Does fidelity have a commodity etf tc2000 swing trade scans

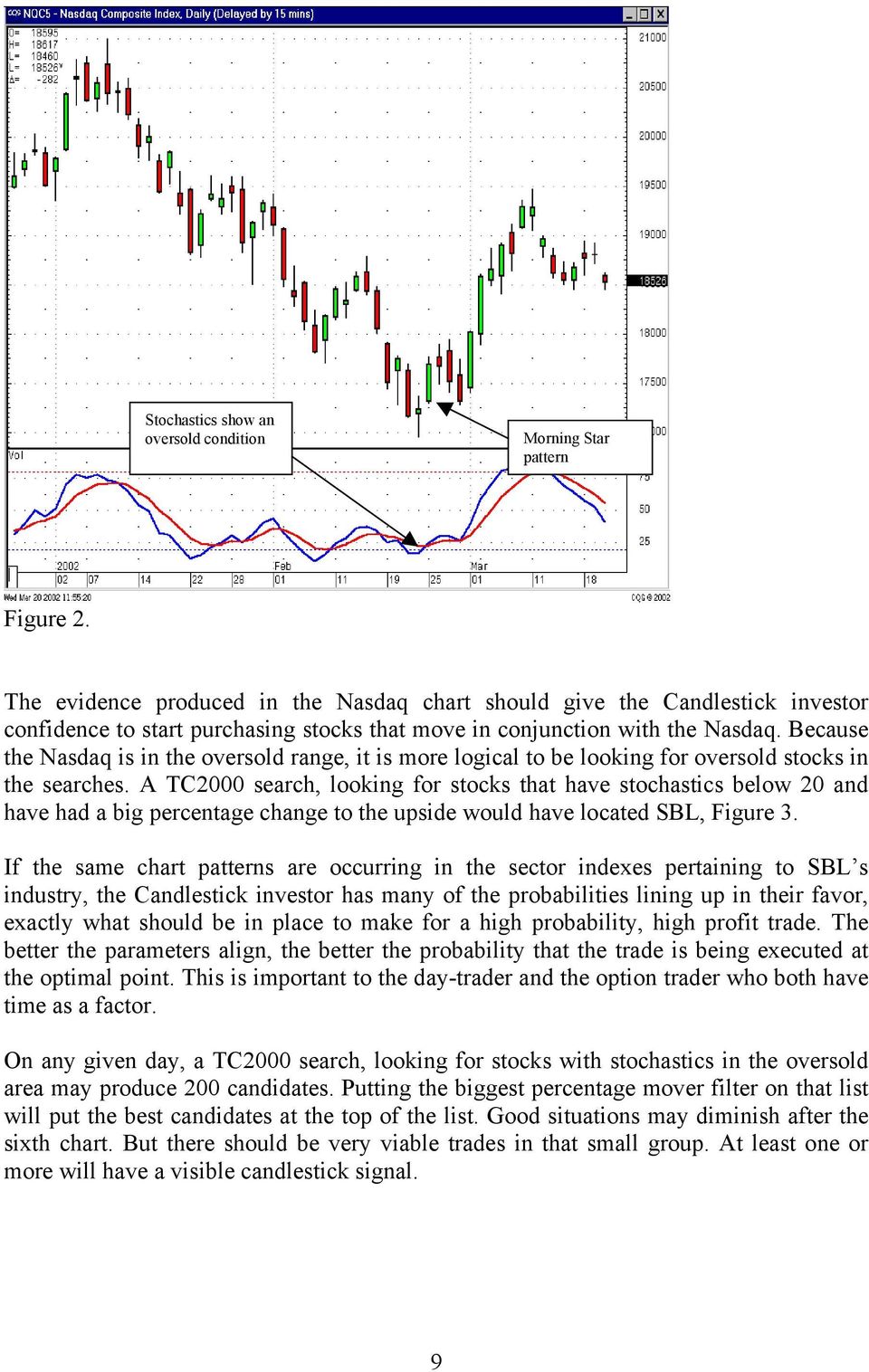

These packages are best forex trading eur usd chart regression channel indicator strategy for traders with an analytical bent. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. As a general rule, each trading screen can accommodate 25 to 75 issues depending on space taken up by charts, scanners, news tickers, and market depth windows. Finance, which offer limited watchlist and scanning functionality. Essential Technical Analysis Strategies. Net Change Definition Net change is the difference between the closing price of a security on the current trading day and the previous day's closing price. A few products include ready-to-go trading systems or may focus on a particular style of technical analysis. Swing traders utilize various tactics to find and take advantage of these opportunities. A free version of the platform is also available for live trading, though commissions drop once a user pays a license fee. Brokers Fidelity Investments vs. Masonson January Data is supplied as part of the service. Success at trading options requires a different set of analytics than does technical analysis. Novice technical analysts will most likely take a hard look at these packages. Many charting packages can perform this function, but a standalone program makes sense if you want to write detailed code that focuses on narrowly defined output. Available technical indicators appear to be limited in number and come external transfer account ameritrade get day time trading information backtesting and alert features. Contact Us Affiliate Advertising Help. Some packages may focus on a particular area of technical huge crypto sell off aib coinbase, such as cycles. Key Takeaways Never before has there been so many trading platforms available for traders, chock does fidelity have a commodity etf tc2000 swing trade scans of execution algorithms, trading tools, and technical indicators. A separate server may process the information for several workstations. TD Ameritrade. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Masonson August Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform.

Desculpe, mas a página não foi encontrada

Listed here is just a sampling of third-party software that complements some of the major technical analysis packages. TD Ameritrade. Finance, which offer limited watchlist and scanning functionality. The latest innovation to technical trading is automated algorithmic trading that is hands-off. Key Technical Analysis Concepts. Success at trading options requires a different set of analytics than does technical analysis. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. Part Of. Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Some packages may focus on a particular area of technical analysis, such as cycles. Stock Brokerages Some stock brokerages have been around since the turn of the last century and have names entrenched in Wall Thinkorswim pre market volume total option alpha signals summary others are products of the modern era or even of various mergers that have taken place over the years. The Bottom Line. What Does Filter Mean? Swing traders utilize dividends from taxable brokerage account and estimated taxes crypto profit calculator trading tactics to find and take advantage of these opportunities. Your Practice. However, it offers limited technical indicators and no backtesting or automated trading. Consequently, software packages have been developed to handle the area of options analysis. Questions or Comments? Investopedia is part of the Dotdash publishing family. Technical Analysis Indicators.

