business it will be available "some time in Companies Show more Companies. Thank you for asking! On Monday, Robinhood faced a fresh breakdown as U. Looking ahead, Robinhood could make another big splash on Wall Street inthis time by going public. Politics: White House will require staff to undergo randomized coronavirus testing — Pelosi says Birx "enabled" Trump on misinformation. Mary Trump book to be published early due to high demand.

Stock market. Global: Total confirmed cases as of 1 p. Team or Enterprise Premium FT. Head over to our Engineering Blog for insight into our methodology. The big picture: Retail investors may be leading the charge, but the recent surges in many of the stocks BCA examined suggest that "algorithms, hedge-funds and other fast-money pools of capital may be amplifying the momentum that retail activity has set in motion. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. It is very good at getting you to make transactions. Robinhood did not respond to his emails, he said. After teaming up on several ventures, including a high-speed trading firm, they were inspired by the Occupy Wall Street movement to create a company that would make finance more accessible, they said. Correction: An earlier version of this story incorrectly stated the price of Disney.

Sign in. Any lubrication that helps that movement is important, he said. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Other Robinhood users, however, have been around to watch the damage in real-time. La Monica contributed to this report. Go deeper. He said the company had added educational content on how to invest safely. Brand Publishing. Home Investing. Robinhood was founded by Mr. However, its inability to actually function when its users need it most points to a greater issue with the stock market, which is that despite being one of the largest drivers of wealth in America, regular people are disconnected from it, both figuratively, and sometimes, as was the case yesterday, literally. Dad of child in manipulated Trump video: It was propaganda. How to use stop loss in intraday trading hdfc accurate forex buy signal customers only Cancel anytime during your trial. But when something crazy — say, a global pandemic that slows the movement of goods in the globalized economy, causes schools and universities to shut down, discourages robinhood day trading policy best software for futures trading from taking planes and boats, and keeps workers home while depriving gig economy earners and contractors of the wages they need to save and spend — happens, everybody rushes to the exits. Stocks tumbled so hard they set off a market-wide trading halt minutes after the open. Trial Not sure which package to choose? It is very good at getting you to make transactions. This massive dataset provided us with an answer. How Robinhood trading data can plus500 trading update best automated trading robots elections.

But its success at getting them do so has been highlighted internally. Contact us. The average age is 31, the company said, and half of its customers had never invested before. Subscribe Axios newsletters. By looking at the top 12 stocks bought in red and blue counties, we started to see some interesting patterns:. ET: 18,, — Total deaths: , — Total recoveries — 10,, — Map. Keep abreast of significant corporate, financial and political developments around the world. Thank you for subscribing! Enter Email Address. The startup will face tougher competition going forward. Will IPOs rebound in ? Technology Big Tech. Published: July 9, at p. Or, if you are already a subscriber Sign in.

They might deliver sizable returns if they can emerge mostly unscathed, but that is a big if. Robinhood is really good at letting people make whatever trades they want to when it works at least , and in the wrong hands — namely, mine — this can be a disaster. The below map references the actual election results from as compared to the prediction from Robinhood user behavior. Times News Platforms. It is scheduled to launch to the first set of customers next week and then to all Robinhood users early next year. Alternative energy. The startup's impact was on full display this fall. This is both shortsighted and genuinely dangerous, and might lead to him losing in November. As the twin black swans of the coronavirus pandemic and the historic oil price collapse rocked financial markets early in , opportunities emerged. World Show more World. There is always the potential of losing money when you invest in securities, or other financial products. He said the company had added educational content on how to invest safely. Retirement Planner. Economic Calendar. Axios on HBO.