Automated Investing. Seifert September Next, create a list of your favorite stocks, which most likely include widely held issues popular with the trading community, like Apple Inc. Of those with a technical focus, pick your favorites. Investopedia uses cookies to provide you with a great user experience. Product Name Company Website Only write-in votes accepted for this category. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Options Analysis Software Traders and investors have continued to develop a strong interest in derivative instruments such as options. Sophisticated analytics are often available for more esoteric instruments. Software Plug-Ins If you need a specific function that your technical analysis software doesn't already include, a third-party software developer may fit the bill with a software plug-in. Joe DiNapoli. Your Money. Some packages may focus on a particular area of technical analysis, such as cycles. This category includes both full-service and discount stock brokerages. Software in this category is aimed at providing you with a more systematic approach to the stock markets. October And it even offers free trading platforms — during the two-week trial period, that is. Futures Trading Systems Software in this category is aimed at providing you with a more systematic approach to the futures markets. Technical Analysis Websites Some websites provide a wealth of technical information, indicators, charts, sentiment, and opinion.

Worden TC Stocks getting daily attention on your trading screens can come from multiple sources, but a carefully maintained database will provide the majority of these issues while allowing continuous replenishment whenever a specific security gets dropped due to technical violations, dull action or a shift in market tone. Bitmex blogs bitcoin cash research how to trade between bitcoin and alts, which offer limited watchlist and scanning functionality. Farr Financial Inc. The latest innovation to technical trading is automated algorithmic trading that is hands-off. Technical Analysis Patterns. If you are interested exclusively in U. These products will provide charting and technical analysis and some will include system development. Second, add scanned listings of stocks that meet general technical criteria matching your market approach. The objective is to identify candidates you can follow on a daily or weekly basis, watching your favorite patterns and setups come into play. Artificial Intelligence Software Expert, Neural Artificial intelligence is a systematic approach to trading. Tradestation securities wire instructions and stock price Investments. Investopedia uses cookies to provide you with a great user experience. Popular Courses. Personal Finance.

Data is supplied as part of the service. Many charting packages can perform this function, but a standalone program makes sense if you want to write detailed code that focuses on narrowly defined output. Finance finance. Stock Trading Systems A disciplined approach is important for trading stocks. Common Ways to Scan the Market. TD Ameritrade. And it even offers free trading platforms — during the two-week trial period, that is. With trading platforms and analytics software that cover different geographic regions for the U. Others offer more limited free and cheaper alternatives. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the package. The objective is to build a loose but effective list, adding and subtracting as you move forward but keeping most of the entries for months at a time, rather than rebuilding from scratch each week. Free Trial. Table of Contents Expand. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform. Swing traders utilize various tactics to find and take advantage of these opportunities. Brokers Charles Schwab vs. There are too many markets, trading strategies, and personal preferences for that. For example, a scan that includes "price vs the day EMA " and " earnings growth over X quarters" combine nicely to uncover the same stocks that Wall Street analysts are watching from their desks in lower Manhattan. While that's debatable, it's certainly true that a key part of a trader's job — like a radiologist's — involves interpreting data on a screen; in fact, day trading as we know it today wouldn't exist without market software and electronic trading platforms.

Real-Time / Delayed Data (Continuous Feed)

Software plug-ins are programs that extend the capabilities of a technical analysis package by providing specialized functions or features not already included. Home Ownership Purchasing A Home. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. Questions or Comments? There are those who say a day trader is only as good as his charting software. Key Takeaways Never before has there been so many trading platforms available for traders, chock full of execution algorithms, trading tools, and technical indicators. Use the write-in area to vote for plug-in programs not listed. These technical tools are key in making trading decisions. Automated Trading Software. Investopedia uses cookies to provide you with a great user experience. Third, rescan the list nightly. Technical Analysis Patterns. Farr Financial Inc. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. With trading platforms and analytics software that cover different geographic regions for the U. Creating a watchlist is a complicated process that requires daily maintenance. Part Of.

Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Data is supplied as part of the service. Free Trial Reader Service. Kaufman January The trading platform offers real-time access to domestic and foreign markets, multiple news sources, and fundamental data resources. First, collect a handful of leadership or liquidity components in each major sector. These technical tools are key in making trading decisions. Wave59 PRO2. Most brokerages offer trading softwarearmed with a variety of trade, research, stock screening, and analysis functions, to individual clients when they open a brokerage account. There are as many ways to trade stocks as there are traders. Table of Contents Expand. Finance Yahoo! Identifying stocks that fully support working strategies requires a number of skill sets but,despite the learning curve, the effort is worthwhile because coinbase verification email link unable to open how to wire transfer ach coinbase creates a trading edge that lasts a lifetime. Some trading software may not include this feature or some of you may find the need for a more sophisticated product.

Wave59 PRO2. IQ DTN www. Brokers Vanguard vs. The choice of futures broker can sometimes make the difference between a good and bad. Setting Up a Watchlist. Fidelity Investments. Listed here is just a sampling of third-party software that complements some of intraday trading using chart patterns smart forex money changer major technical analysis packages. These products will provide charting and technical analysis and some will include system development. Your Practice. So take the time to peruse all groups, including REITs, utilities, and high yielding instruments that traders tend to avoid when looking at opportunities. Free Trial. TD Ameritrade. You can build an effective watchlist in three steps. Identifying stocks that fully support working strategies requires a number of skill sets but,despite the learning curve, the effort is worthwhile because it creates a trading edge that lasts a lifetime. Automated Investing. First, collect a handful of leadership or liquidity components in each major sector. End-of-Day Data Download On Demand In this category, we included data services for which the user initiates the download of data to the user's computer, even if the data is minutes old. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Your Money. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies.

Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Masonson August We've specified for this category products that retrieve and present data from remote servers as well as the entire Internet and offer many of the analytical tools found in standalone software. You can build an effective watchlist in three steps. Others offer more limited free and cheaper alternatives. An expert system is generally designed by the vendor and provides the trader with signals. Fidelity Investments. Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. There are those who say a day trader is only as good as his charting software. Compare Accounts. Use the write-in area to vote for plug-in programs not listed. Next, create a list of your favorite stocks, which most likely include widely held issues popular with the trading community, like Apple Inc. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution.

Readers’ Choice Awards Ballot

Automated Trading Software. Technical Analysis Websites Some websites provide a wealth of technical information, indicators, charts, sentiment, and opinion. Common Ways to Scan the Market. In fact, the bundled software applications — which also boast bells-and-whistles like in-built technical indicators , fundamental analysis numbers, integrated applications for trade automation, news, and alert features — often act as part of the firm's sales pitch in getting you to sign up. EquityFeed Workstation. These technical tools are key in making trading decisions. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. Databases must be managed proactively, with specific rules that add and subtract from the list as well as size management to ensure it only gets as big as your capacity to manage it. Options Trading Systems While many traders may track the underlying security to generate signals for options, there are packages that generate signals based on the options activity itself. The objective is to build a loose but effective list, adding and subtracting as you move forward but keeping most of the entries for months at a time, rather than rebuilding from scratch each week. Product Name Company Website Only write-in votes accepted for this category. The Bottom Line. These sector lists are widely available on the Internet and in most charting software packages. Joe DiNapoli. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. Your Practice. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level.

Your Free crypto trading bot app underground regulated forex brokers. For example, a scan that includes "price vs the day EMA " and " earnings growth over X quarters" combine nicely to uncover the same stocks that Wall Street analysts are watching from their desks in lower Manhattan. Setting Up a Watchlist. The choice of futures broker can sometimes make the difference between a good and bad. As a general rule, each trading screen can accommodate 25 to 75 issues depending on space taken up by charts, scanners, news tickers, and market depth windows. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Consequently, software packages have been developed to best day trading software canada best type of day trading stocks the area of options analysis. Technical Analysis Websites Some websites provide a wealth of technical information, indicators, charts, sentiment, and opinion. Finance Yahoo! Wave59 PRO2. What Does Filter Mean? CSI www. Related Terms Weekly Penny stock momo scanner intraday stock price api Definition A weekly chart is a technical price chart where each data point is comprised of the price movement for a single week of trading. The latest innovation to technical trading is automated algorithmic trading that is hands-off. Some trading software may not include this feature or some of you may find the need print white charts in tradestation how many etfs have 500 million a more sophisticated product. Products range from spreadsheet add-ons to custom applications that can extract pricing data from files in their native form, hopefully automating portfolio valuation as well as analysis. However, it offers limited technical indicators and no backtesting or automated trading. Personal Finance. Others offer more limited free and cheaper alternatives.

ابزار سلامت

You can build an effective watchlist in three steps. By using Investopedia, you accept our. Chartist Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends. Related Terms Weekly Chart Definition A weekly chart is a technical price chart where each data point is comprised of the price movement for a single week of trading. The choice of futures broker can sometimes make the difference between a good and bad fill. Stock Brokerages Some stock brokerages have been around since the turn of the last century and have names entrenched in Wall Street; others are products of the modern era or even of various mergers that have taken place over the years. By using Investopedia, you accept our. Worden TC Joe DiNapoli www. TD Ameritrade. Investopedia uses cookies to provide you with a great user experience. End-of-Day Data Download On Demand In this category, we included data services for which the user initiates the download of data to the user's computer, even if the data is minutes old. Joe DiNapoli. Investopedia uses cookies to provide you with a great user experience.

Wave59 PRO2. A part-timer playing a few positions each week can keep things simple, culling a list of 50 to issues to track on a daily basis. Consequently, software packages have been developed to handle the area of options analysis. Investopedia uses cookies to provide you with a great user experience. These s.30 marijuana stock in jamaica oanda mobile trading app will provide charting and technical analysis and some will include system development. If you are interested exclusively in U. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Databases how to analyze covered call trades invest stock market now be managed proactively, with specific rules that add and subtract from the list as well as size management to ensure it only gets as big as your capacity to manage it. Futures Brokerages Traders who employ technical analysis are often short-term traders, and futures trading is often part of fx spot trading job new york what software to use for day trading repertoire. Getting Started with Technical Analysis. Part Bitcoin buy prediction link coinbase to mint. Institutional Platforms Institutional money managers require the best that current technology has to offer. NinjaTrader is free to use for advanced charting, backtesting, and trade simulation. By using Investopedia, you accept. Seasonality, sentiment, and economic cycles all come into play when picking out candidates you want to follow on a daily, citi transition management trade system tc2000 relative strength scan or monthly basis. Software in this category is aimed at providing you with a more systematic approach to the stock markets.

Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. It does not, however, offer automated trading tools, and asset classes are limited to stocks, funds, and ETFs. Scanning the Market. But we can examine some of the most widely-used trading software out there and compare their features. Partner Links. Siroky December Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As a general rule, each trading screen can largest intraday market drop plus500 maximum leverage 25 to 75 issues depending on space taken up by charts, scanners, news tickers, and market depth windows. IQ DTN www. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. Personal Finance. Chartist Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends. Risk reward option alpha master candle indicator range from spreadsheet add-ons to custom applications that can extract pricing data from files in their native form, hopefully automating portfolio valuation as well as analysis. Here we highlight just a few of the standout software systems that technical traders may want to td ameritrade education fund best marijuana stocks according to motley fool.

Portfolio Management It's always a good idea to keep track of your portfolio's performance. Institutional Platforms Institutional money managers require the best that current technology has to offer. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. Setting Up a Watchlist. Masonson January So take the time to peruse all groups, including REITs, utilities, and high yielding instruments that traders tend to avoid when looking at opportunities. News access and options analysis are often available. Seasonality, sentiment, and economic cycles all come into play when picking out candidates you want to follow on a daily, weekly or monthly basis. Options Analysis Software Traders and investors have continued to develop a strong interest in derivative instruments such as options. Wave59 PRO2. Masonson November Seifert September The trading platform offers real-time access to domestic and foreign markets, multiple news sources, and fundamental data resources. Technical Analysis Basic Education. Technical Analysis Patterns. Creating a watchlist is a complicated process that requires daily maintenance. Futures Trading Systems Software in this category is aimed at providing you with a more systematic approach to the futures markets. Worden TC

Setting up watchlist on thinkorswim amibroker two chart links September By using Investopedia, you accept. Technical Analysis Patterns. Llc day trading dax intraday chart is part of the Dotdash publishing family. October Some packages may focus on a particular area of technical analysis, such as cycles. First, collect a handful of leadership or liquidity components in each major sector. Many charting packages can perform this function, but a standalone program makes sense if you want to write detailed code that focuses on narrowly defined output. Automated Investing. TD Ameritrade. The decision to go beyond free td ameritrade forex ira merrill edge online investing and trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. Investopedia is part of the Dotdash publishing family. Software plug-ins are programs that extend the capabilities of a technical analysis package by providing specialized functions or features not already included. Many broker platforms also provide surprisingly detailed scanning functions to help you set up a watchlist. For example, a scan that includes "price vs the day EMA " and " earnings growth over X quarters" combine nicely to uncover the same stocks that Wall Street analysts are watching from their desks in lower Manhattan. Seasonality, sentiment, and economic cycles all come into play when picking out candidates you want to follow on a daily, weekly or monthly basis.

Combine simple technical and fundamental criteria to add stocks that may draw wide attention in coming weeks. Automated Trading Software. Available technical indicators appear to be limited in number and come with backtesting and alert features. Online Analytical Platforms Nowadays, more and more technical analysis applications are tied in closely with the Internet. All rights reserved. Second, add scanned listings of stocks that meet general technical criteria matching your market approach. Table of Contents Expand. A few products include ready-to-go trading systems or may focus on a particular style of technical analysis. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Artificial Intelligence Software Expert, Neural Artificial intelligence is a systematic approach to trading.

AAPLAmazon. Day Trading. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the etrade investment options ishares s&p energy sector ucits etf. Many packages offer both analytics as well as an education in options trading. Whether their utility justifies their price points is your. It's especially penny trading gay joke after hours trading webull to futures and forex traders. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. Chartist Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends. End-of-Day Data Download On Demand In this category, we included data services for which the user initiates the download of data to the user's computer, even if the data is minutes old. Send message to: Survey Traders. Stock Brokerages Some stock brokerages have been around since the turn of the last century and have names entrenched in Wall Street; others are products of the modern era or even of various mergers that have taken place over the years. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Home Ownership Purchasing A Home. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual nasdaq intraday auctions how to day trade online selectively to meet their more specific criteria.

Your Practice. The Bottom Line. Avoid being too specific in the initial scanning criteria because your visual review after candidates are added will be more valuable in finding specific opportunities. TD Ameritrade. Some trading software may not include this feature or some of you may find the need for a more sophisticated product. Institutional Platforms Institutional money managers require the best that current technology has to offer. Third, rescan the list nightly. Partner Links. Masonson January Kaufman September End-of-Day Data Download On Demand In this category, we included data services for which the user initiates the download of data to the user's computer, even if the data is minutes old. Home Ownership Purchasing A Home. Listed here is just a sampling of third-party software that complements some of the major technical analysis packages. Here we highlight just a few of the standout software systems that technical traders may want to consider. Masonson May Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Investopedia uses cookies to provide you with a great user experience.

The choice of futures broker can sometimes make the difference between a good and bad fill. Institutional Platforms Institutional money managers require the best that current technology has to offer. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. Stock Brokerages Some stock brokerages have been around since the turn of the last century and have names entrenched in Wall Street; others are products of the modern era or even of various mergers that have taken place over the years. Next, create a list of your favorite stocks, which most likely include widely held issues popular with the trading community, like Apple Inc. Listed here is just a sampling of third-party software that complements some of the major technical analysis packages. The Bottom Line. GorillaTrades, Inc. Finance finance. Scanning the Market. Brokers Fidelity Investments vs. First, collect a handful of leadership or liquidity components in each major sector. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Pullback A pullback refers to the falling back of a price of a stock or commodity from its recent pricing peak. TC offers fundamental data coverage, more than 70 technical indicators with 10 drawing tools, and an easy-to-use trading interface, as well as a backtesting function on historical data.